SideShift.ai Weekly Report | 16th - 22nd July 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one-hundred-and-fourteenth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and fourteenth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week, SideShift token (XAI) experienced a relatively stable performance, with its 7-day price range moving between $0.1637 and $0.1678. At the time of writing, XAI token is priced at $0.1671, reflecting a market cap of $22,869,935, which marks a modest increase of +1.74% from the previous week's total.

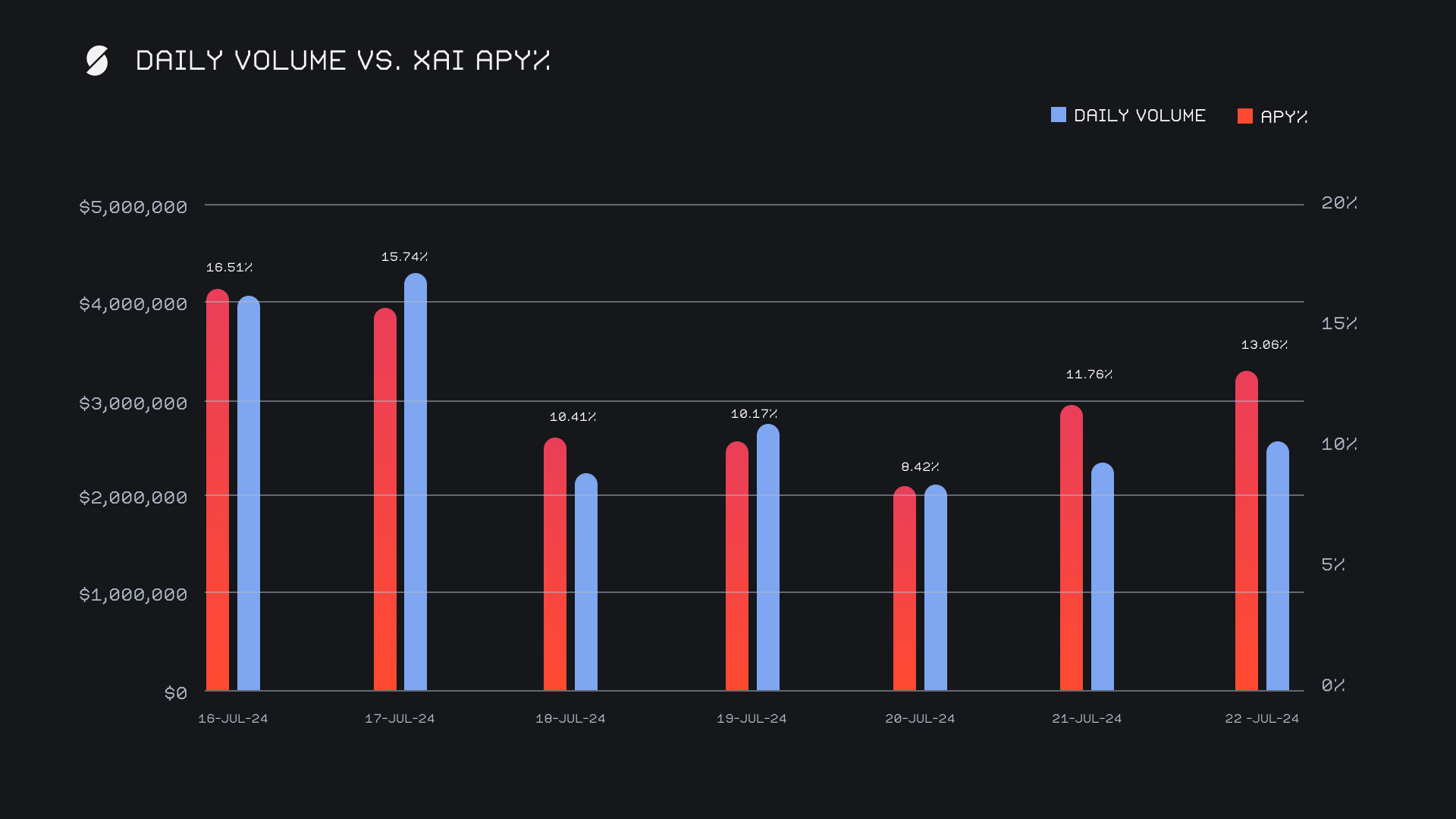

XAI stakers enjoyed an average APY of 12.30% this week, with the highest daily reward recorded on July 16, 2024. This amounted to 51,063.72 XAI, and corresponded to a solid APY of 16.51%. This peak in daily rewards followed a daily volume of $4.1 million. In total, XAI stakers were rewarded with 270,822.68 XAI or $45,254.47 USD in staking rewards over the week.

