SideShift.ai Weekly Report | 24th - 30th September 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one-hundred-and-twenty-fourth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and twenty fourth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week, SideShift token (XAI) faced a slight dip as it moved within the 7-day price bounds of $0.15408 / $0.16042. At the time of writing, XAI has leveled out at a price of $0.1554, with a market cap of $21,667,318 (-1.95% from last week).

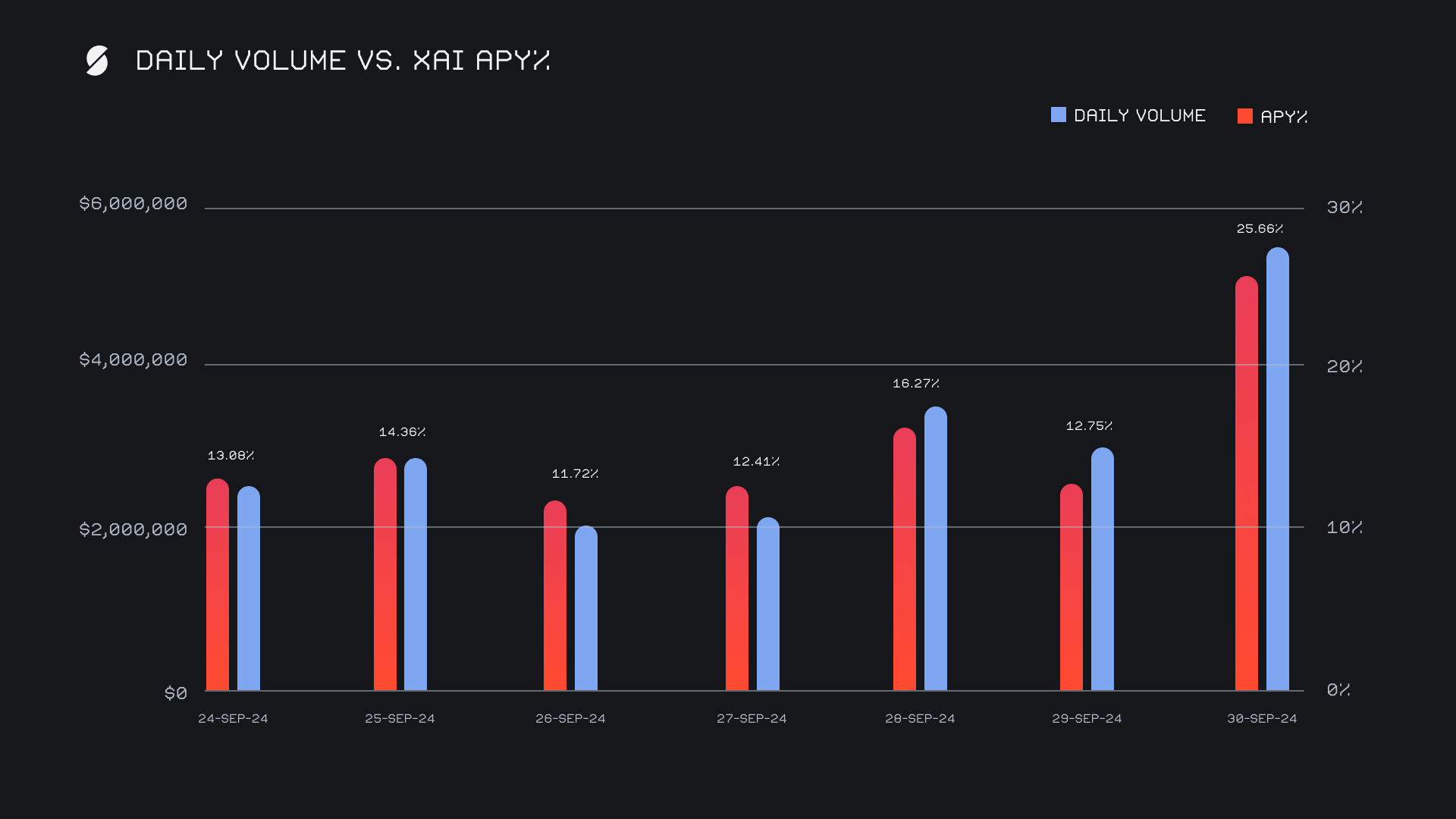

XAI stakers enjoyed an average APY of 15.18% throughout the week. The highest daily rewards occurred on October 1st, 2024, with 78,064.4 XAI being distributed (an impressive APY of 25.66%) directly to our staking vault, supported by a significant daily volume spike of $5.5m. XAI stakers received a total of [XAI total rewards] 336,108.72 XAI or USD 52,231.30 in staking rewards this week.

