SideShift.ai Weekly Report | 23rd - 29th April 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one-hundred-and-second edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and second edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week saw SideShift token (XAI) slowly grind its way higher and move within the 7 day price range of $0.1775 / $0.1883. It was capped off however with a quick, single move back down to the middle of that range, where XAI is now currently positioned - at the time of writing XAI is sitting at a price of $0.1826 with a market cap of $24,452,705 (+2.6%).

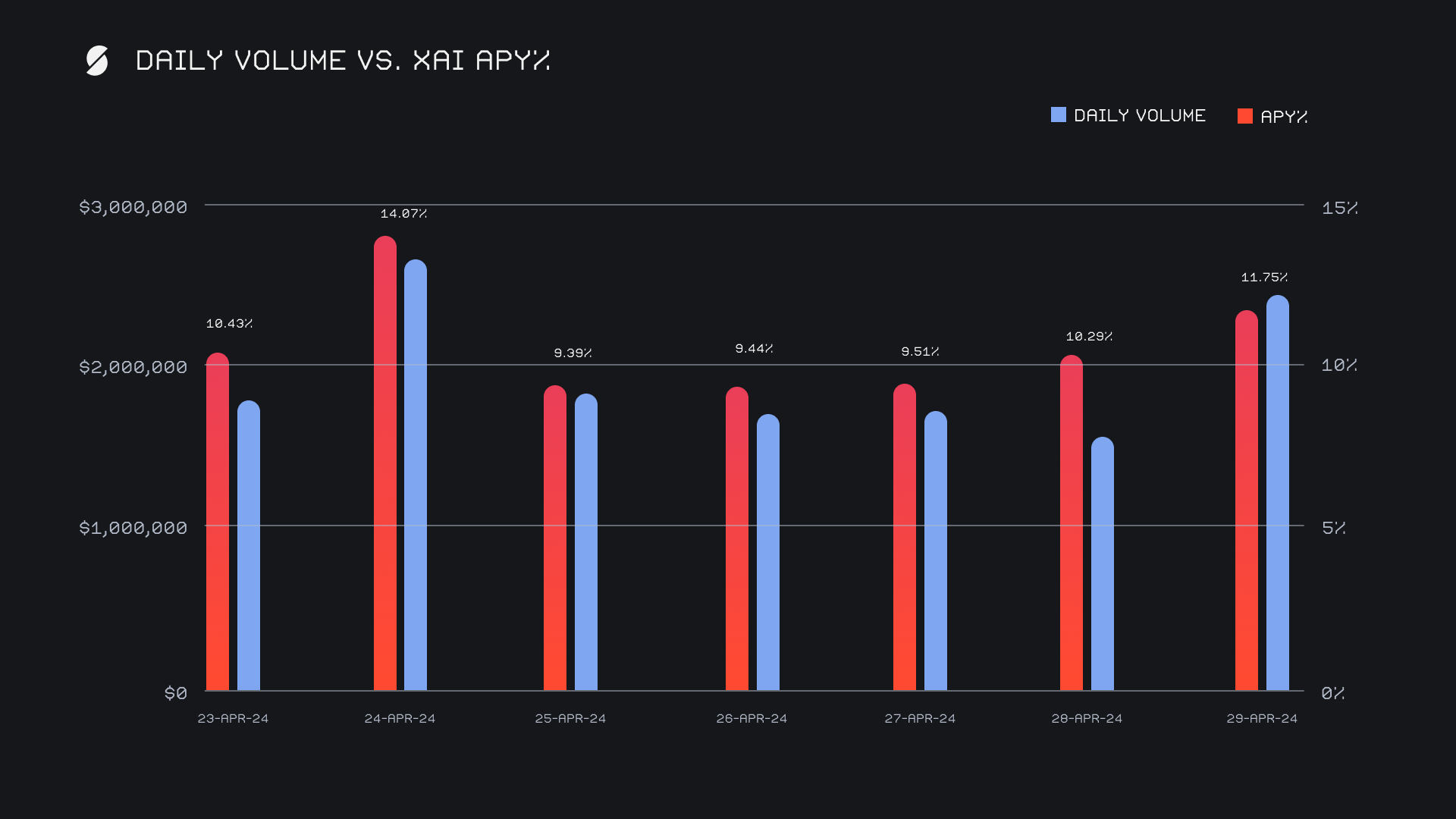

XAI stakers were rewarded with an average APY of 10.70% this week, with a daily rewards high of 42,975.5 XAI (an APY of 14.07%) being distributed to our staking vault on April 25th, 2024. This was following a daily volume of $2.7m. This week XAI stakers received a total of 232,109.43 XAI or $42,383.18 USD in staking rewards.

