SideShift.ai Weekly Report | 2nd - 8th April 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the ninety-ninth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the ninety-ninth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

SideShift token spent the week moving within the 7 day price range of $0.1815 / $0.1882. It rounded off the period on a positive note and rose beyond the $0.19 cent mark - at the time of writing the price of XAI is sitting at a price of $0.1914 and has a current market cap of $25,415,551 (+3.6%).

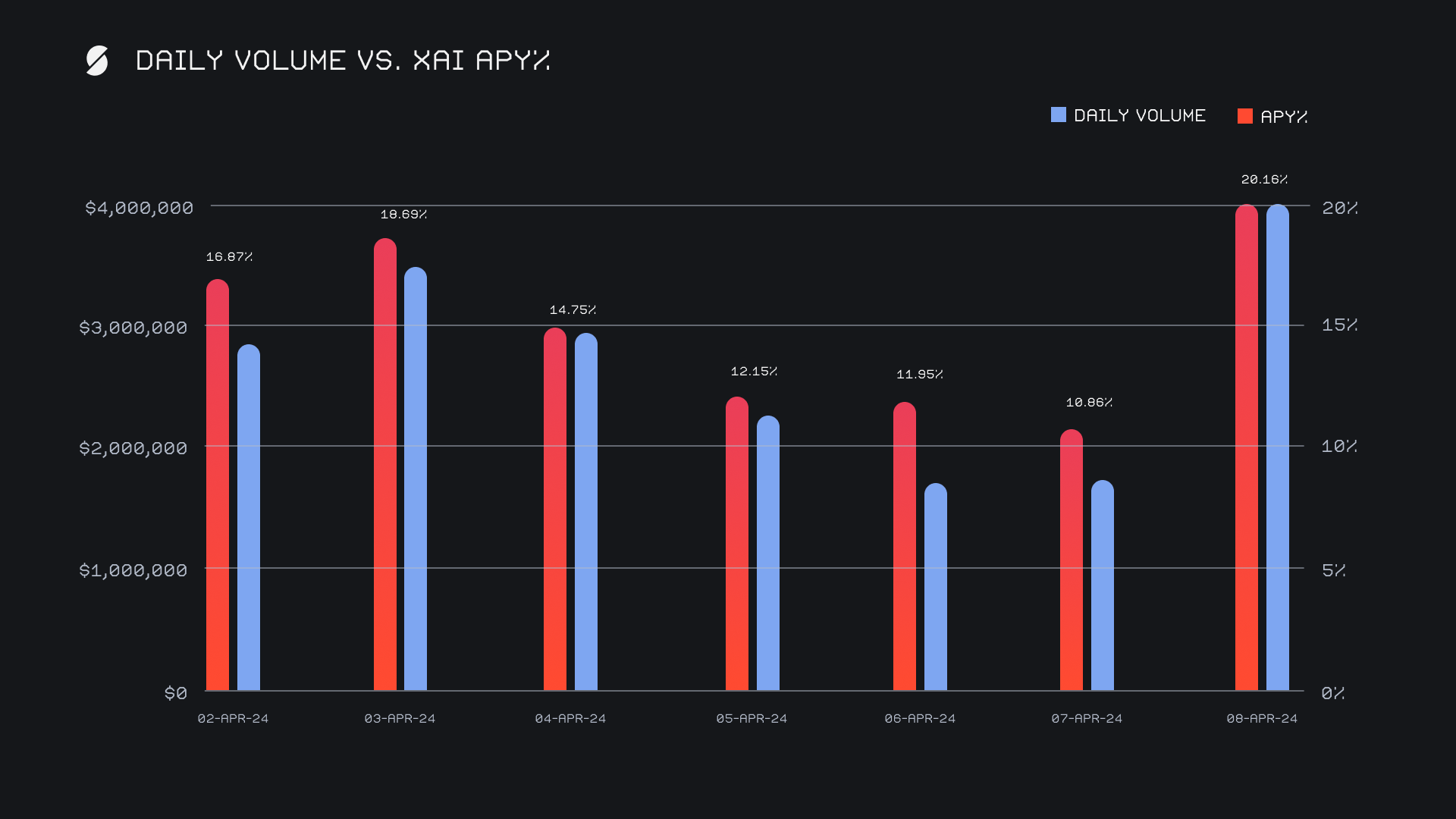

XAI stakers were rewarded with an average APY of 15.06% this week, with a daily rewards high of 59,591.16 XAI (an APY of 20.16%) being distributed to our staking vault on April 9th, 2024. This was following a daily volume of $4.2m. This week XAI stakers received a total of 317,333.07 XAI or $60,737.55 USD in staking rewards.

