SideShift.ai Weekly Report | 19th - 25th September 2023

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the seventy-third edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the seventy-third edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

After resisting the bear market for quite some time, SideShift token (XAI) took a hit and dipped below the $0.08 mark last week. It managed to come back and reclaim that point earlier today, moving within the 7 day range of $0.0783 / $0.0885 throughout the week. At the time of writing, it is sitting at a price of $0.08 on the dot and has a current market cap of $9,732,736 (-11%).

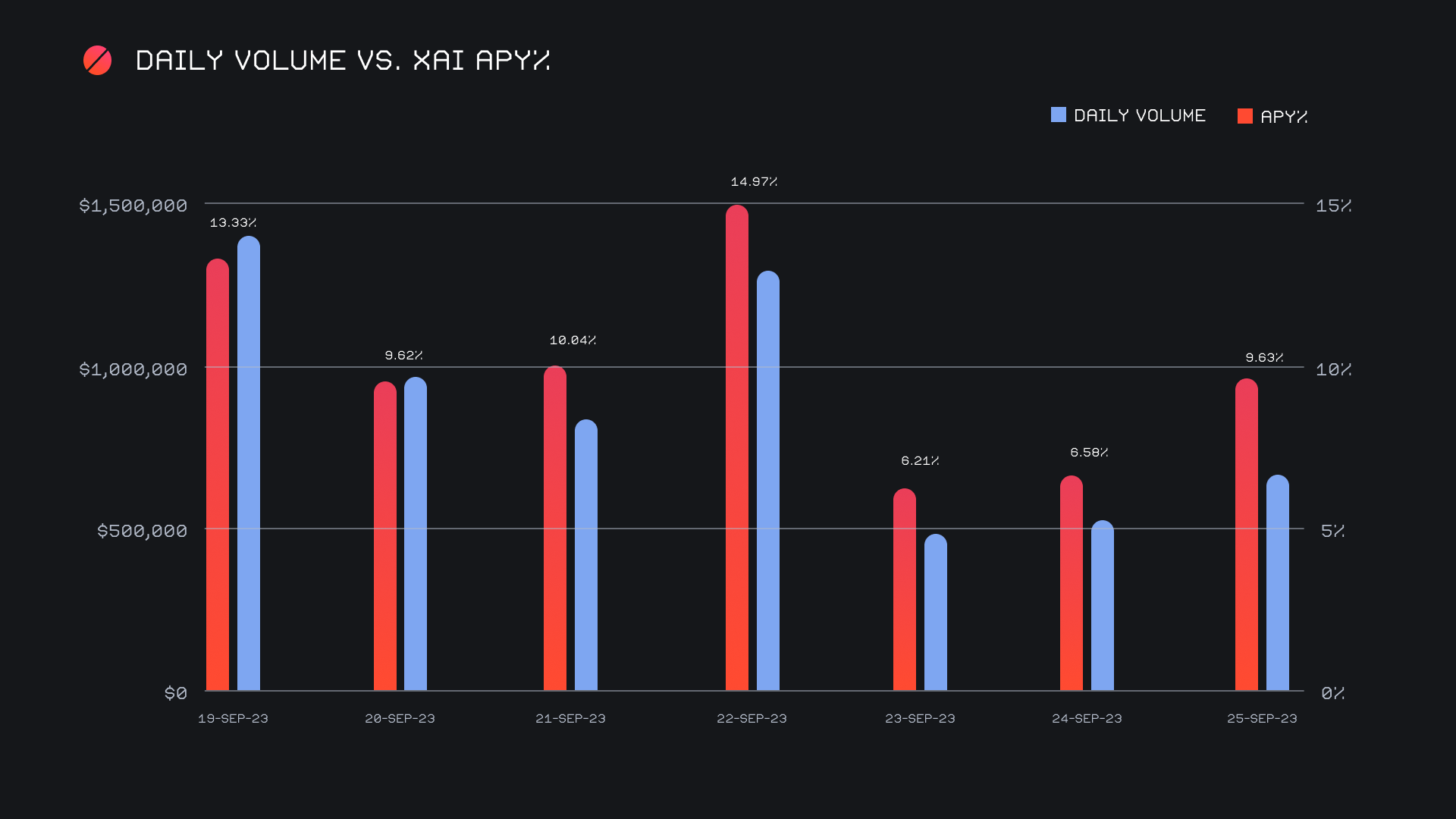

XAI stakers were rewarded with an average APY of 10.13% this week with a daily rewards high of 42,582.74 XAI or $3,286.49 (an APY of 14.97%) being distributed to our staking vault on September 23rd, 2023. This was following a daily volume of $1.3m. This week XAI stakers received a total of 203,847.97 XAI or 15,900.14 USD in staking rewards.

