SideShift.ai Weekly Report | 20th - 26th February 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the ninety-third edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the ninety-third edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week saw SideShift token (XAI) trend lower, after climbing to a monthly high at the close of last week. It spent the 7 day period moving within the range of $0.1201 / $0.1412, and is currently sitting at the lower end of that bound at a price of $0.1215. At the time of writing, the market cap of XAI is $15,875,508 (-13.8%).

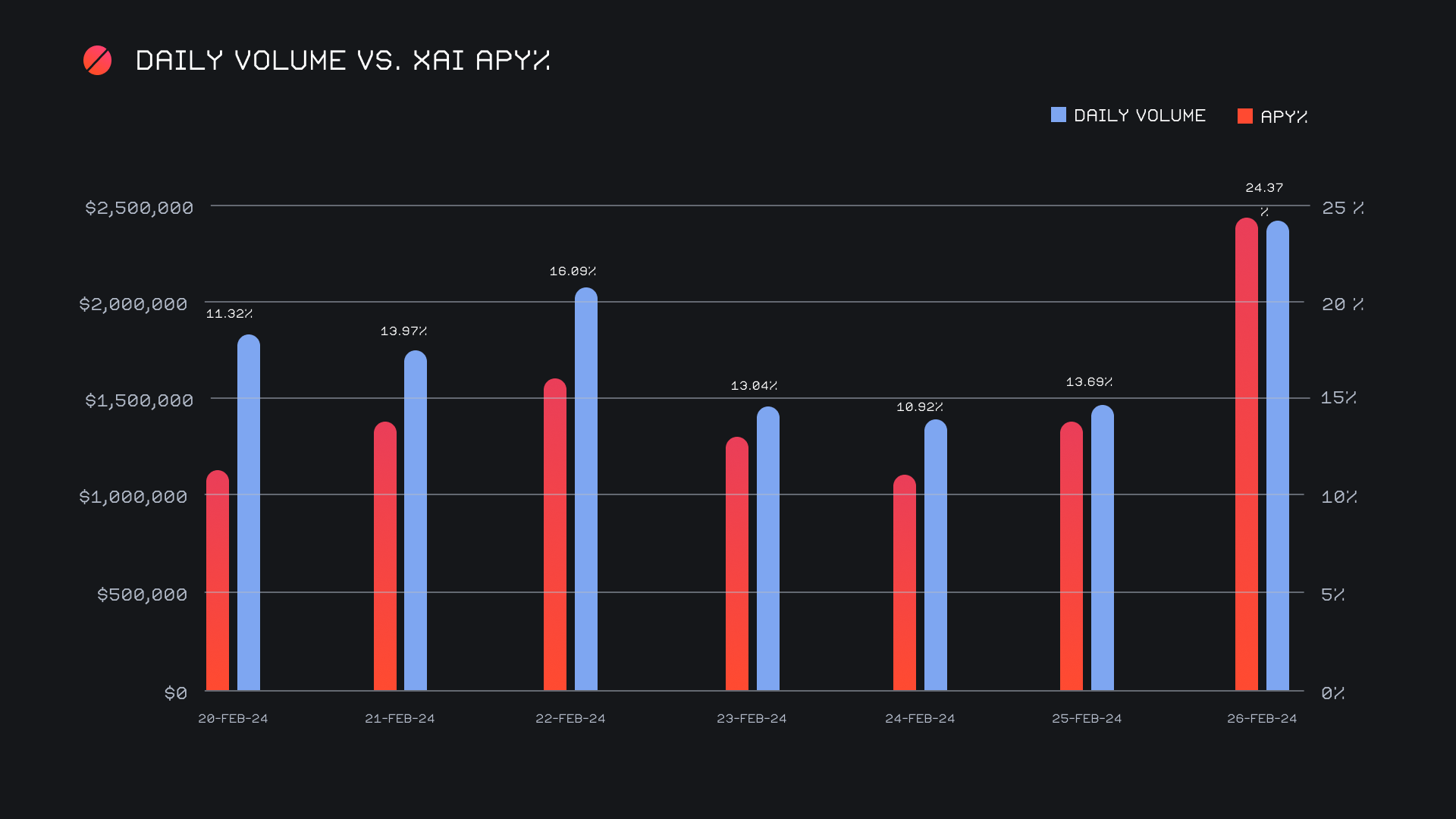

SideShift’s APY remained strong, and XAI stakers were rewarded with an average APY of 14.77% this week. A daily rewards high of 68,863.07 XAI (an APY of 24.37%) was distributed to our staking vault on February 27th, 2024, following a daily volume of $2.4m. This week XAI stakers received a total of 303,872.87 XAI, or $36,920.55 USD.

