SideShift.ai Weekly Report | 5th - 11th December 2023

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the eighty-fourth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the eighty-fourth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

SideShift token (XAI) has been making moves recently, stepping its way higher from the beginning of the week to the end. Throughout the 7 day period it moved within the range of $0.0917 / $0.1170. At the time of writing, XAI is keeping up its momentum at the top of the range and looking to push higher, with a current price of $0.1173. The market cap of XAI saw another sizable increase this week, and is currently measured at $14,997,215 (+27.2%).

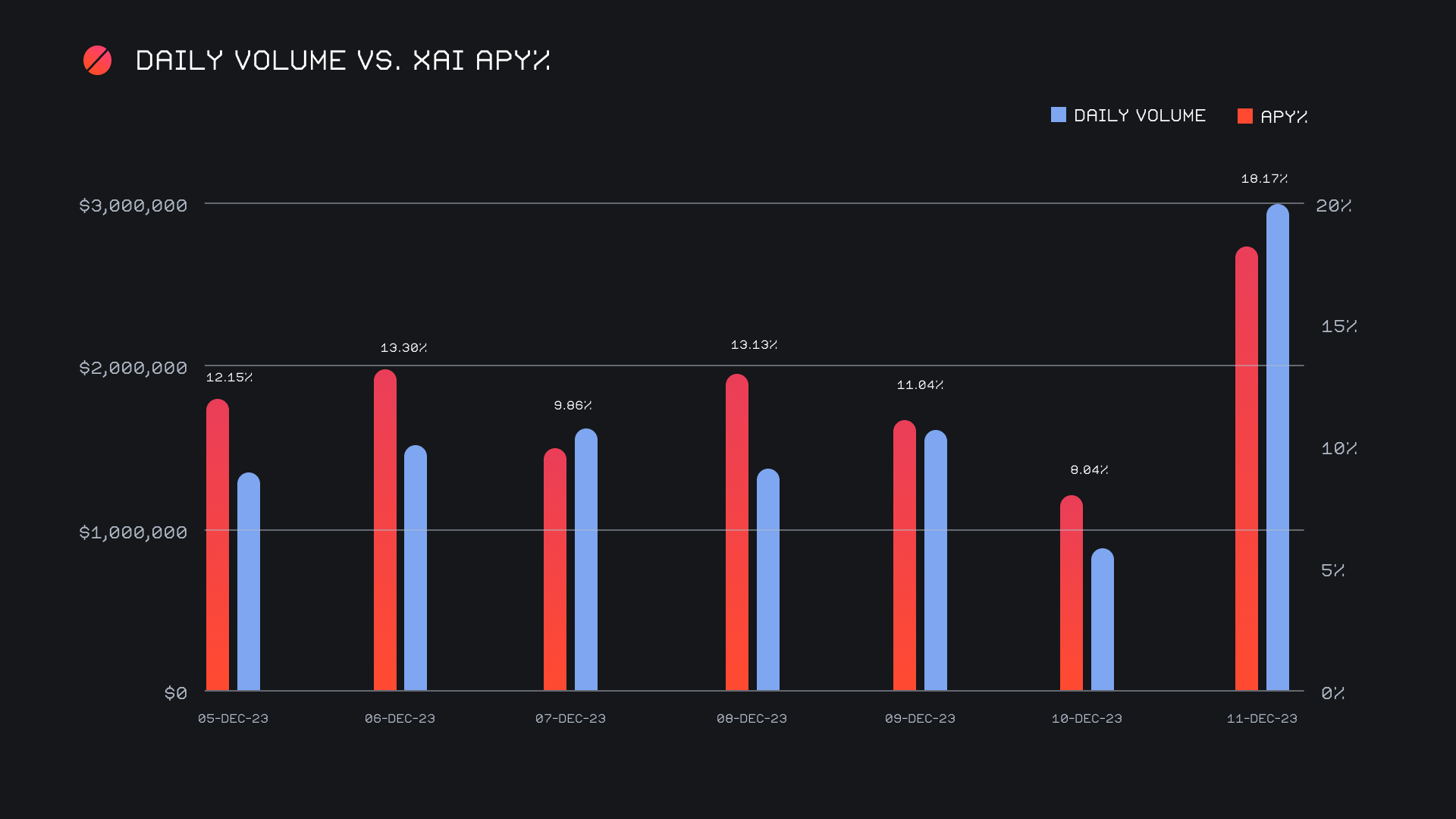

XAI stakers were rewarded with an average APY of 11.25% this week, with a daily rewards high of 52,242.13 XAI being distributed to our staking vault on December 12th, 2023. This was following a hefty daily volume of $3.1m. This week XAI stakers received a total of 251,626.06 XAI or $28,460.68 USD in staking rewards. As outlined by the growth of XAI’s ‘total value locked’ shown below, there has been a recent influx of users wanting to stake XAI.

The price of 1 svXAI is now equal to 1.2659 XAI, representing a 26.59% accrual on stakers investments. A friendly reminder that the easiest way to participate in XAI staking is to shift directly to svXAI, from any coin of your choice.

An additional 50 ETH was added to SideShift’s treasury on Friday, December 9th. The recent market drawdown saw this total fall slightly, and it has a current valuation of $7.0m. Users are encouraged to follow along directly with live treasury updates, via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 114,315,658 XAI (+0.4%)

Total Value Locked: $13,488,159 (+27.2%)

General Business News

The week opened on a strong note, with BTC thrusting upwards to yearly highs, an area where it would spend most of the 7 day span. However, as the week came to a close, a sharp dip retraced most of the upwards move, spurring $500m of long liquidations along the way. Other L1s such as Solana and Cardano seemed unbothered and carried on to record monster gains.

