SideShift.ai Weekly Report | 14th - 20th October 2025

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one hundred and seventy-sixth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and seventy-sixth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

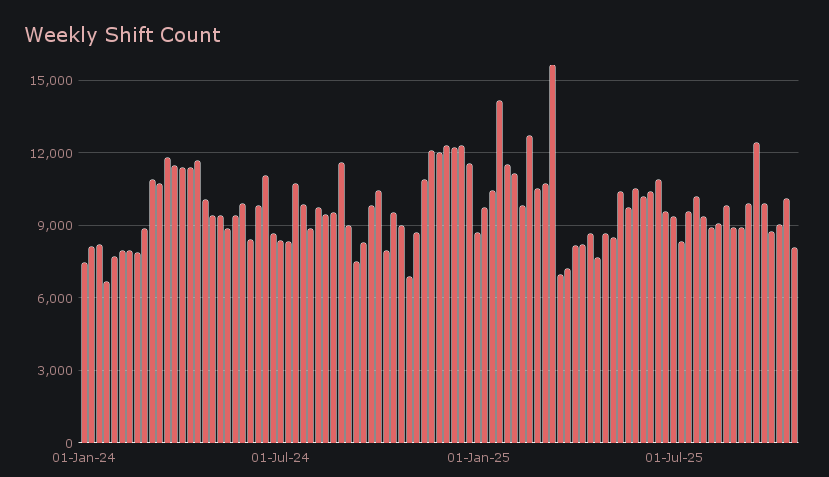

- SideShift volume totaled $10.72m (−40.1%) across 8,052 shifts (−20.1%)

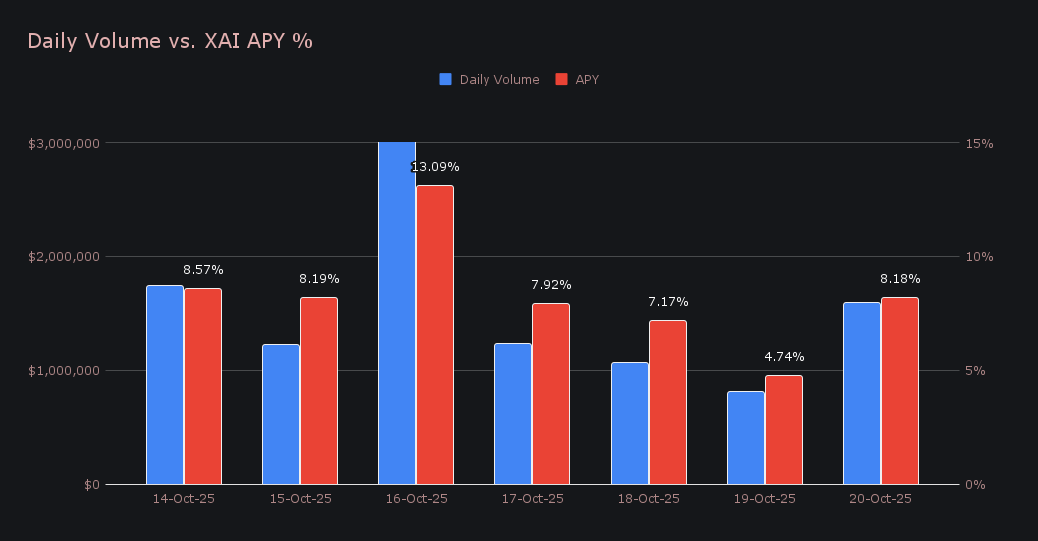

- XAI staking distributed 212,023 XAI ($29,535) to stakers at an average APY of 8.27%

- BTC and SOL led activity, with BTC at $2.45m (−56.3%) and SOL at $1.77m (−31.0%), the only top coin to post growth in any major metric

