SideShift.ai Weekly Report | 22nd - 28th April 2025

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one hundred and fifty-first edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and fifty-first edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

- BTC still dominated shifting – $9.7m (-13.0%) in volume, nearly 3x the next coin. Deposits rose +18.6%, while settlements fell -23.0%.

- USDT (ERC20) posted strong gains – Volume hit $5.4m (+29.0%), with deposits up +44.6% and settlements +20.9%, reclaiming second spot.

- Shift count climbed – 8,659 shifts (+13.3%) marked the highest weekly count this month.

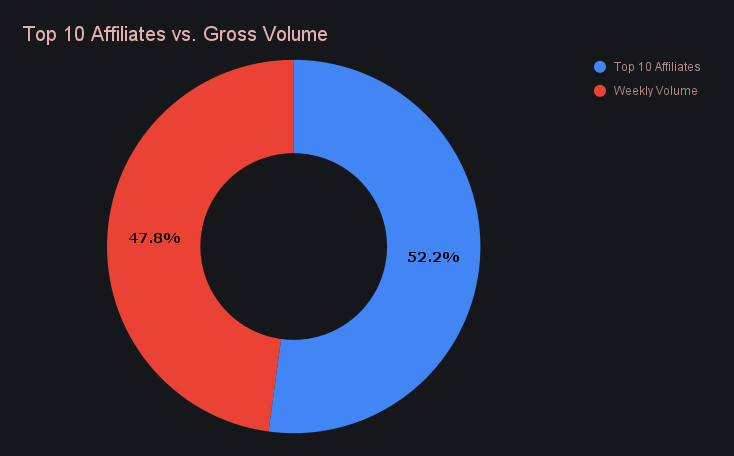

- Top affiliate drove $5.2m – Stayed above $5m for the 4th straight week, topping 1,000 shifts and driving 52.2% of volume.

- Arbitrum bucked the trend – Jumped +19.8% to $536k, while most alt L1s saw declines.

XAI Weekly Performance & Staking

This past week saw SideShift token (XAI) hold relatively steady, trading between a 7-day low of $0.1332 and a high of $0.1355. After some mid-week fluctuations, XAI closed the week at $0.1338, reflecting stable movement within the tight range. XAI’s market cap finished at $19,619,657, marking a slight decline of -0.29% from the previous week and reflecting the tempered movement in price.

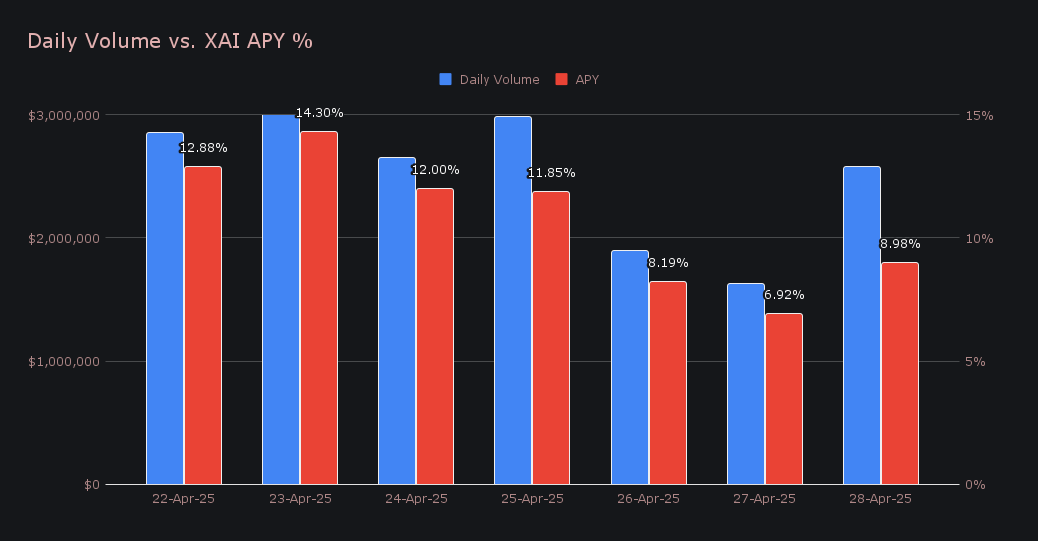

A total of 258,337.42 XAI was rewarded to XAI stakers via our staking vault, equal to $34,788 USD in value. The weekly staking APY averaged 10.73%, with the highest daily rewards being distributed on April 23rd, totaling 48,475.3 XAI. This followed an APY of 14.3%, and stemmed from a daily shift volume of $3,016,457.

An additional 150,000 USDC was sent to SideShift’s treasury over the course of the week, bringing the current total to a value of $18.91m. Users are encouraged to follow along directly with live treasury updates, via sideshift.ai/treasury.

Additional XAI Updates:

Total Value Staked: 132,686,706 XAI (+0.2%)

Total Value Locked: $17,732,174 (-0.1%)

General Business News

This past week, BTC held steady around $95k (+7.5%), while ETH edged up to $1,800 (+13.6%), helping lift overall sentiment as the Fear & Greed Index rose to 60/100, up from 47 just a few days prior. Meanwhile, the TRUMP memecoin soared +67% following news of an exclusive dinner for top holders, drawing further attention back to Solana-based tokens after months of heavy bleeding across the sector.

