SideShift.ai Weekly Report | 2nd - 8th January 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the eighty-sixth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the eighty-sixth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

The first full week of 2024 saw SideShift token (XAI) continue a strong climb, moving within the 7 day range of $0.1232 / $0.1789. This translated into XAI rising a respectable +44% over the course of the past week, regaining price levels not seen in over a year. At the time of writing, the price of XAI is $0.1746 and has a market cap of $24.3m.

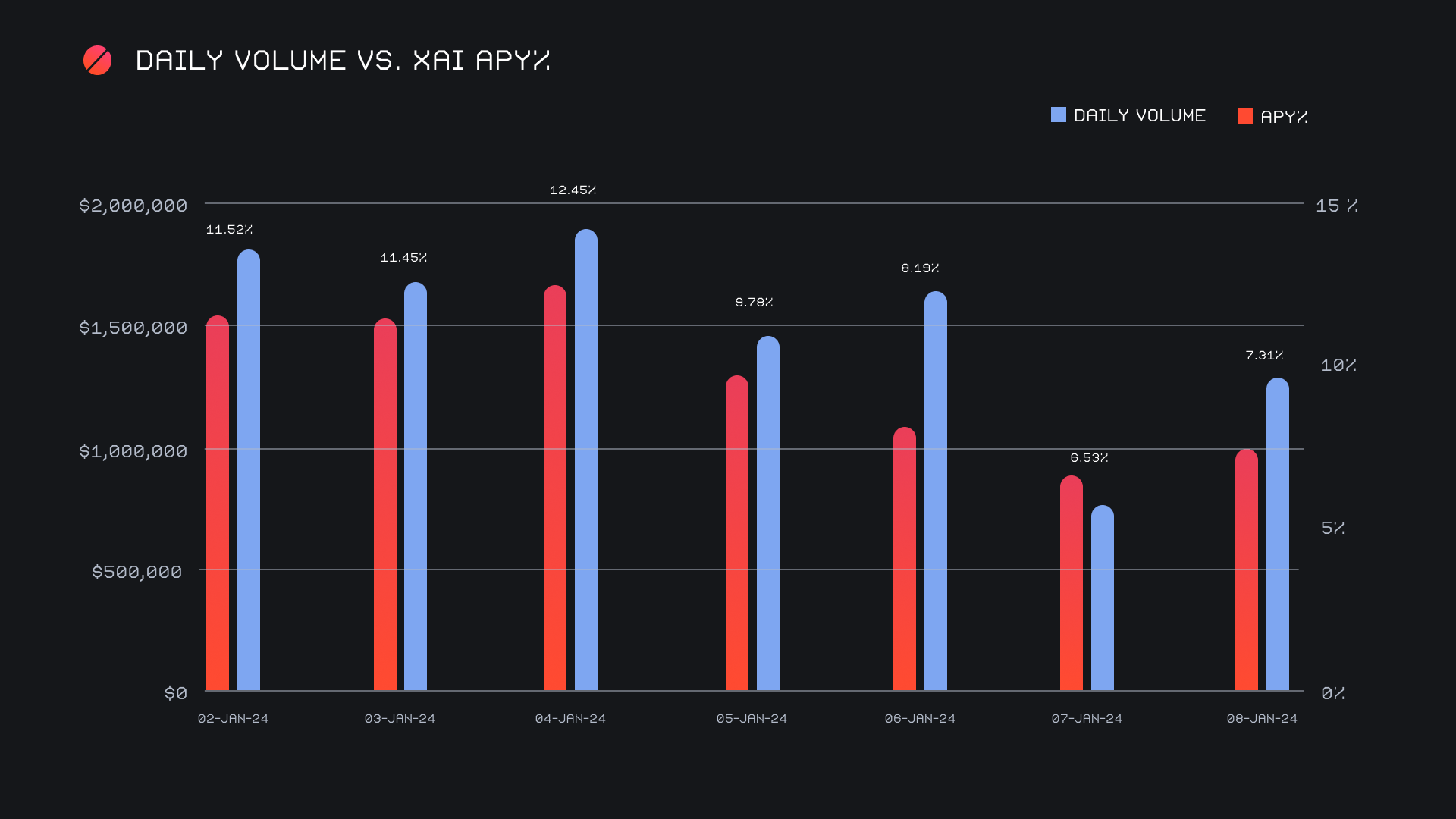

XAI stakers were rewarded with an average APY of 9.6% this week, with a daily rewards high of 37,187.48 XAI being distributed to our staking vault on January 5th, 2024. This was following a daily volume of $1.9m. This week XAI stakers received a total of 202,871.40 XAI, or $36,293.69 USD.

