SideShift.ai Weekly Report | 16th - 22nd September 2025

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one hundred and seventy-second edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and seventy-second edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

- SideShift volume totaled $17.48m with 9,879 shifts, with shift count closing just 0.5% from the YTD average.

- BTC led at $5.77m, with settlements up +70.7% to $2.86m as users bought near the lows, while deposits fell to a two-month low of $1.32m.

- SOL ranked second at $4.15m, with deposits collapsing without last week’s whale flow, though steadier settlements of $1.92m kept it ahead of ETH.

- USDT (BSC) cracked the top 5 for the first time in 2025, finishing third at $3.83m and surpassing all other stablecoins in total volume this week.

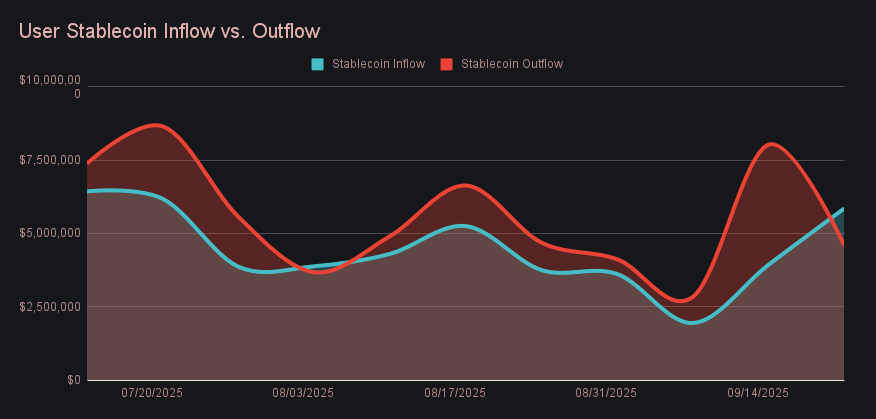

- Net stablecoin flows flipped positive at +$1.28m, a $5.3m swing from last week’s outflows and the largest inflow of the year.

XAI Weekly Performance & Staking

XAI spent the week bouncing between $0.1633 and $0.1683, with the chart showing a mix of short-lived rallies and quick retracements that ultimately kept it in a tight range. It closed at $0.1645, slightly below last week’s $0.1656. Market cap ended at $25.25m, a −0.79% change from the prior $25.45m, continuing the flattening pattern that has followed the brief climb in early September.

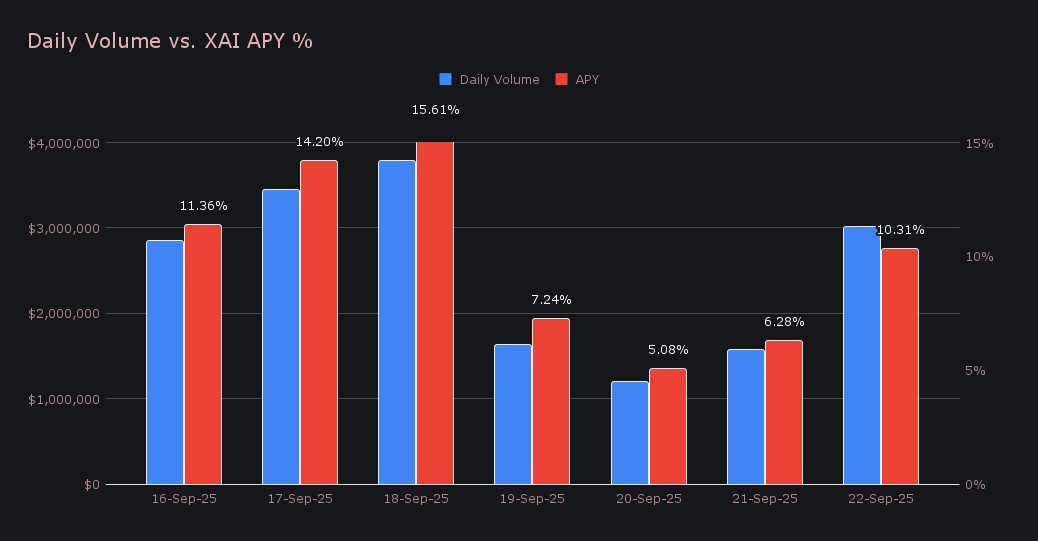

Staking totals moved slightly higher, with 252,197.13 XAI (worth $42,000.84) being distributed to the staking vault at an average yield of 10.01% APY. September 18th was the most notable day, with 55,085.99 XAI rewarded at an APY of 15.61%, supported by $3.79m in daily shift volume. Both rewards and yields finished above last week’s levels, reflecting a steady uptick alongside ongoing platform activity.

