SideShift.ai Weekly Report | 21st - 27th May 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one-hundred-and-sixth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and sixth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week, SideShift token (XAI) continued its upward momentum, experiencing a steady rise within the 7-day price range of $0.1930 to $0.2006. At the time of writing, XAI is sitting at a price of $0.1995, with a market cap of $26,900,472 (+3.5%).

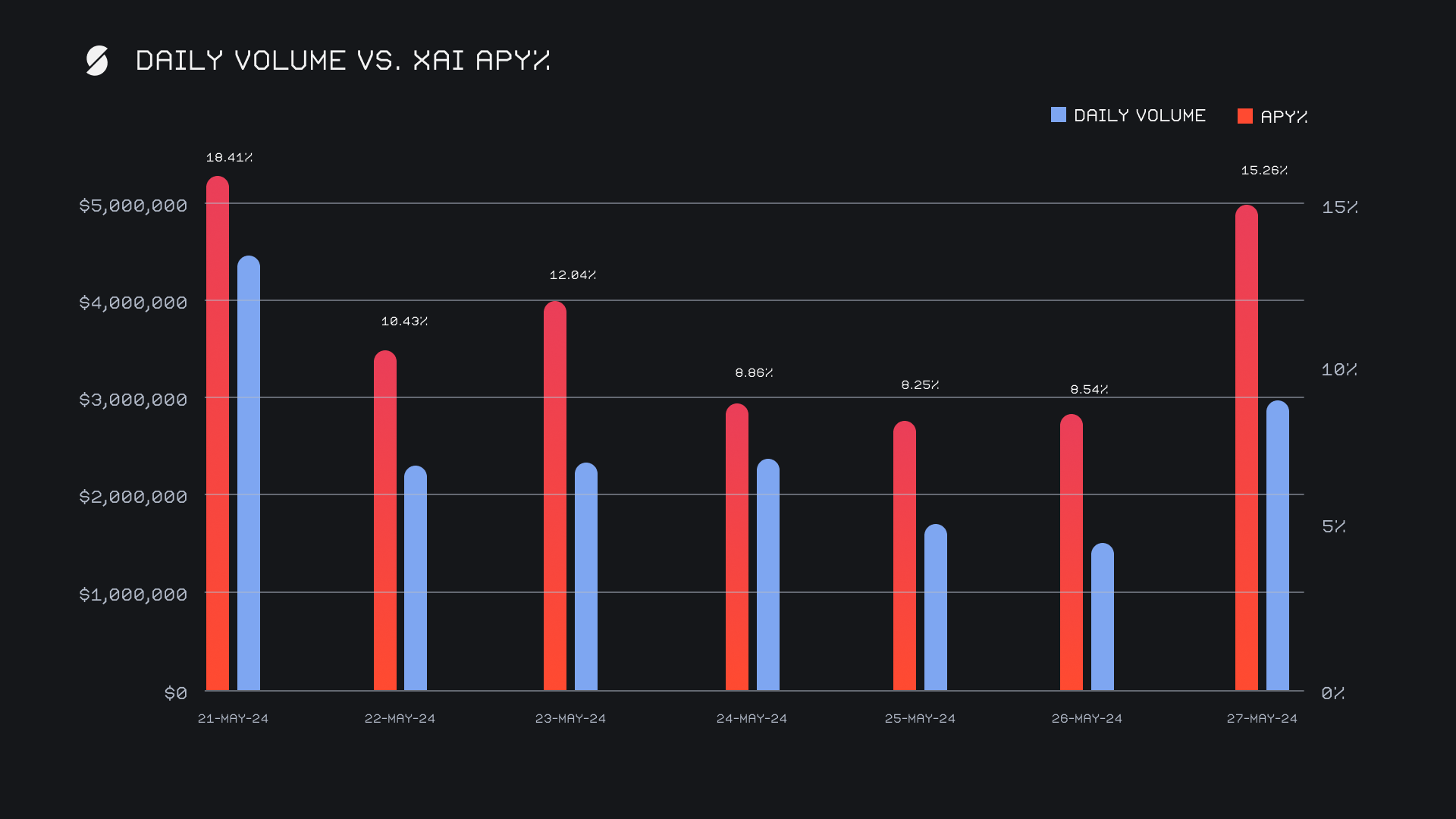

XAI stakers enjoyed an average APY of 11.68% this week, with a daily rewards high of 55,585.53 XAI (an APY of 18.41%) being distributed to our staking vault on May 22nd, 2024. This was following a sizable daily volume of $4.5m. This week XAI stakers received a total of 253,579.31 XAI or $50,589.07 USD in staking rewards.

