SideShift.ai Weekly Report | 24th - 30th June 2025

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one hundred and sixtieth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and sixtieth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

- SideShift processed $17.3m across 9,362 shifts, with count holding firm (-2.3%) despite a -30.8% drop in volume.

- XAI closed at $0.1565 and paid out 242,428 XAI ($37.97k) in staking rewards, lifting market cap +4.54%.

- BTC led with $9.15m in volume, followed by USDT (ERC-20) at $5.46m and ETH at $3.71m.

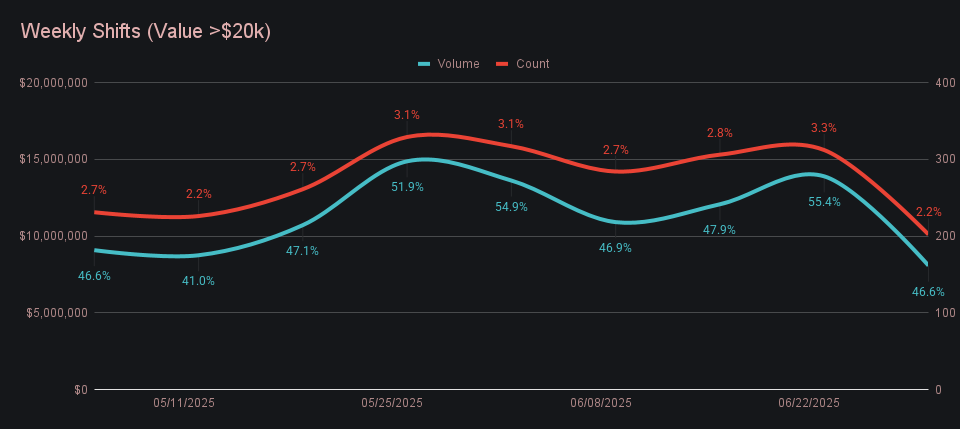

- Large shifts ($20k+) dropped to 202, their lowest since early May, driving the overall volume decline.

- Top affiliate held first with $4.91m, despite a -43.3% dip; third place rose +39.5% to $808k.

XAI Weekly Performance & Staking

XAI pushed steadily higher this week, stringing together several green daily closes and climbing from the low $0.149s to end at $0.1565. Price action traced a smooth upwards slope, ultimately traveling within the weekly range of $0.1493 to $0.1582. That gradual ascent lifted XAI’s market cap by +4.54%, bringing the total to $23,297,586.

