SideShift.ai Weekly Report | 18th - 24th November 2025

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one hundred and eighty-first edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and eighty-first edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

- SideShift held firm above $10m, closing the week at $10.73m (−7.3%) despite market-wide drawdowns and a mid-week selloff that propelled daily volume to $2.90m.

- BTC settlements jumped +167.4%, driving more than $7m in combined BTC + L-BTC flow as users bought heavily into the dip.

- Net stablecoin flow flipped positive, with platform-wide net flows reversing by +$1.7m to land at a modest +$43k after four straight weeks of outflows.

- XAI gained +3.1% on the week, marking its first upward move in a month, while stakers earned 202,482.54 XAI at a 7.90% average APY.

- Alt networks extended their six-week decline, led by Solana’s $2.07m (−31.3%) finish, as cross-chain activity remained concentrated in just a handful of major networks.

XAI Weekly Performance & Staking

XAI flattened out this week and finally moved against the month-long slide that has defined most of November. The token bounced within a compact range of $0.1205 to $0.1234 before finishing at $0.1224, marking a +3.1% gain over the past 7 days and the clearest upward shift in the past month. Market cap echoed the minor improvement, advancing +3.35% to $18.81m, a welcome change after several weeks of drifting lower.

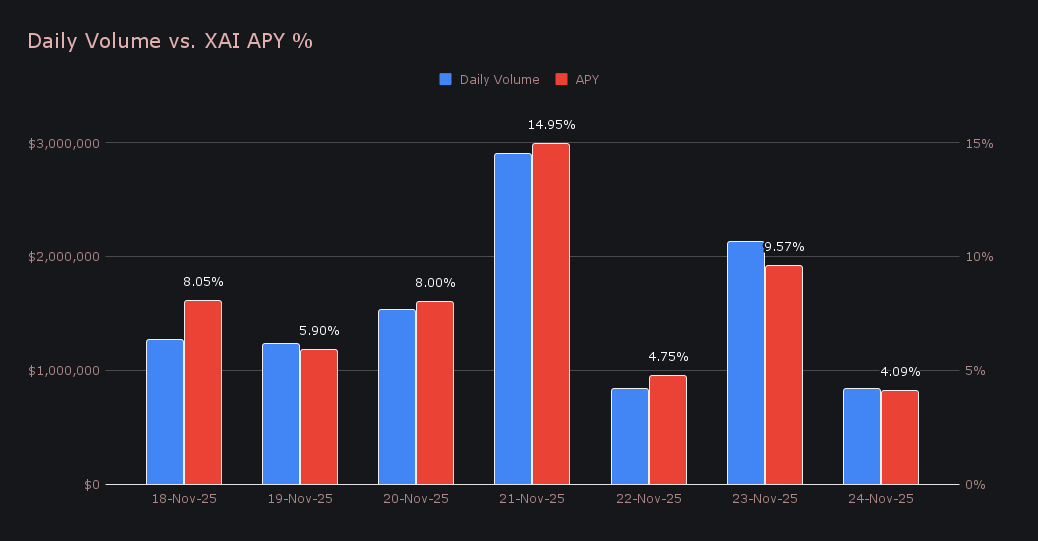

Stakers earned 202,482.54 XAI ($24,721.63) at an average APY of 7.90%, keeping returns broadly in line with recent weeks. The standout moment came on November 21st, when 53,241.07 XAI was sent to the staking vault at 14.95% APY, backed by $2.90m in daily volume. Outside of that high point, activity settled into a consistent rhythm, with daily volume hovering in the $1.2m–$1.5m band, steady enough to keep yields firm without any sharp swings.

Additional XAI updates:

Total Value Staked: 139,638,586 XAI (−0.6%)

Total Value Locked: $17,003,746 (+2.5%)

General Business News

Crypto spent the past week unwinding further as risk appetite evaporated across global markets. BTC slid toward the $80k region earlier in the week before reclaiming ground to roughly $88k, a move that trimmed part of the drop but did little to change the broader trend. The pullback has now pushed total crypto market capitalization roughly $1.2 trillion lower, a punishing slide across just six weeks. Sentiment reflected this stress as the Fear & Greed Index hit 6/100, one of the lowest readings ever recorded, before stabilizing near 15 by week’s end. Traditional stock indices also weakened over the same stretch, reinforcing the broader risk-off backdrop across major asset classes.

