SideShift.ai Weekly Report | 25th November - 1st December 2025

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one hundred and eighty-second edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and eighty-second edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

- SideShift closed the week with $7.01m in total volume alongside 7,192 shifts.

- BTC led all assets at $2.12m (-60.4%), still leading despite marking the most pronounced cooldown among all major coins.

- The Tron network climbed to $2.3m (+25.5%) and was the only alternate chain to post growth as others saw double-digit declines.

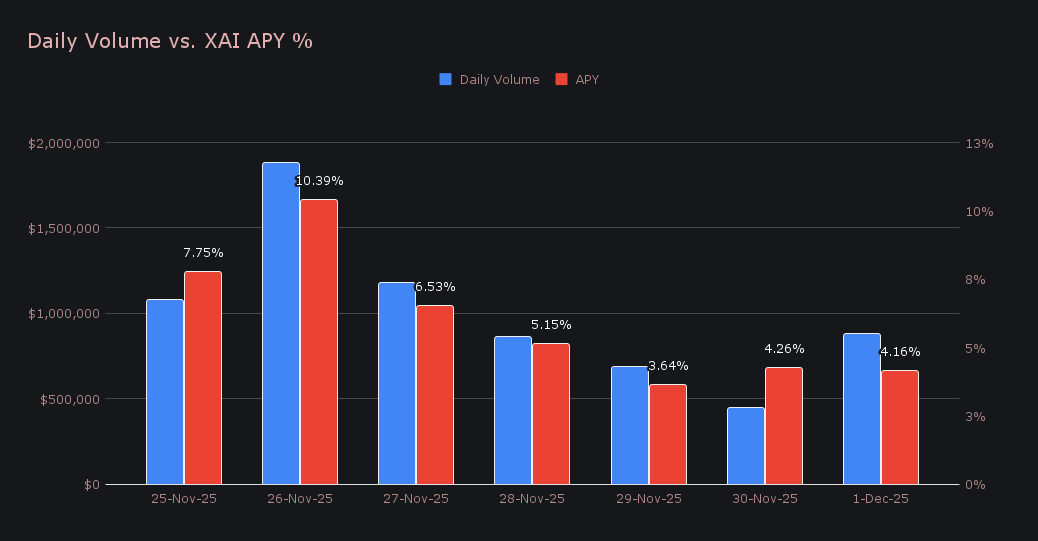

- XAI stakers earned 155,011 XAI ($19,009.74) at a 5.98% APY, consistent with the calmer tempo across the platform.

XAI Weekly Performance & Staking

XAI worked higher in a gradual grind this week, moving between $0.1204 and $0.1241 before a late dip and bounce settled it at $0.1224, a +0.3% finish that kept its price effectively flat.The 7-day chart showed some intraday swings with quick rebounds, while the 30-day view still reflected cooling from earlier highs. Even so, this week’s behavior suggested a market that has found equilibrium rather than continuing to slide. Its market cap closed the period at $18.89m.

XAI stakers earned 155,011.20 XAI ($19,009.74) at an average APY of 5.98% as rewards followed the quieter tempo of the week. The standout came on November 26th, when 37,820.27 XAI was distributed to the staking vault at 10.39% APY backed by $1.88m in daily volume. Beyond that peak, the rhythm held steady and matched the overall flow of activity on the platform.

SideShift is in the process of converting its entire treasury to BTC, which now holds an estimated total value of $24,291,807 (280.18 BTC). Users can follow along with live updates at sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 139,797,484 XAI (+0.1%)

Total Value Locked: $17,121,067 (+0.7%)

General Business News

BTC started December near the $86k mark after a near -20% November drop, its weakest showing for that month since 2018. ETH moved in the same direction and settled around $2,800, repeatedly failing to gain any momentum toward $3k. SOL eased to roughly ~$127 as its three week streak of ETF inflows came to an end, removing a steady source of demand that had supported its late November levels. More than $600m in Sunday liquidations fueled the dip to close the month, accelerating the drop and pushing the market into December on shaky footing.

