SideShift.ai Weekly Report | 3rd - 9th September 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one-hundred-and-twenty-first edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and twenty first edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week, SideShift token (XAI) saw an initial drop early in the period, falling towards the $0.13 level before gradually recovering. The token moved within the 7-day range of $0.1325 / $0.1435 and, at the time of writing, is in the middle of that range with a price of $0.1372. XAI’s market cap is now $19,000,517, reflecting a -5.02% decline from last week’s $20,005,072.

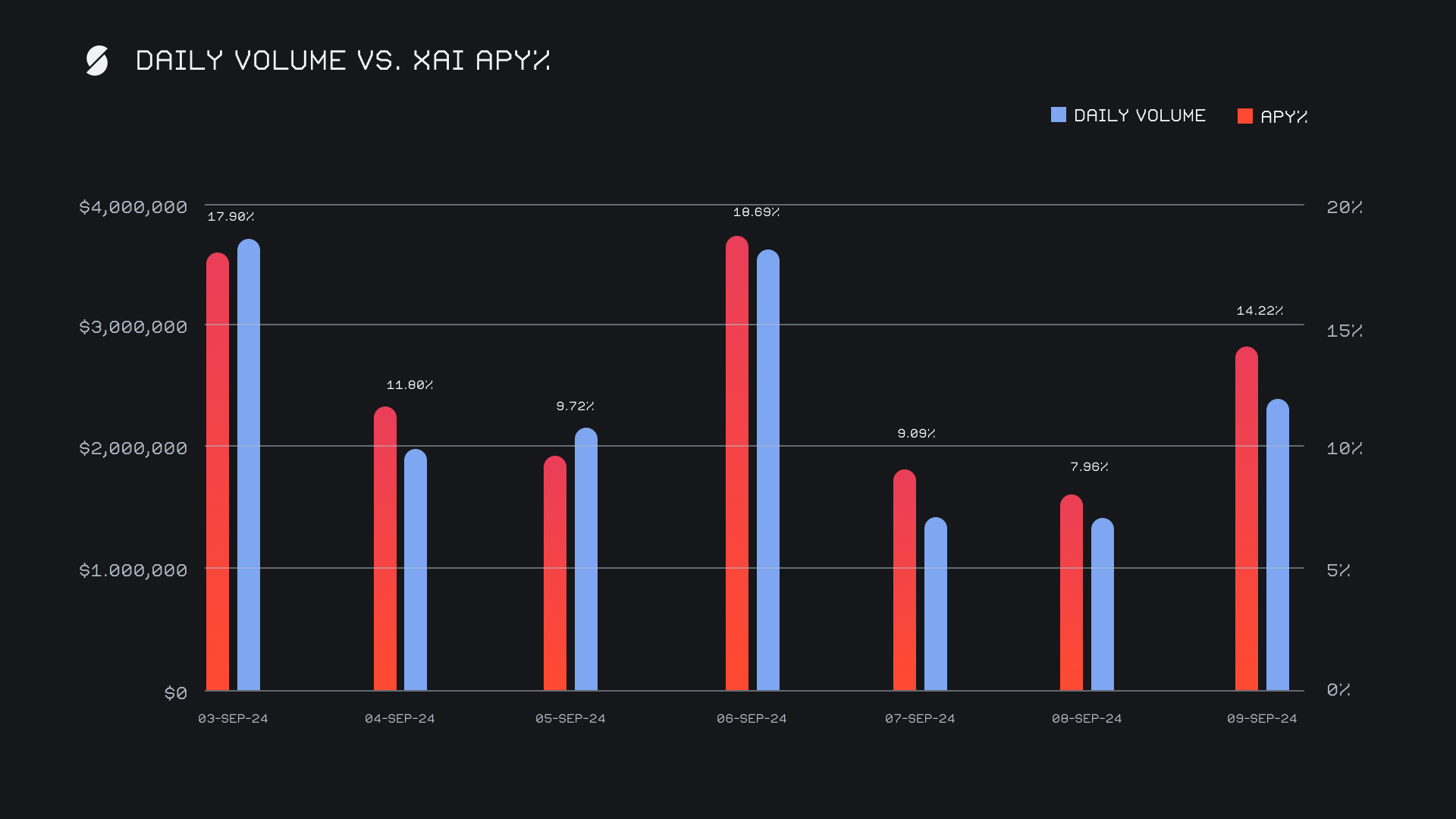

XAI stakers were rewarded with an average APY of 12.77% for the week. A daily rewards high of 58,148.67 XAI (APY of 18.69%) was distributed on September 7th, 2024, following a daily volume of $3.6m. In total, XAI stakers received 283,999.8 XAI or $38,964.78 USD in staking rewards.