The price of 1 svXAI is now equal to 1.3250 XAI, representing a 32.5% accrual on stakers investments. A friendly reminder that the easiest way to participate in XAI staking is to shift directly to svXAI, from any coin of your choice.

Additional XAI updates:

Total Value Staked: 119,409,366 XAI (+0.2%)

Total Value Locked: $22,072,583 (+4.2%)

General Business News

Further ETF chatter circulated throughout the news this week, but this time stemming from Hong Kong. The debut of Asia’s first spot BTC ETF certainly sparked excitement and has captured the attention of many, but ultimately it was a fairly lackluster week in the crypto markets with the majority of coins trending downwards or sideways.

SideShift continues to prioritize new listings, and we are always welcome to suggestions from our users. This month two new coins were added on Binance Smart Chain (Floki Inu (FLOKI) and Pancake Swap Token (CAKE), as we are quickly approaching the milestone of 200 assets supported overall.

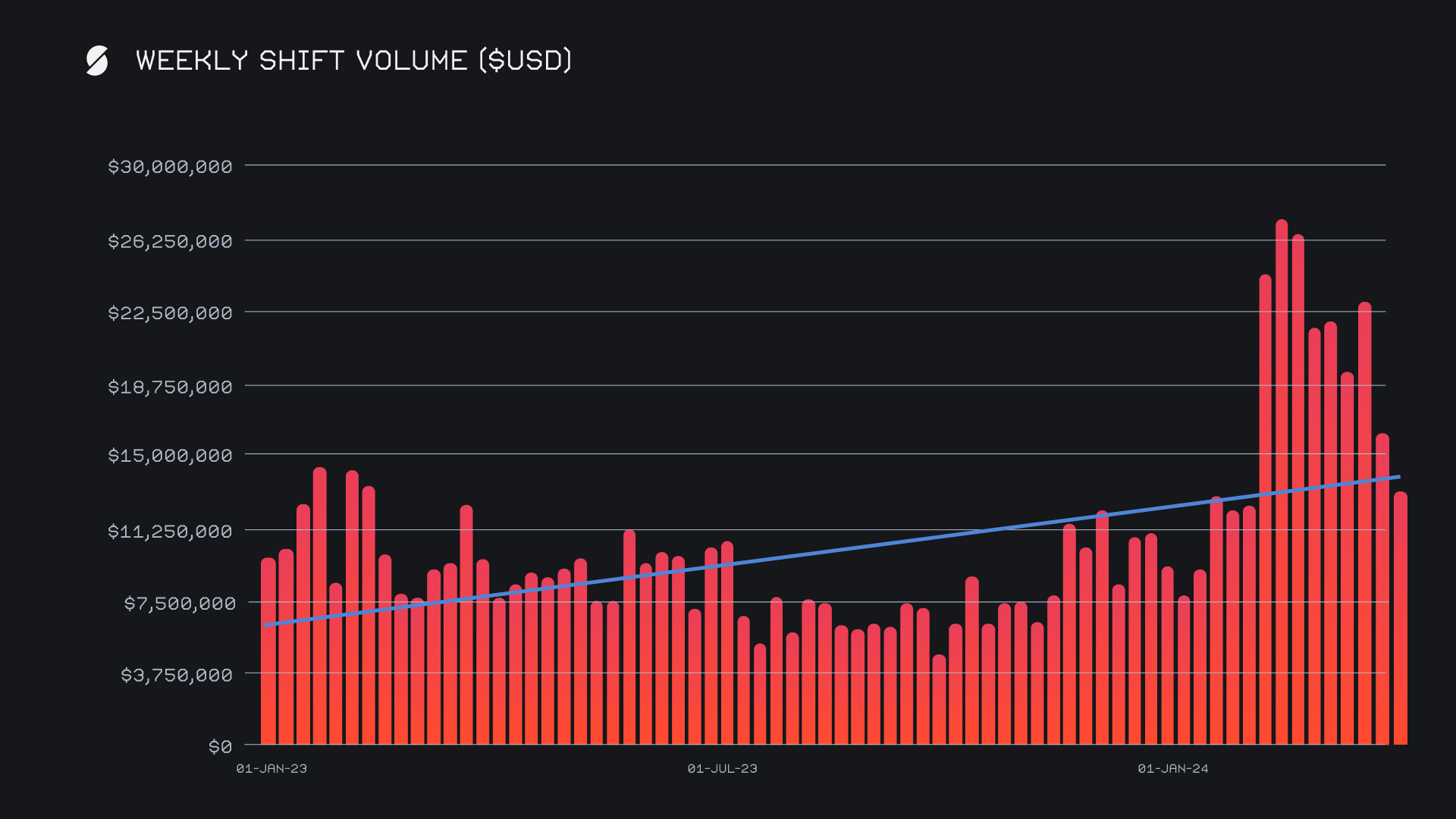

We ended the last full week of April with a gross volume of $13.7m (-19.4%), a decline which looks to be correlated with broader market consolidation. The previous 8 week stretch which saw BTC press up against all time highs also resulted in record-shattering performances for SideShift on both the weekly and monthly timeframes. As the market simmers down, users are more likely to sit on their hands, a trend reflected in this week’s stats. Throughout the continual ebb and flow it is always encouraging to zoom out and see the trendline pointed in the right direction.