An additional 4 WBTC were added to SideShift's treasury throughout the course of the week, bringing the current total to a value of $14.9m. Users can stay updated on live treasury developments via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 124,887,325 XAI (+0.2%)

Total Value Locked: $19,261,952 (-3.0%)

General Business News

This past week, BTC initially climbed towards $66,000, but the momentum faded, causing it to retreat and close the week where it began at $64,000 (-0.5%). However, market sentiment has flipped quite bullish alongside growing institutional interest, as shown by an inflow of $61.3 million into US spot bitcoin ETFs. Meanwhile, memecoins raged on this week, with PEPE, WIF and BONK all recording weekly gains greater than +40%, and thereby leading the way among the top 100 coins.

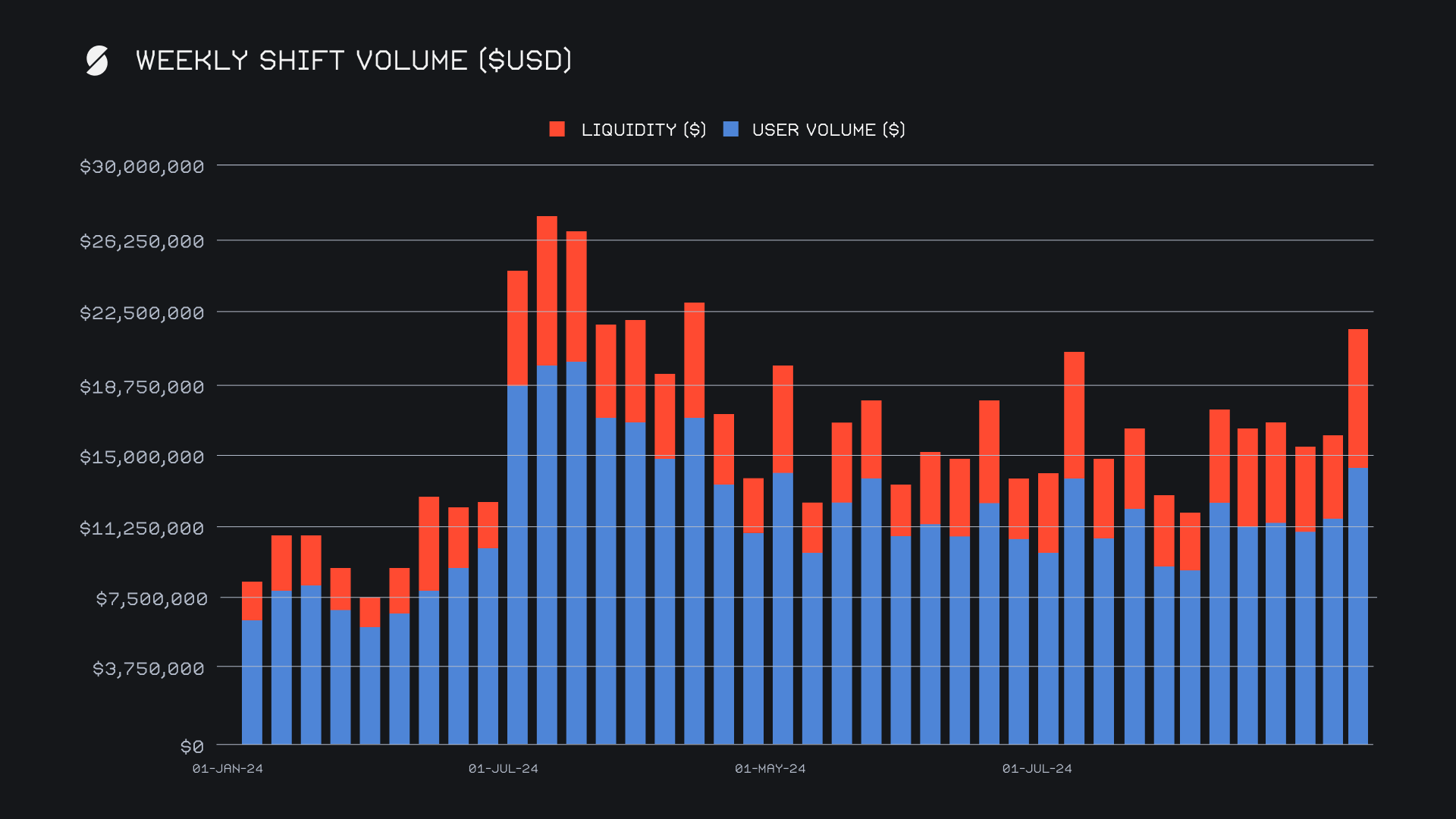

SideShift had an impressive week, with our gross weekly volume surging to $21.5m (+34.4%), marking the highest weekly volume since March, 2024. The standout performer this week was the LTC/ETH pair, which generated $3.3m in weekly volume on the back of some large scale shifts. This strong presence of LTC/ETH shifting resulted in a substantial increase in user shifting volume, which climbed to $14.3m. However, the imbalance in directionality for LTC/ETH shifts necessitated a greater reliance on liquidity shifting, which rose to $7.2m in order to accommodate the volume. This week’s liquidity volume sat about 6% higher than last week’s proportion.

