SideShift.ai Weekly Report | 10th - 16th September 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one-hundred-and-twenty-second edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and twenty second edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week, SideShift token (XAI) traded within a 7-day price range of $0.1372 to $0.1489, maintaining a stable trajectory. At the time of writing, XAI’s price has risen to $0.1492, reflecting gradual upward movement from the week’s earlier levels. Alongside this, XAI’s market cap saw a strong increase, reaching $20,706,040, up +8.98% from last week’s value of $19,000,517.

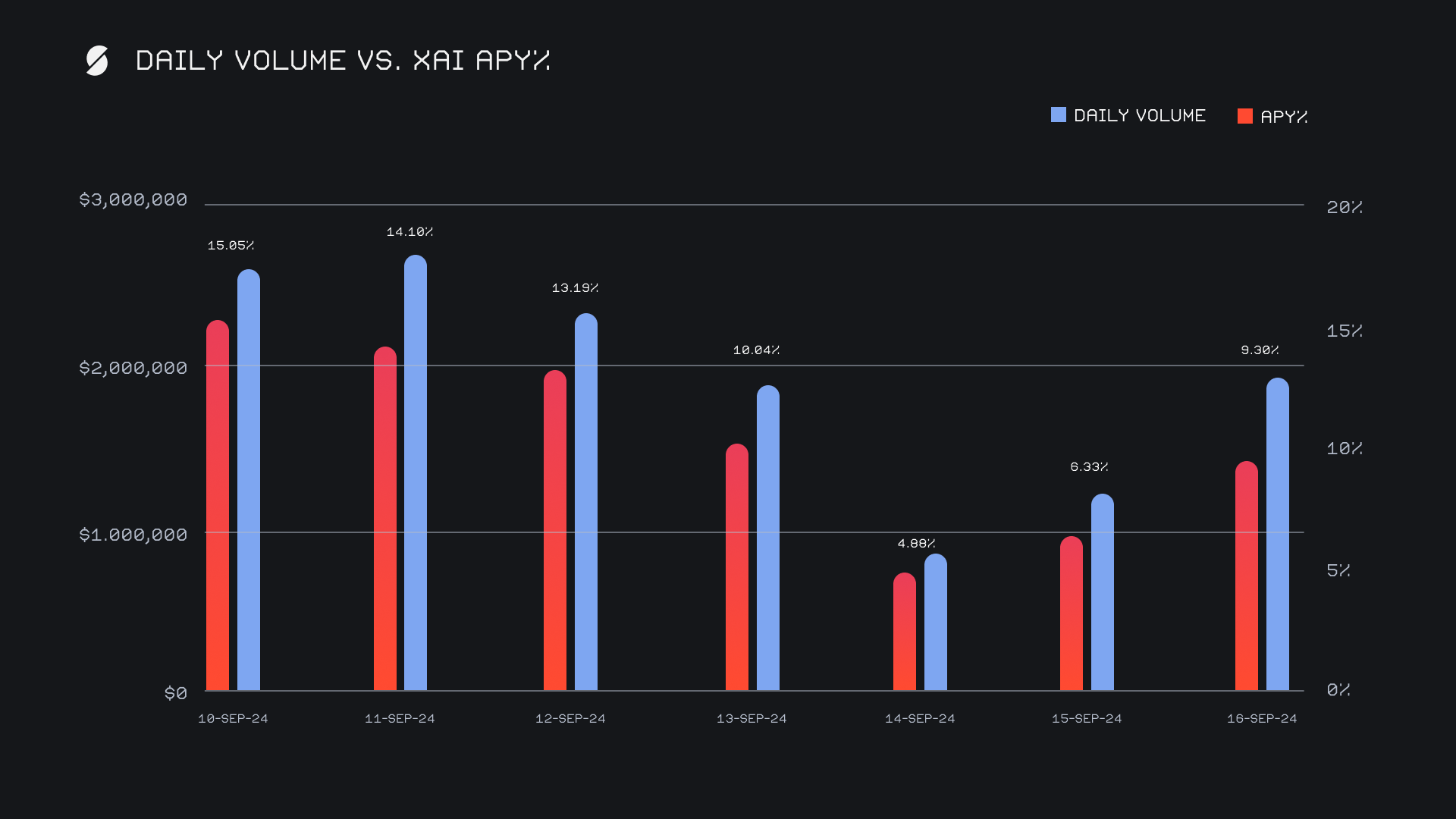

XAI stakers benefited from an average APY of 10.41% this week, with the highest daily APY hitting 15.05% on September 11th, 2024, when 47,666.02 XAI was distributed after a daily volume of $2.7m. In total, 234,648.61 XAI or $35,009.57 USD was distributed in staking rewards over the course of the week, continuing to provide solid returns for those staking XAI.

Additional XAI Updates:

Total Value Staked: 124,388,965 XAI (+0.2%)

Total Value Locked: $18,929,265 (+10.1%)

General Business News

Over the past week, Bitcoin held steady above $58K, as markets increased the probability of a significant 50 basis points rate cut by the Federal Reserve. This potential shift in monetary policy contributed to the anticipation of further upward price movement. Meanwhile, Tether's USDT continued to dominate the stablecoin market, growing its market share to 75% as its market cap surpassed $118B.

