SideShift.ai Weekly Report | 26th August - 1st September 2025

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one hundred and sixty-ninth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and sixty-ninth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

- SideShift volume rebounded +28% to $18.40m, with Sept 1 hitting $5.57m, the first $5m+ day in a month.

- XAI broke out above $0.17 to $0.1792 (+6.6%), with stakers earning 194,126 XAI ($33.8k) at a 7.61% APY.

- BTC climbed to $8.58m (+55.3%), driven by deposits even as settlements fell to a 2025 low.

- SOL surged to $7.05m (+370.8%), its strongest tally in six months, pushing past ETH’s $4.63m.

- Whale shifts totaled 66.5% of volume, concentrated in BTC/SOL and contributing $12.2m of the weekly sum.

XAI Weekly Performance & Staking

XAI put in a very strong performance, breaking out from the ~$0.15 zone it had held for months and moving convincingly above the $0.17 handle. The token traded in a band between $0.1710 and $0.1809, carrying momentum higher through the latter half of the week before finishing at $0.1792. That climb lifted market cap to $27.1m, a +6.63% increase from $26.0m the week prior, marking a clear continuation of the steady uptrend that has defined August.

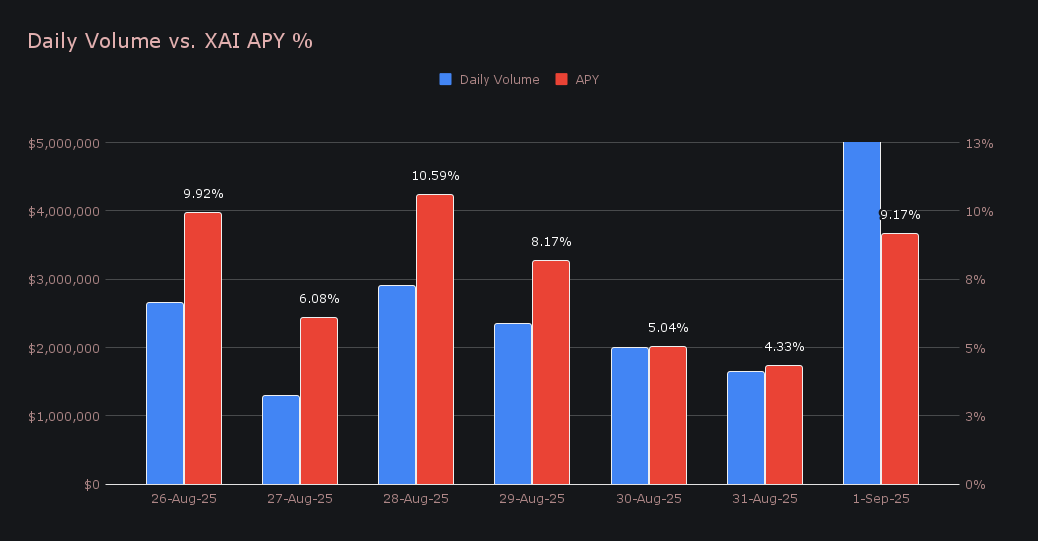

Stakers collected 194,126.24 XAI ($33,759.65) over the week at an average APY of 7.61%. The peak day came on August 28, when 38,161.81 XAI was sent to the staking vault at 10.59% APY, supported by $2.89m in daily volume. Compared to the prior period’s 194,611.53 XAI in rewards at a 7.65% APY, this week’s totals were broadly consistent, showing a stable flow of staking returns even as price action gained strength.

Additional XAI updates:

Total Value Staked: 138,549,343 XAI (+0.1%)

Total Value Locked: $24,813,189 (+5.0%)

General Business News

This week saw BTC hold steady around $110k, showing resilience despite a wave of profit-taking from long-term holders. ETH eased to ~$4.4k after its surge to fresh all-time highs last week, while SOL moved +15% towards ~$218 as it looked to play catch up with peers and showed signs of renewed momentum. Meanwhile, HYPE climbed to record levels and breached $50 for the first time as Hyperliquid posted $100m in monthly revenue, and Trump-backed WLFI debuted turbulently, briefly touching a $30B+ FDV before pulling back sharply.