An additional 2 WBTC ($134k) were sent to SideShift’s treasury over the course of the week, bringing the current total to a value of $17.37m. Users are encouraged to follow along directly with treasury updates, via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 120,466,750 XAI (+0.3%)

Total Value Locked: $24,146,984 (+4.5%)

General Business News

This past week saw the spotlight shone on Ethereum, following the approval of an Ethereum ETF by the SEC. The result was a renewed sense of optimism for ETH users following multiple months of lagging. ETH outperformed BTC as the weekend came to a close.

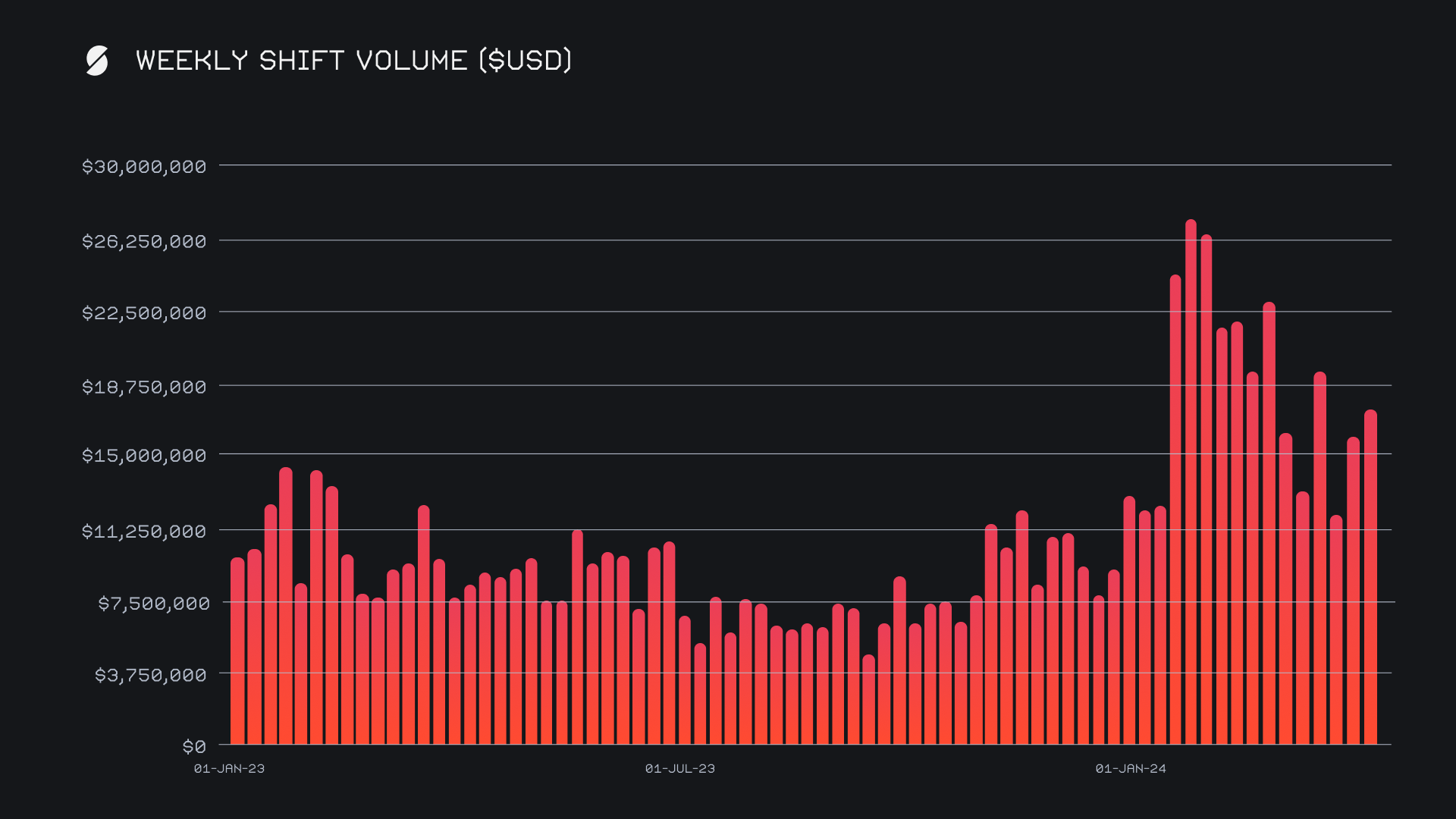

SideShift had a solid performance and continued the upward momentum observed in previous weeks. Our gross volume rose by +6.7% for a total $17.7m, ending as the second highest weekly volume in the month of May. The rise in shift volume was most notable for our top integrations as they all enjoyed a rise of +10% or greater, while volume stemming directly from the site remained more or less consistent.