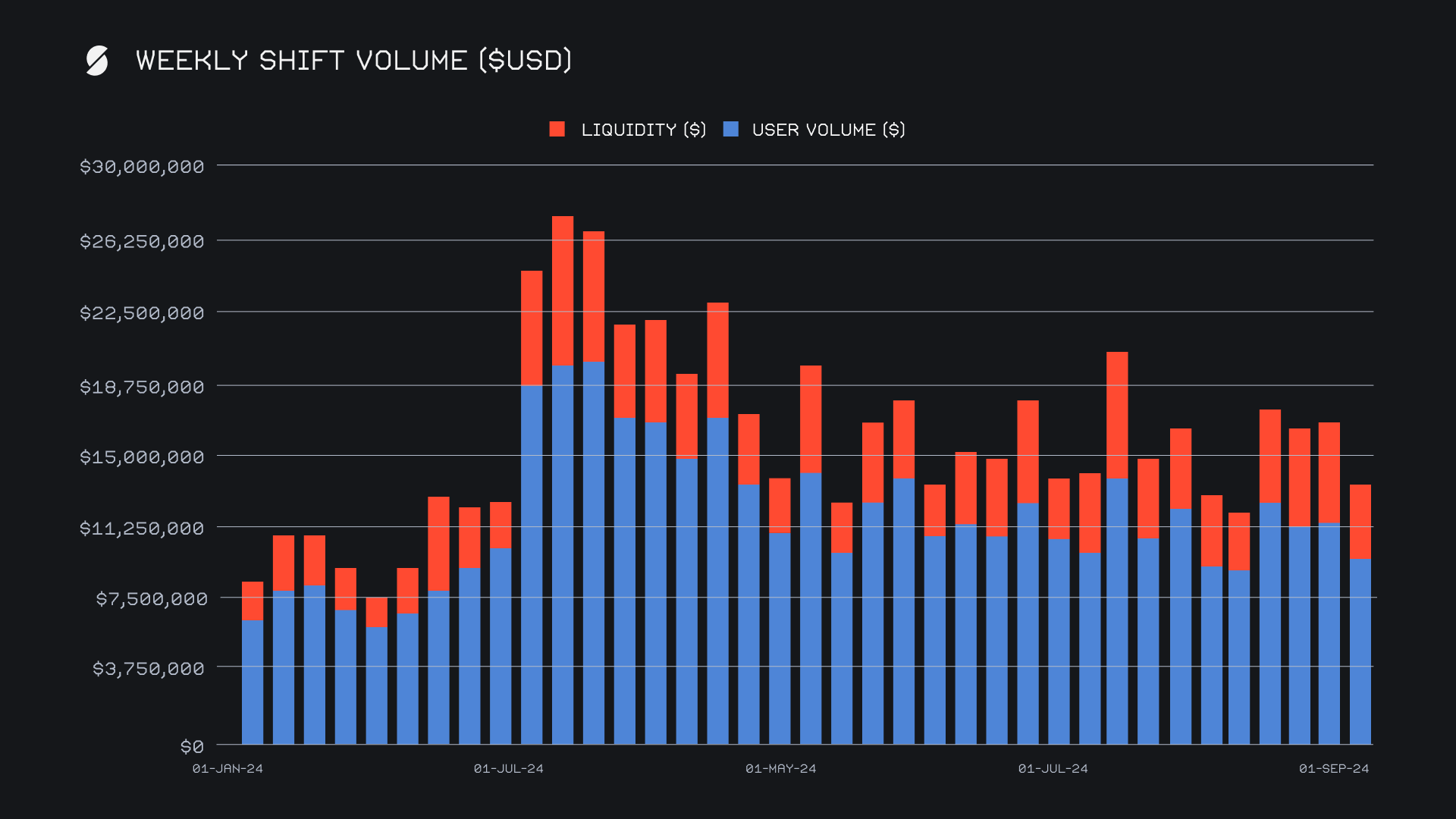

This week, SideShift's gross weekly volume reached $13.4m, marking a -19.4% decline compared to the previous period. The drop in volume reflects a noticeable decrease in the size of large shifts, which had been far more prominent last week. On average, SideShift processed $1.92m daily, indicating a pullback in overall volume heading into the middle of the month. Liquidity shifting represented $3.9m of our gross volume, an approximate -3.5% decrease from our YTD average, as compared to a gross user volume of $9.5m.