The value of 1 svXAI is now equal to 1.2383 XAI, representing a 23.83% accrual on stakers investments. The easiest way to participate in XAI staking is to shift directly to svXAI, from any coin of your choice.

SideShift’s treasury is currently sitting at a value of $4.76m. Users are encouraged to follow along directly with live treasury updates.

Additional XAI updates:

Total Value Staked: 111,540,617 XAI (+0.2%)

Total Value Locked: $8,788,285 (-9%)

General Business News:

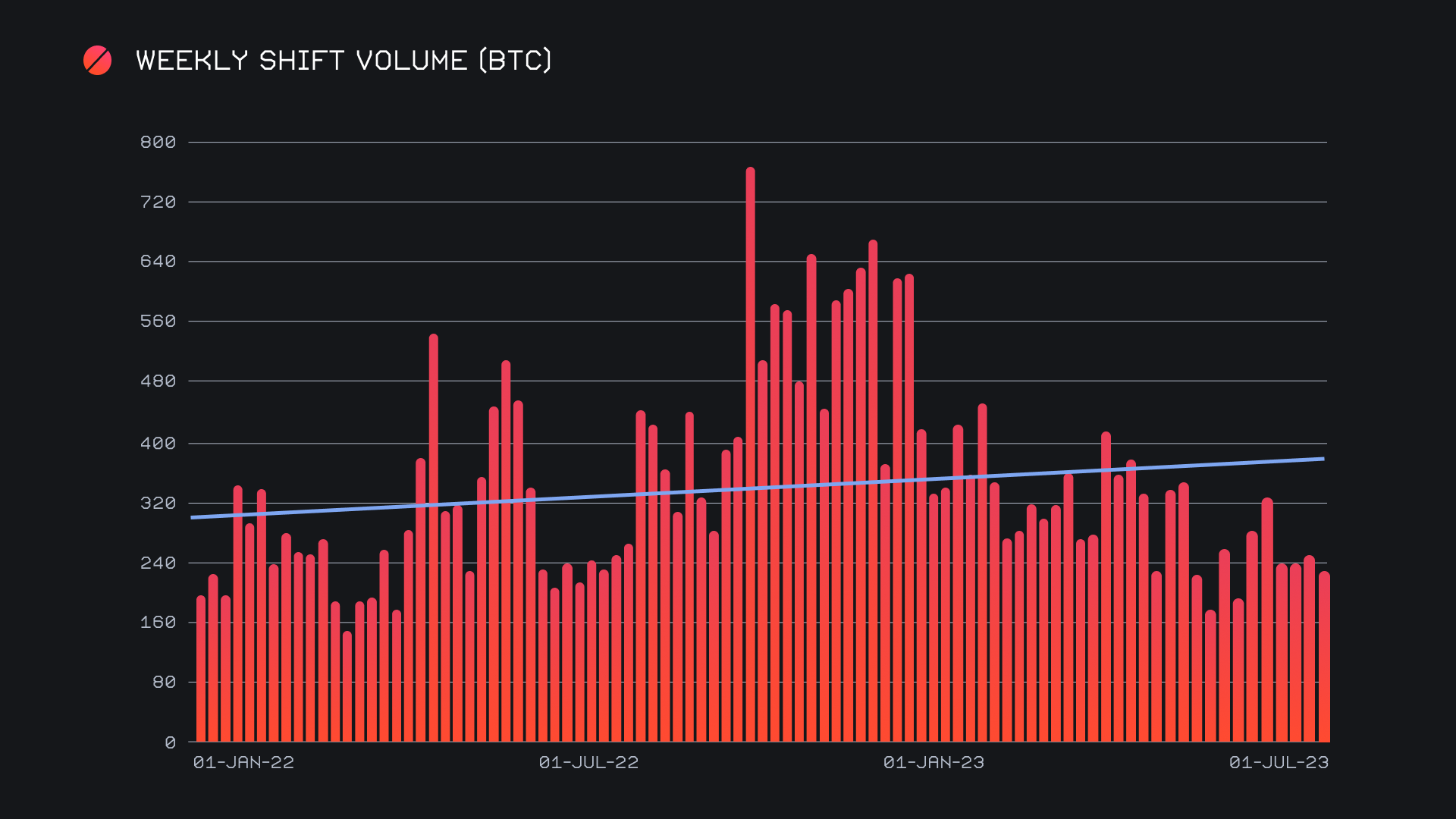

After momentarily revisiting $27k territory, BTC has now returned to the familiar price zone it has occupied for the better part of the last month. Despite relatively quiet market conditions, SideShift continues to plug along, showing record stability while continuing to add support for new chains and tokens. All time volume has already exceeded $1.1b, confirming the saying that “the first billion is the hardest one”.

SideShift spent the week with daily volumes averaging around $1m, before slowing to around $500k upon entering the weekend. We ended the period with a gross volume of $6.2m (-2.2%) alongside a shift count of 5,229 (+5%), figures which have not wavered much throughout the month. Whereas last week saw an extremely large portion of volume coming from integrations, this week saw a reversion as most of it occurred directly on SideShift.ai. Together, these figures combined for daily averages of $885k on 747 shifts. When denoted in BTC, our daily volume amounted to 231.69 (-3%).

