SideShift.ai Weekly Report | 23rd - 29th May 2023

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the fifty-sixth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the fifty-sixth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

XAI Token Market Update

This week SideShift token (XAI) moved within the 7 day range of $0.1090 / $0.1278. At the time of writing the price of XAI is sitting closer to the weekly lows, at a price of $0.1113, and has a current market cap of $14,749,193 (-3.5%) as denoted on our Dune Dashboard.

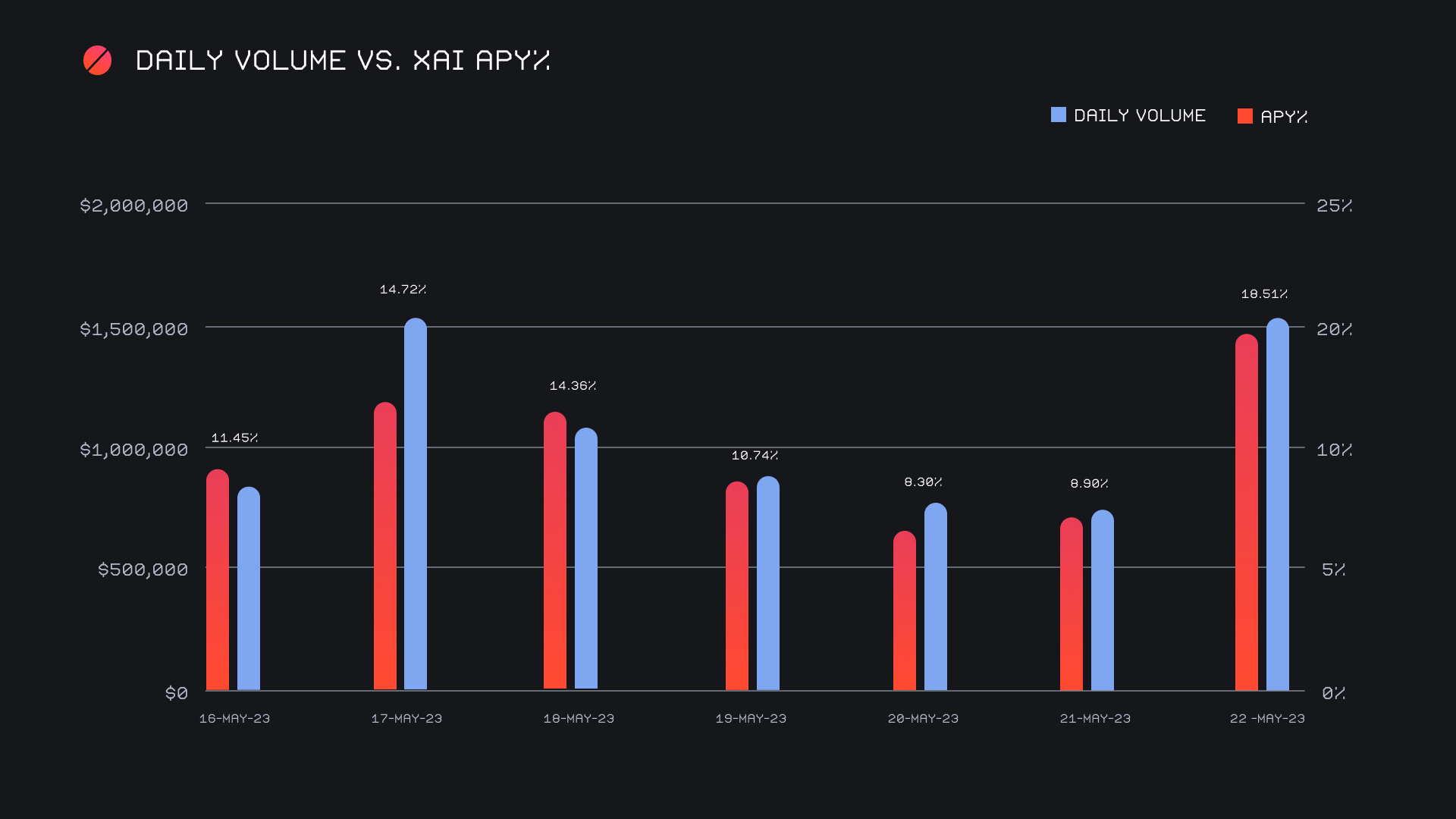

XAI stakers were rewarded with an average APY of 12.59% this week, with a daily rewards high of 46,764.97 XAI (an APY of 18.51%) being distributed to our staking vault on May 30th, 2023. This was following a daily volume of $1.5m. This week XAI stakers received a total of 224,877.73 XAI, or $25,377.23 USD in staking rewards.