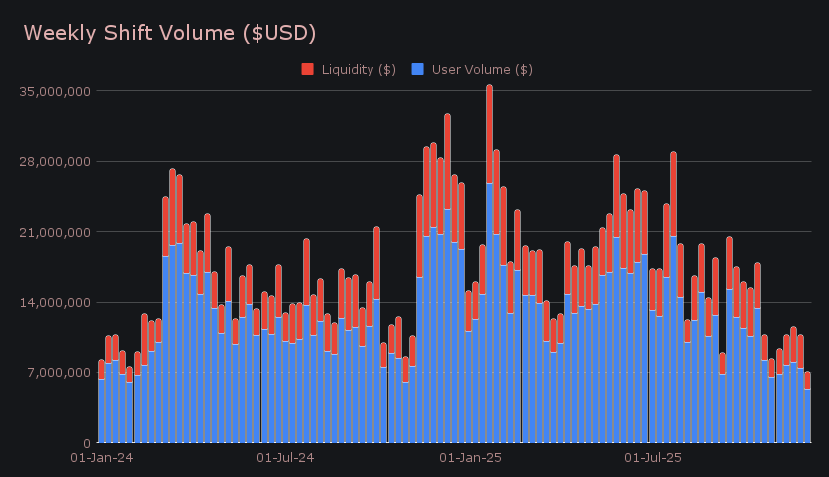

SideShift rounded out the period with $7.01m in total volume (−34.7%), the quietest stretch of 2025 and a stark contrast to last week’s steady $10m+ rhythm. User volume contributed $5.40m (−27.7%), while liquidity shifting halved to $1.61m (−50.7%), a sum that reflected a far more balanced two way flow, and therefore a reduced reliance on internal rebalancing. This week’s top user pairs were USDT(TRC-20)/ETH at $492k, BTC/USDT(ERC-20) at $260k, and L-USDT/USDT(ERC-20) at $194k. The large BTC-settling routes that led last week did not return at the same scale or ranking, and were replaced by smaller ETH and USDT paths, with last week’s $624k second-place pair nearly triple the size of this week’s $260k BTC/USDT(ERC-20) result.

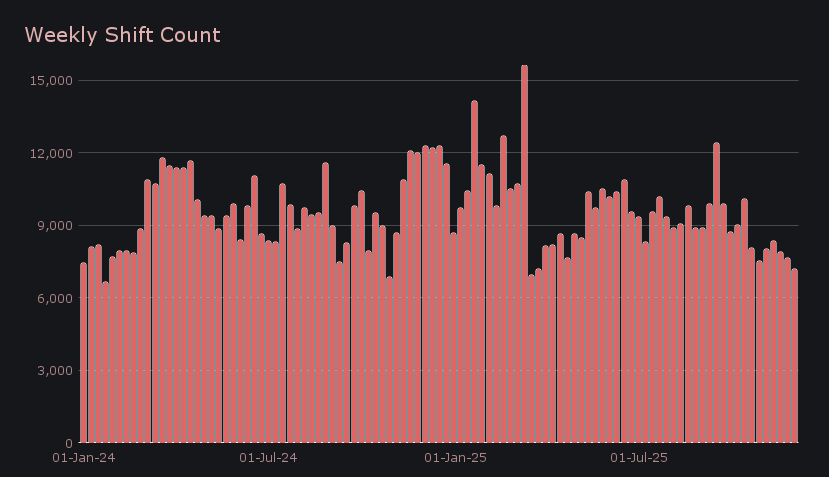

Shift count closed at 7,192 (−6.0%), averaging 1,027 shifts per day alongside roughly $1.01m in daily volume. Shift count declines were most noticeable across top integrations, where combined averages fell by more than −10%. Activity stayed fairly evenly spread through the week but slipped below the 1,000-shift mark to the mid 800s over the weekend, a normal weekend lull, but a sharper move down than normally seen.

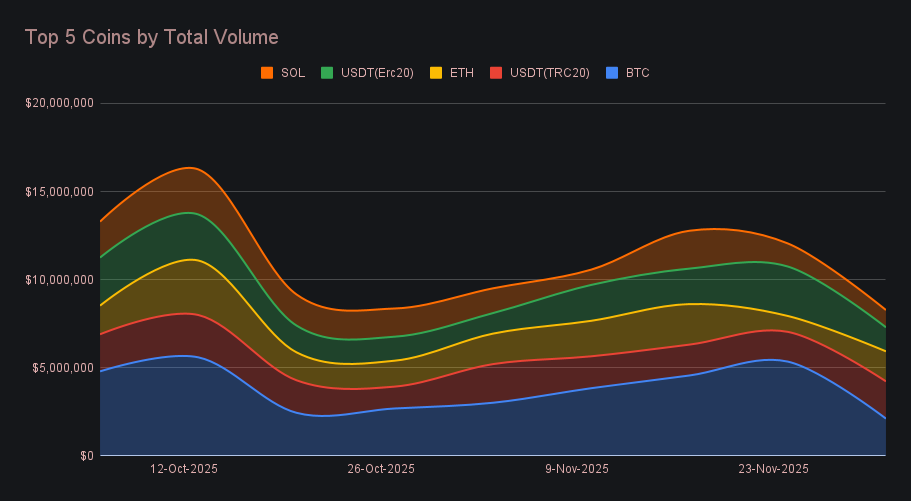

BTC remained in the top spot with $2.12m, despite marking a dramatic reset from the $5m+ level seen last week. User deposits fell to $1.02m (−45.7%), while settlements slid to $643k (−61.9%), placing BTC’s decline as the sharpest across the leaderboard. The drop was broad and even, suggesting users simply stepped back from BTC activity rather than shifting to another dominant pathway.

