SideShift.ai Weekly Report | 27th February - 4th March 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the ninety-fourth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the ninety-fourth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

SideShift token (XAI) spent the week moving within range of $0.1216 / $0.1699, incrementally climbing higher as the week came to a close. At the time of writing, XAI is continuing the trend and pushing against the upper bounds of that range, as it is sitting at a price of $0.1706 with a current market cap of $22,327,682 (+40.6%).

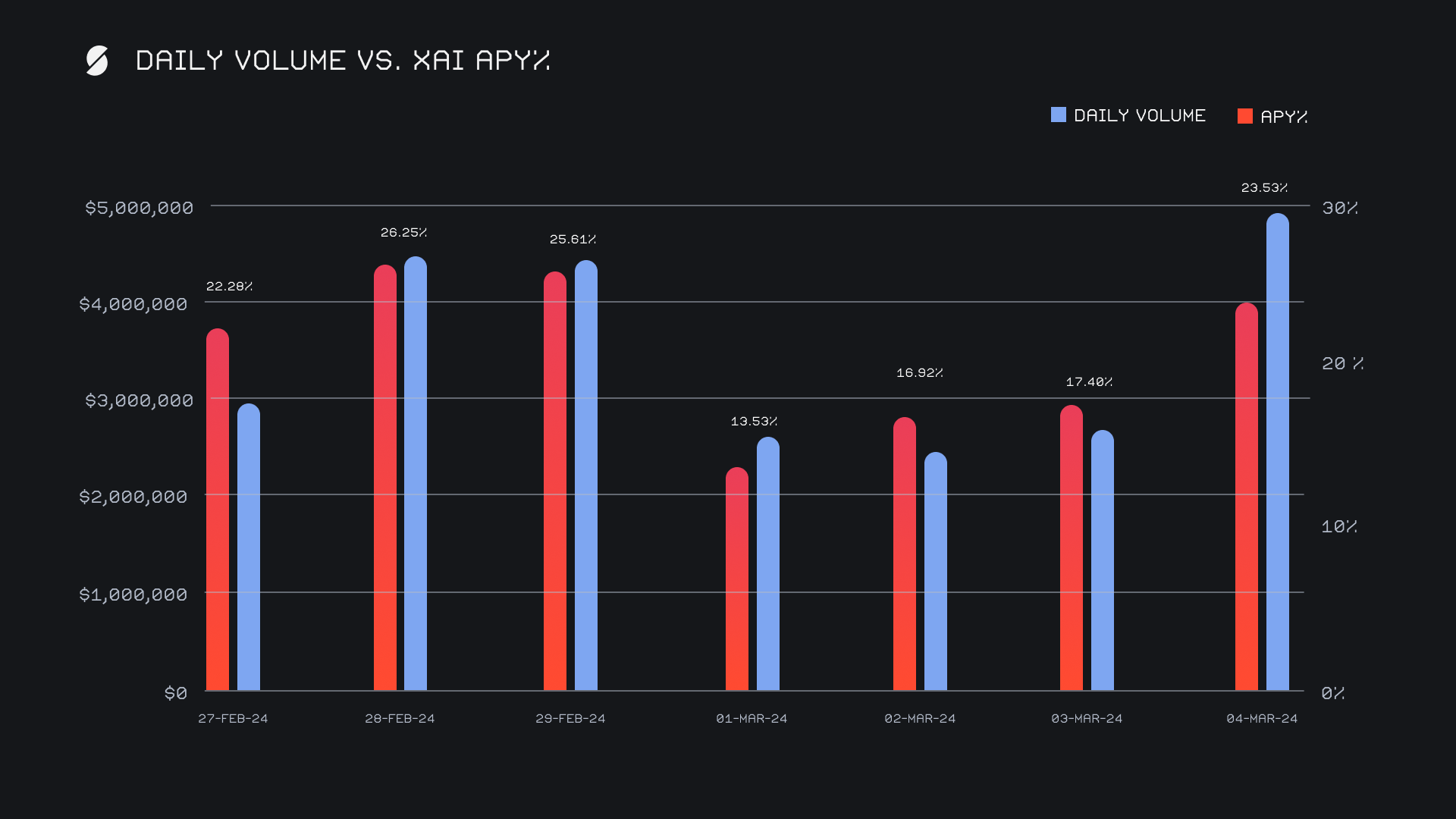

SideShift’s APY was very healthy this week, and XAI stakers were rewarded with an average APY of 20.79%. A daily rewards high of 73,747.57 XAI (an APY of 26.25%) was distributed to our staking vault on February 29th, 2024, following a daily volume of $4.5m. This week XAI stakers received a total of 417,780 XAI, or $71,028 USD in staking rewards.

