SideShift.ai Weekly Report | 14th - 20th November 2023

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the eighty-first edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the eighty-first edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week SideShift token maintained its ground above $0.07, inching its way higher as the week came to a close. It moved within the 7 day range of $0.0722 / $0.0796, and at the time of writing is sitting at the very top of that range, at a price of $0.0796. The current market cap of XAI is $9,988,799 (5.6%).

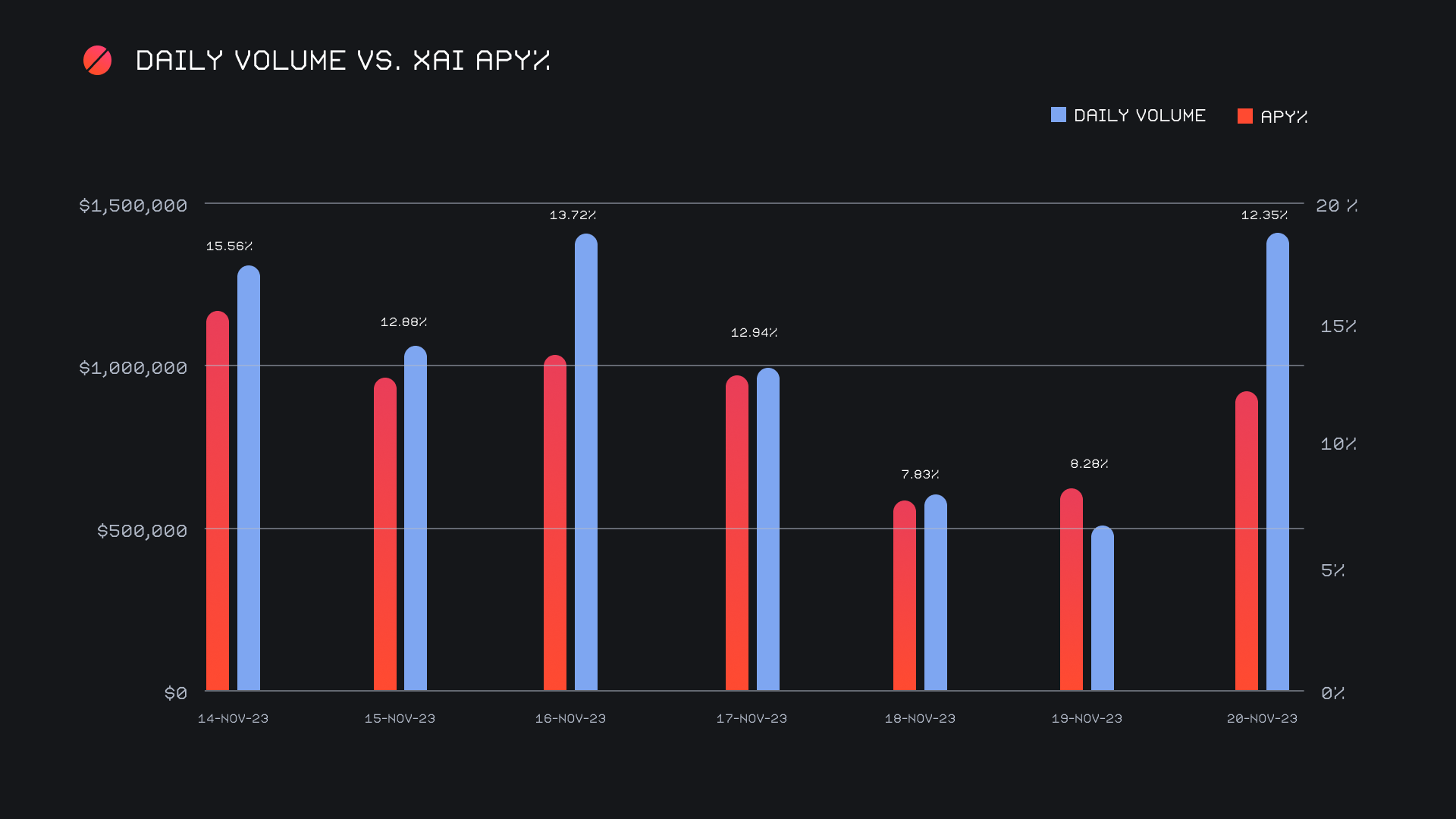

XAI stakers were rewarded with an average APY of 11.87% this week, with a daily rewards high of 44,766.44 XAI being distributed to our staking vault on November 15th, 2023. This was following a daily volume of $1.3m. This week XAI stakers received a total of 243,923.50 XAI or $18,927.67 USD in staking rewards.