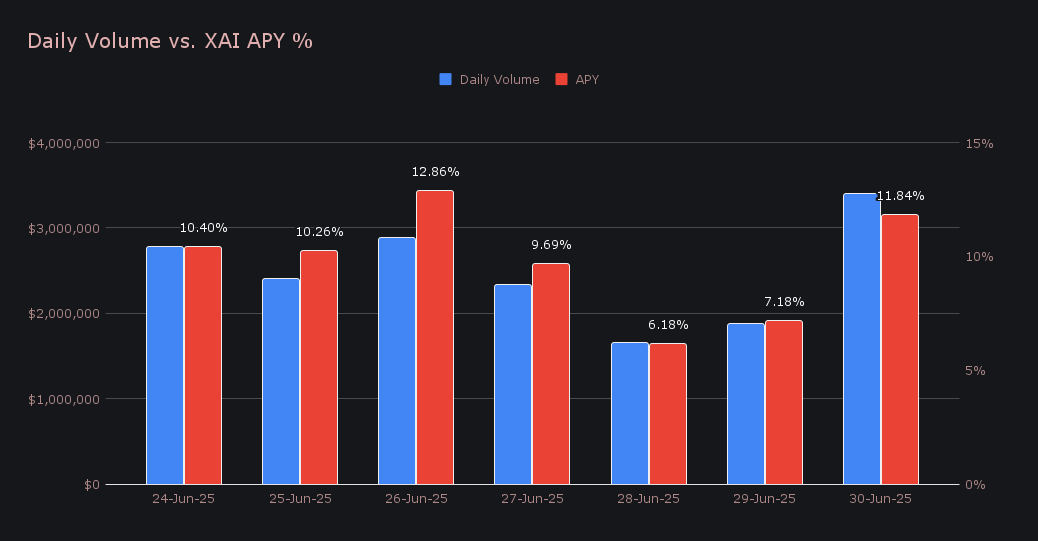

Stakers earned a weekly average APY of 9.77%, with the strongest day arriving on June 27th. That day saw 45,022.27 XAI distributed to our staking vault, delivered at a 12.86% APY and powered by $2.89m in shift volume. In total, XAI stakers received 242,428.12 XAI, equal to $37,968.36 USD.

SideShift’s treasury received an additional 100,000 USDC this week, bringing its total value to an estimated $22.90m. Users can follow with live treasury updates via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 136,076,873 XAI (+0.2%)

Total Value Locked: $20,514,685 (+1.5%)

General Business News

Major crypto assets drifted sideways this week, with Bitcoin pinned near $107k and Ethereum rangebound around $2,450. With little movement among the top two, attention shifted to altcoins - BCH gained +12%, while SOL saw a modest climb and hosted some of the week’s strongest memecoin performers. Speculative appetite was evident, with Pudgy Penguins jumping +45.5% and Fartcoin gaining +9.5% to lead the top 100 coins by market cap.

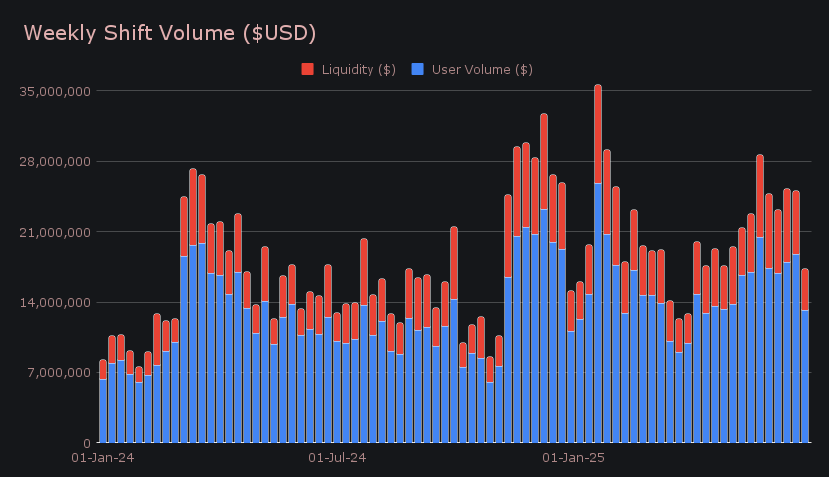

SideShift wrapped the week with a gross volume of $17.3m, a -30.8% decline that marked a quieter stretch compared to the platform’s previously strong two-month run. The slowdown reflected a broader dip in overall activity, with lower volumes seen across affiliates, direct site traffic, and liquidity shifting. User shifting noted a -29.6% volume decline, while liquidity shifting followed suit and fell by -34.6%, partially due to a more balanced spread of user deposits that reduced the need for rebalancing. BTC<>USDT (ERC-20) led for another week with $2.25m in combined user volume, extending its current streak as the platform’s top pair to four weeks, while ETH/BTC followed with $650k.