Additional XAI updates:

Total Value Staked: 124,084,345 XAI (+0.2%)

Total Value Locked: $17,191,638 (-6.0%)

General Business News

The crypto market displayed strength this week as Bitcoin reclaimed the $57,000 level, signaling a potential bottom after weeks of uncertainty. Traders viewed the weekly close above key support as a positive indicator for further upward movement. Ethereum mirrored Bitcoin’s upward momentum, holding steady around $2,350. Meanwhile, Cardano saw a price boost following the announcement of FET token deployment on its blockchain, driving active address activity to a five-month high.

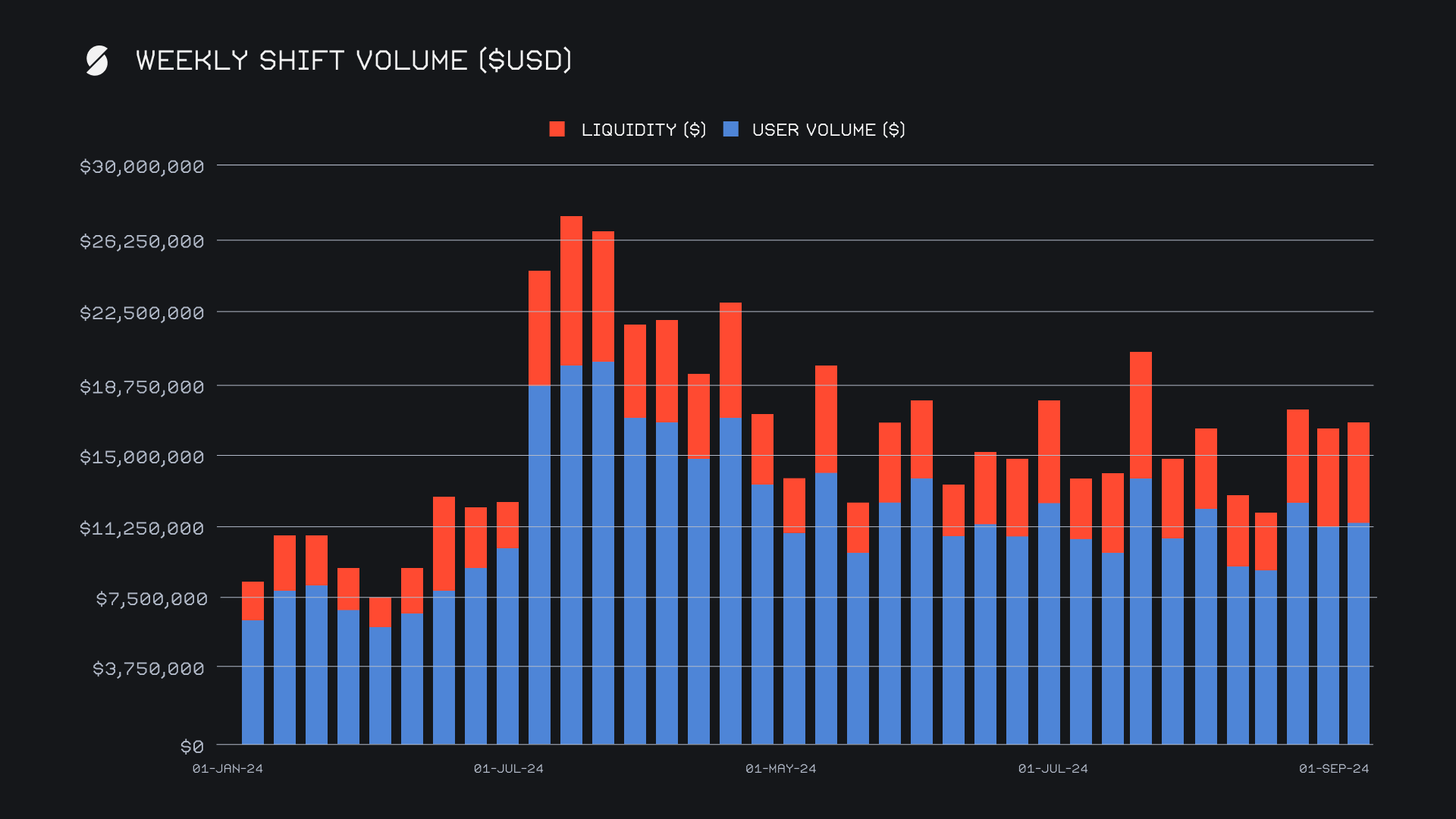

This week, SideShift maintained a strong performance, generating a gross weekly volume of $16.69 million, a +1.9% increase compared to last week. The steady rise in volume despite some broader market uncertainty, highlights SideShift’s use case and ongoing strength. On a daily basis, SideShift averaged a solid $2.38 million in volume, with much of this volume being driven by shifts through top integrations. Overall, we saw little to no change in the composition of our weekly volume, with $5.1m coming from liquidity shifting, and the remaining $11.6m deriving from user shifts. This week’s gross volume ended +6.5% higher than our YTD running average.

