SideShift.ai Weekly Report | 22nd - 28th October 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one-hundred-and-twenty-eighth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and twenty eighth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

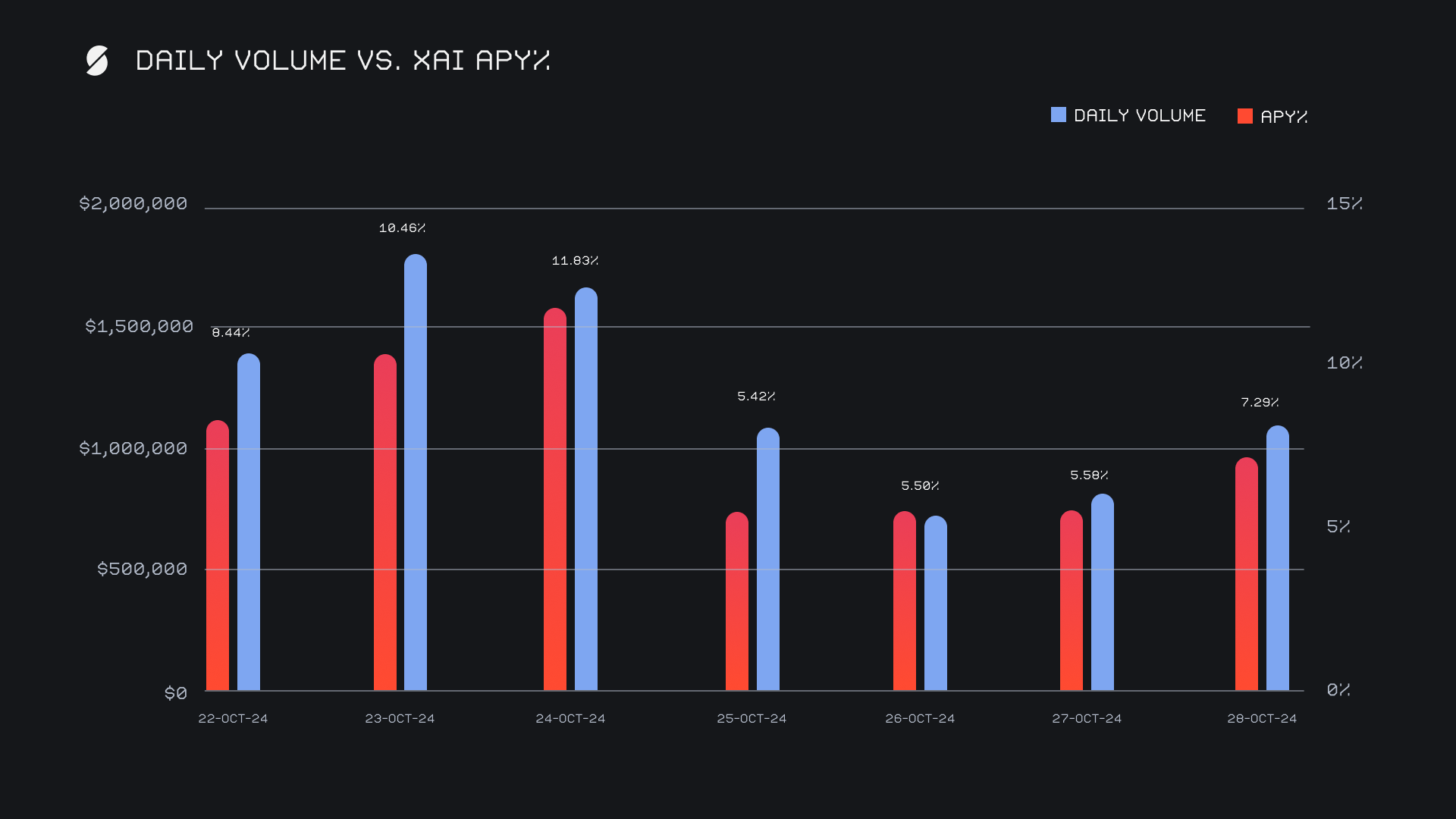

This week, SideShift token (XAI) navigated a minor decline within the 7-day price range of $0.1190 to $0.1305. At the time of writing, XAI is priced at $0.1212, with a current market cap of $17,023,569, marking a slight dip of -1.96% compared to last week’s sum of $17,364,118.XAI stakers enjoyed an average APY of 7.79% throughout the week, with the highest daily reward distribution reaching 38,529.92 XAI on October 25th, 2024. This daily rewards peak corresponded to an APY of 11.83%, and came on the back of a $1.7m daily volume. This week, XAI stakers received a total of 180,362.39 XAI or $21,859.92 USD in staking rewards.