SideShift’s treasury grew with 100,000 USDC being added last week, bringing the current total to an estimated $30,473,011. Users can follow along with live treasury updates directly at sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 138,809,668 XAI (+0.1%)

Total Value Locked: $22,949,992 (+0.5%)

General Business News

Crypto markets saw a powerful shake-out this week as over $1.7 billion in leveraged positions were liquidated in a single 24-hour stretch — the largest long liquidation event so far in 2025. BTC dropped to tag $112,000, while ETH fell roughly -9% towards $4,150, before stabilizing. Meanwhile, the launch of Aster, a new DEX rising as a rival to Hyperliquid, pulled in massive attention. Aster’s debut showed surging TVL, bullish early user engagement, and large token price appreciation, climbing to a market cap just shy of $3 billion in its first week.

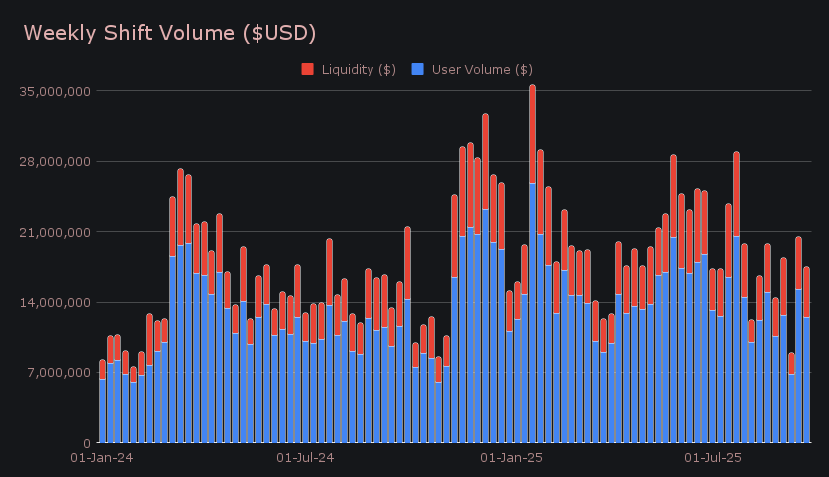

SideShift volume cooled to $17.48m (−14.7%) following last week’s rebound, with user activity summing $12.52m (−18.1%) and internal liquidity rebalancing adding a further $4.96m (−4.3%) in shift volume. The smaller pullback in rebalancing pointed to a more even balance between supply and demand of top coins, which required fewer internal moves along with the overall reduced volume. The week’s leaders also told a story — our top two pairs, USDT (BSC)/BTC at $1.20m and USDC (SOL)/SOL at $736k, were both stablecoin inflows, and less common ones at that, highlighting heavy buying interest from multiple chains. This contrasted with recent months, when flows more often leaned toward selling into stables. ETH/SOL rounded out the group at $429k, keeping BTC and SOL at the center of activity.