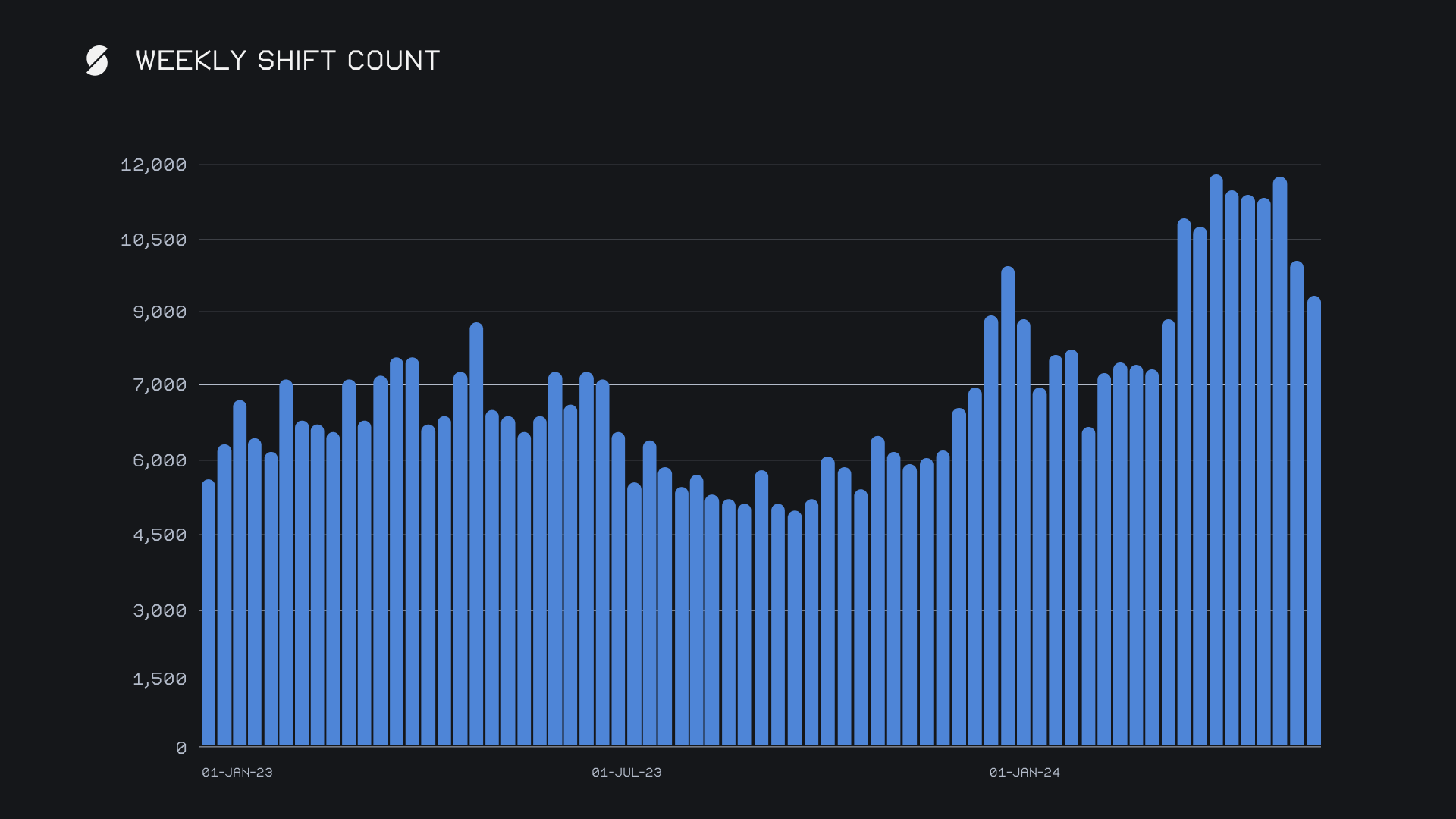

Our weekly volume was accompanied by a gross shift count of 9,377, representing a weekly change of -6.8%. Shift count declined by a lesser extent than volume, thereby indicating that the biggest impact this week was due to a lower amount of big volume shifts taking place. In particular we noticed this for our top two affiliates, although the pattern also unfolded with shifts which took place directly on the site. Together, our gross volume and count combined to produce daily averages of $2.0m on 1,340 shifts.

