SideShift.ai Weekly Report | 27th Aug - 2nd Sept 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one-hundred-and-twentieth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and twentieth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week, SideShift token (XAI) saw mostly flat price action, with its price fluctuating within the narrow range of $0.1424 to $0.1468, ultimately consolidating at its current price of $0.1446. Notably, XAI’s market cap crossed the $20 million threshold, marking a +1.41% increase from the previous period, and closed the week at $20,005,072.

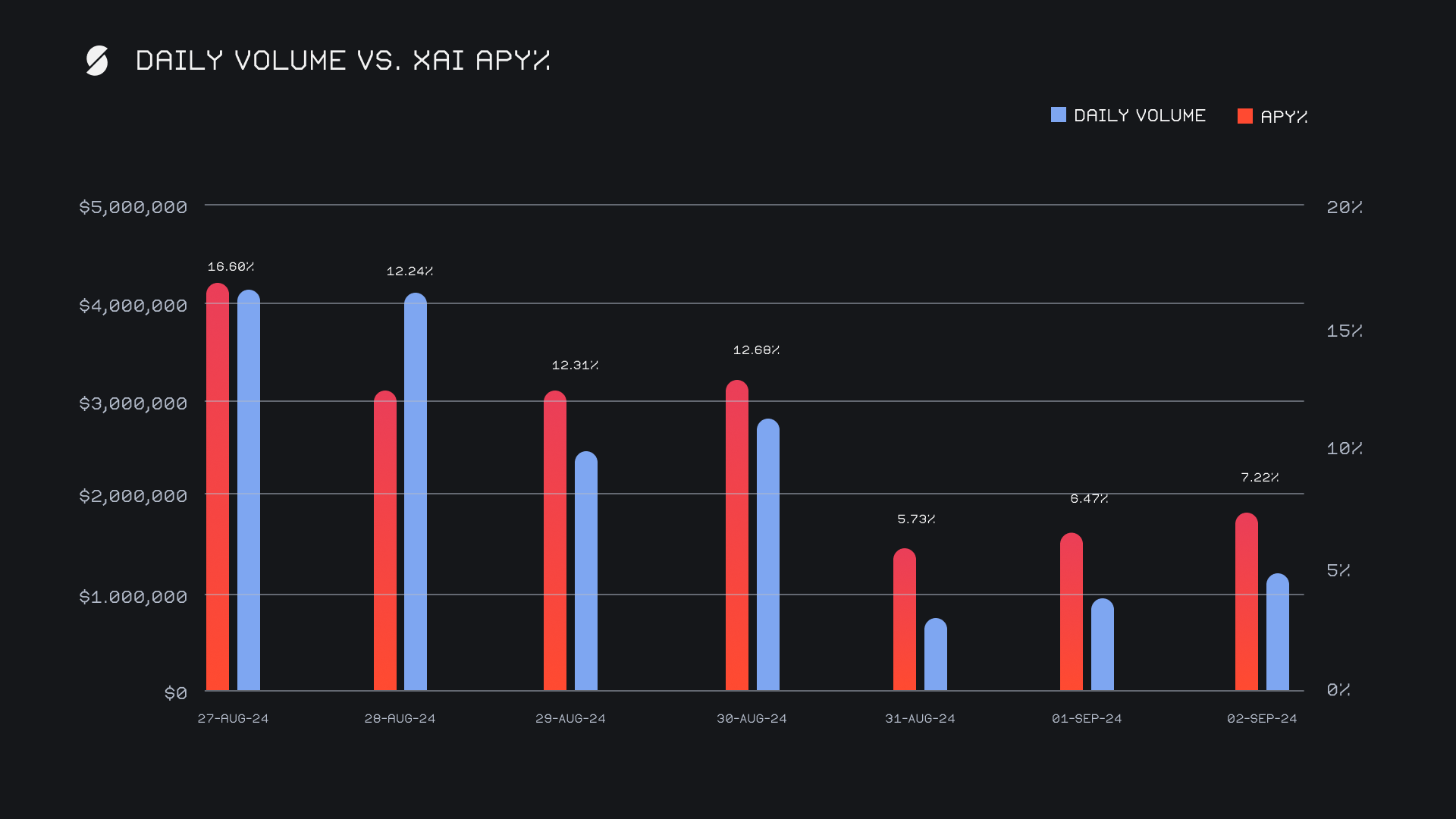

XAI stakers enjoyed a solid average APY of 10.46% throughout the week. A peak in staking rewards was observed on August 28th, 2024, when stakers received 51,956.6 XAI, corresponding to an impressive APY of 16.60%. This was driven by a respectable daily volume of $4.1 million. Over the week, stakers were rewarded with a total of 234,529.34 XAI, or $33,912.94 USD.

Additional XAI Updates:

Total Value Staked: 123,782,984 XAI (+0.2%)

Total Value Locked: $18,286,830 (+4.5%)

General Business News

Despite some minor fluctuations, the broader crypto market carried on mostly stable this week. Bitcoin hovered around $58,000, struggling to maintain upward momentum in what is historically a bearish month, while Ethereum continued to underperform relative to Bitcoin, drawing attention to its lagging price action. Meanwhile, broader market movements remained subdued, with traders keeping a close eye on potential shifts in sentiment as September unfolds.