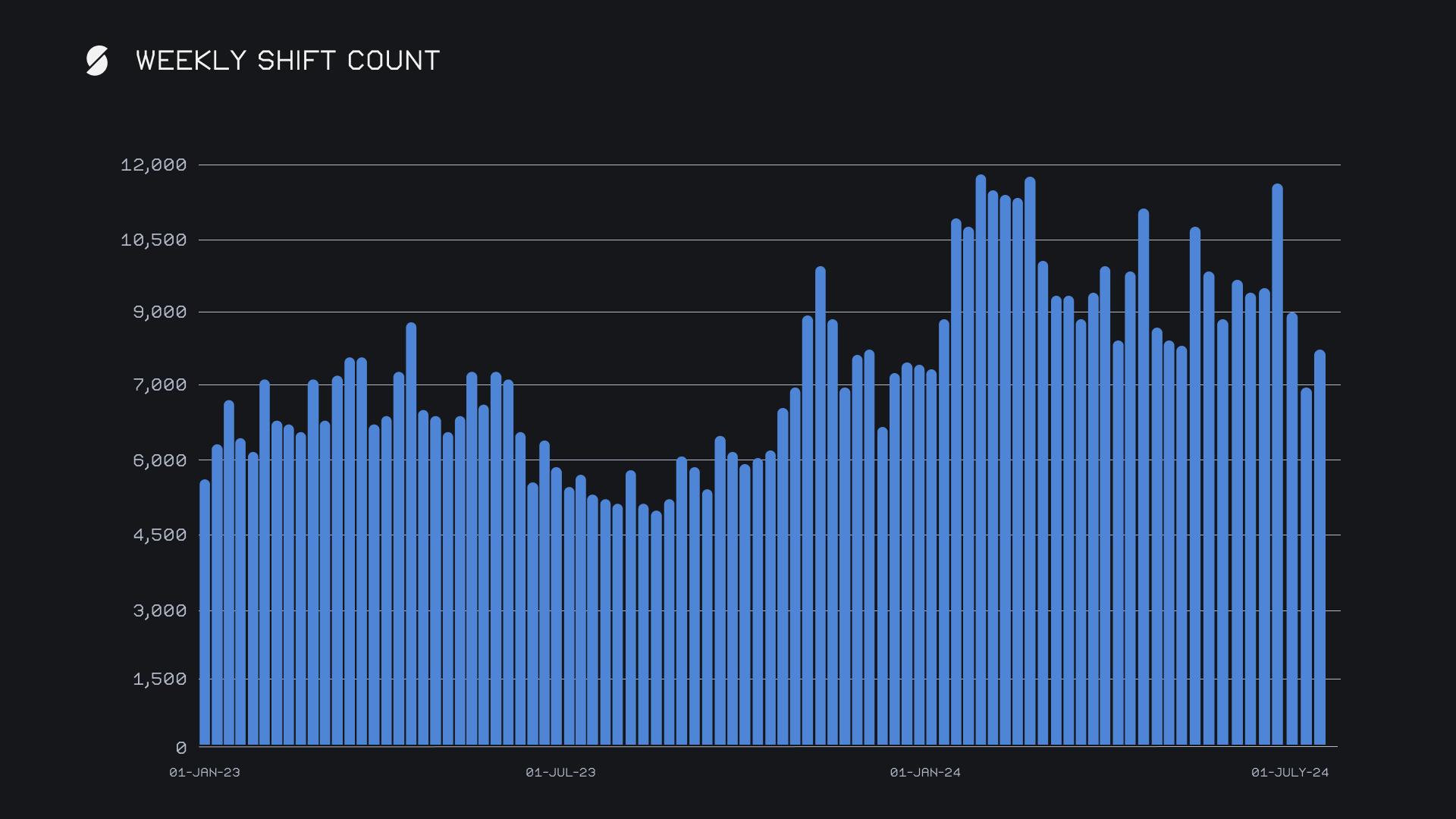

In contrast, our weekly shift count saw an increase of +10.4%, ending the week with a total of 8,279 shifts. This rise in shift activity suggests a higher frequency of smaller transactions, somewhat compensating for the drop in larger volume shifts. The most popular shift pair among users was USDT(erc20)/BTC, which led the week with $1.1m in volume, and also marked the first time since April 2024 that BTC was the receiving coin of the top shift pair among users.