Since the time of the last report, SideShift has added an additional 250 ETH to our treasury, spread over 5 separate deposits. These have helped bring the current value of our treasury to a total of $8.3m. Users are encouraged to follow along directly with live treasury updates, via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 115,387,701 XAI

Total Value Locked: $20,340,113

General Business News

SideShift started off the new year on a strong note, propelling forwards alongside the wave of positive sentiment that is storming through the industry. All eyes are now firmly focused on the long awaited ETF deadline, which will provide us with a definitive answer one way or another. BTC has been buzzing as a result, as has its weekly shift action on SideShift.

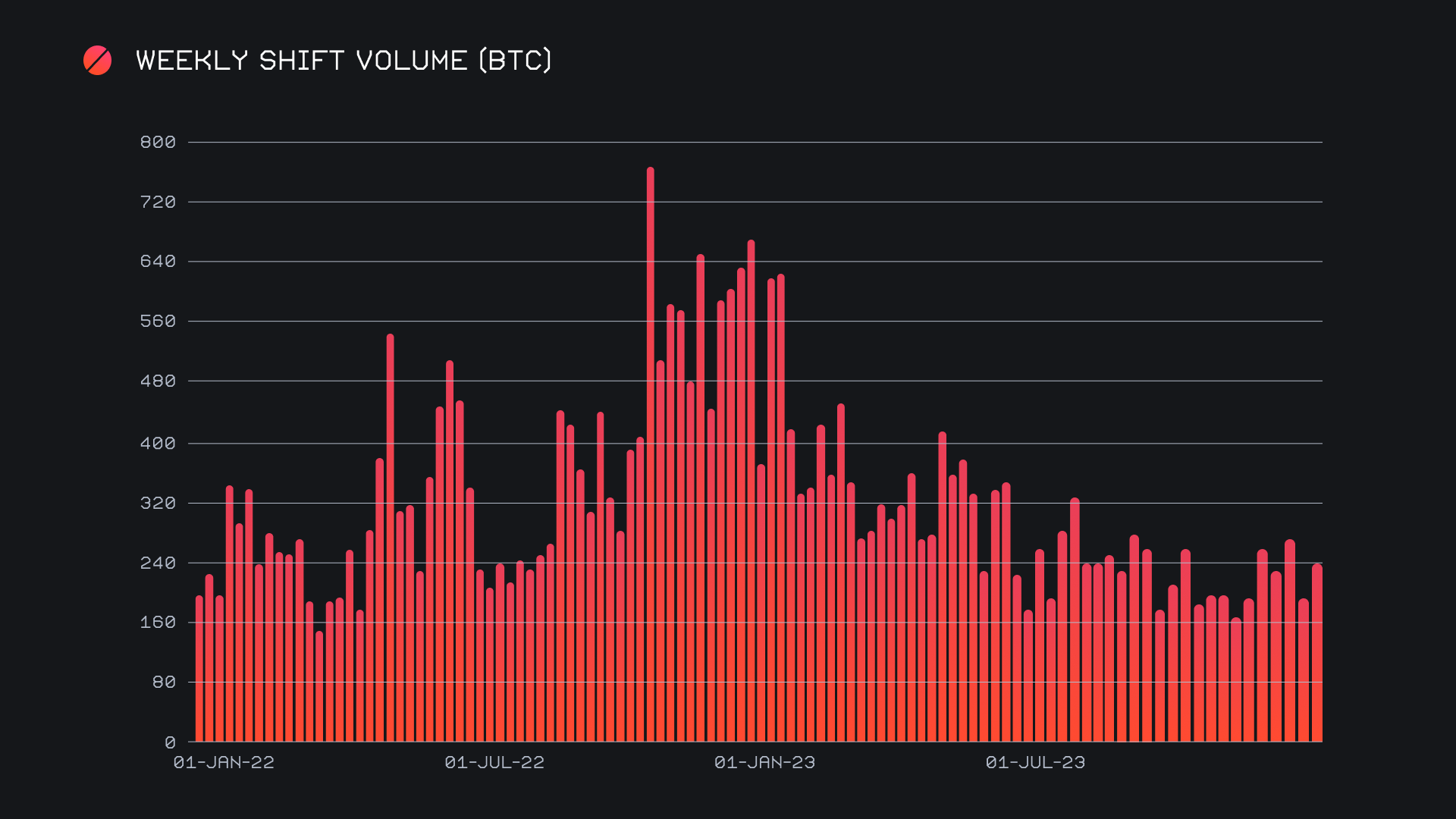

When compared to a slightly quieter performance over the 2023 holiday season, this week thrusted upwards, with weekly volume jumping +28.3% for a gross $10.6m. Shift count also sustained its strength and stayed firmly above the 1k per day benchmark, totalling 8,112 (+8.8%) shifts for the week. Despite the minor Christmas lull, the past month displays a genuine shift of momentum on SideShift, with 4 of the past 5 weeks netting a weekly volume greater than $10m. This week’s figures combined to produce daily averages of $1.5m alongside 1,159 shifts. When denoted in BTC, this amounted to 239.16 BTC, an approximate increase of +24% from last week’s total.

