SideShift.ai Weekly Report | 21st - 27th October 2025

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one hundred and seventy-seventh edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and seventy-seventh edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

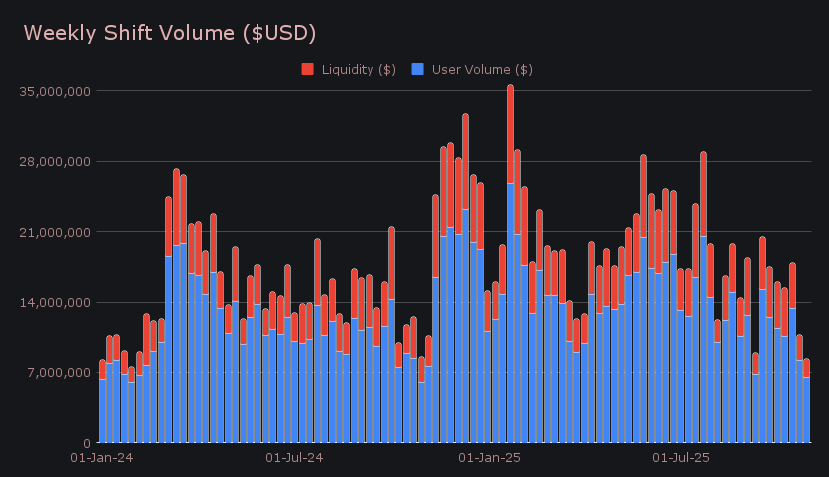

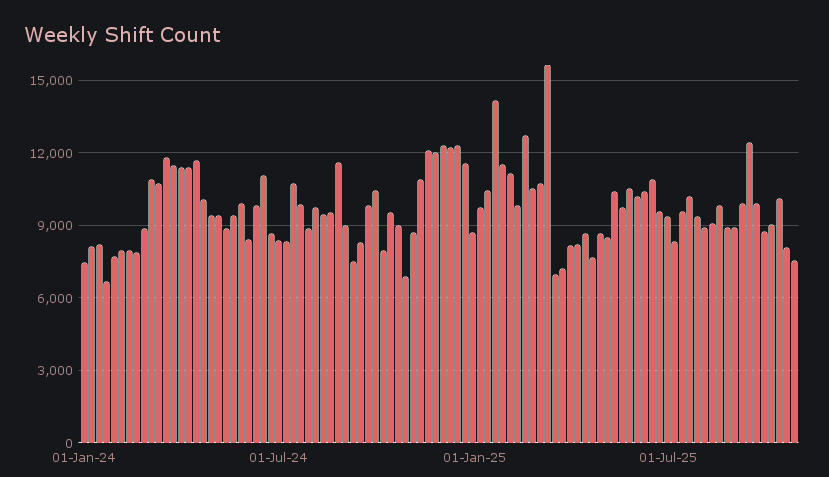

- SideShift finished the week with $8.31m across 7,513 shifts, averaging $1.19m in daily activity.

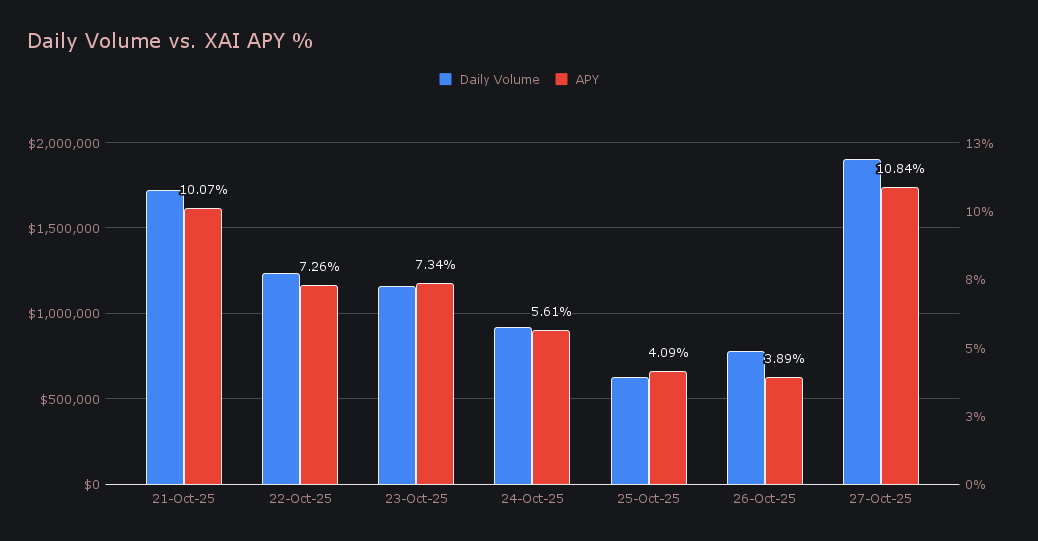

- XAI staking distributed 181,051 XAI ($25,292) at a 7.01% average APY, with total value staked at 139.97m XAI and TVL at $19.26m.