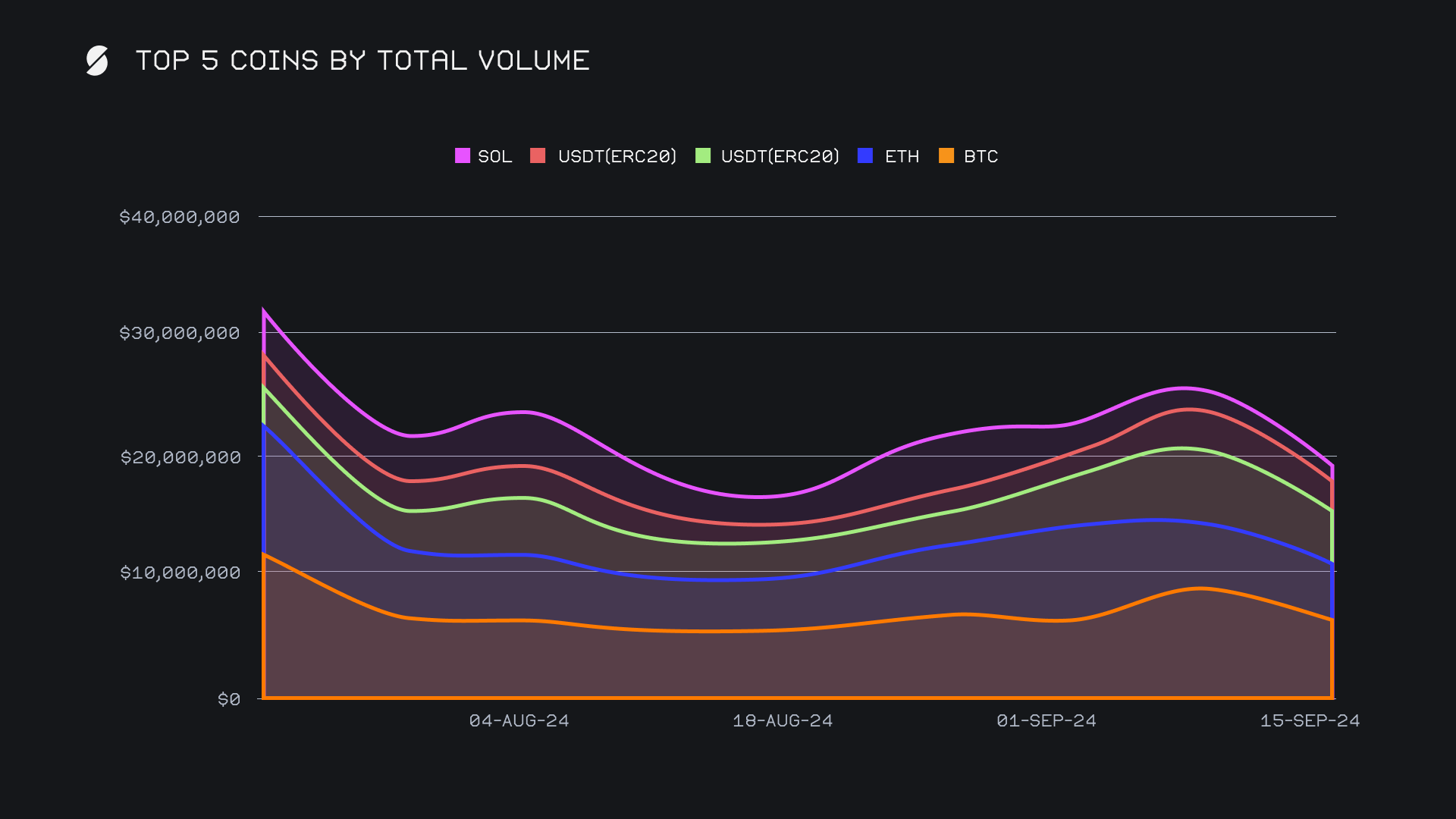

BTC remained in the top spot with a total weekly volume of $6.6m, despite a -27.1% decline from the previous week. User deposits for BTC saw a significant drop of -45.7%, bringing in just $1.6m, while settlements were higher at $3m with a more modest decline of -2.1%. This shows that while fewer users shifted into BTC, there was still a solid demand for BTC as a settlement coin.

ETH followed closely behind, finishing the week with a volume of $4.6m, reflecting a -15.4% decrease compared to last week. Deposits for ETH were stable at $1.97m with only a -1.5% dip, resulting in ETH being the least volatile coin overall among our top 5. However, settlements dropped more significantly by -21.3% to $1.6m, which meant users felt less enthusiasm for receiving ETH as the week progressed.