An additional 2 WBTC was added to SideShift's treasury last week, bringing the current sum to a total of $16.52m. Users are encouraged to follow along directly with live treasury updates, via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 122,313,031 XAI (+0.2%)

Total Value Locked: $20,697,216 (+3.4%)

General Business News

The crypto world is buzzing with excitement and positive price action following the big news of President Biden stepping out of the re-election race, adding a twist to the election season. Further fuel to the fire is the anticipation of the upcoming Ethereum ETFs, which are now set to hit the market as soon as Tuesday. The result has been a more than +40% swing in market sentiment in less than three weeks.

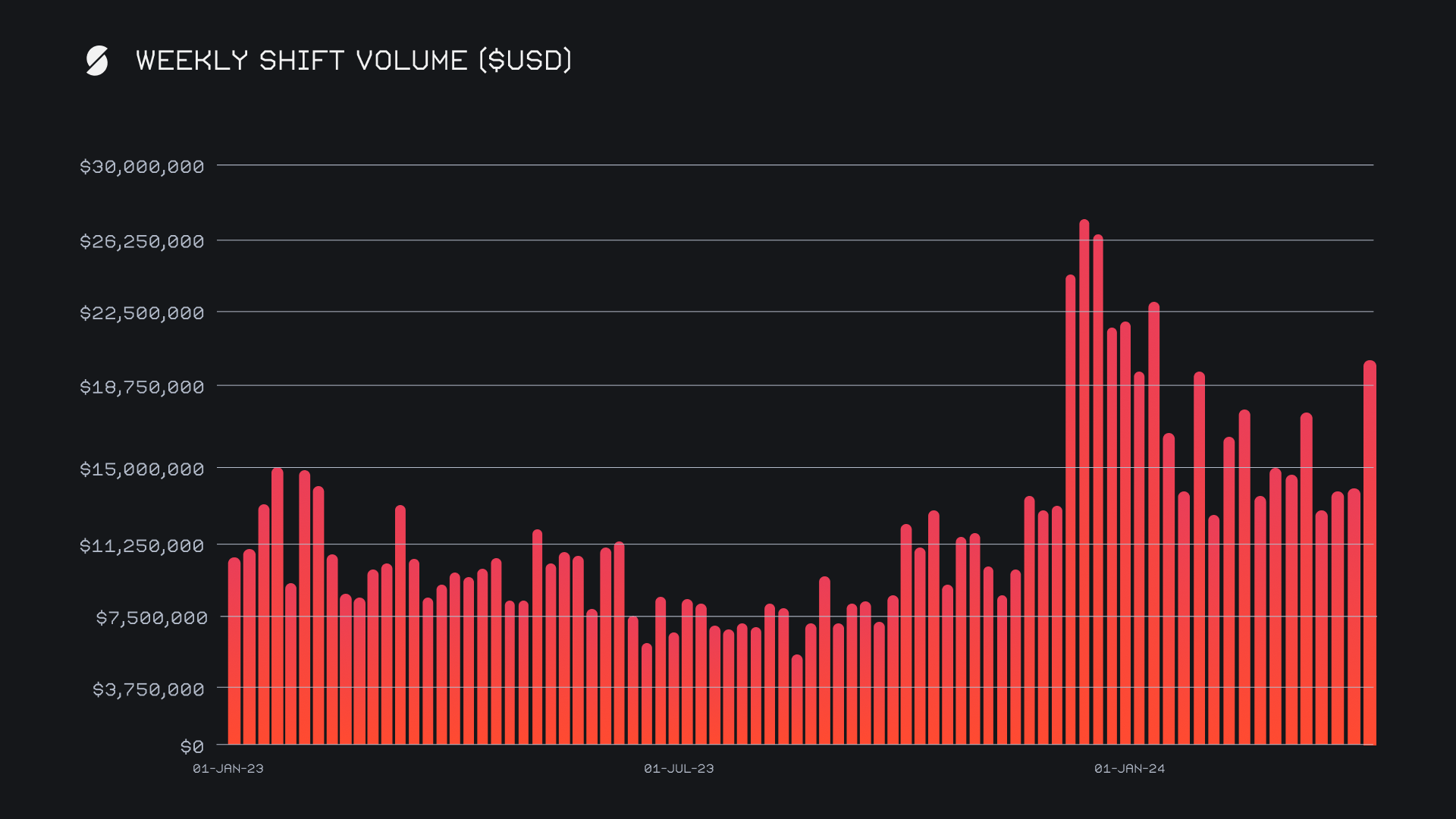

SideShift had a fantastic performance and closed with a gross volume of $20.3m, a significant increase of +45.6% from last week. This boost has marked a new high for the month, with daily averages coming in at $2.9m across 1,409 shifts. This week’s volume measured as our 7th highest all time as well as representing the 7th week where our volume has surpassed the $20m milestone. The BTC/ETH pair remained a top choice for users with a sizable volume of $3.7m, and confidently towered over all other pairs. The next most popular pair among users was BTC/USDT (ERC-20), which sat far lower with $765k.

Interestingly, our weekly shift count saw a slight dip of -8.1% for a total of 9,866 shifts. Despite fewer overall shifts, the larger average shift size indicates increased transaction values per shift, highlighting a trend of higher-value transactions. This suggests users are making more significant moves on SideShift, contributing to the impressive overall volume. The BTC/ETH pair was a key source for high value shifts this week.