Among top stablecoins, USDT (TRC-20) was the standout, climbing to $2.11m (+25.2%) and nearly overtaking BTC for first place. Its deposit volume more than doubled to $851k (+111.0%), giving it the strongest inflow profile of any asset this week, while settlements fell to $567k (−17.4%). USDT (ERC-20), by contrast, dropped to a gross $1.36m (−51.5%) on steep retreats in both user deposits ($432k, −64.5%) and settlements ($642k, +3.0%), reflecting a divergence between the two main USDT rails — TRC-20 surged, while ERC-20 retrenched.Rounding out the top 5 were ETH and SOL, which moved in different directions this week. ETH rebounded sharply to $1.70m (+89.0%) after last week’s unusually low showing, powered by a surge in settlements to $838k (+90.0%) that helped push several ETH-settlement pairs into the top user flows to make ETH the most demanded coin on SideShift this week. SOL, meanwhile, fell to $981k (−25.1%), with deposits at $434k (−25.1%) and settlements at $363k (−26.4%), extending its multi-week slide and landing well below the levels it held through most of Q3.

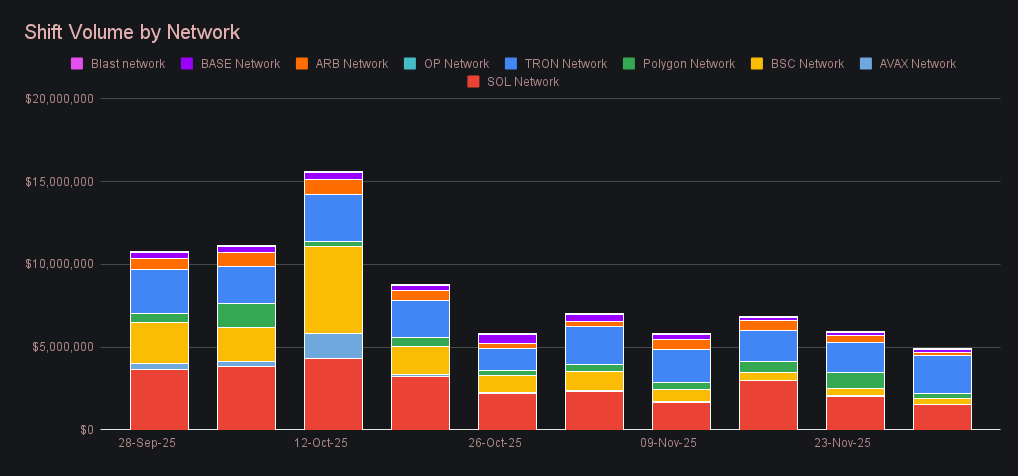

Activity across alternate networks was washed almost entirely in red, with nearly every chain posting double-digit declines. The Tron network was the lone exception, climbing to $2.3m (+25.5%) and standing as the only chain with upward momentum. The Solana network followed at $1.6m (−24.1%), extending the cooldown seen in its broader activity. BSC came in at $335k (−18.8%), while Polygon slumped to $284k (−70.6%), the heaviest drop of the group after last week’s WBTC(poly) driven rush. Arbitrum posted $196k (−50.9%), and the Base network finished at $193k (−2.5%), a minor move but still negative. Alt networks collectively ended the period at $4.9m (−16.9%), with Tron providing the only bright spot in an otherwise dull showing.

In listing news SideShift recently added support for Monad (MON) on its native chain, as well as Metis (METIS) on the Ethereum network.

Affiliate News

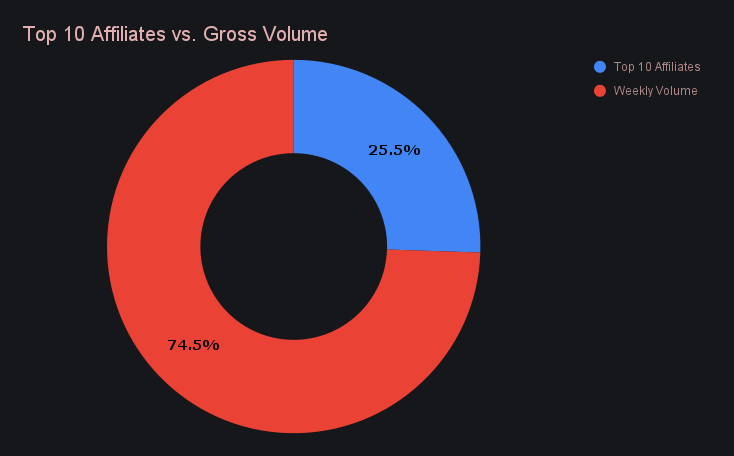

Our top-tiered affiliates closed the week at $1.79m (−30.2%), a step down from last week but still a smaller hit than the site-wide drop. The ordering didn’t budge, with first place contributing $591.9k (−36.9%), second place delivering $437.7k (−6.2%), and third adding $264.2k (−45.8%). Even with slower activity across the board, affiliate volume compressed less sharply than the gross total, leaving their footprint relatively larger.

All together, our top affiliates represented 25.5% of total weekly volume, +1.6% higher than last week’s proportion.

That’s all for now - thanks for reading and happy shifting.