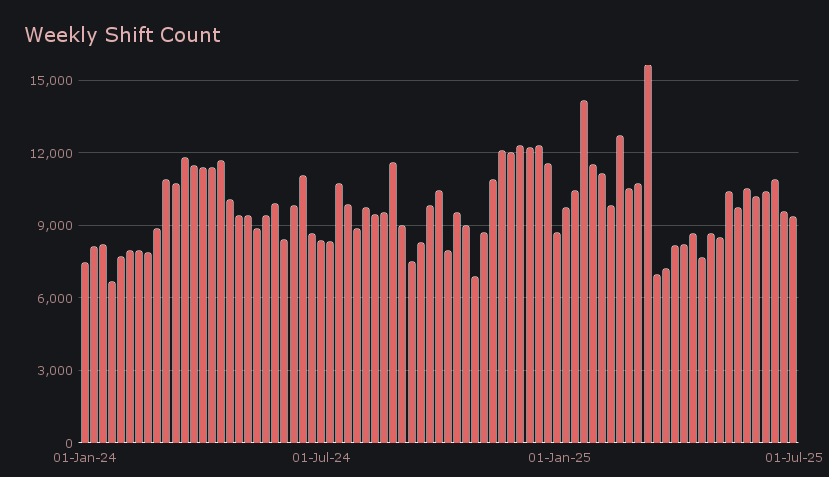

Weekly shift count held up relatively well, easing just -2.3% to 9,362 total shifts. That translated to a daily average of 1,337, a figure that continues to reflect solid baseline usage even as volume cooled. The resilience in count points to a healthy cadence of smaller shifts, with engagement showing consistency across both weekdays and weekends, even as overall transaction sizes pulled back.

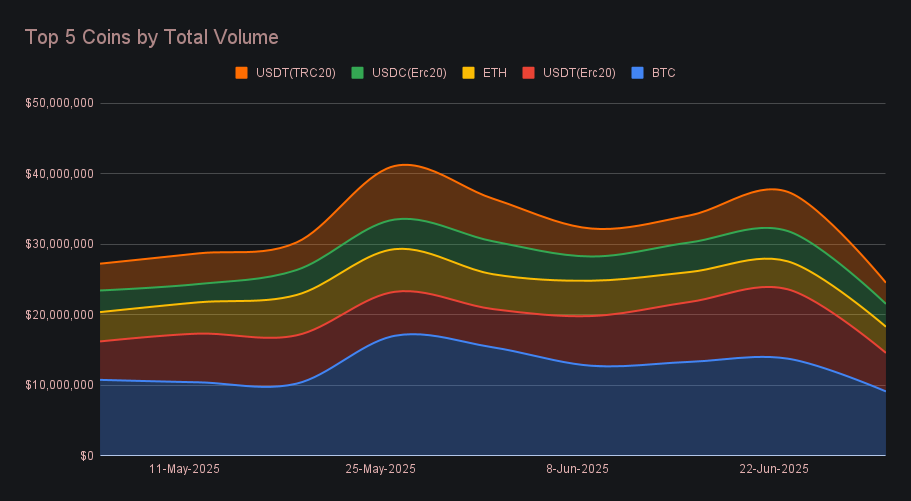

BTC remained the undisputed volume leader, topping $9.15m across all shifts. Despite a -33.7% weekly drop, it still made up over half of SideShift’s total volume, with $4.20m coming from deposit activity. However, settle volume fell more sharply, down -48.0% to $2.95m, a figure which pointed to reduced demand for BTC and an overall decline in large size shifts.

ETH held firm in third with $3.71m and stood out as the only top 5 coin to see growth in settlement volume, which climbed +23.0% to $1.44m. The movement hinted at some rotation into ETH amid the week’s broader decline, helping narrow its gap to USDT (ERC-20), which saw its total volume nearly halve to $5.46m. That figure included a -44.3% drop in deposit volume and an even steeper -48.0% fall in settle volume - the sharpest settle-side drop of any top coin. Stablecoins more broadly were hit hardest, with both USDT variants and USDC falling across the board, particularly USDT (TRC-20), which tumbled -46.0%.

This marked the first time in some weeks that all five top coins saw a decline in deposit volume, underscoring the more muted market tone. While no new assets entered the upper tier, the shifting flows between them, especially ETH’s relative resilience, made for anything but a flat leaderboard. A sole standout from the broader red week was ADA, which surged more than 10x to crack the top 10 with $604k. It joined USDC (SOL) as one of only two coins in the top cohort to avoid a weekly decline.

