SideShift.ai Weekly Report | 2nd - 8th December 2025

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one hundred and eighty-third edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and eighty-third edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

- SideShift recorded $6.36m in volume (−9.4%) and 7,009 shifts (−2.6%), extending the quiet start to December.

- XAI stakers earned 149,829.15 XAI ($18,130) at a 5.77% average APY.

- BTC led all assets with $2.67m (+26.2%), posting increases on both sides of the shift.

- USDC (ERC-20) climbed to $1.90m (+102.5%), boosted by whale activity that formed the week’s top pair.

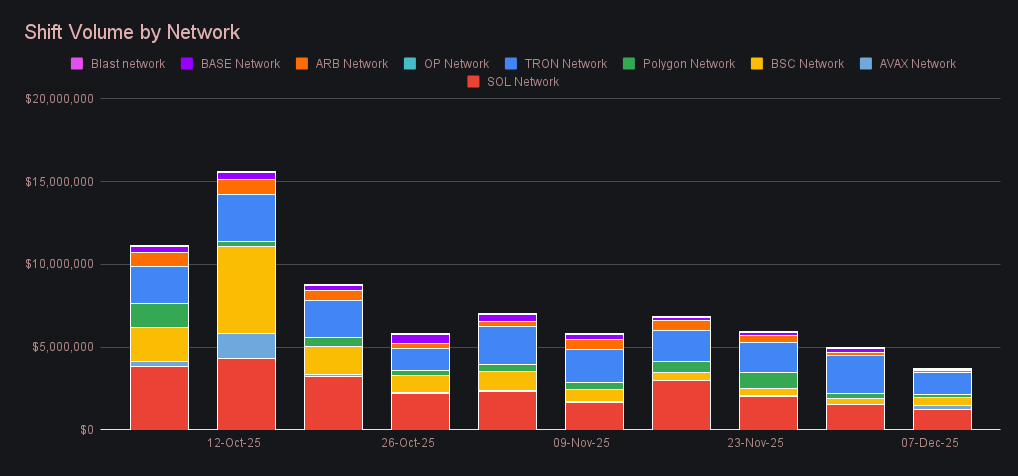

- Alt networks fell to $3.68m (−24.9%), continuing their multi-month cooldown.

XAI Weekly Performance & Staking

XAI traded with a steady, low-volatility rhythm throughout the week, with price action clustering tightly around the mid-$0.12s before easing back to $0.1204 by the period’s close. The 7-day and 30-day charts both showed a similar pattern, a price that has stabilized after the gradual slide seen through September and October, with little intraday movement and no meaningful swings. XAI’s market cap finished at $18.48m, a −2.2% change from last week’s $18.89m.

