SideShift.ai Weekly Report | 11th - 17th June 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one-hundred-and-ninth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and ninth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week, SideShift token (XAI) experienced some minor fluctuations within the 7-day price range of $0.1705 to $0.1745. At the time of writing, XAI is priced at $0.1732, reflecting a market cap of $23,720,376.

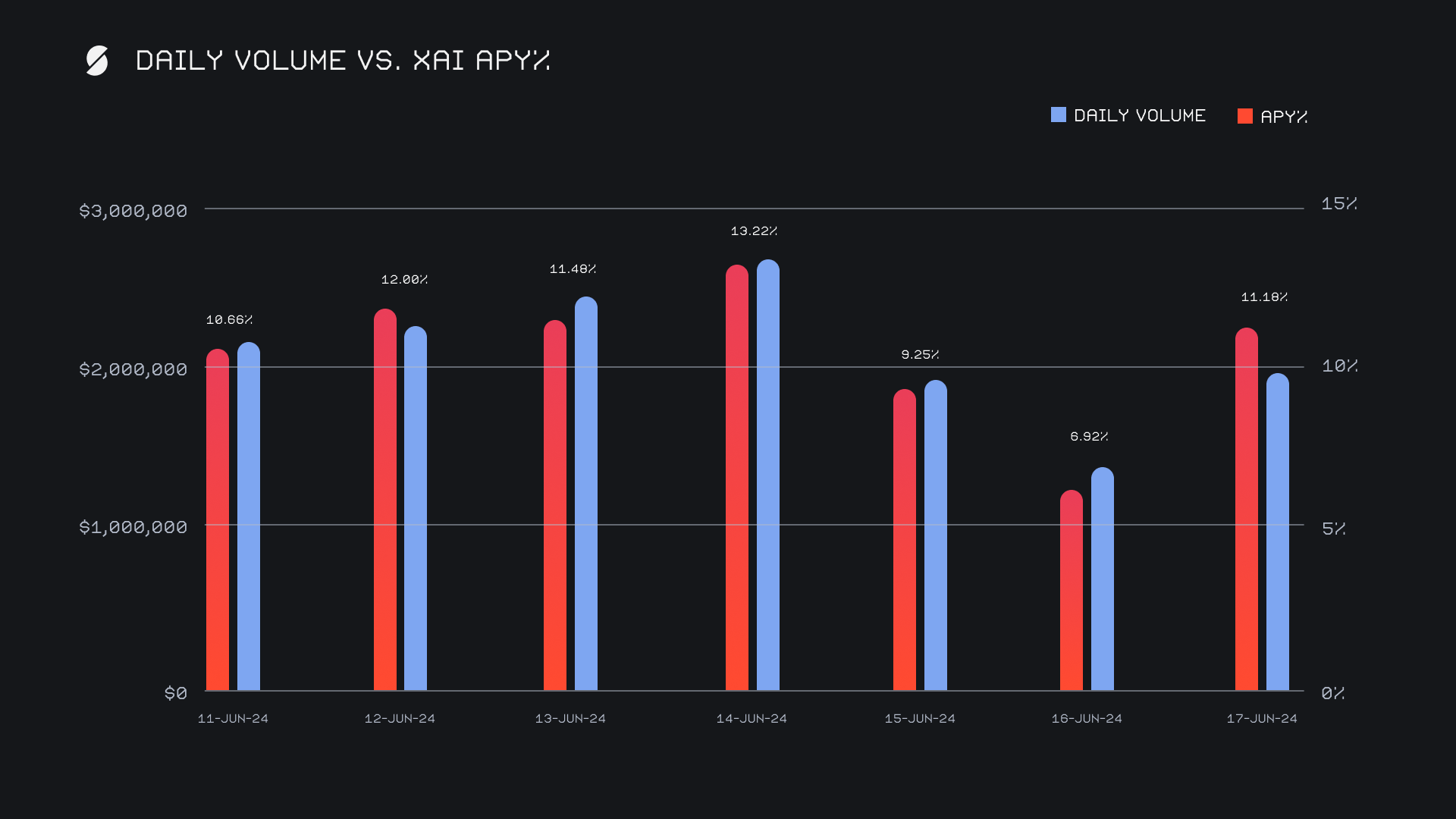

XAI stakers were rewarded with an average APY of 10.67% this week. The highest daily reward distributed to our staking vault amounted to 41,195.6 XAI (equating to an APY of 13.22%), and was deposited on June 15th, 2024, following a daily volume of $2.7m. This week, XAI stakers received a total of 235,106.21 XAI or $40,720.40 USD in staking rewards.The price of 1 svXAI is now equal to 1.3435 XAI, representing a 34.35% accrual on stakers investments. A friendly reminder that the easiest way to participate in XAI staking is to make a shift directly to svXAI, from any coin of your choice.

