SideShift.ai Weekly Report | 28th October - 3rd November 2025

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one hundred and seventy-eighth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and seventy-eighth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

- SideShift volume rose +12.4% to $9.34m, rebounding from last week’s yearly low as overall activity picked up.

- XAI staking rewards totaled 183,221 XAI ($25,082) at an average 7.07% APY, remaining steady week to week.

- BTC led all coins with $3.02m (+12.0%), maintaining a wide lead even as 11 of the top 15 assets recorded double-digit gains.

- USDT (TRC-20) surged +76.8% to $2.19m, the largest increase among top coins, while the ERC-20 version dropped −14.4%.

- Alternate networks climbed to $7.01m (+21.7%), driven by Solana and Tron, and accounted for roughly 80% of total shift count.

XAI Weekly Performance & Staking

XAI traded between $0.1298 and $0.1382, and spent the week moving mostly sideways near the $0.14 mark before easing to $0.1328 yesterday. That left the token’s market cap at $20.38m (−3.82%), a modest retreat after two weeks of uneventful action. The move places XAI back at levels last seen earlier this spring, before its summer climb toward the $0.18 area.

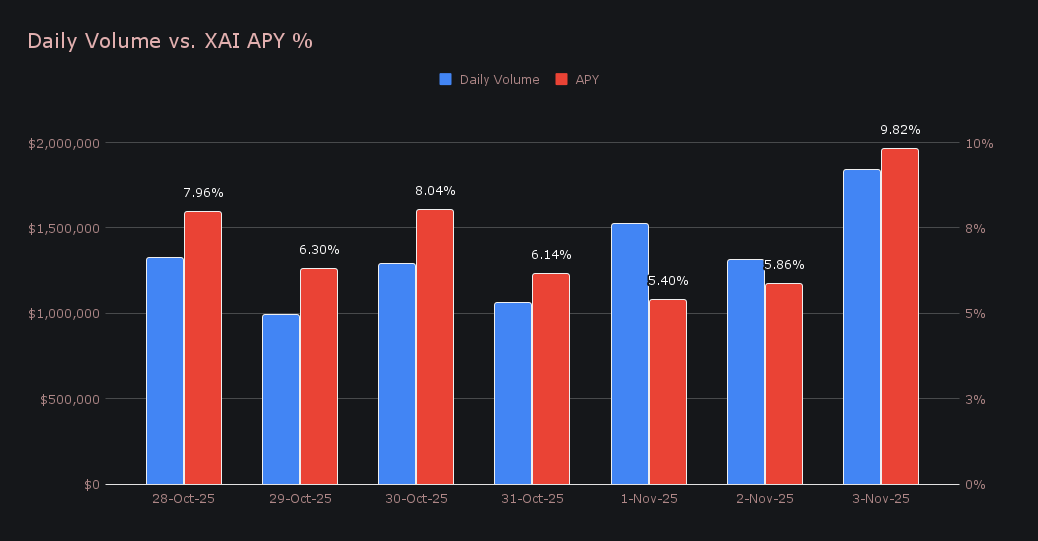

A total of 183,221.38 XAI ($25,082.07) was distributed to stakers, with an average APY of 7.07%, nearly unchanged from last week’s 7.01%. The most active day came on November 3, when 35,915.18 XAI was sent to the staking vault at a 9.82% APY, backed by $1.84m in daily shifting volume. Yields continue to track closely with site volume, which has remained on the lighter side in recent weeks, keeping rewards modest but steady.

SideShift’s treasury is sitting at an estimated current total value of $28,259,611. Users are encouraged to follow along with live treasury updates, via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 140,048,199 XAI (+0.1%)

Total Value Locked: $18,463,219 (−4.2%)

General Business News

The crypto market saw a dramatic bifurcation this week, with Decred (DCR) and Dash (DASH) posting triple-digit gains, as DCR surged nearly +140% in just 24 hours. Zcash (ZEC) also continued its remarkable run, climbing past $449 to mark a seven-year high and extend its streak of explosive weekly growth. Meanwhile, the rest of the market told a very different story, as BTC slipped below $105k and ETH fell beneath $3,500, dragging almost everything lower. The Crypto Fear & Greed Index plunged to 21/100 (Extreme Fear), reflecting a market that remains fragile and deeply uncertain beneath the surface.