SideShift’s treasury hit a milestone this week, as it is now sitting at a value of $16.12m, which officially surpasses that of our TVL. A friendly reminder that users can follow along directly with treasury updates, via sideshift.ai/treasury.

Additional XAI Updates:

Total Value Staked: 125,971,193 XAI (+0.1%)

Total Value Locked: $16,049,680 (+1.5%)

General Business News

The crypto market was flooded by a wave of optimism this week, led by BTC’s surge past $70,000, its highest level in over seven months. ETH followed with a modest climb to $2.6k, although the ETH/BTC pair continues to weaken, now at its lowest point since the spring of 2021. Instead, SOL is showing impressive strength and surging to all time highs vs. ETH, driven by unprecedented levels of memecoin trading.

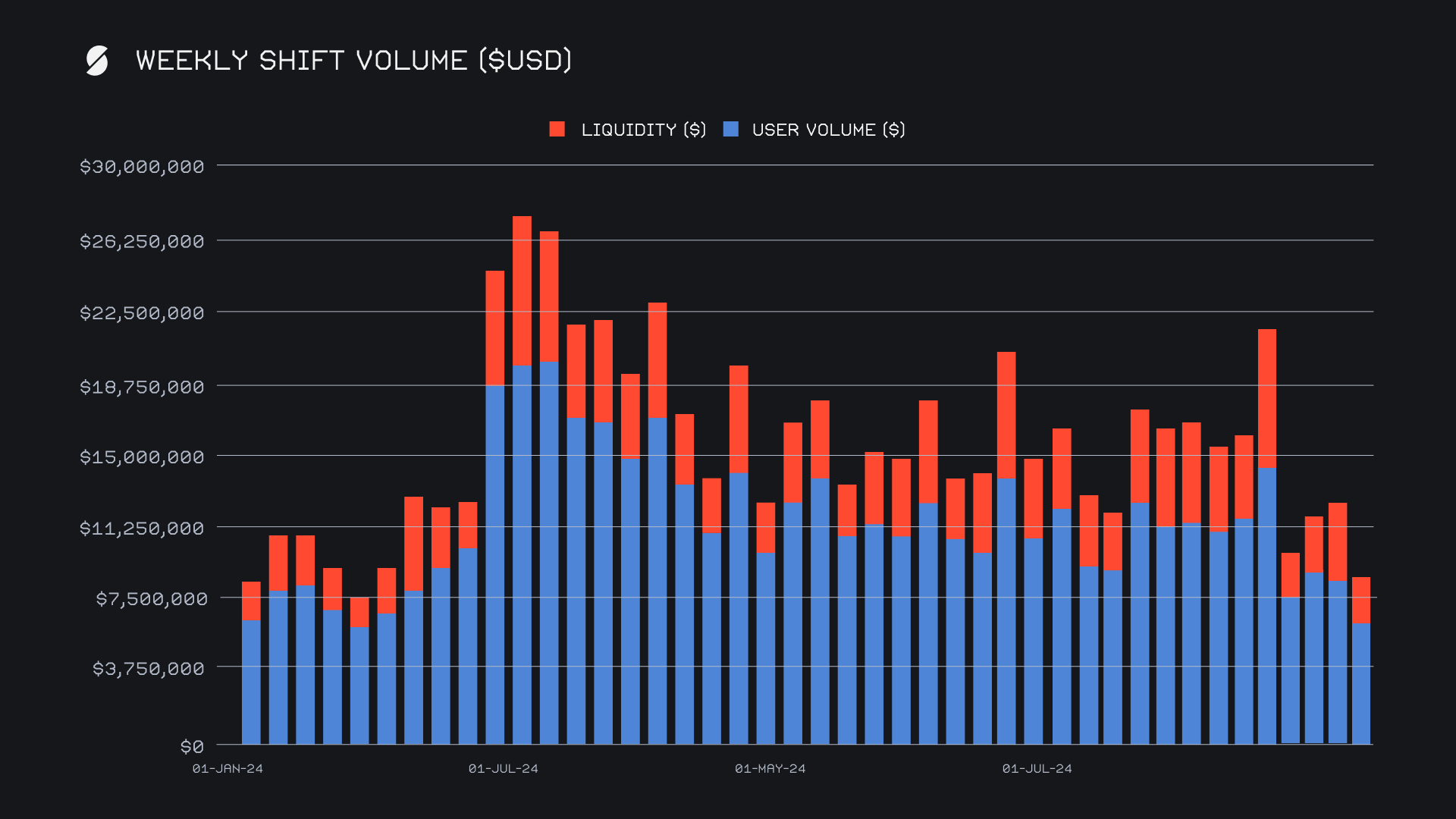

This week, SideShift recorded a gross weekly volume of $8.6m, a decrease of -31.9% compared to the previous period. User shifting volume contributed $6.1m (-28.4%), while liquidity shifting volume saw a more pronounced decline of -39.1% and ended at $2.5m, meaning there was a more even spread between user shifts and therefore less of a need for rebalancing. We experienced some performance issues which affected our shift volume and site stability this week - this remains the top priority for our engineers who are actively working on resolving any issues. While this week’s drop was notable, it brought our volume more in line with levels observed earlier in the year.

