SideShift.ai Weekly Report | 14th - 20th May 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one-hundred-and-fifth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and fifth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week saw SideShift token (XAI) climb its way higher in a very linear fashion, moving within the 7 day price bounds of $0.1824 / $0.1940. At the time of writing, XAI has leveled out at the upper end of that range, and has a current price of $0.1930 with a market cap of $25,990,138 (+5.9%).

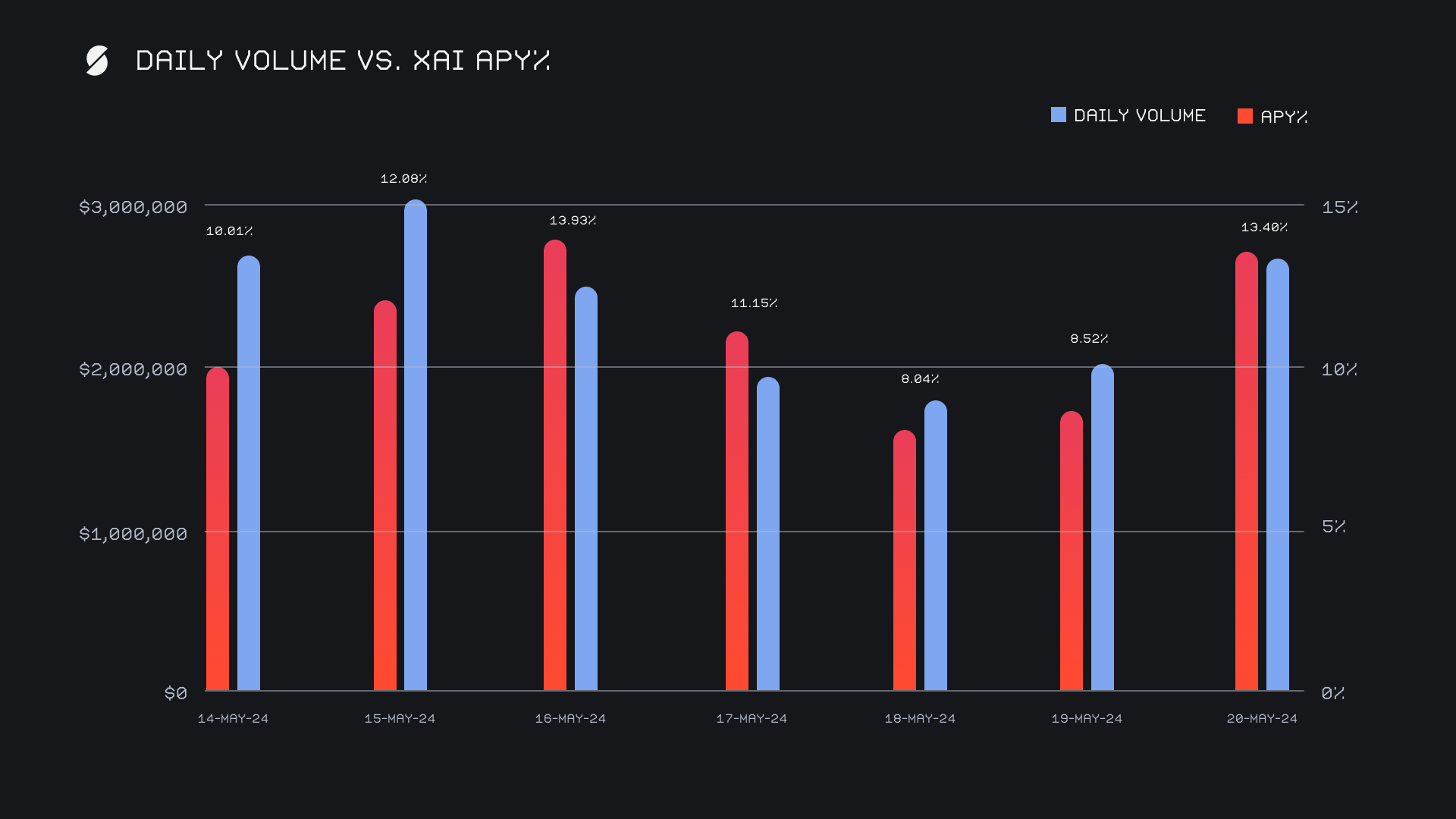

XAI stakers were rewarded with an average APY of 11.02% this week, with a daily rewards high of 42,834.96 XAI (an APY of 13.93%) being distributed to our staking vault on May 17th, 2024. This was following a daily volume of $2.5m. This week XAI stakers received a total of 239,989.19 XAI or $46,317.91 USD in staking rewards.

