SideShift.ai Weekly Report | 1st - 7th October 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one-hundred-and-twenty-fifth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and twenty fifth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This past week saw SideShift token (XAI) slide within the 7-day price bounds of $0.1086 to $0.1553. XAI has since settled at $0.1138, marking a drop from earlier in the week when the price briefly touched the top of the range on October 1st. This price dip contributed to a decline in XAI’s market cap, which now stands at $15,912,523.

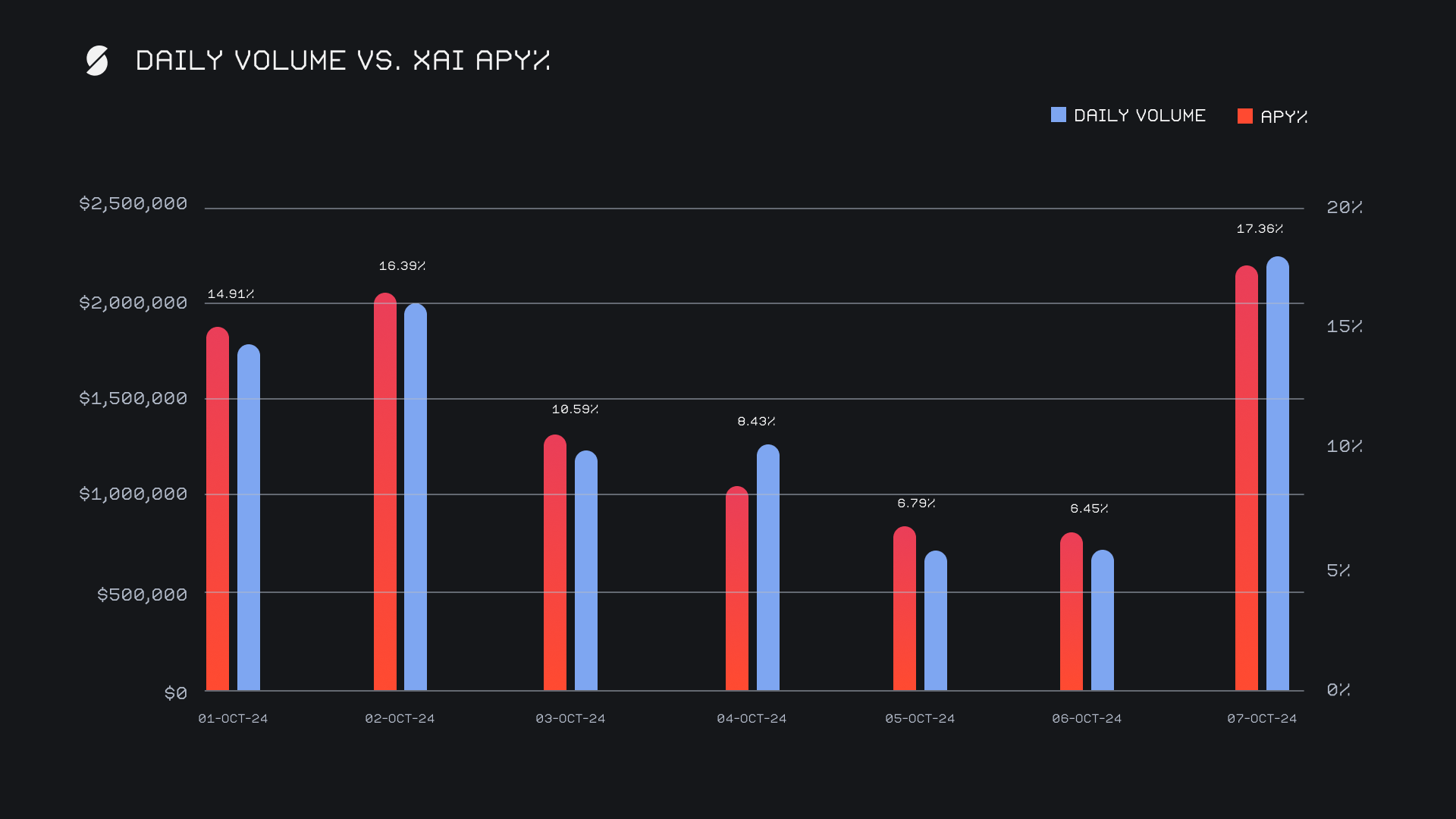

XAI stakers enjoyed an average APY of 11.56% over the week, with the highest daily rewards reaching 54,852.07 XAI (an APY of 17.36%) and being distributed directly to our staking vault on October 8th - this was following a daily total volume of $2.2m. All together, XAI stakers received a total of 260,361.66 XAI or USD 29,629.16 in rewards throughout the week.