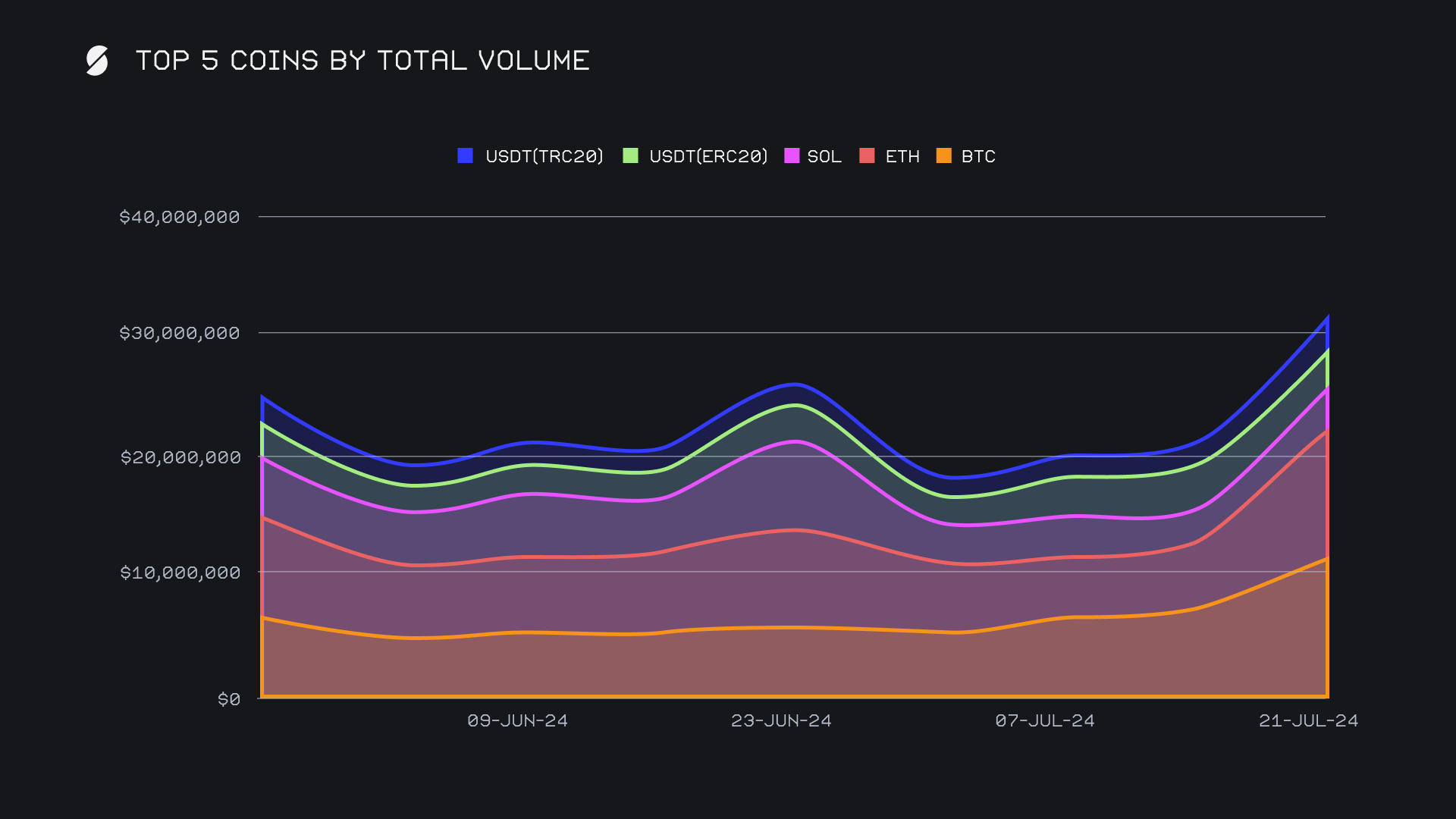

BTC surged to the top with a total volume (deposits + settlements) of $12.1m, marking a substantial increase of +62.6%. The week saw a continuing trend of users preferring to deposit more BTC than receive it, as deposits boomed by +53.7% and reached $5.6m. Settle volumes also rose but still sat at less than half that of deposits, ending with a total of $2.2m (+19.9%). This incredibly dominant showing for BTC marked the highest weekly volume achieved by any coin on SideShift since early March 2024, a period when BTC was touching ATH’s.

ETH followed with a total volume of $11.0m, showing an outstanding rise of +91.9%, and the highest gain among our top 5 coins. While deposit volume slightly decreased to $1.9m (-3.6%), settlement volumes skyrocketed to $5.4m (+124.4%). The considerable rise in settlement volume indicates an obvious high demand for ETH, which was a critical factor in its total volume nearly doubling from last week’s $5.7m. This week’s total signified an all time high total volume for ETH on SideShift, just narrowly surpassing the previous high set back in March 2024.

SOL maintained third placed position with a total volume of $3.5m, an increase of +35.3%. This derived from a fairly even split between user deposits and settlements, which ended with respective sums of $1.4m (+94.1%) and $1.3m (+4.3%). From this, we can see user deposits were the more volatile of the two sides this week, with the demand for SOL still struggling to replicate figures it had a few months ago. Despite this decent growth, it is still clear that the focus of users intensely remains on top coins BTC and ETH for now.

In addition to our top coins, several outside the top 5 recorded remarkable 3 digit gains in weekly total volume. The most notable example was 6th placed ETH (BASE), which climbed +178.5% to end with $850k. Other examples included stablecoins USDC (SOL) (+102% for 614k) and USDT (BSC) (+124% for $546k), as well as XRP, which jumped +251% for $309k. This wide scope of increases seen across coins was certainly an added boost to our gross volume, and supplemented the already strong performance stemming from top coins.