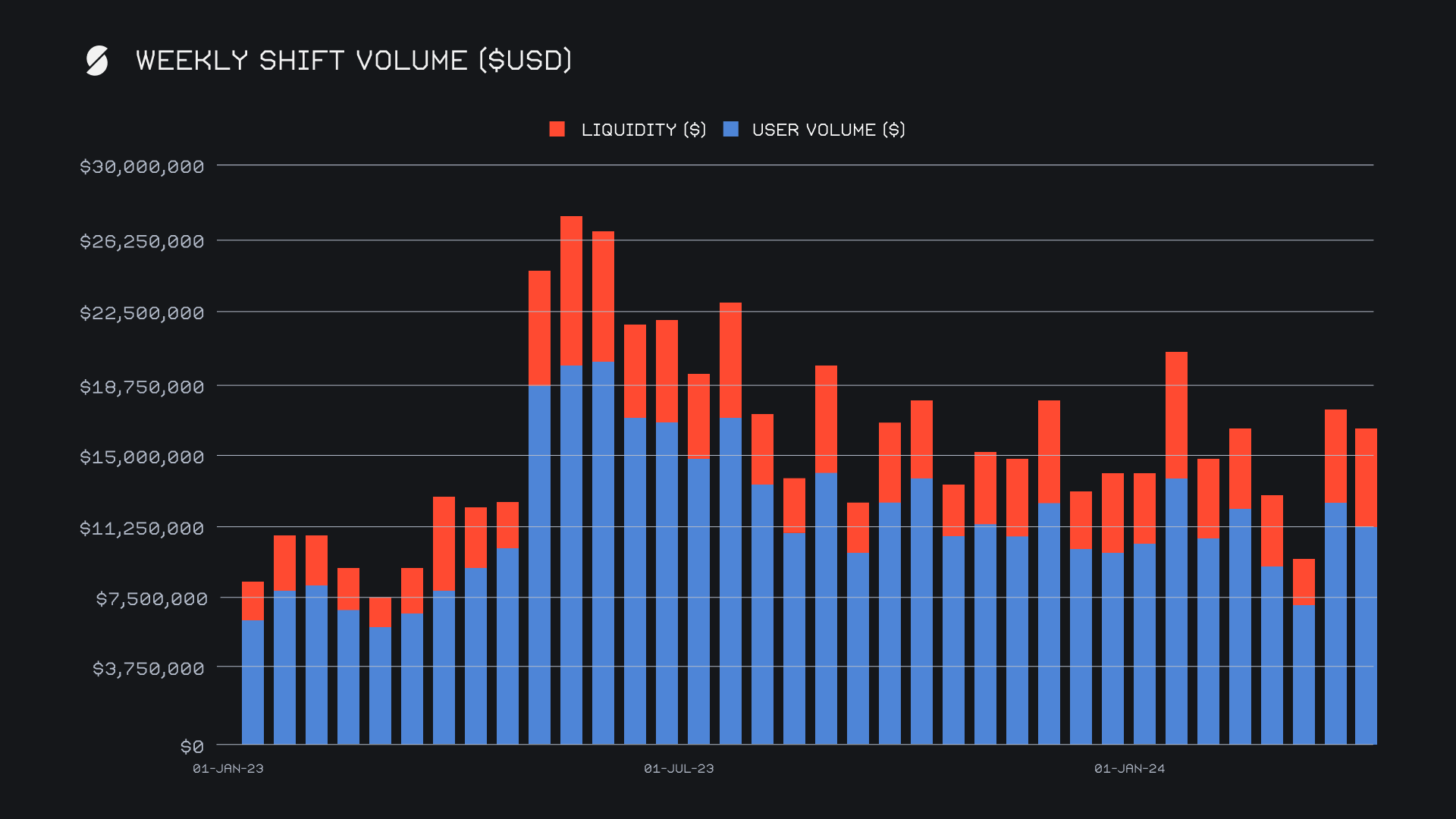

SideShift had another solid performance this week, although our gross weekly volume underwent a slight decline of -5.2% to end the period with $16.4m. Despite the lower total volume, there was a notable concentration in higher-value shift pairs, which helped to maintain stability in our daily averages. We observed an approximate +5% rise in liquidity shifting, which was necessary to even out the imbalance between these high value shift pairs. Liquidity shifting ended with $5.1m this week, slightly higher than last week's $4.9m, with the remaining $11.3m stemming from user shifts.