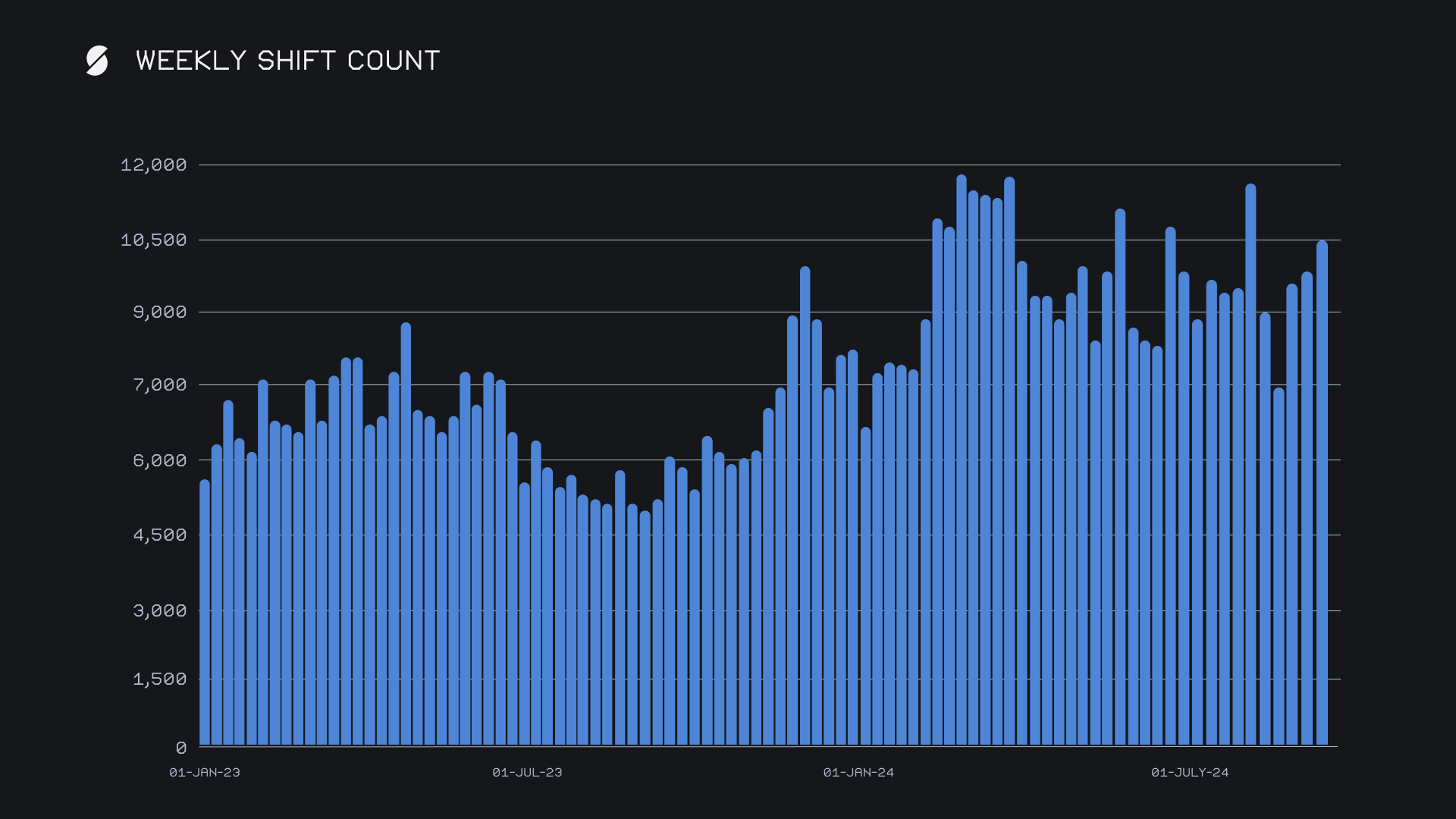

Our gross weekly shift count saw a more moderate rise of +6.3%, but surpassed the 10k mark to finish at 10,435 shifts, which is about 11% higher than our YTD average. This gross count contributed to some healthy daily averages, which totaled $3.07m in volume across 1,491 shifts per day. The discrepancy between the shift count and the more significant volume growth suggests that larger shift sizes dominated this week, further driven by the relevance of our top shift pair.

