SideShift.ai Weekly Report | 27th June - 3rd July 2023

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the sixty-first edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the sixty-first edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

XAI Token Market Update

This week SideShift token (XAI) bounced within the fairly tight 7 day range of $0.1108 / $0.1180. At the time of writing, the price of XAI is sitting at the upper ends of that bound with a price of $0.1176. The current market cap of XAI is $14,153,455 (-0.8%) as denoted on our Dune Dashboard.

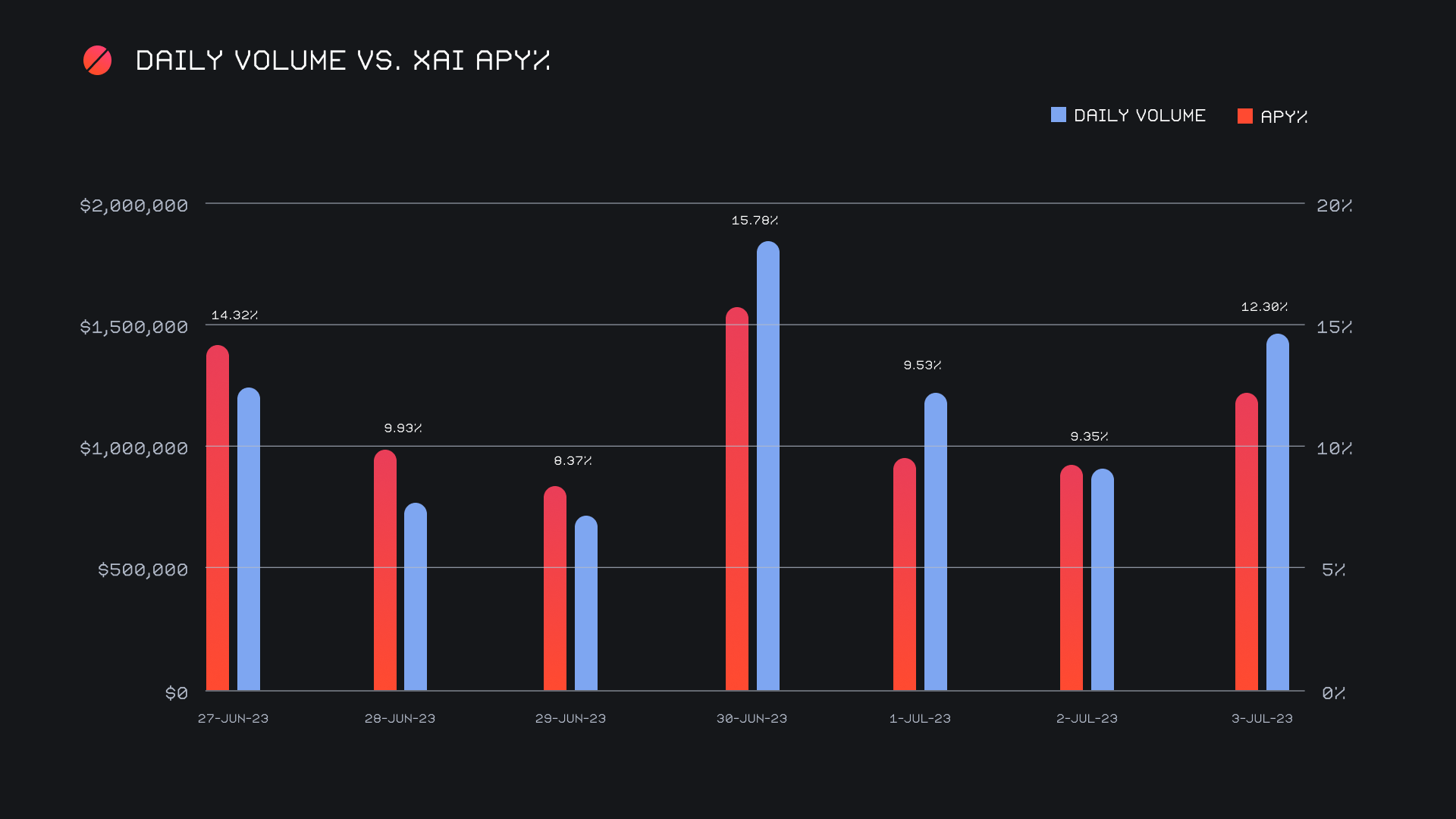

XAI stakers were rewarded with an average APY of 10.88% this week, with a daily rewards high of 42,864.85 XAI (an APY of 15.78%) being distributed to our staking vault on July 1st, 2023. This was following a daily volume of $1.9m. This week XAI stakers received a total of 219,966.04 XAI or $25,615.71 USD in staking rewards.