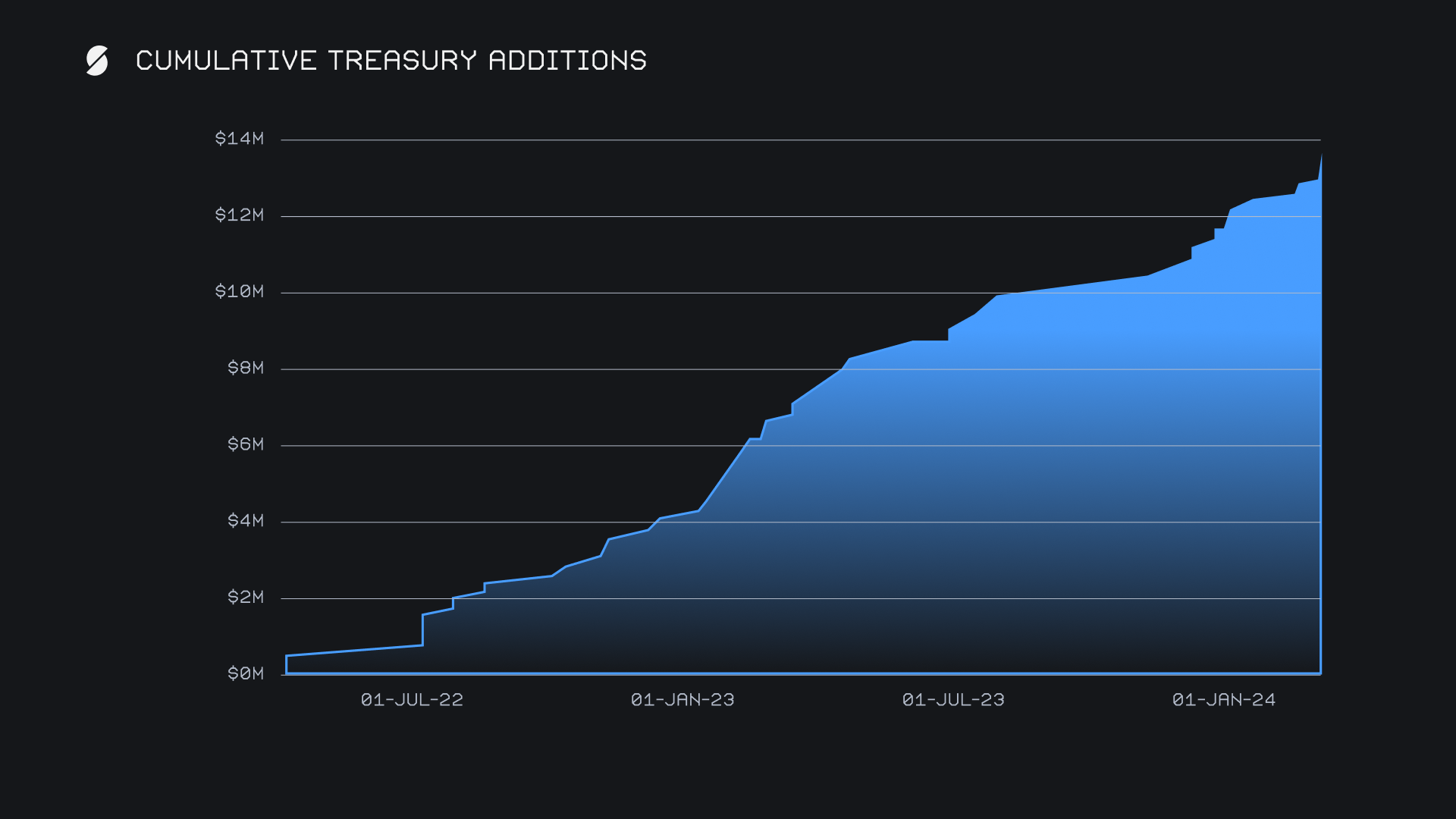

A strong performance allowed us to deposit an additional 100 ETH and 14 WBTC to our treasury over the course of the week. Since its inception, a total of $7.54m has been added to the SideShift treasury (valued at the time the deposits were made). Currently, the value of our treasury is measured at $14.22m, representing a price appreciation of +88.5% overall. The below chart outlines our cumulative treasury additions to date, and is representative of current prices.