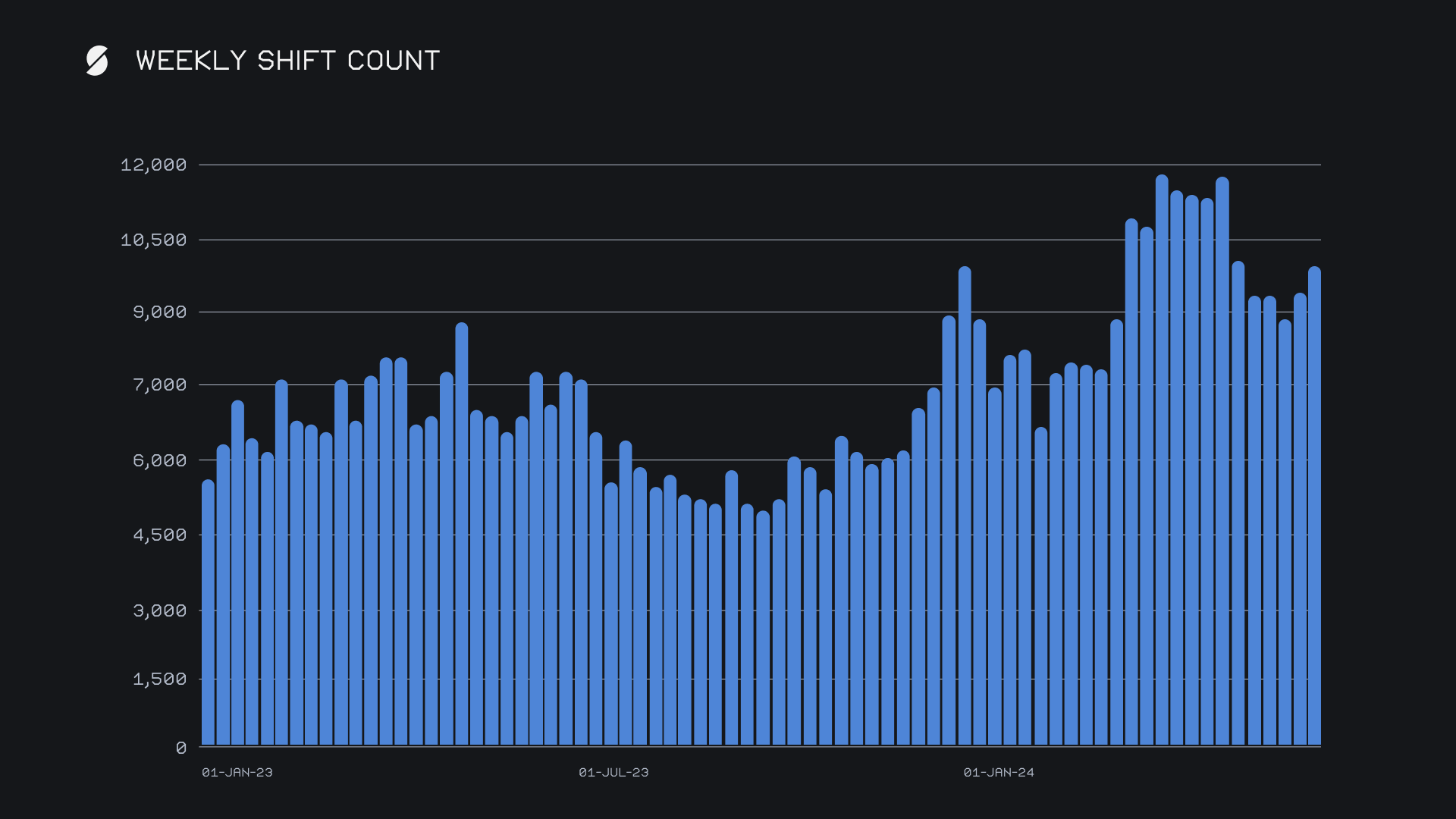

Similarly, our gross shift count saw a +5.4% uptick, moving from 9,392 shifts last week to 9,899 shifts this week. As seen in the chart below, the upwards trend for weekly shift count began in mid 2023 and looks to be continuing on, as we now are once again sitting just shy of the 10,000 shifts per week benchmark. This week, our weekly volume and count combined to produce daily averages of $2.5m on 1,414 shifts.