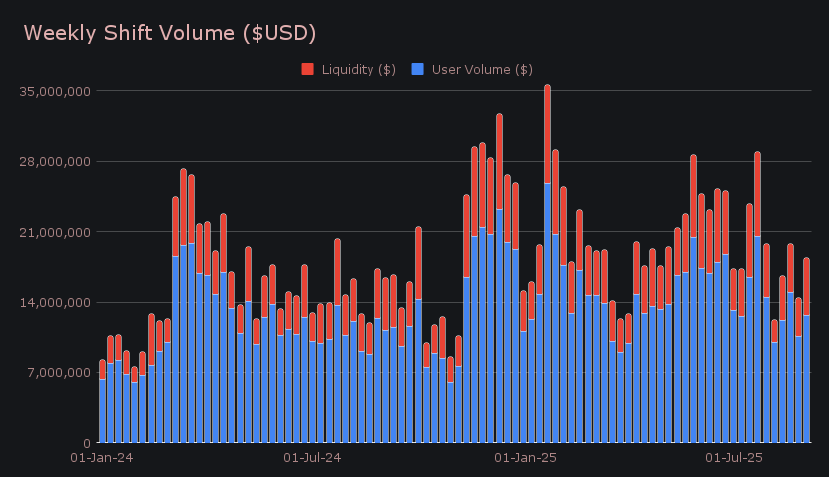

SideShift posted a gross weekly volume of $18.40m (+28%), a nice rebound from last week’s dip. The highlight came on September 1 when $5.57m was shifted, the first $5m day in the past month. Overall activity was driven by $12.68m in user volume, alongside $5.72m from liquidity shifts, a mix that reflected both stronger site flows and heavier internal balancing. A major contributor was the BTC/SOL pair, which climbed to $2.79m largely from a top affiliate, and propelled SOL’s broader totals. By contrast, BTC/USDT (ERC-20), which had dominated for much of the year, dropped out of the leading pairs. Rounding out the top were USDT (TRC-20)/USDC (ERC-20) at $865k and BTC/ETH at $671k.

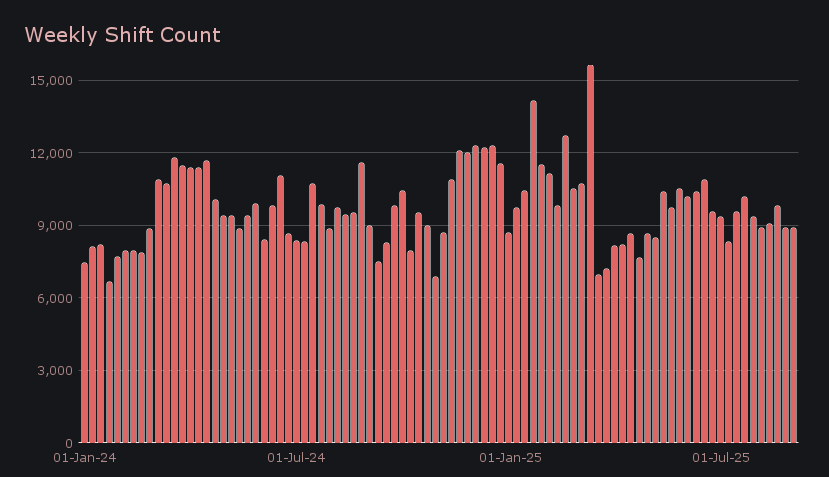

Gross shift count finished steady at 8,874 (−0.1%), with a daily average of 1,268 shifts. While daily tallies for count remained evenly dispersed, the volume pattern shifted toward fewer, heavier days rather than a consistent daily clip. As a result, shift count growth was essentially flat, standing in contrast to the sharp rebound in volume and highlighting the divergence between throughput and the number of individual transactions.