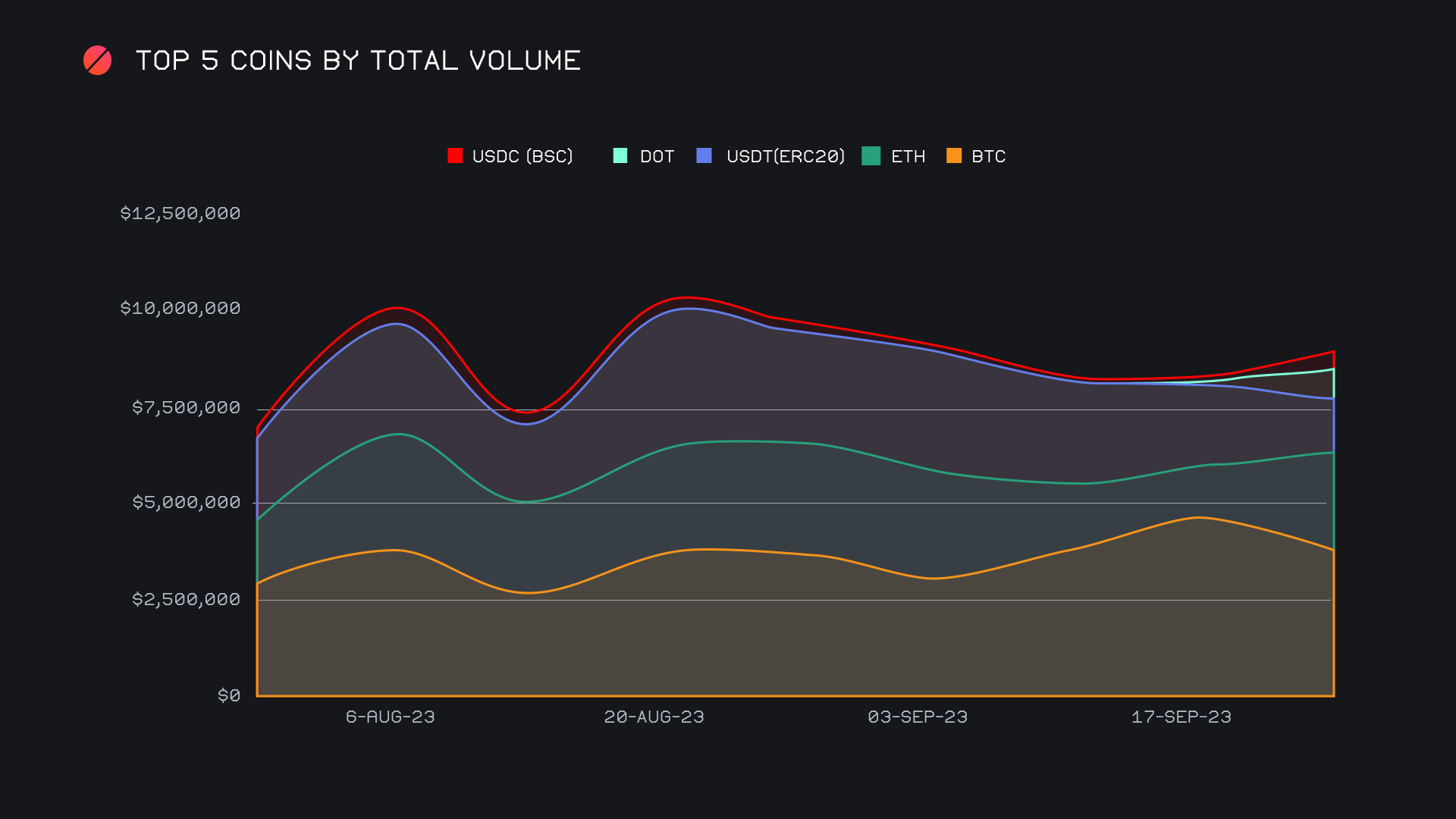

Site volume may have stayed fairly similar, however the composition this week looks quite different. In particular, this applies most of all to our top coin, BTC, which unsurprisingly has remained our top coin for both deposits and settlements nearly every week this year. It sees significant demand, although deposits have been strong in recent months as well, riding the winds of the BTC / USDT (ERC-20) pair which has seen its popularity surge amidst a timid market. This week however saw the end of that 14 week hot streak, with the BTC / USDT (ERC-20) pair generating just $393k, a 64% drop from its 3 month running average. This was also a leading cause as to why there was a sharp 53.4% decline in user BTC deposits - a total of $963k marked the first time since March 2023 that user BTC deposits have fallen below $1m.

Instead, we saw an influx of user ETH deposits, as they climbed a respectable 59% to claim first place with ~$1.1m. More unusual was fourth placed DOT, which catapulted off of its near zero volumes just last month to see more than $770k in total volume (deposits + settlements) this week. In addition to this, we had various other upswings in deposits for less commonly shifted coins. User TRX deposits spiked 476.6% for a sum of $141k, while DOGE had an even more dramatic change, growing more than 15x for $110k.

In the majority of instances, including for the three coins just mentioned, the deposit volume funneled into BTC resulting in it blowing other settlement coins out of the water.

With $1.8m (+43.5%), BTC dominated the top of the settlement chart - the next closest (ETH) failed to even breach $700k. This speaks volumes to the strong demand for BTC at the moment, with SideShift users preferring it to even stablecoins by a hefty margin.

