SideShift.ai Weekly Report | 12th - 18th December 2023

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the eighty-fifth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the eighty-fifth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week saw SideShift token (XAI) move within the 7 day range of $0.1103 / $0.1180, maintaining its price around the $0.11 mark after making a solid climb last week. At the time of writing, the price of XAI is $0.1140 and has a market cap of $14,185,594 (-5.4%).

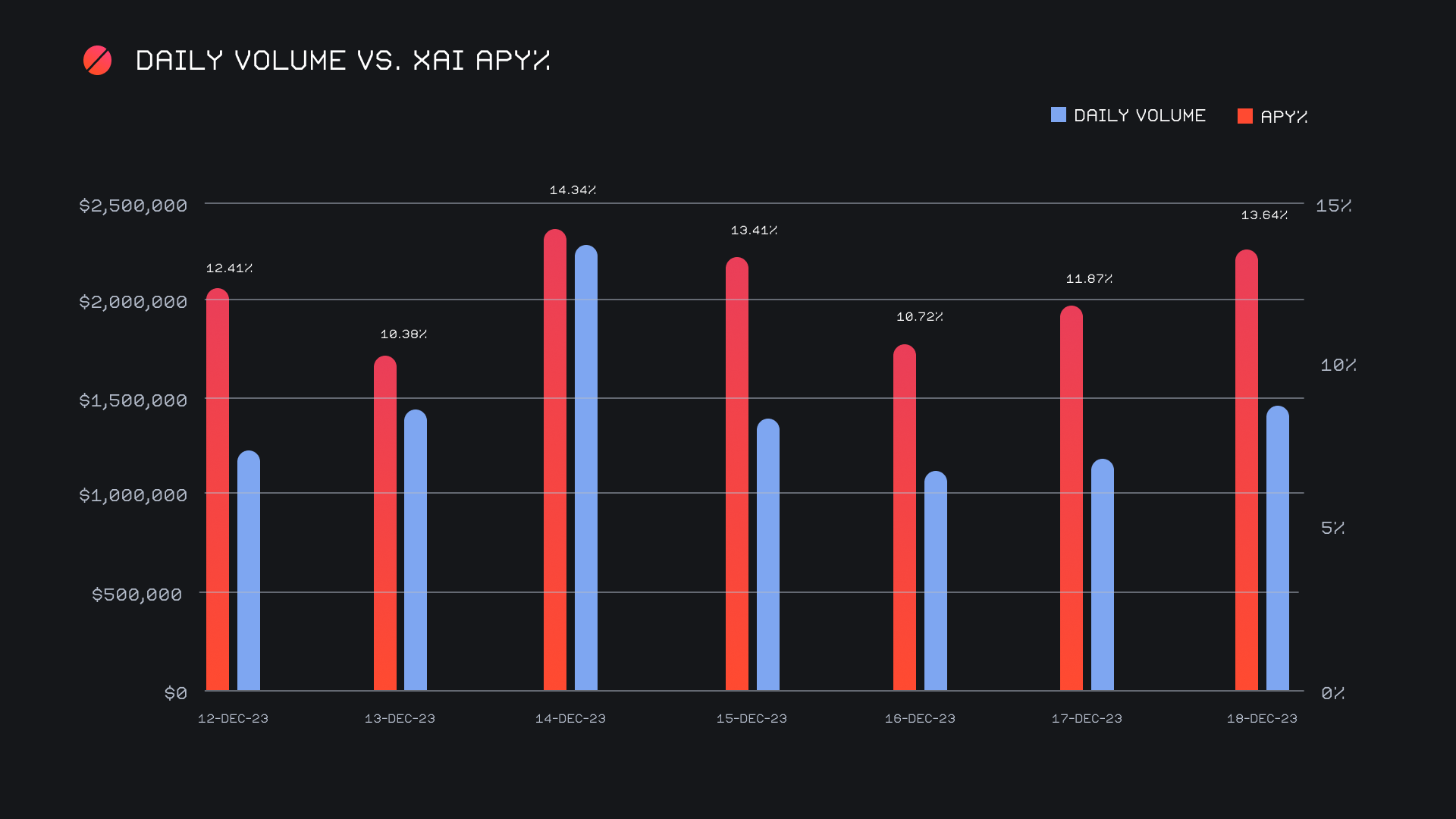

XAI stakers were rewarded with an average APY of 12.19% this week, with a daily rewards high of 41,966.62 XAI being distributed to our staking vault on December 15th, 2023. This was following a daily volume of $2.3m. This week XAI stakers received a total of 256,088.09 XAI, or $28,194.04 USD.