SideShift’s treasury surpassed $11m this past week and is currently valued at a total of $11.07m. Users are encouraged to follow along directly with live treasury updates, via SideShift.ai/treasury.

Additional XAI updates:

Total Value Staked: 115,355,186 XAI (-1.2%)

Total Value Locked: $13,912,550 (-15.8%)

General Business News

Things are certainly beginning to heat up, as this past week saw the vast majority of coins gain traction and close the period firmly in green. BlackRock’s Bitcoin ETF hit an all time high of $1.3b in daily volume on Monday, February 26th, 2024, helping thrust BTC up towards the $56k mark, and thereby confidently setting the tone for the broader market.

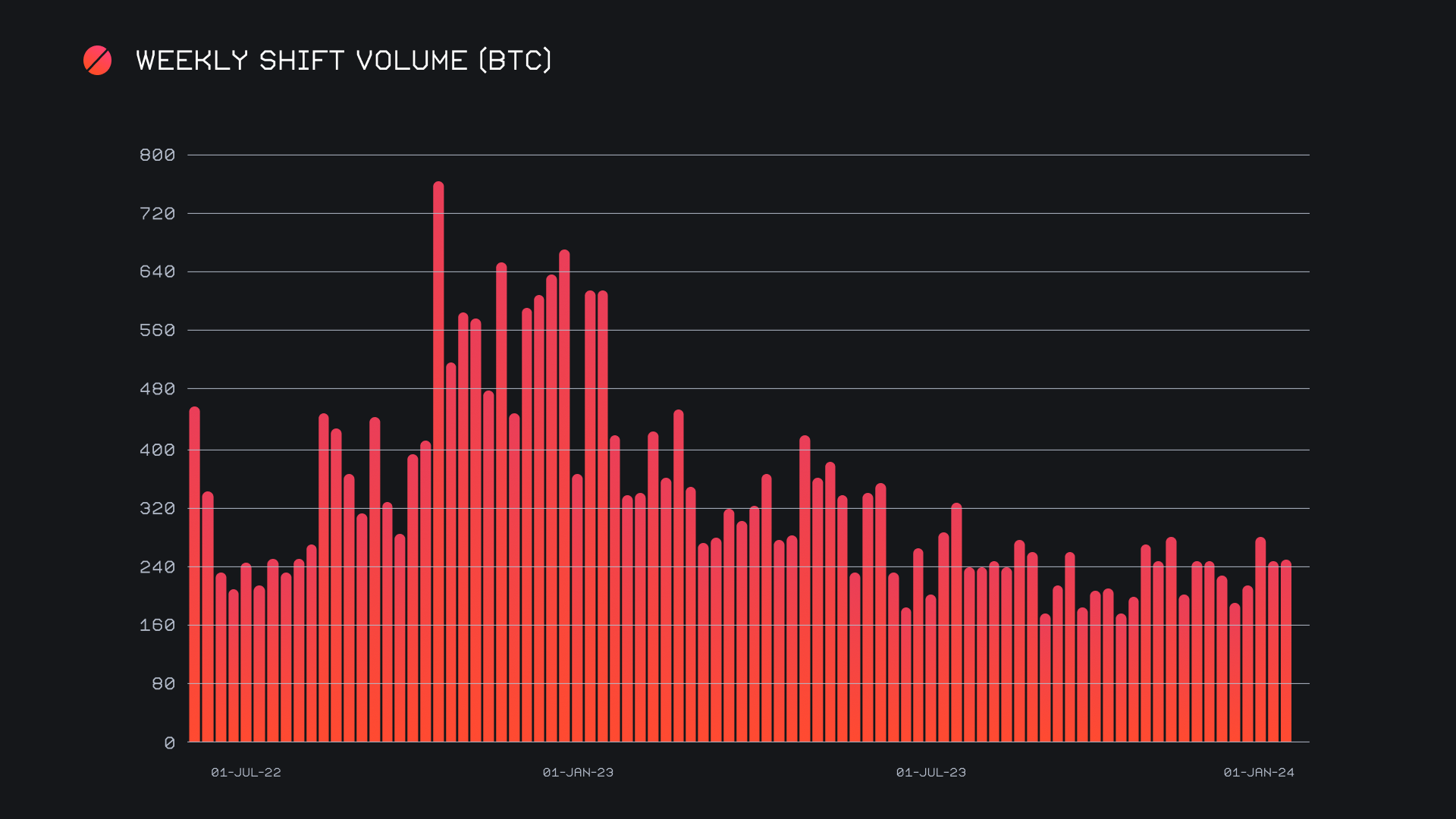

Weekly shift action on SideShift was a reflection of the positive momentum, as we rounded off the 7 day period with a healthy gross volume of $12.4m (+1.6%). Despite being a rather minimal change in gross volume, a weekly net volume of $10.0m caught our attention, as it was the highest recorded since May 2022. Shift count had a strong performance as well and ended with a total of 8,855 (+12.9%). Not only did this shift count represent a 10 week high, but it was also nearly 1,000 shifts higher than our running 10 week average. For the most part, this increase in shift count derived from shifts taking place directly on the site. Together, these gross figures combined to produce daily averages of $1.8m on 1,265 shifts. When denoted in BTC, our weekly volume amounted to 236.91 BTC (+0.4%).

