SideShift.ai Weekly Report | 29th April - 5th May 2025

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one hundred and fifty-second edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and fifty-second edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

- Volume stable at $19.5m, matching the 5-week range and landing within 2% of the YTD average.

- BTC led with $10.8m in volume, maintaining dominance for the fifth straight week and marking a clear departure from March’s lower levels.

- Tron network outpaced Solana for the third straight week with $4.7m in volume.

- Telegram bot surpassed $350k in total volume, with a new record $29k single deposit.

- Top affiliate hit a record $6.59m across 1,602 shifts, the highest ever for any affiliate.

XAI Weekly Performance & Staking

This past week, SideShift token (XAI) traded within a 7-day range of $0.1192 to $0.1459, gradually moving lower as it continued to establish a new price range beneath the levels seen earlier in April. After some brief upward movement in the middle of the week, the price declined once again and now sits at $0.1251. As a result, XAI’s market cap now totals $18,337,638 (−6.53%), down from last week’s figure of $19,619,657.

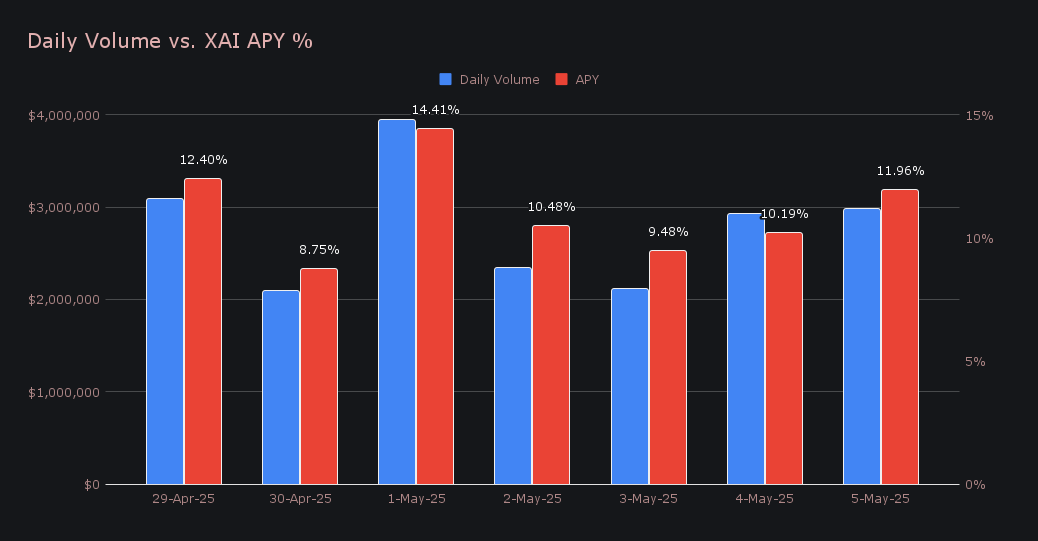

Staking activity remained steady, with an average APY of 11.10%. The highest daily rewards occurred on May 1, 2025, when 48,944.88 XAI were distributed directly to our staking vault at a daily APY of 14.30%, supported by a volume of $3,939,757. All together, XAI stakers received a total of 267,495.21 XAI or $34,172.96 USD in rewards throughout the week.

An additional 150,000 USDC was sent to SideShift’s treasury over the course of the week, bringing the current total to a value of $19.85m. Users are encouraged to follow along directly with treasury updates at sideshift.ai/treasury.

Additional XAI Updates:

Total Value Staked: 132,935,429 XAI (+0.2%)

Total Value Locked: $16,595,798 (−6.4%)

General Business News

This past week was broadly uneventful across majors, with BTC, ETH, and SOL all closing within a few percent of where they opened. BTC ended flat at $94.3k (+0.0%), ETH dipped to $1,800 (-0.3%), and SOL slipped slightly by a few percent. Meanwhile, the Fear & Greed Index sits at 59 and continues to bounce between Neutral and Greed, reflecting the market’s sideways drift.