The price of 1 svXAI is now equal to 1.3151 XAI, representing a 31.51% accrual on stakers investments. A friendly reminder that the easiest way to participate in XAI staking is to shift directly to svXAI, from any coin of your choice.

Additional XAI updates:

Total Value Staked: 118,534,769 XAI (+0.3%)

Total Value Locked: $22,375,028 (+5%)

General Business News

April 8th saw BTC reclaim the $70k mark after making a gradual climb throughout the previous week. With the BTC halving looming just around the corner, anticipation is now building as everyone is eager to see the ripple effect it will have on the broader market. An equally prevalent topic of discussion was the intense congestion of Solana, an issue that ruffled some feathers and bogged down the entire network for the latter half of the week.

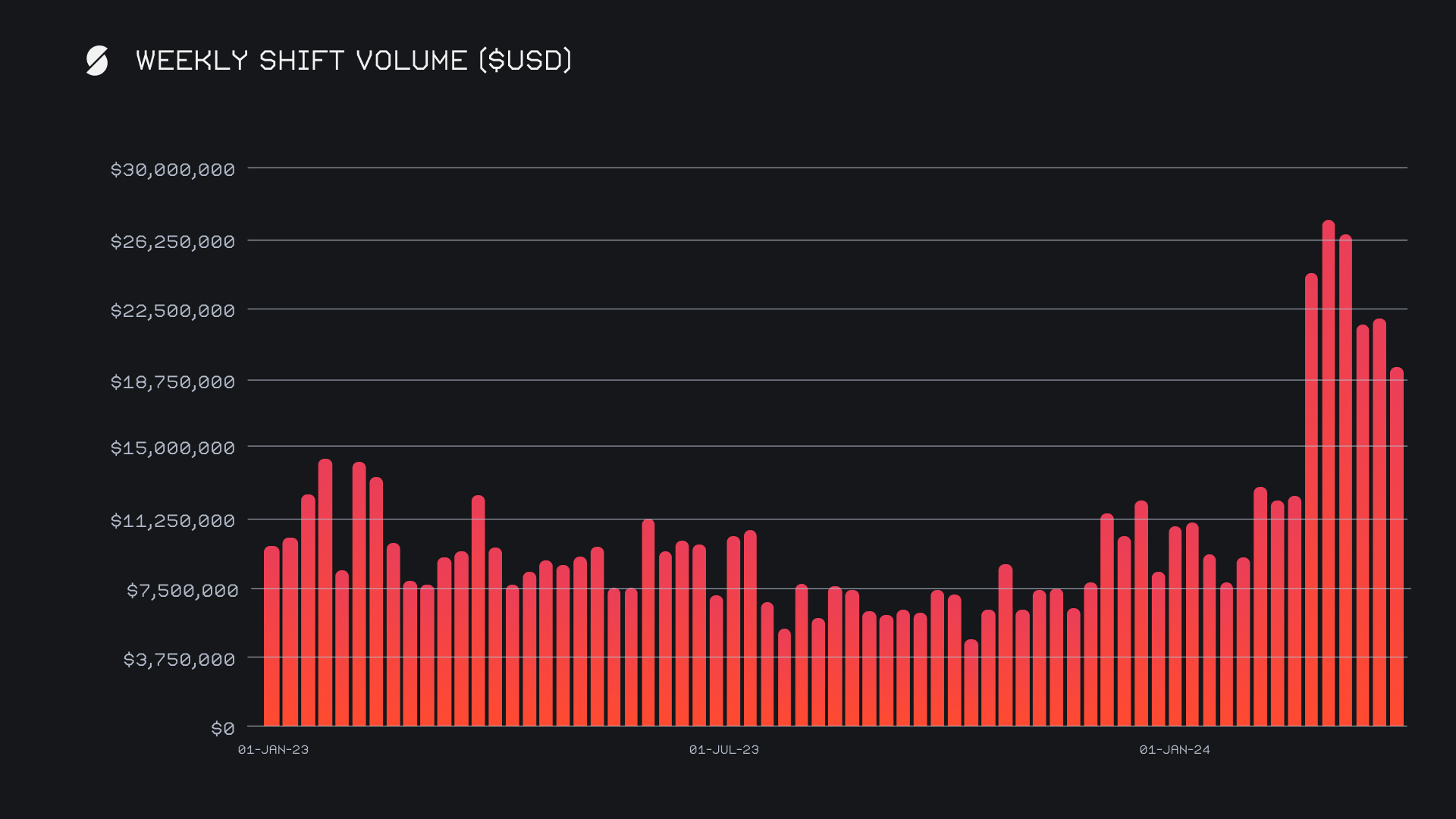

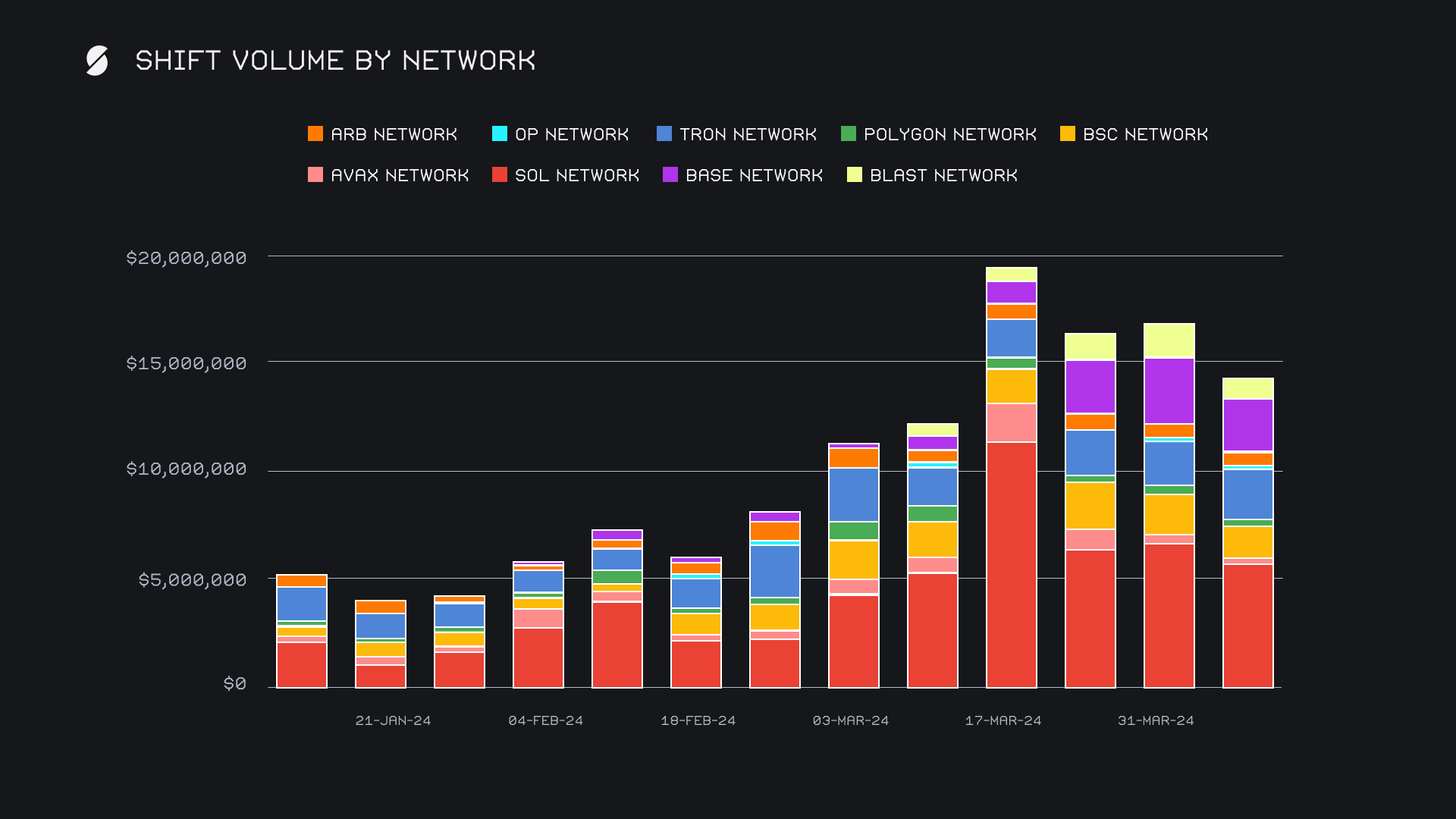

Upon entering this week, SideShift had seen a gross weekly volume that exceeded $20m overall for five consecutive periods. This week ended just shy of that marker with a total $19.1m (-12.8%), representing a bit of a decline, but still a definite indication of continued strength. Specifically, volume deriving from shifts made directly on the site remained rather consistent, but instead, it was our integrations which saw a decrease in weekly shifting. This gross sum occurred alongside a weekly shift count which did not budge and coincidently ended with the exact same total as last week, with 11,368 (+0%) shifts. Together, these figures combined to produce healthy daily averages of $2.7m on 1,624 shifts.