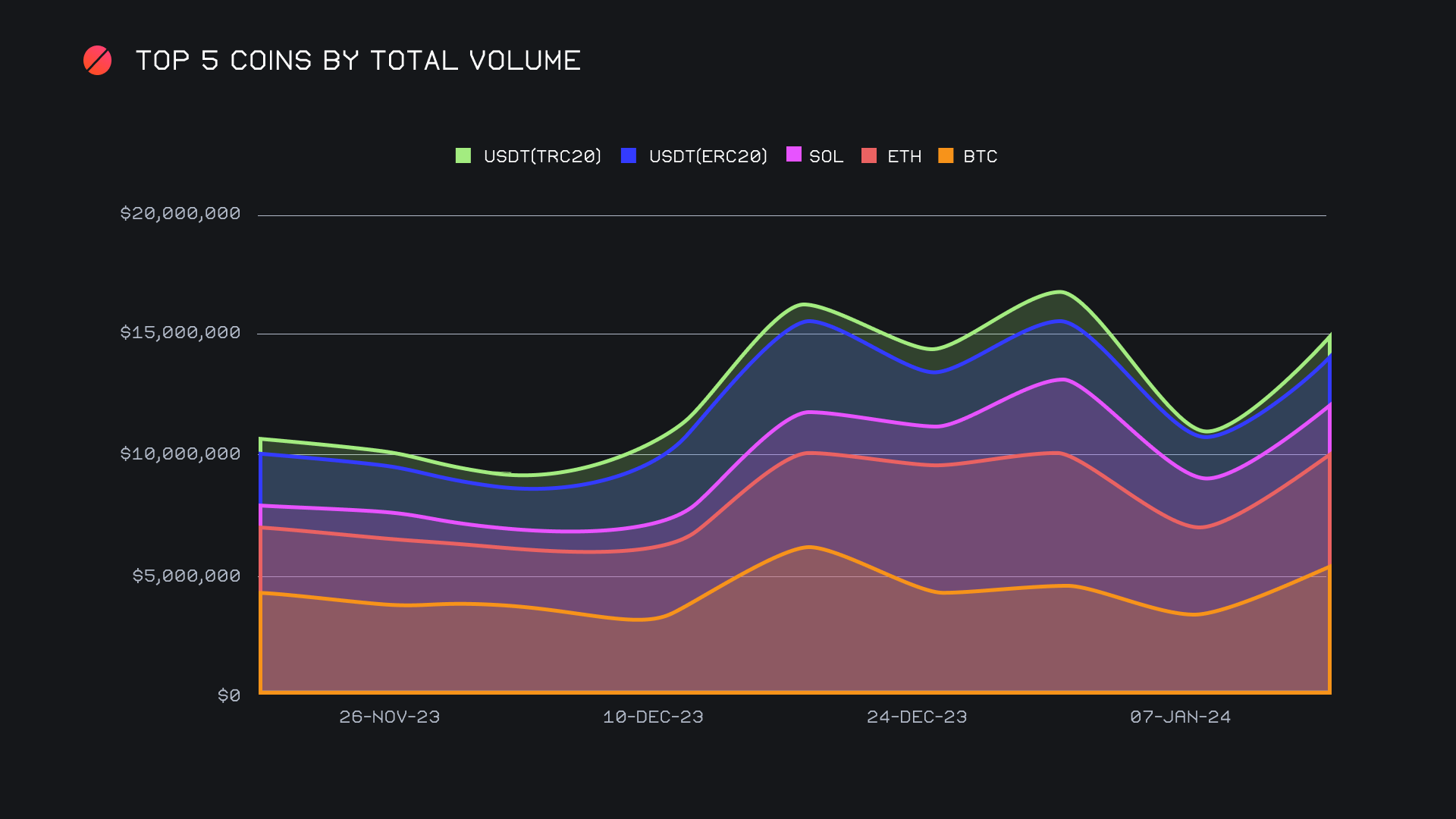

Starting with the usual suspects - our top performing coins for the week remain largely unchanged, but recorded some impressive volume changes. Likely in anticipation of the upcoming ETF announcement, BTC shift volume has soared, spiking +72.7% to claim first place with a total volume (deposits + settlements) of $5.7m. Although user BTC settlements rose by +53%, it was more so user deposits which contributed to the overall increase in volume. User BTC deposits climbed +66% to end with $2.4m, indicating that although BTC has piqued the interest of some, there remains a majority who are more interested in stacking other top coins, ETH in particular. On that note, the BTC/ETH pair ended as the week’s most popular, finishing with a total of $668k.

This BTC surge knocked out ETH along the way, which had managed to hold first place in the prior three weeks. With that in mind, ETH shifting is still looking fairly strong, this week summing $4.3m (+14%). Opposite to BTC, a slight edge here can be given to the settle side, with user ETH settlements totaling $1.8m as compared to $1.4m for user deposits. The user demand for ETH remains. In third place sat SOL, which doesn’t appear to be slowing down either. With $2.3m this week (+12.9%), SOL’s total volume on SideShift has now remained above $2m for three consecutive weeks. As a reminder, this is roughly 3x higher than weekly volumes recorded just one month ago.

Although all of our top 8 coins recorded a weekly gain and most definitely represented a majority of volume, we still noted relatively large percentage changes on some far less common ones. For example, the Liquid network saw shift action make quite a move, with L-USDT rising 10x for $125k, and L-BTC increasing +139% for $113k. ETH volume on both the zkSync and Base networks more than doubled, while Celestia (TIA) boomed +252% for $96k, an increase aligning with the massive tear the coin has been on in recent weeks.

