SideShift.ai Weekly Report | 23rd - 29th September 2025

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one hundred and seventy-third edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and seventy-third edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

- SideShift volume totaled $16.01m with 8,734 shifts, keeping activity broadly in line with recent weeks.

- BTC dominated at $6.93m (+20.0%), with settlements at $3.40m — the highest in 3.5 months and 3.5x larger than any other coin.

- Stablecoins reestablished core leadership, led by USDT (ERC-20) and USDC (ERC-20), replacing newer BSC and SOL variants that fell away.

- Net stablecoin flows closed positive at +$558k, the second straight weekly positive flow, and just the 7th occurrence this year.

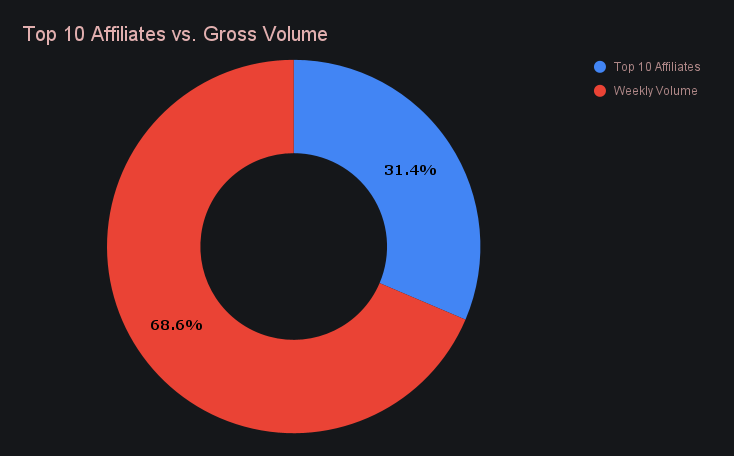

- Affiliates contributed $5.03m (+4.8%), with our top partners carrying 31.4% of total volume.

XAI Weekly Performance & Staking

XAI shifted lower this week, moving out of the mid-$0.16s and into the mid-$0.15s, where it remained through the period. Trading activity was relatively contained, with the token ranging between $0.1532 and $0.1564 after the step down incurred early in the week set the tone. It closed at $0.1555, compared to $0.1645 at the time of the previous report, leaving the market cap at $23.80m versus $25.29m previously, a −5.9% change across the 7 day span.

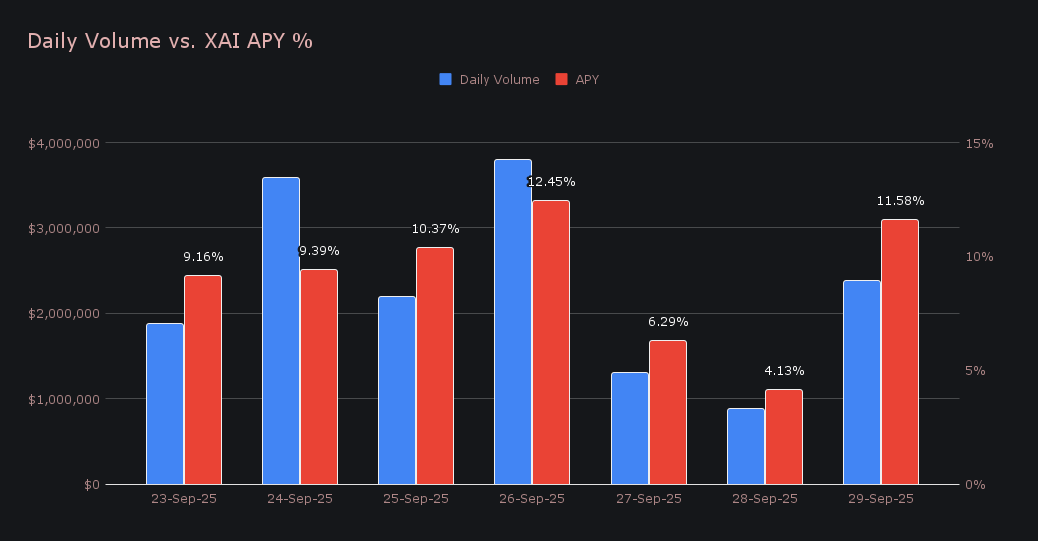

Staking totals told a similar story and closed lower, with 229,931.48 XAI ($35,774.04) distributed to the staking vault at an average yield of 9.05% APY. September 26th marked the peak day, with 44,637.69 XAI rewarded at 12.45% APY alongside $3.79m in daily volume. Both rewards and yields finished the week below the prior period, rounding out an overall quieter stretch for staking activity.