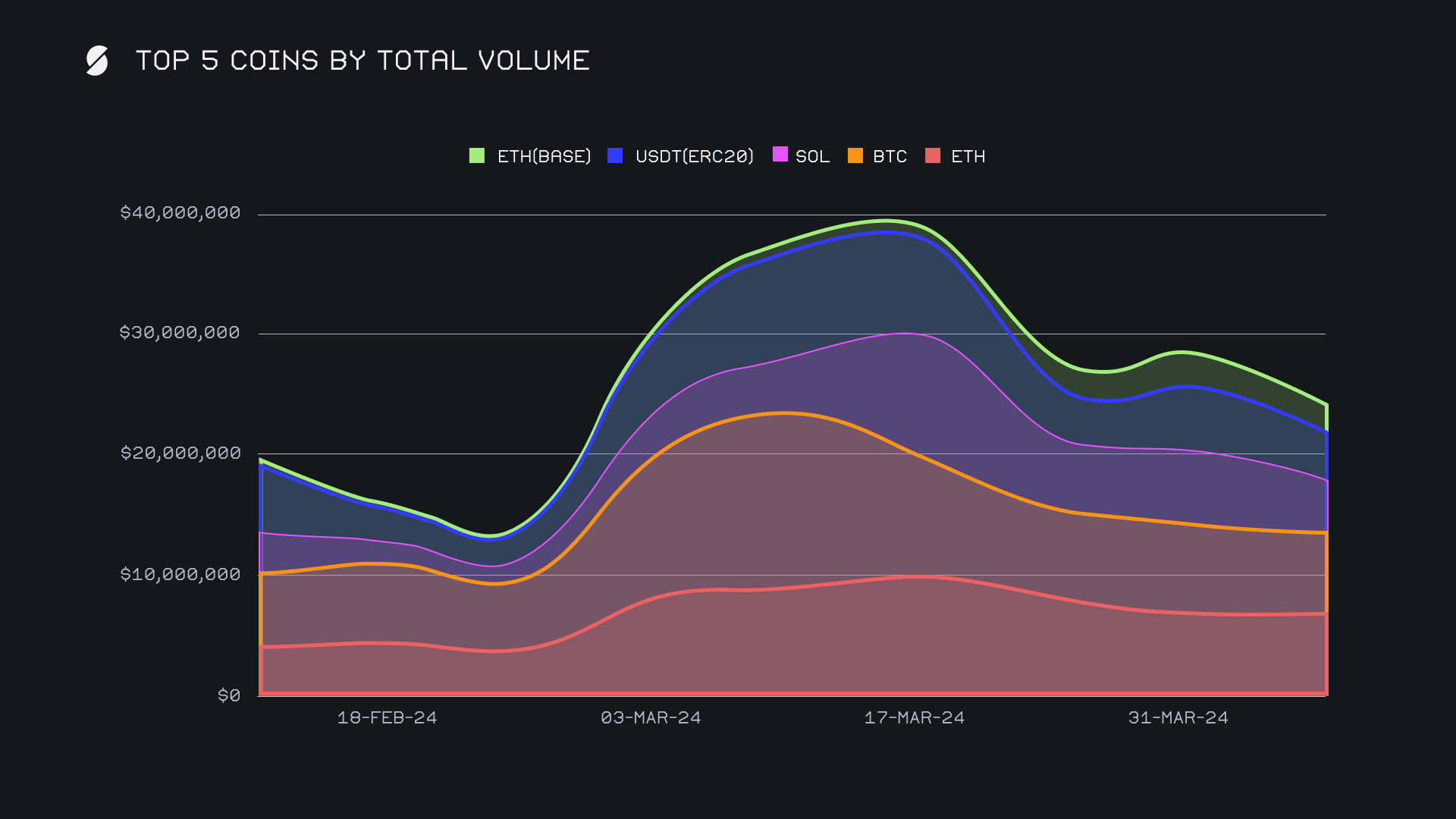

This week’s top 5 coins by total volume (deposits + settlements) didn’t have any new joiners, but did see a slight change in their ordering. ETH managed to grab first place from BTC, doing so with a total volume of $7.1m. Although this amounted to a relatively minor increase of +4.4%, it ended up being the only coin among our top 5 to see a positive change in weekly shift volume. The user demand of ETH was indeed notable, as user settlements outweighed deposits by a measure of $3.4m to $2.5m. In a dominant fashion, this was enough to finish as the week’s most settled coin as it sat ~$1m higher than the runner up. Particularly, it was BTC deposits that flowed into ETH, as this week’s top pair was BTC/ETH with $904k. About 30% of the deposited user BTC volume this week was shifted to ETH.

BTC was demoted to second place, with its total volume falling -11.2% for $6.9m overall. Once again its composition proved to oppose ETH, as BTC user deposits outdid that of settlements by $3.2m to $2.5m. With that, BTC was the week’s most deposited coin by users, a pattern which has only been broken in 1 of the previous 10 weeks. Solana followed in third and summed $4.3m in total volume, representing a drop of -28.4%. Shift count for SOL however fell by just -1.7%, telling us that there was still a very large amount of SOL shifting taking place despite the heavily congested network. SOL ended with a total 3,189 shifts this week, representing the 5th straight week that SideShift has seen more than 3,000 weekly shifts for SOL.