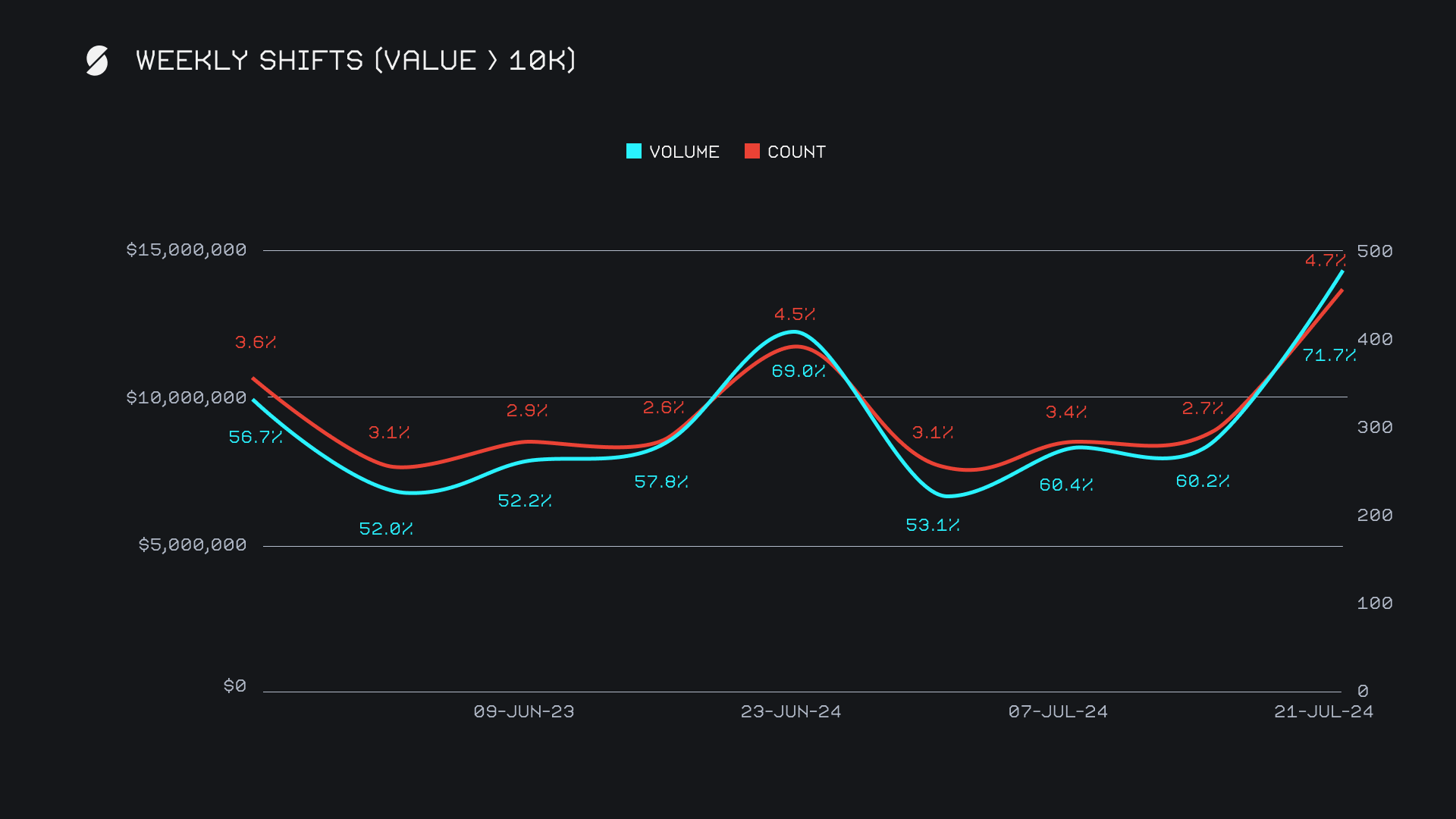

The previously mentioned significance of the BTC/ETH pair in addition to the overall volume increases across coins resulted in one of the most observable spikes in whale shifting ever measured on SideShift. When analyzing shifts with a value greater than $10k, we can see that this week an overwhelming 71% of our volume came from a shift of this size. In dollar terms, that translated into $14.5m coming from shifts with a value >$10k this week, or $6.1m more than was seen last week - certainly a bullish metric.