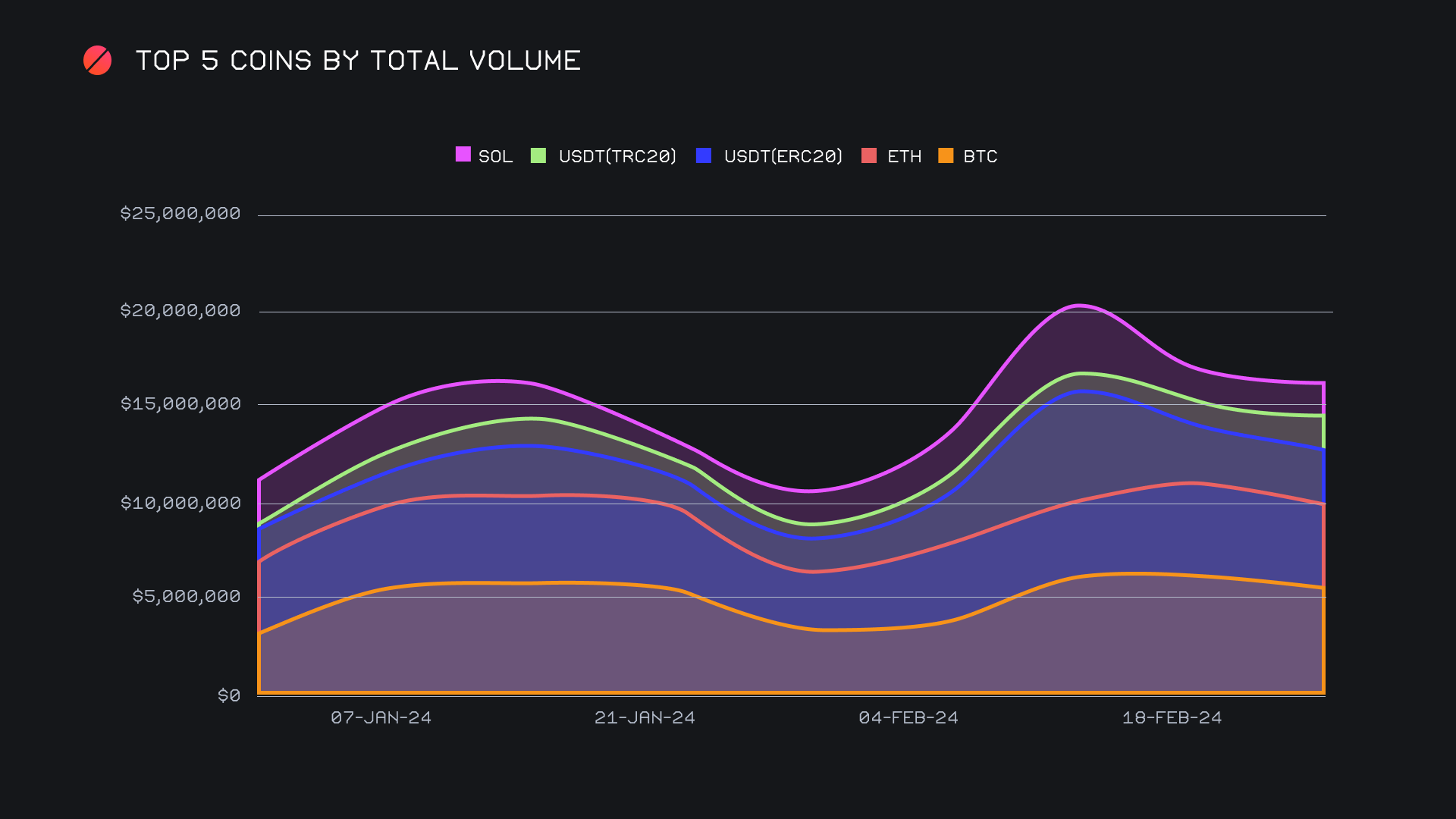

When looking at the combined sum of our top 5 coins, you will notice little to no weekly change. In fact, the combined sum of $16.3m was just -4.3% lower than last week’s total, a strong indication that the overall growth we experienced this week came from elsewhere. A deeper dive will reveal that 4 out of our top 5 coins actually saw volumes decrease on the weekly timeframe, with BTC, our top coin, showing the biggest drop among these. A total volume of $5.6m represented a decrease of -13.4% for BTC, indeed the largest percentage decline among top coins, but still amounting to the highest overall total volume. Whereas last week saw this ratio heavily skewed to favor user deposits, this week was a more balanced outcome, with user BTC deposits totaling $2.6m (-19.2%) as compared to a settlement total of $2.1m (+25.3%). The lesser amount of user BTC deposits was the reasoning behind its total volume decrease, and instead we noticed user deposits flow in from other coins.

ETH finished in second place with a total volume of $4.3m (-9%), followed by USDT (ERC-20) with $2.8m (-7.6%). For the most part, both of these behaved oppositely to BTC - they saw an increase in user deposits with a slight decrease in user settlements, an opposing trend which has seemed to play out rather consistently as of late. Moving forward it will be interesting to see if this pattern continues, or if top coin flows will eventually converge and move in the same direction. Next came fourth placed USDT (TRC-20), which was the only coin among our top 5 to record a positive week. A total volume of $2.0m represented an sizable weekly gain of +71.7%, thereby offsetting the losses recorded by other top coins. This swift increase in USDT (TRC-20) shifting was significant, and resulted in the Tron network surging to lead all alternate networks to ETH.