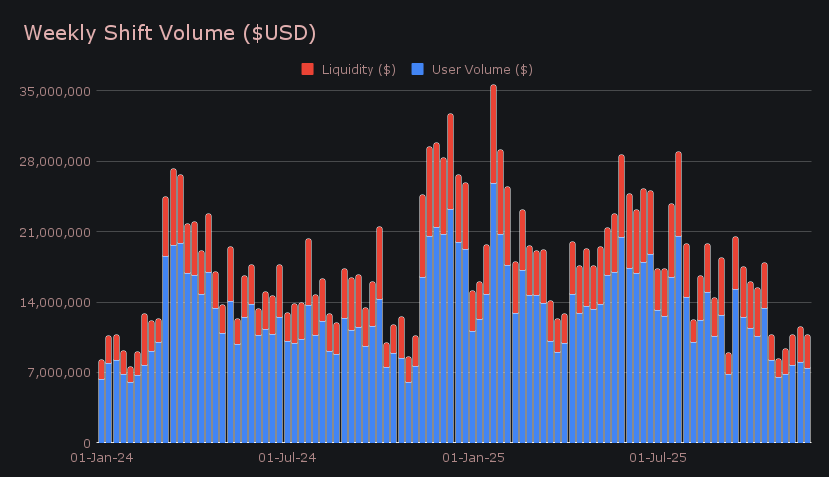

SideShift closed the period with $10.73m (−7.3%) in total volume, holding above the $10m level even as markets continued to trend lower. Activity stayed relatively uniform aside from a clear mid-week spike, when shift volume jumped to $2.90m amid the sharp selloff. User shifting finished at $7.47m (−7.2%), while liquidity shifting totalled $3.25m (−7.5%), reflecting a near-parallel pullback across both segments. USDT(ERC-20)/BTC led all user pairs at $713k, followed by L-BTC/WBTC (poly) with $624k, a pathway that has become one of SideShift’s more recurring user pairs as of late and often delivers concentrated bursts whenever it rises towards the top.

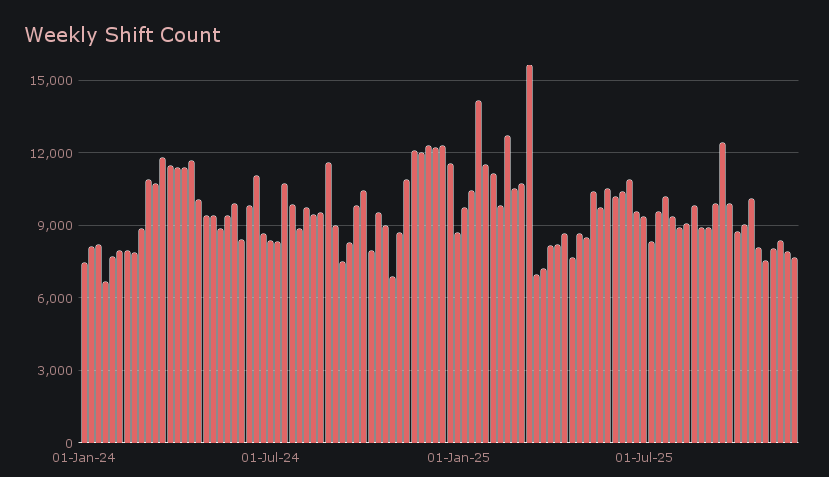

Shift count finished at 7,648 (−3.4%), placing the week at the lower end of 2025 readings and sitting roughly -20% below the year-to-date average. Daily activity averaged 1,093 shifts, while daily volume averaged $1.53m, both metrics reflecting a stretch where engagement was steady but clearly lighter outside the volatility window. With gross volume holding up more than shift count, the data pointed to larger average transaction sizes in general.