Additional XAI updates:

Total Value Staked: 121,282,412 XAI (+0.2%)

Total Value Locked: $21,035,784 (+2%)

General Business News

The past week saw significant downturns in the broader market, with major tokens like Dogecoin and Solana leading the plunge. Bitcoin fell below $65k, while Ethereum and other altcoins also experienced notable declines as the interim trend is looking slightly bearish.

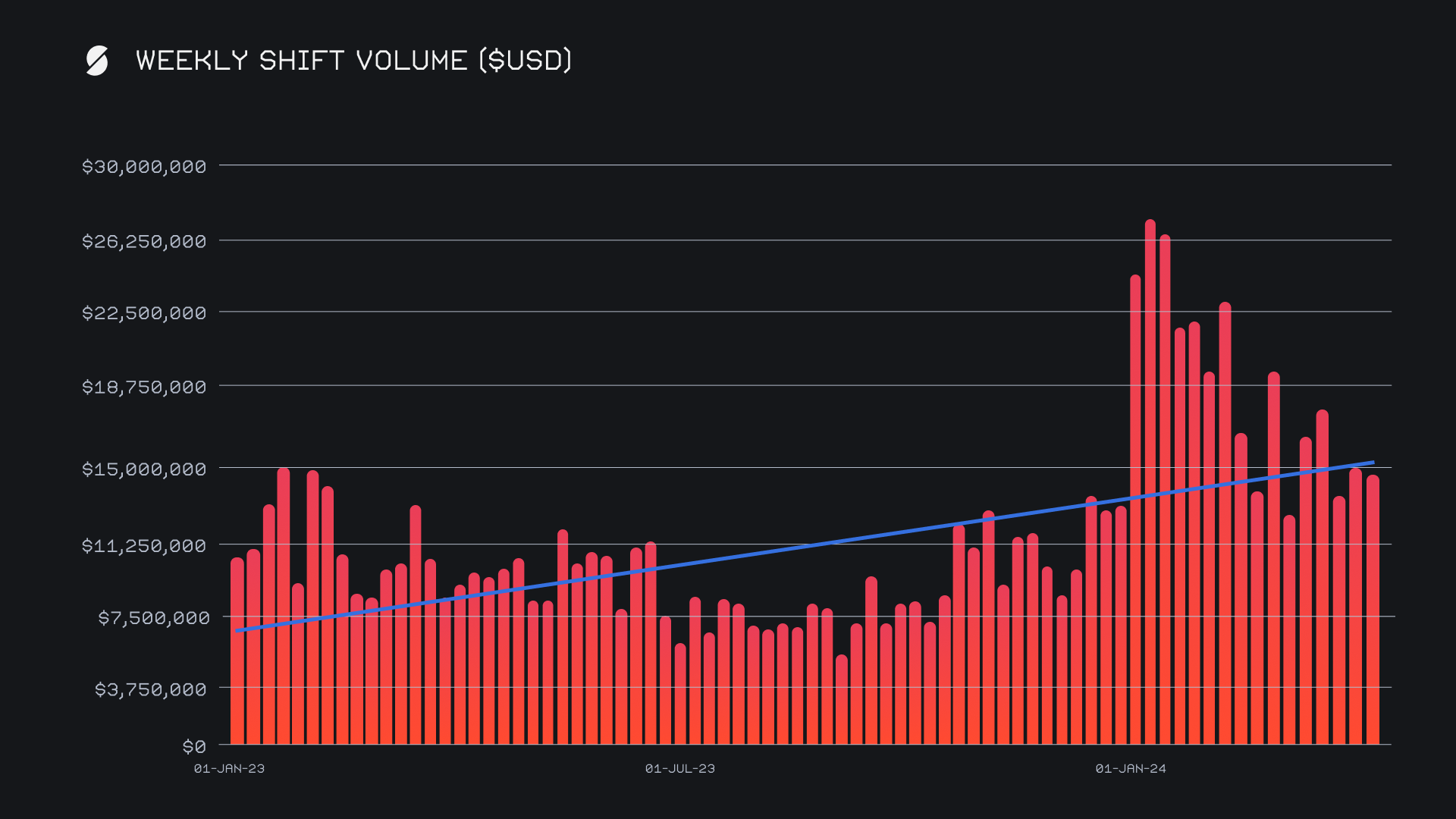

SideShift had a steady performance and ended with a gross weekly volume of $14.6m, marking a decrease of -2.5% as compared to the previous week. The volume totals of both last week and this week have ended almost exactly on par with the current trendline, which is tilted upwards and ascending in a consistent fashion. As compared to exactly 1 year ago, this week’s volume total measures +46% higher.