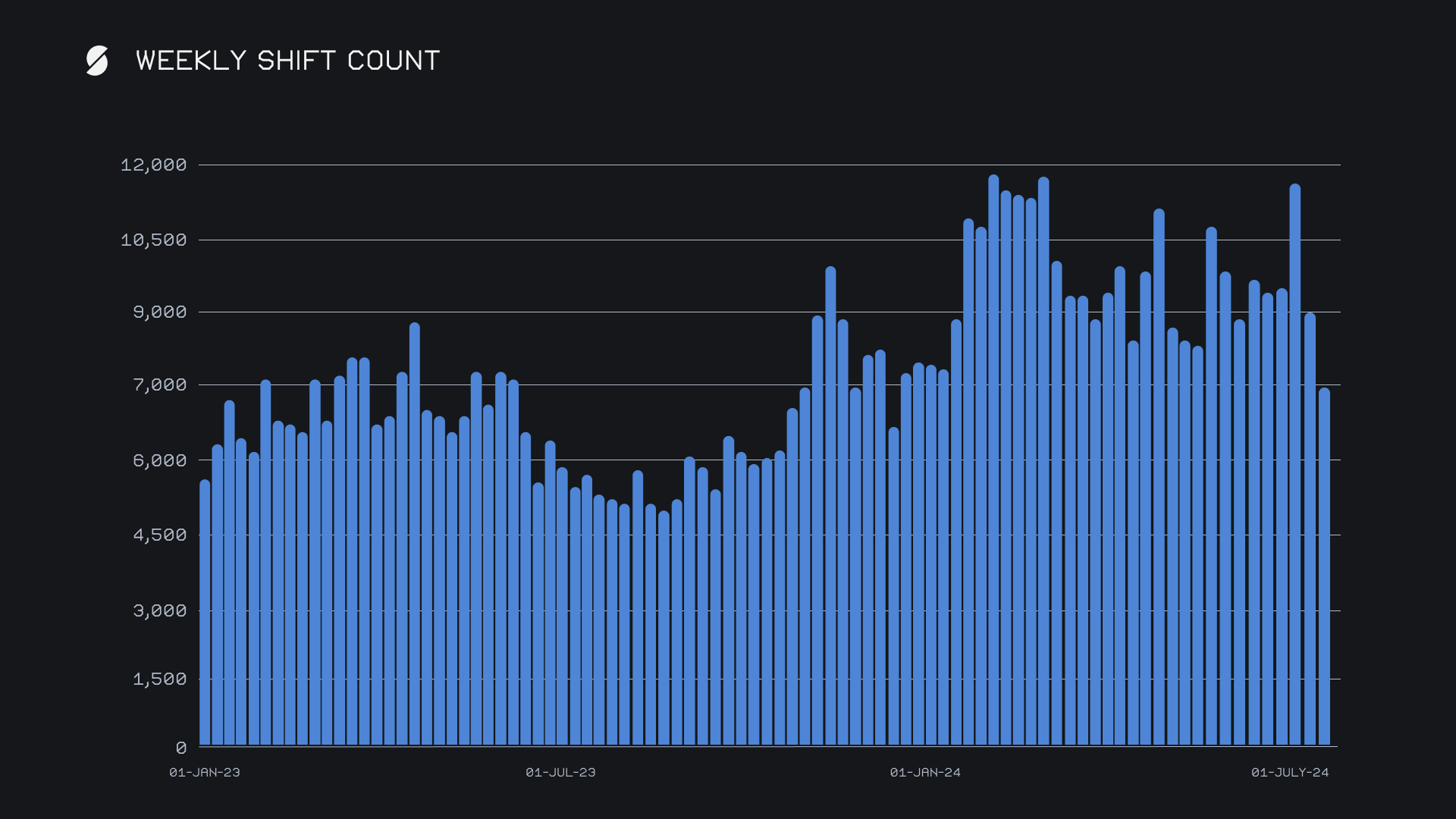

Meanwhile, our total shift count saw a notable decline and dropped to 7,496 shifts, a -16.5% decrease as compared to the previous period. This dip suggests a shift toward larger individual transactions, which boosted overall volume even as fewer shifts were performed. On average, SideShift handled 1,071 shifts per day, reflecting this ongoing trend of higher-value shifts dominating the week’s performance. BTC/USDT (ERC-20) re-emerged as the week’s most popular user pair, ending with $1.4m on some generally high value shifts.