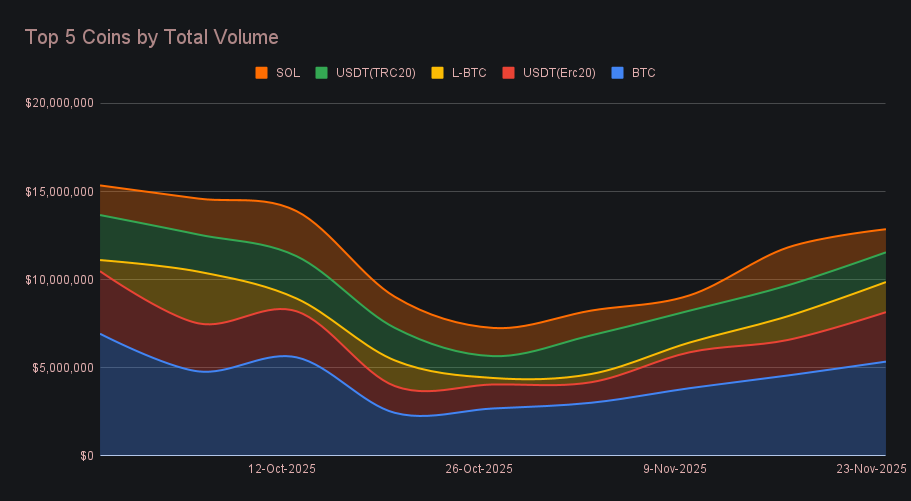

BTC held the top spot with $5.35m (+17.2%), but the composition shifted meaningfully from the last report. Deposits slipped to $1.88m (−15.6%), but settlements vaulted to $1.69m (+167.4%), showing users were stepping in with conviction and buying BTC far more aggressively than in prior weeks. Together with L-BTC, which finished third at $1.71m (+26.7%) on a split of $823k (+20.3%) in deposits and $120k (+40.3%) in user settlements, BTC-related assets accounted for more than $7m in weekly flow and dominated the top of the leaderboard.

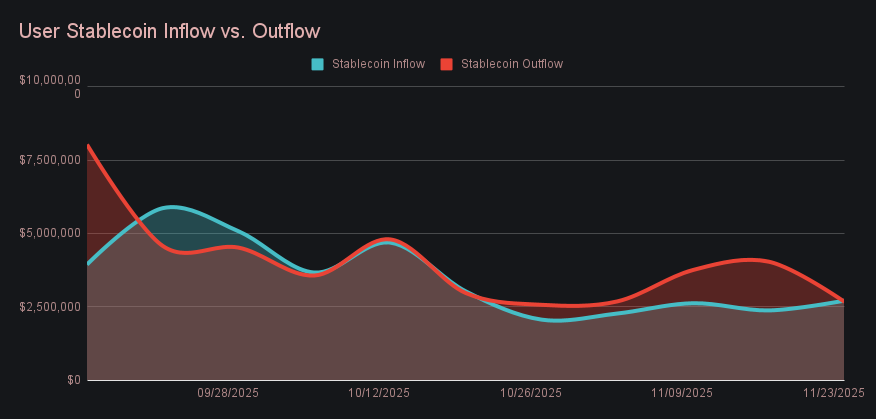

USDT (ERC-20) ranked second overall with $2.81m (+39.4%), driven by a sharp rise in deposits to $1.22m (+79.9%), making it the main source of stablecoin inflow this week and the driver behind the top user pair, USDT (ERC-20)/BTC. USDT (TRC-20) followed at $1.69m (−3.7%), with deposits at $403k (−33.4%) and settlements at $686k (+10.0%), giving it a level but still meaningful role in overall activity. Platform-wide stablecoin behaviour flipped for the first time in a month, with net stablecoin flows across all assets reversing by +$1.7m week-on-week to finish at a modest net positive of +$43k, breaking a four-week run of negative flow that’s historically far more typical on SideShift.

SOL finished at $1.31m (−39.0%), the steepest decline among the current top five coins and a clear reversal from last week’s strength. Deposits fell to $474k (−40.3%), while settlements dropped to $493k (−22.8%), reflecting a broad pullback in user activity on both sides of the shift. ETH, meanwhile, fared even worse, with total volume collapsing −60.8% to $902k, placing it eighth overall, an unusually low showing for an asset that typically sits comfortably inside the top tier. This week also continued the structural move seen since late October, with activity increasingly funneled into the top five coins as their combined volume has trended higher and reclaimed a larger share of total flow.