Additional XAI updates:

Total Value Staked: 139,166,188 XAI (+0.3%)

Total Value Locked: $21,470,420 (−6.4%)

General Business News

For the second straight week, crypto markets were rattled by a massive round of liquidations, with more than $1.1b in positions wiped out in just 24 hours following last week’s $1.7b flush. The cascade sent BTC down to $109,000, while ETH briefly broke below $3,900 and SOL tested the $190 level before staging partial recoveries. Away from the volatility, the spotlight shifted to the launch of XPL, Plasma’s native token, which entered trading with a market cap above $2.4b and quickly became one of the week’s most-watched stories.

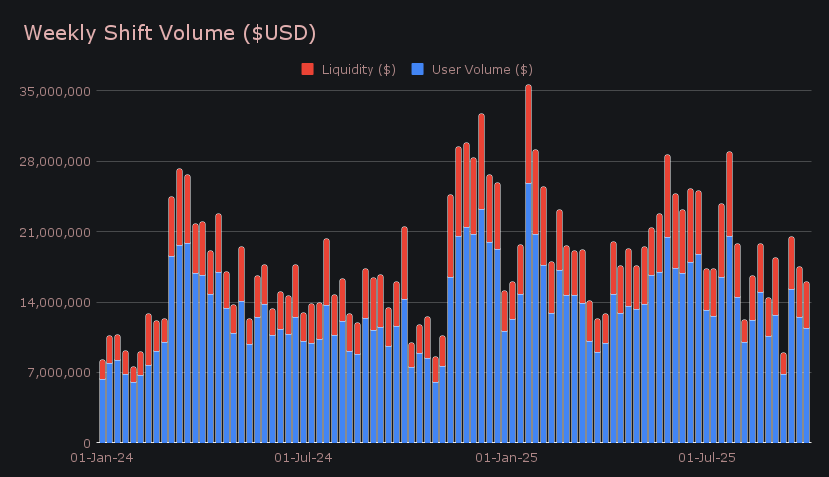

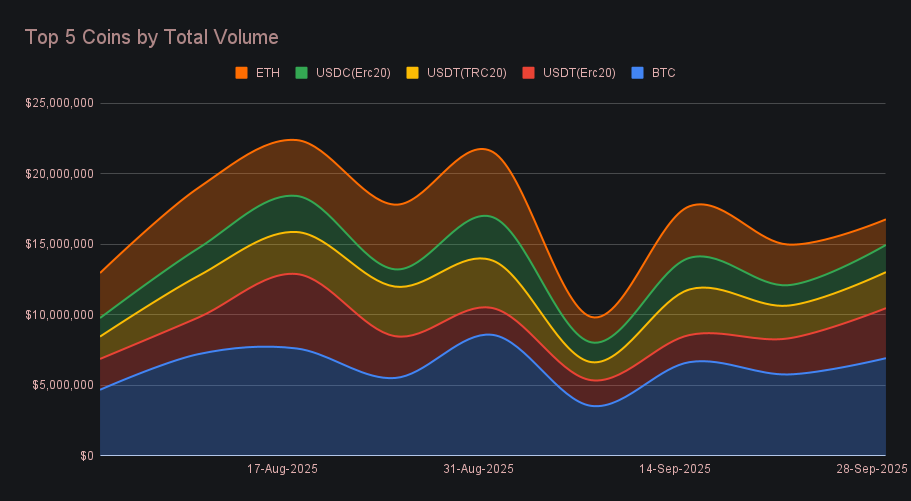

SideShift volume closed the period with a total volume of $16.01m (−8.5%), marking a fairly standard stretch that fell mostly in line with recent performances. User shifting contributed $11.38m (−9.2%), while liquidity rebalancing added a further $4.63m (−6.6%). The slower pullback in liquidity volume particularly was a reflection of the heavy one-way flow into BTC settlements, which required proportionally more internal rebalancing even as there was a broader drop in user activity. Top pairs reflected this tilt — USDT (ERC-20)/BTC led at $922k, followed by DOGE/BTC at $770k and LTC/USDC (ERC-20) at $393k. Outflows into BTC even from atypical sources such as DOGE underlined the broader general direction of activity, while key stablecoins reasserted their roles after a quieter stretch in recent weeks.

