SideShift.ai Weekly Report | 20th - 26th Aug 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one-hundred-and-nineteenth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and nineteenth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week, SideShift token (XAI) experienced a consistent upward trajectory, showing a clear trend of growth throughout the week. Starting from a low of approximately $0.1350, XAI steadily climbed to reach its current price of $0.1428. This positive movement resulted in a market cap increase of +0.78%, bringing it to $19,726,607, up from $19,573,119 last week.

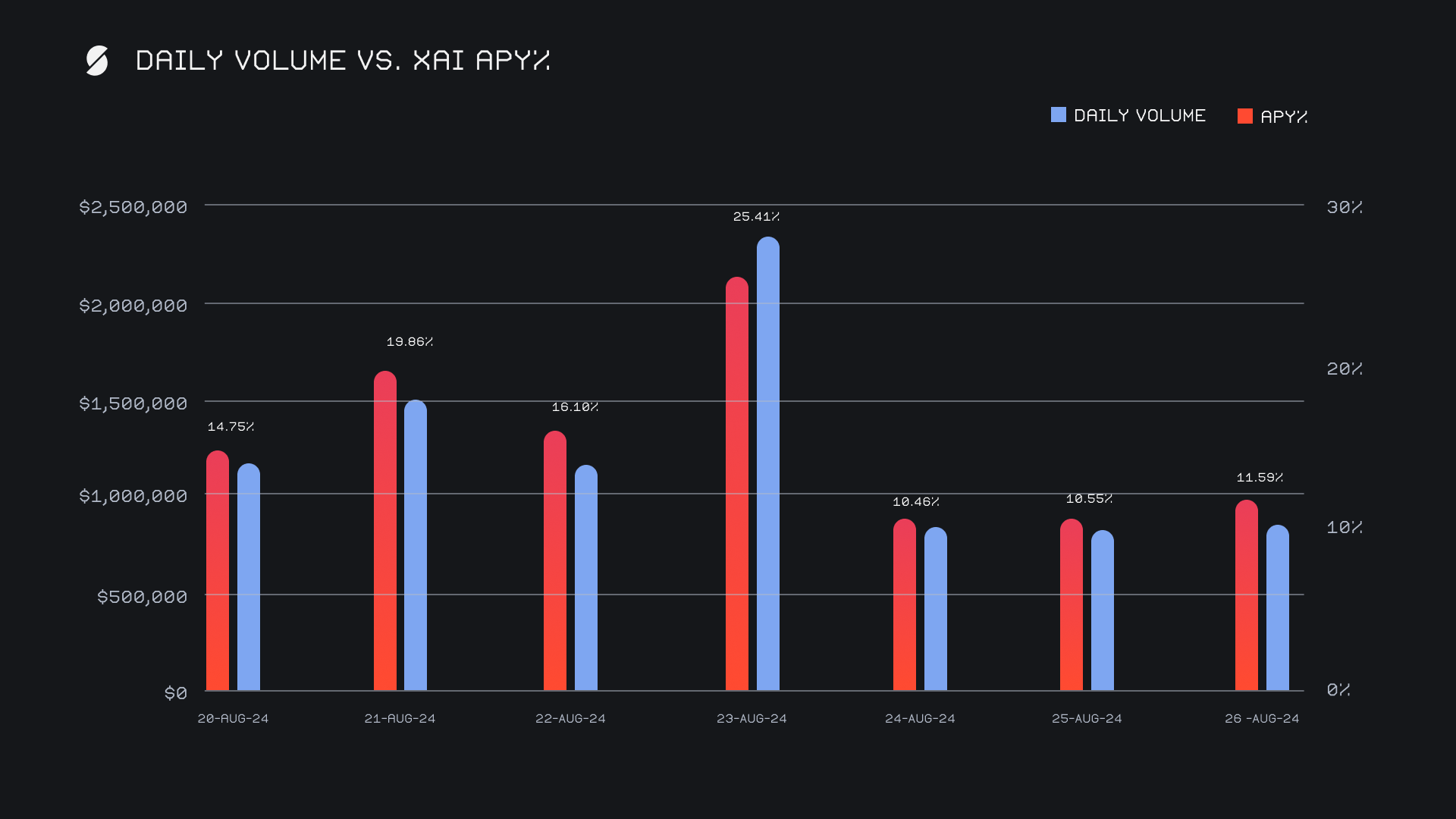

XAI stakers were rewarded handsomely, with a healthy average APY of 15.53% over the week. Notably, on August 24th, 2024, stakers received a daily rewards high of 76,489.86 XAI, equating to an impressive APY of 25.41%. This spike in rewards coincided with a solid daily volume of $4.7m, which centered around a sharp uptick in activity on the Tron network. This week, XAI stakers received a total of 339,107.70 XAI , or $48,424.58 USD in staking rewards.