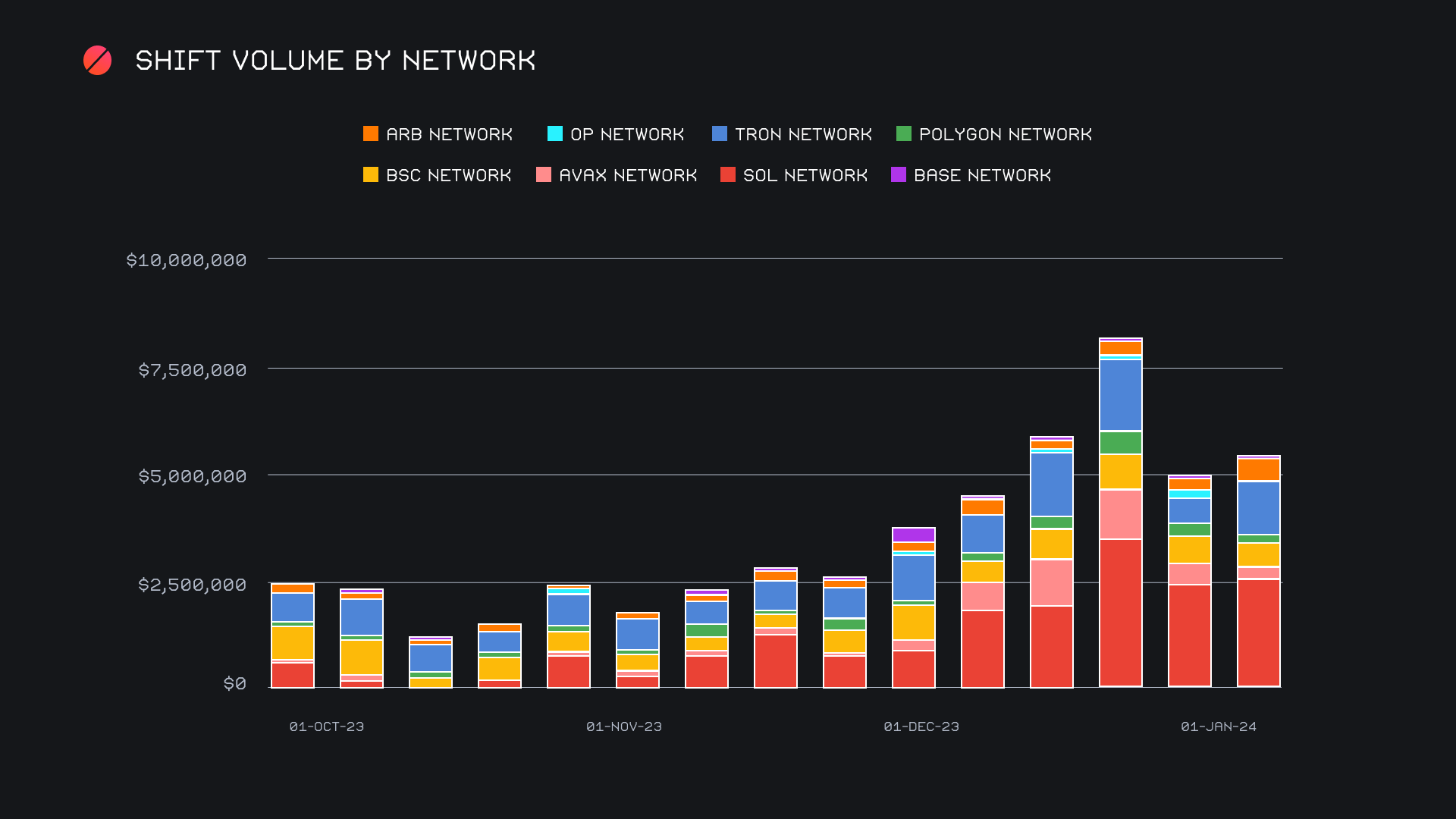

Alternate networks to ETH continue to close the gap on the Ethereum network, with combined total volume summing to $5.5m this week. This tells us that about ~26% of the total shift volume this week contained a coin on one of these networks. This compares to the Ethereum network's sum of $6.5m, which sat approximately 4% higher, with ~30% of shift volume containing a coin on Ethereum. As a proportion of the total, the Ethereum network’s dominance on SideShift is dwindling, despite there still being significant demand for the native ETH token.

Leading the way among this group, and doing so in dominant fashion was the Solana network, as its sum of $2.7m (+6%) accounted for nearly half the total of all alternate networks combined. You can really visualize the growth it has undergone in the chart below. Sitting behind that came the Tron network, recording a sizable gain of +93% for $1.2m, but still less than half that of the Solana network. Once we move past first and second place, the rankings flip flops between gains and losses. The Binance Smart Chain Network (BSC) fell -22% for a $510k, 3rd placed finish, while the Arbitrum network behaved oppositely, increasing +49% for $493k. This back and forth pattern continues down the line, as the lower volume alternate networks seem to be in a constant ebb and flow. Shift count for these networks however is far more distributed than volume, although the one constant factor here is the Solana network’s dominance.