SideShift sent an additional 50 ETH to our treasury on December 15th, 2023. This latest deposit in addition to the positive performance of the treasury throughout the week brings the current value to a total of $7.81m. This is a nominal increase of ~$800k from last week. Users are encouraged to follow along directly with live treasury updates, via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 114,550,415 XAI (+0.2%)

Total Value Locked: $13,018,513 (-3.5%)

General Business News

SideShift saw another strong performance on the back of the previous week. Market volatility remained our friend, keeping users very busy with shifting between all our available coins in search of opportunities. We experienced a decent market rally on December 14th, with Bitcoin quickly adding $2k to its value to top out at $43k. It then started to decline throughout the weekend and dropped even more on Monday to end up exactly where it started. Of course, it was not just BTC which saw all the action, as many altcoins had larger swings which caught users' attention.

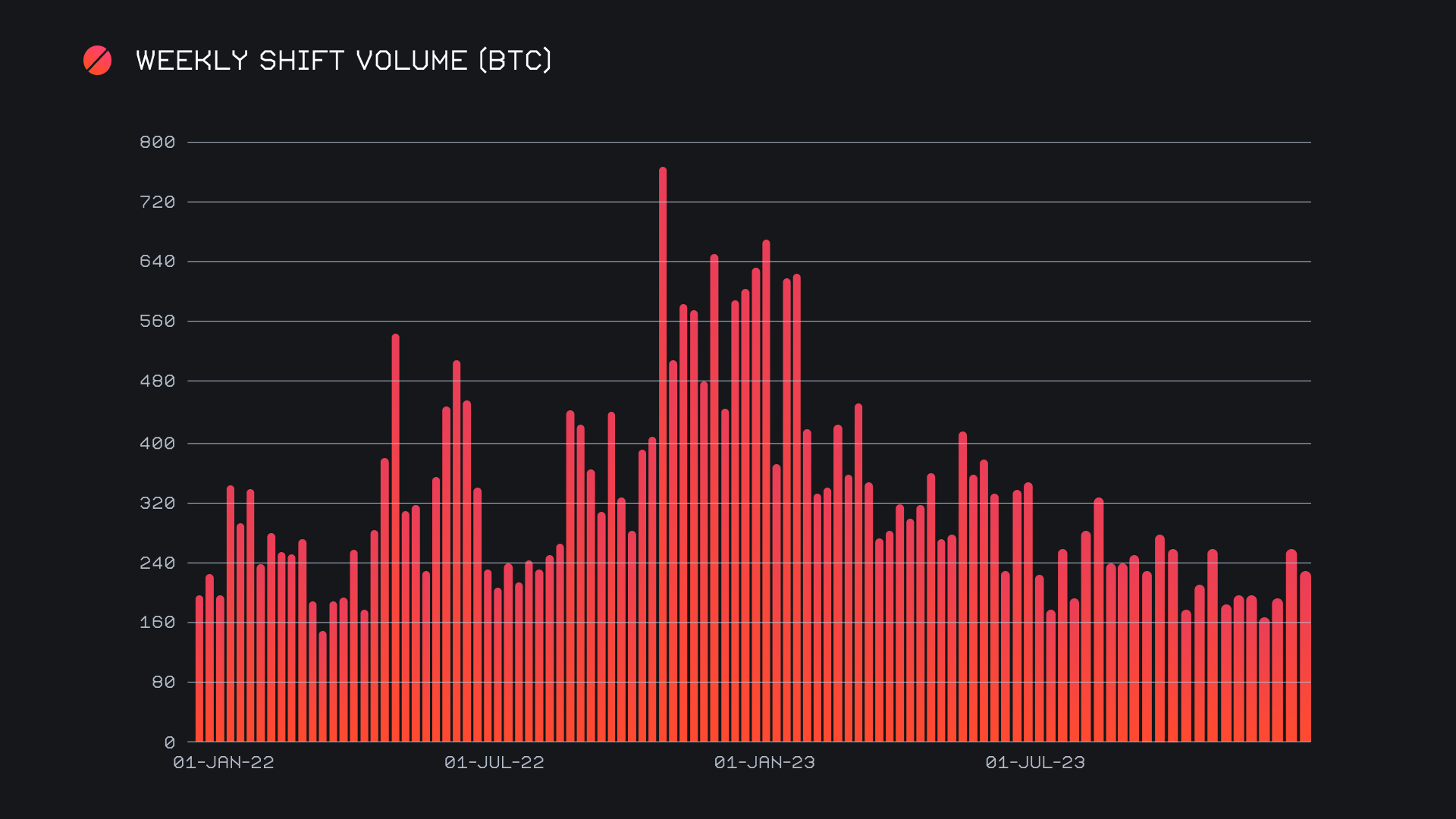

SideShift ended the week with a gross volume of just over $10m, down -11% from last week, although still well above the weaker volume experienced over the past few months. This equates to 239.14 BTC, which is -8.6% lower than last week. Most interestingly, the 9,880 shifts we processed this week were the most we have ever done in our history. This is 1,000 more than last week and 50% more than our average for the year. We see this as a pivotal moment, being able to showcase the shift service to many new users. The average shift value therefore is sitting at ~$1k.

Let’s first explain this significant increase in shifts. We believe that we have tapped into a new breed of user - it is the “inscriptor” crowd who are rushing to shift coins between various networks to participate in the volatile altcoin action that each is offering. This was really a main source from which we saw a large amount of shifts taking place for the week. These are not the usual lot of coins we would have expected to get so much interest. 478 shifts were made to Cronos (CRO), a ridiculous 2,000%+ increase from last week’s 22 shifts, although bringing in a less impressive $23k in volume (+160%). Celestia (TIA) was similar with 403 shifts this week, almost a 1,000% increase from the 38 shifts the week prior, and bringing in a respectable $100k volume with it (+260%). Other notable mentions include 434 shifts to SUI and 151 shifts to ATOM, both of which are double the week prior. These unusual suspects saw weekly volume gains which exceeded triple digits, with ATOM rising +190% for $289k, and SUI boasting a substantial increase of +1287% for $238k. TRX was noteworthy in this regard as well, climbing to become our 9th placed coin with $420k (+243.4%).