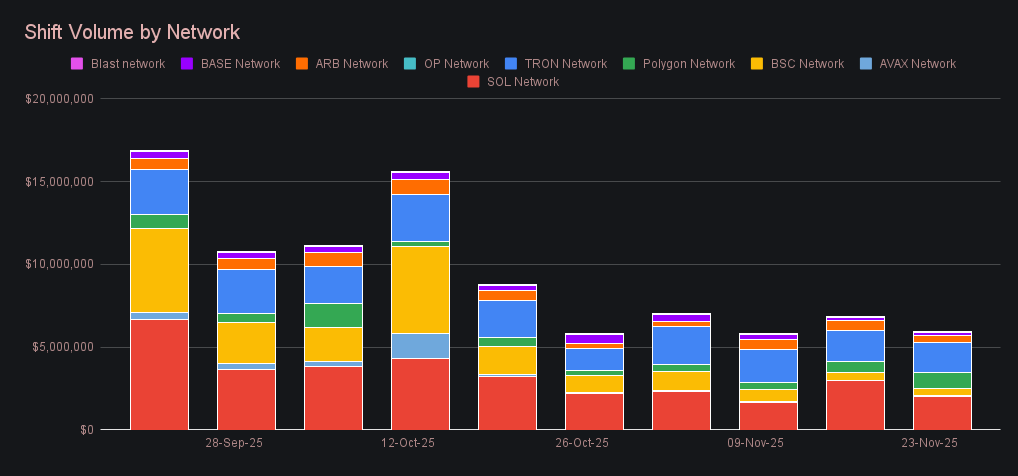

Alternate networks remained locked in the six-week downswing that began in September, with this week’s totals continuing that same trajectory. The Solana network led with $2.07m (−31.3%), continuing its steady pullback from the $3m–$4m zone seen earlier this quarter. The Tron network followed at $1.85m (−3.0%), holding above the $1.5m mark but still trailing the stronger prints from October. Polygon came in at $965k (−30.2%), while BSC logged $413k (−11.6%), both extending their multi-week drift lower. Arbitrum recorded $399k (+20.7%), a small bounce that kept it within its usual range, and Base contributed $196.9k (+27.7%), an oscillating mid-band result consistent with its typical week-to-week movement.

In listing news, SideShift added support for a handful of Ethereum based tokens this week, including Wrapped eETH (WEETH), Ethena Staked USDe (SUSDE), and SUSDS.

Affiliate News

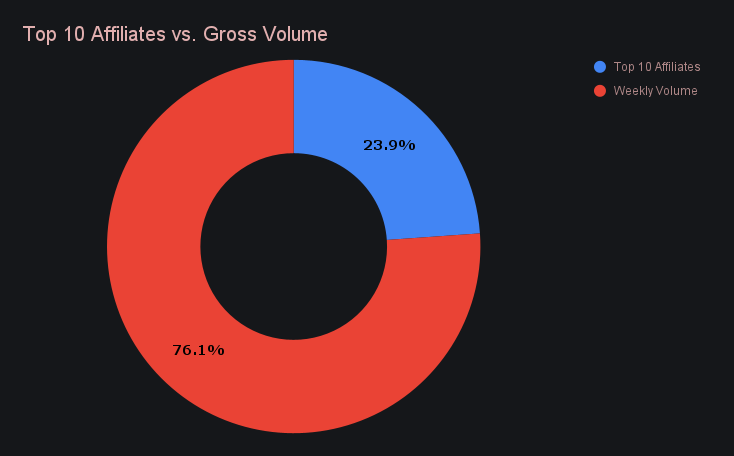

Top affiliates slowed from last week’s stronger performance, finishing with $2.56m (−25.4%) in combined total volume. Our first placed partner retained its rank and generated $938k (−30.6%), while second and third improved to $487k (+51.7%) and $467k (+19.7%), respectively, increases that helped overall throughput but did not offset the broader decline in aggregate affiliate shifting.

Altogether, our top affiliates accounted for 23.9% of weekly volume, a decline of −5.8% from last week’s share.

That’s all for now - thanks for reading and happy shifting.