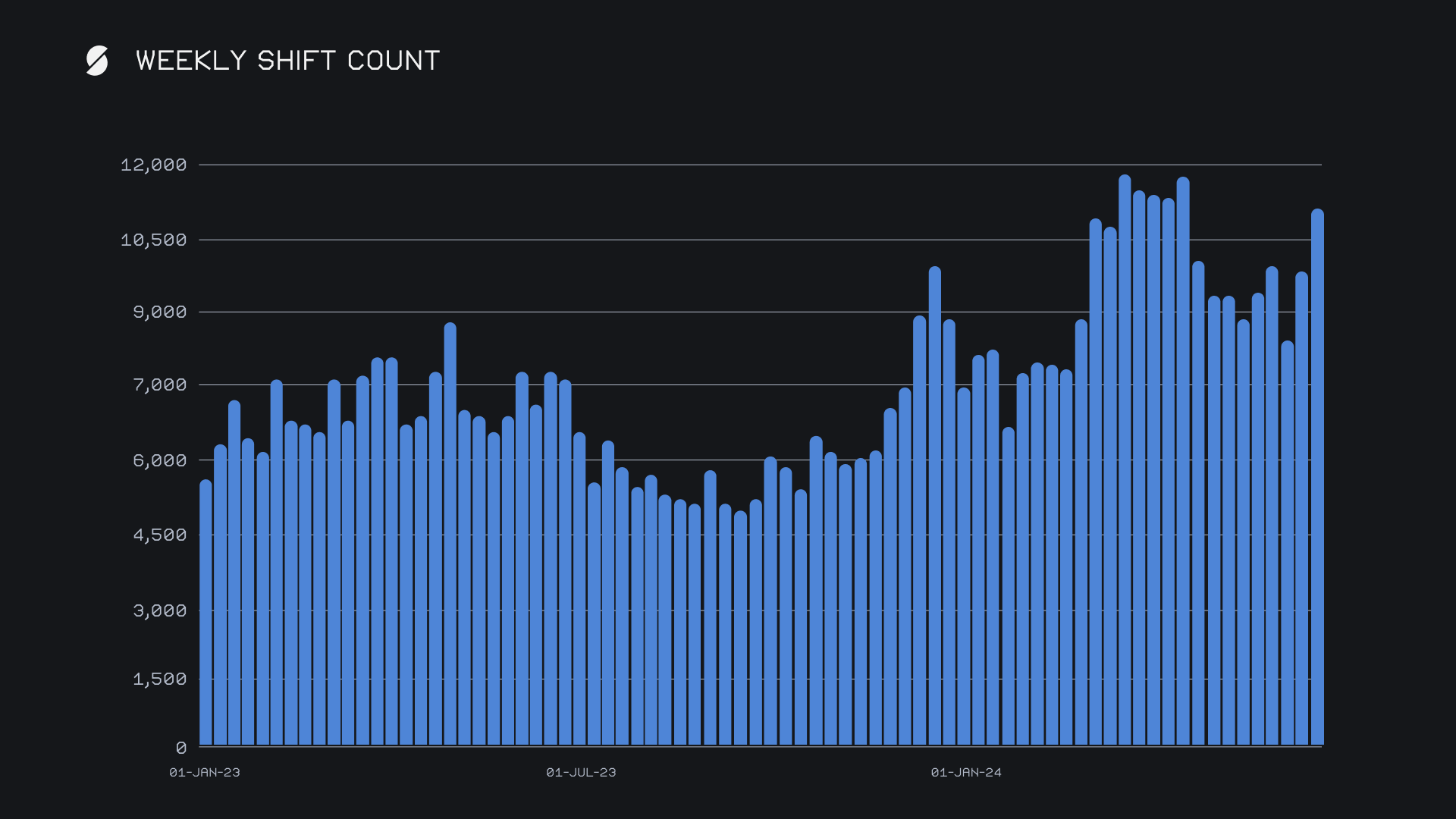

Despite the slight decline in weekly volume, SideShift saw a strong increase in shift activity, with our gross weekly count rising by +12.3%, for a total of 11,026 shifts. This sum approaches our all time record for shift count and is just the 6th time our weekly count has exceeded 11,000 - the rest occurred consecutively from late March to early April 2024. While weekly volume can be more volatile, shift count in 2024 so far has clearly been robust, as displayed in the chart below. Together, our volume and sum combined to produce daily averages of $2.1m on 1,575 shifts.