An additional 50 ETH was added to our treasury last week, bringing us past the $5m milestone. Currently the sum is sitting at a value of $5.1m. Users are encouraged to follow along with live treasury updates directly on DeBank.

Additional XAI updates:

Total Value Staked: 104,904,809 XAI (-0.8%)

Total Value Locked: $12,021,587 (+0.7%)

General Business News:

The past 7 days saw fairly positive sentiment disseminate throughout the broader market. Most coins encountered a steady upwards climb as they approached the week’s end, with some well into double digit gains.

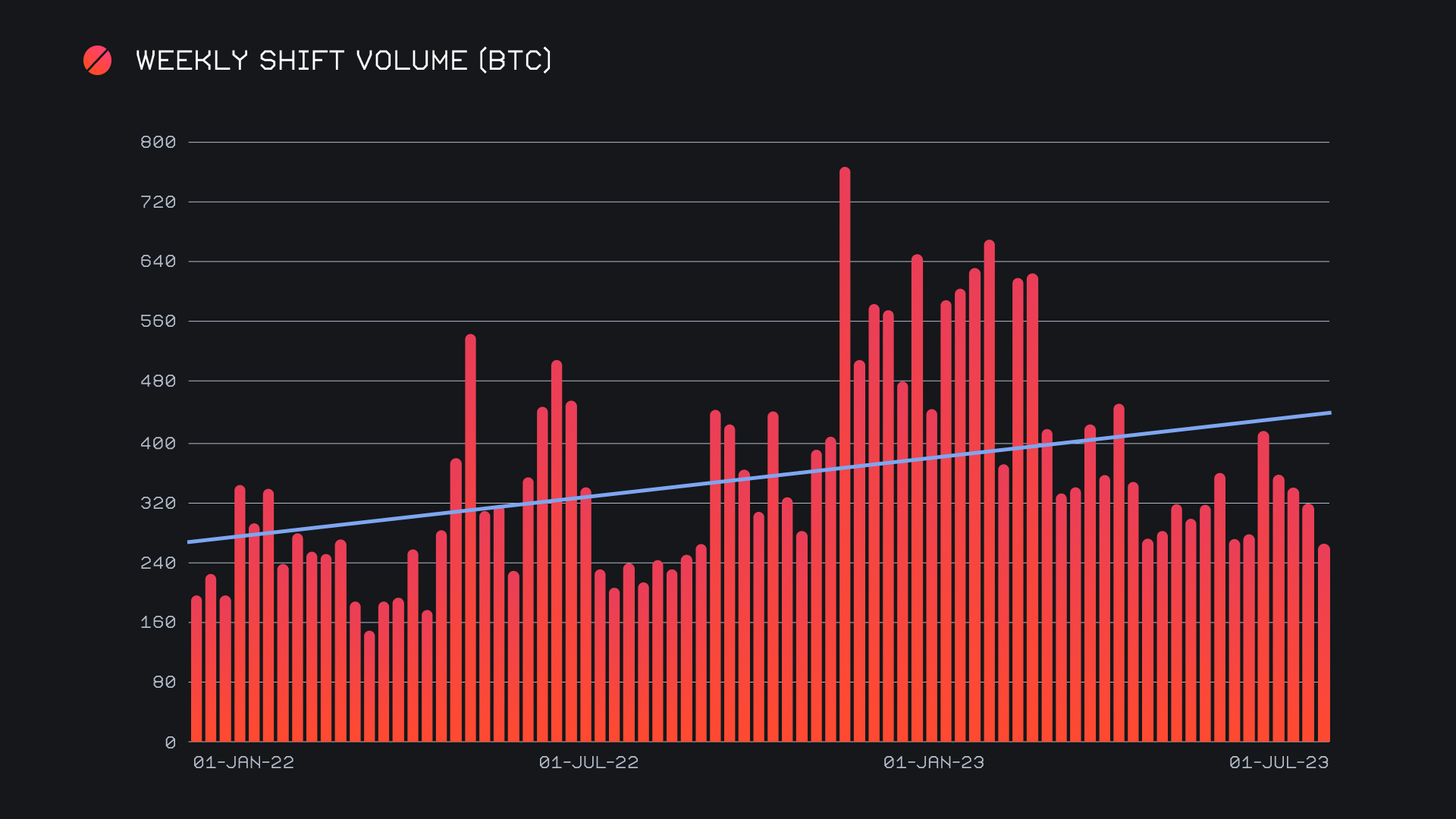

SideShift ended the period with a gross volume of $8.2m (-13.2%) alongside a shift count of 7,756 (+1.6%). These figures combined to produce daily averages of $1.2m on 1,108 shifts. When denoted in BTC, our weekly volume summed to 267.13 BTC (-15.6%), a slightly larger decrease as compared to the USD denomination due to both the appreciation in BTC’s price and lower overall volume.