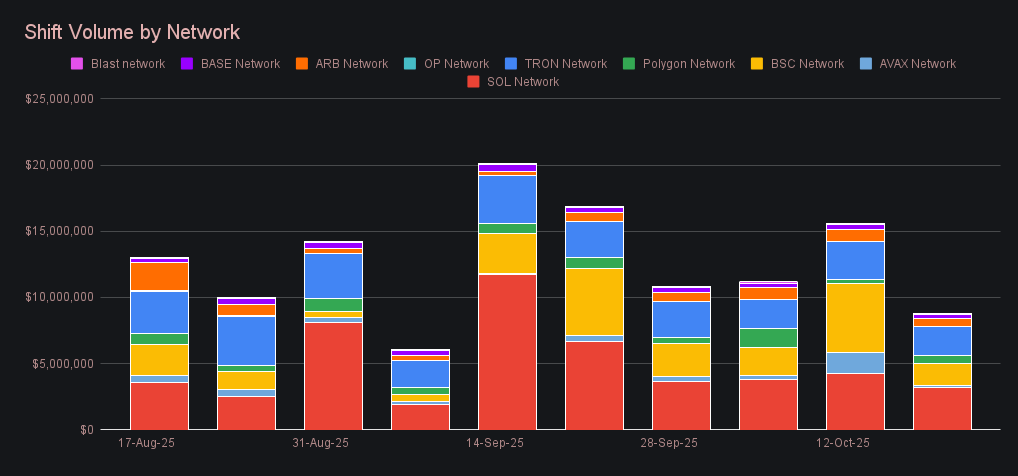

- Alt network volume fell −43.8% to $8.74m, with Polygon ($574k, +76.2%) the lone gainer among major chains

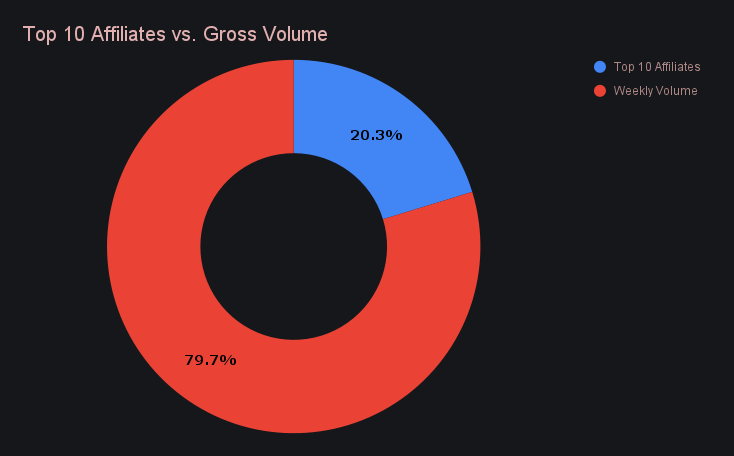

- Affiliate shifts totaled $2.17m (−36.3%), accounting for 20.27% of total volume, in line with last week’s proportion

XAI Weekly Performance & Staking

Since peaking near $0.16 in early September, XAI’s price movement has been characterized by sharp, isolated moves followed by periods of consolidation, a pattern that has gradually brought it lower over time. This week was no exception, as the token traded between $0.1361 and $0.1410 before closing at $0.1370, leaving it just below the $0.14 mark. Market cap followed at $21.06m (−3.6%), continuing the gradual decline observed in recent weeks.

Staking activity mirrored the slower pace of overall volume but remained decent, supported by brief bursts of engagement midweek. A total of 212,023.29 XAI ($29,534.89) was distributed directly to our staking vault at an average APY of 8.27%, maintaining stable yields. The most active day came on October 16, when 47,048.89 XAI was deposited to the vault at a 13.09% APY, backed by $3.04m in daily shifting volume. Despite lower market activity, staking yields held steady and continued to reward stakers.

An additional 100,000 USDC was added to our treasury last week, bringing the total to a current estimated value of $29,659,343. Users are encouraged to follow along directly with treasury updates, via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 139,793,379 XAI (+0.2%)

Total Value Locked: $19,304,510 (−1.5%)

General Business News

This week, crypto markets struggled to find direction, with choppy trading defining the tone. BTC briefly fell below $105,000 mid-week before recovering toward $108,000, while ETH slipped to around $3,700, following a similar rhythm of short, sharp sell-offs and extended periods of sideways drift. Roughly $1.2 billion in leveraged positions were liquidated mid-week, followed by another $320 million in the past 24 hours, underscoring the unstable footing across markets. Sentiment remains deeply negative, with the Fear & Greed Index sitting near 22/100, marking “extreme fear” even as BTC remains only about 10% from its all-time highs.