- BTC led for the sixth consecutive week with $2.69m in total volume.

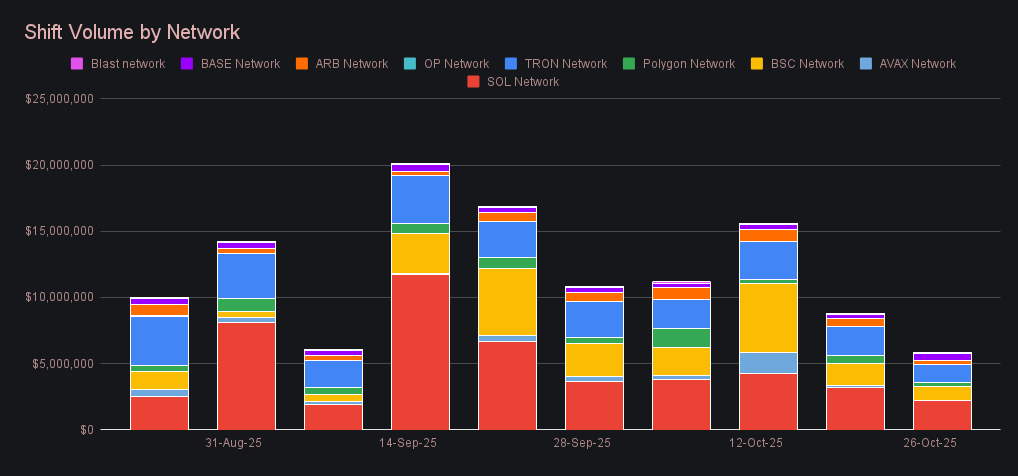

- Alt networks totaled $5.77m, led by Solana at $2.25m, with Base the lone gainer at $507k (+64.6%).

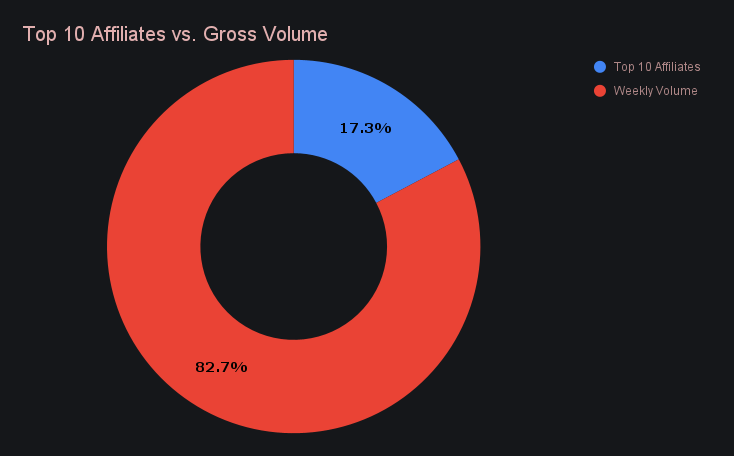

- Affiliates generated $1.43m in total volume, with top rankings unchanged from the previous week.

XAI Weekly Performance & Staking

XAI spent the past seven days trading between $0.1361 and $0.1395, showing calm to slightly upward price action after several weeks of gradual decline. It ended the period at $0.1379, placing its market cap at $21.19m (+0.65%). Over the past half-year, XAI’s range has stretched from a low near $0.12 to highs around $0.17, with the current level sitting just below that midpoint — a zone that has repeatedly acted as a short-term floor where price has tended to stabilize.

A total of 181,050.72 XAI ($25,292.49) was distributed to stakers, generating an average APY of 7.01%. The most active day was October 27, when 39,445.92 XAI was sent to the staking vault at a 10.84% APY, supported by $1.90m in daily shifting volume. Overall staking yields and rewards both eased modestly from the previous report, aligning with the quieter volume seen on the site.

Additional XAI updates:

Total Value Staked: 139,974,429 XAI (+0.1%)

Total Value Locked: $19,264,304 (−0.2%)

General Business News

Crypto markets closed the week in mixed form, with BTC’s October candle currently up just +0.4%, technically in the green, but barely. After a month defined by sharp two-way action and a $20k+ trading range, the move leaves BTC hovering near breakeven as November approaches. In contrast, Zcash (ZEC) has stolen the spotlight, surging 40–50% to reach intraday highs around $370 and pushing its market cap above $5b for the first time in years. Beyond ZEC’s surge, HYPE and PUMP both enjoyed +30% weekly gains, while most other altcoins remained flat or mildly lower, as cautious sentiment and continued liquidation pressure kept the broader market on edge.

SideShift activity eased further this week, with gross volume falling −22.5% to $8.31m, marking the lowest total of 2025 so far. The slowdown was broad-based, though most notable across major integrations, which combined for a yearly low share of total shifting. User volume reached $6.52m (−20.7%), while liquidity shifting added a further $1.78m (−28.4%), both pulling back in line with the timid market. Combined, SideShift averaged $1.19m in daily volume, underscoring how quiet conditions have become after several volatile trading weeks.