Additional XAI updates:

Total Value Staked: 116,415,630 XAI (+0.9%)

Total Value Locked: $19,770,777 (+42.1%)

General Business News

The bulls are back in full force, as this week saw memecoins absolutely soar alongside strong moves from both BTC and ETH. Bitcoin is now just a short 2% move away from breaching all time highs, a historic milestone that the entire industry has been patiently waiting for since it began its bear market decline in late 2021.

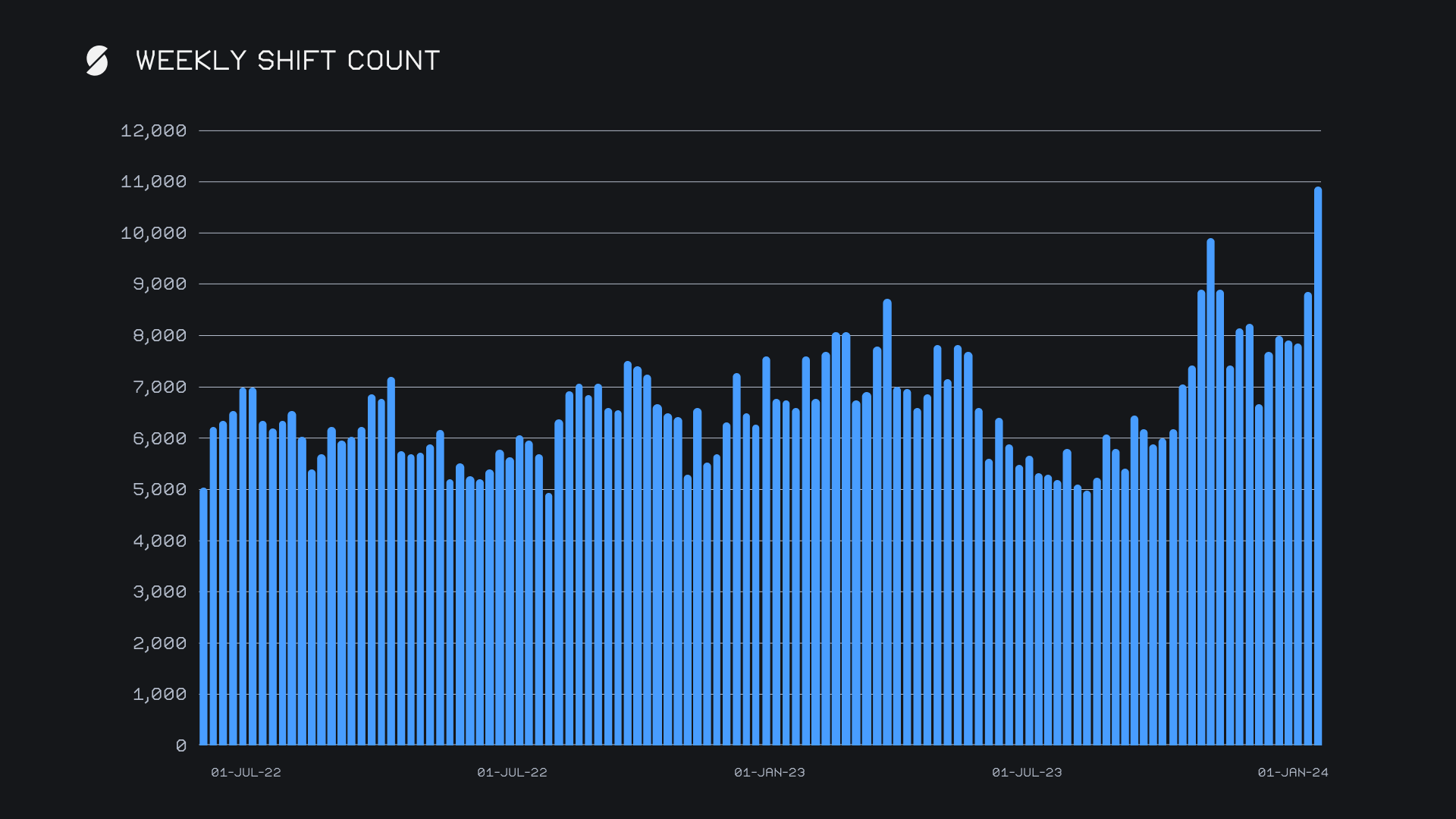

SideShift had a record shattering week, ending with a gross volume of $24.5m (+98.1%). For some perspective on the magnitude of this increase, throughout the entire month of November 2023 we saw a grand total of $29.1m. This sharp upwards move easily pierced through our previous gross weekly volume high of $16.1m, which was set back in May 2022. Alongside this significant volume increase was a +22.1% jump in weekly shift count, which surpassed the 10k mark for the first time and ended with a total count of 10,887. This was another all-time high, climbing past our previous record of 9,883 which was achieved just a few months ago in December, 2023.