The value of 1 svXAI is now equal to 1.2581 XAI, representing a 25.81% accrual on stakers’ investments. A friendly reminder that the easiest way to participate in XAI staking is to shift directly to svXAI, from any coin of your choice.

Additional XAI updates:

Total Value Staked: 113,272,658 XAI (+0.2%)

Total Value Locked: $9,013,486 (+7.4%)

General Business News

The general market moved mostly sideways throughout the week, after making a solid climb to begin the month. The total crypto market cap has now reached a YTD high, and the positive attitude embraced by many is certainly evident on CT (Crypto Twitter).

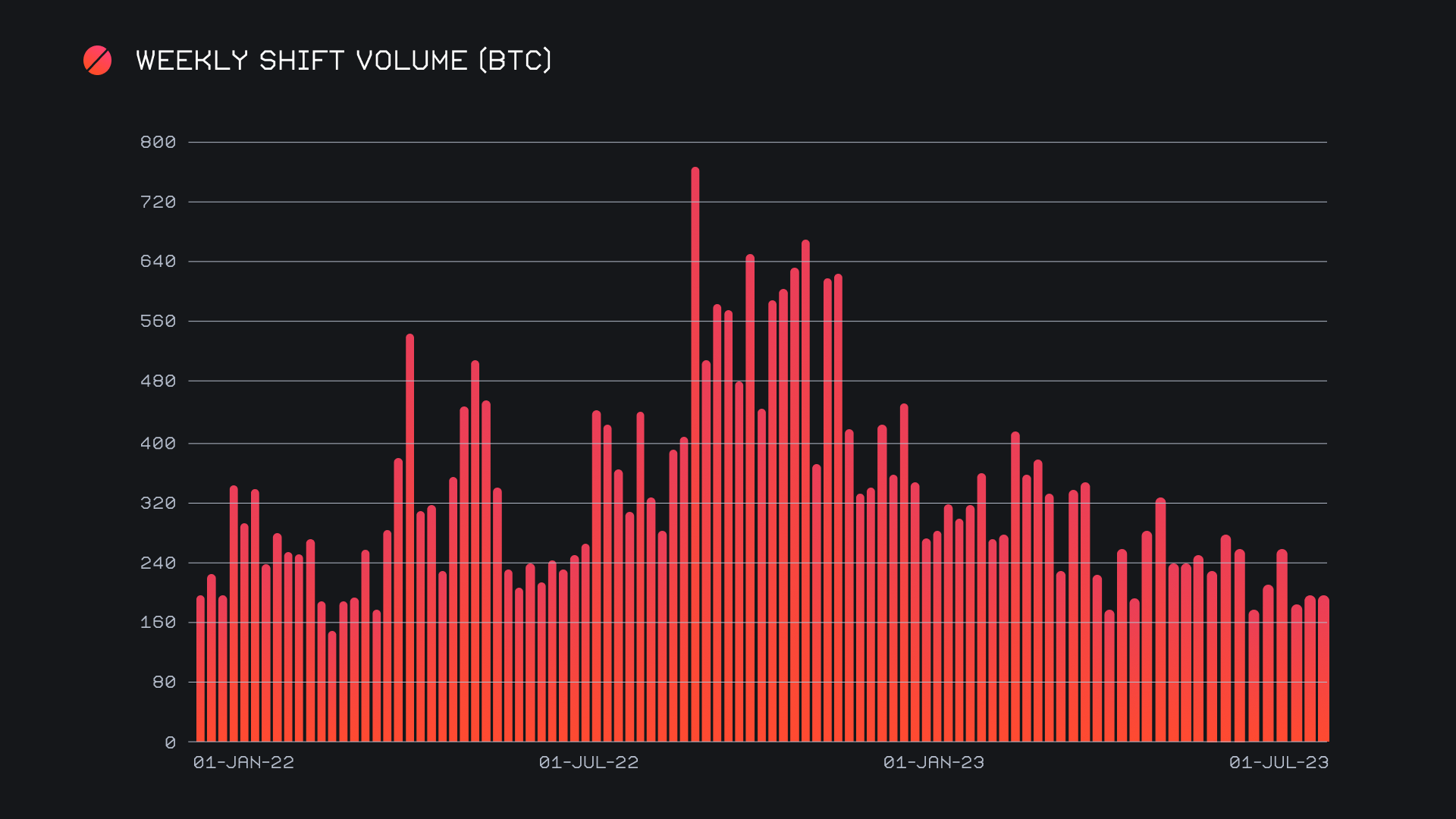

SideShift carried on with the behavior outlined in last week’s report, and recorded incremental increases across most metrics. We ended the period with a gross volume of $7.3m (+1.5%), alongside a shift count which rose by a similar proportion, finishing with a total of 6,128 shifts (+2%). As most of our top affiliates actually noted decreases in their total weekly volume (ranging from 7-25%), the minor increase in gross volume indicates to us that more shifting was occurring directly on the site. When denoted in BTC, our weekly shift volume amounted to 198.87 BTC (+0.9%).

