SideShift.ai Weekly Report | 18th - 24th February 2025

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one hundred and forty second edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and forty-second edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This past week saw SideShift token (XAI) trade within the price range of $0.1892 to $0.1961, holding relatively steady throughout the period, aside from a brief wick beyond $0.20 on February 20th. At the time of writing, XAI is priced at $0.1933, with a current market cap of $27,853,536, reflecting a slight dip of -0.88% from last week.

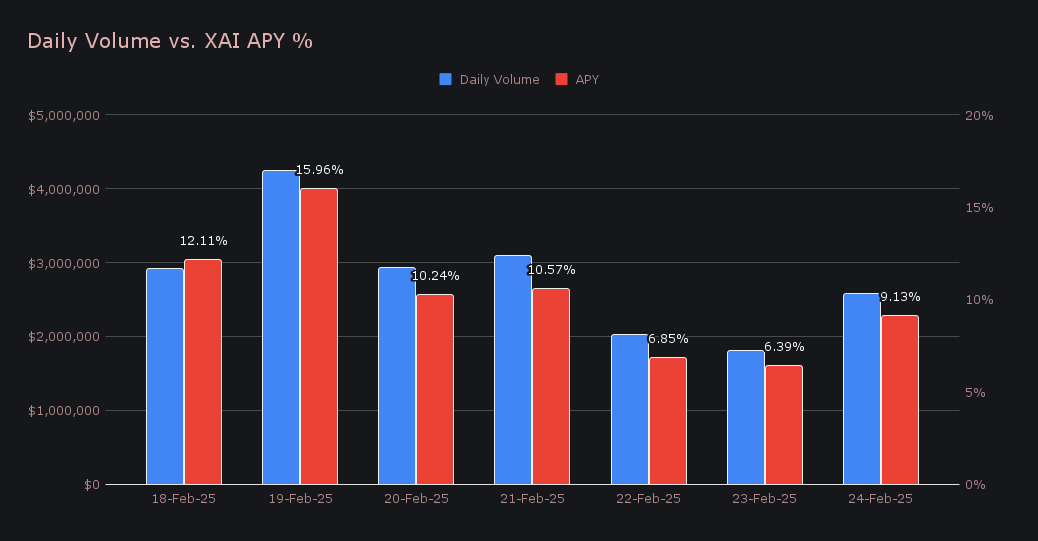

XAI stakers saw steady returns throughout the week, earning an average APY of 10.18%. The largest payout was on February 20th, when 53,075.89 XAI was distributed to the staking vault, yielding an APY of 15.96%. This peak coincided with a daily volume of $4.2m, reflecting SideShift’s heightened activity early in the week. By week’s end, stakers had amassed a total of 242,502.17 XAI, valued at $46,855.21 USD.

An additional 150,000 USDC was sent to SideShift's treasury over the course of the week, bringing the current total to a value of $22.2m. Users are encouraged to follow treasury updates directly via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 131,197,206 XAI (+0.2%)

Total Value Locked: $25,575,053 (+0.9%)

General Business News

This week the crypto market was shook by Bybit’s $1.4 billion hack - the largest crypto heist in history allegedly carried out by North Korea’s Lazarus Group. Despite Bybit swiftly replenishing its ETH reserves with a $742 million buyback, market sentiment remains quite bearish. BTC has since slid to $90k, while SOL has plunged more than -20% to $140 ahead of an impending token unlock, leaving holders cautious and the market bracing for further volatility.