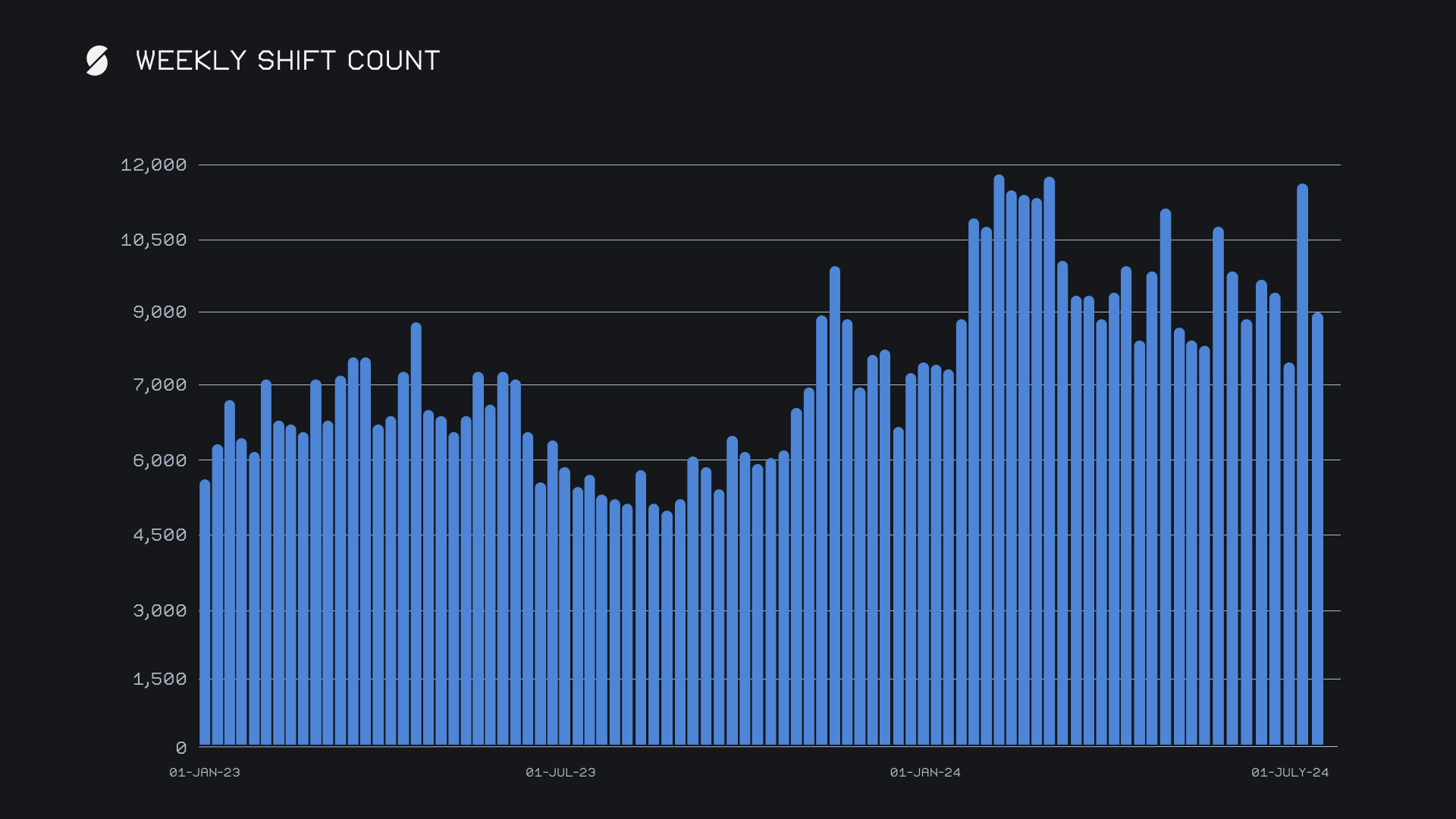

This week's volume was accompanied by a gross weekly shift count of 8,976, representing a significant -22.6% decrease from the previous week. Although this was a notable drop, the overall impact on volume was less severe, indicating that users favored larger transactions despite the reduced number of shifts. Daily averages reflected this trend, with our daily volume average holding steady at $2.3m, while our daily shift count average reached 1,282. The relative consistency in volume, even with fewer shifts, underscores the growing preference for high-value shift pairs - this includes the sudden breakout of BCH/ETH, which led the way with $1.4m, and the always popular BTC/ETH, which placed second with $915k.