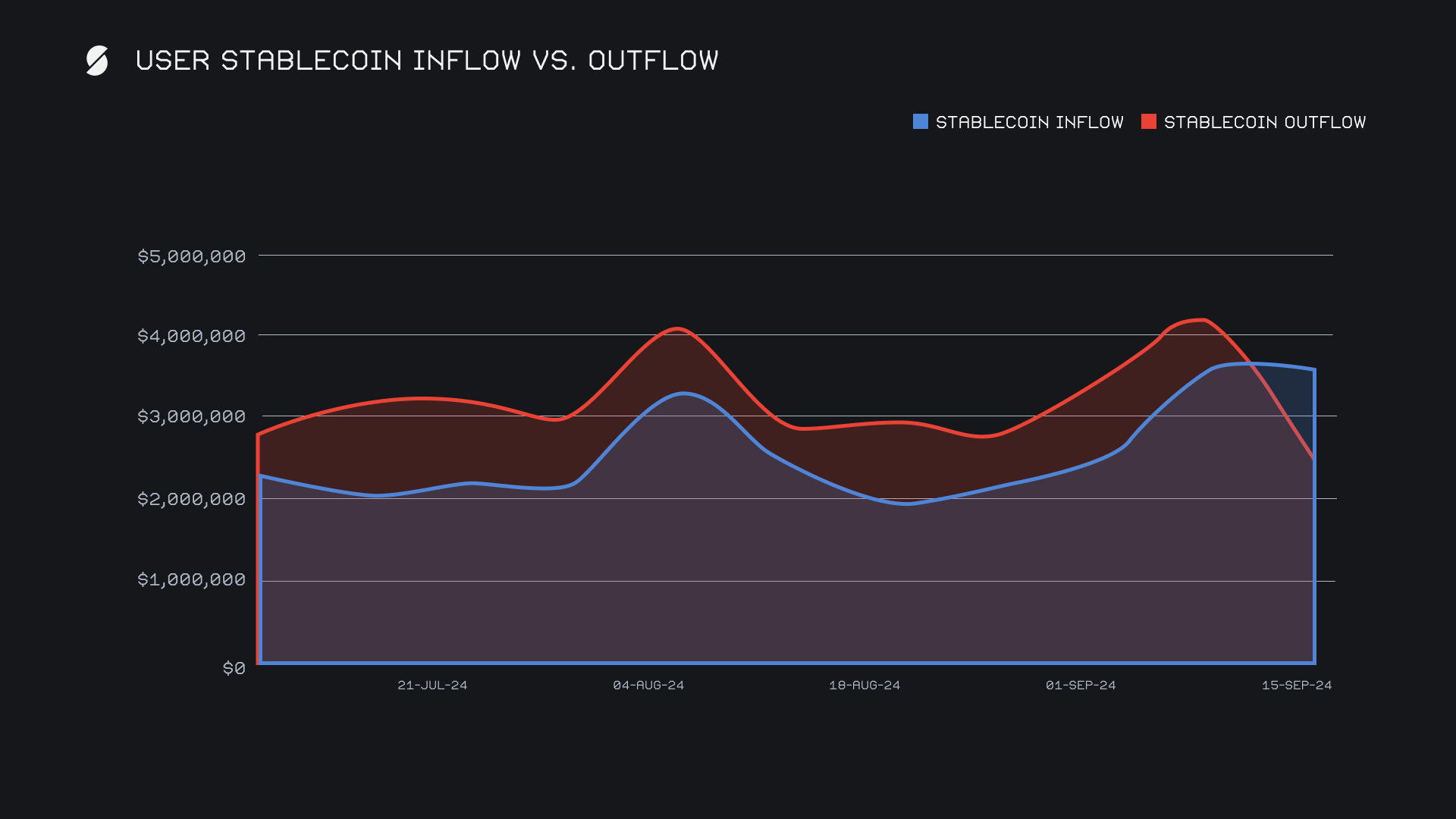

In third place, USDT(erc20) recorded a volume of $4.4m, down -27.0% from the previous week. Interestingly, deposits for USDT(erc20) rose by +13.0%, bringing in $1.7m, suggesting increased interest in shifting out of this stablecoin. In fact, this was the first time stablecoin inflows have exceeded outflows since May 2024, and the first significant week of positive stablecoin flows (>$1m) in 2024, representing a bullish signal among SideShift users as they displayed a preference to move into more risk on assets. USDC(erc20), DAI(erc20) and USDT(bsc) also joined this grouping, adding >$200k of positive stablecoin flows. Additionally, USDT(erc20) settlements dropped sharply by -49.6% to $1.25m, pointing to less activity from users shifting into USDT(erc20) compared to the previous week.