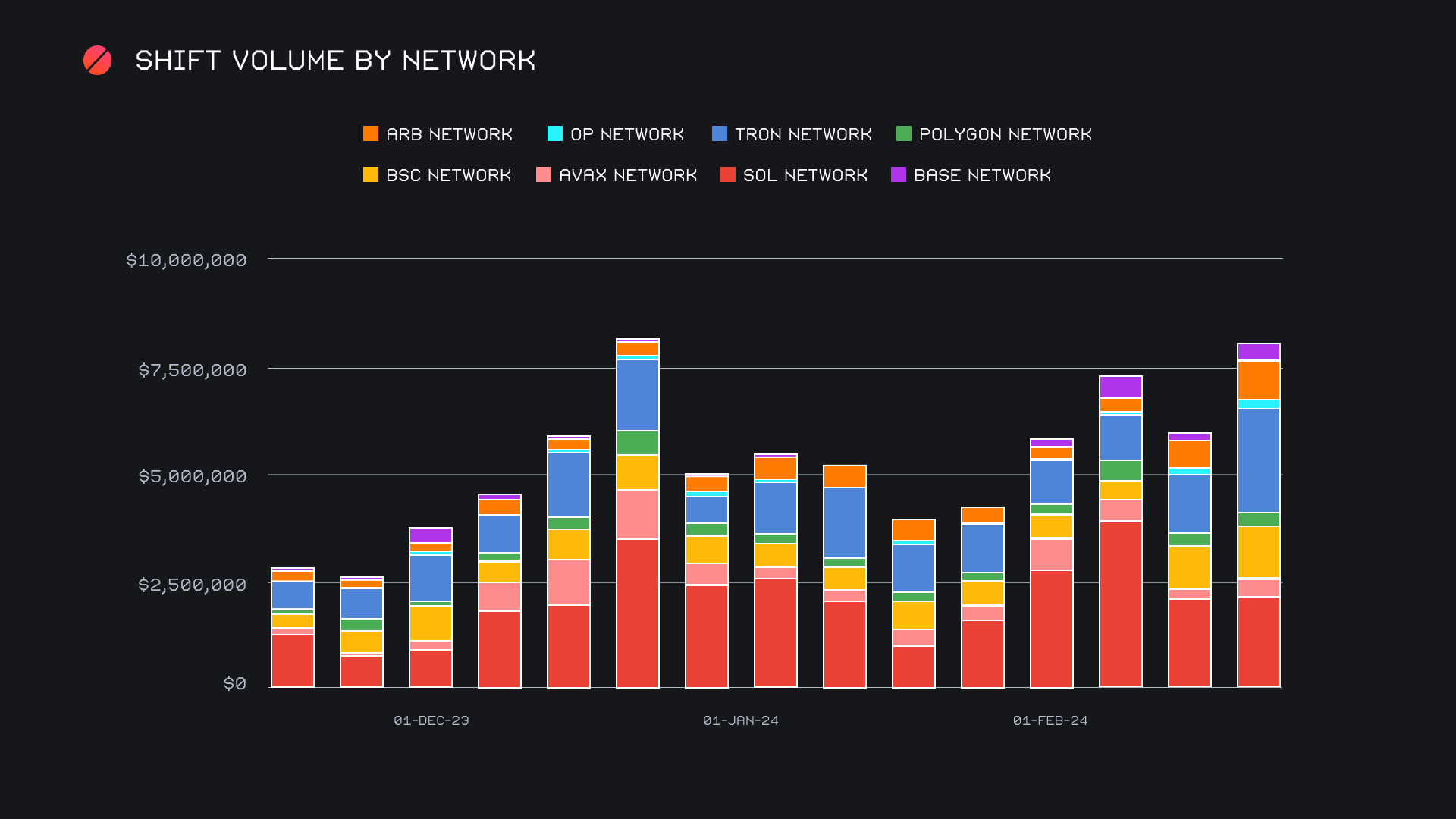

An analysis of alternate networks to ETH is where we can note a real change of character in our weekly numbers. To begin with, our top 3 coins of BTC, ETH and USDT (ERC-20) combined to represent only just over 50% of the weekly total, nearly 15% lower than its typical weekly volume proportion of ~65%. Next, we saw increases in 7 of 8 alternate networks to ETH, as they saw, on average, a weekly gain of +40%. As we know, the Tron network emerged as the frontrunner with a combined $2.5m this week (+73%). Next came the Solana network with $2.2m (+2.1%), which unlike the Tron network, tends to see most of its volume stem from its native token. In third came the Binance Smart Chain (BSC) network, also surpassing the $1m marker and rounding off the period with a total sum of $1.2m (+22.6%). The Arbitrum, Avalanche, and Base networks all recorded weekly percentage gains exceeding 60%, with the Arbitrum network finishing with a solid $949k. The Optimism network was our worst performer and proved to be the only network to see a decrease, yet still finished with $137k (-12.3%).

Together, the combined volume of these alternate networks summed to $8.1m, now just a stone's throw away from ETH’s total of $8.7m. This translated into a coin on one of these alternate networks being included in 32.6% of weekly shifts, as compared to 35.3% for a coin on Ethereum. It is a true representation that users are branching outwards, and utilizing the full offering of networks on SideShift.