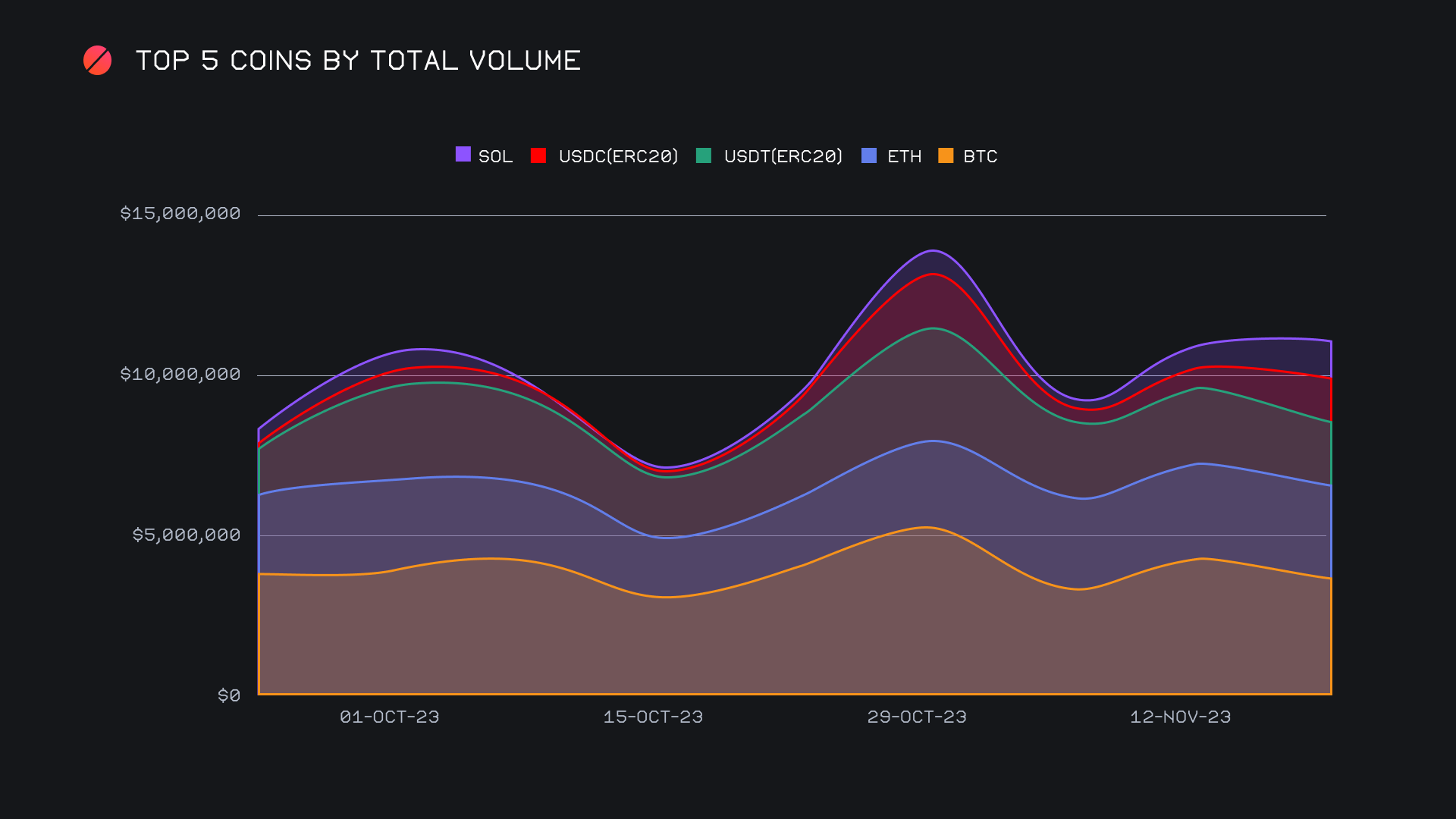

While BTC remained our most popular coin and retained its position atop the leaderboard on SideShift, a look at our top 5 coins by total volume reveals the growing strength of others. BTC ended the week in first place with a total volume (deposits + settlements) of $3.6m, despite incurring a decline of -14.7%. This decrease was mostly due to less demand for BTC from users, following its stabilization in price over the course of the week. Instead, we saw user demand stem from other top coins, most notably, USDC (ERC-20), and SOL. Regarding strictly user settlement volume, these two coins saw respective gains of +242.6% and +45.4%, which proved to be the primary reason for their strength overall. Respective total volumes of $1.4m and $1.2m solidified their places in 4th and 5th, while also representing the biggest gains among any top coin.

ETH had another steady performance, with user interest remaining fairly high. A total volume of ~$2.9m marks just a -4% decline from last week’s 15 week high. Although it is still quite an even split between deposits and settlements, weekly settlements took the slight edge, ending with $1.5m. Further is the fact that BTC/ETH regained its title as the most popular pair for users, as it tallied $709k this week. This surpassed BTC/USDT (ERC-20), which has remained the standout favorite since the summer months. It sat ~$213k lower, with $496k. Interestingly, this is one of the lowest volumes generated for the pair since the beginning of June, 2023.

For the first time in a long while, the total weekly volume of all top 5 coins exceeded $1m, resulting in a far more distributed spread, as illustrated below.