Additional XAI updates:

Total Value Staked: 125,172,256 XAI (+0.2%)

Total Value Locked: $14,622,117 (-24.1%)

General Business News

The week began with strong upward momentum across the crypto market, as BTC rallied toward $64k. However, resistance at this level saw BTC pull back to $62.4k, marking a modest -1.7% decline to close the week. ETH mirrored this movement, climbing early before settling around $2,430 (-2.2%). Meanwhile, SUI emerged into the top 20 with a remarkable +115% monthly gain, driven by surging network activity following its integration of USDC.

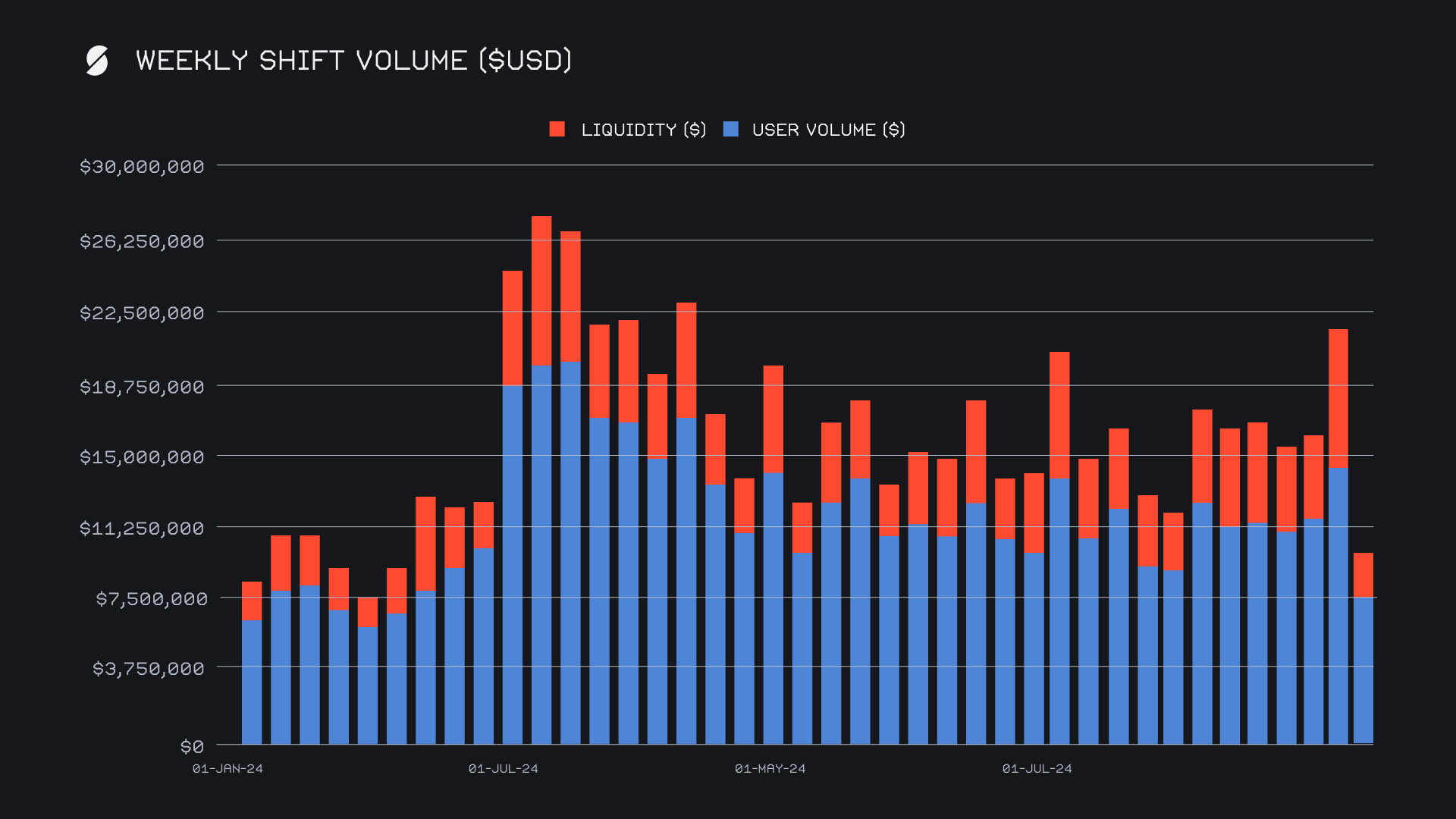

This past week saw a pullback in activity on SideShift, with our gross weekly volume finishing at $9.9m (-53.8%). This was a significant decline compared to last week’s exceptionally strong performance, which resulted in our volume ending more in line with levels previously seen at the beginning of 2024. Specifically, this volume came from a net $7.6m in user shifting, as compared to $2.3m in liquidity shifting, both of which saw weekly declines exceeding 50%. Lesser overall liquidity shifting was partially the result of a more balanced mix of deposits and settlements from users, and was especially influenced by the lack of LTC/ETH shifting, which was in full swing last week.