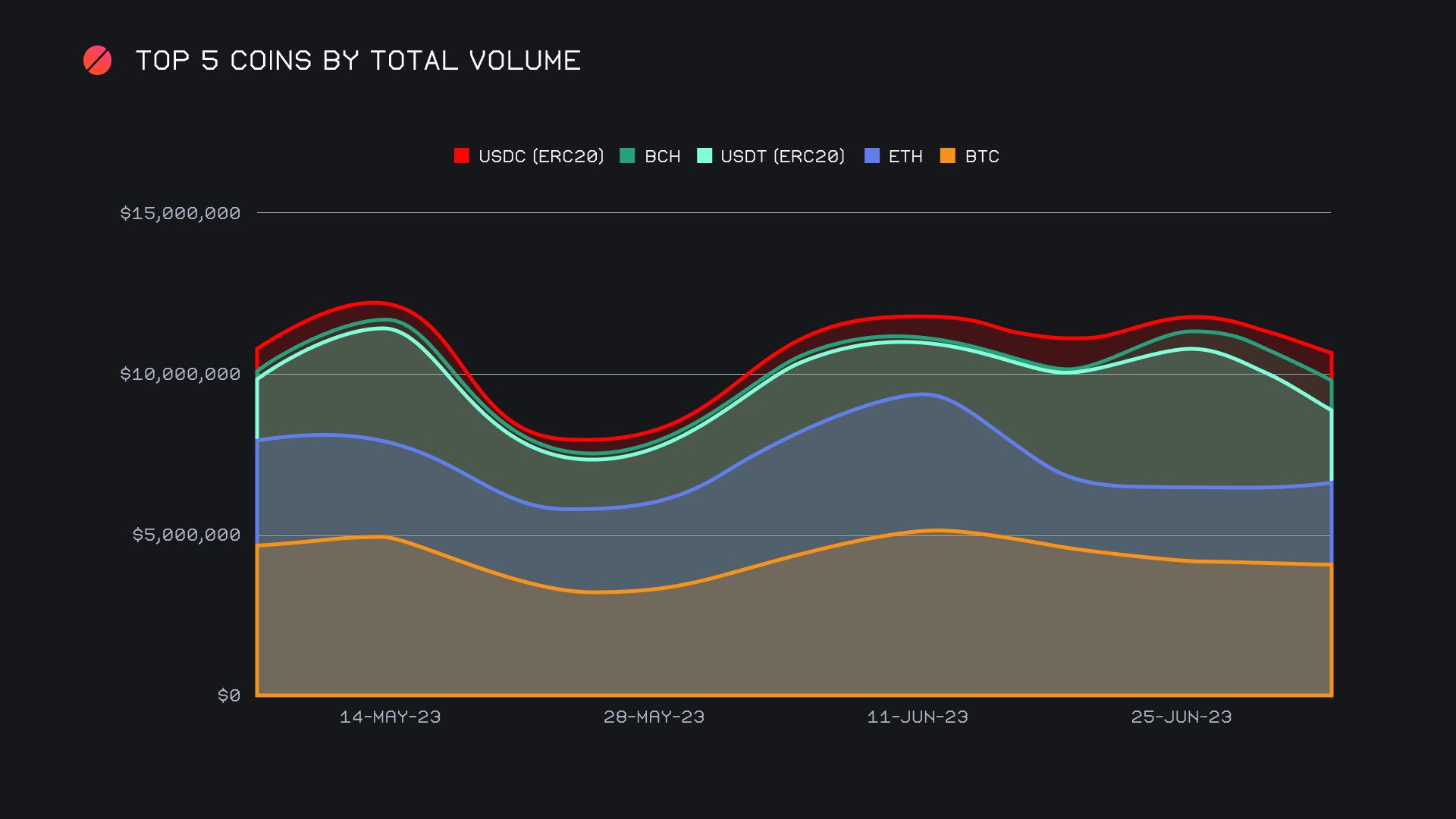

Whereas last week saw stablecoins capture the spotlight to be the focal point of shifting, this week the attention mainly rotated back to BTC. With a total volume of $4.1m (-2.2%), it reclaimed the top spot among our most shifted coins. This predominantly derived from the settlement side, with user BTC settlements summing to $1.7m, despite only having a modest percentage gain of 1.8%. ETH was no slaggard in this category either, placing second in total volume with a sum of $2.5m (+11.4%). Opposite to BTC however, this stemmed from user deposits, which grew a respectable 25.9% for a total of ~$1m. Interestingly, the top pair for ETH deposits was ETH/BTC, which yielded a weekly volume of $366k. Although a slight decline in nominal BTC volume, its return as the top coin in the wake of a few weeks of heavy stablecoin centric shifting may suggest the dawn of a new day.

All together our top 5 coins combined to produce a slight downtrend, the major factor here being the near 50% decline incurred by USDT (ERC-20). You can visualize this in the chart below. It is however worth noting the gains seen in coins outside of the top 5. A few examples include the total volume of SOL increasing 63.7% for a net $691k, in addition to DASH, which exploded over 18x for $869k. Coins on the ARB network also saw increased attention, with ETH (ARB) up 188% for $382k, and USDC (ARB) rising 497% for $203k. So not only does it appear that shifting is revolving back around to BTC, but also spreading out among certain altcoins.