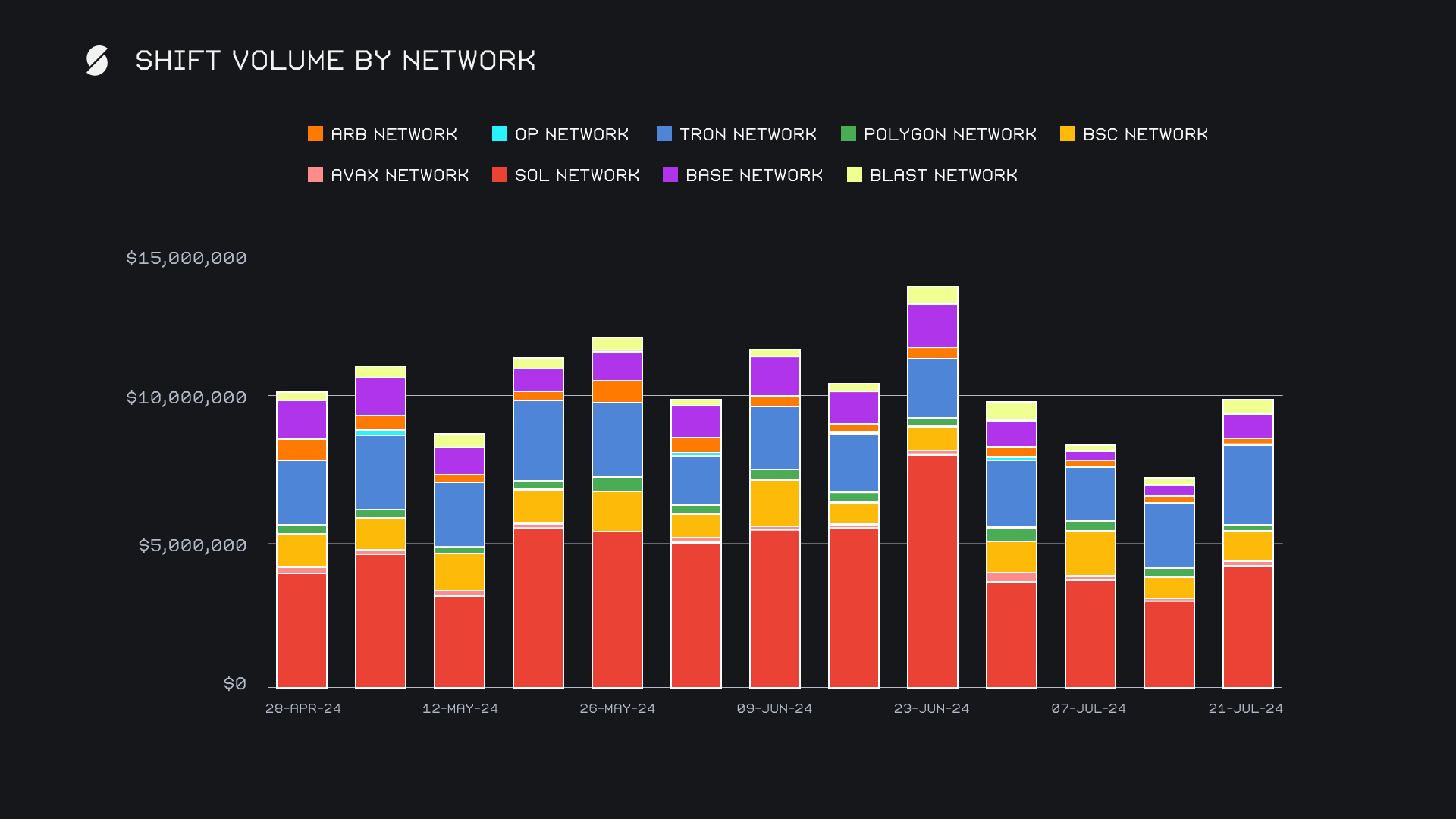

It was a good week for alternate networks to ETH, with 8 out of the 9 seeing weekly increases in user shifting. There wasn’t much changing in the order, as the SOL network continued to lead the way with a volume of $4.2m, up +39.3% from last week's $3.0m. In second was the usual TRON network with $2.8m (+21.1%), followed by the Binance Smart Chain (BSC) network, which saw a strong rise of +57.4% to $1.1m. The BASE network also had a great week and soared +152.7% to reach $916k thanks to the sudden interest in its native ETH token. The only network going against the grain this week was the Polygon network, which saw its volume fall -39% to $194k. All together, alternate networks to ETH were involved in 24.5% of weekly shift volume, as compared to the Ethereum networks proportion of 31.7%.