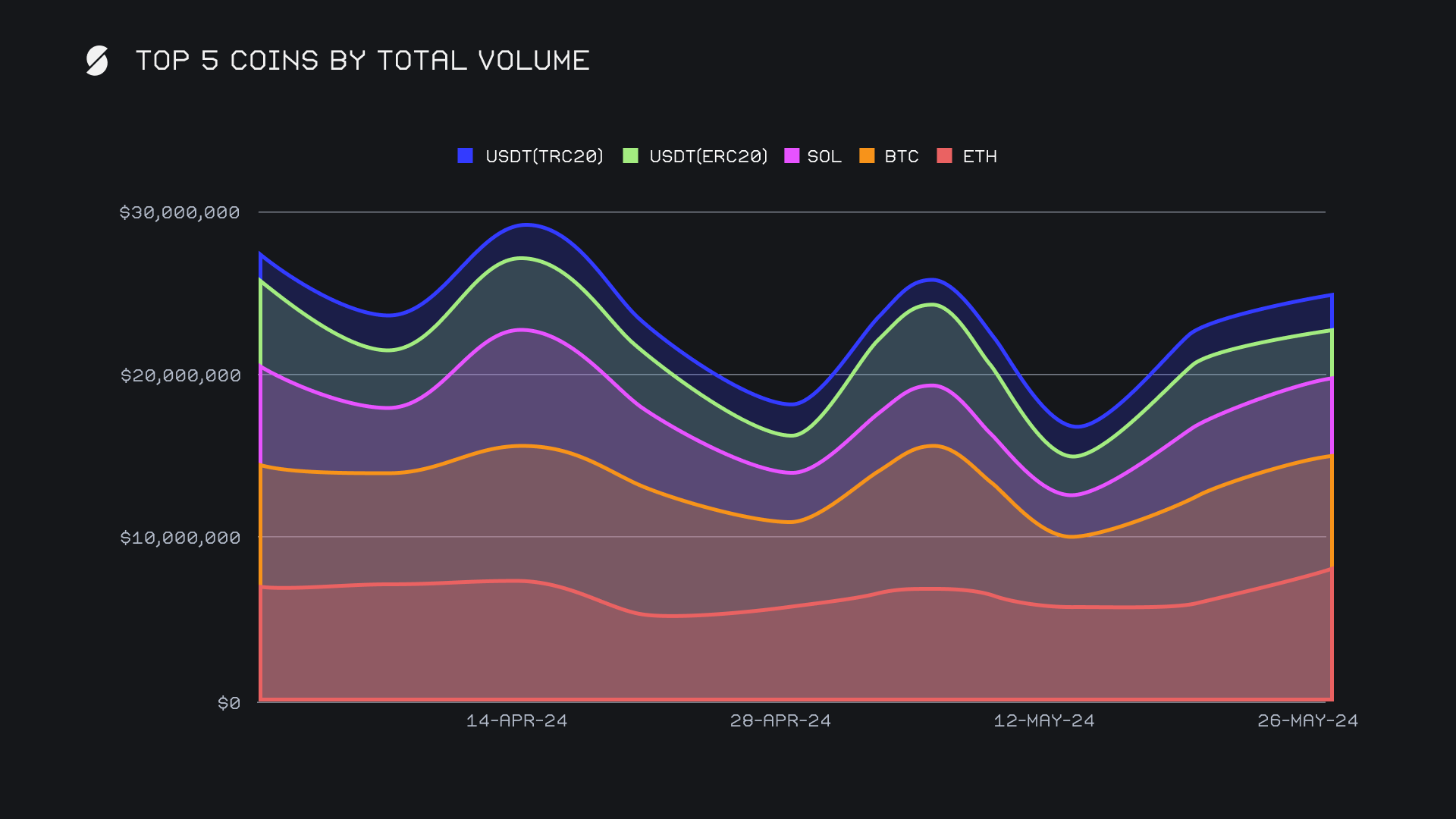

Our weekly top 5 coins by total volume (deposits + settlements) recorded a +9.9% increase in their combined sum, with 4 out of 5 enjoying a weekly gain. The exception here was fourth placed USDT (erc-20), which fell -15%, possibly as users turn their attention to risk-on assets.

ETH asserted its dominance with a remarkable rise in total volume, surging by +39% to reach $8.2m overall. It ended up towering more than $1m higher than second placed BTC. This came from a breakdown of $2.7m to $4.0m in user deposits vs. settlements, a variance which provides a clear indication of the current demand for ETH with user settlements skyrocketing +84.4%. A bulk of this settlement volume stemmed from both the SOL/ETH and BTC/ETH pairs, which finished with respective weekly sums of $1.3m and $1.2m. This week’s ETH volume represented a 2 month high on SideShift, not seen higher since March 2024, when ETH briefly breached the $4k mark.

Despite the heightened interest placed on ETH, we saw BTC maintain its position as a cornerstone asset on SideShift ending in second place with a respectable total volume of $7.0m (+4.0%). However, the weekly composition for BTC starkly contrasted that of ETH, and a comparison of $3.4m vs. $2.3m in user deposits vs settlements signified users eagerness to shift their BTC for other coins this week (eg. the previously mentioned BTC/ETH pair). As is often the case, the $3.4m user deposit sum for BTC was the highest among our top coins.

SOL followed in third with a total volume of $4.7m and noted a similar percentage increase to BTC, with its sum growing by a modest +3.3%. This overall increase was mainly as a result of an influx in user SOL deposits, which jumped +55% for $1.9m. User SOL settlements however did not follow the same trend, falling -24.8% to a total of $1.6m. When analyzing this information along with the numbers from our top 2 shift pairs, we can distinctly see users' preference for shifting to ETH and desire to ride the current Ethereum wave.

Although mainnet ETH captured the majority of users attention, it should be mentioned that ETH on alternate chains also saw a jump in user activity on SideShift. ETH on Base sat right outside of our top 5 this week, as its total volume increased +30.5% for $925k. ETH on Arbitrum spiked a more impressive +110% after a couple of weeks of fairly low action, ending with $515k. Finally, ETH on Blast continued the pattern and rose +19.7% for a total of $457k.