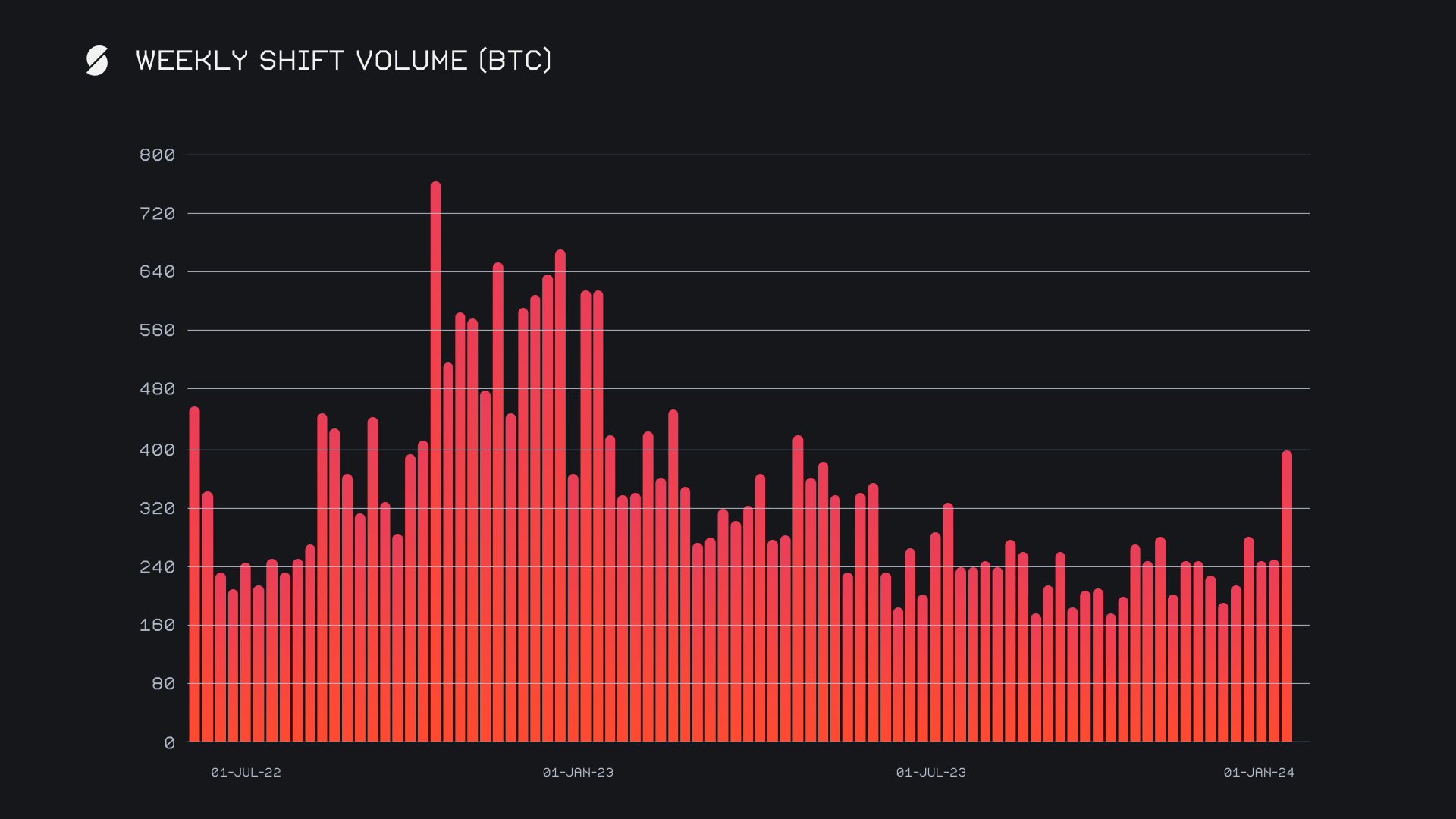

Together these weekly totals combined to produce impressive daily averages of $3.5m on 1,554 shifts. When denoted in BTC, our weekly volume amounted to a total of 390.88 BTC, a solid increase of +65%. We can note a nice weekly bar in the chart below due to the fact that our weekly volume in USD increased at a faster rate versus BTC’s price. This BTC volume total has only been surpassed a handful of times in the previous 15 months, and was only significantly exceeded back in late 2022, which marked the bear market lows for BTC’s price.