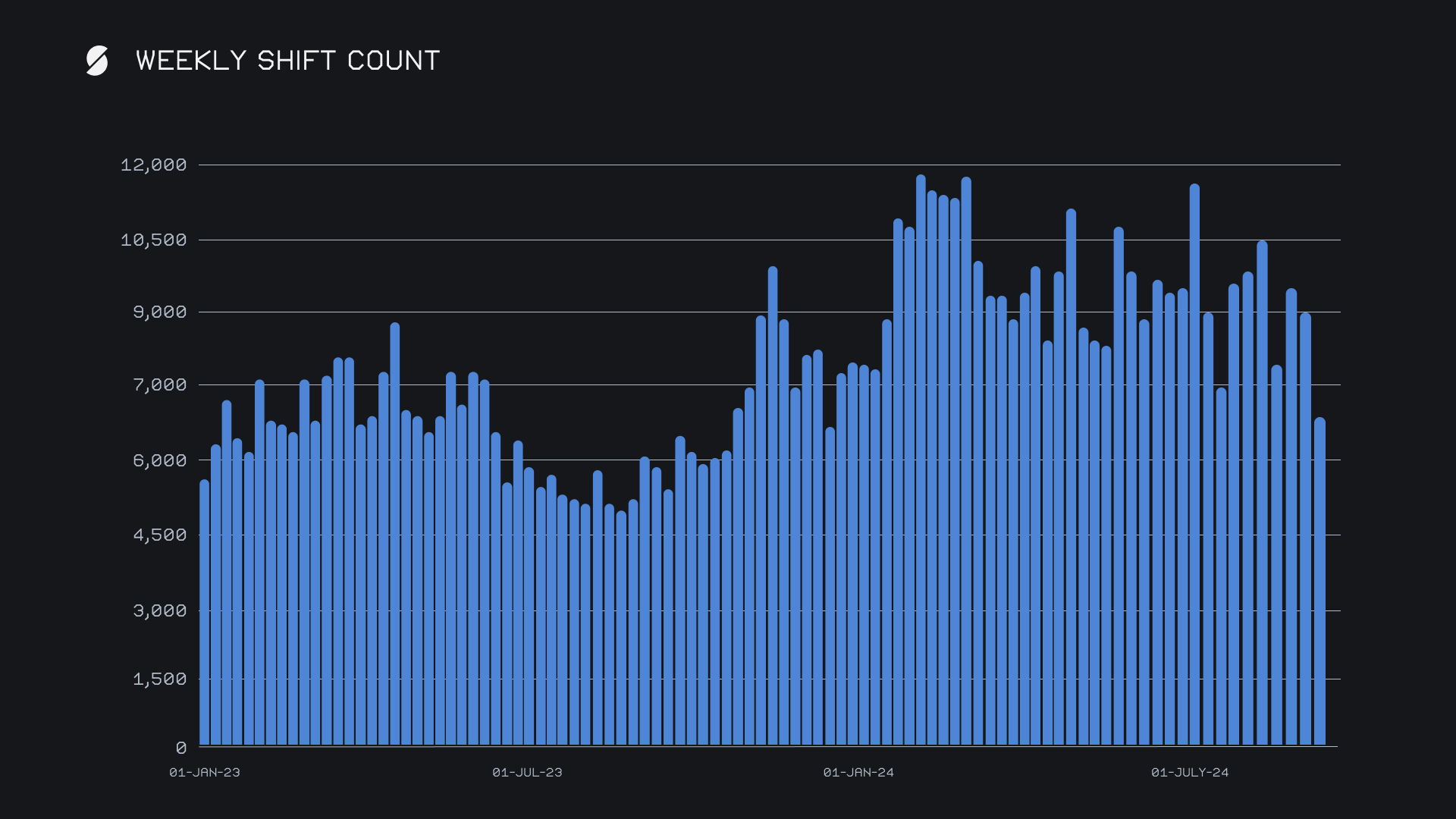

Meanwhile, our gross weekly shift count declined at a slower rate than volume, finishing at 6,878 shifts, down -23.3% from last week. Although the shift count decline was notable for both shifts made directly on the site as well as through our top affiliates, the latter was more prominent, with affiliate shift count falling by nearly -40% this week. When combined with our gross volume, our daily averages amounted to $1.2m across 983 shifts. Despite the overall dip, the ETH/SOL pair remained a focal point of users, finishing as the most shifted pair for the fourth consecutive week. Its shift volume of $861k was more than double that of the inverse pair of SOL/ETH, indicating the ongoing preference of users to move from Ethereum to Solana.