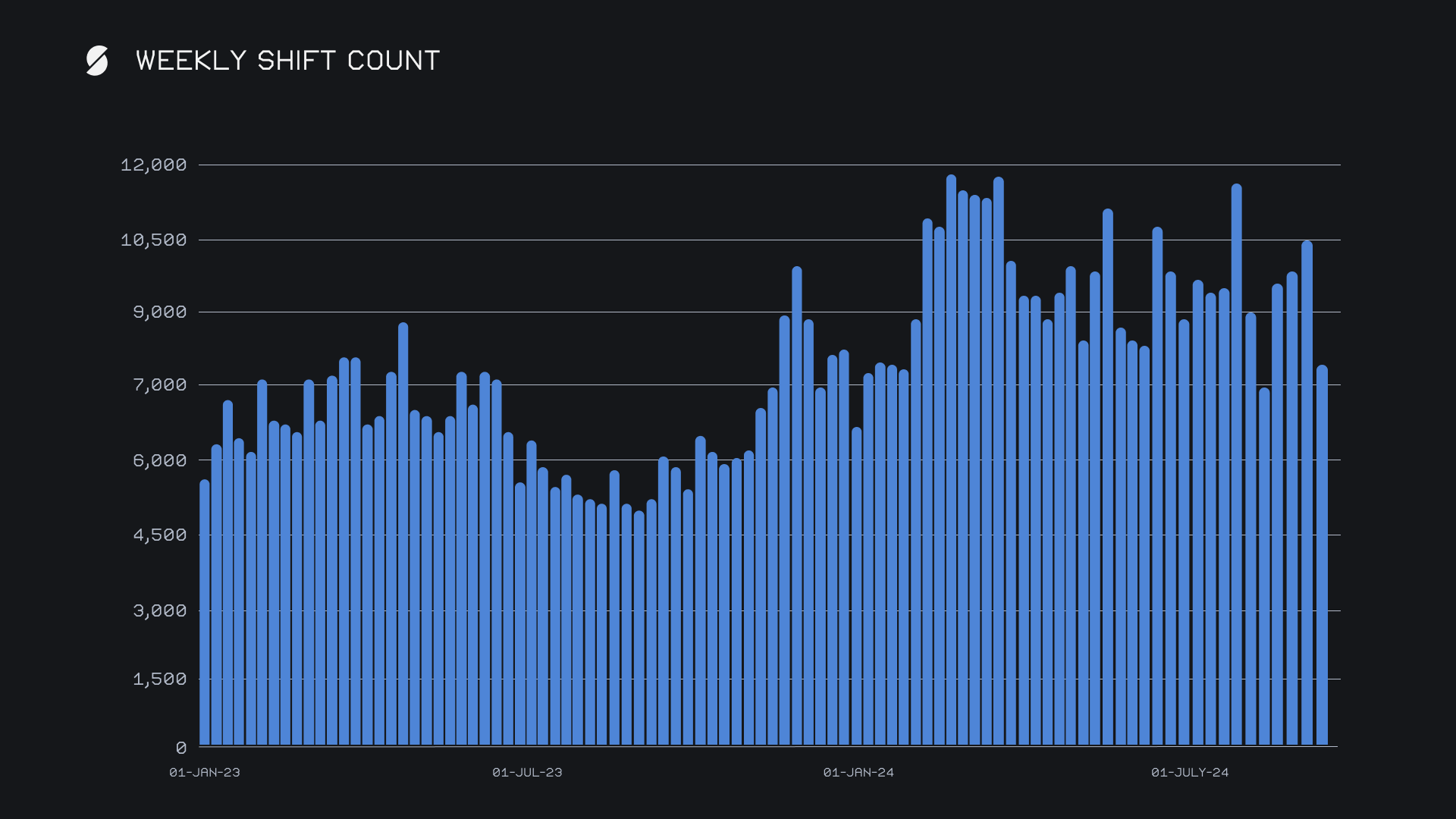

In terms of shift count, we completed 7,923 shifts (-24.1%), a number that also aligns more closely with earlier periods in 2024. Daily averages totaled $1.42m in volume across 1,132 shifts per day. The drop in volume, combined with a more moderate shift count decrease, suggests that smaller shift sizes were more common this week, and reflects a more cautious shift mindset displayed by users for the time being.