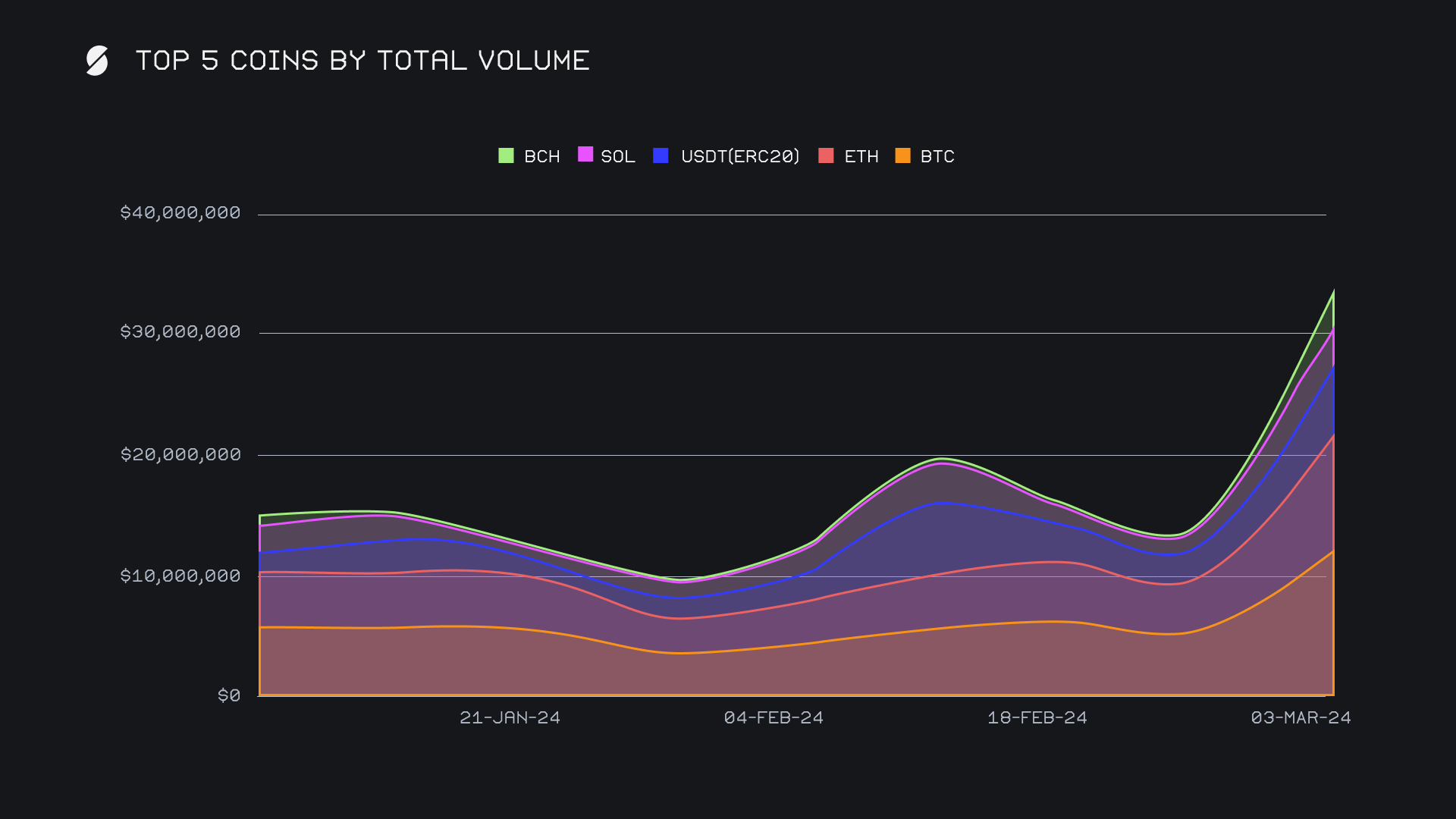

Our top 5 coins made a steep incline this week with 4 out of 5 seeing their weekly volume double, or more. Maintaining its position in first was BTC, as it finished with a total volume of $12.3m (+120.5%) in a show of dominance. Similar to last week, this breakdown was quite skewed to favor deposits, as user BTC deposits ended with a total $6.2m (+139%). This compared to a +85% jump in user BTC settlements, which ended ~$2.3m lower with a total of $3.9m. This settlement sum still proved to be the highest among all coins, although other top coins such as ETH and USDT (ERC-20) trailed very close behind.

ETH ranked second overall and finished the week with a total volume of $8.5m (+98%). It was the only top coin which didn't see its total volume at least double, although it was very close to doing so. Here, the breakdown between deposits and settlements was quite even, with only a $200k difference between the sides. Still, as we have outlined in previous reports, it was user settlements which had the slight edge and finished with $3.7m (+86%). USDT (ERC-20) followed in third with a total volume of $7.3m (+160%), which was less evenly spread and heavily driven by user settlements. User settlements for USDT (ERC-20) spiked +170% for just over $3.7m, which was nearly enough to rank as our most demanded coin, BTC. Our top two coin pairs for the week were BTC/USDT (ERC-20) with $2.6m, and BTC/ETH with $1.3m, further explaining the flow of top coins. Together here, about ⅔ of user BTC deposits were shifted to either USDT (ERC-20) or ETH.

As compared to last week, our top 3 coins accounted for ~57% of the weekly total volume, about 5% higher than last week’s proportion. Although dominance increased here, we still saw other coins make substantial moves. Fourth placed SOL rose +104% for a total $3.4m, while BCH made a comeback and rocketed +707% for a fifth placed, $2.5m finish. This came after several months of its total volume remaining rather dormant, down near the low 6 figure range. Certain coins outside of the top 10 had even more drastic moves, with several recording more than 10x increases on their total weekly volume. Examples include USDC on Polygon with $399k (a 23x), as well as dog themed coins DOGE, SHIB and WIF, all of which watched their total volume increase from from the sub ~$2k mark, to as high as $300k in the case of DOGE.