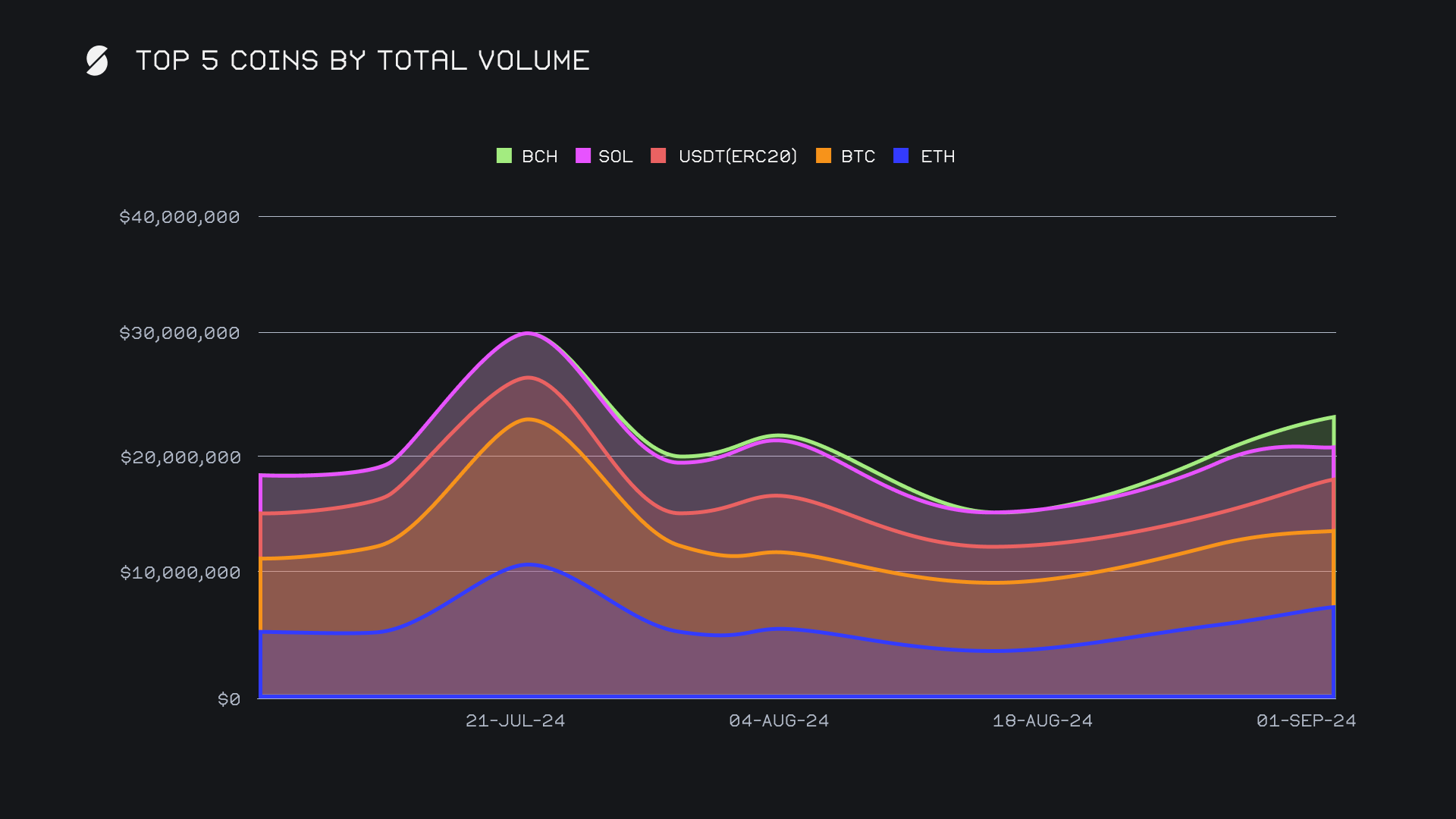

ETH seized the top spot for the first time in nearly 10 weeks, with a noticeable increase in total volume to $7.8m, reflecting a strong +42.3% gain from the previous period. Although ETH deposits saw a slight decrease of -5.2% to $1.9m, settlement volumes experienced a robust surge, and rose by +56.3% to $3.5m, indicating a heightened preference among SideShift users to hold ETH. This swift rise secured ETHs place as the most in-demand coin this week.

BTC followed in second place with a total volume of $6.1m, marking a -12.2% decline compared to last week. User trends revealed a shift towards holding BTC, as deposits fell by -29.2% to $2.3m. Additionally, BTC recorded a +34.7% increase in settlement volume, reaching $1.7m, underscoring its continued relevance despite the overall dip.

Meanwhile, USDT (ERC-20) saw a significant uptick and climbed +70.2% in total volume to reach $4.2m and claim third place. USDT (ERC-20) deposits rose by +83.1% to $514k, with settlements also increasing, but by +58.1% for a far more substantial $2.1m. Interestingly, this was the highest total volume for USDT (ERC-20), or any stablecoin for that matter, since the spring of 2024. The rise in stablecoin demand on SideShift could represent a cautious attitude embraced by SideShift users for the time being, likely as a hedge against anticipated market volatility.