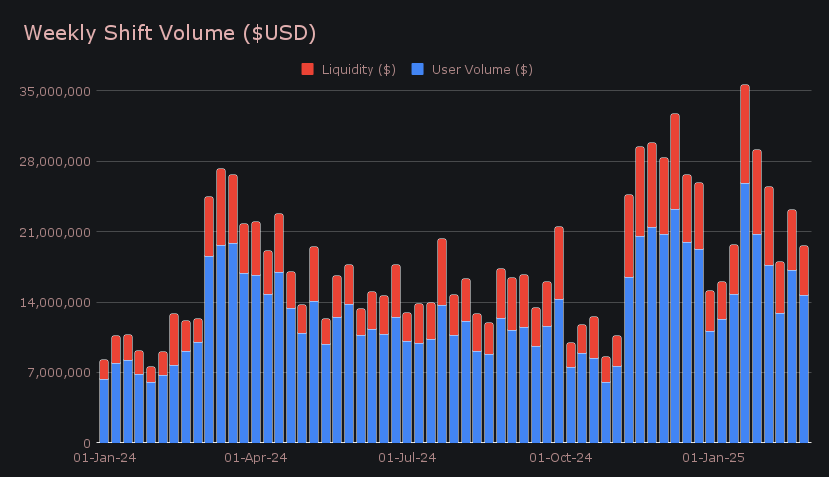

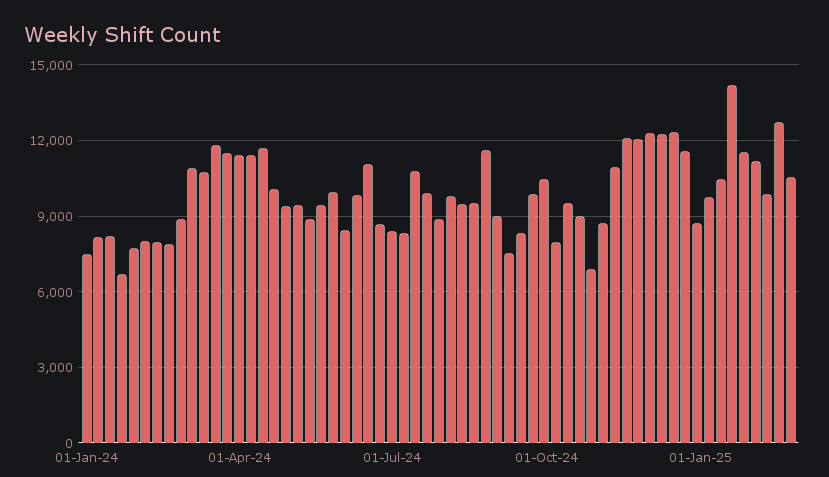

SideShift experienced a pullback in shift activity, with gross weekly volume closing at $19.5m (-15.7%). The slowdown was evident across both user and liquidity shifting, as user volume dropped to $14.7m (-14.8%), while liquidity shifting summed $4.9m (-18.4%), falling at a faster rate due to a lesser need for rebalancing. Last week’s surge in liquidity shifting was partially driven by unidirectional BNB shifts, which proved to be a fleeting anomaly as opposed to an ongoing trend.

While not the slowest week of 2025, this week's total volume sat -16% below our running YTD average. Meanwhile, our gross weekly shift count declined -17.3% to 10,506 shifts, landing just -6.5% lower than its YTD average. Notably, the BTC/USDT (ERC20) pair emerged as a focal point of activity, surpassing $1m with a gross $1.02m in user volume, as users flocked to stablecoins amidst ongoing market uncertainty. Daily averages wrapped up at $2.79m in volume across 1,501 shifts per day.