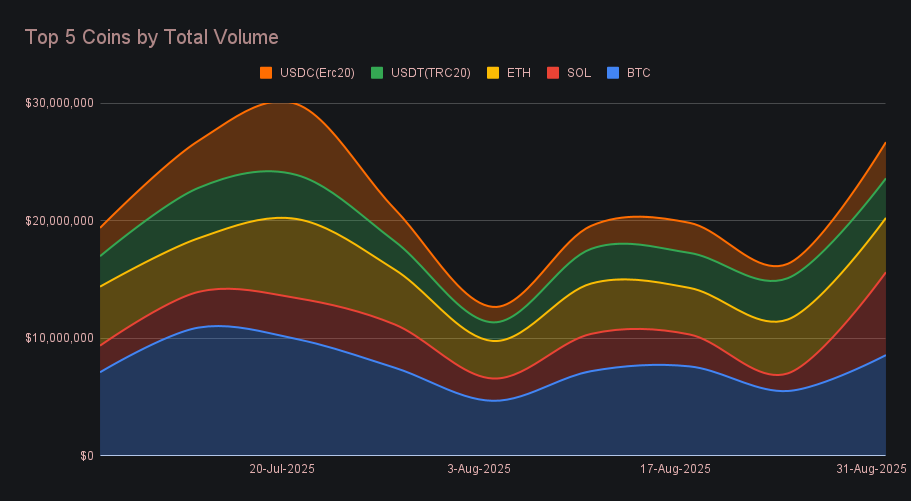

BTC held the top spot again, climbing to $8.58m in total volume (+55.3%). That marked a sharp turnaround from the prior week’s $5.53m total, and was driven primarily by user deposits, which rose to $4.41m (+122.9%). Settlements, however, dropped to $1.21m (−46.9%), the lowest weekly settlement total for BTC so far in 2025. The uneven split between deposits and settlements stood in stark contrast to the previous period’s more balanced profile, but the rise in deposit inflows was enough to lift BTC’s aggregate volume to its highest point in six weeks.

SOL ranked second with $7.05m in total volume, a +370.8% surge from the prior week’s $1.50m. User settlements made up the bulk at $3.68m (+436.0%), driven almost entirely by the BTC/SOL pair which confidently stood as the week’s largest overall. Deposits slipped to $572k (−18.0%), but the scale of settlement flows carried SOL to its strongest total tally since early February 2025, breaking above the $7m mark for the first time in six months. ETH, by contrast, finished third with $4.63m in total volume (+0.8%), as deposits fell to $1.76m (−23.5%) while settlements climbed to $1.58m (+51.6%). The two assets effectively swapped positions since the time of the last report, with SOL re-entering the mix of SideShift’s most active coins as ETH held steady but ceded ground.

The final two spots in the top five went to USDT (TRC-20) and USDC (ERC-20). USDT (TRC-20) finished at $3.37m (−4.2%), ending a four-week growth streak but still holding steady well above the $3m mark. Deposits climbed to $1.16m (+28.2%), while settlements declined to $954k (−25.8%). USDC (ERC-20), meanwhile, jumped to $3.08m (+151.9%) overall, powered by a rush in settlements which jumped to $1.37m (+168.9%). The move was especially notable given that it came as USDT (ERC-20) fell out of the top five for the first time this year and logged its lowest weekly total of 2025 at just $1.89m, a rare shake-up in stablecoin activity on SideShift.

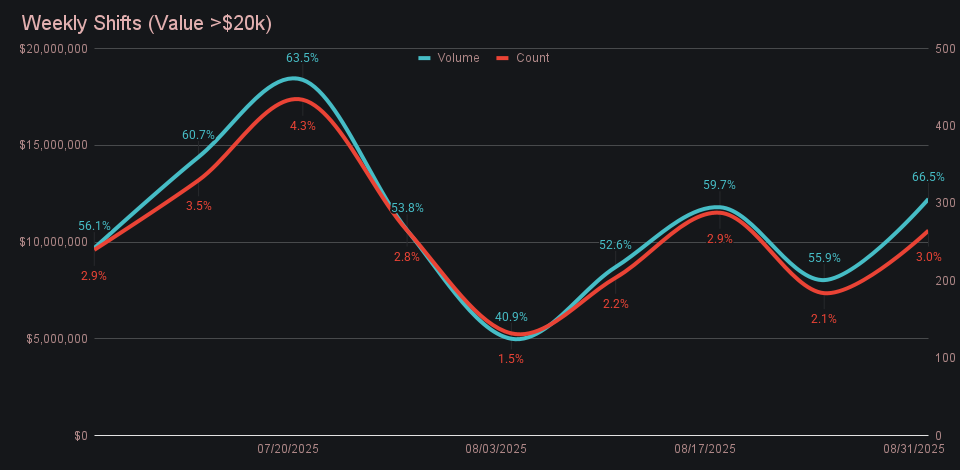

Whale shifts valued above $20k were a defining feature of volume and came across several major pairs. In the chart, the blue line tracks the weekly volume of shifts sized >$20k, with the percentages representing the proportion of that week’s total, while the red line shows their count. Last week whale shifts accounted for 66.5% of our total volume, the highest proportion seen over the past two months. The increase was fueled largely by the BTC/SOL pair, but also featured a sudden burst in large ADA/ETH activity that lifted ADA’s gross sum more than tenfold to $1.06m, making it a peculiar but important contributor to whale volume over the past seven days.