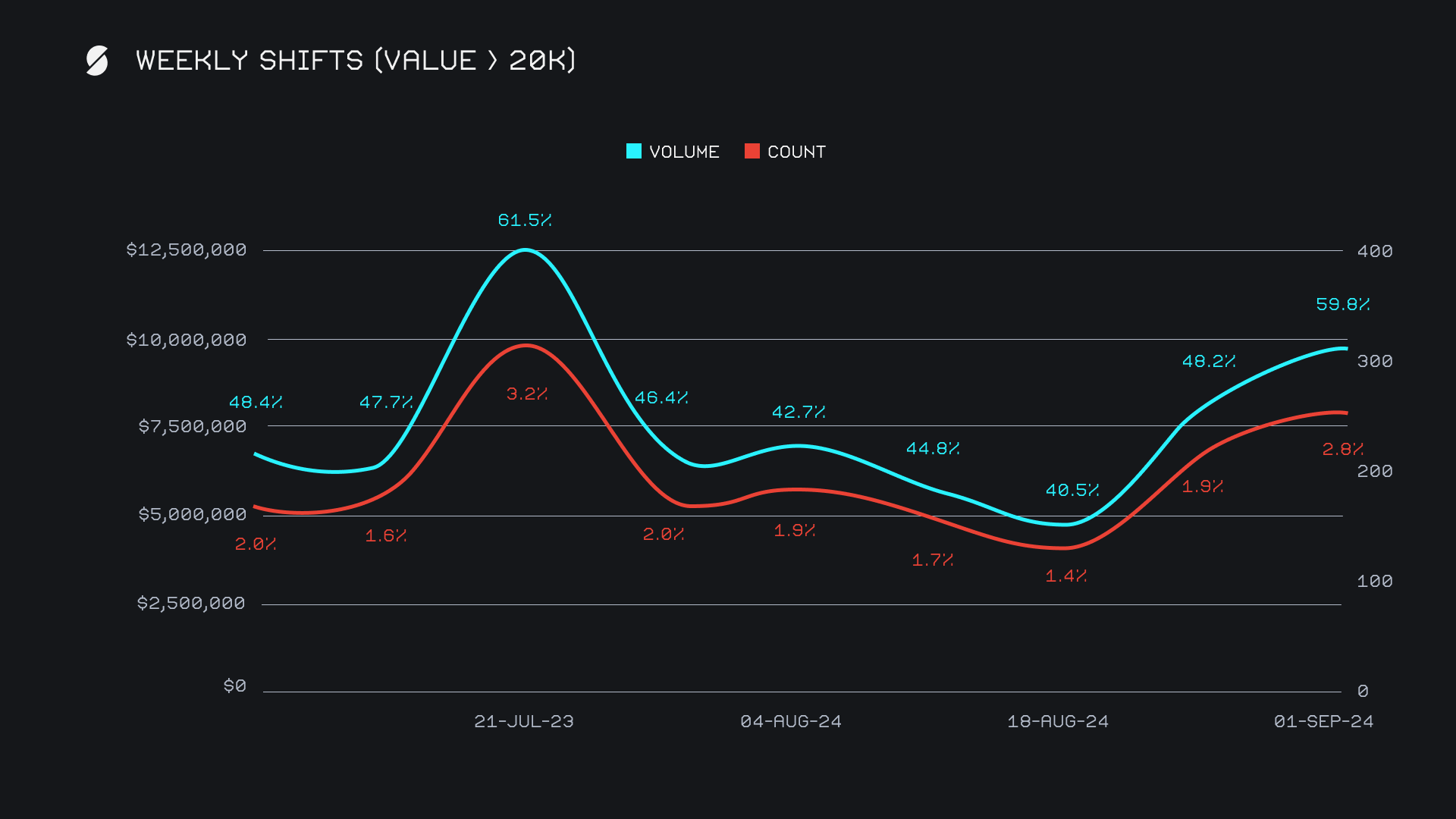

The rise in whale shifting was clear this week, and the factor that was mainly responsible for maintaining our weekly volume. Shifts with a value greater than $20k accounted for $9.8m this week, approximately ~60% of our weekly total volume, and 2.8% of our weekly shift count - in the past 5 months, both of these figures have only been surpassed twice. This week, the catalyst was the eruption of BCH, which saw its total volume explode more than 8x.