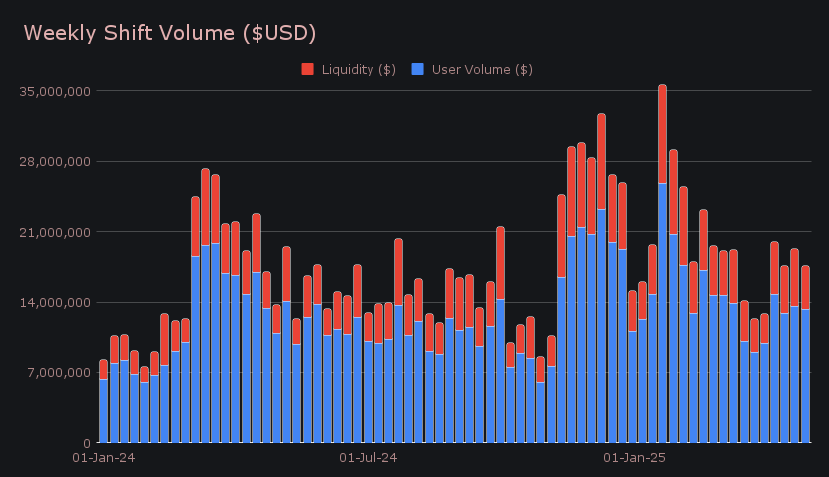

SideShift rounded out the period with a gross weekly volume of $17.6m (-8.7%), maintaining a steady rhythm as both volume and shift count finished within ±5% of our monthly averages for April. User shifting volume totaled $13.3m (-2.5%), while liquidity shifting fell sharply by -23.6% to $4.3m, as a more balanced mix of deposits and settlements naturally reduced the reliance on liquidity shifts. Among user-driven shifts, BTC/USDT (ERC20) reclaimed the top spot with $1.4m in volume, far outpacing the next most popular pair, BTC/ETH, which totaled $844k. This marked the fifth time in the past six weeks that BTC/USDT (ERC20) ranked first among user pairs.

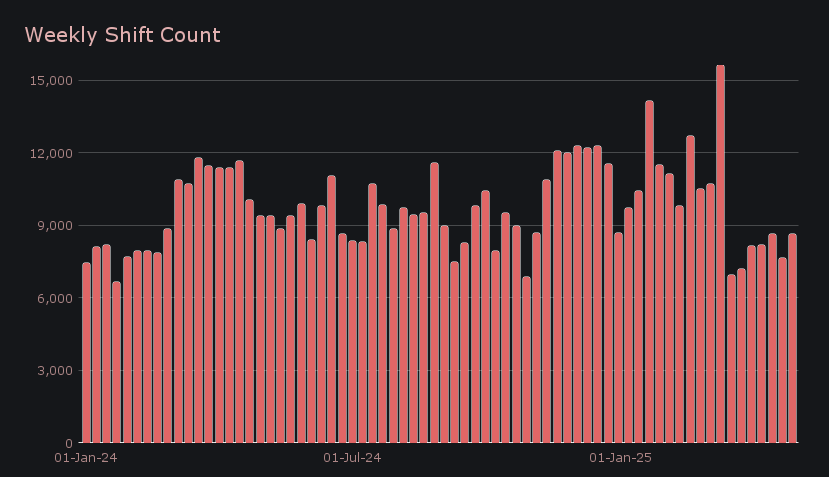

Meanwhile, our gross shift count climbed +13.3% to 8,659 shifts, helped by a noticeable boost coming from top integrations. This resulted in daily averages of $2.51m in volume across 1,237 shifts per day, reflecting a steady pace of user activity throughout the 7 day span. Notably, this marked our highest weekly count so far this month, although it still trails our YTD average, which currently sits closer to 10,000 shifts per week.