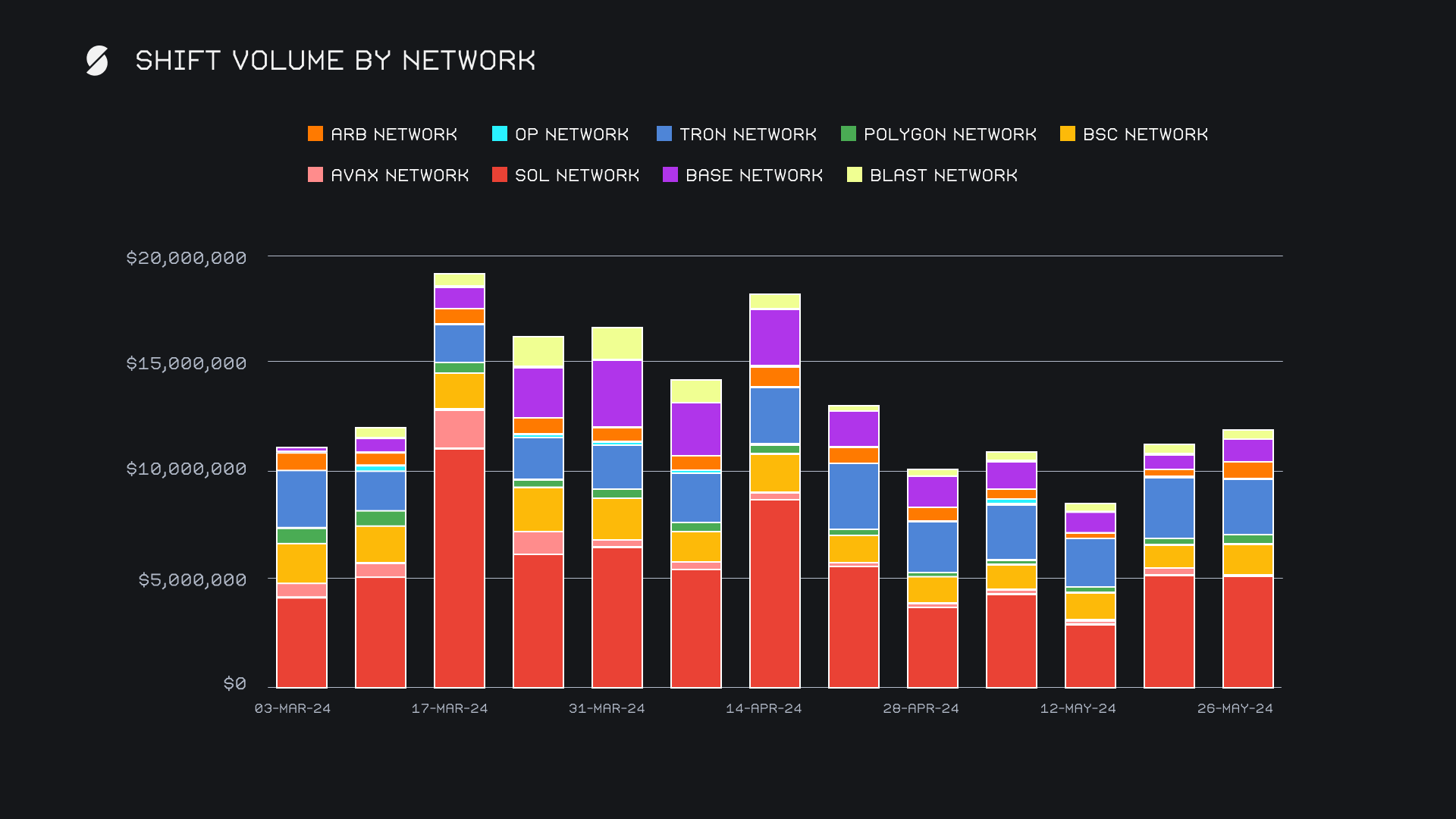

Alternate networks to ETH had a decent week and combined for a total $12.1m, but failed to surpass the Ethereum network's cumulative $12.5m sum. As a percentage of our weekly shift volume, coins on alternate networks to ETH were involved in ~34% of weekly shift volume. Our two leading alternate networks of Solana and Tron both recorded weekly declines, although nothing drastic. They ended with respective totals of $5.4m (-2.7%), and $2.6m (-7.9%). Aside from these two, the rest of the group enjoyed double digit rises in weekly volume. The Binance Smart Chain (BSC) network came in third with $1.4m (+24.3%), thanks to a doubling in the shift action of its native BNB coin. The Base and Arbitrum networks followed, mainly thanks to the aforementioned rise in ETH shifting, and ended with respective totals of $1.0m (+29.5%), and $750k (+141%).