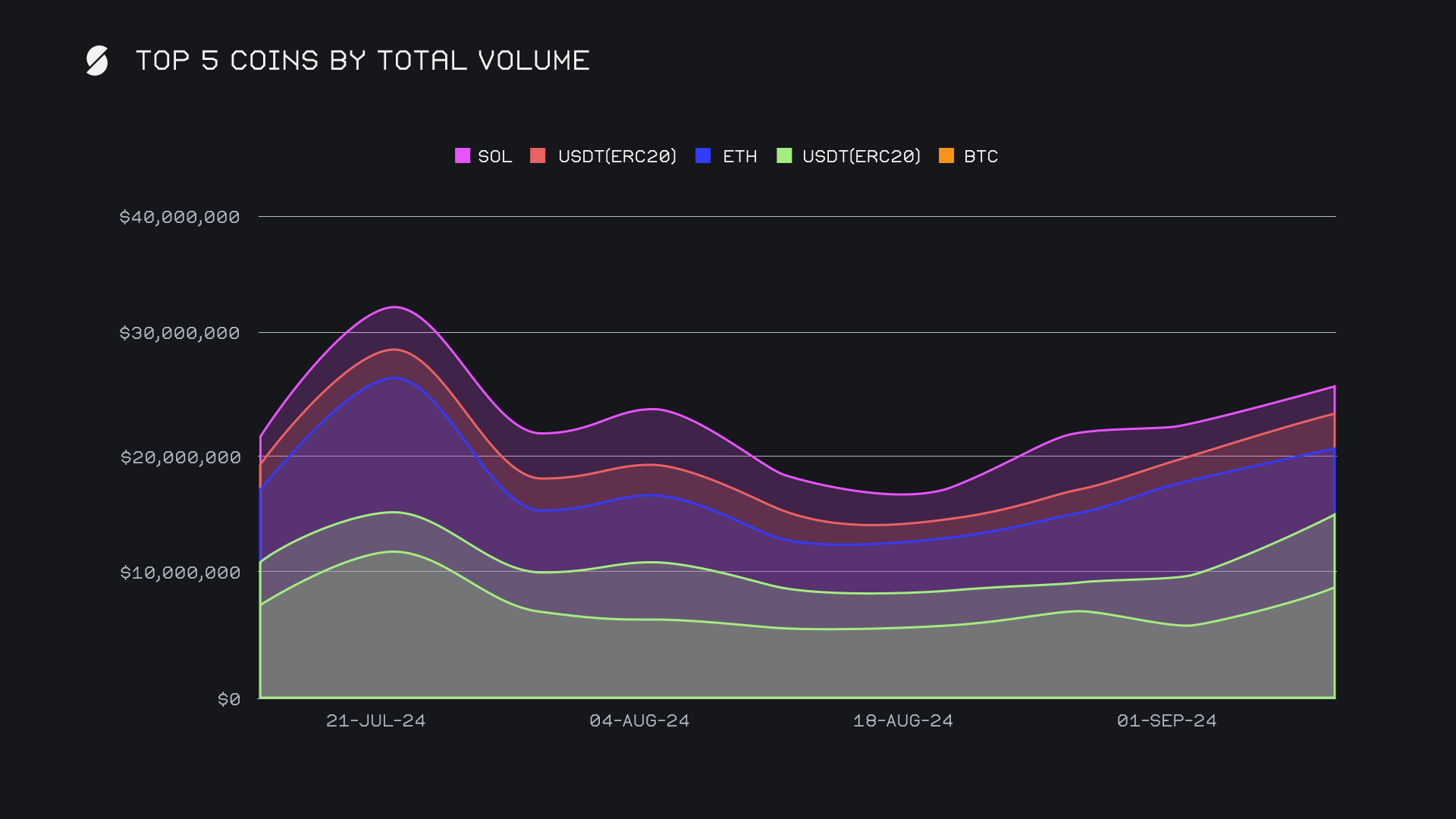

BTC led the pack this week with a total volume of $9.0m, marking a strong +47.3% increase compared to the previous week. The split between deposits and settlements was fairly even despite different behaviors, with deposits accounting for $2.9m, a +28.4% rise, while settlements surged to $3.1m, up +78.8%. The sharp increase in settlement activity indicates a heightened demand for shifting out of BTC, likely in response to favorable market conditions during the week.

USDT (ERC-20) followed in second place with $6.1m in total volume, a +44.3% rise from last week. Deposits came in at $1.5m, showing an outstanding +193.8% increase, while settlements ended at $2.5m, rising by a more modest +19.9%. This rise in settlement volume indicates that while there was a rush of users looking to shift into other assets following the market bounce, USDT remains popular for storing value. However, it was not just USDT (ERC-20) which noted a rise in activity - stablecoins as a whole on SideShift enjoyed a cumulative +25% jump in shift action, following the same pattern as the group leader, USDT (ERC-20).

ETH slipped to third place this week with a total volume of $5.4m, down -30.7% compared to last week. While deposits saw a modest increase of +8.3%, reaching $2.0m, the real story lies in settlement volume, which dropped sharply by -42.5%, also ending at $2.0m. This decline in settlement activity contrasted sharply with Bitcoin’s rising settlement demand, causing Ethereum to fall behind in overall rankings. The reduced demand for settling ETH positions was the primary factor in its slump to third place, reflecting a shift in user preferences for other assets like BTC.

Outside of our top 5 coins, a handful of others enjoyed noteworthy rises in shift volume. Standing out the most was 6th placed LTC, which rocketed +244% for $1.8m, an uncharacteristic spike. XRP and L-BTC also witnessed triple digit gains, ending with respective total volume sums of $626k and $321k. Conversely, BCH shifting screamed to a halt after an explosion last week, and fell -92% to a more typical sum of $190k.