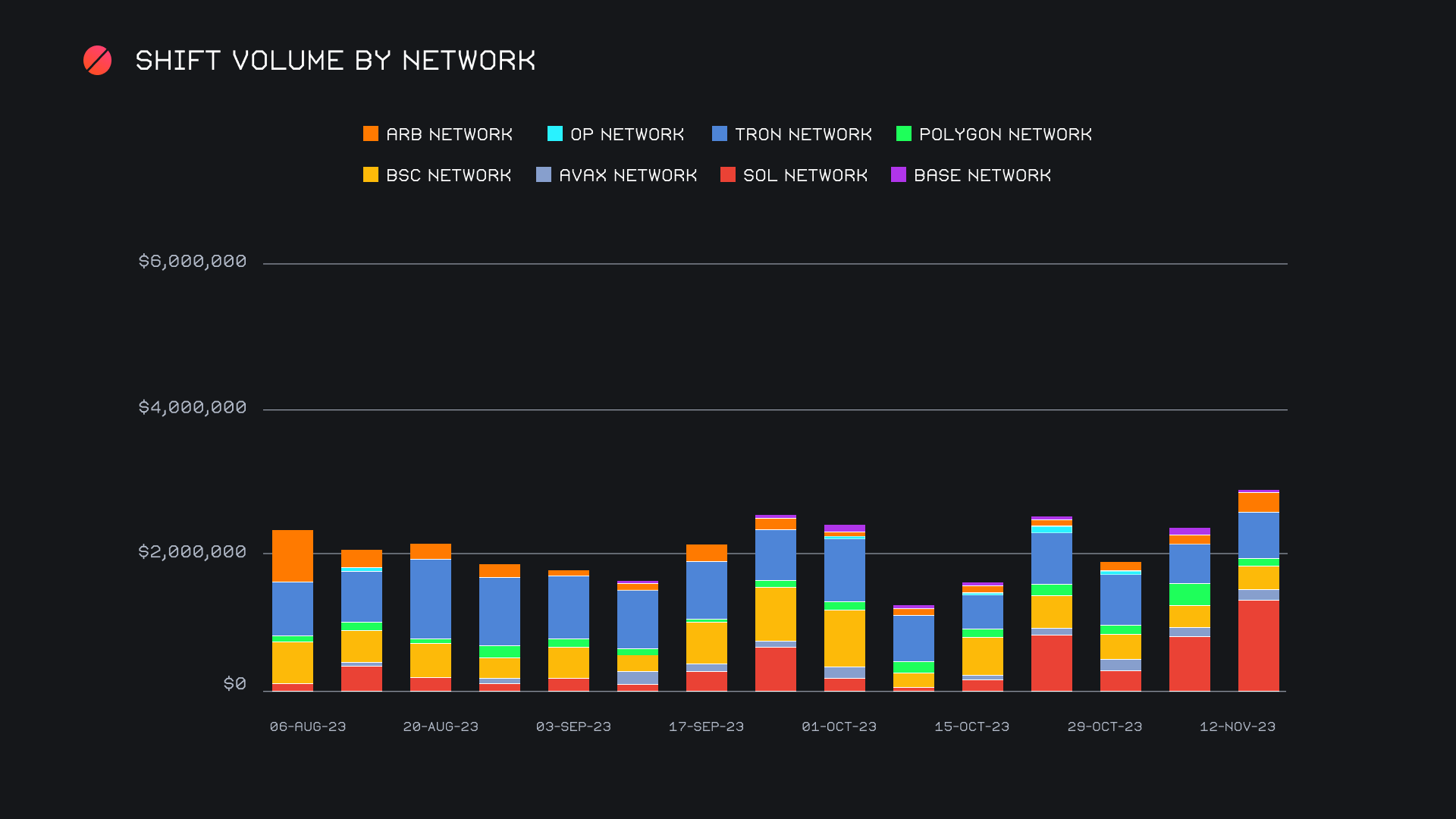

When looking at alternate networks to ETH, we can note another example of this wider distribution. Cumulatively, these 8 alternate networks rose by a combined +22% to end with $2.9m in total shift volume. This sum represents another running high, which is only surpassed if we look back to the beginning of August, 2023. However, a key difference this time is the growth appears to be much more organic, and less of a one off spike.

Feeding off of its fantastic run, the Solana network confidently asserted itself on top of alternate networks on SideShift this week, rounding off the period with a total $1.4m (+58.6%). The vast majority of this was accounted for by the native SOL token, however USDC on Solana still enjoyed a decent +17.2% gain to end with $128k. In particular, most of this SOL volume came from users shifting between SOL and either ETH, or USDC (ERC-20). A hefty way below sat the TRON network in second place, which generated $664k (+25%). As usual, this came from USDT (TRC-20) shifting, with a near 50/50 split between deposits and settlements. In third was the Binance Smart Chain (BSC) network with $324k (+8%). As a whole, all alternate networks except two saw a rise in shift volume this week, the most significant of which being the Polygon network, which fell -71.6% for $88k overall. Ultimately, the growth in shifting on these alternate networks is a positive sign for SideShift, as users look to diversify their portfolios across assets and chains we support.