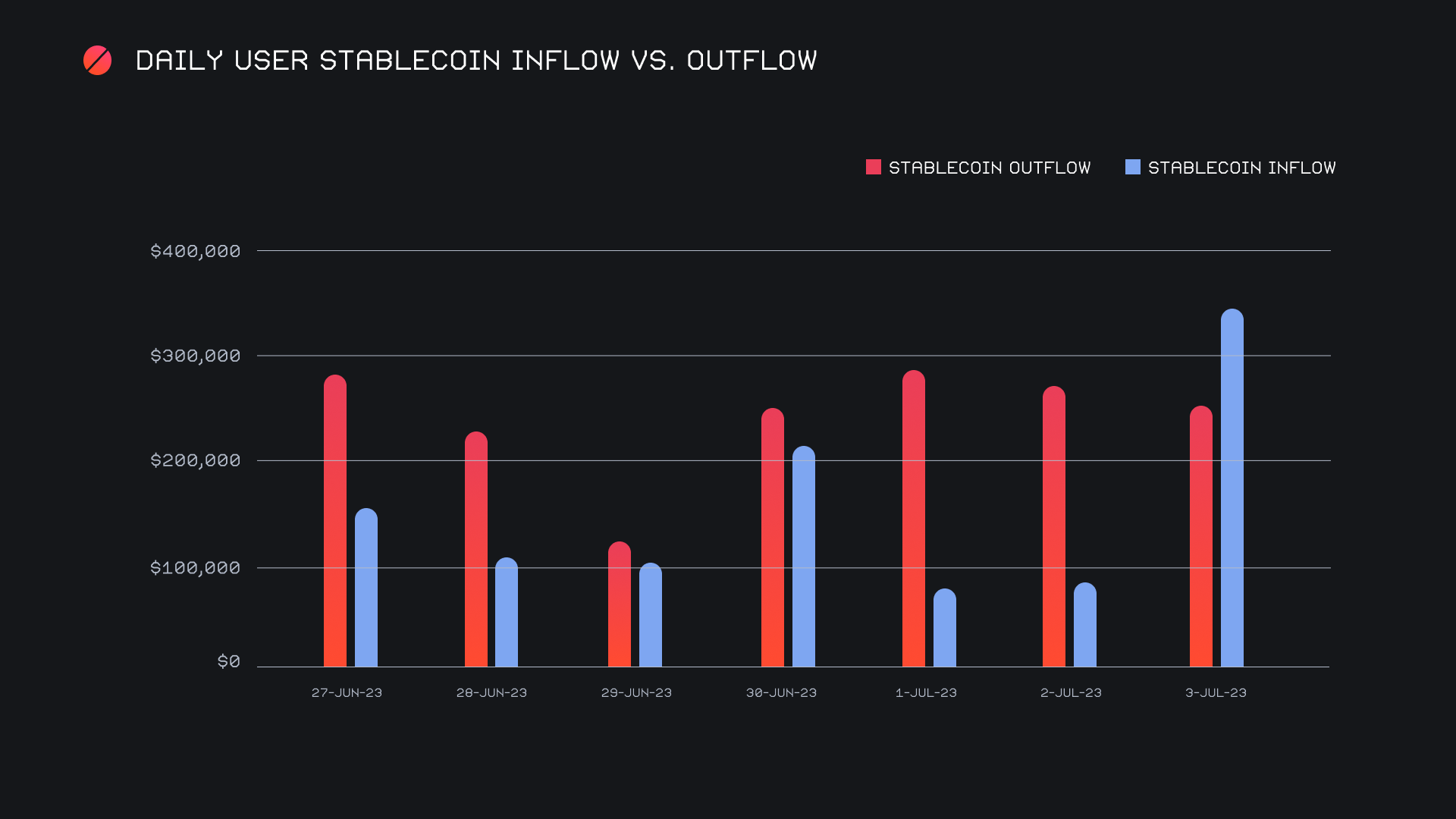

Coinciding with the increased shifting of some coins which typically are considered less popular was an overall decrease in stablecoin shifting. Combined stablecoin deposits fell by $727k, with stablecoin settlements declining by a similar amount of $750k. In percentage terms, these were respective drops of -39.4%, and -29.5%. Because these declined in unison, stablecoin settlement volume continues to exceed that of deposits. This week, our net stablecoin outflow summed to $675k. What is particularly eye catching here is the daily breakdown. In the bar chart below, you can notice the influx of deposits received (inflow) on July 3rd, 2023. This was the highest daily stablecoin volume for both deposits and settlements, and came at a time when the market was pumping. This aligns with the notion that perhaps the fear is beginning to dissipate, as users are beginning to step in and buy coins.