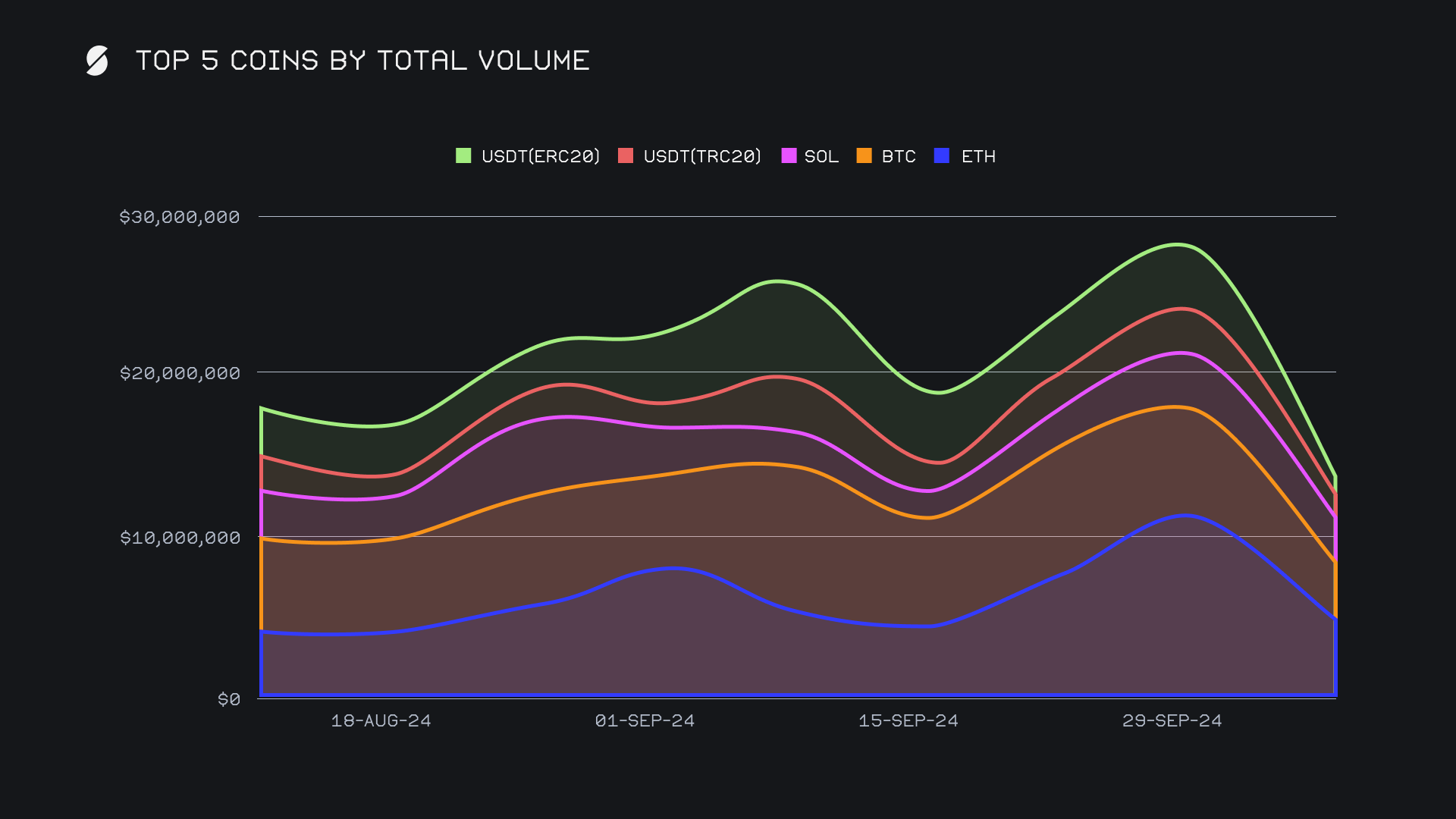

ETH retained its top spot this week with a total volume of $4.6m (-59.0%). While overall shift activity slowed, ETH remained a central focus of user shifts, particularly on the deposit side. This was reflected by our leading shift pairs, with ETH/SOL generating $682k, while BTC/ETH followed closely at $622k. ETH deposits totaled $1.6m (-22.4%), while settlements fell to $1.8m (-66.2%), representing a sharp drop in demand from last week’s sudden surge.

BTC followed in second place with a total volume of $3.4m (-45.8%). This marked a surprisingly low weekly volume for BTC, considering its usual position as the dominant leader on SideShift, and represented a 8-month low. BTC deposits dipped to $1.4m (-46.1%), while user settlements summed just $993k (-34.4%), less demand than both ETH and SOL. This was the first time user BTC demand has fallen beneath $1m in several months.

SOL took the third spot overall with $3.0m (-15.6%) in volume, making it the most resilient among our top coins. SOL also dominated shift count, with 2,668 shifts - the highest among any coin. This sat approximately +6% higher than its 10 week average, a trend which was not achieved by any of our other top coins. SOL deposits amounted to $1.2m (-6.7%), while settlements reached $1.4m (-15.5%) and showed continued demand, particularly evident in the leading shift pair of ETH/SOL.

Outside of our top 5, SUI emerged as a notable gainer, with a +18.9% increase in volume, reaching $778k. This growth in SUI volume on SideShift occurred alongside its ongoing price appreciation, which is now approaching all-time highs. BCH also posted an impressive +222% climb, finishing at $449k. On the other hand, LTC experienced a sharp -93% decline, dropping to $511k. This significant fall was primarily due to the absence of the LTC/ETH shift pair, which saw an atypical rush of shifts last week, but did not continue into this week.