A total of 6 WBTC were added to SideShift’s treasury over the course of the week, bringing the current total to a sum of $14.95m. Users are encouraged to follow along directly with live treasury updates, via sideshift.ai/treasury.

Additional XAI Updates:

Total Value Staked: 123,548,580 XAI (+0.2%)

Total Value Locked: $17,493,607 (+0.8%)

General Business News

The crypto space has been turbulent this week, with the arrest of Telegram CEO Pavel Durov by French authorities sending shockwaves through the industry, and raising concerns about potential stricter controls on decentralized technologies. The overall market has heated up, with strong ETF inflows sending Bitcoin to nearly $64,000, although it has since consolidated below that level as traders await new developments. Additionally, the continued strength of Tron saw its native TRX token climb to 9th overall in marketcap, surpassing TON along the way, which dove more than -20% on the week.

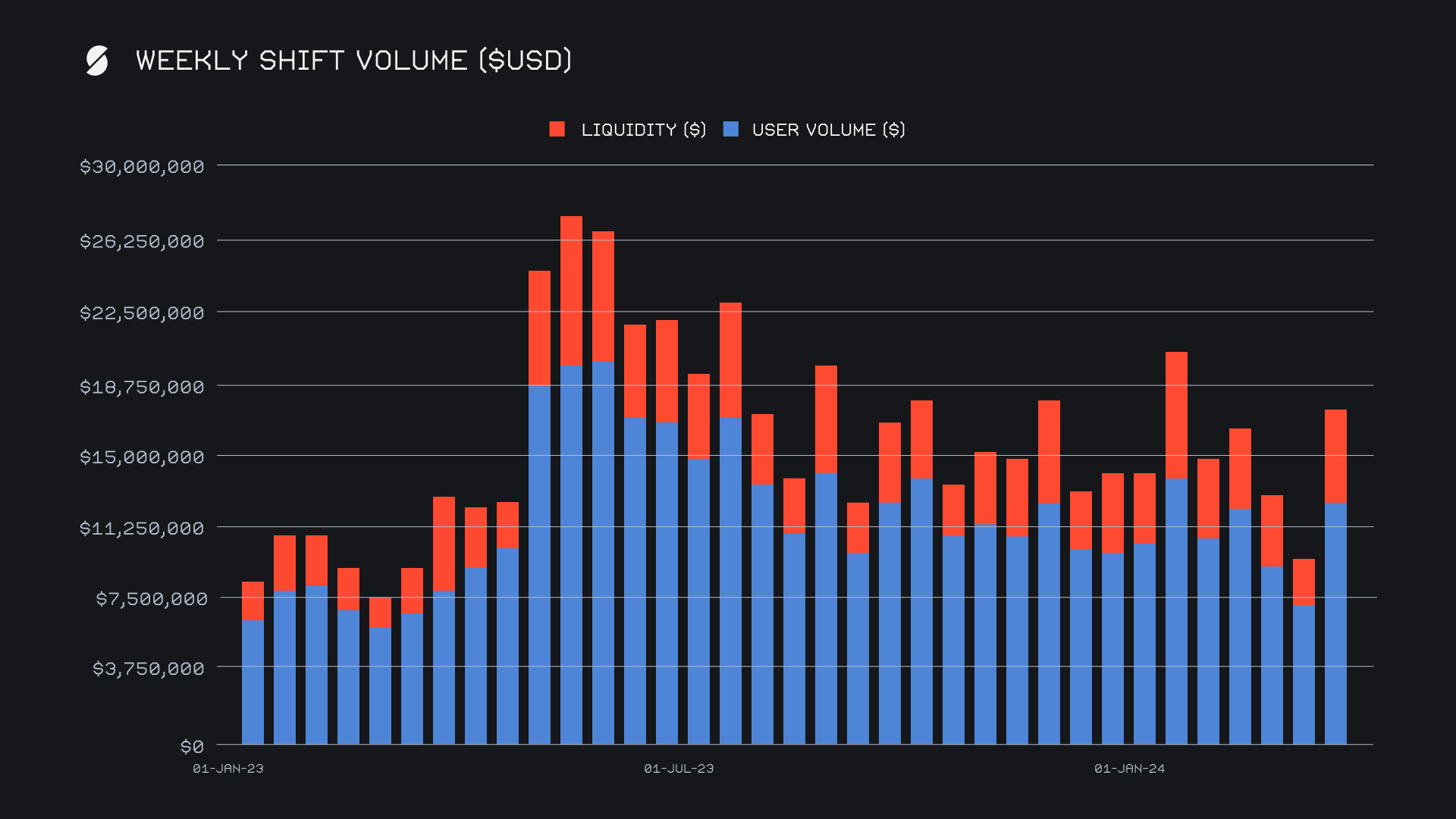

SideShift had an exceptional performance, with our gross weekly volume surging to $17,280,166, marking a significant +45.1% increase compared to the previous period. We saw a +26% rise from our weekly average in liquidity shifting (represented by the red bar below), which was needed to satisfy the sudden increase of unidirectional shifting. The outcome was a weekly $4.9m deriving from liquidity shifting, while the remaining $12.7m came from user shifting. There was also a fairly varied spread of volume amongst coins, with 7 of our top 8 exceeding the $1m threshold in total weekly volume.