An additional 4 WBTC ($272k) were sent to SideShift’s treasury over the course of the week, bringing the current total to a value of $17.2m. Users are encouraged to follow along directly with treasury updates, via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 120,131,075 XAI (+0.2%)

Total Value Locked: $23,105,025 (+6.4%)

General Business News

A positive week in the crypto markets saw the total crypto market cap rise by more than +15%, regaining levels not seen in nearly two months. Likely related to ongoing ETF chatter, ETH led the charge and closed May 20th with a striking daily candle of +20%, effectively erasing the downwards trend which began in March, 2024.

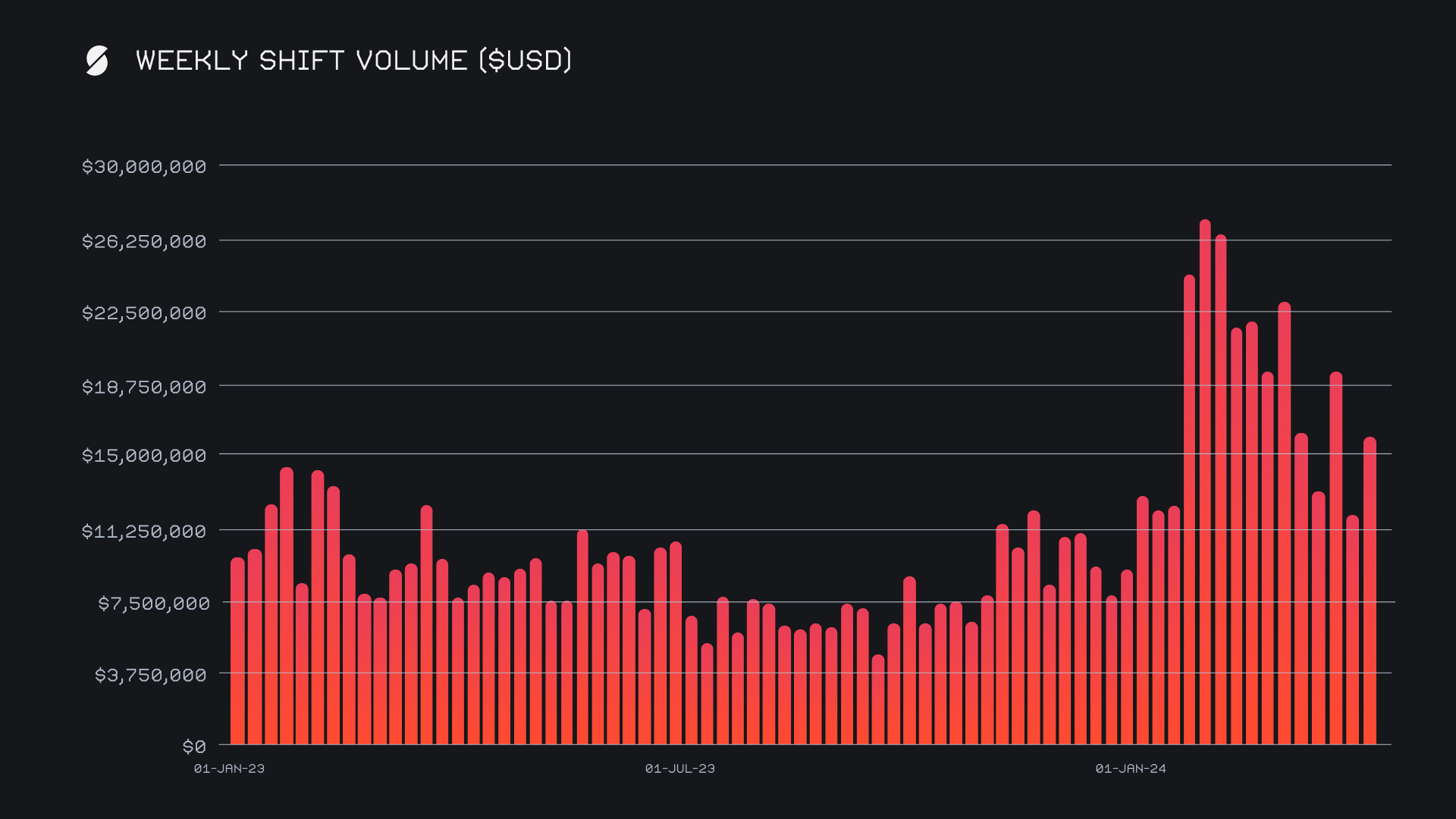

SideShift had a strong performance and bounced hard off of last week’s local lows. We rounded off the period with a gross volume of $16.6m (+34.1%) alongside a steady shift count of 9,391 (+6.3%). This rise in shift action was particularly notable with shifts coming from our top integrations, although the nominal volumes of shifts performed directly on the site also enjoyed some solid increases. The coin source of this shift volume ended up being quite varied, with 7 unique shift pairs generating a user volume greater than $500k. Together, our weekly sums combined to produce daily averages of $2.4m on 1,342 shifts.