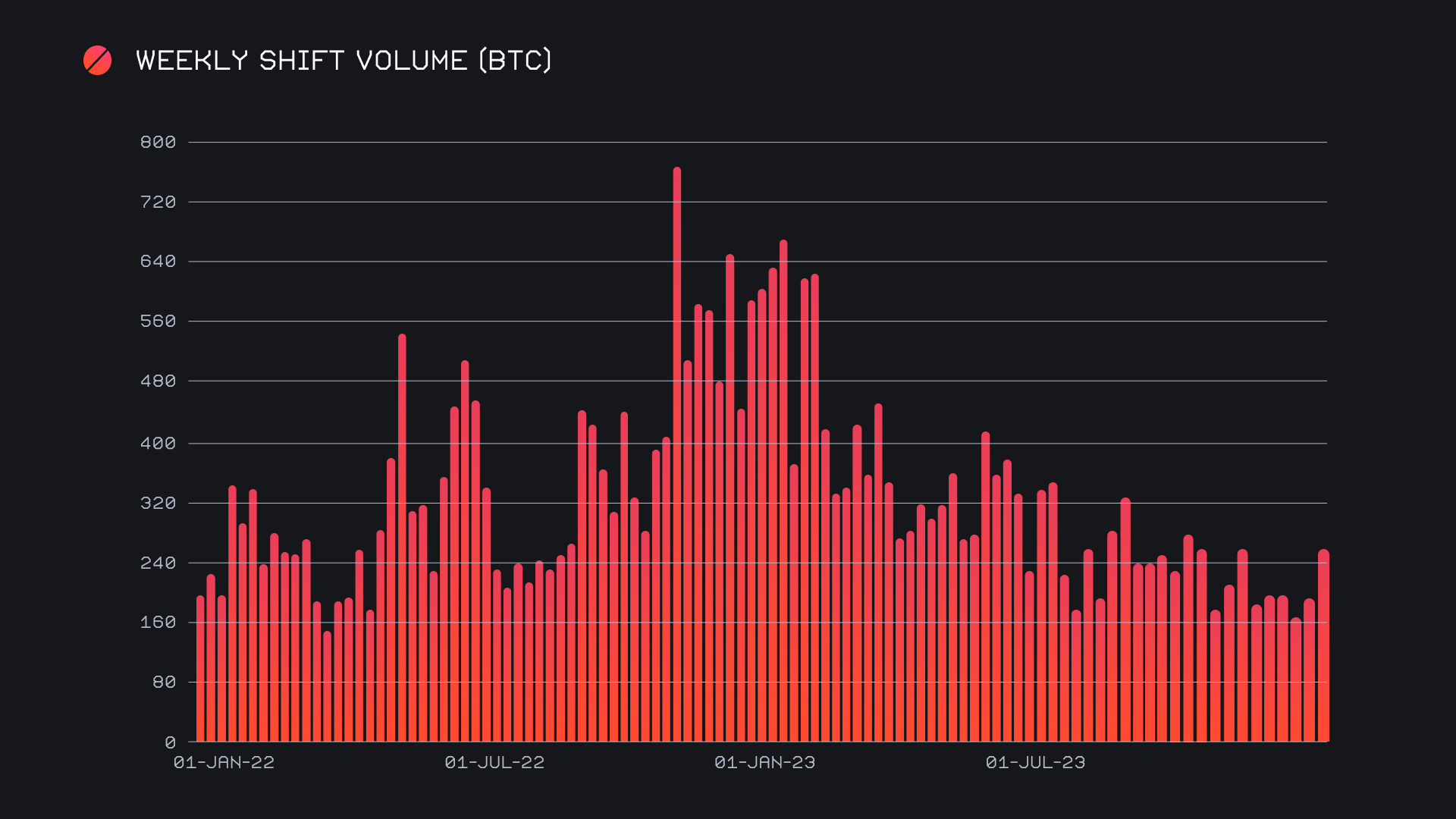

SideShift had a very strong performance and saw gross volume boom by +51.4% to end with $11.4m. This move occurred alongside a gross shift count of 8,893, a respectable increase of +20% from last week, and representing SideShift’s highest weekly shift count ever. Despite the record setting influx of shifts, SideShift experienced no downtime nor incurred any significant issues. The above figures combined to produce solid daily averages of $1.6m on 1,270 shifts. When denoted in BTC, our weekly volume amounted to 261.68 BTC (+36%), a slightly lower percentage gain due to the general appreciation of BTC’s price throughout the week.