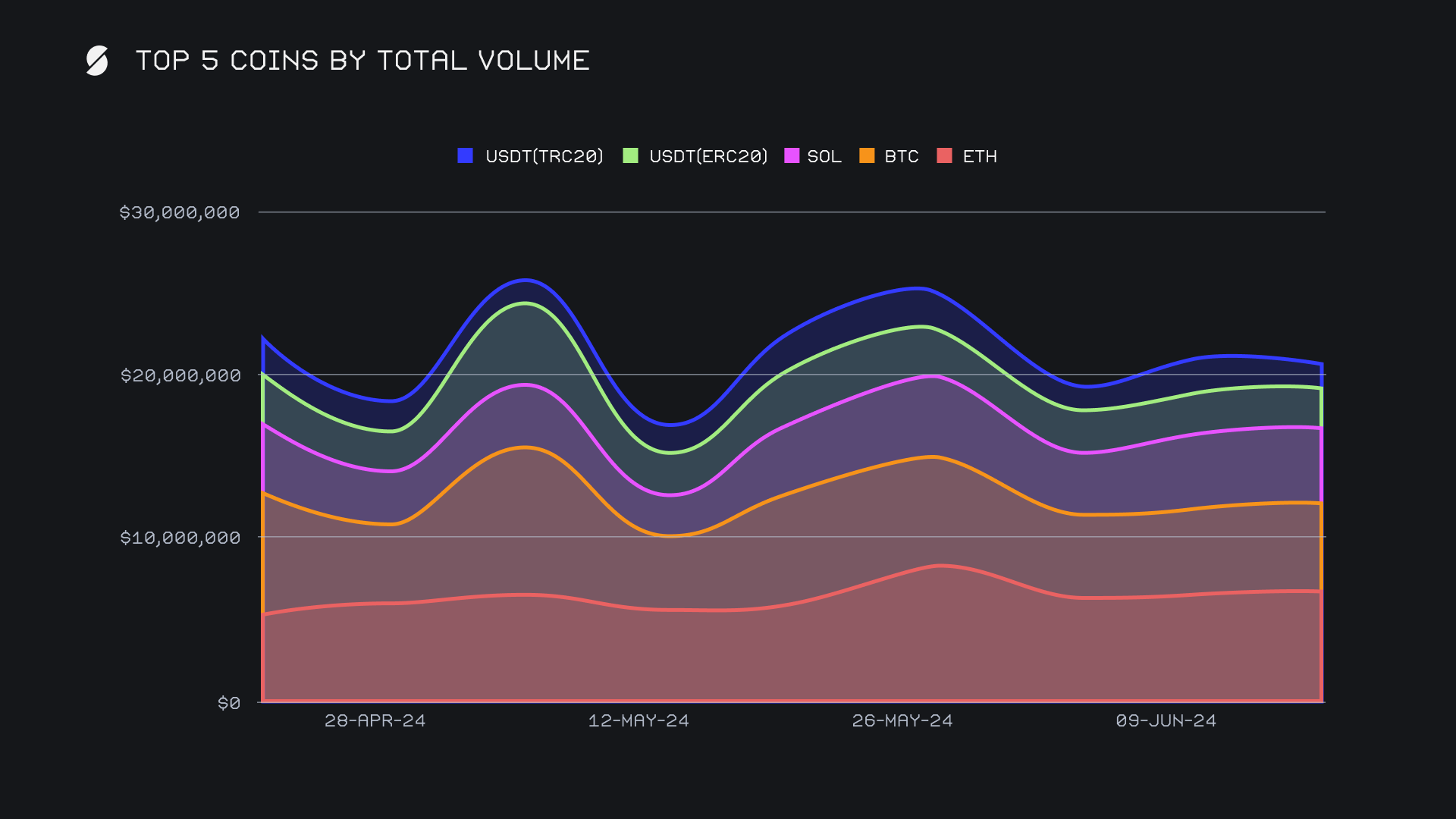

ETH continued its strong performance, leading the pack for the fourth consecutive week with a total volume of $7.0m, which marks a +6.1% increase from the previous week. This week’s volume was the second highest in the past 2.5 months, with user settlements ending at $3.1m (+4.3%) and continuing to drive ETH shifting. This was reflected by the week’s top shift pair of BTC/ETH, which surpassed all other pairs with $1.2m overall. Although its deposit volume incurred a -5.6% drop to $2.2m, ETH still remained the most shifted coin on SideShift.

BTC followed with a respectable total volume of $5.3m, showing a modest +3.2% rise. The recent trend of users preferring to deposit BTC and receive other top coins such as ETH and SOL continued, as BTC topped all other deposit coins with a $2.5m sum (+3.2%). Conversely, BTC user settlements sat $1m lower at a total of $1.5m (+3.2%), which was only enough to finish as our third most demanded coin, behind SOL.

SOL ranked third overall with a total volume of $4.3m, experiencing a -10.0% decline from the previous week. Deposit volumes for SOL saw a fairly significant drop of -25.4% to $1.3m, while settlements also decreased by -7.2% to $2.0m. This decrease in deposit volume came from a lack of SOL/ETH shifting, which had ended the previous three consecutive weeks as the top shift pair among users. In spite of these declines, SOL still remains a popular choice for users and has surpassed $4m in total weekly volume for over a month. ETH <> SOL shifting remains notable, with ETH/SOL ending the week as our second most shifted pair with a volume of $880k.

Stablecoins as a whole saw a mixed performance this week, as our usual top two of USDT (erc20) and USDT (trc20) both recorded declines in weekly total volume. This resulted in respective totals of $2.5m (-6.2%), and $1.7m (-11.5%), which largely came from a lesser amount of settlements. The same applied for USDC (erc20), which fell a sharper -55.1% for an even $600k. Interestingly, the same did not apply for stablecoins on the Solana network, as both USDC (sol) and USDT (sol) recorded noteworthy positive changes. USDC (sol) finished just shy of the top 5, climbing +72% for $988k overall. Meanwhile, USDT (sol) jumped a solid +140%, albeit with a lower total volume of $233k. It will be interesting to see if the popularity of stablecoins on Solana continues to grow, or if this was more of a one-off.