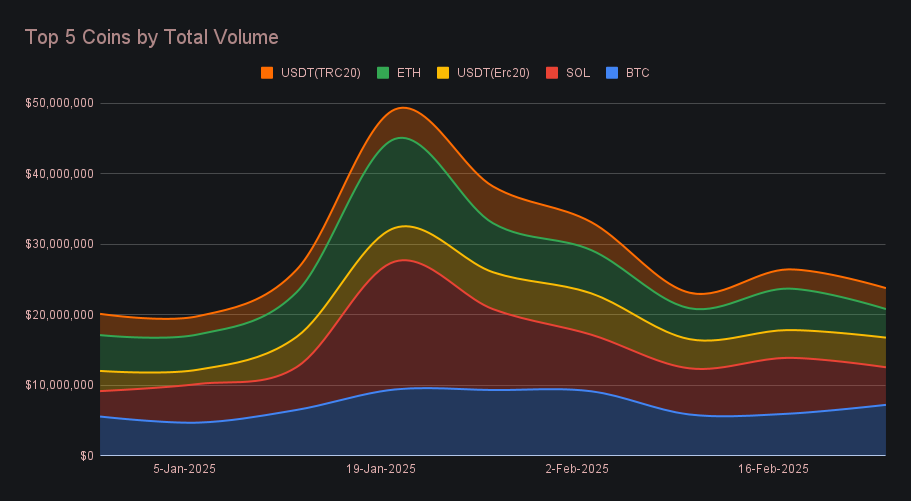

BTC climbed to the top spot this week with a total volume of $7.25m (+21.1%), regaining its dominance after several weeks of varied performance. Deposits led the charge, climbing +29% to $2.68m, while settlements dipped slightly by -1.8% to $3m. Notably, BTC settlements have held steady near the $3m mark in four of the past five weeks, reflecting rather consistent user demand despite the choppy price action.

In contrast, SOL tumbled to second place with $5.33m (-32.8%), marking a sharp reversal from last week’s surge. User deposits dropped -36.8% to $2.27m, while settlements followed suit, falling -23.3% to $1.82m. The change highlights a fading appetite for SOL, particularly after last week’s rush to offload positions amid bearish price action. With SOL’s price slipping further and sentiment turning cautious, users appeared more hesitant to engage, leaving SOL’s volume trailing well behind BTC.

USDT (ERC20) rounded out the top three with $4.21m (+6.7%), driven by a rising user demand for stablecoins. Settlements jumped +27.1% to $2.0m, while deposits pulled back -23.8% to $1.04m, reflecting a strong preference for receiving stable assets as market volatility persisted. USDT (ERC20)’s steady performance stood out among the week’s top coins, as users sought stability amid declining interest in riskier assets.

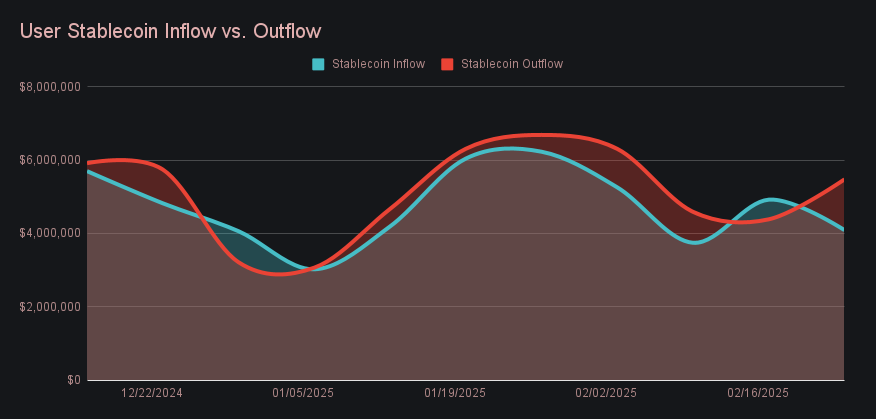

This trend was echoed across other top stablecoins, with USDT (TRC20), USDC (ERC20), and USDC (SOL) reaching settlement volumes of $1.19m, $922k, and $593k respectively. Each experienced a rise of more than +20% compared to last week. Collectively, net stablecoin flows (inflows minus outflows) swung to -$1.39m, a sharp reversal from last week's positive flow of $536k as shown in the chart below. Further, last week marked the first time since October 2024 that stablecoin inflows outpaced settlements. The shift back to negative flows this week highlights a more risk-averse stance that has become increasingly apparent.