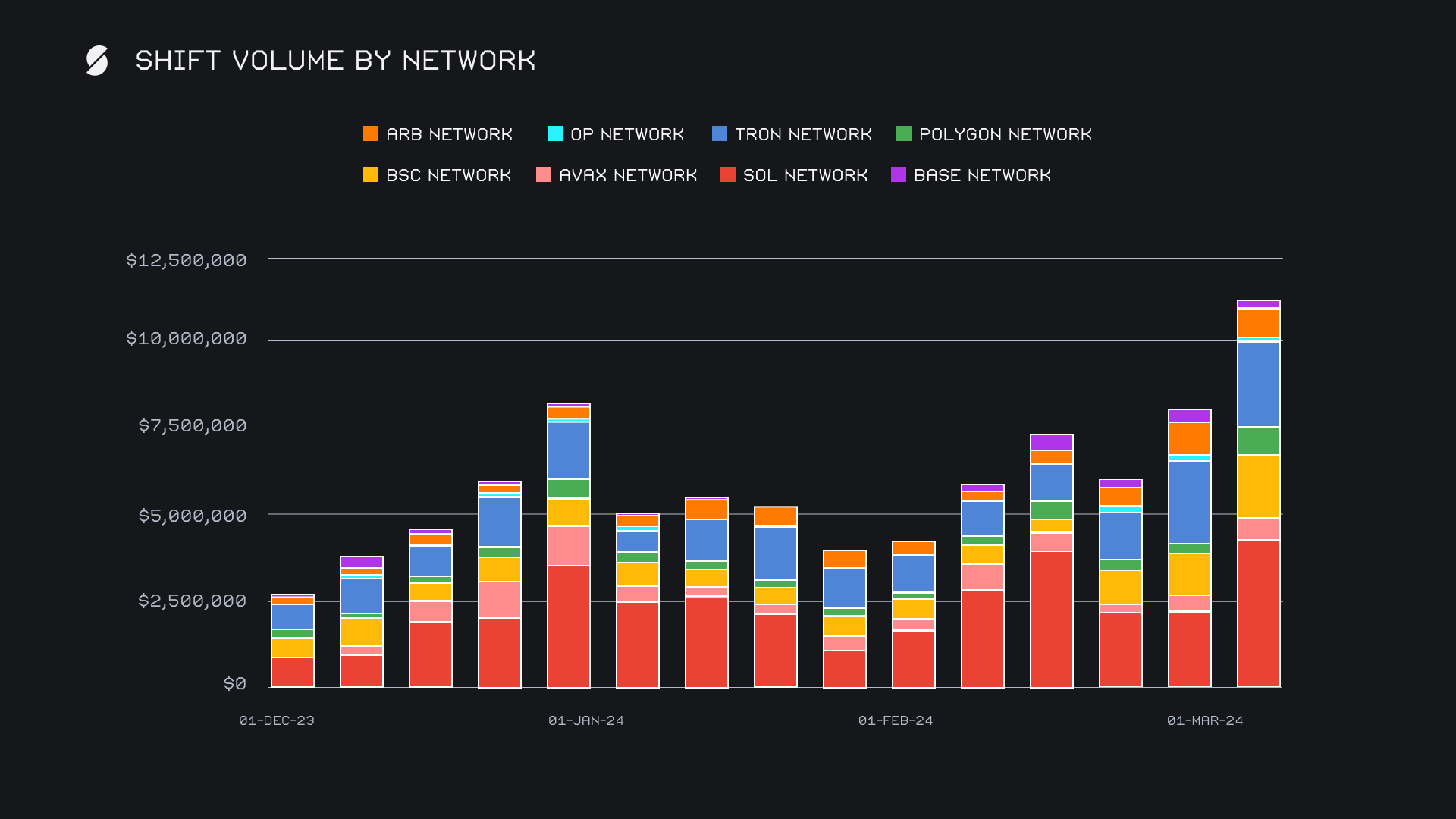

Alternate networks to ETH were no exception to the upwards momentum and ended with a cumulative total of $11.2m, a nominal increase of +39%. Although this still was a respectable change, when looking at their combined proportion of the total, we can note a -9.7% decrease. This meant that a coin on an alternate network to ETH was used in 22.9% of weekly shifts, indicating that a heavier focus was placed on the Ethereum network and other top coins such as BTC this week.

Five out of our eight alternate networks to ETH incurred a weekly volume increase, led once again by the Solana network. The native SOL coin accounted for a vast majority of this volume, however USDC on Solana enjoyed a +85% boost in overall shift volume as well. The result was the Solana network ending with $4.3m (+94%). In second place was the Tron network with $2.5m, just a +2.1% rise from last week’s sum. In third came the Binance Smart Chain (BSC) network with $1.8m (+55%). The Polygon network ended with the highest change among all, rising +148% for a sum of $805k. Conversely, the Arbitrum, Optimism and Base networks all saw weekly declines, with Optimism and Base falling more than -30%.