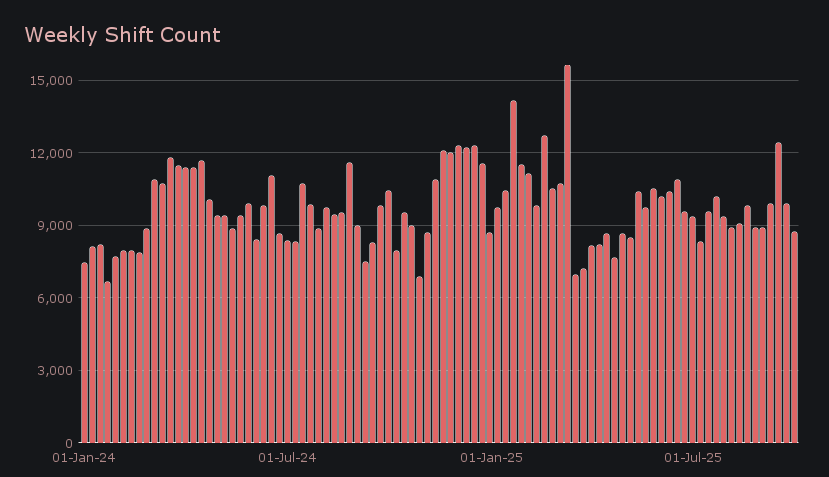

Shift count ended with a gross 8,734 (−11.6%), resulting in daily averages of 1,248 shifts and $2.29m in volume. This worked out to an average shift size of about $1,833, +3.6% higher than last week’s average. The rise underscored how a smaller number of transactions still carried weight, with BTC-focused shifts accounting for much of the difference.

BTC strengthened its position at the top with $6.93m (+20.0%) in total volume. User settlements climbed to $3.40m (+18.5%), the highest weekly total in nearly four months and marking the fourth consecutive week of growth. Deposits, meanwhile, were steady at $1.32m (−0.5%). The profile reflected a decisive preference toward settlement flows as BTC’s price lingered near the $110k mark, signaling that users were willing to take on risk and step into larger positions. Its settlement sum alone was more than 3.5x higher than the next closest coin, setting BTC well apart from the rest of the pack and signifying clear buying appetite from users.

Stablecoins reestablished their presence on the leaderboard, led by USDT (ERC-20) which jumped back to second place with $3.55m (+39.1%) in total volume. After only just rejoining the top 5 last week following a prolonged lull, it pushed higher again as user deposits more than doubled to $1.76m (+143.6%), highlighting its role as the main inflow coin for BTC. USDT (TRC-20) followed at $2.55m (+9.7%), with a steadier balance of $514k in deposits (−6.1%) and $1.11m in user settlements (+8.3%). USDC (ERC-20) also advanced to $1.93m (+33.2%), supported by user settlements nearly doubling to $937k (+95.8%) — the highest settlement total among stablecoins this week. Collectively, the reappearance of these three core stables marked a return to the familiar form that has dominated for much of the year, replacing newer variants like USDT (BSC) and USDC (SOL) which slipped off the board.