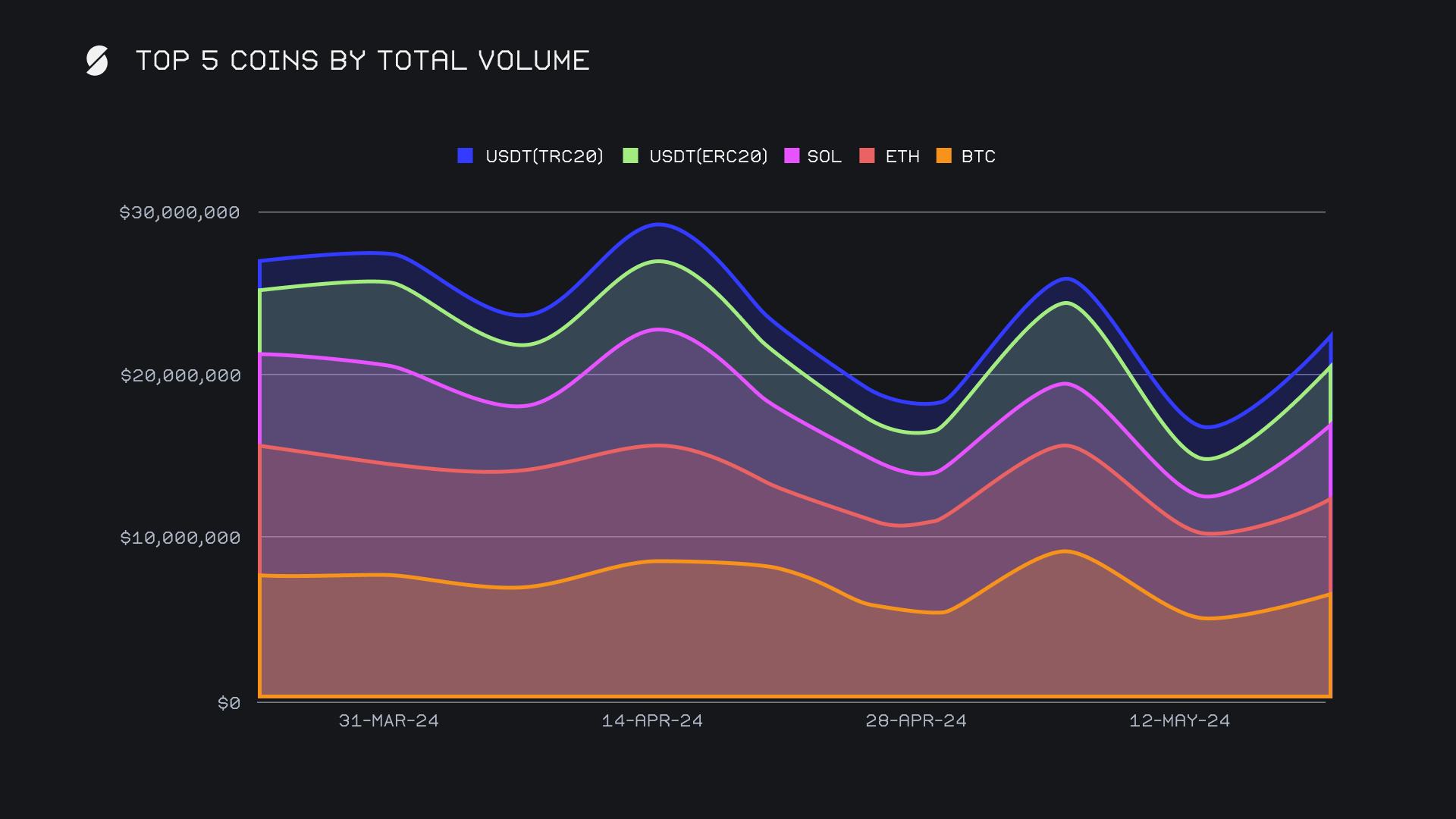

Our top 5 coins by total volume (deposits + settlements) increased by +35.6%, rising at a rate just slightly faster than our overall weekly volume. This was mainly due to upswings in both BTC and SOL, while ETH on the other hand remained more stable. BTC regained its position as the week’s top coin, doing so with a total volume of $6.7m (+45.7%). This source of this surge can be credited to an influx of user deposits, which rose by +57.3% to lead all top coins. A deposit vs. settlement breakdown of $3.3m to $2.1m tells us that SideShift users were more keen to shift out of BTC as opposed to shifting to receive it. The most common option this week was to shift into USDT (erc-20), as the BTC/USDT(erc-20) pair ended as the week’s most popular with $1.1m.

ETH followed in second place with a total volume of $5.9m (+6.8%) and represented the lowest weekly change among our top coins. This consistency came from a fairly even split of $2.5m to $2.2m in user deposits vs settlements, which was essentially a repeat of what occurred last week. Although ETH once again managed to generate more user demand than BTC, it was SOL that ended up narrowly squeaking past both of them to finish as the week’s most settled coin. A +78% jump in user SOL settlements produced a sum of $2.2m, representing the largest week on week change for any top coin. Our top 3 coins of BTC, ETH and SOL all had extremely similar demand this week, with all 3 settlement sums finishing above the $2m mark, and within just ~$90k of each other.

Although our top 5 was composed of the usual top coins, USDC (eth) teetered right on the cusp, and ended in 6th place with a total sum of $1.9m, an outstanding jump of +366%. This easily topped the list as our biggest overall gainer this week among coins with significant volume. Still, a few other less popular options also managed to record triple digit increases, albeit with far lower volumes. A few examples include USDT (sol) with $424k (+290%), XRP with $293k (+188k), and Liquid BTC with $205k (+378%). The TON network is still gaining traction, with its native TON token seeing more than $200k in each of the past 6 weeks since listing. Additionally, the recently added USDT (ton) has now generated ~$210k in its first two weeks on SideShift.