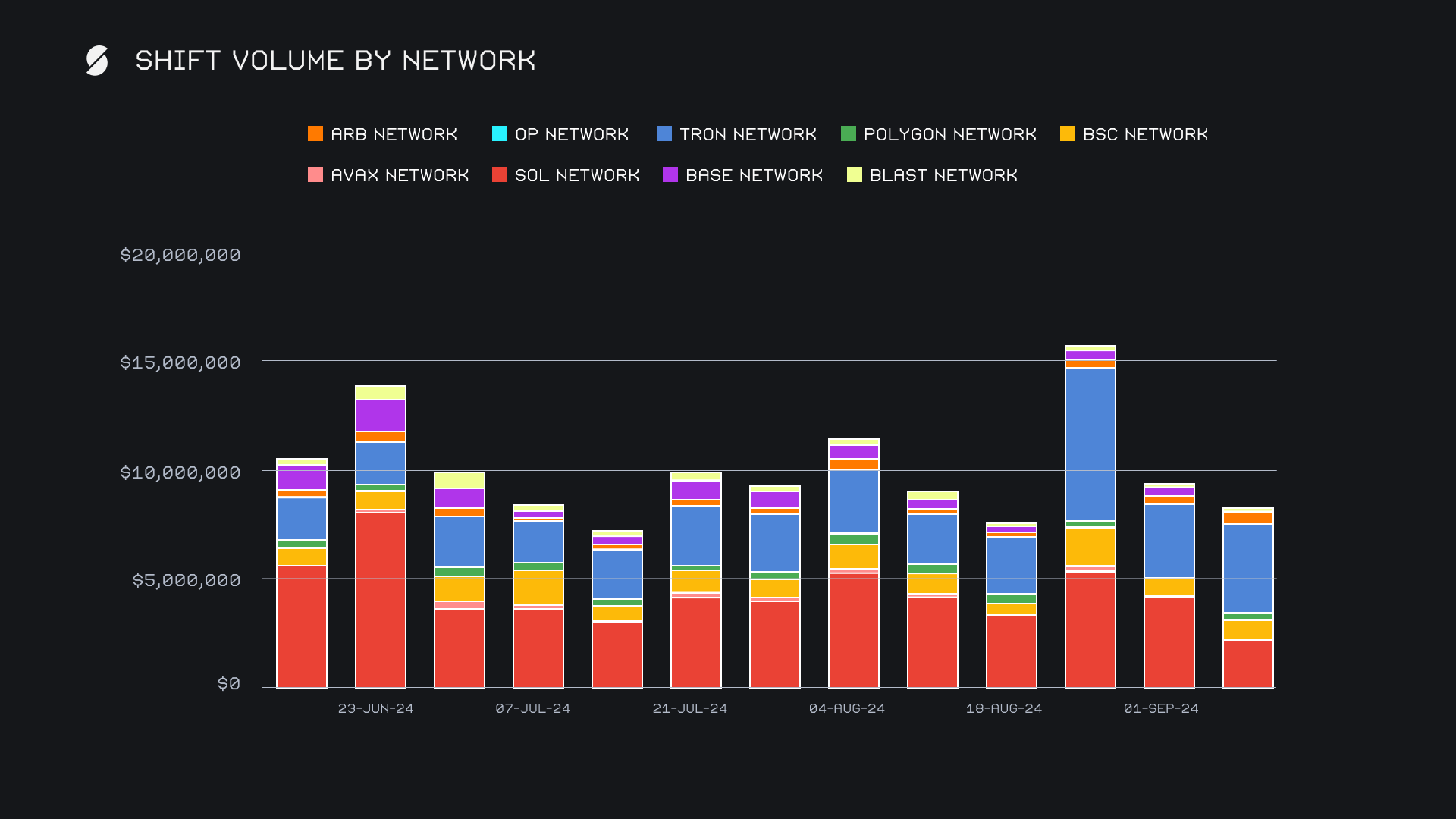

Among alternate networks to ETH, the Tron network overtook Solana for just the second time in the past three months, fueled by a +75% jump in USDT (TRC-20) shifts. The Tron network ended with $4.2m in total volume, up +22.3% from last week, demonstrating continued strength in stablecoin transactions. Meanwhile, the Solana network, which has been a consistent leader, saw a steep decline in activity and dropped by -46.1% to $2.2m, as users have turned their attention elsewhere. The Binance Smart Chain (BSC) network managed to hold third place with a total volume of $849k, marking a +13.5% increase. The Arbitrum network followed next, recording a decent +47% rise to $482k, but on lower overall volume. For the time being, it is clear that the emphasis is being placed on Ethereum as opposed to alternate networks - the Ethereum network ended up accounting for 37.2% of weekly shift volume as compared to alternate networks' combined proportion of just 24.6%.

In general news, SideShift is still working towards finalizing our integration with Ledger. Another important announcement is the SideShift telegram bot, allowing users to shift any supported token without ever leaving the Telegram app. If you are interested in testing the beta version, feel free to join our dedicated group.