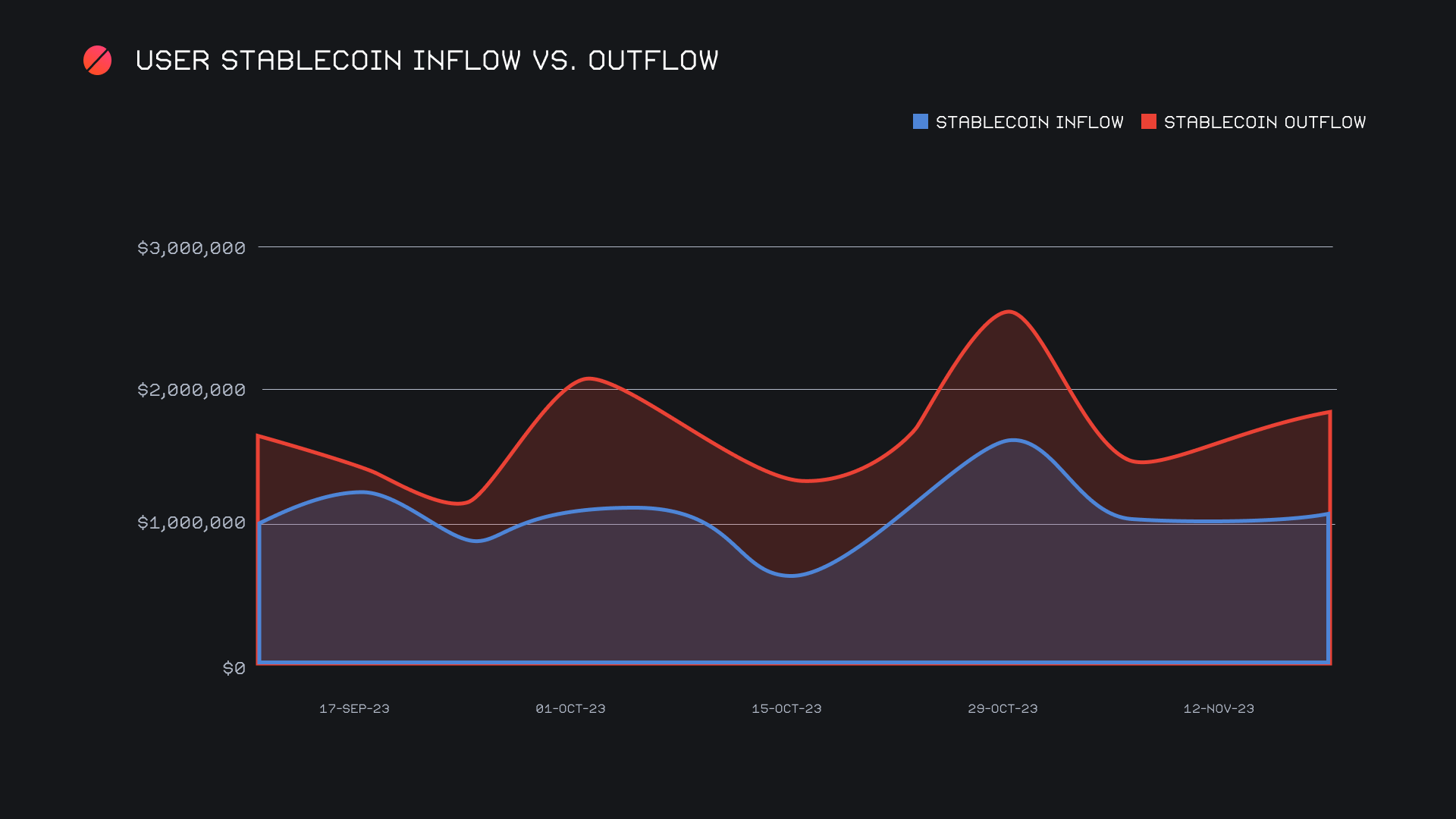

A final look at stablecoin flows on SideShift tells much of the same, with user settlements heavily outweighing that of deposits. Led by USDT (ERC-20), this week recorded a net stablecoin outflow of ~$1.8m, as compared to an inflow of ~$1.1m. This trend has remained more or less consistent for several months now, and it seems demand for USDT (ERC-20) is always present. However, this settlement advantage only seems consistent for our top stablecoins of USDT (ERC-20), and USDC (ERC-20). Nearly all others have noted a general, multi-week trend of net deposit volume exceeding settlements.