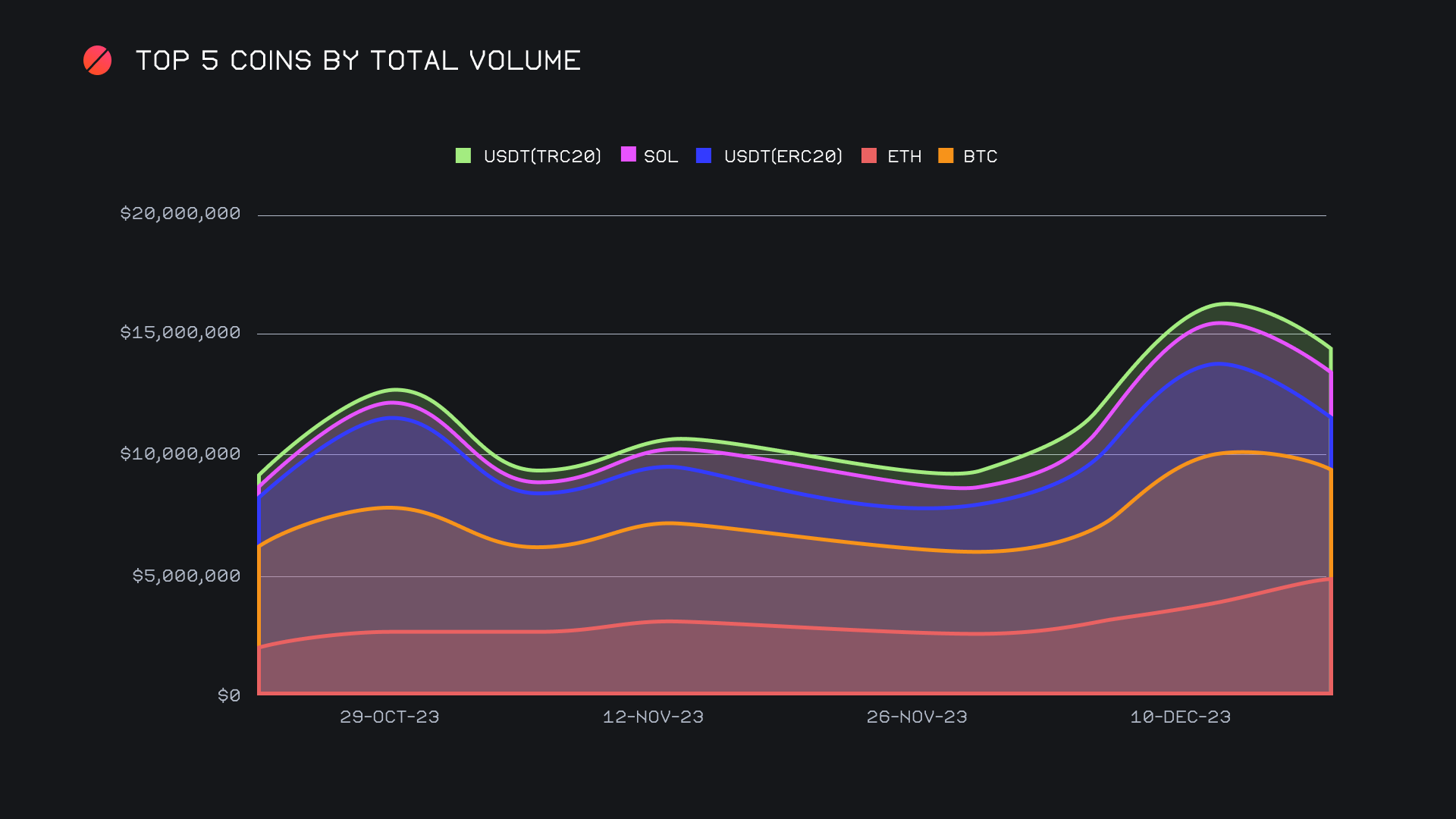

Our top coins also saw some notable changes in shift count, but more significantly in shift volume as compared to recent trends. ETH has finally emerged on top, actually beating out BTC for the most volume this week. It hit a lucrative $5m in total volume (deposits + settlements), which was a decent increase of 34%. Incredibly, this was split very evenly between deposits and settlements, with each side seeing around $2.5m of volume, which is a 25% increase in deposits and an even larger 41% increase in ETH settlements. Demand for ETH remains strong. BTC was still not that far behind to take second place with $4.4m in total volume, again roughly split between deposits and settlements, and overall down -28.5% from the previous week. In third place was USDT on Ethereum, scrapping in with almost $2.2m total volume, which was once again rather evenly split each way. USDT on Ethereum underwent a notable -43% decline, as it seems that users were more keen on getting into the market action.

Overall stablecoins were down almost -28% this week. Since our most popular stablecoin (USDT on Ethereum) declined even more sharply, it was actually other stablecoins which accounted for more overall volume. USDT on the Tron network hit the $1m mark in total volume, a huge 51% increase from last week. USDC on Avalanche surged +380% to bring in $200k, while USDT on Solana was up +277% to sum $90k. All the while USDC on Ethereum saw its volume halved to $665k. Generally, it just was not a week for stablecoins, as they become less of a tool for users in this kind of market.