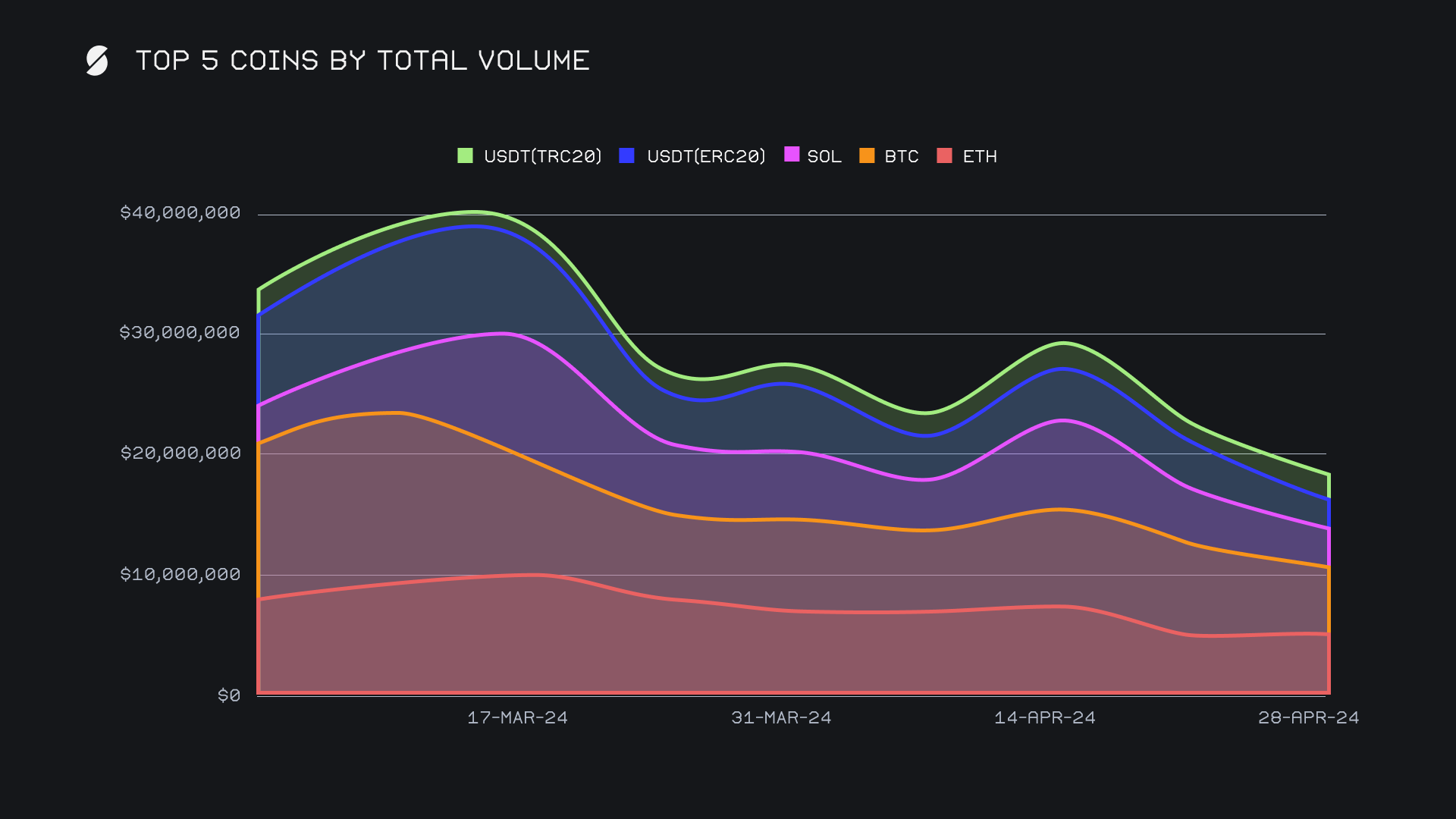

Most of our top coins by total volume (deposits + settlements) saw their weekly volumes decline, with the sole exception of our new leading asset. With $5.8m, ETH seized first place from BTC and experienced a +17.3% jump in weekly shifting. Although quite an even split between user deposits vs settlements, ETH user deposits managed to have the slight upper hand by a margin of $2.4m to $2.2m. These user deposit and settle volumes for ETH were strong enough to rank first overall in their respective categories. This tells us that this week’s ETH shifting was largely widespread, and not so heavily concentrated in one direction as is often the case. Further supporting this diversity was the week’s most popular shift pair of ETH/BTC, which netted a relatively low total of $727k. This compares to a running 8 week average where our top shift pair totalled ~$1.7m. The fact that ETH was not the settlement half of our most popular shift pair but still managed to be our most settled coin by users supports the idea that shifting to ETH derived from a variety of coins.