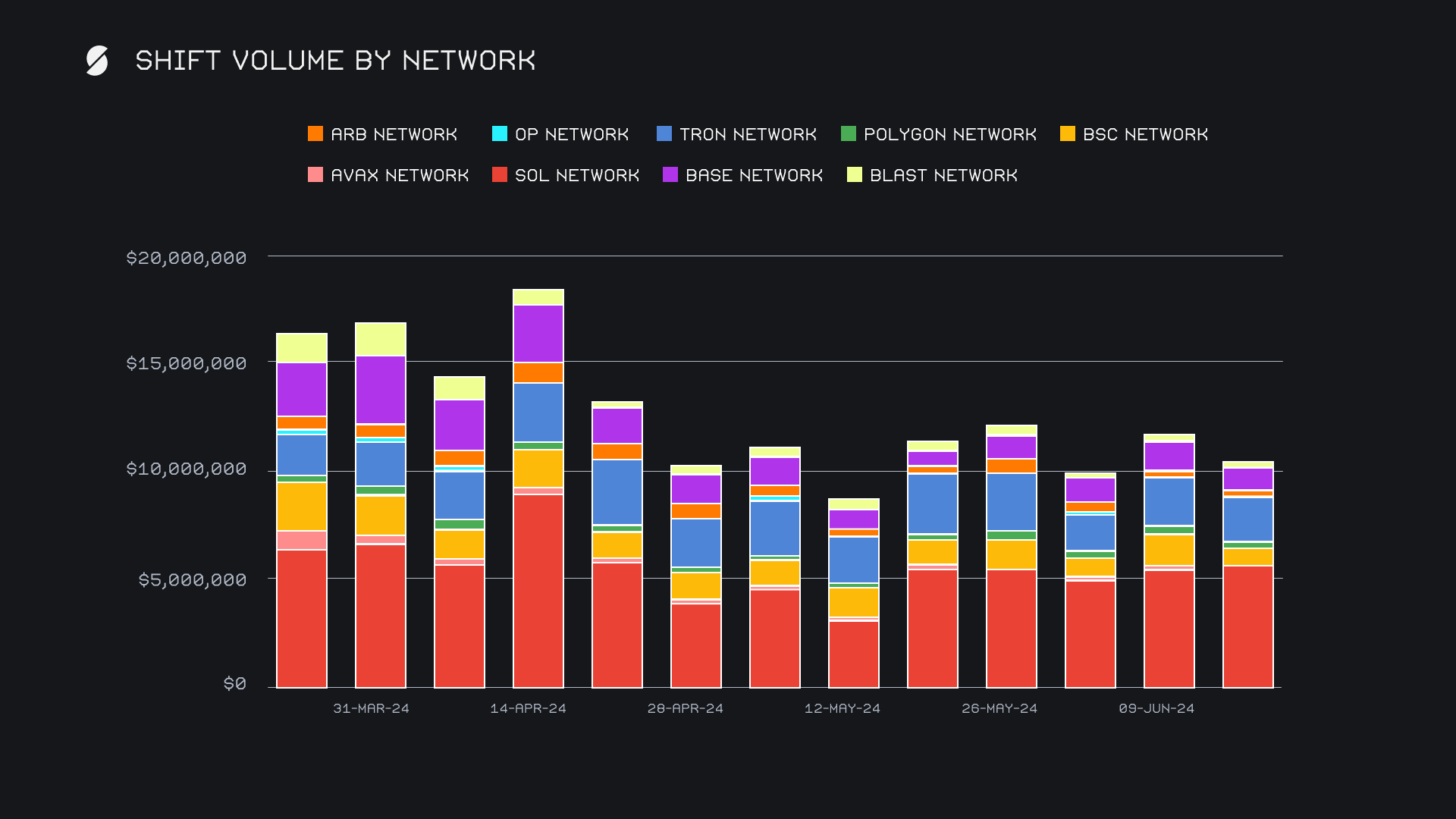

When looking at alternate networks to ETH, there is not much of a change in the typical breakdown outlined over the past few months. The Solana network continues to dominate, regularly accounting for nearly half of all of the combined alternate networks volume. This week, it ended with $5.6m (+1.6%) overall, thanks to the added boost coming from the previously mentioned stablecoin shifting. The Tron network finished in its routine second spot with $2.0m (-9%), predominantly impacted by less USDT(trc20) shifting. The Base network came in third with $1.2m (-14.6%), followed by the Binance Smart Chain (BSC) network in fourth, which showed the most significant weekly change and fell -48.6% for $813k. This came after a week of particularly high amounts of BNB shifting. Overall, alternate networks were involved in 35.9% of weekly shift volume, almost identical to the Ethereum networks proportion of 36.2%.

In listing news, SideShift added support for memecoins Tremp and Boden on the Solana network, in addition to Brett on the Base network.