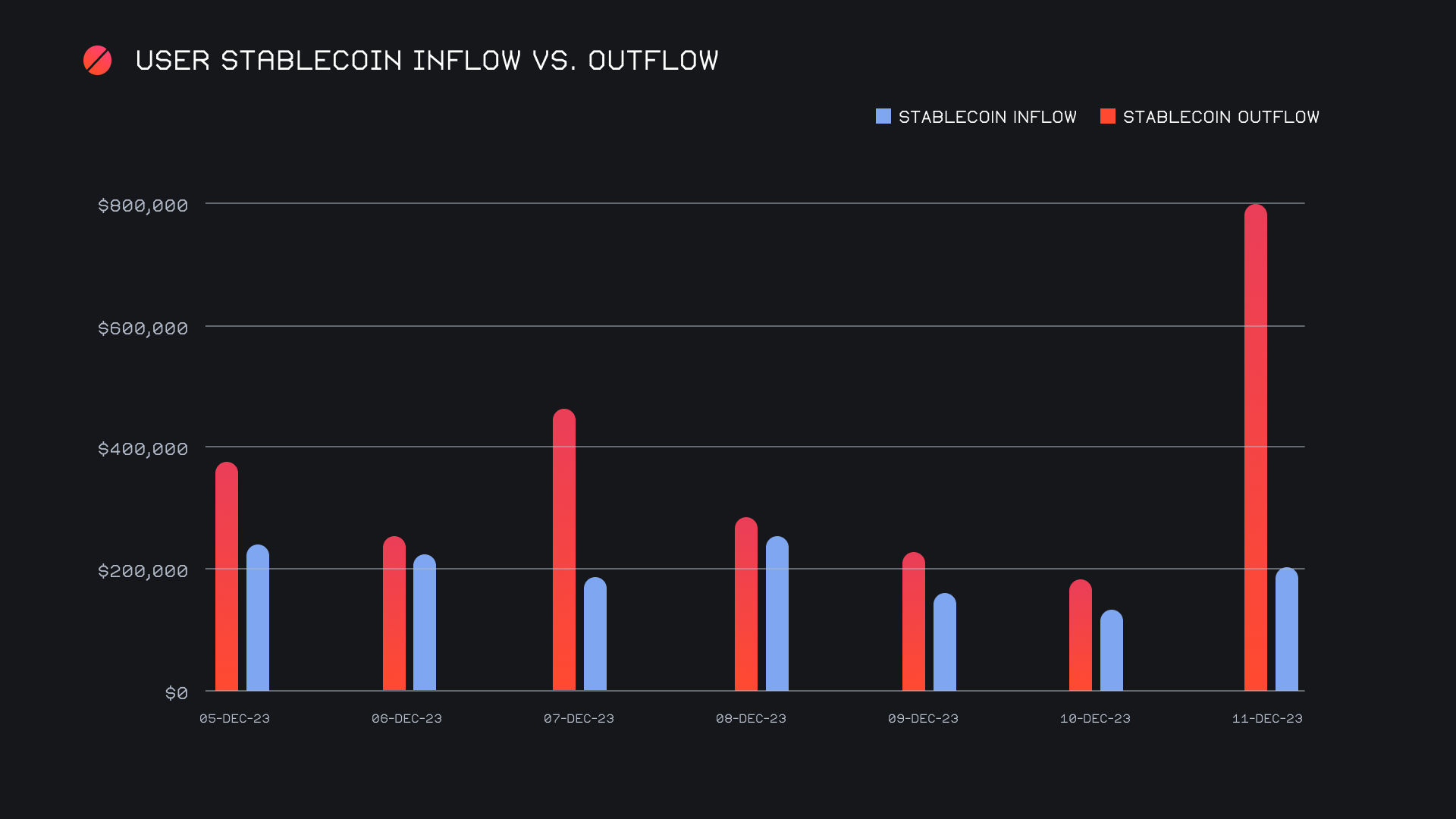

Our biggest volume day of $3.1m unfolded on Sunday the 10th, coinciding with the market flush. It was unusual to see such large volume occur on a weekend, but it was evident that users were quick to protect their capital by rushing to stablecoins when the markets turned red. USDT (ERC-20) was the clear choice for users. This quick downwards move resulted in a weekly stablecoin flow which heavily favored settlements, as we ended the period with a net stablecoin outflow of -$1.3m, our biggest discrepancy in some time.