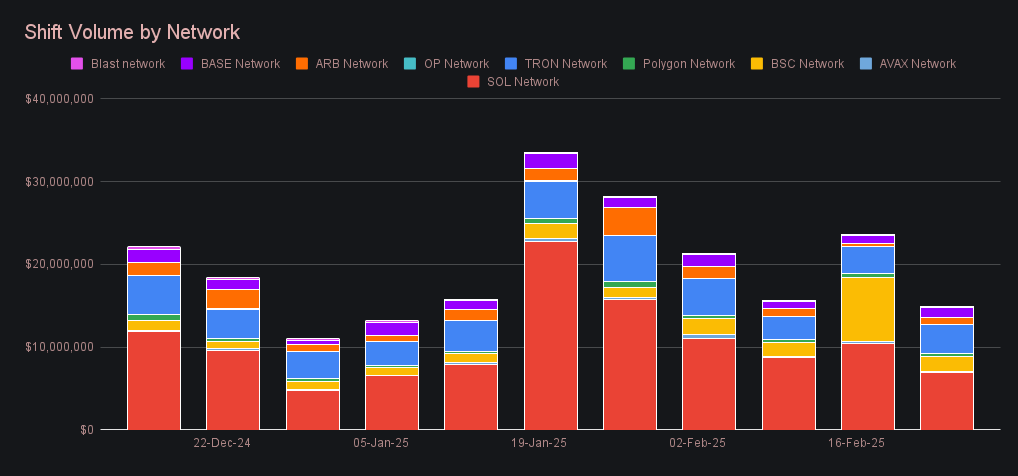

The Solana network remained the frontrunner among alternate networks to ETH, but its momentum waned as volume dropped -33.3% to $6.98m - its lowest weekly total since the first week of the year. The Tron network followed with $3.51m (+10.3%), with USDT (TRC20) being the primary driver behind the increase in volume. Meanwhile, shifting on Binance Smart Chain (BSC) plummeted -77.5% to $1.75m, returning to normal levels after last week's frenzy which saw BNB end as our week’s second most shifted coin. Elsewhere, the Base network climbed +18.9% to $1.21m, while the Arbitrum network more than doubled its total to $790k (+127.3%). In contrast, Polygon dipped to $386k (-21.2%), while the Avalanche network slipped to $158k (-23.9%).

In general news, SideShift’s Telegram bot is slowly gaining traction, offering users the convenience of shifting directly from within the Telegram app. February’s shift count has already surpassed January’s total of 98, with 115 shifts so far, while volume is on pace to match last month’s $66k. Larger shifts are beginning to surface as well, with February 20th generating $12k from just seven shifts - one of the bot’s biggest single-day totals to date. Our engineers continue to refine the Telegram bot, ensuring a seamless experience as adoption grows.

Affiliate News

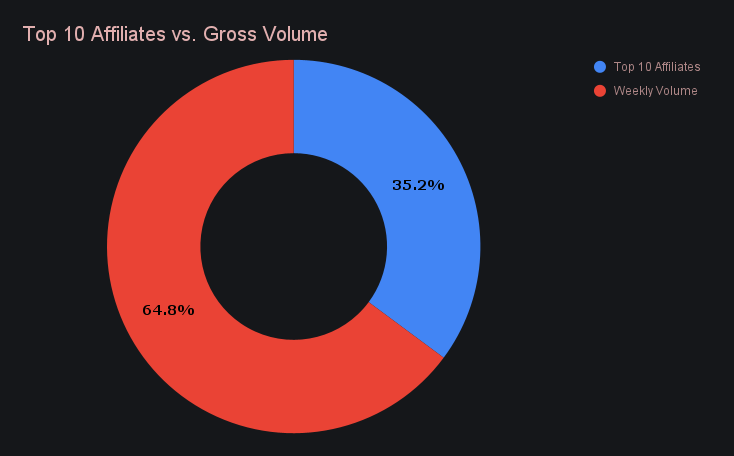

Our top affiliates combined for a collective volume of $6.87m, marking a minor drop of -2.1% from last week’s sum. Our first placed affiliate, which has confidently held its spot since late 2024, led the charge with $5.03m (+12.4%) and recorded one of the highest weekly totals ever seen from a single affiliate. This standout performance alone contributed over a quarter of SideShift’s weekly total volume. Meanwhile, second place increased +40.1% to $689k, climbing past the former number two, which fell -35.3% to $436k for third place overall. Altogether, our top affiliates accounted for 35.2% of total volume, about +5% higher than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.