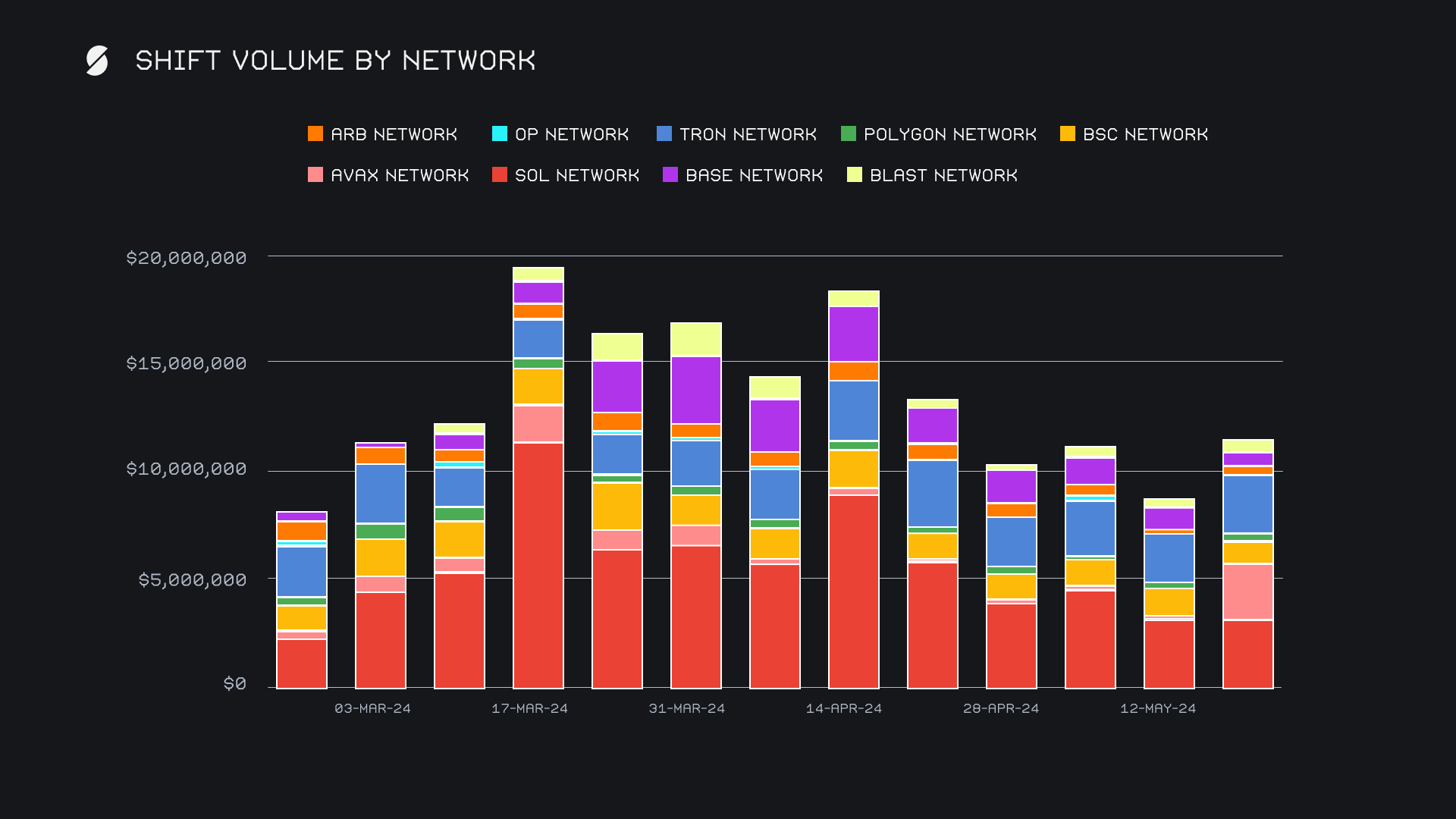

Alternate networks to ETH came together for a total volume of $11.4m this week, accounting for approximately 34% of our weekly total. This was primarily thanks to the increased attention given to the Solana network, which resulted in alternate networks combining to finish just higher than the Ethereum network’s proportion of 30.3%, or $10m total. The aforementioned rise of activity for the native SOL allowed the Solana network to dominate all others with $5.5m (+71.8%), as it finished nearly twice as high as second place. It also has proved to be the most volatile among alternate networks by far, with its weekly volume commonly fluctuating by more than $1m on a weekly basis, something which can be observed in the bar chart below.

The Tron network came in second place with a respectable $2.7m (24.7%), followed by the Binance Smart Chain (BSC) network with $1.1m (-13.2%). Opposite to Solana, the Tron and BSC networks continue to see a majority of their volume derive from stablecoins, as opposed to the native token. These were the only three alternate networks to exceed the $1m mark this week - although most of the others ended with positive weekly changes, their volumes were relatively lackluster. For now it is clear that Solana, Tron, and BSC have established themselves as the clear winners among alternate networks, with the Solana network being the sole standout.