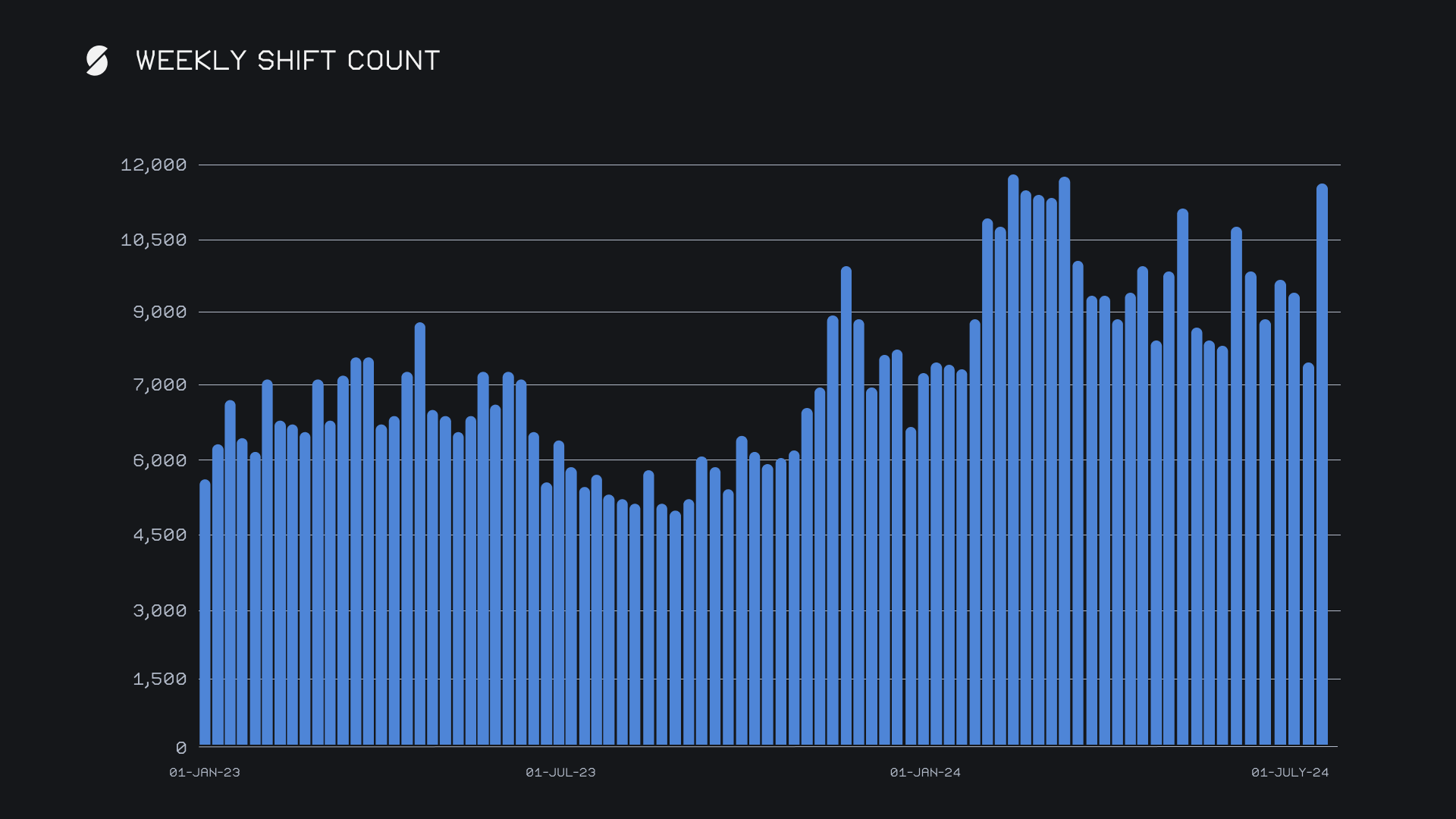

This overall rise in volume was accompanied by a gross weekly shift count of 11,601, which not only represents a +22.2% increase from last week but also stands as our third highest shift count in 2024. Notably, this shift count finished +24% higher than our YTD average, underscoring the sustained growth of user activity on SideShift.

Daily averages also reflected this positive trend, as our daily volume average of $2,468,595, ended +9.5% above our YTD average. The consistent rise in both volume and shift count highlights a strong week for SideShift, driven by high engagement across several popular shift pairs, both old and new. BTC/ETH continued to be highly prevalent, and once again ended as the most popular user pair with $949k. However, the sudden rise in Tron action saw the emergence of two new pairs, SOL/TRX with $668k, and ETH/TRX with $607k.