Affiliate News

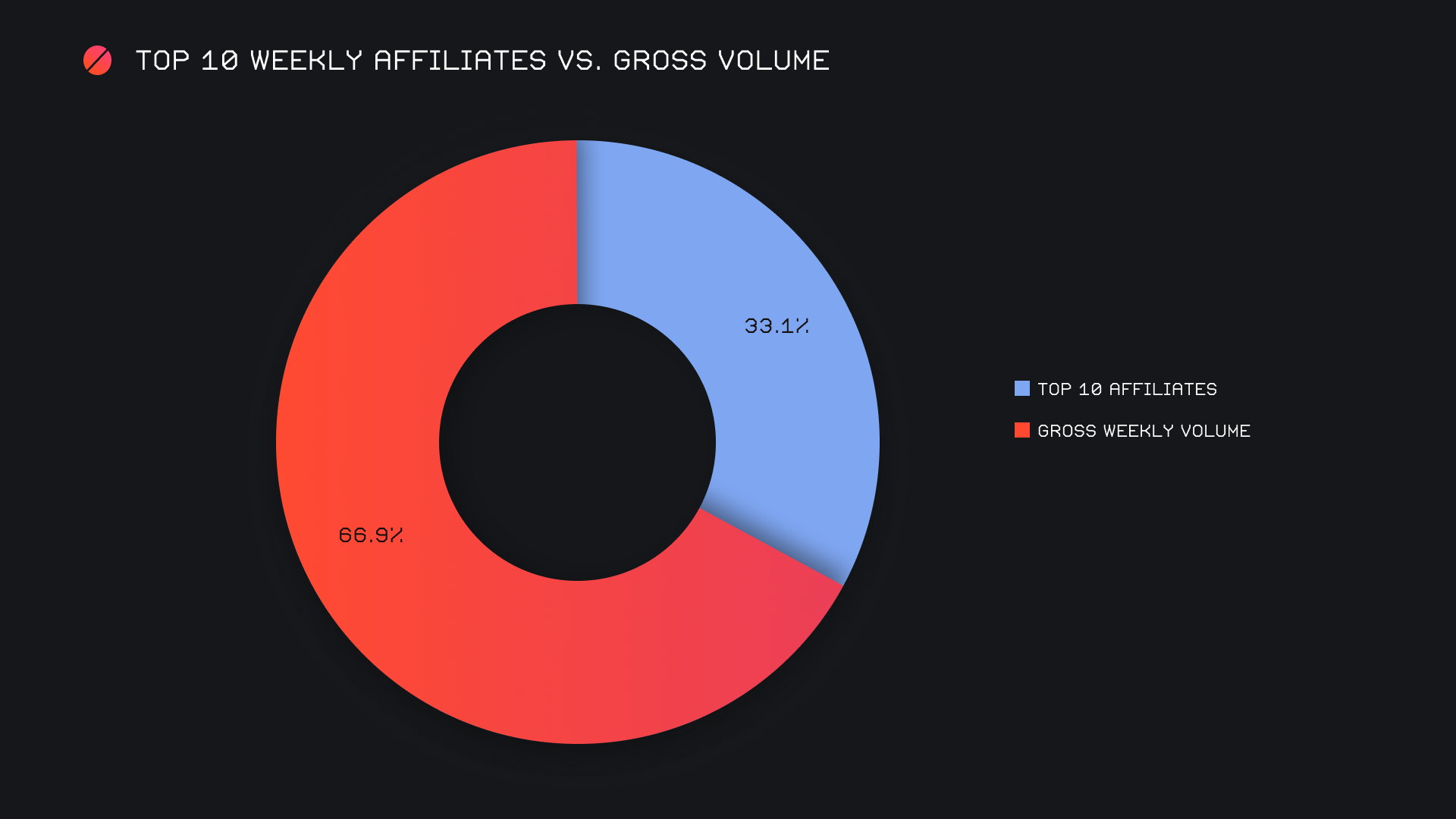

Our top affiliates had a decent week, but saw a decline when compared to last week’s solid showing. The top 10 combined for a total $2.4m (-14.4%), and had a shift count which wavered less, ending the week with 2,069 shifts (-4.3%). The first placed affiliate not only remained unchanged, but also noted the smallest decline among top affiliates. It ended with $1.1m (-7.9%), still representing 15.4% of our total weekly volume, and 18.7% of shift count.

Overall, our top affiliates accounted for 33.1% of weekly volume, a decrease of -6.2% from last week’s proportion.

That’s all for now. Thanks for reading, happy shifting and we’ll see you next time.