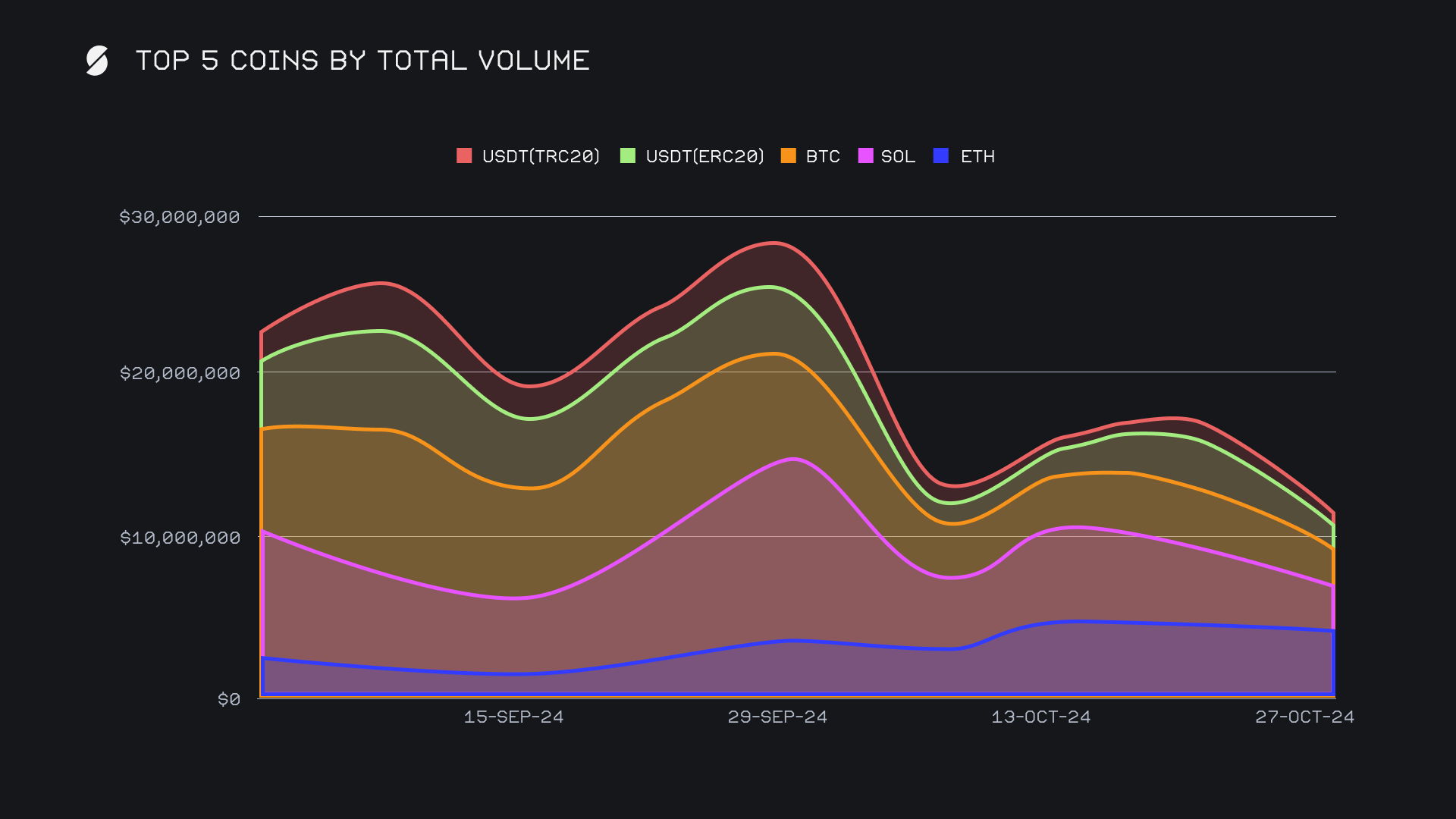

SOL maintained its lead as the top coin, with a total volume of $4.2m, experiencing a modest decline of -7.6% compared to last week. However, it was the only coin among our top 10 to not experience a drop exceeding -10%, magnifying its resilience and ongoing popularity on SideShift. This week’s breakdown saw user SOL deposits reach $1.3m (+11.7%), while settlements stood at $1.9m (-11.5%). Despite the decline in settlements, demand for SOL remained strong, standing out as the only coin to surpass $1m in user settlements during an unusually quiet week.

ETH followed as the second most-shifted coin, totaling $2.7m in volume, with a more pronounced decline of -38.7%. Deposits for ETH summed $1.4m (-28.1%), while settlements dropped to $955k (-40%), reflecting a continued cooling in ETH activity as users increasingly explore other options, particularly in a market where SOL remains the standout. This significant dip places ETH’s current volume at less than 20% of the total seen near the end of September, 2024, highlighting a notable shift in user interest over recent weeks.

BTC rounded out the top three with a total volume of $2.3m, marking a hefty decline of -41.4% from the previous period. This drop was led by a decrease in user deposits, which fell to $746k (-54.8%), while settlements summed $863k (-30.8%). The lower figures reflect a continuing trend of subdued user demand for BTC on SideShift, with this week's total volume finishing well below typical levels seen throughout the entire year. With that, BTC was the coin which was impacted most by the recent performance issues on SideShift, which contributed to it experiencing one of its quietest periods throughout all of 2024.