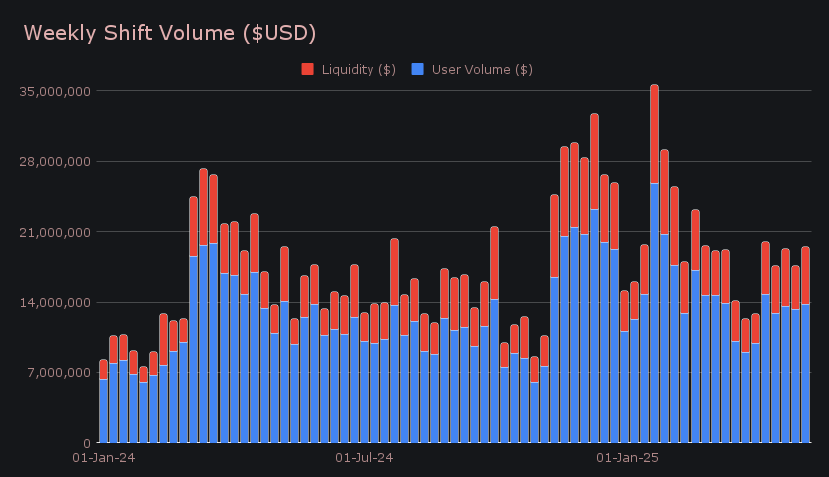

SideShift recorded a gross weekly volume of $19.5m (+10.8%), continuing with a steady stretch of volume following a local low in late March. Since then, weekly totals have consistently hovered between $17m–$19m, with the latest figure landing within 2% of our YTD average. User shifting contributed $13.8m (+4.0%), while liquidity shifting climbed to $5.7m (+31.9%), driven in large part by ongoing, one-sided demand for USDT (ERC-20), which has firmly maintained its role as the platform’s leading stablecoin. BTC/USDT (ERC-20) once again topped user shift pairs with $2.01m, marking its eighth first-place finish in the past 10 weeks, followed by ETH/BTC with $1.24m.

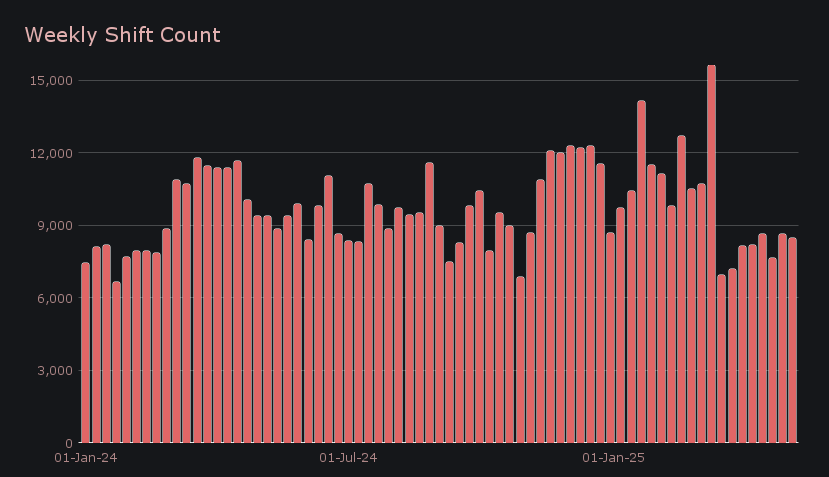

Our gross shift count edged down to 8,500 (-1.8%), settling into a more typical range after following the one-off spike seen a few months ago. Compared to volume, which has shown more pronounced week-to-week movement, weekly count has followed a flatter trend, often landing within the 8,000–9,000 mark throughout the past year. This range has become increasingly common, while the larger swings in volume suggest that growth is often driven by generally larger shift sizes rather than an uptick in shift count. Together, this week’s figures resulted in daily averages of $2.78m across 1,214 shifts.