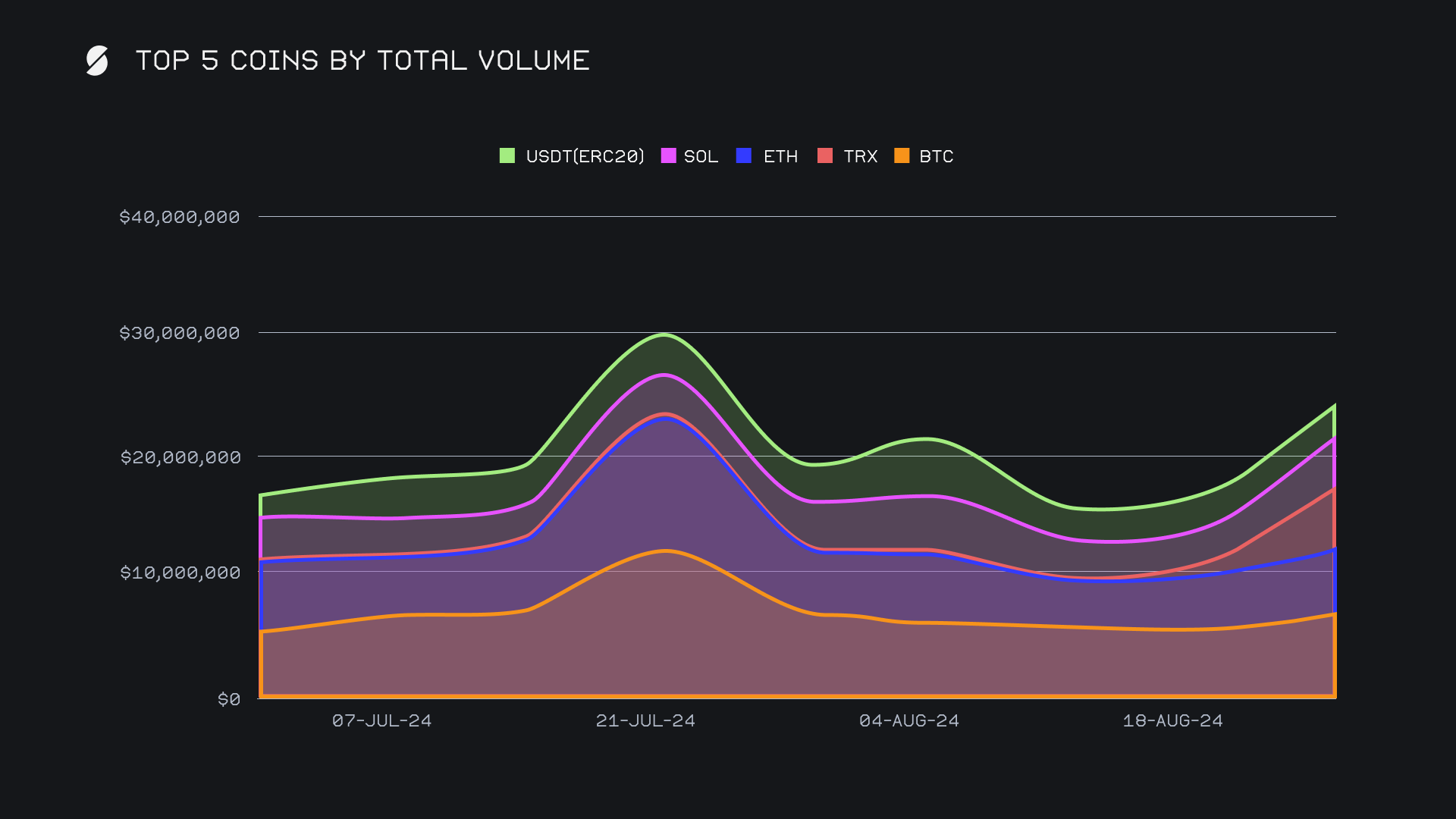

BTC once again led the pack this week, solidifying its dominance with a total volume of $7.0m, up by +21.2% from the previous period. Despite this growth, there was a noticeable shift in user behavior, with deposits climbing by +23.0% to $3.2m, while settlement volumes took a hit, dropping by -24.6% to $1.3m. The result was BTC ending as only our 5th most settled coin, a dip in the rankings which is not typically seen. This suggests that BTC remains a preferred asset for deposits with users being more inclined to convert their holdings into other assets.

ETH followed in second place, continuing its upward momentum with a total volume of $5.5m, reflecting a robust +31.6% increase from last week. Similar to BTC, ETH saw a particularly strong influx in deposits, which surged by +62.8% to $2.0m. However, opposing the pattern of our week’s top coin, ETH also recorded a +17.8% rise in settlement volume and reached a sum of $2.3m. This was enough to secure its spot as the most demanded coin from users this week.

The dark horse was undoubtedly TRX, which exploded into third place overall, climbing a resounding +307.6% for a total volume of $5.0m. This dramatic increase was driven by a substantial +472.0% rise in deposit volume, which reached $1.3m. Although deposits saw a large jump, the recent hype around the Tron ecosystem was the true catalyst behind its rise on SideShift this week, with users shifting a multitude of coins to TRX to participate in the action. Settlement volumes soared by +263.9% and closed at $2.2m, positioning TRX as a standout performer this week. You can observe its rise in the chart below.