Affiliate News

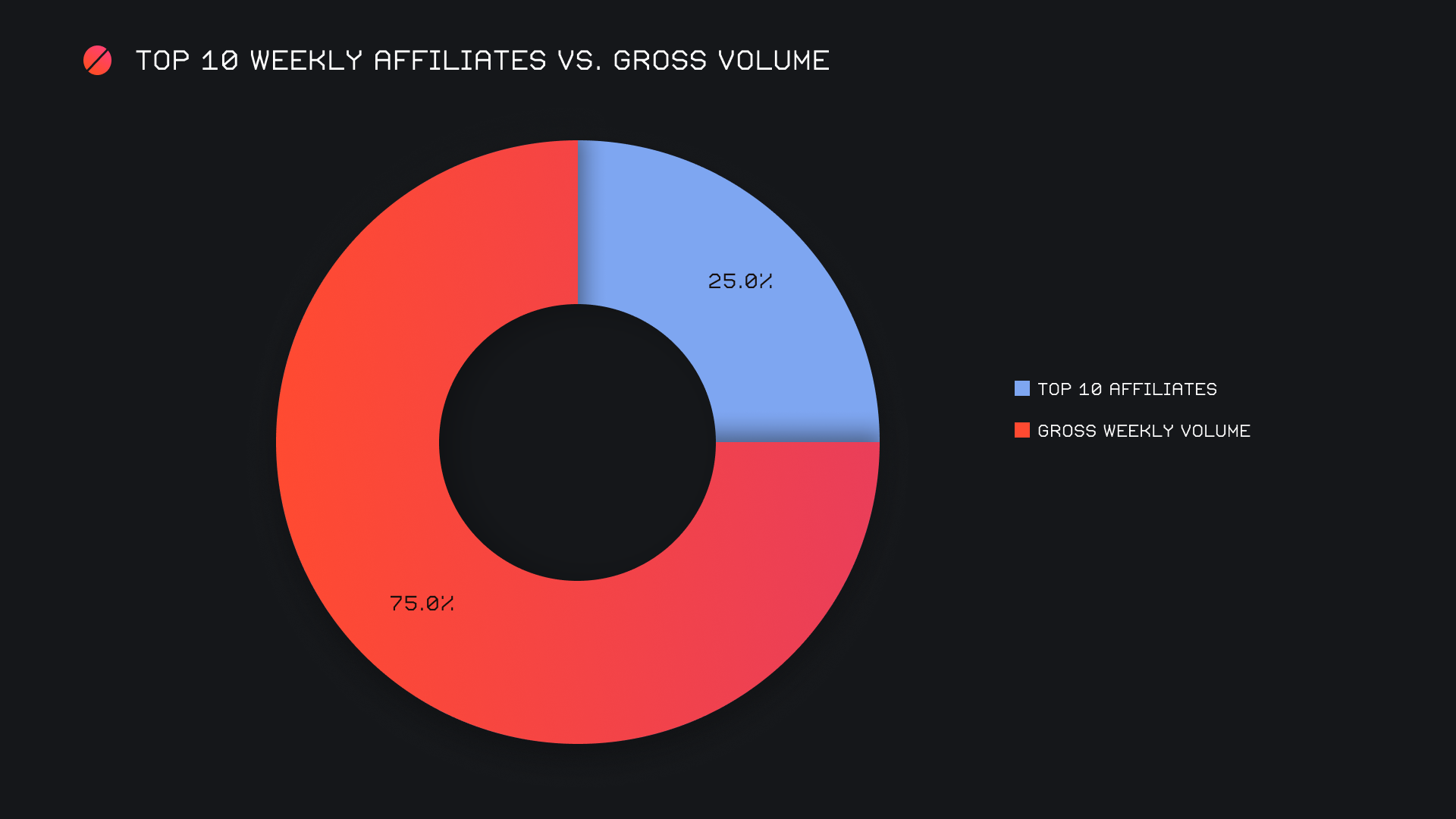

All together, SideShift’s top affiliates combined for $2.7m, and a shift count of 1,750 this week. In particular, our top affiliate had an excellent performance and saw its weekly volume climb +68% for a gross $1.4m. This was achieved with a decent number of shifts, as its tally of 800 shifts sat nearly 4x higher than the next closest. Our top affiliate represented approximately 13% of our weekly total, while all affiliates came together to account for ~25% of our weekly volume.

That’s all for now. Thanks for reading, happy shifting and we’ll see you next time.