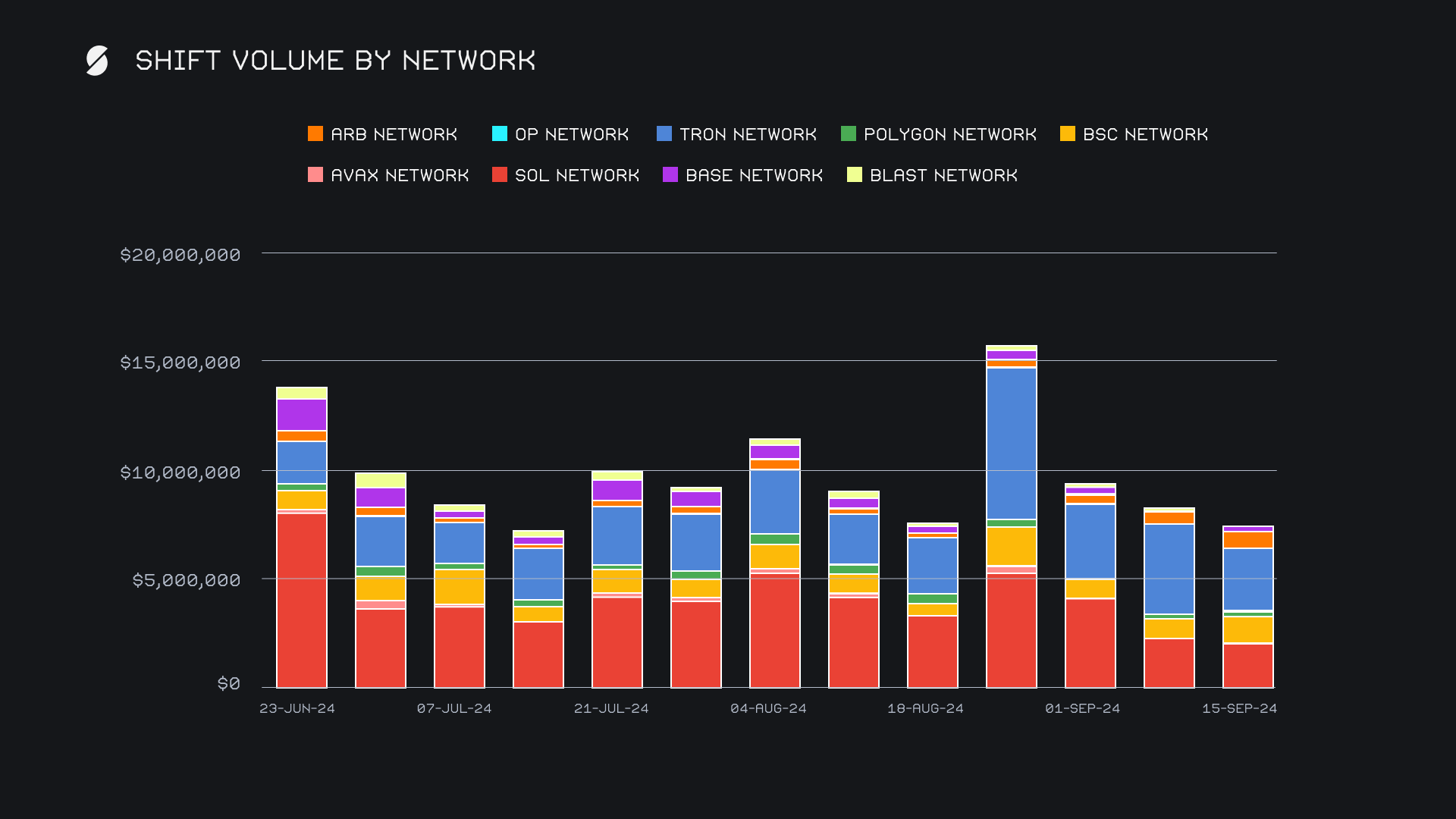

This week, the TRON network led alternate networks to ETH with a total volume of $2.93m, despite experiencing a -29.5% decline compared to last week. The Solana network followed behind with $2.05m in volume, reflecting a -7.5% dip. Meanwhile, the Binance Smart Chain (BSC) network saw a substantial increase of +48.5%, reaching $1.26m, driven largely by a +440% surge in native BNB shifting. Additionally, the Arbitrum (ARB) network rose +37.5% to finish the week at $663k, indicating a recent spike in interest in a network which is fairly volatile on SideShift. In total, alternate networks to ETH made up 27.3% of SideShift’s weekly volume, still trailing far behind the Ethereum network's larger share of 41%. The ebb and flow of these alternate networks is outlined in the below chart, as their combined weekly volume has moved within the broad range of $7m to $15m throughout the past few months.