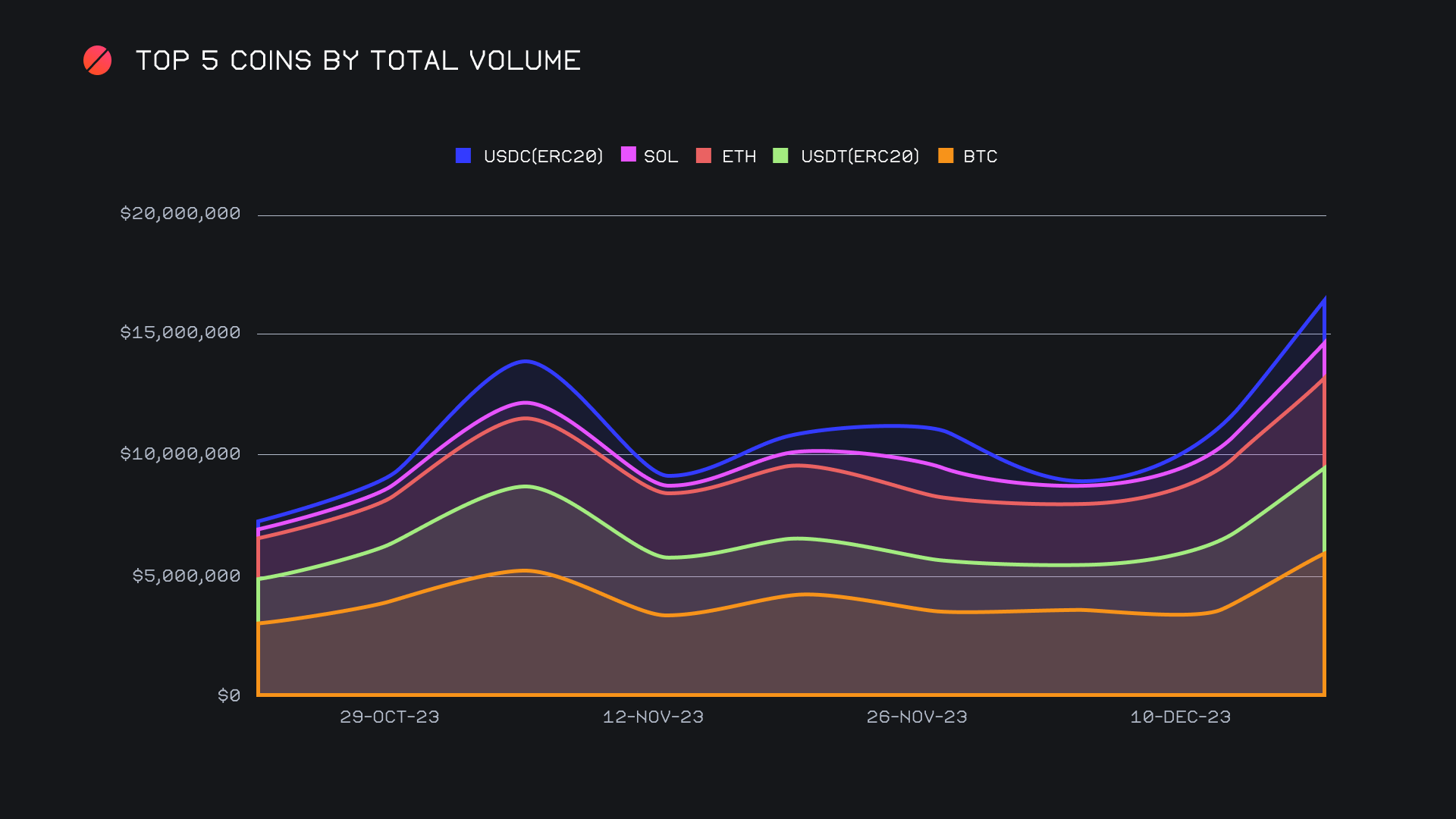

Our top 5 coins by total volume (deposits + settlements) combined to chart a steep climb, as they cumulatively broke through the $15m milestone. Although nearly all coins saw growth in shift volume, there was none more significant than BTC. As our top coin, it saw its total volume spike +82.7% to end with an impressive $6.2m overall. Quite a ways behind that sat second placed USDT (ERC-20) with $3.8m (+45.3%), and third placed ETH with $3.7m (+26.7%), respectable runs but not nearly as noteworthy as BTC.

With that in mind, the source of these volume surges differed. BTC saw a considerable wave of user deposits flow in, increasing +85% from last week to sum just over $3m. This was still most commonly shifted to USDT (ERC-20), as the BTC/USDT (ERC-20) pair tallied $1.6m this week, 3x more than any other pair. A large portion of this occurred on Sunday, December 10th. Meanwhile, BTC settlements sat at less than half of that value, rising just +4% for $1.4m and thereby indicating a somewhat waning interest from users.

Conversely, the bulk of the volume for USDT (ERC-20) and ETH came from user demand. They ended with respective settlement totals of $1.9m and $1.7m, both exceeding +40% increases on the week, and finishing as our top two most settled coins for users. This, along with the increased activity on SideShift of other large cap coins such as SOL, BCH and AVAX tells us that users are slowly gravitating away from BTC, and seem more interested in holding other assets in an uptrending market.