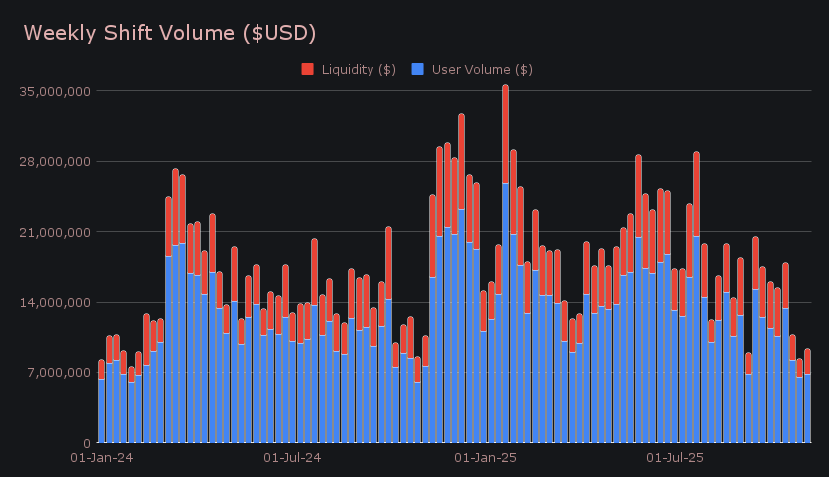

SideShift activity bounced higher this week, with gross volume up +12.4% to $9.34m after bottoming out last week at a yearly low. The move was driven by a +5.2% rise in user shifting to $6.86m, with an additional $2.48m (+38.8%) added in liquidity shifting, as internal rebalancing picked up particularly around ETH and SOL flows. The week’s leading user pairs, USDT (TRC-20)/BTC ($327k), BNB/SOL ($203k), and TON/BTC ($168k), underscored a broader trend outlined in the last report, showing that recent upticks are being powered more by breadth than size.