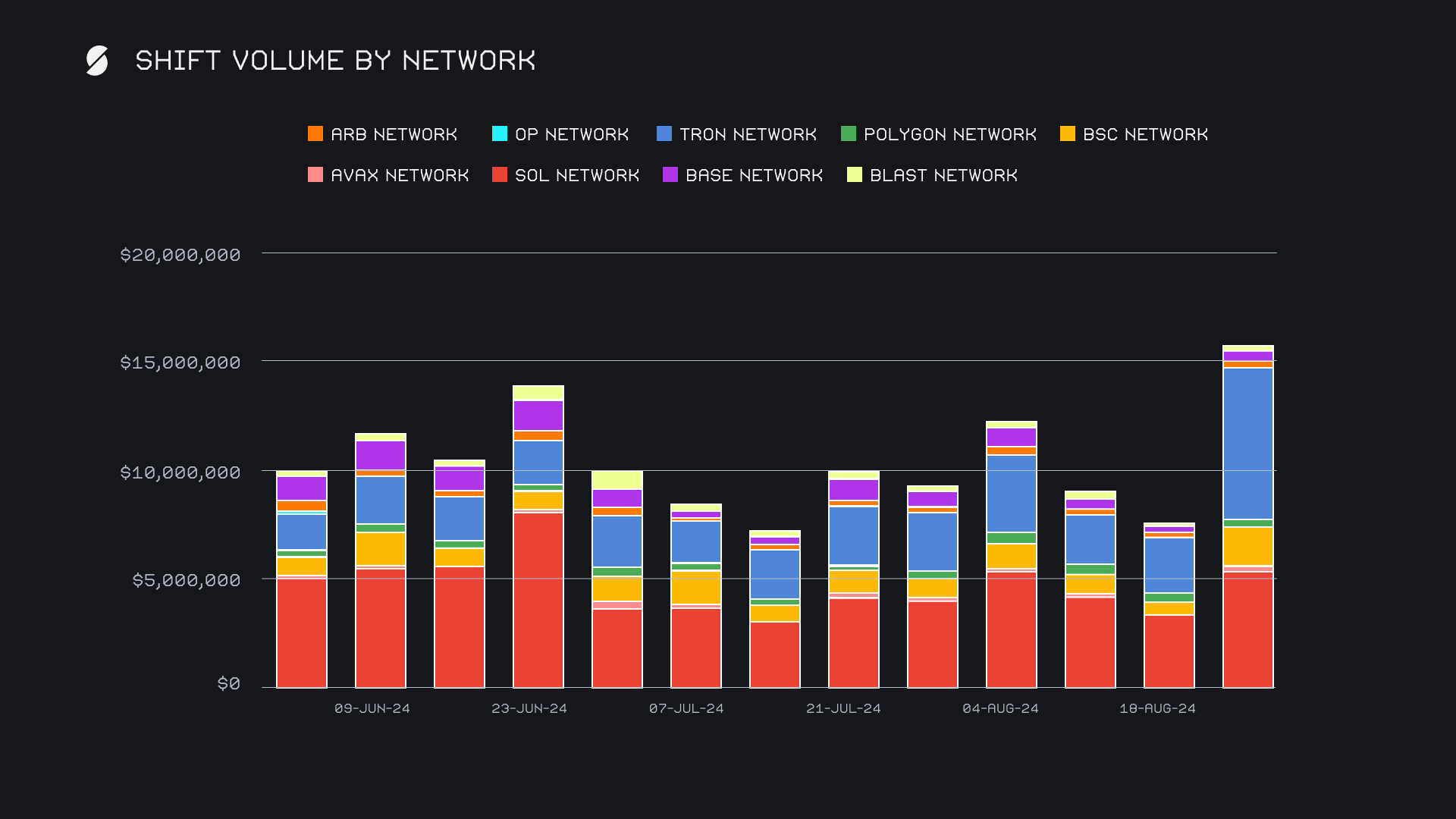

This week, the Tron network emerged as the frontrunner among alternate networks to ETH, achieving a significant volume of $7.0m, a +168.3% rise from the previous period. This marks a notable improvement to last week's performance, when Tron was unable to surpass Solana. The Solana network, however, still continued to perform strongly and finished with a gross $5.4m, marking a +60.4% increase. The Binance Smart Chain (BSC) also saw a substantial rise of +272.5% for a total $1.8m in volume, thanks to a rush of shifting of its native BNB token. The Base network followed with $463k, up +49.7%, while the Avalanche network experienced the largest percentage increase of +562.7%, despite its lower overall volume of $274k.