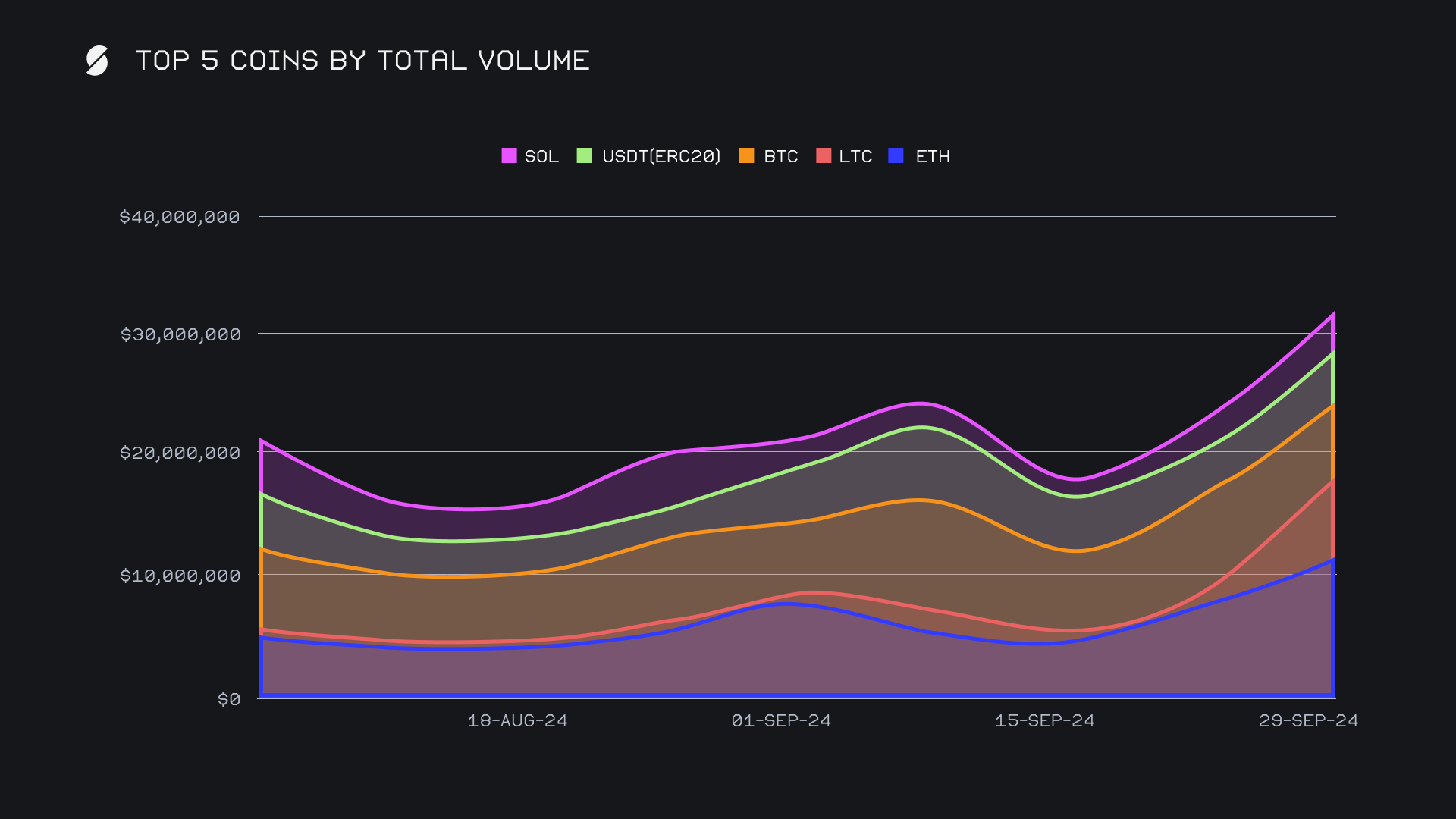

This week, ETH climbed to the top spot with a total weekly volume of $11.2m (+44.5%). Despite a -31.6% drop in deposit volume, settlement volume jumped by +82.6% to $5.5m, reflecting strong demand for ETH transactions even as its price underperformed. Once again, ETH’s rise on SideShift was further fueled by the week’s top shift pair, LTC/ETH, which played a key role in its rise to first place.

For the same reason, LTC followed in second place with $6.9m (+820.4%) in total volume, marking its first appearance in the top 5 in 2024. Opposite to ETH, this sharp increase came from a +1105% surge in user deposits, which ended with $3.5m. The unidirectionality was evident, as settlement volume lagged significantly behind, and summed just $170k (-29%), suggesting users were almost entirely offloading rather than receiving LTC.

BTC, meanwhile, slipped into third place with a total volume of $6.3m (-22.2%). Both deposit and settlement volumes decreased, with deposits down to $2.7m (-17.9%) and settlements falling by -35.3% to $1.5m. Although still a cornerstone of shifting among SideShift users, the overall declines for BTC signal that users are beginning to direct their focus elsewhere as the general bullish sentiment continues to grow. This is supported not only by the decline in BTC shifting, but also the widespread increases elsewhere.

Coins outside of the top 5 saw notable growth, with 14 out of our top 15 recording increases in total weekly volume. ADA finished above $1m for the second consecutive week, rising slightly by +2.6% to $1.1m. BNB saw a significant boost, and reached $758k (+84.5%) as shifting interest picked up following weeks of varied performance. SUI continued its recent growth trajectory and closed the week with $654k (+55.6%), driven by increasing interest in the token alongside its ongoing price climb. Additionally, a handful of tokens on the Polygon network saw their total volumes rise by 10x or more, a sizable increase from their more typical 4 figure weekly sums. USDC (POLY) and WBTC (POLY) ended with respective sums of $536k and $460k, thereby highlighting a recent heightened demand for Polygon-based assets on SideShift.