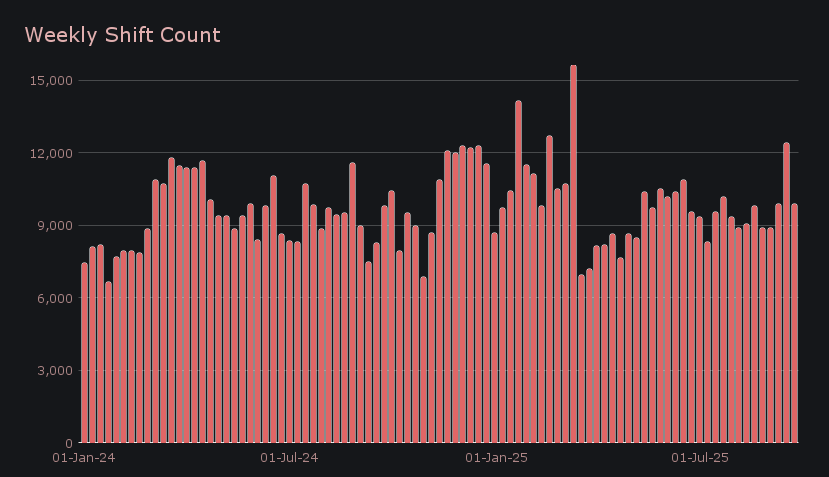

Gross shift count finished at 9,879 (−20.3%), or an average of 1,411 per day. Rather than representing a meaningful downturn, this instead marked a reset to SideShift’s baseline, closing within just 0.5% of our running YTD average. Last week’s spike was the outlier whereas this week reflected the platform’s typical rhythm, with shift counts settling back into alignment even as volume eased from the prior week’s highs.

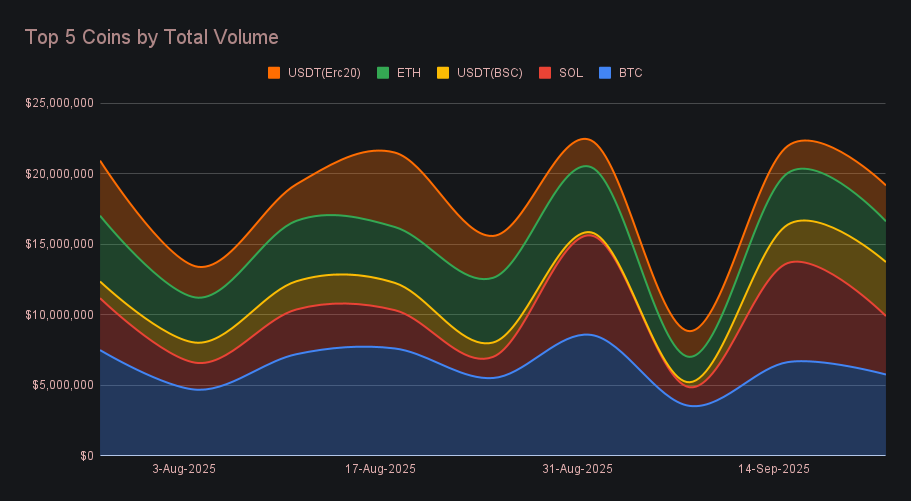

BTC led the board at $5.77m (−13.2%), a step back from last week but still the week’s largest mover. Its profile flipped from deposit-heavy to settlement-driven, with user deposits plunging to $1.32m (−54.6%), the lowest deposit volume recorded in the past two months, while settlements surged to $2.86m (+70.7%). This change reflected strong buying flows into BTC as its price approached the low $112k range, in tandem with a considerable slowdown in fresh inbound deposits.

SOL followed in second with $4.15m (−41.0%), giving back much of last week’s explosive gain. Deposits collapsed to $1.35m (−68.2%), with the absence of the large SOL/USDC (SOL) whale flow standing out as the main reason for both last week’s surge and this week’s pullback. Settlements, by contrast, looked steadier at $1.92m (+13.4%), leaving total SOL volume relatively resilient and enough to keep it ahead of ETH. Meanwhile, ETH slipped to fourth with $2.89m (−21.1%), as deposits fell to $1.31m (−21.2%) and settlements to $779k (−26.5%), leaving it weaker across the board and looking comparatively softer in recent weeks.

Stablecoins rounded out the top five, with USDT (BSC) breaking into the leaderboard for the first time in 2025 and even finishing third at $3.83m (+40.7%). Its climb was heavily aided by the week’s leading pair, echoing the way SOL volume was lifted by SOL/USDC (SOL) a week earlier. User deposits reached $1.63m (+28.7%) while settlements totaled $746k (+54.8%), confirming broad engagement on both sides. USDT (ERC-20) also advanced to $2.55m (+32.7%), marking its return to the top five after a string of comparatively slower weeks, consisting of $724k in deposits (+62.2%) and $1.21m in settlements (+25.4%).

For stablecoins as a whole, the bigger story was the shift in user flows. Net stablecoin activity ended the week at +$1.28m, a swing of more than $5.3m compared to last week’s heavy outflows. It marked the sixth positive flash this year and the largest to date, signaling a clear uptick in user risk appetite, and was driven by heavy deposits into both USDT (BSC) and USDC (SOL). A positive stablecoin flow has yet to sustain in back-to-back weeks in 2025, leaving this as a key trend to watch as we move forward.