Affiliate News

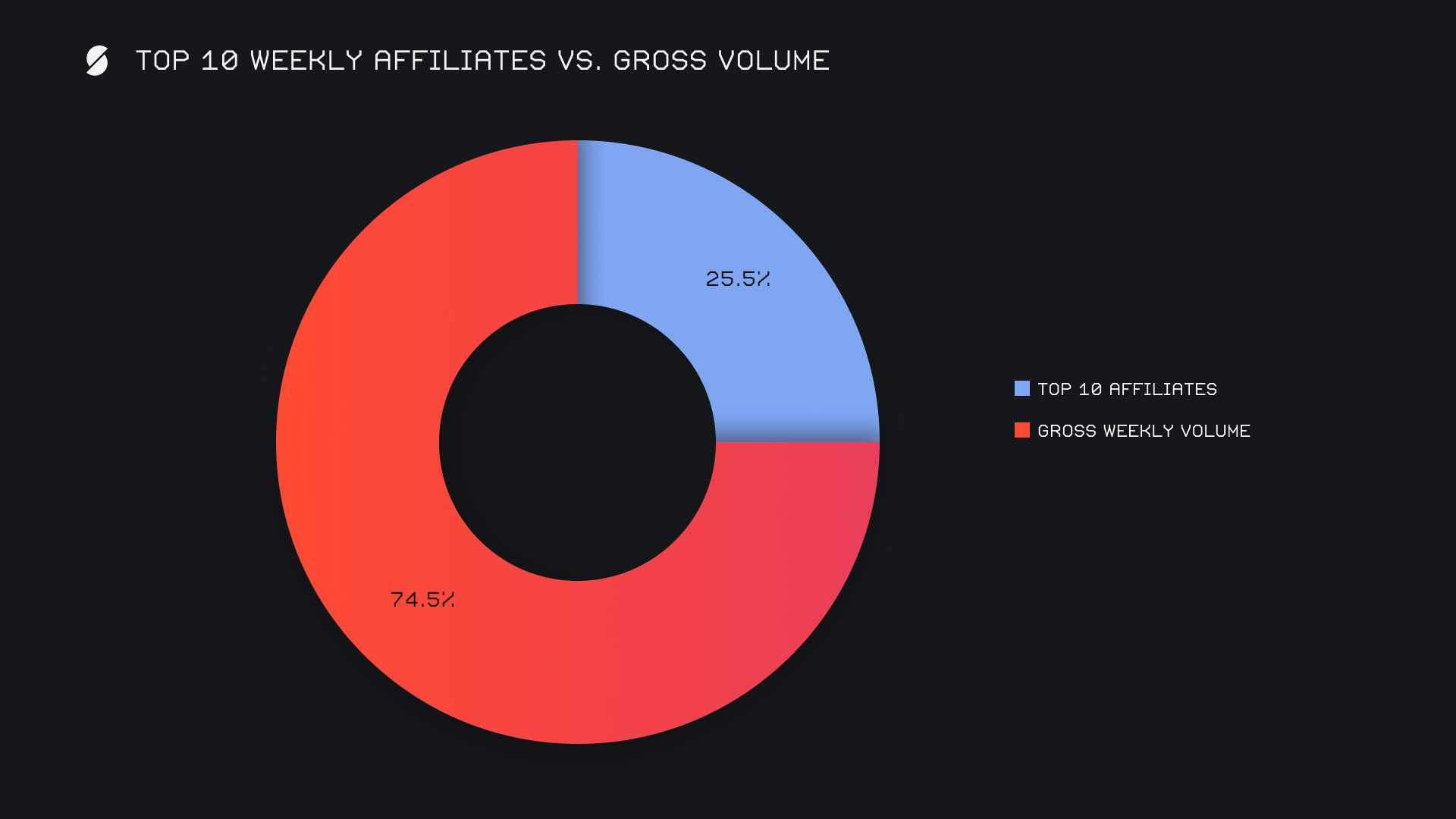

This week, our top affiliates generated a combined total volume of $3.7m, marking a nominal increase of +8.8% from the previous week. Interestingly, this occurred alongside a minor overall decline in shift count (-2.4% for 2,003 shifts), suggesting a rise in the average shift value. Our first-place affiliate surged by +55.7% to $1.7m, swapping places with the former top affiliate, who now holds the second spot with $1.1m (+7.5%). Meanwhile, our third-place affiliate saw a sharp decline, and dropped by -45.1% to $399k.

All together, our top affiliates accounted for 25.5% of our total weekly volume, +2.7% higher than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.