In treasury news, an additional 50 ETH was added to our treasury on May 29th, 2023, bringing the current total to $4.64m. A friendly reminder that users can follow along with live treasury updates directly on zapper.fi.

Additional XAI updates:

Total Value Staked: 100,593,167 XAI (+1.1%)

Total Value Locked: $11,613,481 (-4.9%)

General Business News:

The general market spent most of the previous week trending sideways, although it has shown some signs of life in the past couple of days.

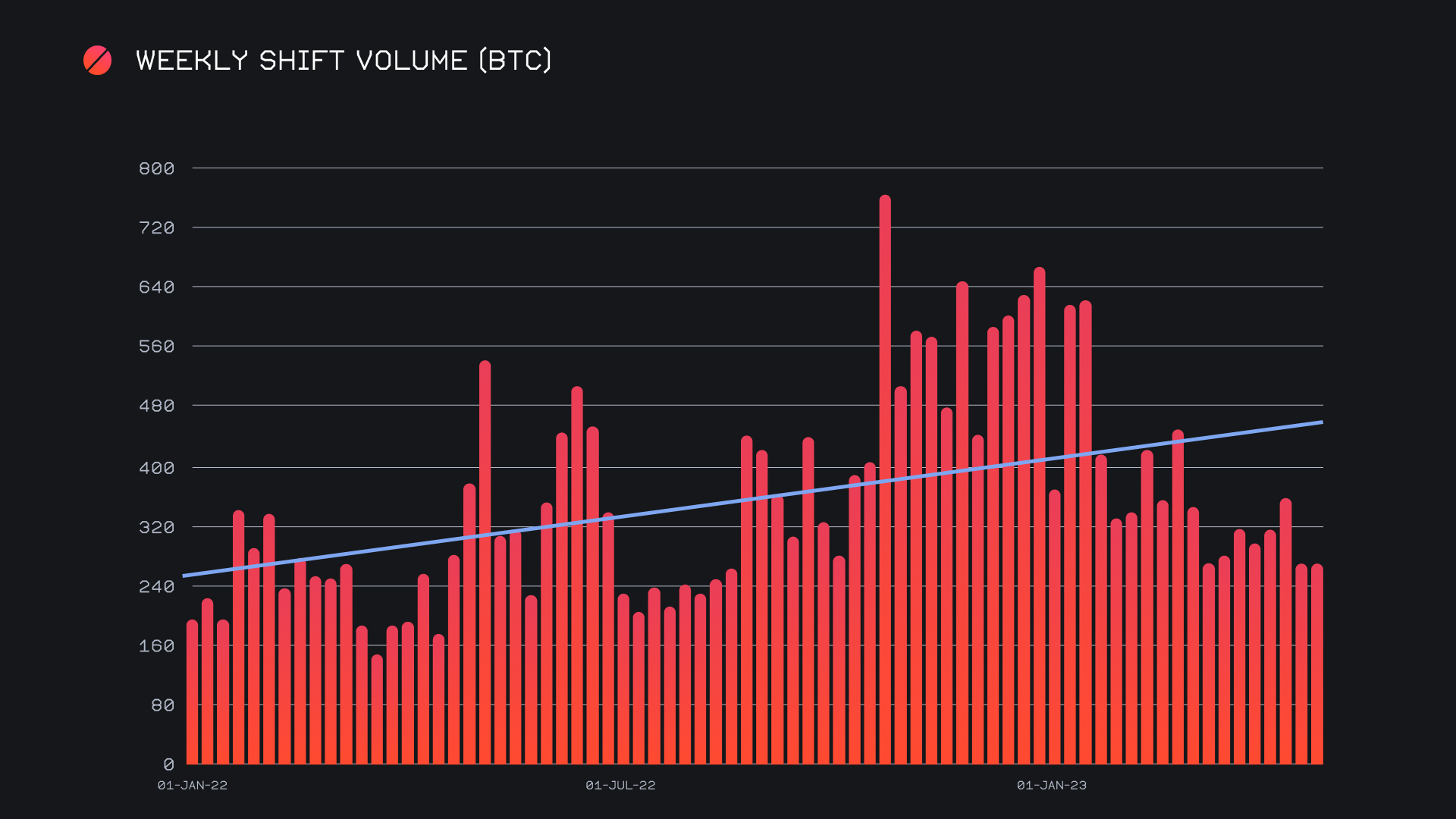

SideShift ended the week with a gross volume of $7.4m (+1.9%) alongside a shift count of 6,850 (+4.1%). Although fairly on par with totals seen last week, it should be noted that these numbers were achieved with a near 20% decline in liquidity shifting - this means that user volume actually increased by a decent amount. Together, these figures combined to produce daily averages of $1.1m on 979 shifts. When denoted in BTC, our weekly volume amounted to 247.04 BTC (+1.9%).

This week was a bit of a mixed bag with half of our top 10 coins seeing volume increases, while the other half saw decreases. As usual, BTC remained the most shifted coin with $3.3m in total volume (deposits + settlements), despite incurring a 5.6% drop. This volume was fairly evenly split down the middle, although settlements did have a slightly higher sum, as user BTC settlements sat atop the list and accounted for $1.5m (+16.4%). This comfortably surpassed user settlements from both ETH and USDT (ERC-20) which had respective volumes of $1.2m (+2.8%), and $818k (-1.0%).

More out of character were the changes noted in user deposit behavior. As expected, BTC ended up being the most deposited coin with $1.4m (-0.3%), but it is coins ranked 3-5 which caught our eye. Third placed ETH jumped 46.8% off of last week’s unusual lows to end the period with $1m. Fourth placed USDT on Ethereum climbed 95.8% for $633k, while fifth placed BNB on Binance Smart Chain spiked an even more impressive 155.2% to finish with $273k. In most cases, this deposit volume appeared to flow into BTC, although, in the case of BNB, the pairing of choice proved to be BNB / USDT (TRC-20), which likely stemmed from one user doing large shift volume with this pair.