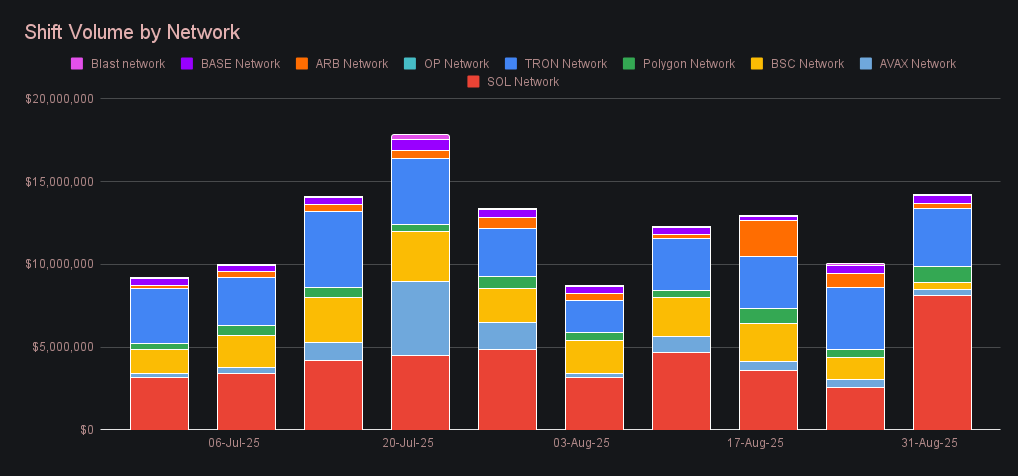

Alternate networks to ETH totaled $14.20m, a weekly increase of +42.1%, with the Solana network as the catalyst. It accelerated to $8.12m (+218.2%), while the second placed Tron network eased to $3.45m (−8.1%). Meanwhile, the Polygon network saw a strong uptick on the backs of elevated stablecoin shifting, rising to $968k (+111.4%) and against the grain of the majority of alt networks. By contrast, the BSC network fell to $452k (−66.3%), the Arbitrum network dropped to $341k (−60.0%), and the Avalanche network slipped to $391k (−24.1%), leaving the broader alt growth almost entirely in the hands of the week’s leader.

Affiliate News

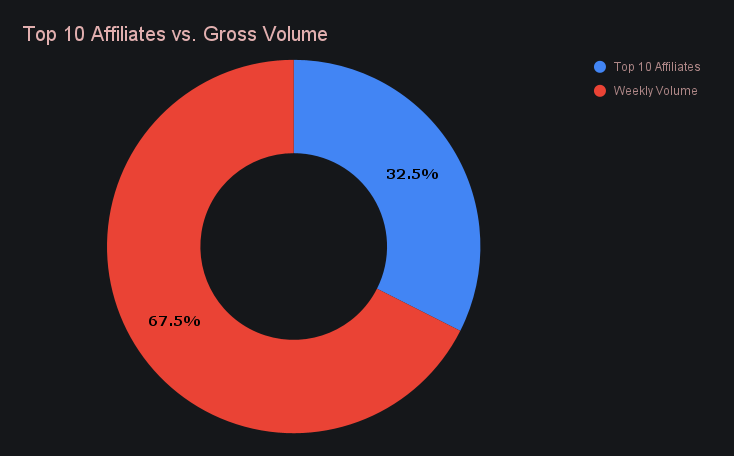

Affiliate activity finished at $5.97m, a +15.3% rise from the prior total. The leaderboard was once again shaken up — first place stayed on top and nearly tripled its volume to $4.15m (+177.7%), opening a decisive lead. The new second place logged $503k (−34.2%), while third place followed closely at $447k (−46.5%). Notably, last week’s runner-up fell outside the top three entirely, a change to a ranking order that had remained consistent for much of the year.

Collectively, our top affiliates contributed 32.5% of total SideShift volume, down slightly from last week’s proportion of 36.0%.

That’s all for now - thanks for reading and happy shifting.