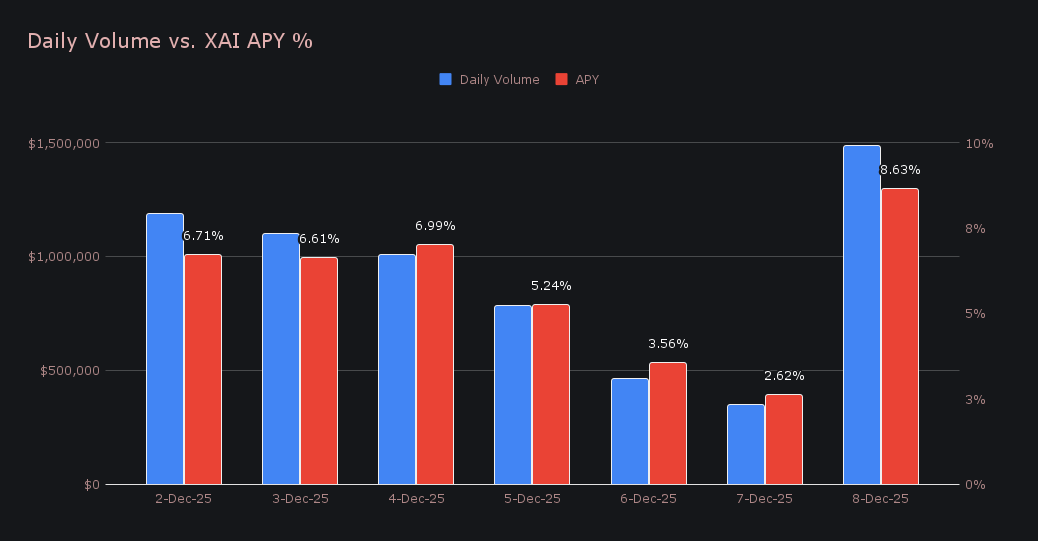

Staking followed a similar tempo. Stakers earned 149,829.15 XAI worth $18,130, with the average APY landing at 5.77%. The clearest high point came on December 8th, when 31,727.95 XAI was distributed to the staking vault at an 8.63% APY, supported by $1.48m in daily shifting volume. The December 8th payout stood out only marginally, serving more as a mild outlier than a true spike in an otherwise quiet backdrop.

Additional XAI updates:

Total Value Staked: 139,948,381 XAI (+0.1%)

Total Value Locked: $16,824,670 (−1.7%)

General Business News

Crypto markets spent the week drifting without direction, as BTC oscillated around the $90k mark in a series of uneven moves that failed to establish momentum either way. BTC’s attempts to press higher were brief, and dips into the high-$80k range were similarly short-lived, leaving the asset modestly higher on the 7 day timeframe but lacking conviction. Major altcoins followed almost the same pattern, resulting in a market that was active in the intraday sense but ultimately flat across the board.

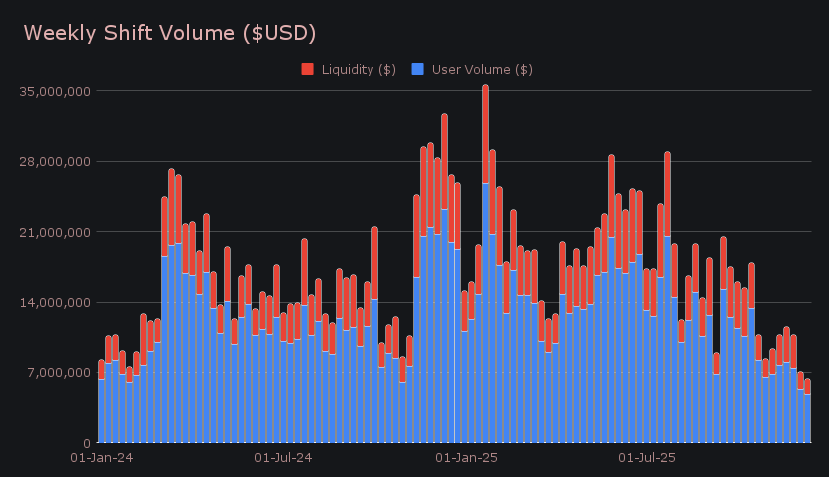

SideShift finished the first full week of December with $6.36m in total volume (−9.4%), a step down from last week’s already quiet showing, and largely matching the market’s hesitant tone as most assets struggled to build any sustained moves. User shifting contributed $4.87m (−10.2%), while liquidity shifting totaled $1.50m (−6.8%), keeping the balance between the two areas of volume largely intact with what we saw last week. The week’s top user pairs were BTC/USDC (ERC-20) at $423k, BTC/ETH at $371k, and USDC (ERC-20)/USDT (TRC-20) at $250k. Their appearance marked a shift from last week’s ETH- and USDT-led mix, bringing BTC pairs back into the top spots, though still at tempered levels compared to the larger BTC activity seen earlier in the quarter.