Affiliate News

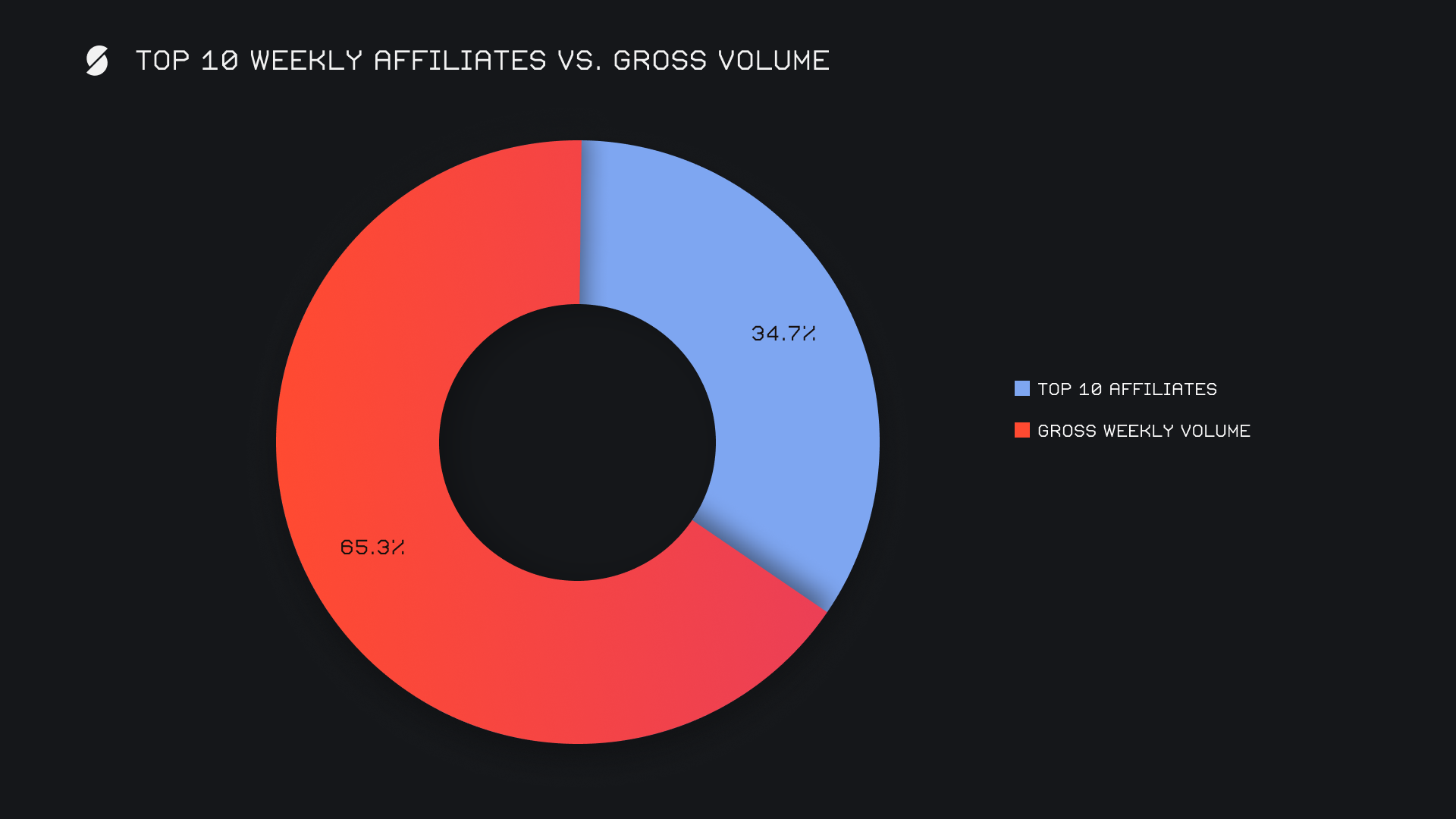

This week, our top affiliates generated a combined total volume of $7.0m, marking a considerable increase of +62.2% from last week. Our leading affiliate more than doubled its performance and closed the week with a volume of $4.0m, up by +102.1%. It achieved this alongside an ever steady shift count of 1,074. Both our second and third placed affiliates also saw decent rises, and ended with respective sums of $1.7m (+18.8%) and $839k (+30.2%).Collectively, the top affiliates contributed to 34.7% of our total weekly volume, +3.5% higher than last week's proportion, and reflecting a nice boost in affiliate-driven activity.

That’s all for now. Thanks for reading and happy shifting.