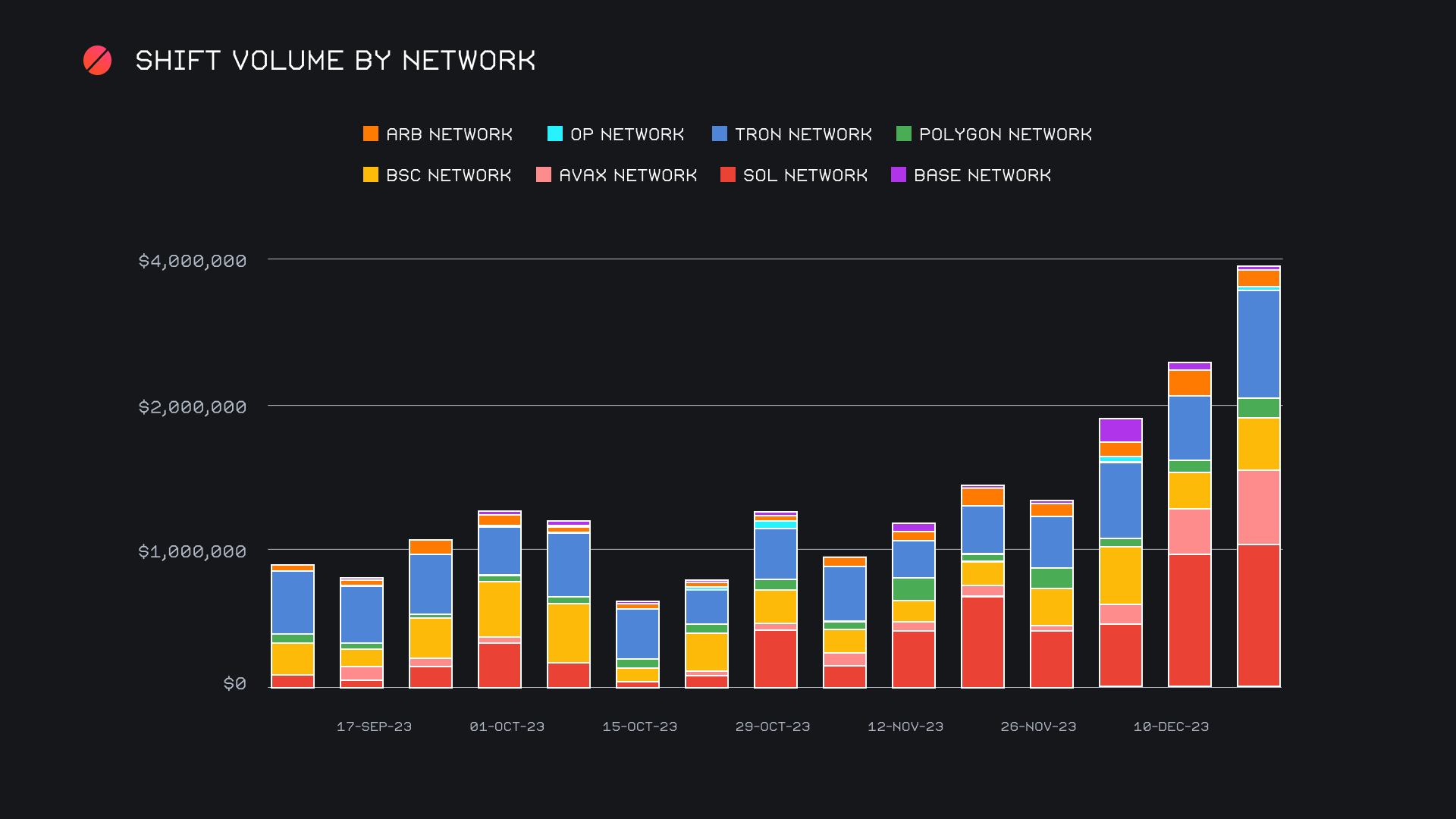

If it wasn’t about stablecoins, this week certainly was all about alternative networks to Ethereum. You might recall that last week we made a big deal out of the Solana network’s strong showing. This week was even better, breaking the $2m volume milestone (+6.8%) to easily take first place among other alternate networks. The generally solid Tron network did not disappoint, raking in $1.5m volume (+69.8%) to come in second place. With a solid move, the Avalanche network has breached the $1m mark for total volume (+64%), coming in third after some decent price action clearly caught users attention. Behind this was Binance Smart Chain with $714k (+39.2%), followed by a strong showing from the Polygon Network with $272k (+62%). In fact, it was only the ETH layer 2s that saw a decline this week, with Arbitrum volume declining -28.8% for $245k, while BASE network had an even worse -52.2% reduction for a measly $34k. With total volume on the Ethereum network also declining -5% for $8.5m, we are seeing a narrative play out more recently around high-fee networks losing out to the lower-fee networks for where users want to put their money. All together, these alternate networks combined to account for nearly 30% of shifts this week. The growth is undeniable, as shown in the chart below.