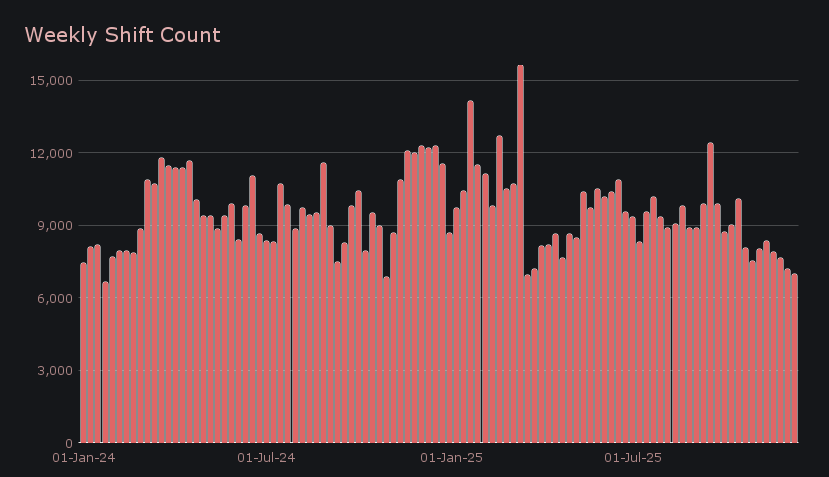

Shift count closed at 7,009 (−2.6%), marking the fourth straight week in the 7k range, a level that has quietly become the norm through November and early December. Although it moved lower this week, count has been far steadier than volume in that same timespan, which comparatively has fallen much more sharply as larger shifts significantly slowed. With fewer whale transactions and many users waiting out the market, activity centered on smaller, routine moves, leaving overall engagement present but carrying less weight. The result was a daily average of 1,001 shifts per day, accompanied by $909k in daily volume.

BTC led all coins with $2.67m (+26.2%), further recovering some of the ground lost during its pullback two weeks ago. User deposits rose to $1.33m (+31.0%), while settlements improved to $718k (+11.7%), making BTC one of the few assets to post increases on both sides of the shift. The totals remain well below the higher figures seen as recently as late November, but the bounce back showed that users were more willing to engage with BTC again after a notably cautious prior week.