Affiliate News

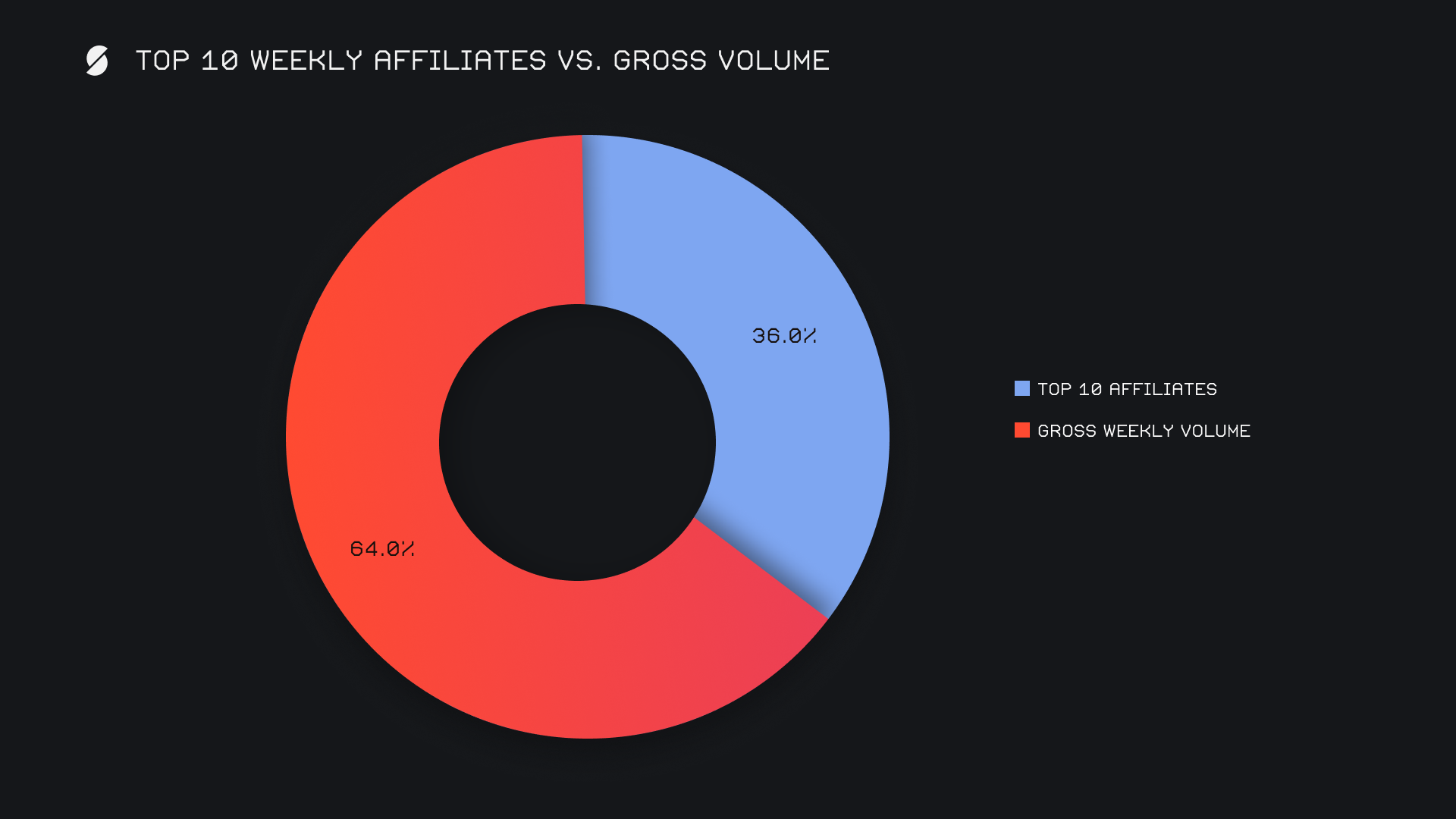

This week our top affiliates generated a combined total volume of $6.0m, representing a +4.5% rise from the previous period. There were no newcomers, but a reshuffling among the order. Our former second-place affiliate rose to the top with a total of $2.7m, a solid increase of 43.3%. Meanwhile, the previous first-place affiliate slid to third, recording $485k after a -77.7% decline. Second place remained unchanged, finishing the week with $2.6m, a significant +76.3% increase, in addition to an always steady shift count of 1,018. Together, our top affiliates accounted for 36% of our weekly volume, a +0.9% increase from last week's proportion.

That’s all for now. Thanks for reading and happy shifting.