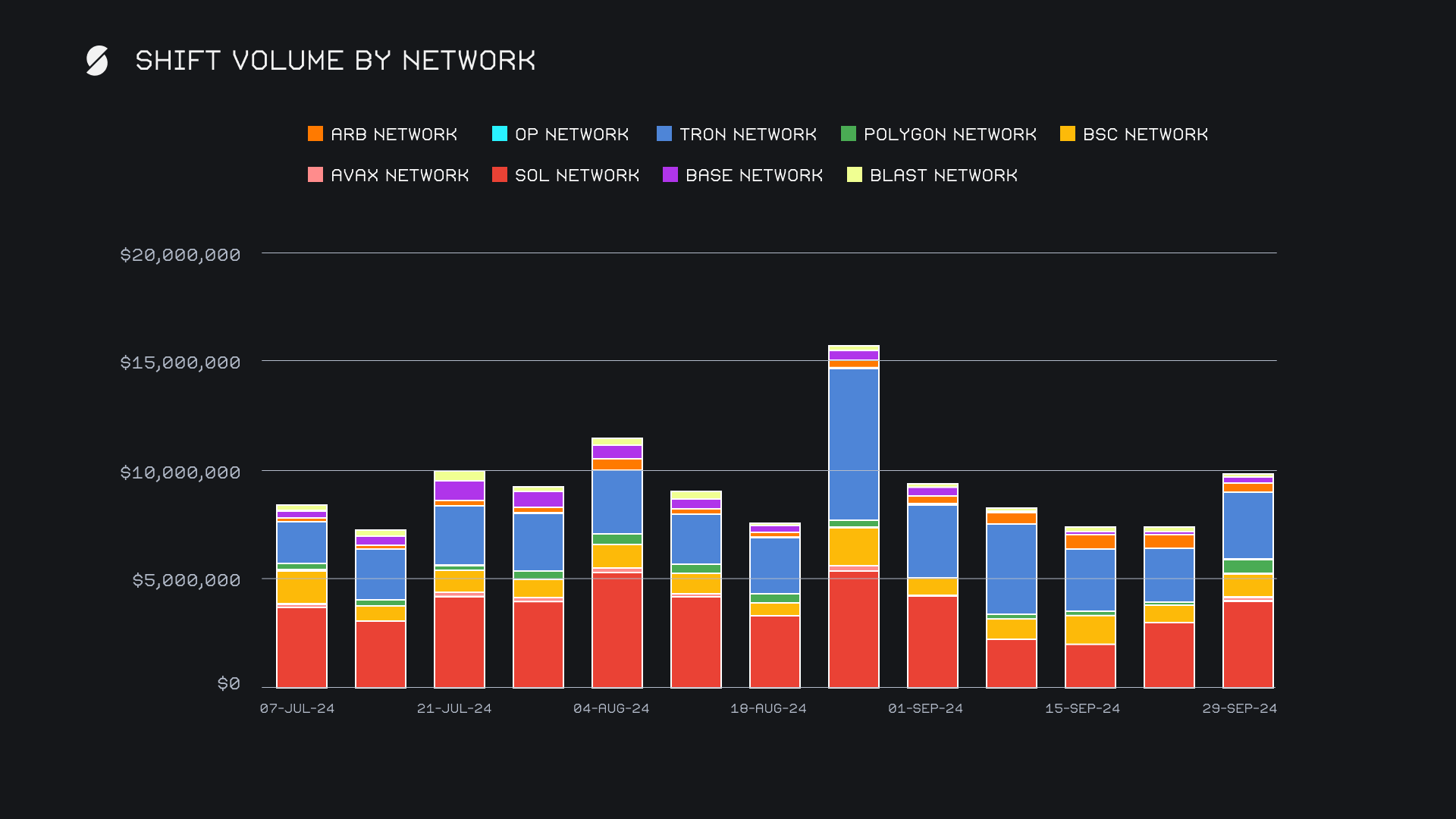

This general trend carried over to alternate networks to ETH, with the majority of networks recording positive performances. As usual, the Solana network led the way and recorded $4.0m in volume (+33.6%) with a dominant shift count of 4,940, more than 4 times that of any other alternate network. The Tron network followed and secured the second spot with $3.1m (+23.2%), primarily driven by the continued popularity of USDT (TRC20). The Binance Smart Chain (BSC) network had a strong week, and grew by +54.4% to $1.2m due the aforementioned rise in BNB shifting, while the Polygon network surged by +297.6% overall to $626k. In contrast, the Optimism and Arbitrum networks struggled, with shift volume dropping by -73.4% and -18.6, respectively, as users favored more active alternatives like Solana and Tron.

In listing news, SideShift recently added support for PayPal’s stablecoin, PYUSD. Shifting to PYUSD is now live, directly from any coin of your choice.