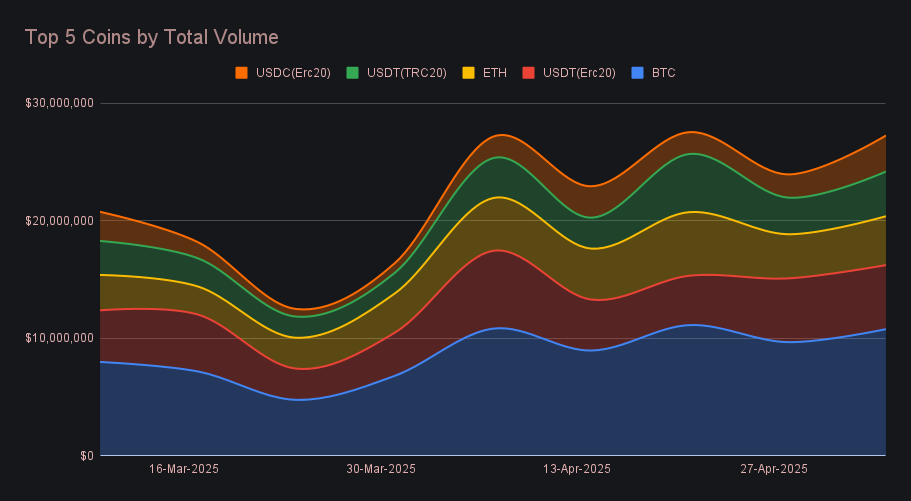

BTC held firm at the top with $10.8m in total volume (+11.4%), marking its fifth straight week above $10m - a dominant run that reflects a clear break from the lower volumes seen throughout March. User deposit volume slipped -4.1% to $3.8m, while settlements increased +12.1% to $4.2m, continuing a broader trend in which BTC is more often being shifted into than out of. While it still remains one of the most common deposit coins, particularly in stablecoin pairs, overall demand to receive BTC has consistently outweighed supply in recent weeks.

USDT (ERC-20) followed with $5.4m in total volume, increasing slightly (+0.5%) despite a sharp -37.0% drop in deposits, which ended at just $934k. This figure was more than offset by a +9.3% rise in settlements to $2.7m, continuing a clear trend of one-way demand that has held for several consecutive weeks. That directionality has made it a mainstay in SideShift’s top user shift pairs and cemented its status as the preferred stablecoin among users. In contrast, volumes for USDT (TRC-20) and USDC (ERC-20) have shown more sporadic activity with weekly volumes that vary sharply, often driven by short bursts of action rather than continuous flow.

ETH returned to third place with $4.2m in total volume (+10.6%), bolstered by a strong +21.8% rise in deposits to $2.1m, while settlements fell -6.9% to just under $1m. Notably, ETH ranked just sixth in terms of user settlements this week, and the widening gap between deposits and settlements has continued to grow over the course of the past few months. SOL followed closely behind with $3.5m in total volume, as deposits rose +9.6% to $1.9m and settlements slipped -7.7% to $1.1m. For now, SOL appears to be keeping a low profile, with relatively balanced flows and no standout directional trend.