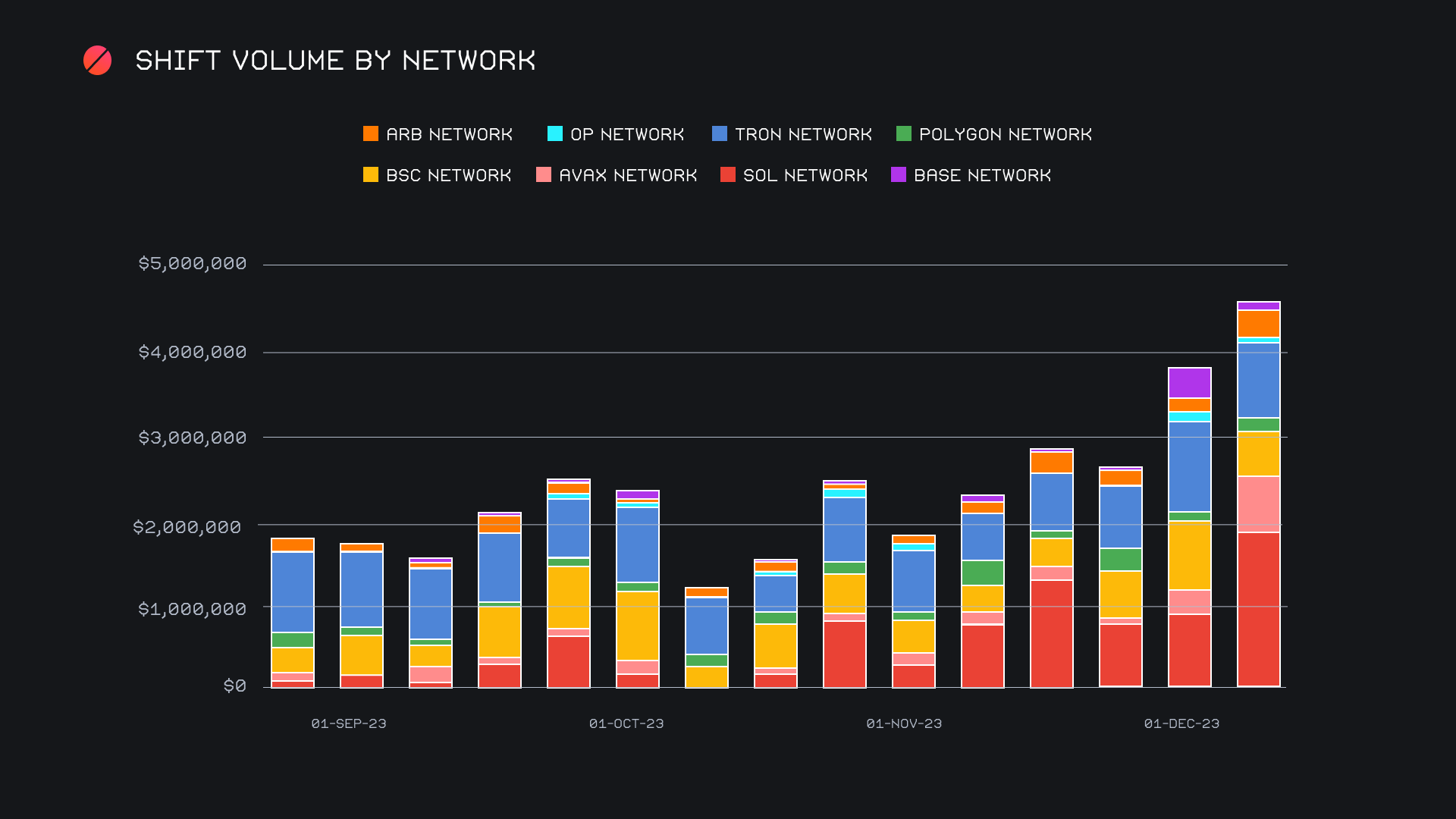

Another indication of the sentiment shift for users is the continued performance of alternate networks to ETH. Their cumulative sum has now risen for the third consecutive week, summing to end this one with a total $4.6m (+20.2%). The strength of the Solana network is hard to deny, as it visibly led the way with $1.9m in shift volume. This was nearly a doubling from last week (+94%), and with the current sentiment and on chain activity, it doesn’t seem like it's showing any signs of slowing down soon. Other networks produced somewhat of a mixed bag, with about half increasing and half falling. The TRON network ended in second place with $886k (-17.7%), with its usual USDT (TRC-20) representing a majority of this volume. The Avalanche network screamed into third place with $638k, boasting a massive weekly change of +157%. This represented the largest weekly change by any alternate network, and was no doubt due to the outstanding performance of the AVAX token this past week.

Alternate networks to ETH combined for about ~20% of our weekly shift volume, a decrease from last week’s proportion, but with a higher nominal amount. Very importantly however, this change was less drastic than that of the Ethereum Network, which saw its proportion drop by -8.4%. This means that in spite of the ongoing demand for ETH, the dominance of the Ethereum network is lessening, and users are branching out more and more.