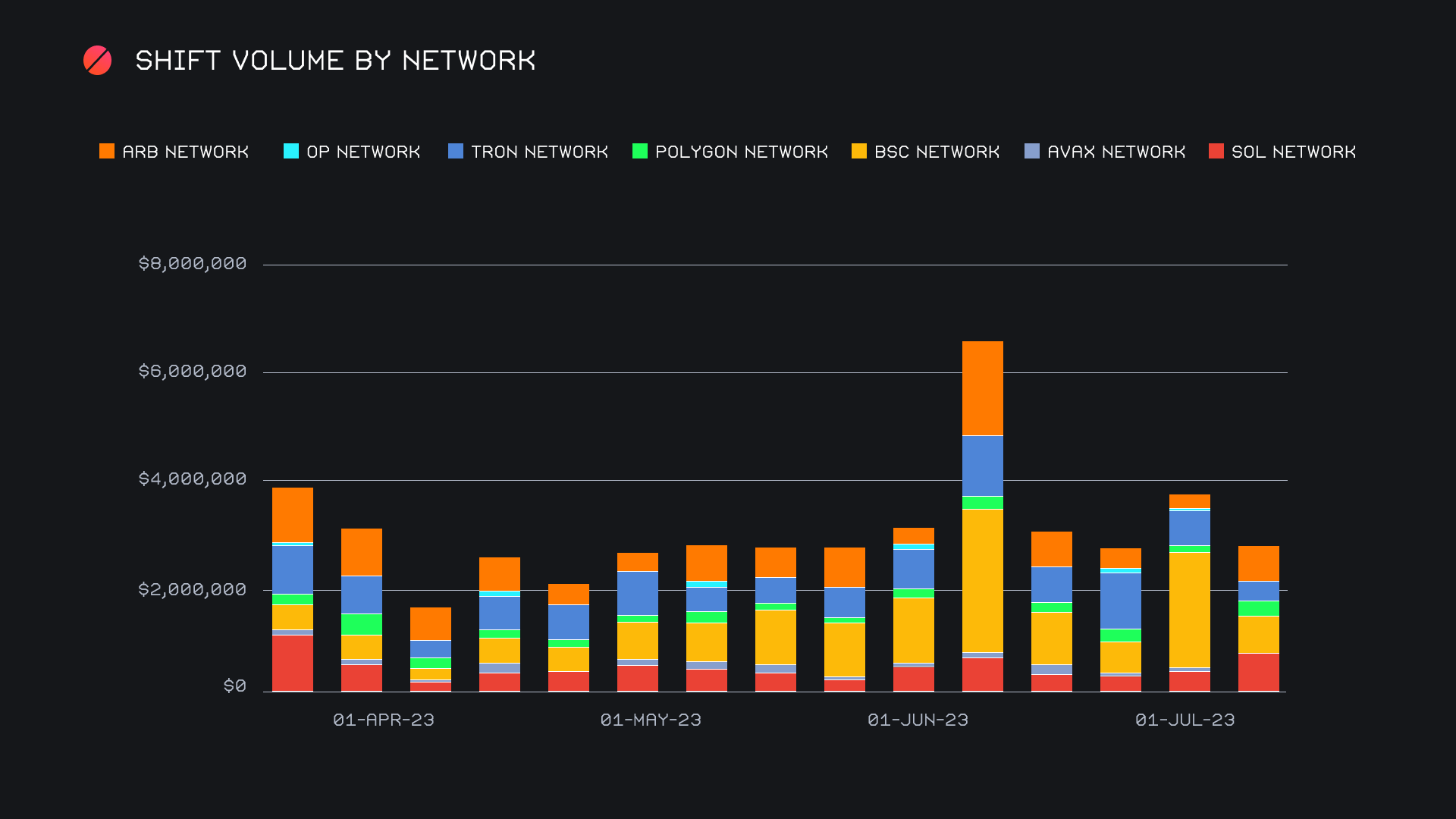

When looking at alternate networks to ETH, we can observe quite a shakeup when compared to the previous week. Following a massive surge, last week’s top network of Binance Smart Chain (BSC) declined sharply, free falling by 68.9%. It rounded off the period with a net $665k which was enough to secure second place. This is because the main catalyst behind last week’s volume (USDT on BSC) encountered far less shifting this week - last week’s deposit influx appeared to be an anomaly. Instead, the SOL network had a nice jump of 65.3% and secured the top spot with a respectable $804k. In third was the ARB network, as it rose by 148.6% to sum $608k. As previously mentioned, the majority of this derived from the shifting of ETH (ARB). Uncharacteristically, the TRON network finished outside of the top 3 networks. A weekly decline of 40.5% produced a volume of just $387k, uncommon for a network which has surpassed $1m multiple times in the past. Here once again, the decline occurred due to a significant decrease in stablecoin shifting, USDT (TRC-20) in this case. All together, shift volume on alternate networks to ETH summed to $~2.7m, approximately $1m less than the previous week.