Affiliate News

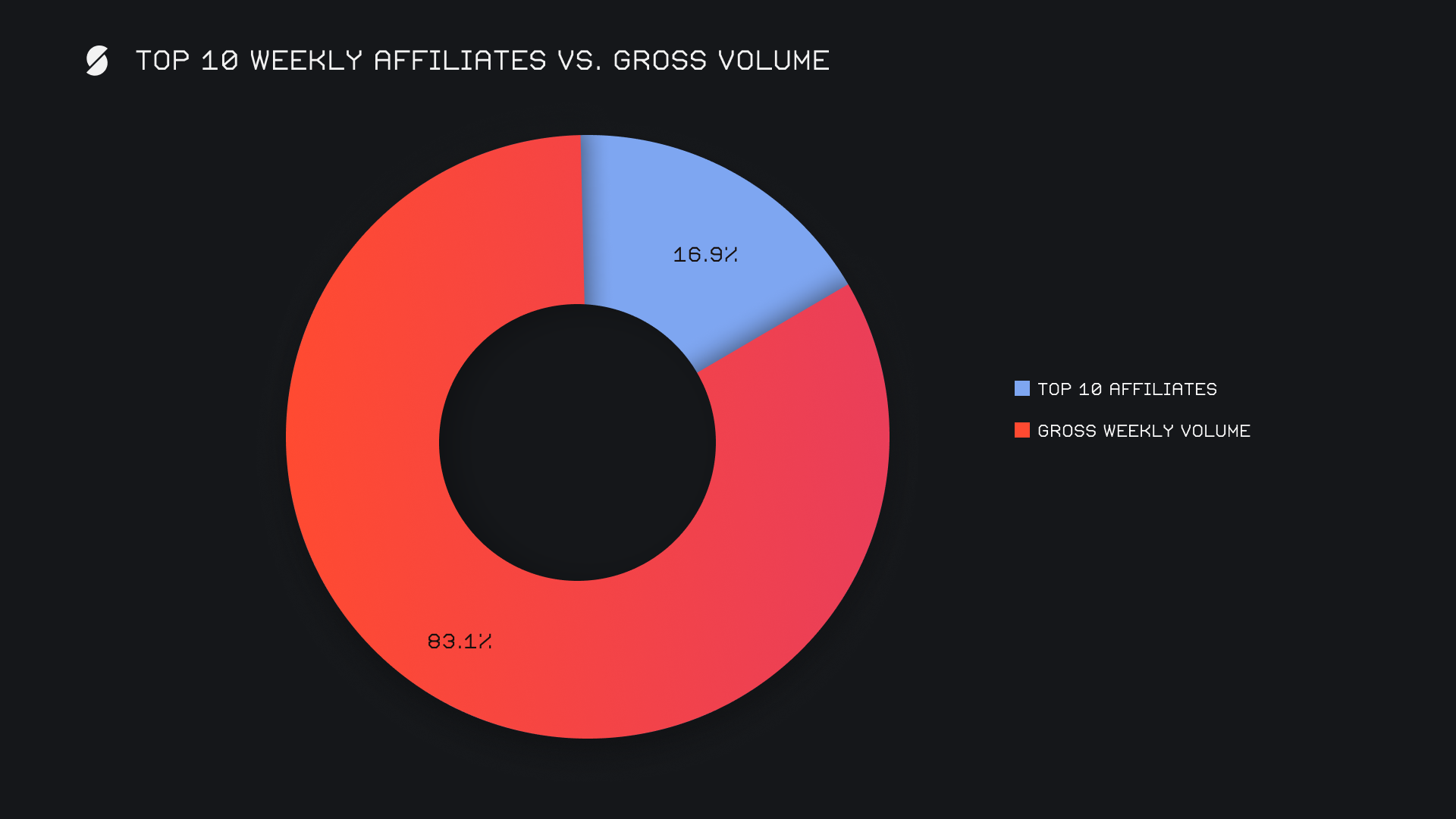

Our top affiliates combined for a total of $3.63m this week, marking a nominal -26.2% decline compared to the previous period. Our first-place affiliate remained virtually unchanged at $2.01m (-0.1%), though its proportional impact was reduced due to a spike in on-site shifting volume. The most notable change occurred between our second and third-place affiliates, as they swapped rankings. Our second place affiliate finished the week with $855k (-31.3%), while third place saw a hefty drop to $503k (-60.9%).

All together, our top affiliates contributed 16.9% to the total weekly volume, -13.8% lower than the previous week’s proportion.

That’s all for now. Thanks for reading and happy shifting.