Affiliate News

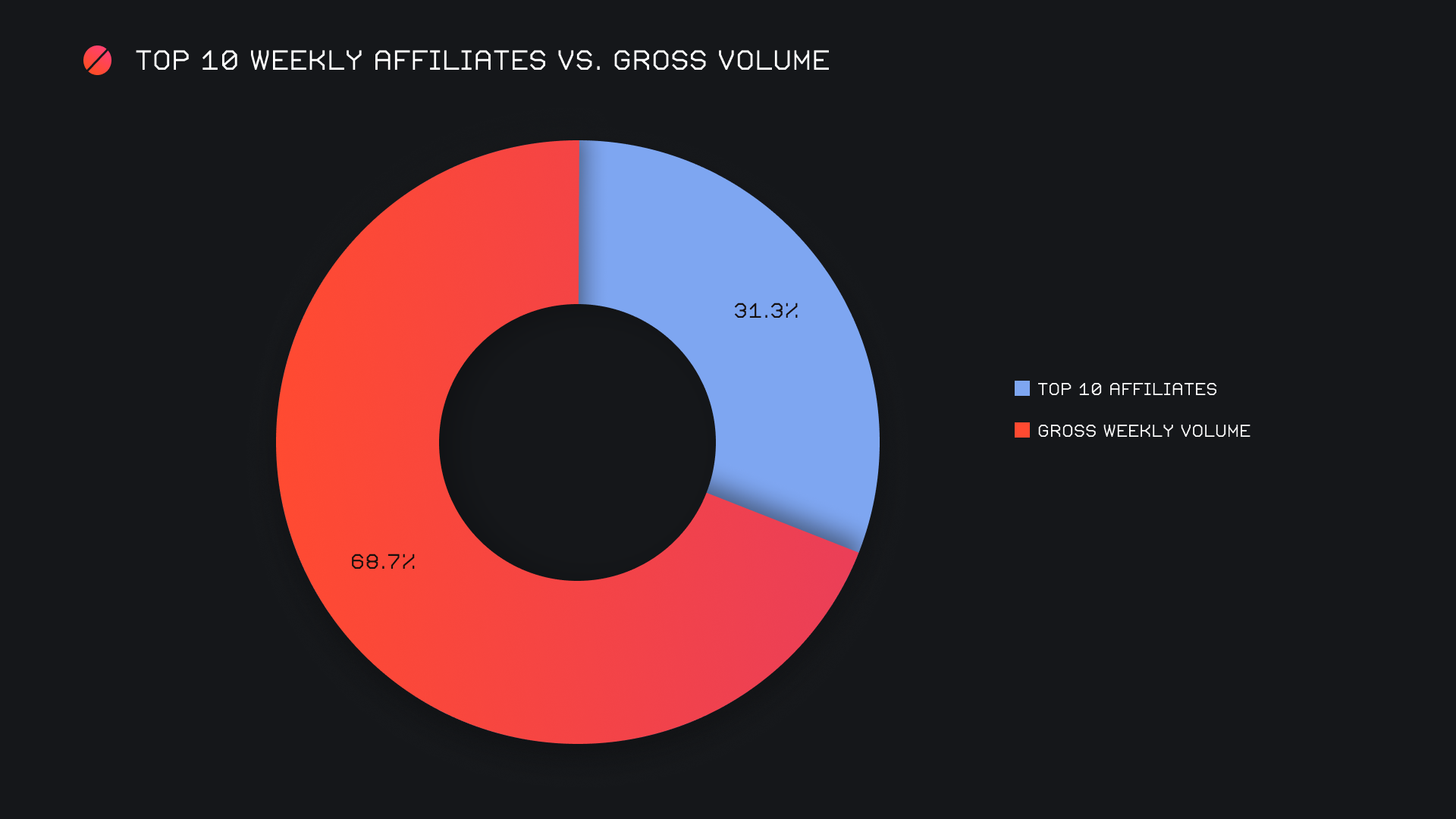

Our top affiliates combined for a powerful $3.5m, an increase of +47% from last week’s sum. This substantial rise took place despite a decline in shift count, which dipped -12% for a gross 2,360 shifts. The driving force behind this strong volume can be credited to our first and second placed affiliates, both of which generated nearly $1.5m for the week. For our top affiliate, this was achieved even though its shift count represented a mere 3.2% of our weekly total count.

Overall, our top affiliates accounted for 31.3% of our weekly shift volume, a minor change of -0.8% from last week’s proportion.

That’s all for now. Thanks for reading, happy shifting and we’ll see you next time.