Affiliate News

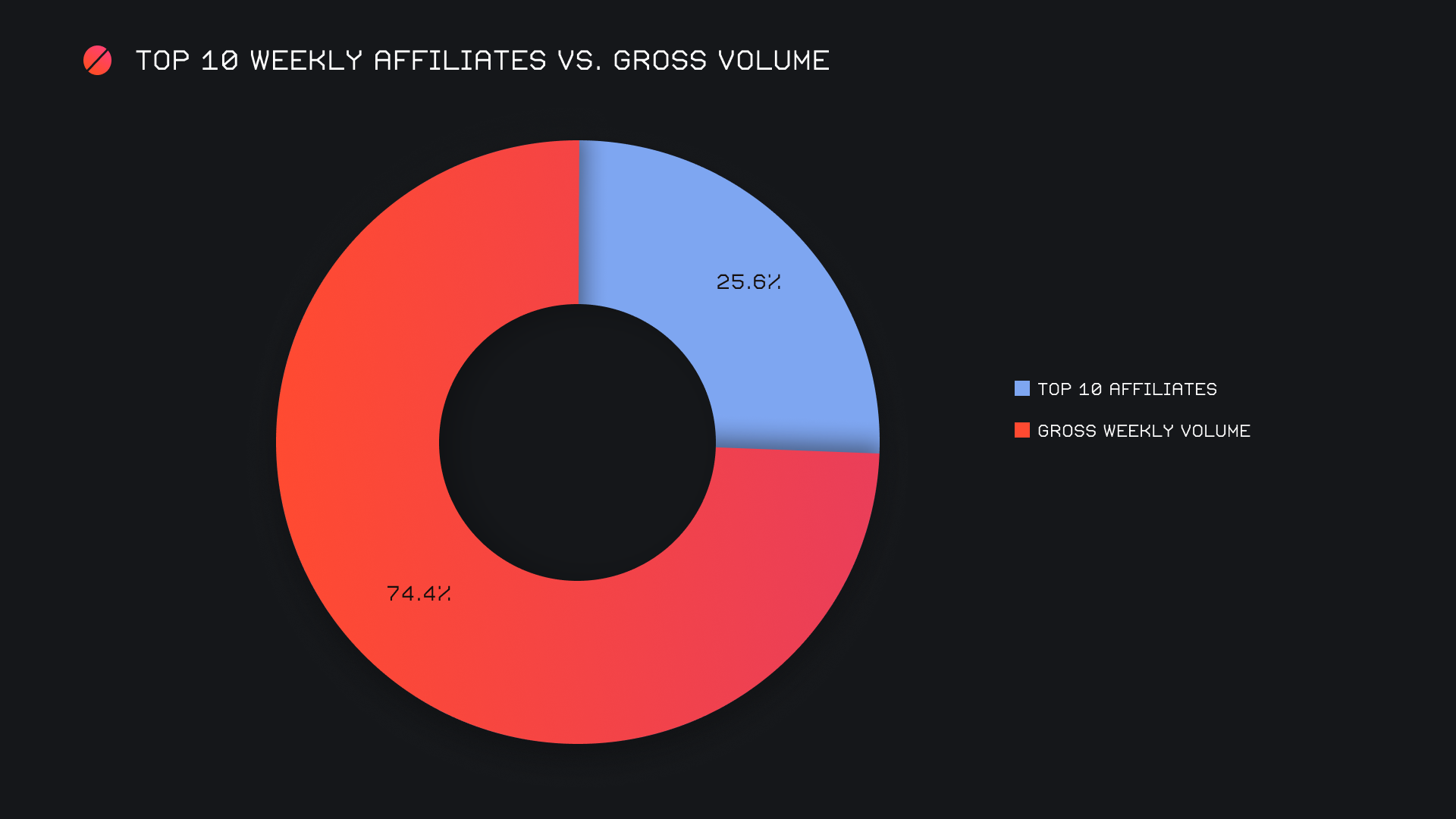

SideShift’s top affiliates finished the week with a combined total of $3.2m, -5.5% lower than last week’s sum. The combined sum for our top affiliates remained mostly on par with that of last week, but there was a noteworthy change which took place. A surprising turn of events saw our previously third ranked affiliate shoot upwards by +71%, and seize first place with a volume of $1.1m. This was a clear show of some continued momentum from the already impressive 8x increase it recorded last week. Second and third ranked affiliates ended with respective volumes of $779k, and $766k.

All together, our top affiliates represented 25.7% of our weekly volume, -1.9% lower than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.