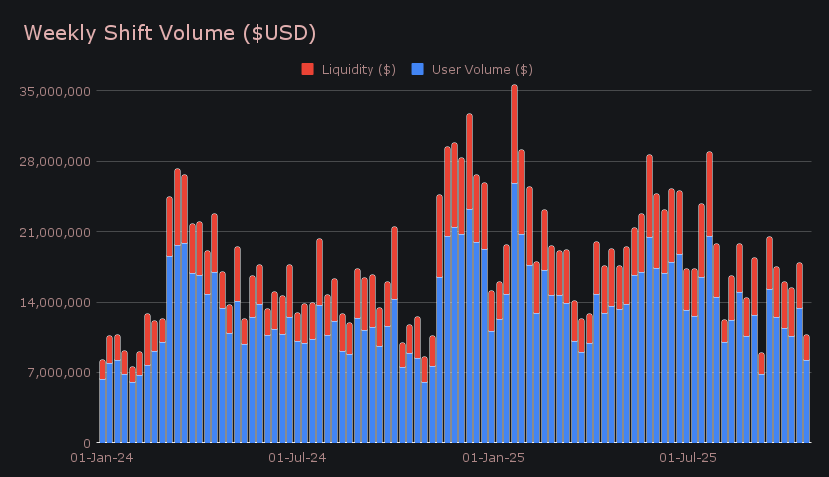

After last week’s volatile but active trading stretch, SideShift activity slowed notably alongside the weakened market sentiment. Gross weekly volume fell to $10.72m (−40.1%), with user shifting contributing $8.22m (−38.7%). Liquidity shifting added a further $2.49m (−44.2%), declining more than user volume as rebalancing needs tapered off in step with timid market conditions. Paired together with user volume, this produced an average daily volume of $1.53m.

There was a clear lack of large-scale shifting, reflected in the relatively light totals of our top pairs. The leading user pair, L-BTC/WBTC (Polygon), reached $540k after a mid-week influx of larger shifts — the only standout among an otherwise subdued set of leaders. Other top pairs — USDT (ERC-20)/USDC (ERC-20) at $290k, ETH/SOL at $212k, and ETH/BTC at $203k — all registered relatively lackluster totals, marking an uncharacteristic week with few BTC-based pairs near the top. Shift count finished at 8,052 (−20.1%), or roughly 1,150 per day, declining alongside volume as users transacted in smaller sizes throughout the past seven days.