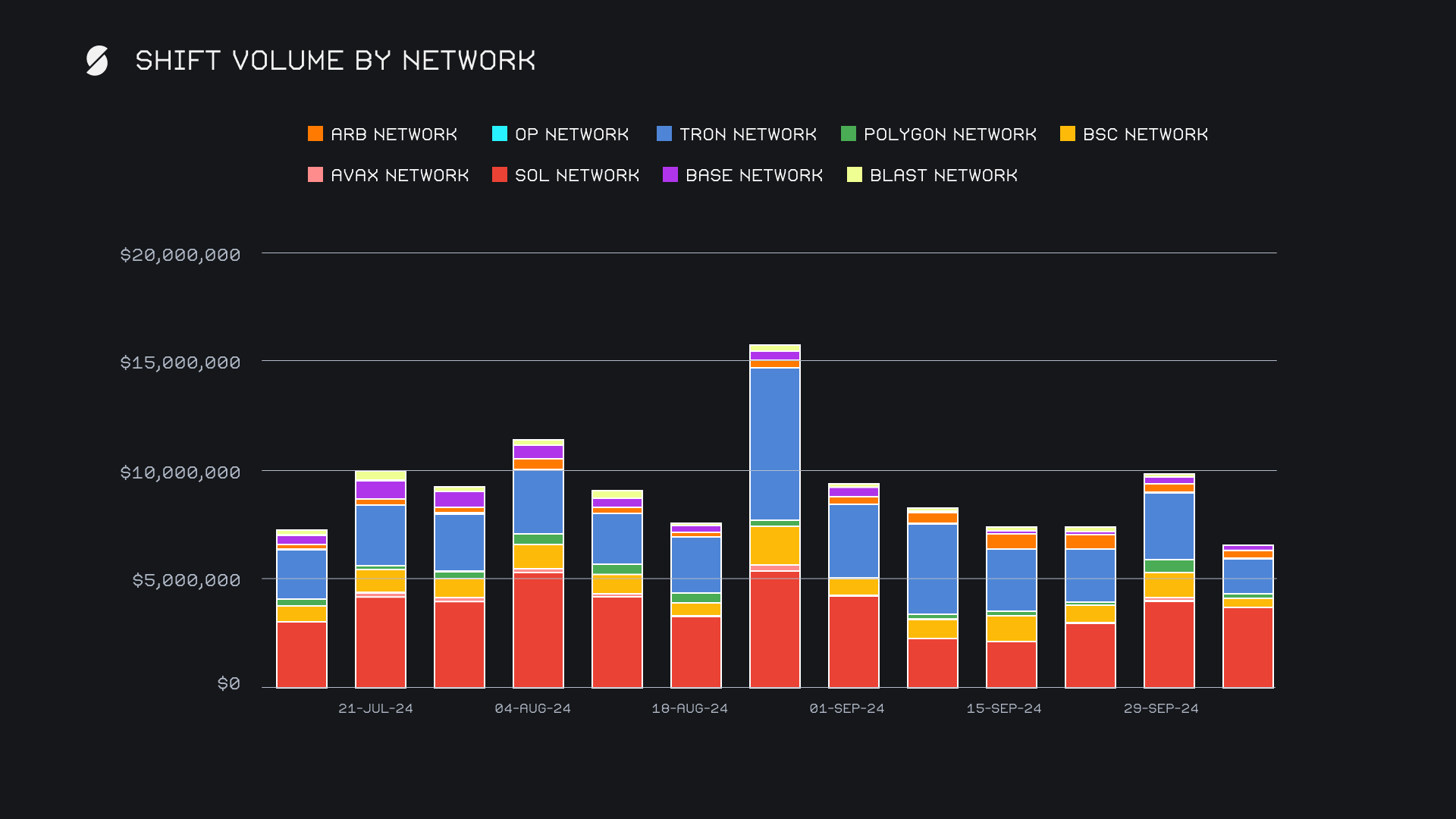

This week’s focus was clearly on Ethereum, as evidenced by the slowdown in volume across alternate networks. The Solana network stood out as the only one to maintain substantial traction, finishing the period with $3.6m (-9.0%), with stablecoins on Solana contributing to its solid performance. The Tron network followed with $1.6m (-47.2%), marking a sharp decline from the previous week. The Base network, on the other hand, saw a slight increase and closed the period at $309k (+9.7%), one of the few networks to register positive growth. Altogether, alternate networks to ETH combined for $6.6m, marking a multi-month low, and struggled to attain just half the volume of the Ethereum network.

In listing news, SideShift recently added support for Eigenlayer (EIGEN). Shifting to EIGEN is now live, directly from any coin of your choice.