Affiliate News

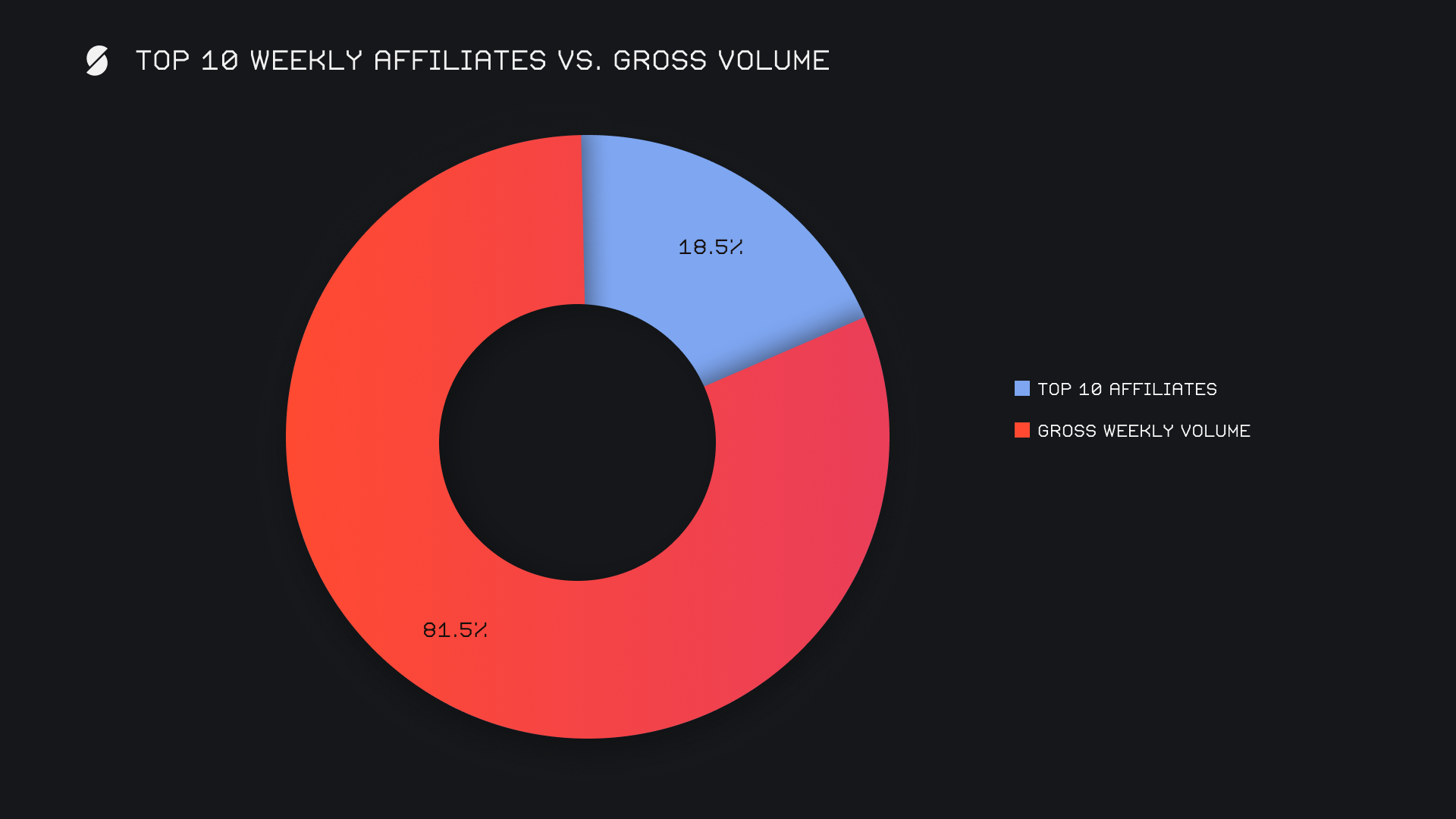

This week, our top affiliates generated a combined total volume of $3.2m, representing a nominal decline of -16.4% compared to last week’s sum. The rankings among our top affiliates remained unchanged, with our first-place affiliate carrying on steady with $1.4m (+5.4%). Our second-place affiliate posted a slight decrease and ended the week at $1.1m, down by -5.7%. Lastly, our third-placed affiliate experienced the most significant drop and saw its volume fall by -59.8% to $405k.

The cumulative proportion volume of our top affiliates accounted for an unusually low 18.4% of our weekly volume. Nevertheless, their combined shift count actually increased +5.4% to end with 2,194 shifts overall.

That’s all for now. Thanks for reading and happy shifting.