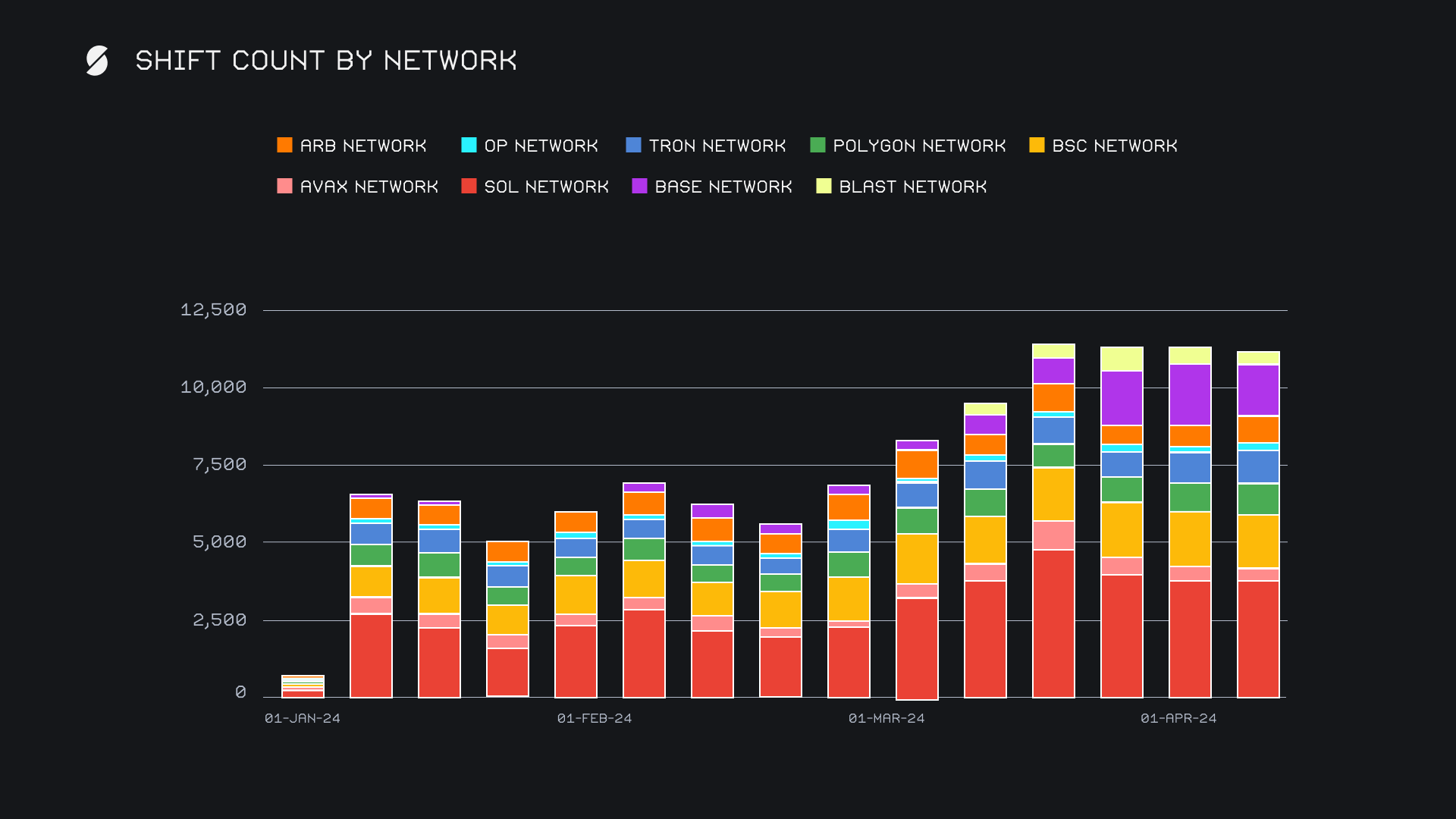

As the Base network continues to gain popularity it also wasn’t a surprise to see ETH (base) retain its place among our top 5. A stable flow of both deposits and settlements kept ETH (base) above $2m for the third consecutive week - it finished with a total of $2.3m (-18.6%), a giant 10x from the weekly volume seen just one month ago. This aided in another solid week for alternate networks to ETH, regarding both volume and shift count. Beginning with the less frequently mentioned of the two, cumulative shift count for alternate networks remains high as ever, even though collective volume has slowed a bit after making a significant run up. Collective shift count for alternate networks to ETH is illustrated in the chart below - here we can observe the steady nature of shift count on alternate networks to ETH, as the combined total has approached all time highs for four weeks in a row. This total count (deposits + settlements) has maintained 11,000+ per week for four weeks, accounting for about ~50% of our shifts overall. Although still led by the Solana network (3,814 shifts), we can note how the Base network has grown over the past few months to now occupy third. It did so this week with a total 1,660 shifts and was only just behind the second placed Binance Smart Chain (BSC) network, which finished with 1,700. Whereas volume for alternate networks to ETH tends to be more concentrated, it remains true that overall shift count is more widespread across networks.

Although the combined volume for alternate networks to ETH fell by -14.8%, its $14.3m sum still managed to surpass that of the Ethereum networks $13.2m. As a percentage of the total, alternate networks to ETH accounted for 37.5% of shift volume as compared to the ETH networks 34.5%. This is a continuation of the trend noted last week, but still remains one of the few times that alternate networks have combined to outperform the Ethereum network. It was a mixed bag, with some networks seeing more volume and some less, but the leaders remained the same. The Solana network led the pack with $5.7m (-15%), followed by the previously mentioned Base network with $2.5m (-22.8%). The Tron network came in third with $2.3m (+8.9%), and was really the only network with significant volume to see a positive weekly change. The only other notable mention is the Blast network, which continues to gain traction - it ended just short of $1m, with a total of $934k.