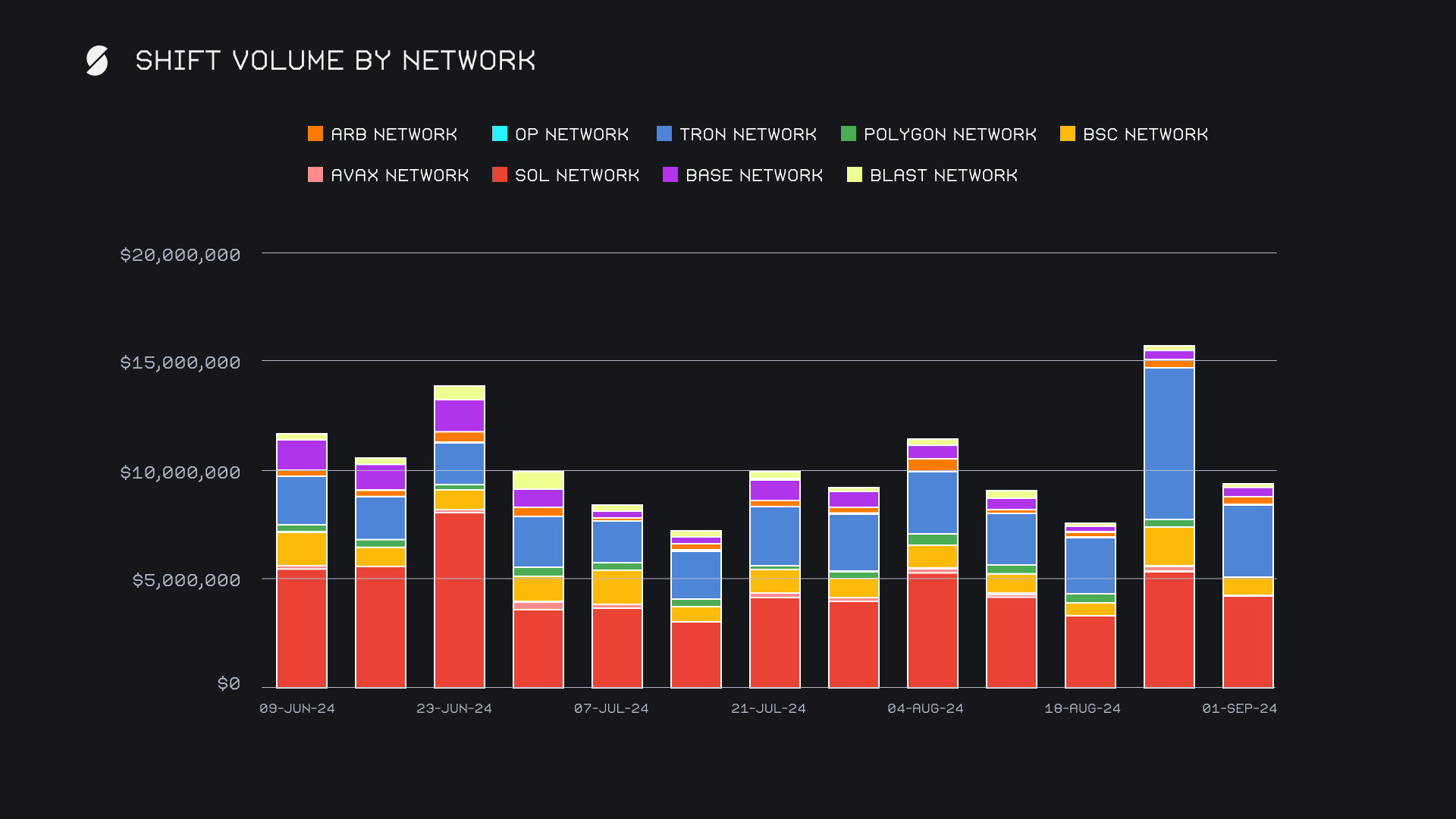

This week, the Tron network maintained its lead among alternate networks to ETH, despite waning interest after a sharp, memecoin driven surge last week - it underwent a sharp -51.6% decline in volume to $3.4m, with USDT (TRC-20) once again taking the helm amongst Tron coins. The Solana network followed closely with $4.2m, though it too saw a significant drop of -21.5%. The Binance Smart Chain (BSC) network was no exception, plummeting by -58.2% to $749k, while the Base network remained relatively stable and rounded off the top 4 with a slight decrease of -4.1% to $444k. Overall, it was a challenging week for alternate networks, as 8 out of 9 recorded declines. Cumulatively, they ended with $9.3m in total volume, a -40% drop from last week’s rush.

