SideShift.ai Weekly Report | 19th - 25th July 2022

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the twelfth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the twelfth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

XAI Token Market Update

Throughout the week SideShift token (XAI) ranged between $0.161437 / $0.171974, and is currently sitting at a price of $0.167747. A market cap of $7,950,724 places XAI in position #940, mostly unchanged from last week.

SideShift is very happy to announce that the staking dashboard is now live for all users. SideShift users can now see live staking statistics, as well as claim svXAI, stake, and unstake easily and directly from the SideShift.ai site. We are continuing to work and expand upon this page to make it as user friendly and straightforward as possible. Our staking rewards bot is also now back in action, providing daily updates to users who have connected their Telegram account with SideShift. If you have yet to do this, you can find more information here.

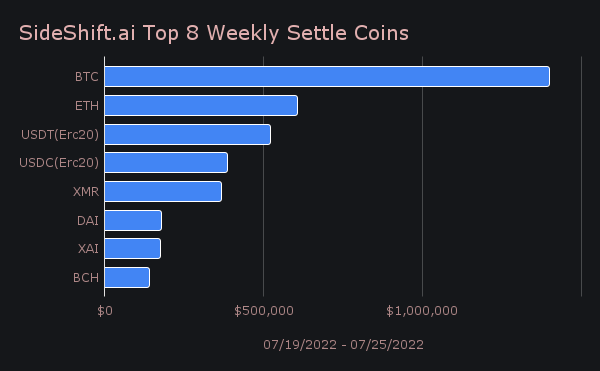

Overall on-chain XAI activity has begun to increase since the migration, and throughout the week, ~$175k of XAI was moved on-chain. This activity ranked XAI as our 7th most popular settle coin, and we hope to see the momentum carry into the next week.

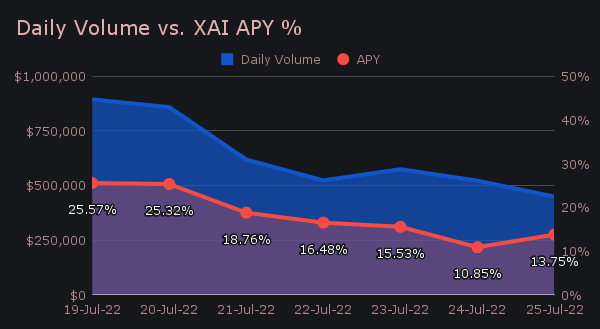

As for our stakers, SideShift averaged an APY of 18.04% this week, with a daily rewards high of 21,115.25 XAI (25.57%) being deposited to our staking vault on July 20th.

We are also happy to announce that Defillama, the largest TVL aggregator for DeFi, is now tracking SideShift’s pool on their yield dashboard. You can check it out here.

Additional XAI updates:

Total Value Staked: 34,871,515 XAI

Total Value Locked: $5,733,450

General Business News:

A subsequent lack of market volatility resulted in a relatively quiet week. SideShift had a daily volume average of $634k on 770 shifts, with a net weekly volume of $4.44m - these numbers are nearly identical to what we encountered last week.

BTC remained our most deposited coin totalling ~$1.08m, which was an approximate 35% decrease from the prior week. ETH placed second with $808k while USDC on Ethereum saw a 125% spike to grab third with $650k. This was the most USDC deposited since the middle of May 2022, a period when the markets were crashing and people rushed to buy alongside the sharp downward move.

On the settle side, BTC retained its position in first place with ~$1.4m. It should be noted that this is the most BTC that has been shifted from on SideShift within the past 5 weeks. In second was ETH, which netted $604k in settlements, while USDT on Ethereum took third with $520k. These 3 coins represented 56.8% of our overall settle volume, which is yet another 4% decrease in top 3 concentration from last week.

As noted in the previous report, the dilution of our top 3 deposit and settle coins has once again continued this week. Coincidentally, both the top 3 deposit and settle coins accounted for ~57% of their respective totals, a number which is quite a bit lower than the typical ~70% concentration seen in recent weeks.

Coinciding with this decrease in the top 3 is the growth in settlement volume of coins that fall outside our top 10. This figure is now 10.5%, which is the first time in nearly 2 months that this percentage has breached the 10% mark. What this means is that users are continuing to shift to a wider variety of coins, and that our additional listings are adding value.

On that note, this week SideShift was happy to list 2 new tokens, as well as relist a coin which has been inactive for 2 years. The first listing was Cosmos (ATOM), a cryptocurrency powering an ecosystem of blockchains designed to scale and interoperate with each other. ATOM is currently ranked #26, with a market cap of ~$2.7 billion. Next up was Cronos (CRO), the native token of Crypto.com’s all in one crypto platform. It sits in position #23, with a current market cap of ~$3 billion. Lastly was the revival of Tezos (XTZ), an open source blockchain that can execute P2P transactions and serve as a platform for deploying smart contracts. Tezos is currently ranked 37th with a market cap of $~1.4 billion. All of these coins have already experienced a handful of shifts within just days of listing, which is a great sign. More listings to come.

After 3 straight months, BTC/BCH has finally been dethroned as our most popular pair. It was replaced by USDC (erc20)/BTC, which saw ~$449k in shift volume throughout the week, with 69% of the deposited USDC volume settling to BTC. BCH volume really fell off, amounting to just $140k for the week. For reference, last week’s settle total was $724k, and just 3 weeks ago it was $4.4m. Instead, the focus is much more centered around BTC, as BTC was either the deposit or settlement coin of each of our top 4 pairs this week.

Last week some less popular coins began to pick up a bit of steam and that trend also played out this week, albeit, not necessarily the same coins. BNB generated $131k (13% higher than the previous week), while Matic on the Polygon network grew by 54% to net $57k. USDT on the BSC network, a token which was just listed last week saw $35k worth of shifts in its first week. Most notably, SideShift token (XAI) on Ethereum saw nearly 3.5x more volume than last week, with a total of $263k. Mainly coming from the settle side, this volume was largely the result of users moving their XAI balance held on SideShift on-chain, but nevertheless is an exciting observation. We will continue to monitor this trend in the coming weeks. Ultimately, this week saw the vast majority of smaller cap coins see more overall trading volume on SideShift.

Despite the generally slow period, it has allowed us to hone our focus on some exciting tasks as we continue to build and grow. During the week SideShift was stable, with only a few brief hiccups. A minor issue with our rate collector caused a display error (“error loading rate”) to briefly appear for some users, resulting in a temporary inability to shift. This has since been resolved. The Solana network also showed some minor instability throughout the week causing some delays, but no downtime was experienced as a result.

That’s all for now. Thanks for reading, happy shifting and we’ll see you next time.