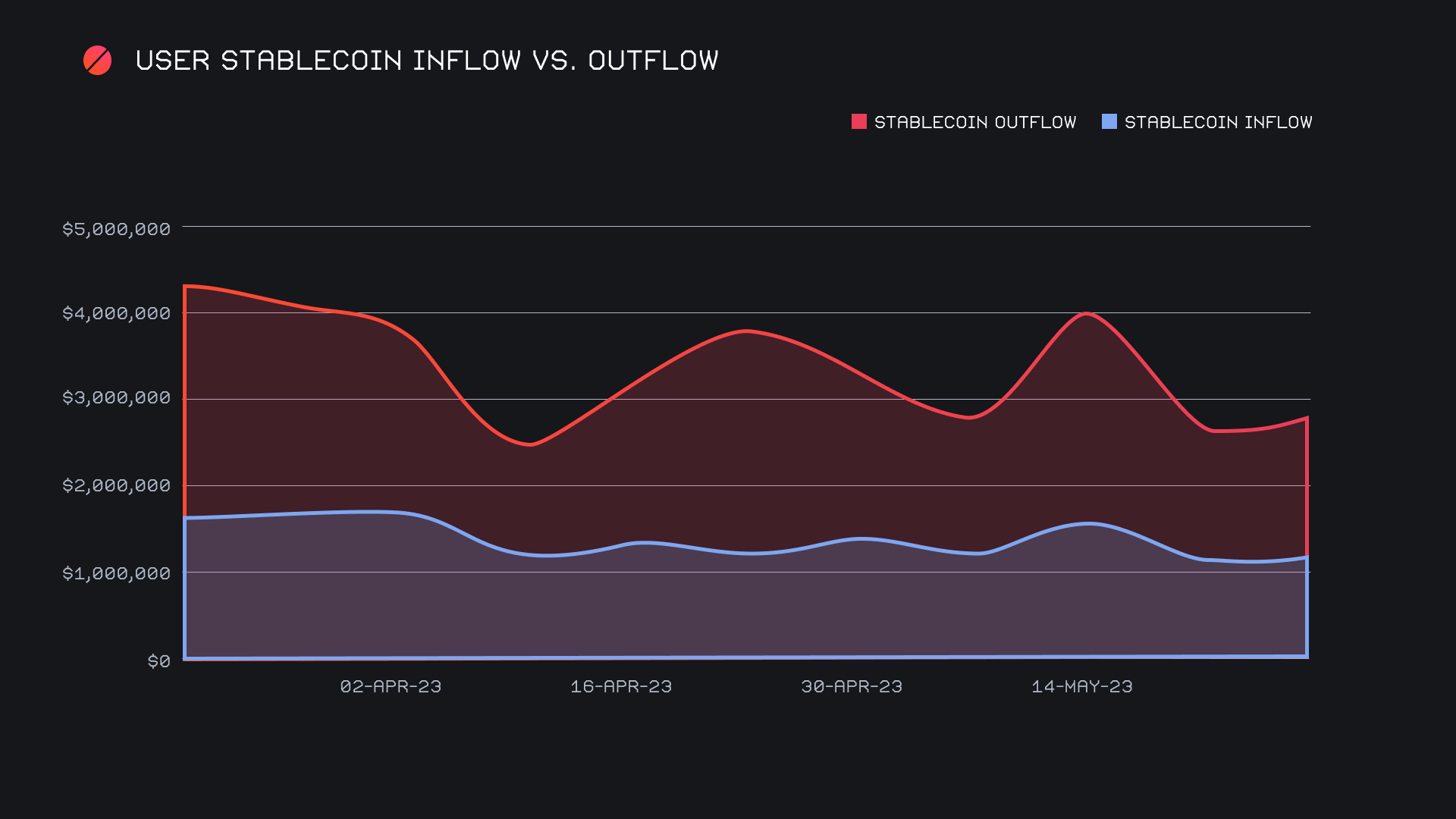

BTC/USDT (ERC-20) remained the most popular pair, despite the rather lackluster volume of $548k, a sum nearly 65% lower than that achieved by the same pair just 5 weeks ago. This pair also contributed to the ongoing trend of general stablecoin flow, with outflow outweighing inflow. SideShift settled ~$1.7m of stablecoins to users this week, as compared to receiving a total of ~$1.2m. A net outflow of approximately $500k was largely due to the high continued demand of USDT on Ethereum by users, much of which comes from integrations.