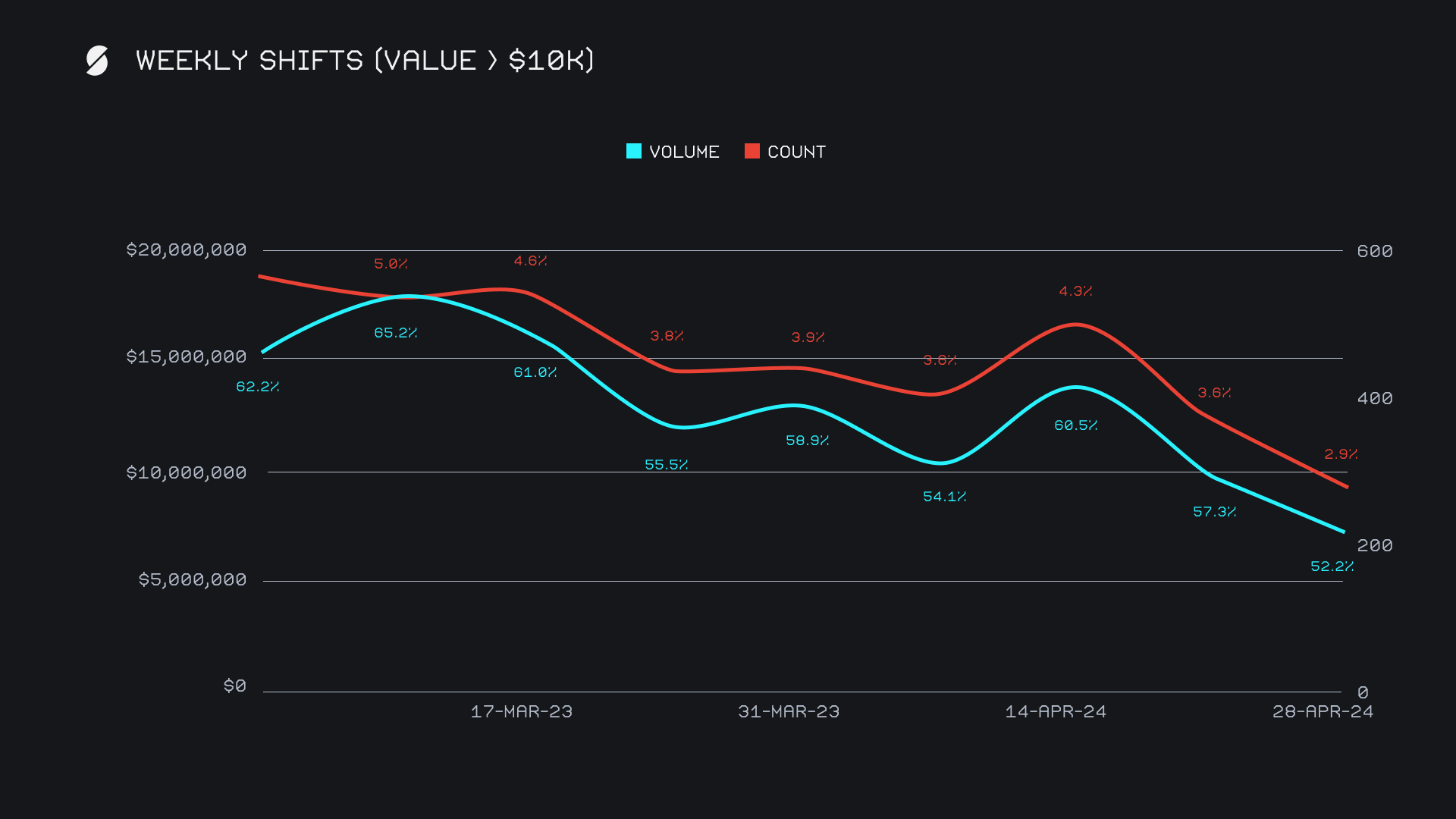

Although BTC and SOL followed in second and third place, they were hit the hardest among any of our top coins and saw their total volumes fall by more than 30%. The results were respective total volumes of $5.1m (-33.5%) and $3.2m (-31.6%). BTC particularly noted a lack of interest displayed from users, as its settlement total plummeted -43.8% for $2.1m. When looking deeper into these declines, we can see that a key reason for the lower total volumes was a major lack in whale shifting. The chart below outlines the weekly volume (blue) and count (red) for shifts with a value >$10k. The % labels represent what percentage of the total shifts with a value >$10k accounted for that week. Within this category, this past week saw sums of $7.2m on 275 shifts, approximately ~40% lower than totals seen at the beginning of the month. Not only do we see nominal declines for both volume and count for these large shifts, but also we can also note 2 month lows in their proportion of the weekly total. In other words, it seems that whales were not shifting and preferred to lay low during the sideways chop.