Affiliate News

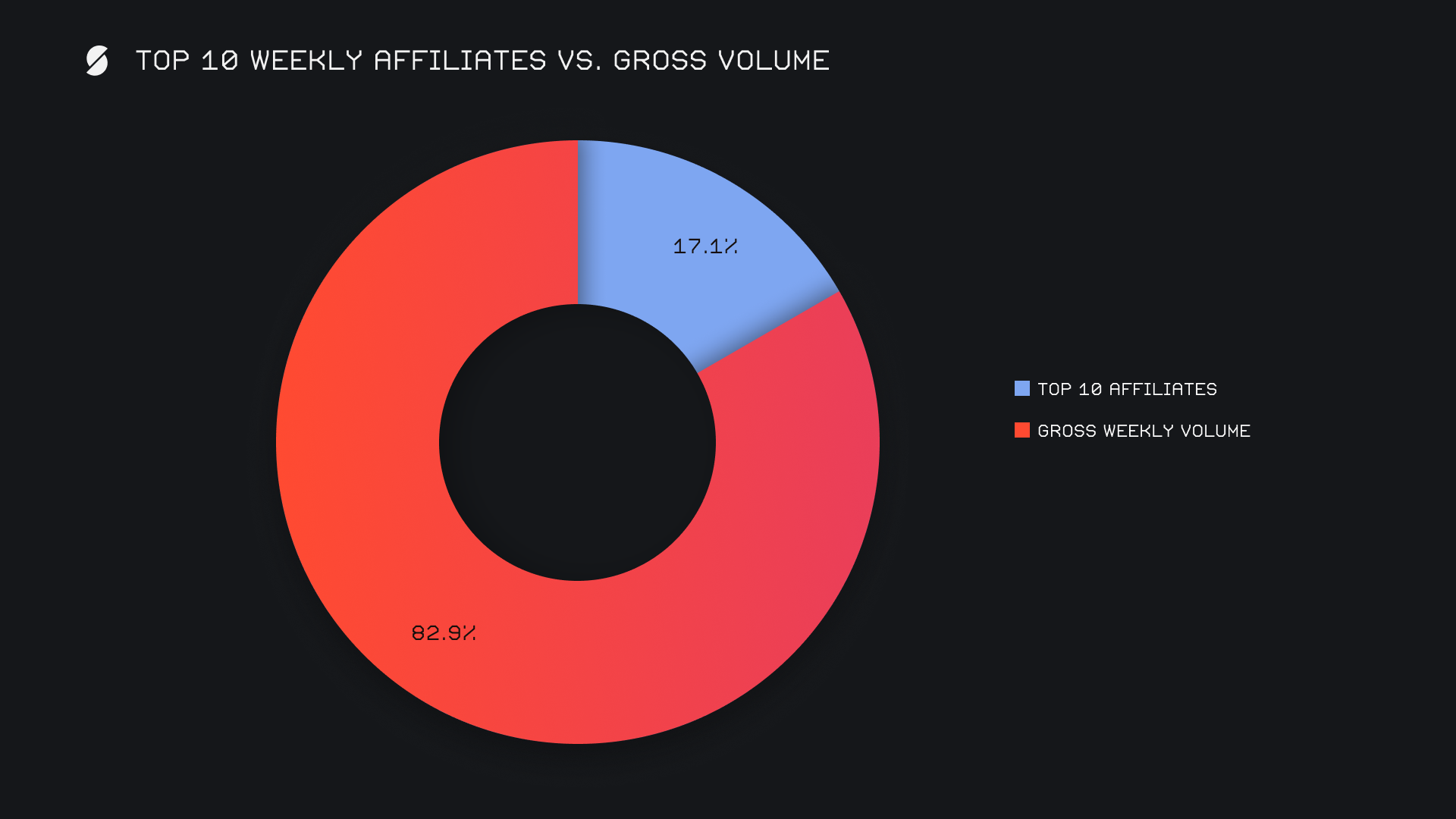

Our top affiliates had a quieter week than usual and came together for a total $3.3m, representing quite a big change of -32.9%. Still, it should be noted that this was following several weeks of outstanding performances. Cumulative shift count was also affected here, as it fell -23% for a total 1,765 shifts. This week’s top affiliate was replaced, as the former second place moved into first with $1.2m on the week. Our top affiliates shift count of 966 was a bright point, as it accounted for about 8.5% of our weekly total. Second and third placed affiliates ended with respective volumes of $1.0m, and $591k.

All together, our top affiliates accounted for 17.1% of our weekly volume, -5.2% lower than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.