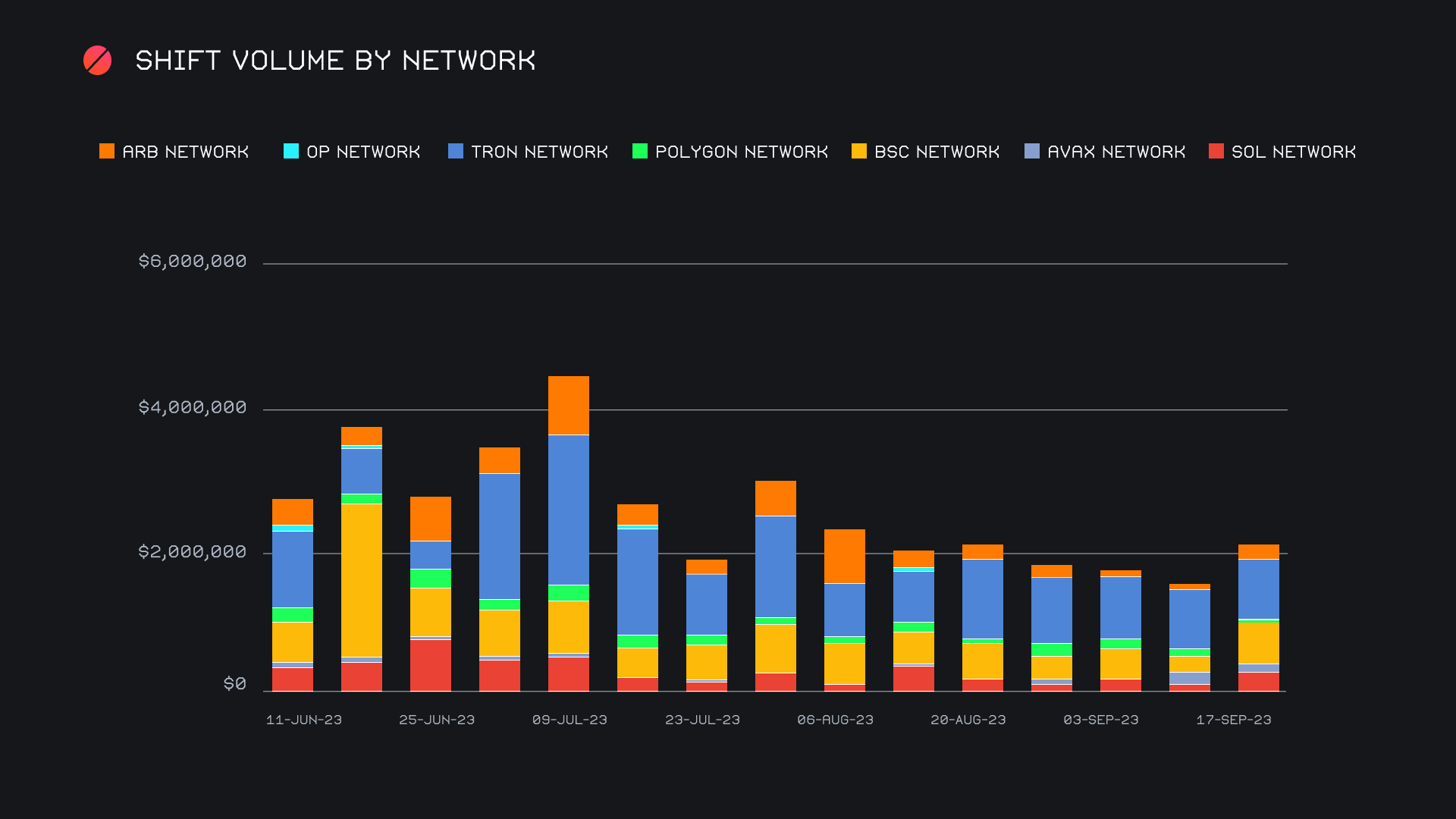

Alternate networks to ETH had a relatively positive performance, as their combined sum of $2.1m reclaimed the $2m mark after falling to fresh lows last week. Increases were seen across the board, with an increase in token deposits playing a role along with higher demand for certain stablecoins such as USDT on both the Binance Smart Chain (BSC) and Tron networks.

The Tron network remained at the top of the group despite being one of the few to witness its total volume decline. With that being said, it continues to be our most steady performer, which may not come as a shock when you consider the fact that it has the highest TVL among alternate networks listed on SideShift. It rounded off the period down 4.1% for a gross $789k to lead all networks.

Nevertheless, it was not the Tron network, but others which grabbed our attention this week. The BSC network enjoyed a solid 141% rise to finish with $579k, with the SOL and ARB networks undergoing equally respectable bounces. They ended with respective volume totals of $363k (+89%) and $203k (+209.8%).