Affiliate News

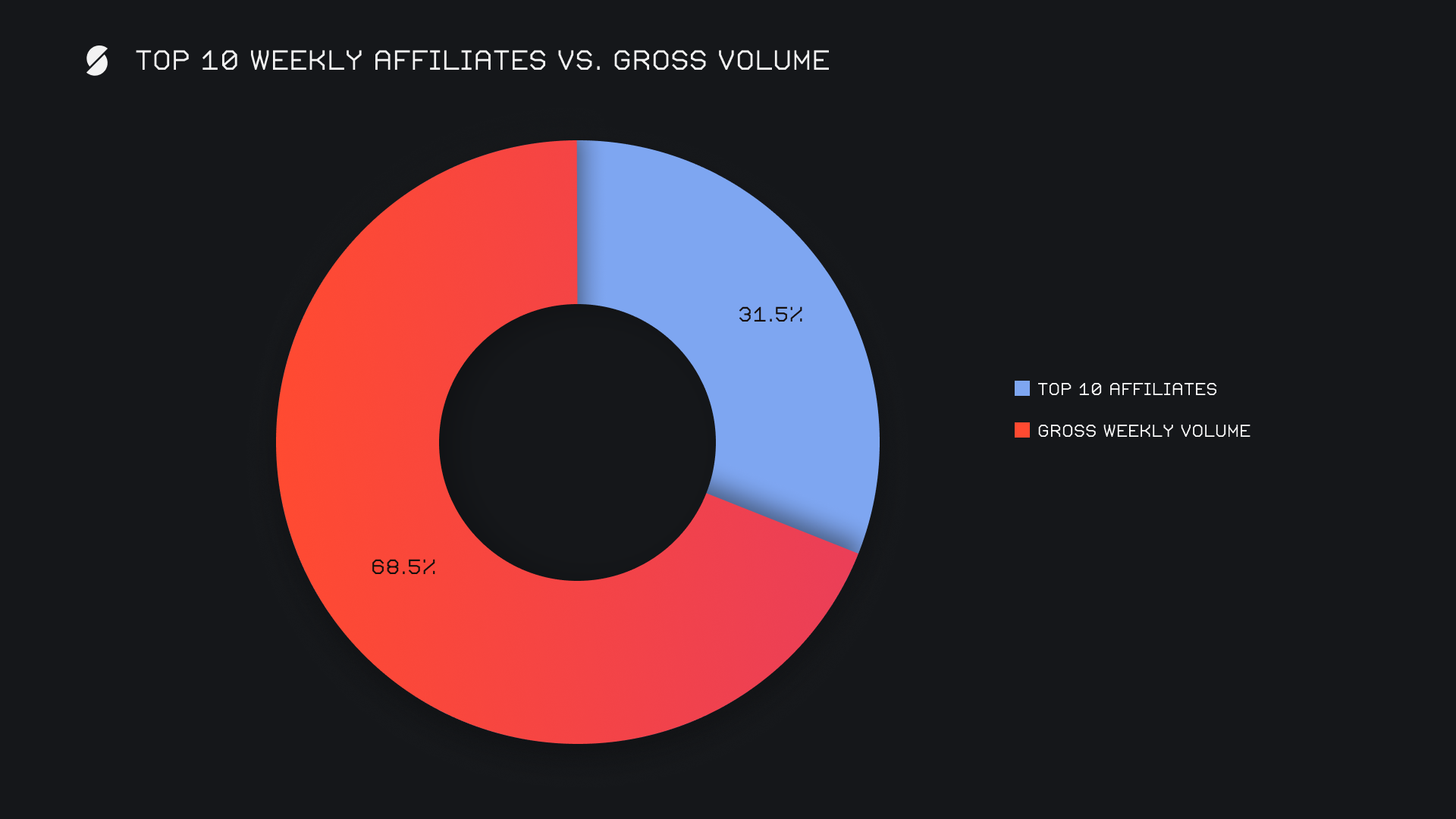

Our top affiliates had some serious moves and saw their cumulative volume increase at a faster rate than our weekly total volume overall. This resulted in a combined sum of $7.2m, a whopping +143.5% rise from last week’s nominal sum. The battle for first place is ongoing, as we once again had a new leader - this is the third week in a row that the title of first place has changed. Our new top placed affiliate showed the most significant growth, rising +354% for $3.5m. Second and third placed affiliates still had a very good week, and ended with respective totals of $2.2m (+180%) and $1.4m (+29%).

All together, our top affiliates represented 31.5% of our weekly volume, +5.8% higher than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.