Affiliate News

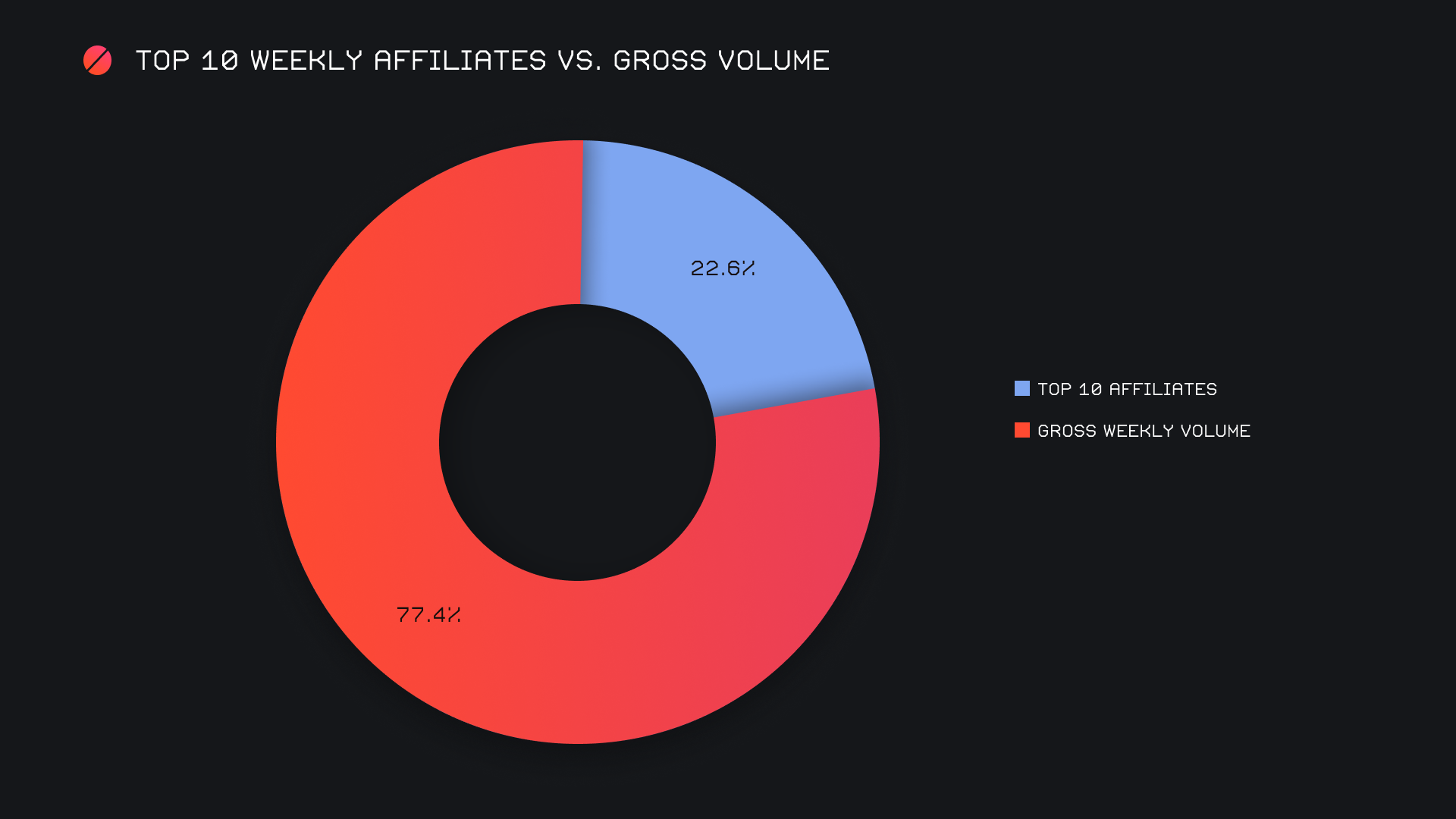

Our top 10 affiliates had quite a solid week, rounding off the period with a combined sum of $1.9m (+16%). This occurred alongside a shift count which also grew, as it increased 12.4% for a total 2,280 shifts. Once again, our top affiliate came in very strong and played a big role in the numbers achieved. It represented 15.3% of the week’s total volume, and an impressive 20.4% of total shift count.

Overall, our top 10 accounted for 22.6% of the week’s gross volume, 5.7% higher than last week’s proportion.

That’s all for now. Thanks for reading, happy shifting and we’ll see you next time.