Affiliate News

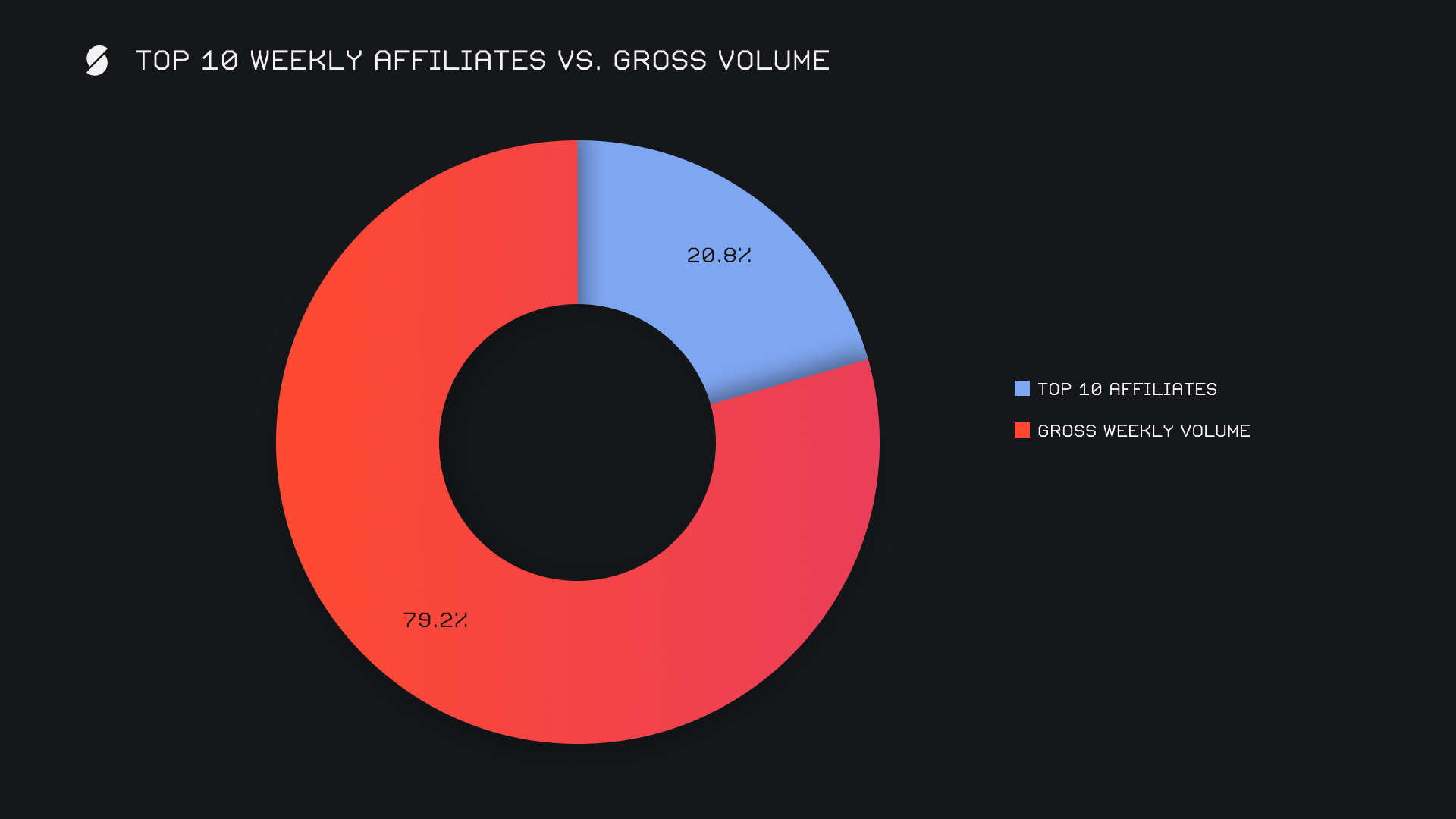

Our top affiliates combined for a total $4.3m, marking a nominal increase of approximately +40% from the previous week’s sum. The former second placed affiliate stormed back to first, with its volume rising +89% for $1.6m. Our second placed affiliate however also had a good performance, ending the week with $1.5m on 416 shifts. Ultimately the week was positive, as every one of our top affiliates noted a double digit percentage volume gain.

All together, our top affiliates accounted for 26.2% of our weekly volume, -+1.4% higher than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.