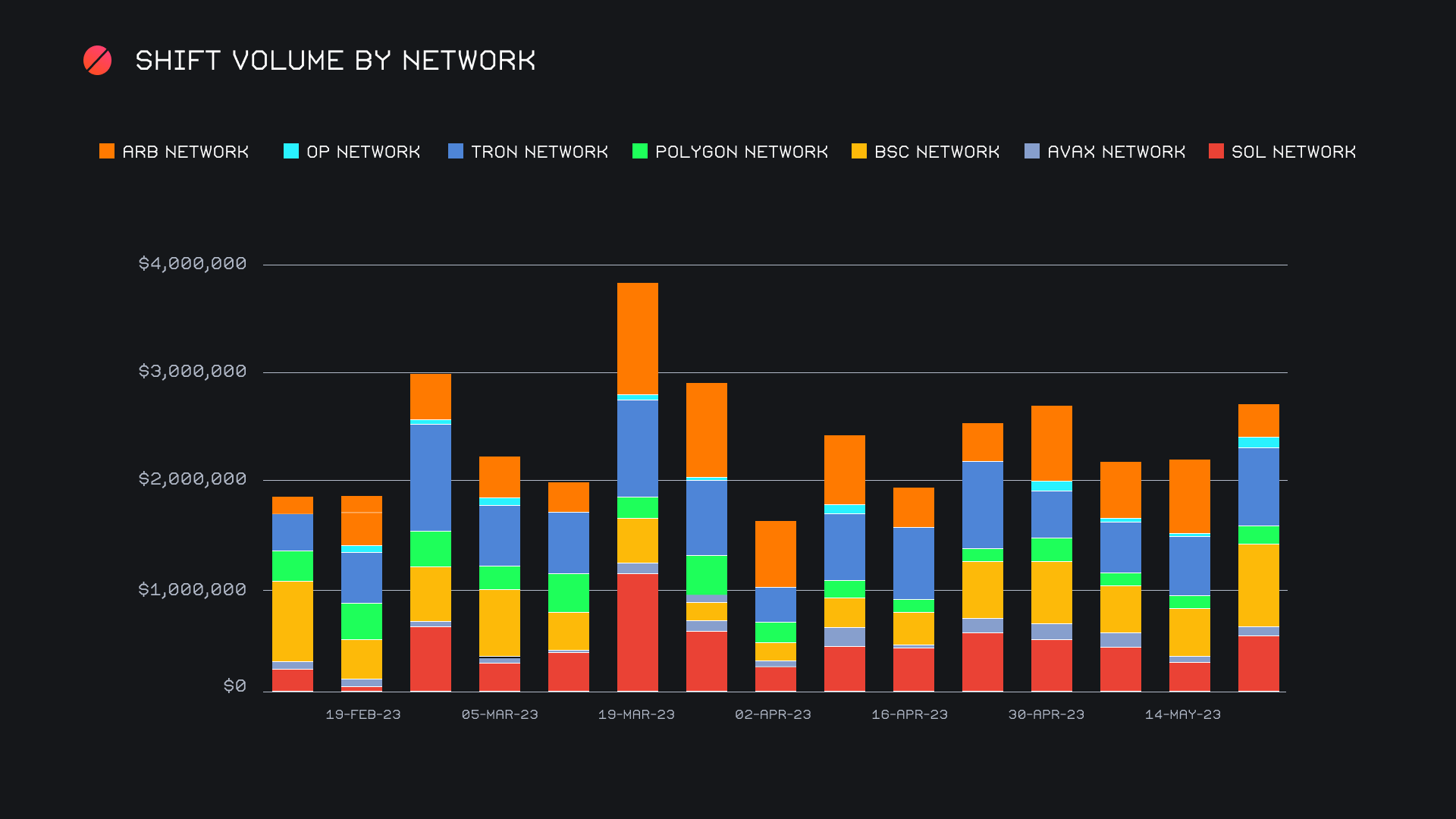

Alternate networks to Ethereum had a very strong week, achieving the highest cumulative weekly volume in the previous 2 months, with $2.7m. Partially thanks to the aforementioned shift pair, the Binance Smart Chain network shot up 74% to seize first place with $775k. This was enough to surpass the Tron network, which still finished with a respectable $719k (+33%). The SOL network also saw sizable growth in shift action, increasing 75% for a third placed finish with $581k. In fact, all alternate networks saw double-digit growth percentages, with the exception of the Arbitrum network, which fell off sharply. Total Arbitrum shifts plummeted 54.3% and finished with $286k after seeing three consecutive weeks above the $500k mark. A decrease in USDC on ARB shifts played a key role in this general decrease. All together, alternative networks to Ethereum made up 36.5% of the total volume on SideShift, which is a healthy increase from last week’s 29.4%, showing the continued popularity of these networks.

In listing news, it was a very big week for SideShift as we added support for 8 new assets. These include USDT, DAI and WBTC on the Optimism network, RAI, PENDLE, EUROC, and BIT on the Ethereum network, in addition to SUI. The addition of these coins helped us firmly cross a benchmark, as we now support over 100 different coins. Shifting to all of these newly added coins is now live, from any coin of your choice.