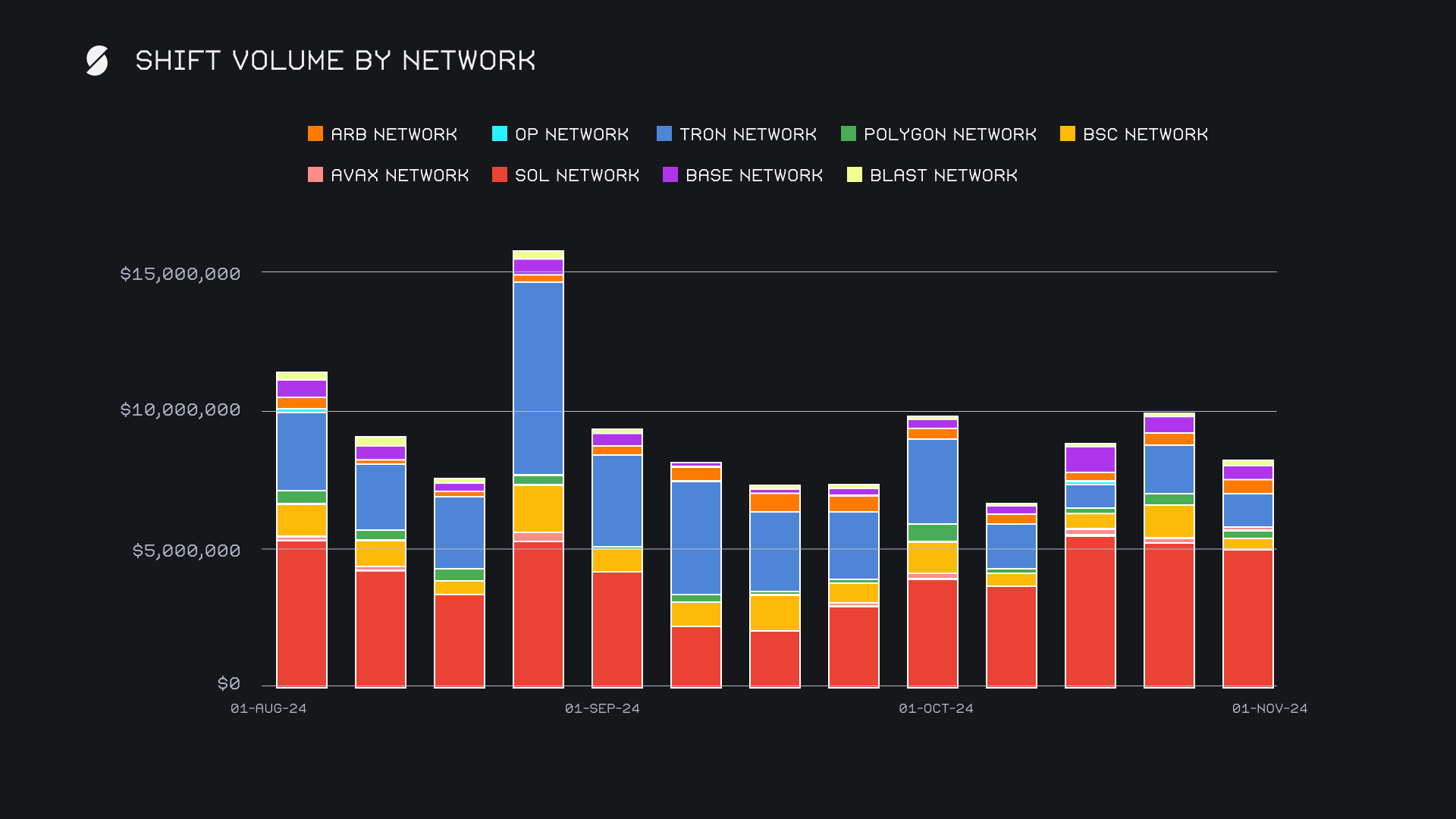

This week, alternative networks to ETH combined for a total volume (deposits + settlements) of $8.2m, down -17.6%, yet still exceeding the $6.2m (-23.4%) volume generated by the Ethereum network. The Solana network continued to lead with $5.0m (-5.9%), holding a significant majority of alternate network volume. The Tron network followed with $1.3m, experiencing a decline of -25.7% as USDT (TRC20) shifting activity tapered off. The Binance Smart Chain (BSC) network came in third with $620k (-51.2%), marking a substantial drop in activity which was also the result of lesser stablecoin shifting. Meanwhile, the Arbitrum network was one of the few to show growth this week, with volume reaching $469k (+16.8%), setting it apart from the broader downtrend observed across most alternative networks.