Shift count reached 7,513 (−6.8%), or about 1,073 daily. The slowdown owed more to reduced shift sizes than to user inactivity, though both ultimately pushed totals down. The week’s top user pair was DOGE/BTC ($353k), narrowly ahead of ETH/BTC ($335k) and BTC/ETH ($179k). The mix offered a slightly different look from recent weeks, with BTC-based pairs regaining presence among leaders and DOGE drawing a noticeable share of user flow.

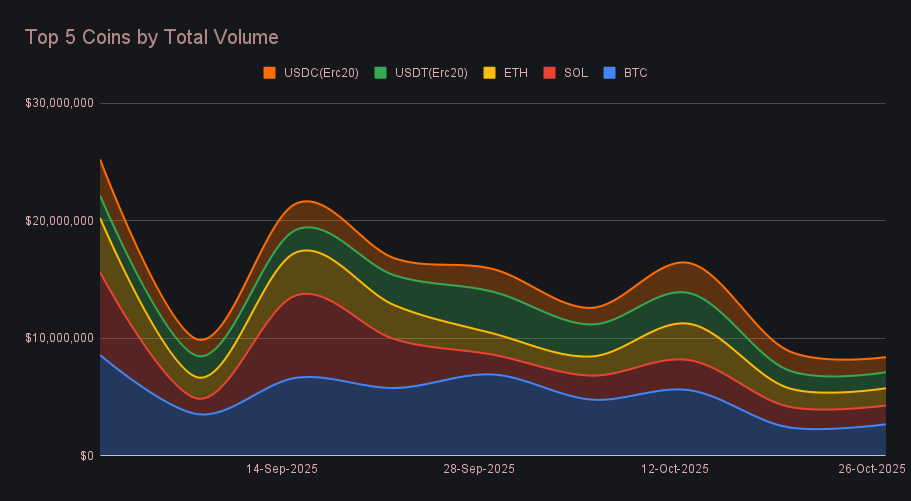

BTC ranked first for the sixth consecutive week with $2.69m (+10.1%) in total volume. Importantly, this was the only top coin to record a net gain on the week. User deposits closed at $1.01m (−10.4%), while settlements rose to $1.27m (+7.2%), bouncing modestly from last week’s yearly low but still quiet overall. The increase came less from broad market strength and more from a selective flow into BTC, as users appeared more willing to shift into the asset than to rotate elsewhere. In a stretch defined by hesitation and limited conviction, BTC stood out as the one place users were comfortable moving funds, while the majority opted to sit on their hands amid the market’s recent unpredictable, stop-start rhythm.

SOL and ETH followed in familiar positions, each logging modest declines after last week’s uneven results. SOL recorded $1.60m (−9.4%), split between $562k (+1.1%) in deposits and $736k (−25.1%) in settlements. ETH finished close behind with $1.47m (−7.2%), comprising $786k (−4.2%) in deposits and $491k (−22.8%) in settlements. The two coins continued to trade places within striking distance of one another, though SOL retained a narrow lead for the third straight week. Despite the lower totals, both showed a slightly more balanced profile compared with last week, when SOL’s settlements were the only positive change among any top asset. This week’s figures instead pointed to steadier user flow on both sides of the shift, even as total volumes remained compressed.

Among stablecoins, USDT (ERC-20) and USDC (ERC-20) rounded out the top five coins with mixed but steady results. USDT (ERC-20) recorded $1.36m (−10.4%), supported by $519k (+0.2%) in deposits and $666k (+19.6%) in settlements — a small but clear pickup in outbound activity. USDC (ERC-20) followed at $1.29m (−22.6%), with deposits rising to $416k (+13.8%) while user settlements dropped to $512k (−33.5%). Despite these week-to-week changes, gross stablecoin volume has now fallen by more than 60% from two months ago, when they remained at the forefront of top shift pairs and anchored much of SideShift’s weekly volume.

Alternate networks to Ethereum extended their retracement this week, combining for $5.77m (−33.9%), their lowest combined total in months. The Solana network once again led the group with $2.25m (−30.3%), a sizable decline but holding up better than other alt networks, which fell fell to multi month lows. Tron fell into this category, and followed with $1.38m (−37.4%), trailed by the BSC network at $1.05m (−37.0%). Base stood out as the lone gainer, climbing +64.6% to $507k, while most others — including Arbitrum ($294k, −52.0%) and Polygon ($262k, −54.4%) — moved lower in tandem. The shift in share toward Ethereum suggests users are leaning back on familiar ground, with most alternate networks seeing momentum dry up for now.

Affiliate News

Affiliates were no outlier this week, combining for $1.43m (−34.0%) in total volume. First place slipped to $373k (−63.4%), while second and third followed with $227k (−35.8%) and $219k (−8.6%), keeping the same order intact from the previous report. Individually, these ranked among the slowest weekly showings from any top affiliate this year, signaling how far activity has cooled.

Together, they made up 17.3% of total volume (−3.0%), the lowest share of 2025, marking a rare stretch where even affiliate activity couldn’t escape the lull.

That’s all for now - thanks for reading and happy shifting.