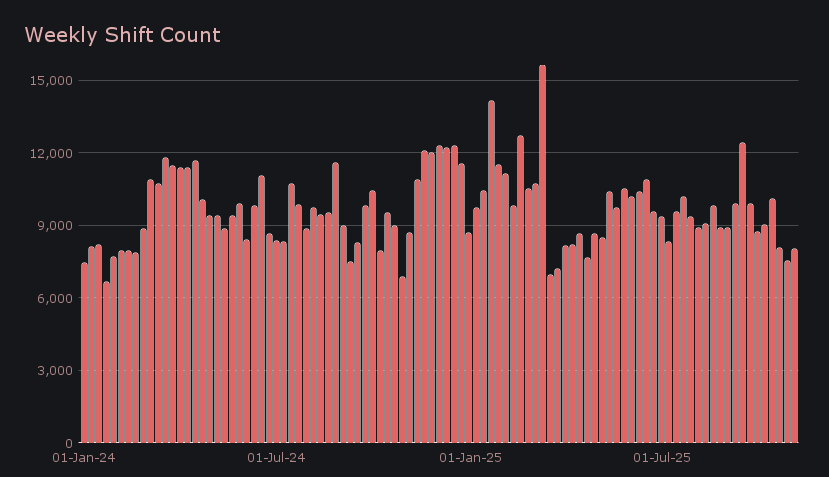

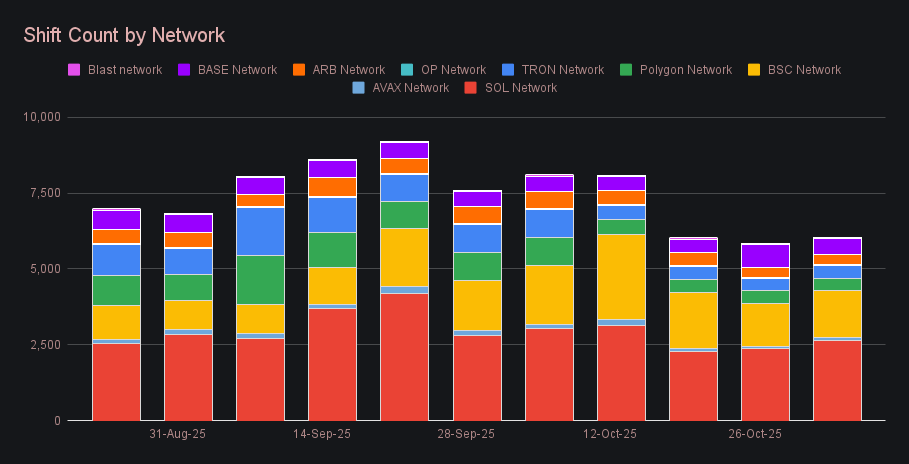

Shift count rose to 8,031 (+6.9%), averaging 1,147 per day, a positive improvement but still sitting about −17% below the running YTD average. Large-scale shifts remain sparse for the time being, with their combined volume down by more than half over the past month. This week brought a minor rebound as market volatility returned, boosting overall platform turnover and reaffirming the link between active price swings and increased shifting activity. Average daily volume finished at $1.33m, broadly consistent with SideShift’s current pacing in quieter market conditions.

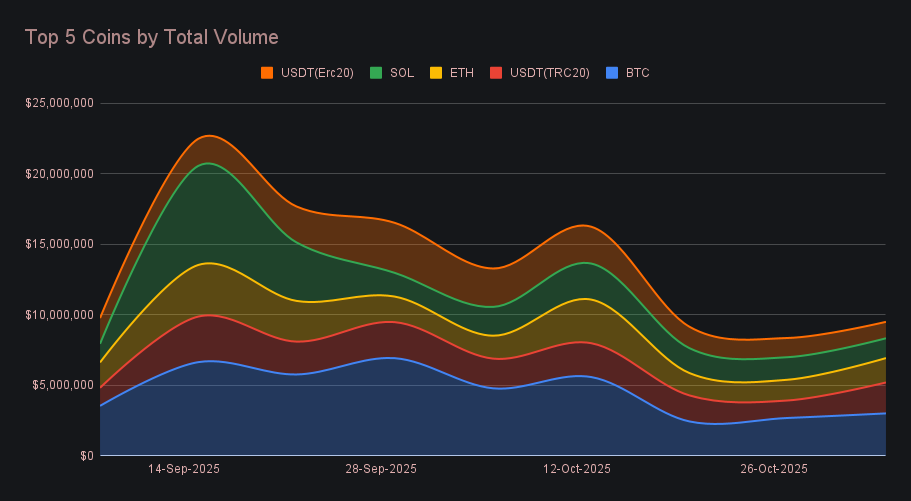

BTC held the top spot for another week with $3.02m (+12.0%) in total volume, continuing a slow upward climb over the past two periods. The split between deposits and settlements remained nearly even, with $1.02m (+0.9%) and $1.23m (−3.1%), respectively, though the latter has been hovering around recent lows. BTC still led all coins on SideShift by a clear margin, even as net totals remain lower than typical levels seen through much of the year. Notably, 11 of the top 15 coins recorded double-digit volume gains this week, yet BTC maintained its lead comfortably, highlighting its ability to retain dominance even as activity broadened across the board.

After falling to a yearly low last week, USDT (TRC-20) snapped back sharply, ranking second overall with $2.19m (+76.8%) in total volume. Deposits climbed to $601k (+43.0%), and settlements reached $789k (+39.5%), making it the single biggest gainer among all top coins. Its strong move widened the distance from USDT (ERC-20), which came fifth at $1.17m (−14.4%). The ERC-20 variant saw both deposits ($433k, −16.6%) and settlements ($446k, −33.1%) continue to retreat, erasing much of the steadiness it displayed earlier in October. Together, the two stablecoins again defined opposite ends of the spectrum, one rebounding decisively from a low, the other sliding further back, as the balance of stablecoin flow shifted firmly toward Tron for the week.

ETH and SOL once again occupied neighboring ranks and rounded out our top coins, though their paths diverged this time. ETH climbed to $1.73m (+17.6%), supported by $806k (+2.6%) in deposits and $588k (+19.7%) in settlements. The pickup marked a clear improvement from last period, with both sides of the shift rising together. ETH edged back ahead of SOL after trailing for the past two reports, though both have posted relatively weak gross volumes across that span. SOL finished at $1.40m (−12.2%), with user deposits ($562k, −0.1%) and settlements ($729k, −1.1%) effectively unchanged. It was an underwhelming performance overall but still enough to secure a place within the top five.