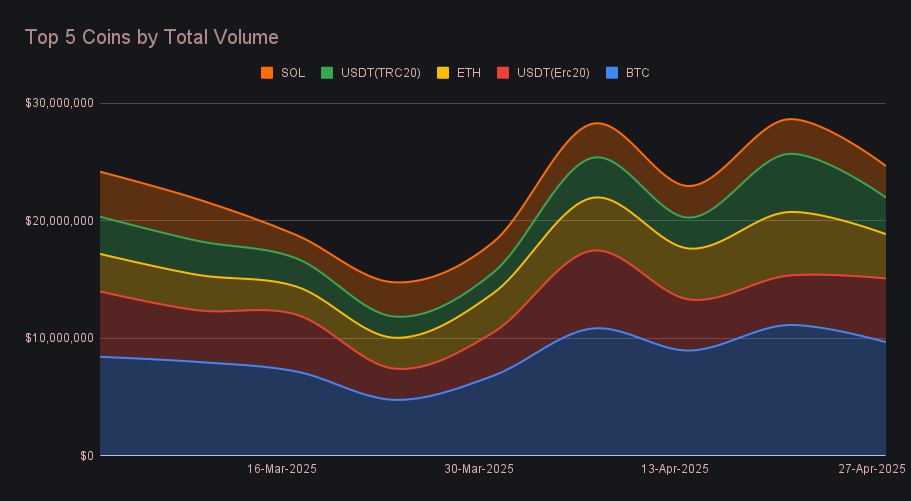

BTC continued to dominate shifting activity, recording a total weekly volume of $9.7m (-13.0%), nearly triple that of the next closest coin. User deposit volume climbed to $4.0m (+18.6%), while user settlement volume fell to $3.7m (-23.0%), suggesting that while users were more inclined to send BTC to SideShift, they were slower to complete outgoing shifts, possibly awaiting stronger price action. Ultimately, we ended with a fairly balanced outcome for BTC between user deposits and settlements, as its price carried on relatively flat after an initial jump to begin the period.

USDT (ERC20) followed in second with $5.4m (+29.0%) in total volume, standing as the only coin in the top 5 to record a weekly increase. Both deposit and settlement flows strengthened, with deposits rising to $1.5m (+44.6%) and settlements to $2.4m (+20.9%), indicating a broader pickup in shifting for the most popular stablecoin. USDT (ERC20) has reasserted itself after last week's slip, whereas USDT (TRC20) cooled sharply, falling back to $3.1m (-37.0%) and signaling that last week’s surge was likely a one-off rather than the start of a new trend.

ETH landed in third with a total volume of $3.8m (-30.5%), marking one of the largest drops among our top coins. Yet the breakdown showed a more interesting trend - while user deposits fell to $1.7m (-38.3%), settlements climbed to $1.1m (+36.3%), hinting that users were actively shifting to ETH, potentially viewing it as a buy opportunity as they await a bottom or broader reversal. SOL, which closed out the top five with $2.7m (-9.2%), showed a similar pattern with settlements far outpacing deposits, and despite lighter volumes lately, continues to maintain a steady footing among our most shifted coins.

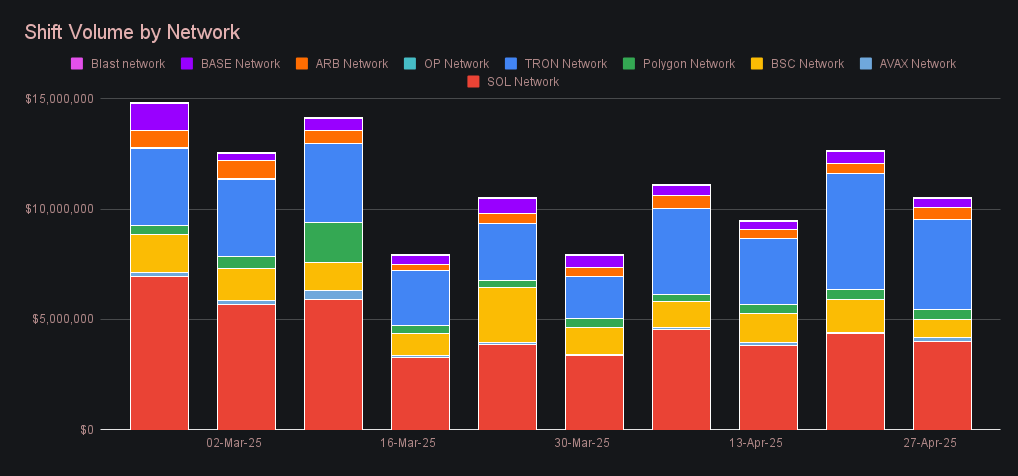

Alternate networks to ETH continued to navigate a general upwards trend throughout April, although this past week brought a modest pullback. Combined volume ended at $10.5m (-16.8%), slipping below the Ethereum network’s $11.5m (-0.6%) after briefly overtaking it last week. The Tron network led the group once more with $4.1m (-22.3%), narrowly beating out Solana for the second consecutive week - a rare reversal given Solana’s usual dominance. Solana followed closely with $4.0m (-7.6%), maintaining a relatively steady performance over the past month. The Binance Smart Chain saw a sharp drop to $825k (-45.9%) and surrendered much of its earlier gains, while Arbitrum was a standout, rising to $536k (+19.8%). Polygon held firm at $452k (+0.9%), and activity across Base and Avalanche remained lighter, with Base easing lower and Avalanche showing a solid recovery.

Affiliate News

Our top affiliates maintained a firm grip on weekly volume, collectively now driving more than half of all shift volume for the third time in the past four weeks. Our leading affiliate generated an impressive $5.2m (-11.8%) and finished with its fourth consecutive finish above the $5m mark. It also stood as the only affiliate to surpass 1,000 shifts, another feat it has achieved throughout the month. Our second placed affiliate continued its momentum with $2.6m (+22.8%), now rising for three straight weeks, while third place ticked up to sum $591k (+3.8%).

All together, our top affiliates combined to account for 52.2% of our shift volume, +2.5% higher than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.