Affiliate News

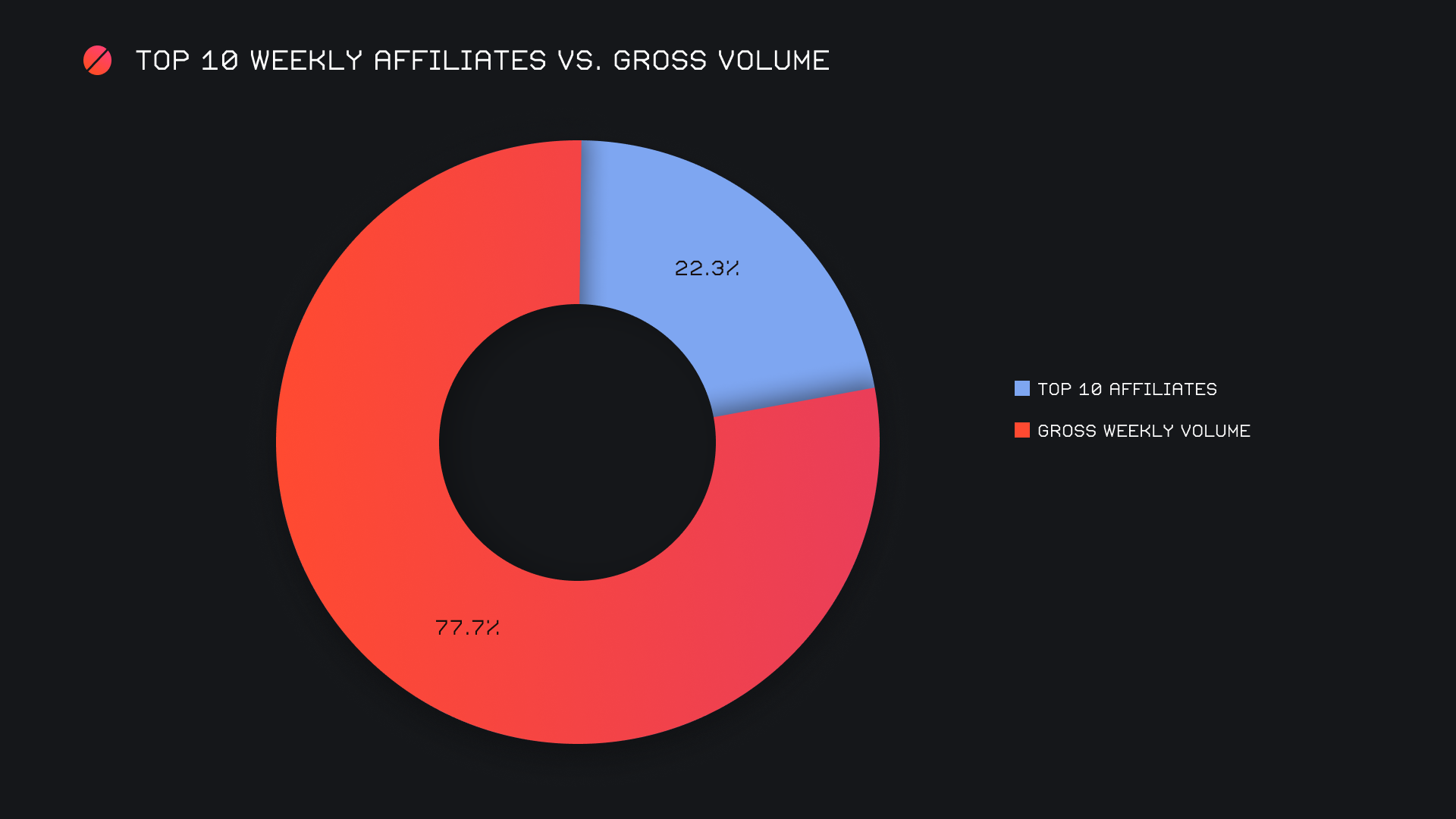

Our top 10 affiliates also had a solid week, rebounding +21.9% for a net $1.7m in combined weekly volume. Interestingly, shift count for these top affiliates actually declined by 3% for 1,678 shifts, thereby suggesting an overall larger average size coming from top affiliates this week.

Our first placed affiliate performed better than last week, and accounted for 11.3% of the weekly volume and a steady 12.1% of weekly count. Overall, the top 10 represented 22.3% of our weekly volume, 3.6% higher than last week’s proportion.

That’s all for now. Thanks for reading, happy shifting and we’ll see you next time.