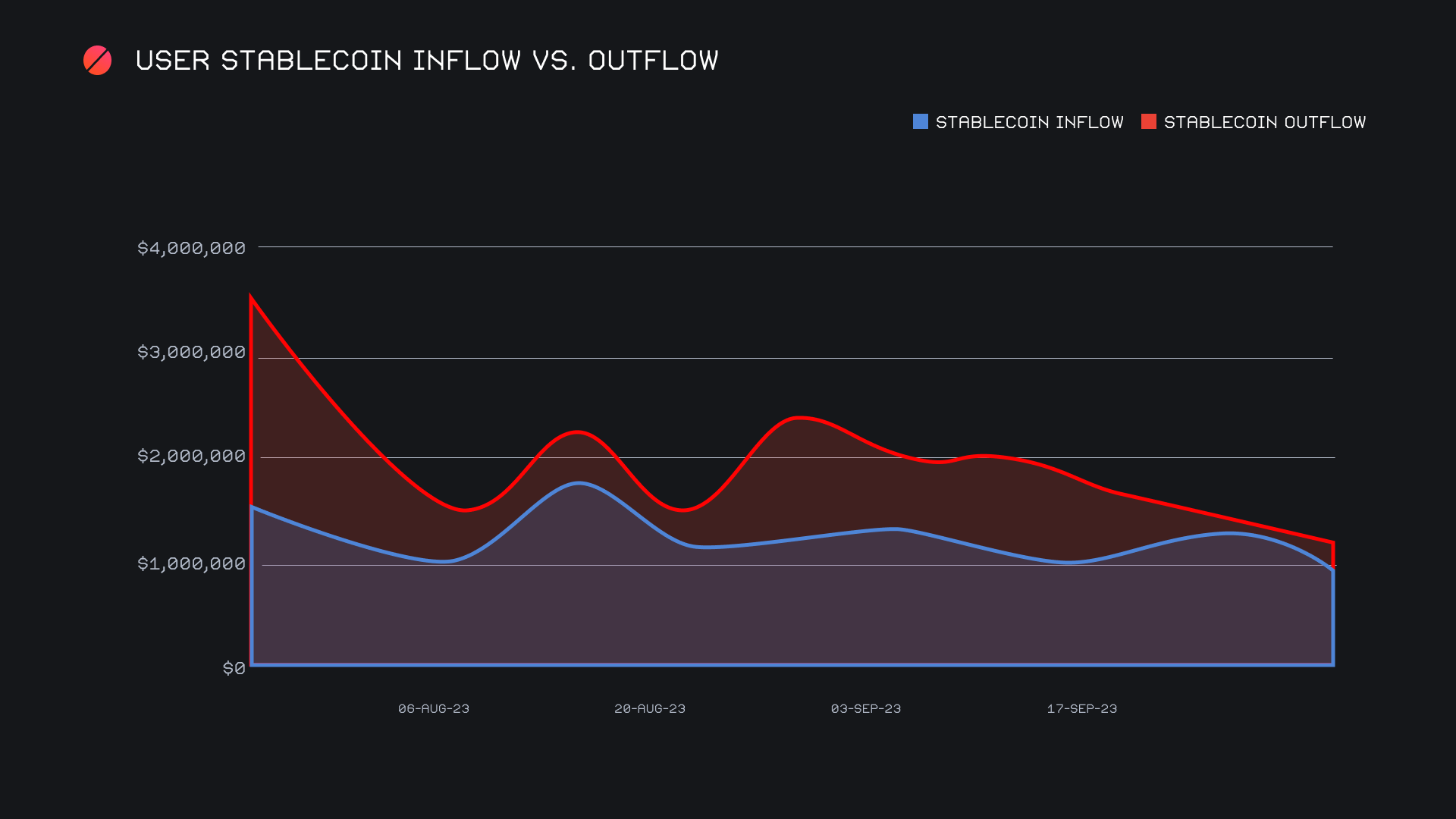

Net stablecoin outflows on SideShift increased slightly from last week but still remain comparatively low. A net outflow of -$278k means that this week saw approximately $106k more in stablecoin settlements. What was uncharacteristic here was the lesser role USDT on Ethereum played, as user settlements declined by 34.2%. With that in mind, it still is the clear stablecoin of choice, with its $684k being more than 3x higher than the next stablecoin, USDT (TRC-20) with $205k. All in all, stablecoin volume in general is trending down with both deposits and settlements moving in parallel as outlined in the chart below.