Affiliate News

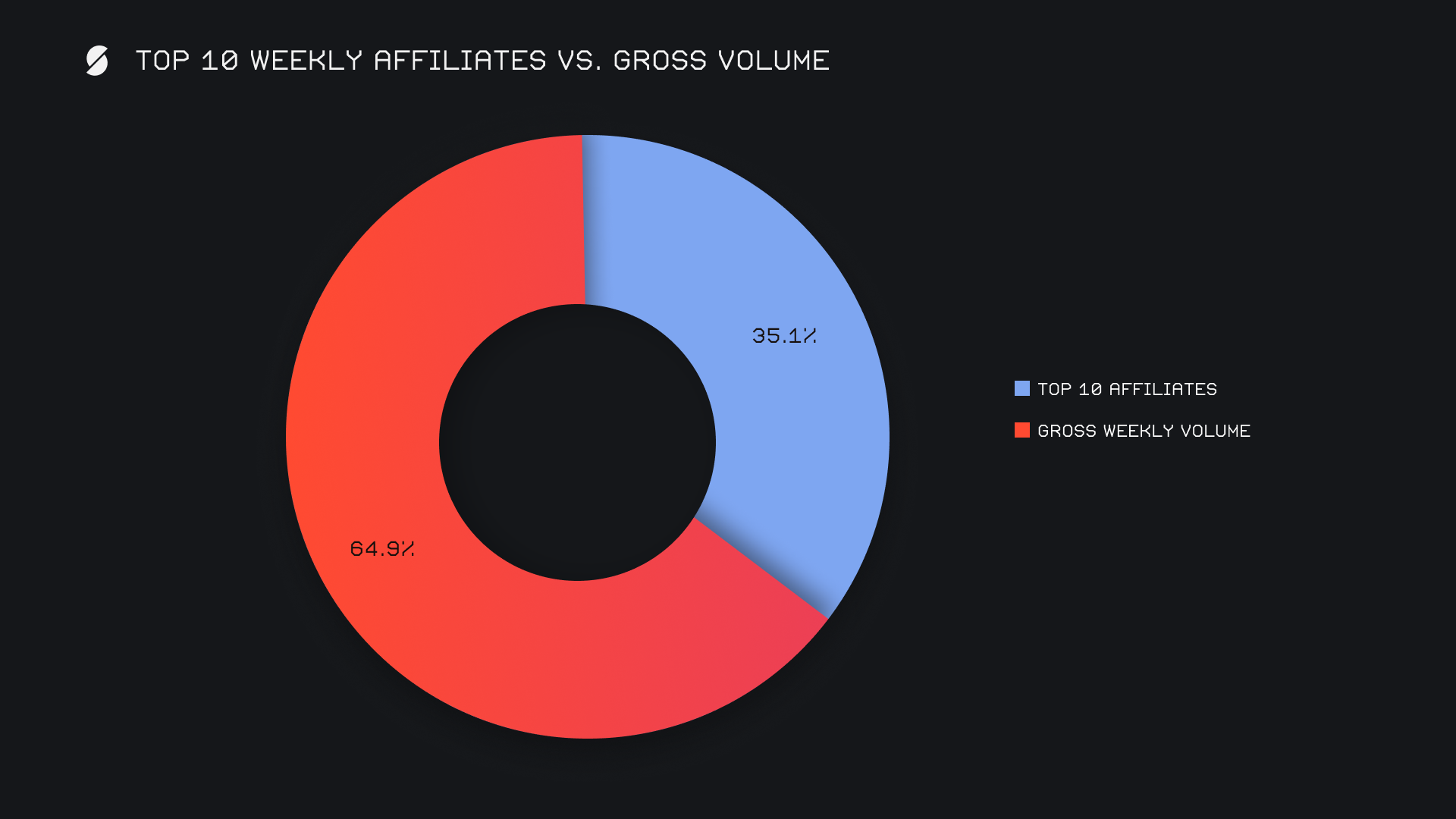

This week, our top affiliates generated a combined total volume of $5.8m, marking a significant +80.0% increase compared to the previous period. Our former third placed affiliate rose to the top on the back of an outstanding +435% gain and ended with $2.2m - this was its highest weekly volume since May, 2024. Our second-place affiliate followed with $1.9m, up by +33.8%, while our third-place affiliate recorded $1.5m, a +38.5% increase, bolstered by an impressive shift count of 1,146. Together, these top affiliates accounted for 35.1% of our weekly volume, playing a significant role in this week’s volume.

That’s all for now. Thanks for reading and happy shifting.