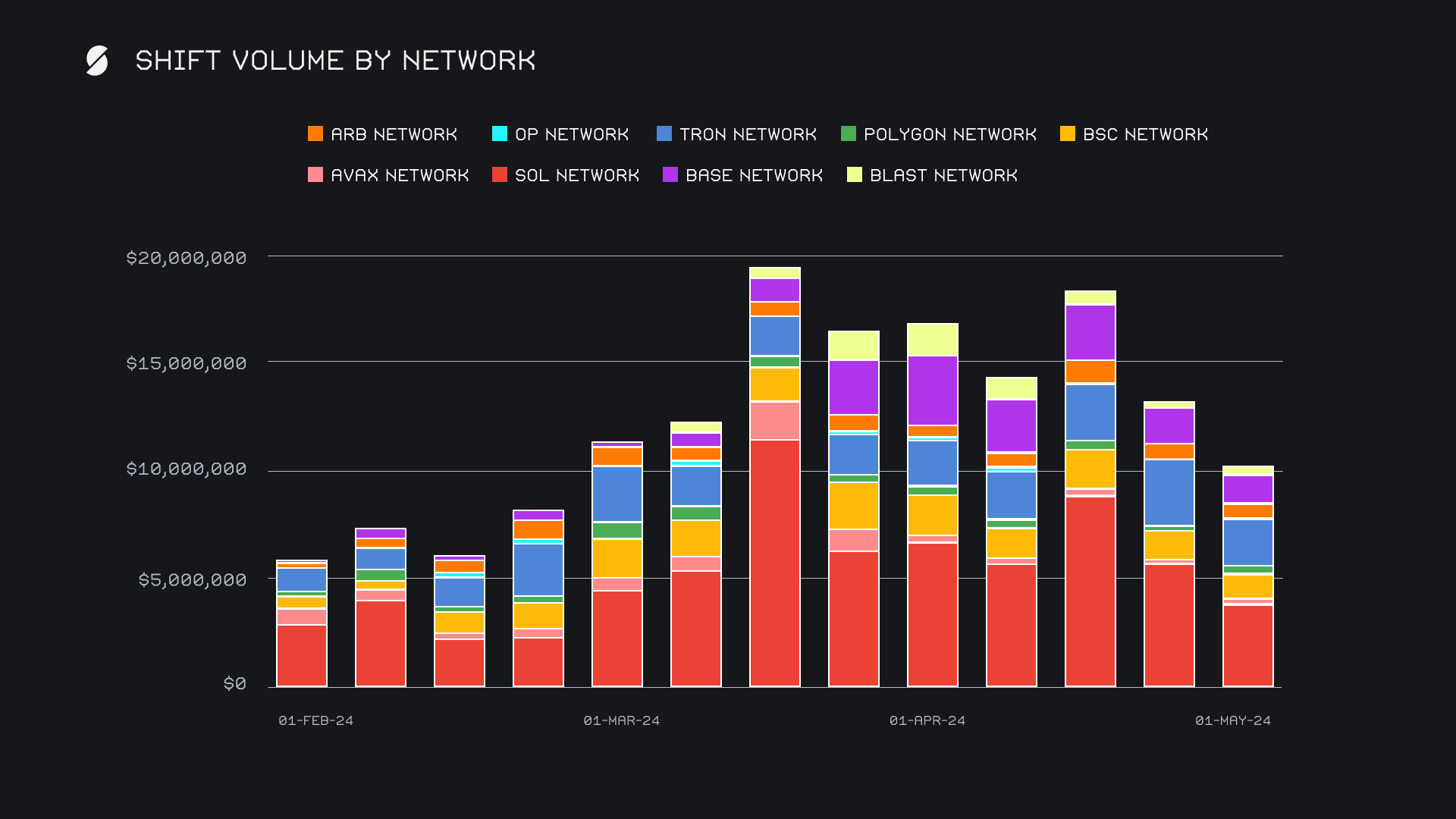

Alternate networks to ETH felt the effects of the slowing market and combined for $10.2m, dropping to a near 10 week low. Nevertheless, this cumulative performance still managed to outdo that of the Ethereum networks $9.5m total. 7 of the 9 alternate networks incurred weekly losses, with most of their stories being the same. The Solana network once again ended atop the list with $3.9m (-32.6%), followed by the typical second placed Tron network, with $2.3m (-22.3%). In third came the Base network with $1.3m (-20%), a chain which is continually gaining traction and cementing itself among our top networks, largely thanks to the popularity of its native ETH (base) token. The two networks that went against the grain this week were the Blast and Avalanche networks, although they finished near the bottom of the list with respective totals of $293k (+18.4%) and $171k (+49.9%).

TON seems to be one of the few coins which is not exhibiting this flip-flopping behavior, as it continues to see steady week to week growth since its listing in late March. It is quickly approaching our top 10, and this week ended with a total volume of $317k (+21.5%).