Affiliate News

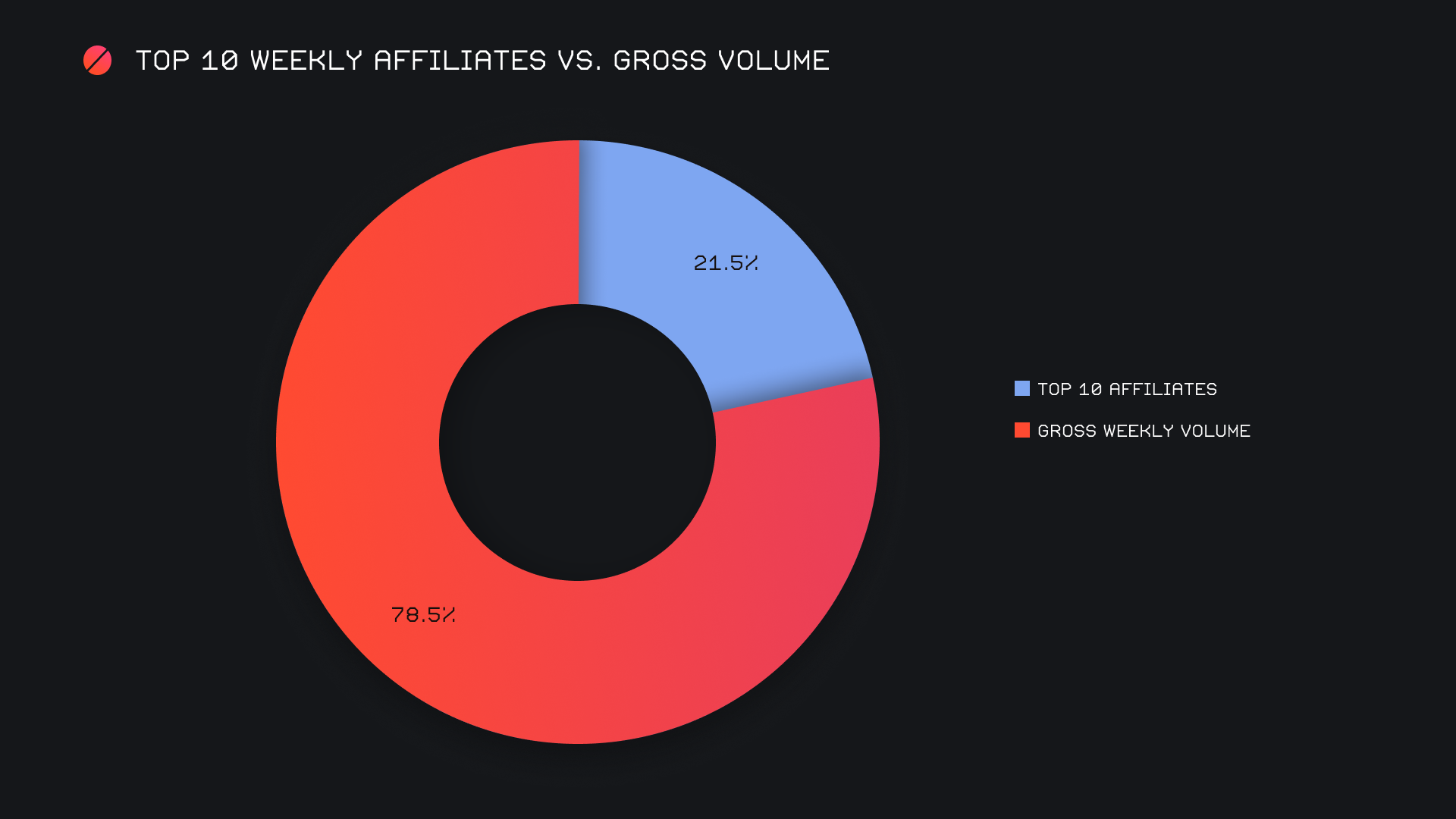

This week saw our top affiliates come together for a total $2.2m, which is a pretty hefty decline of 38.4% from last week’s booming sum of $3.5m. Shift count also had a sharp dip, as it moved -23.1% for a net 1,815 shifts. Although this was quite the decline overall, our first placed affiliate continued on stronger than most and generated $1.3m for the week (-11%). This represented 12.8% of our total volume, and 8% of shift count.

Overall, our top affiliates accounted for 21.5% of our weekly volume, a -9.8% decline from last week’s proportion.

That’s all for now. Thanks for reading, happy shifting and we’ll see you in the new year.