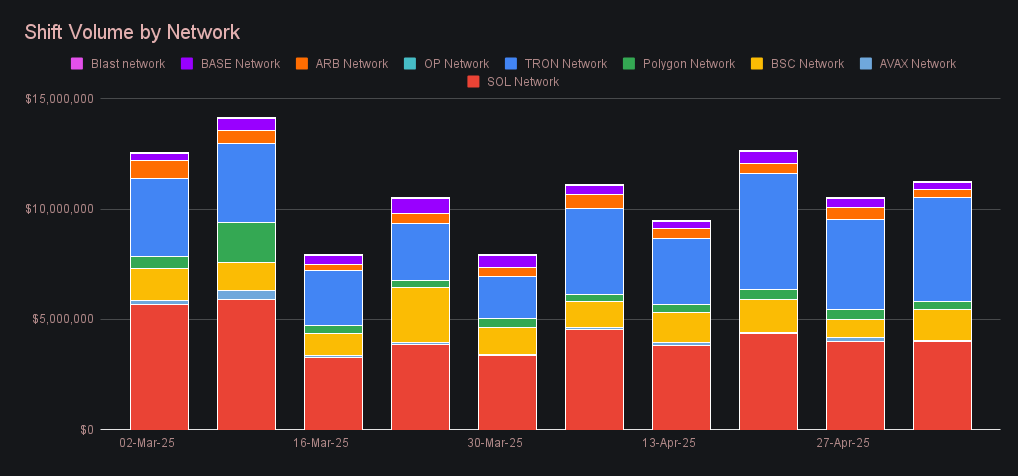

Alternate networks to ETH had a steadier showing this week, with total volume (deposits + settlements) climbing +7.1% to $11.3m narrowly trailing the Ethereum network’s total. The Tron network once again led the group with $4.7m (+15.5%), marking its third consecutive week ahead of the Solana network and signaling a more sustained overtaking of what was previously the dominant network. The Solana network followed with $4.0m (+0.1%), managing to hold its ground but continuing to lack the surges in activity that defined its earlier performance this year. The Binance Smart Chain network bounced back with a +67.9% gain to $1.4m, reclaiming momentum after last week’s drop. Meanwhile, Arbitrum and Avalanche saw declines, while the Base network dropped to $338k (-19.6%), marking its lowest in several weeks. Volumes across the smaller networks continue to fluctuate without establishing a consistent trend.

Momentum surrounding our Telegram bot continued to build, with users shifting an additional $56k across 70 deposits in just the past 11 days. That activity pushed total volume since launch beyond $350k, as both the 7-day moving average and linear regression trend continue to slope upward. Deposit frequency has climbed to an average of 6-7 per day, marking a ~20% increase from the previous month. A new all-time high was also set this week for a single deposit, which landed at $29k, a signal of user trust.

Affiliate News

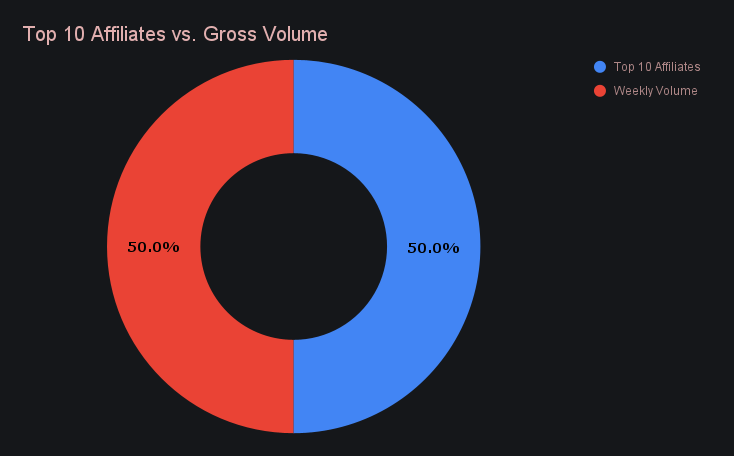

Affiliate activity remained strong this week, with our top affiliates combining for $9.74m in volume (+6.2%), representing exactly 50.0% of the platform’s total. Our first placed affiliate set a new all-time high of $6.59m (+25.5%) across 1,602 shifts (+20%), marking the fifth consecutive week above $5m and the highest weekly total ever recorded by any affiliate. Meanwhile, our second placed affiliate fell to $1.68m (-35.9%), while third place followed with $506k (-14.5%). Just outside the top three, our fourth and fifth placed affiliates posted +73% and +120% volume gains respectively, highlighting a broader uplift in affiliate-driven shifting.

That’s all for now. Thanks for reading and happy shifting.