Affiliate News

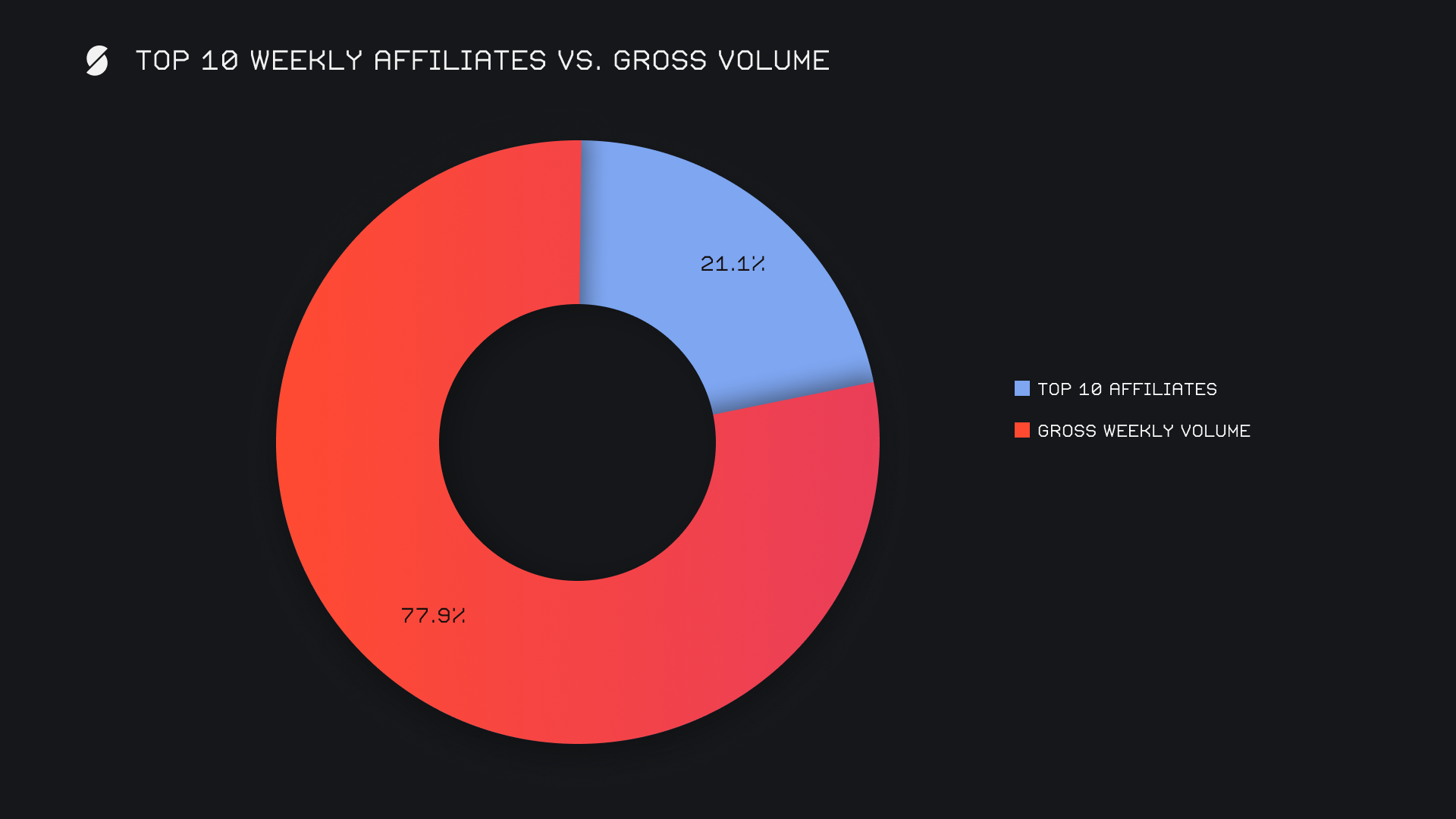

SideShift’s top affiliates combined for a total $2.9m, -23.3% lower than last week’s sum. As previously mentioned, our former top two affiliates noticed the biggest changes as they saw respective weekly volume declines of -34.4% and -46%. Instead, it was the previously third ranked affiliate which claimed the top spot for the first time since February 2024 - it did so with a total $972k on 296 shifts.

All together, our top affiliates accounted for 21.1% of our weekly volume, -1.1% higher than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.