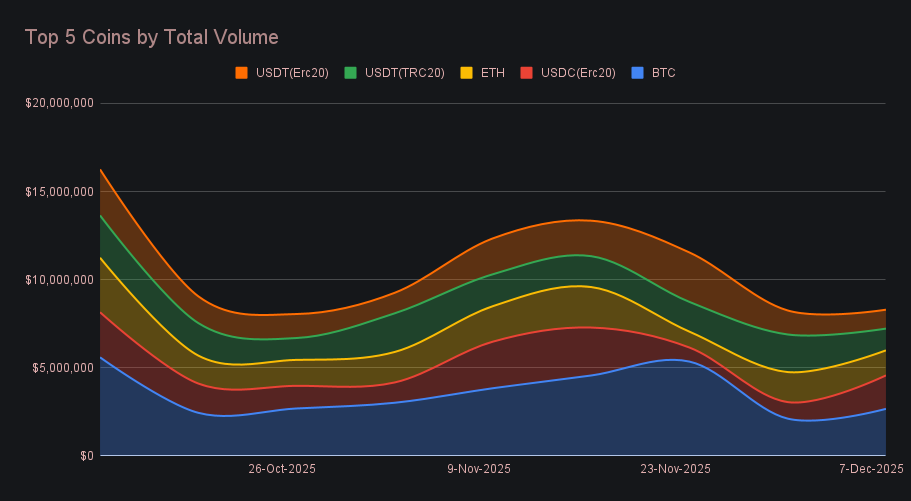

Stablecoin activity saw a reshuffle, with USDC (ERC-20) emerging as the clear outperformer at $1.90m (+102.5%). A large portion of this total came from a whale user whose series of sizable shifts also formed the week’s top pair, making that activity a key driver of USDC’s triple-digit rise. Deposits reached $392k (+34.2%), while settlements climbed to $780k (+80.1%), giving USDC a distinctly stronger profile than in recent weeks. The two USDT variants moved in the opposite direction. USDT (TRC-20) fell to $1.23m (−42.1%), giving back the momentum that nearly carried it to first place last week as deposits slid to $286k (−66.4%) and settlements eased to $533k (−9.0%). USDT (ERC-20) also declined, landing at $1.07m (−21.2%) with deposits steady at $420k (−3.0%) but settlements stepping down to $420k (−34.5%). Taken together, the three formed a clear pattern - USDC stepped into the space left by weakening USDT shifts, producing a stablecoin order that looked almost inverted from last week’s.

ETH ended the period at $1.42m (−16.6%), rolling over after last week’s strong rebound but still holding a firm spot near the top of the leaderboard. User deposits rose to $565k (+35.3%), one of the steadier inflow readings among major assets, while settlements stepped down to $634k (−24.3%), bringing activity back toward a more typical range following last week’s elevated demand. Just outside the top five, SOL recorded $657k (−14.7%), extending its multi-week drift lower, while AVAX offered a rare bright spot among the alts, climbing to $243k after spending months in just the four-digit range — a small but notable burst in a mostly quiet field.

Alt networks collectively fell to $3.68m (−24.9%), extending a two-month slide and underscoring how far attention has shifted away from non-ETH ecosystems. The chart’s steady downward progression shows just how quickly momentum can evaporate in this segment — and, historically, how quickly it can return — but for now alt-chain activity remains firmly in cooldown mode. Within that backdrop, the Tron network led at $1.35m (−42.3%), reflecting the retrenchment seen across stablecoin flows, while Solana followed at $1.23m (−20.4%), continuing the lighter trend that has taken shape over recent weeks. BSC was the lone network to move higher, reaching $454k (+35.5%), though still operating at only a fraction of levels seen just a few months ago. Below that tier, Polygon fell to $187k (−33.9%) and Arbitrum settled at $102k (−47.7%), both solemnly drifting downwards to some of their quietest totals of the year.

Affiliate News

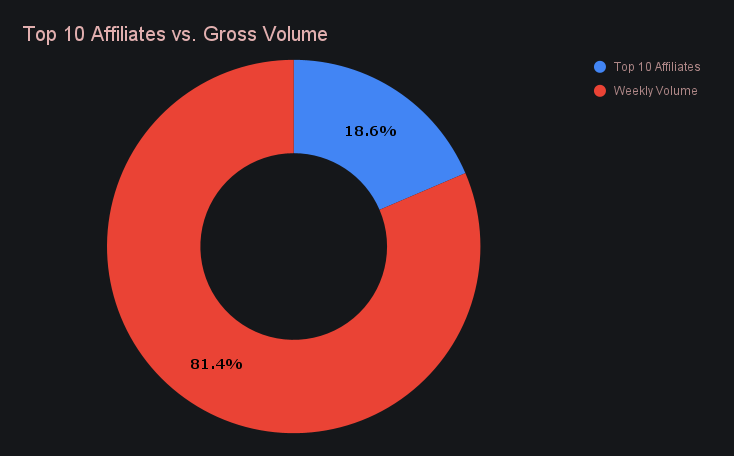

Our top affiliates closed the week at $1.18m (−33.9%), marking one of their weakest showings this year while keeping the usual ranking unchanged. First place delivered $500.0k (−15.5%), the least severe decline of the group, while second and third place slipped far more sharply to $227.1k (−48.1%) and $132.6k (−49.8%), respectively. Lower volume and weaker shift counts stacked together, leaving affiliates with a flat outcome. These declines outpaced what we saw on site, contributing to their notably low proportion.

Together, the top affiliates accounted for 18.6% of total weekly volume, −6.9% from last week.

That’s all for now - thanks for reading and happy shifting.