Large-scale shifts pulled back notably this week, with just 202 shifts with a value larger than $20k, the lowest total since early May. Volume from these shifts dropped -42% week on week, a sharp cooldown from the elevated and upward trending activity in whale shifting seen throughout May and June. Similar percentage declines were also observed in both the $10k–$20k and >$50k brackets, pointing to a broader reduction in high-value shift activity. This absence notably contributed to SideShift’s overall volume decline, highlighting the consistently impactful role that large shifts play in shaping weekly totals.

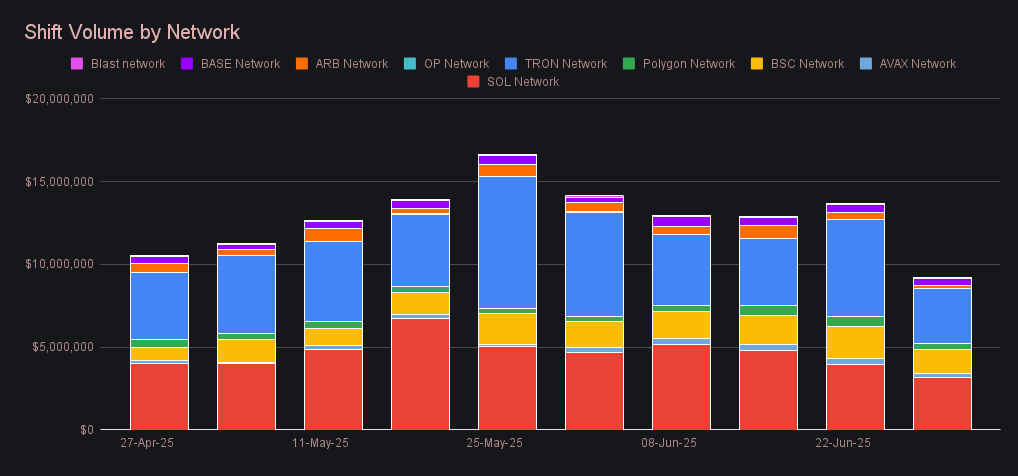

Alternate networks to ETH fell by -32.7% to a combined $9.17m, slipping below the $10m mark for the first time since mid-April. The drop was driven by steep 20–40% declines from Tron, Solana, and BSC, which fell to $3.33m, $3.16m, and $1.45m, respectively. Outside of Base and Avalanche, every other chain saw weekly losses in excess of -40%. Meanwhile, total volume (deposits + settlements) on the ETH network dipped at a slower -16.1% pace to $15.41m, creating further separation from alternate networks this week.

Affiliate News

Combined affiliate volume followed the general trend and decreased by -37.8% for a combined $8.44m. Our top ranked affiliate remained in sole command of the top spot, despite incurring a -43.3% drop to $4.91m. Second place followed suit, falling -35.5% to $1.97m. Third place however moved against the grain and showed resilience, rising +39.5% alongside 1,161 shifts to end with $808k.

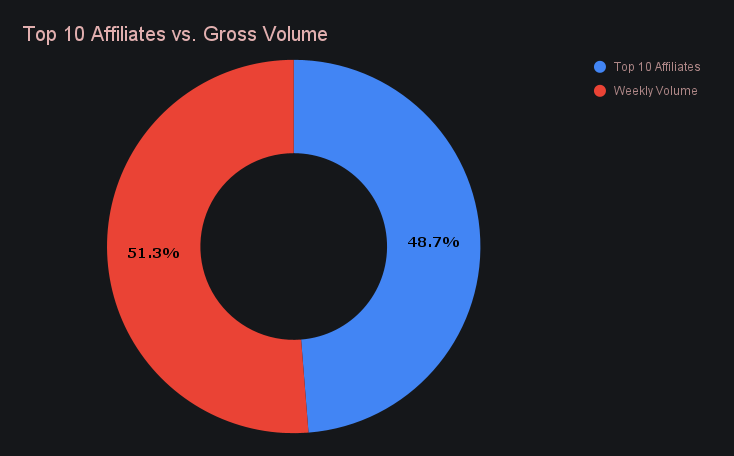

Together, our top affiliates accounted for 48.7% of our weekly volume, -5.5% lower than last week's proportion.

That’s all for now - thanks for reading and happy shifting.