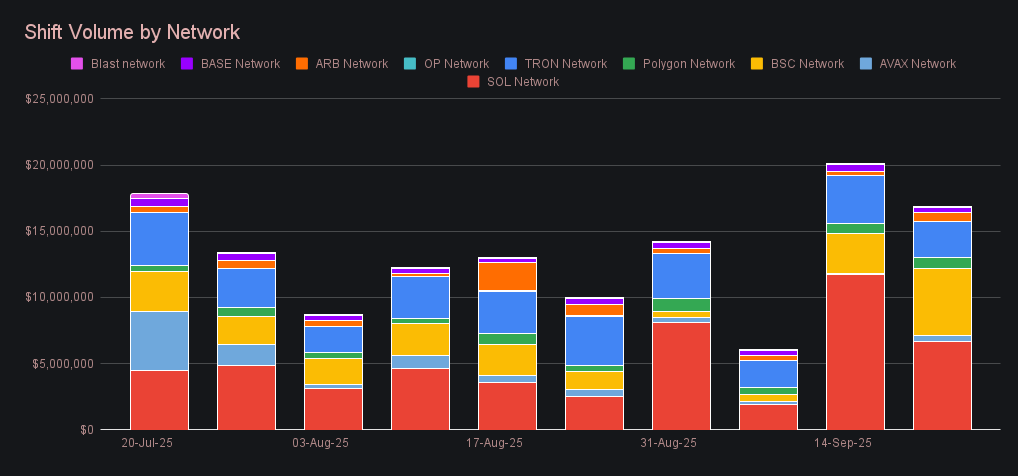

Alternate networks to ETH totaled $16.82m (−16.2%), moving in line with the broader pullback in site activity and still outpacing Ethereum’s $7.85m (−5.6%). The Solana network led with $6.70m (−42.7%), remaining the single largest alt contributor, while the BSC network followed with $5.06m (+67.3%). This move overtook Tron, which eased to $2.74m (−23.3%) as USDT (TRC-20) volume fell out of the top five and was surpassed by stablecoins on other networks. Further down, Polygon ticked higher to $842k (+11.3%), while Arbitrum and Avalanche booked percentage standouts at $649k (+113.7%) and $429k (+224.8%). Base retreated to $399k (−31.3%), underscoring the uneven performance beyond the leading group.

Affiliate News

Affiliate totals landed at $4.80m this week (−48.4%), nearly halving from the level recorded seven days earlier. Last week’s runner-up advanced to first with $1.85m (−1.7%), showing relative consistency at the top. Second place dropped sharply to $1.04m (−82.4%) after the previous week’s burst of whale activity had temporarily propelled it to the lead. Third place was newly filled at $327k (+47.9%), continuing the recent pattern of rotation on the lower steps of the rankings. Affiliate results once again highlighted the knock-on effect of whale flows, where outsized moves can reshape both partner standings and total volume alike.

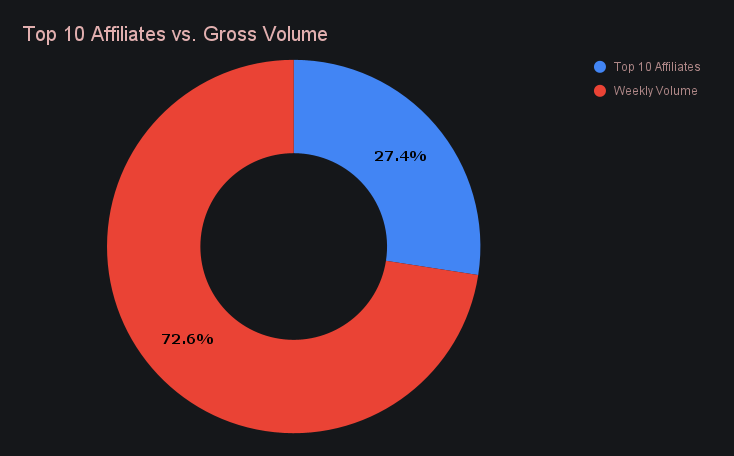

All together, our top affiliates contributed 27.4% of total site volume, down −17.9% from the prior week.

That’s all for now - thanks for reading and happy shifting.