Affiliate News

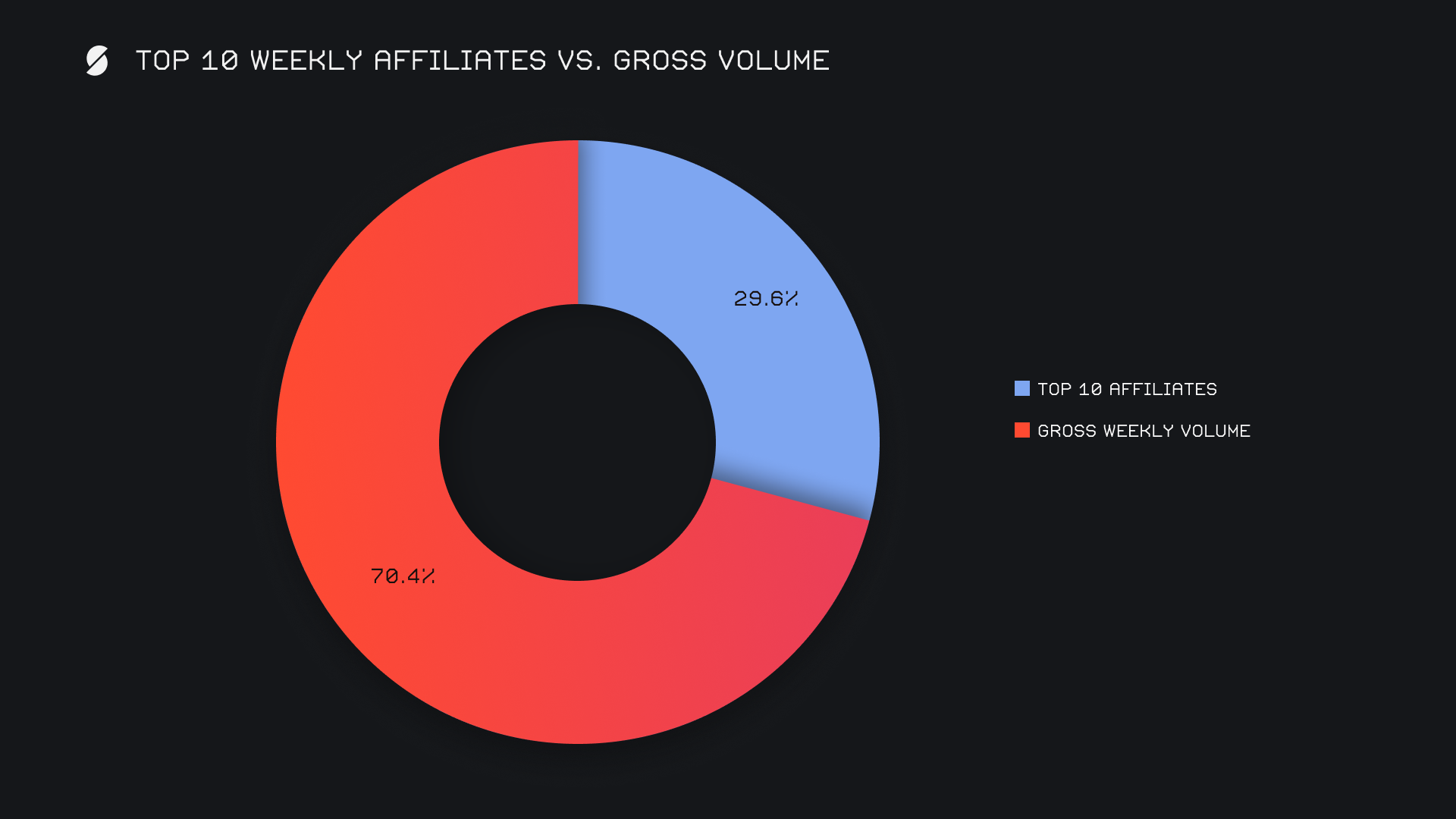

Our top affiliates combined for a total of $5.2m, marking a nominal increase of approximately +20.4% from the previous week’s sum. The ranking remains unchanged for our top three affiliates - our first-placed affiliate maintained its position and saw its volume rise +12.6% for $1.8m. Our second-placed affiliate also had a strong performance, ending the week with $1.7m on 488 shifts. The affiliate that ranked third also cracked $1m in weekly volume, and ended with an impressive shift count just north of 1,000 for the week. All together, our top affiliates accounted for 29.6% of our total weekly volume, +3.4% higher than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.