Affiliate News

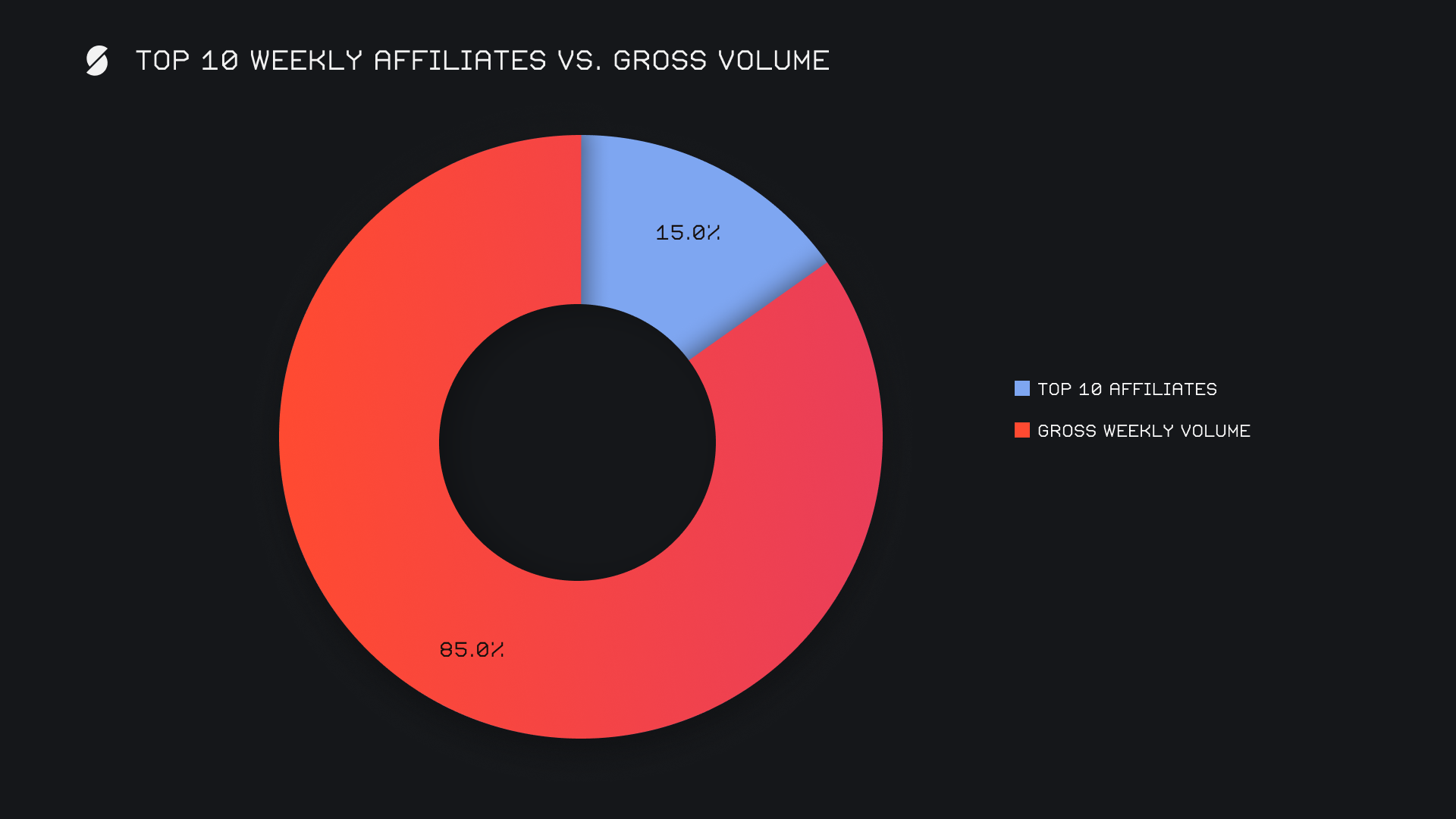

Our top affiliates combined for a total of $1.3m this week, marking a -33.0% decrease from the previous period. Our first-placed affiliate took the lead with $388k (-33.8%), while last week’s leader moved down to second place with $346k (-41.4%). Our third-placed affiliate held its position with $141k (-48.2%), reflecting a quieter week overall. Together, our affiliate contributions accounted for 15.02% of this week’s total volume, a proportion that remains lower than usual.

That’s all for now. Thanks for reading and happy shifting.