Affiliate News

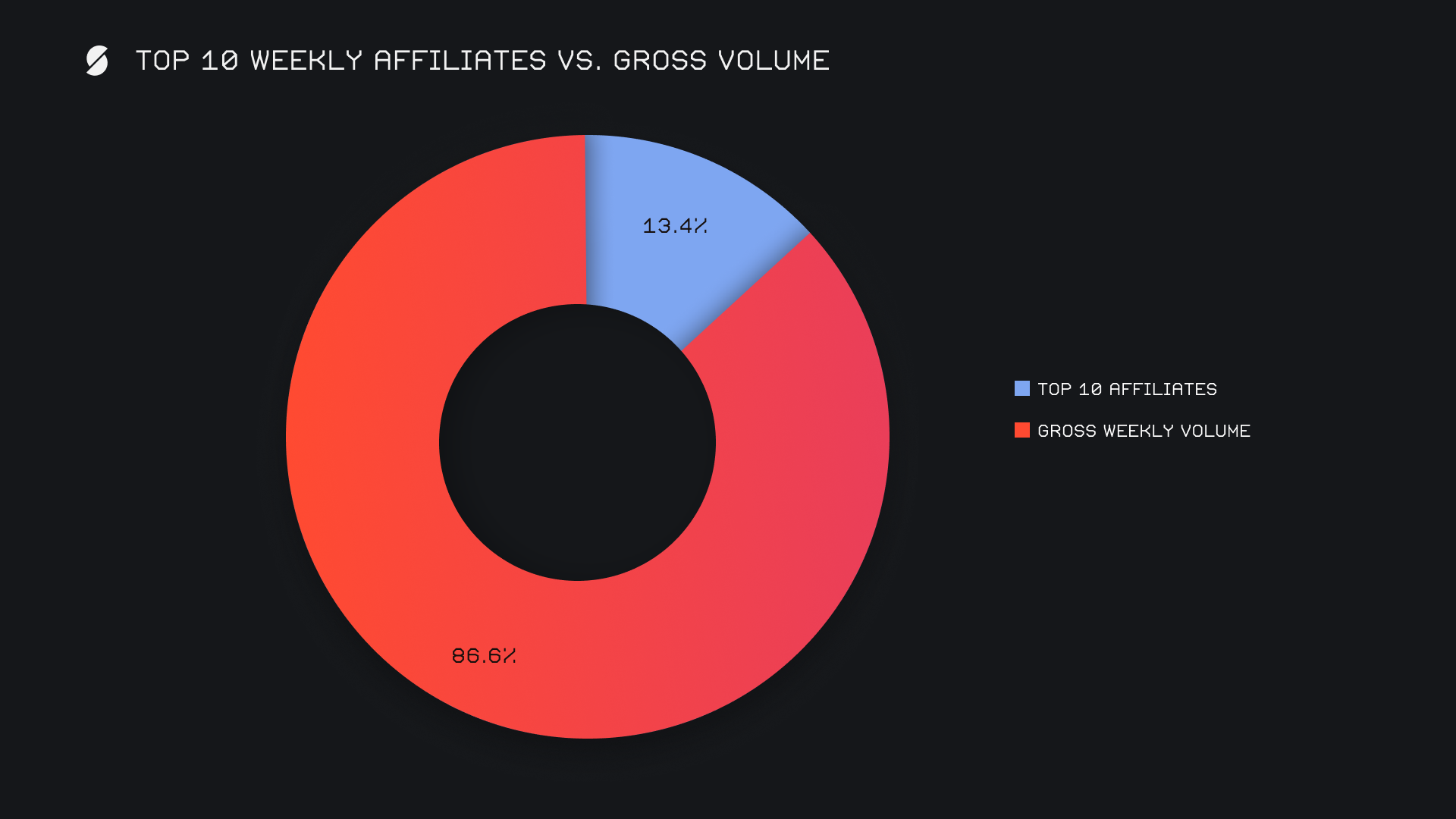

It was a slow showing in particular for our top affiliates, as they combined for a total of $1.3m, marking a substantial -63.4% decline from last week’s $3.6m sum. The ranking order saw a change amidst this cooldown, with our former third-placed affiliate climbing into first place with $653k (+29.7%). Meanwhile, our previous first-place affiliate slipped into third with a weekly sum of $170k, a steep -92% drop, and representing the slowest performance seen since February 2024. Our second-placed affiliate also experienced a significant decline, finishing the period with $213k (-75%).

Altogether, affiliates accounted for 13.4% of this week’s total volume, a decline from last week’s already low proportion.

That’s all for now. Thanks for reading and happy shifting.