Affiliate News

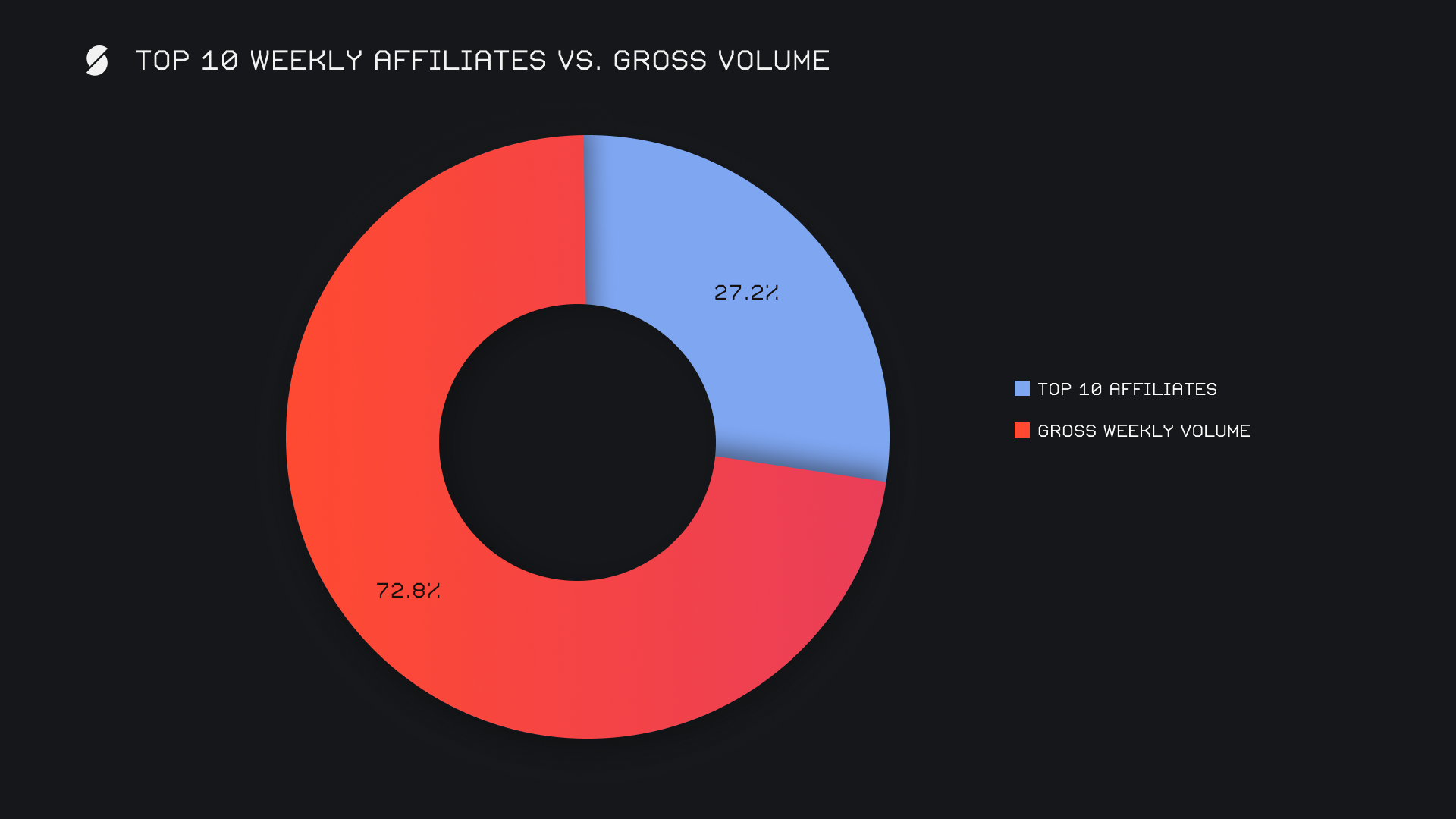

This week, our top affiliates combined for a total of $3.7m, reflecting a -39.1% decline compared to last week’s $6.0m. Despite the drop in volume, the rankings remained unchanged. The first-placed affiliate generated $2.02m, down -23.9%, while the second-placed affiliate saw the most significant decline, dropping -69.2% to end the week with $798k. In contrast, the third-placed affiliate had a slight increase of +4.0%, finishing with $503k. Overall, affiliates contributed to 27.2% of SideShift's gross volume, a reduction from last week, implying a smaller impact on overall volume this period.

That’s all for now. Thanks for reading and happy shifting.