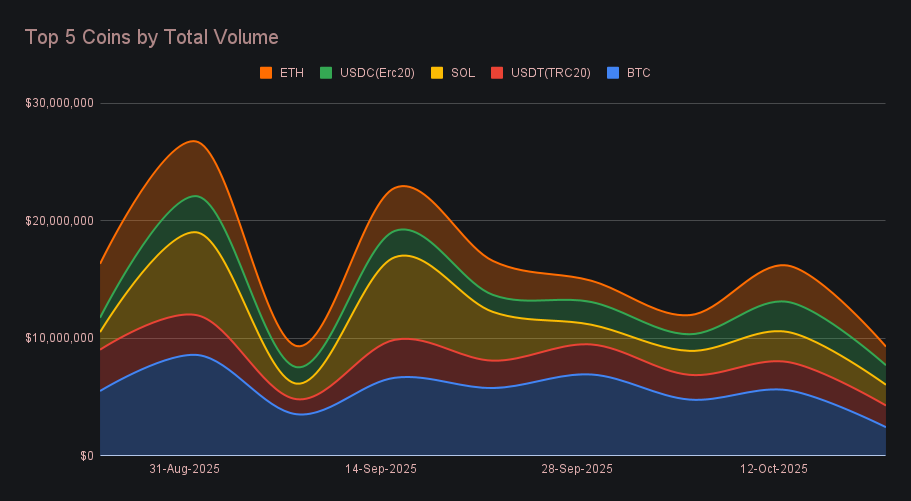

BTC led all coins for the fifth straight week but also recorded the steepest decline among any top asset. Total volume fell to $2.45m (−56.3%), its lowest weekly total of 2025 by a clear margin, with the next closest being $3.55m at the beginning of September. User deposits accounted for $1.13m (−44.6%), while settlements reached $1.18m (−47.8%), together marking a sharp pullback from last week’s levels. The drop also reflected a more dispersed spread of BTC-related activity rather than the usual concentration among top pairs, consistent with this week’s weaker totals across the leaderboard.

Among top stablecoins, USDT (TRC-20) ranked second overall with $1.85m (−23.1%) in total volume, split between $705k (−21.1%) in user deposits and $597k (−26.0%) in settlements. Despite the weekly decline, this marked the first time in seven weeks that the Tron-based variant led all stablecoins, reclaiming its top position after a long stretch dominated by Ethereum-based stables. USDC (ERC-20) also returned to the top five with $1.66m (−35.0%), including $366k (−14.6%) in deposits and $770k (−16.0%) in settlements, while USDT (ERC-20) fell out of the top ranks after leading all stablecoins through October. Notably, net stablecoin flows — which measure the combined total of inflows versus outflows — flipped positive for the fourth time in five weeks, suggesting users continued accumulating risk-on assets even amid reduced overall activity.

Rounding out the top five coins, SOL and ETH finished in third and fifth place, respectively. SOL recorded $1.77m (−31.0%) in total volume, with $557k (−54.4%) in deposits and $984k (+20.2%) in settlements — making it the only top coin to see an increase in activity on either side of the shift. That rise in settlements stood out during an otherwise bleak stretch. SOL has held a modest lead between the two in four of the past six periods, reflecting steady user demand for Solana despite the recent fluctuations in overall volume. ETH followed with $1.59m (−48.8%), including $821k (−45.6%) in deposits and $636k (−33.6%) in settlements. Both coins have declined sharply since their early-September highs, but SOL’s recurring settlement strength has helped it maintain a slight advantage in SideShift activity heading into late October.

Alternate networks to Ethereum endured a broad pullback, dropping −43.8% to $8.74m, though still narrowly outpacing the ETH network’s $7.26m (−21.5%). The Solana network led with $3.25m (−24.4%), followed by Tron at $2.20m (−21.9%) and BSC at $1.66m (−68.2%), the latter heavily impacted by a −66% slide in native BNB shifting from $3.30m to $1.12m. Polygon stood out as the only gainer, up +76.2% to $574k, a move tied directly to the week’s top shift pair, L-BTC/WBTC (Polygon). Meanwhile, Avalanche activity plunged −91.7% to $130k as whale flows in USDC (AVAX), WAVAX, and BTC.b disappeared, while Arbitrum, Base, and Optimism posted smaller declines between −25% and −30%. As a group, these higher-beta networks tended to move in greater magnitude with overall platform activity, showing a slightly sharper downturn in what was already a quieter performance for total volume.

In listing news, SideShift has added support for several tokens on the HyperEVM chain including hwHYPE, wHYPE, and USDT0, in addition to DoubleZero (2z) on Solana, and BSC based tokens ChainOpera AI (COAI), WBNB and MemeCore (M).

Affiliate News

Affiliate activity cooled alongside overall platform volume, with total affiliate shifts amounting to $2.17m (−36.3%). First place remained on top with $1.02m (−22.5%), while second place held dead steady at $353k (0.0%). A new entrant took third spot with $239k, narrowly replacing last week’s finisher. The decline in nominal totals reflected the slower pace seen across SideShift as a whole, though affiliates maintained a steady share compared to last week.

All together, our top affiliates contributed 20.27% of total volume, up +1.2% from the week prior.

That’s all for now - thanks for reading and happy shifting.