Affiliate News

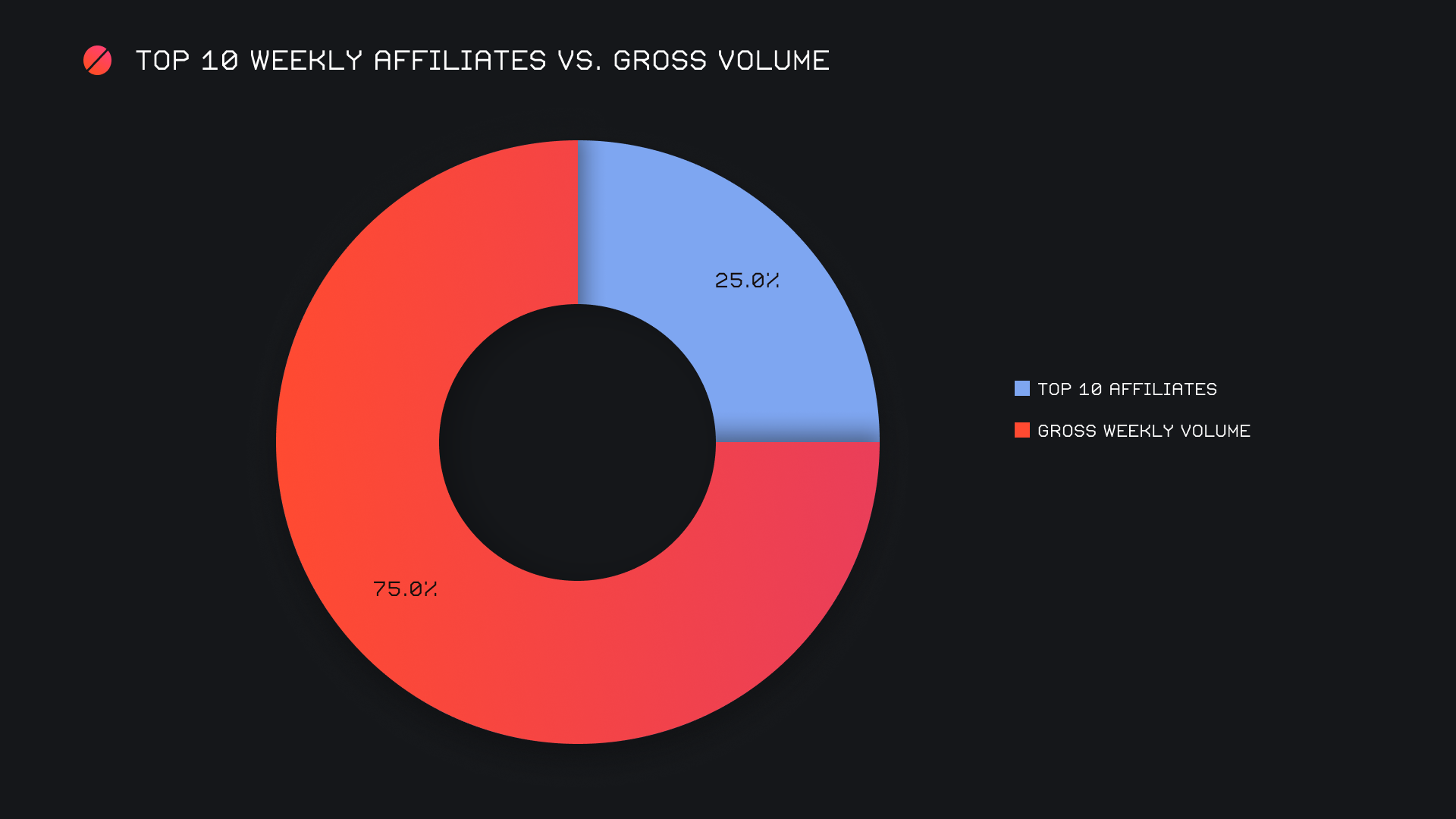

After such strong showings in multiple weeks, our top affiliates saw a decrease in volume. They fell 47.5% for a combined ~$1.6m, representing approximately 25% of our weekly total. Conversely, shift count did not budge and dropped just 1% for a gross 2,173 shifts.

Although there was no change in the ranking of our top affiliate, it was the one impacted most, with volume falling to less than half that of the previous week. It ended with $701k on 1,151 shifts, indicating a steady stream of shifts but with lower overall volume.

That’s all for now. Thanks for reading, happy shifting and we’ll see you next time.