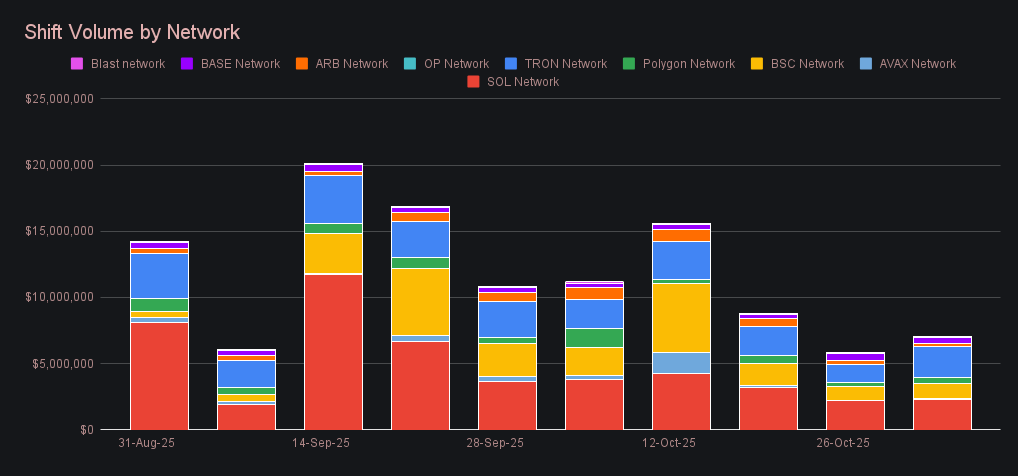

Alternate networks to Ethereum combined for $7.01m (+21.7%), recovering part of last week’s drawdown. Solana again led the group with $2.34m (+4.3%), supported by nearly $900k in stablecoin shifts alongside continued SOL activity. Tron followed closely at $2.31m (+68.0%), its strongest tally in several weeks, bolstered by renewed movement in USDT (TRC-20). BSC ranked third at $1.19m (+13.7%), maintaining steady weekly inflows that kept it firmly within the top three alt networks.

Further down the list, Polygon posted a solid increase to $414k (+57.8%), whereas Base declined to $451k (−11.0%), and Arbitrum fell to $268k (−8.8%). Collectively, alternate networks finished higher than the Ethereum network’s $4.48m (−1.0%), as activity remained quiet and largely unchanged. Alt networks also continued to dominate user participation, accounting for roughly 80% of total shift count this week (6,458 of 8,031).

SideShift introduced support for Meteora (MET) this week, marking the latest addition to its growing roster, with more listings on the way.

Affiliate News

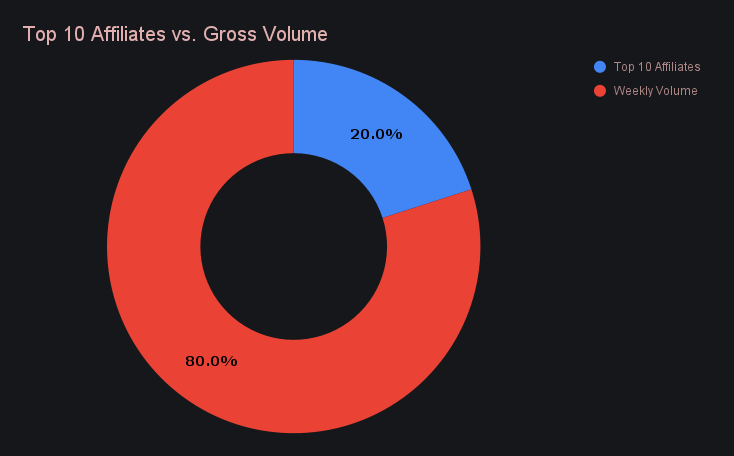

Affiliate volume climbed meaningfully this week, combining for $1.87m (+30.6%) in total. First place led with $490k (+31.1%), while two newcomers claimed the next spots at $329k (+57.9%) and $306k (+34.9%), marking a clear reshuffle in the leaderboard. All of the top five affiliates recorded gains above 20%, a welcome sign of renewed traction even if overall levels remain well below those seen earlier in the year.

In total, affiliates accounted for 20.0% of SideShift’s volume (+2.8%), signaling a steady rebound in partner-driven shifting.

That’s all for now - thanks for reading and happy shifting.