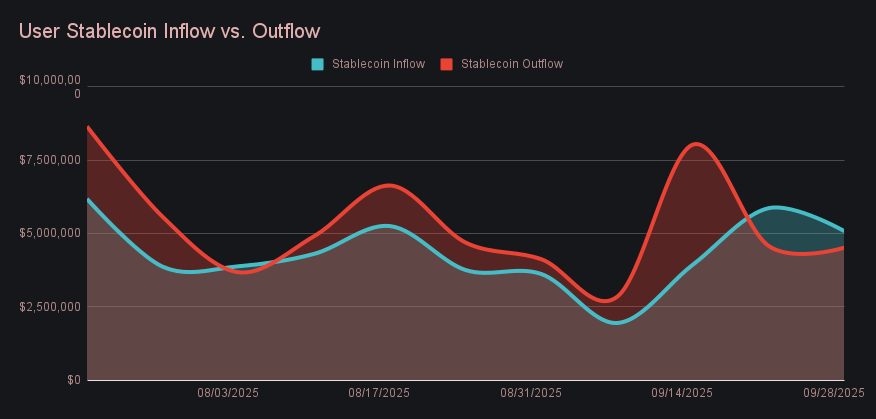

Notably, net stablecoin flows closed with a positive sum of +$558k, meaning inflows exceeded outflows by that amount. This marked the first ever time SideShift has recorded consecutive weeks of positive stablecoin flows, and just the seventh such positive flash this year, underscoring a bullish mentality and strong user buying behavior.

ETH slipped to the bottom of the leaderboard with $1.81m (−37.2%), weakening further after already falling last week. User deposits landed at $876k (−33.2%), while settlements eased to $697k (−10.5%). It was among the sharpest drops in the top group, second only to SOL, which slid to seventh after a swift tumble of −59% in total volume to $1.68m. Together, the declines left both ETH and SOL lagging notably, marking a clear departure from weeks when they had taken turns anchoring the top group. With their pullbacks, the spotlight shifted decisively back to BTC and the core stablecoins, which absorbed the bulk of weekly volume.

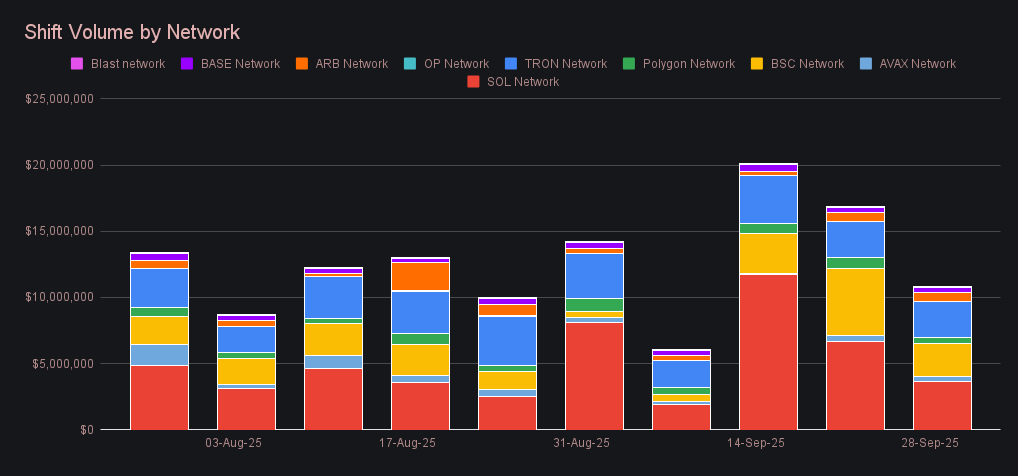

Alternate networks to ETH totaled $10.76m (−35.8%), compared with the Ethereum network’s gross $7.51m (+1.3%). The Solana network led with $3.69m (−44.4%), marking a steep pullback from the week prior. The Tron network followed with $2.71m (−1.1%), comparatively steady against peers, while the BSC network trailed close behind at $2.49m despite seeing its volume cut in half, (−50.8%), giving back much of last week’s surge as USDT (BSC) shifting returned to more regular levels. Meanwhile, Arbitrum contributed $658k (+1.4%), the only network to record growth, while Polygon closed with $495k (−41.3%).

Affiliate News

Affiliate activity totaled $5.03m (+4.8%) this week, showing steady growth with no changes in ranking. First place finished at $2.34m (+26.2%), comfortably ahead of the rest. Second place followed with $1.56m (+50.0%), the largest percentage climb among the group, while third place closed at $442k (+35.0%). All three improved notably from last week, together accounting for more than 85% of affiliate-driven volume.

All together, our top affiliates contributed 31.4% of total site volume, up +4.0% from last week.

That’s all for now - thanks for reading and happy shifting.