SideShift.ai Weekly Report | 2nd - 8th July 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one-hundred-and-twelfth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and twelfth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week, SideShift token (XAI) underwent a slight downwards trend, with its 7-day price moving within the bounds of $0.1683 / $0.1800. At the time of writing, XAI is sitting at the lower end of that range at a price of $0.1694, reflecting a market cap of $22,882,267, which is an approximate decline of -6.6% from last week.

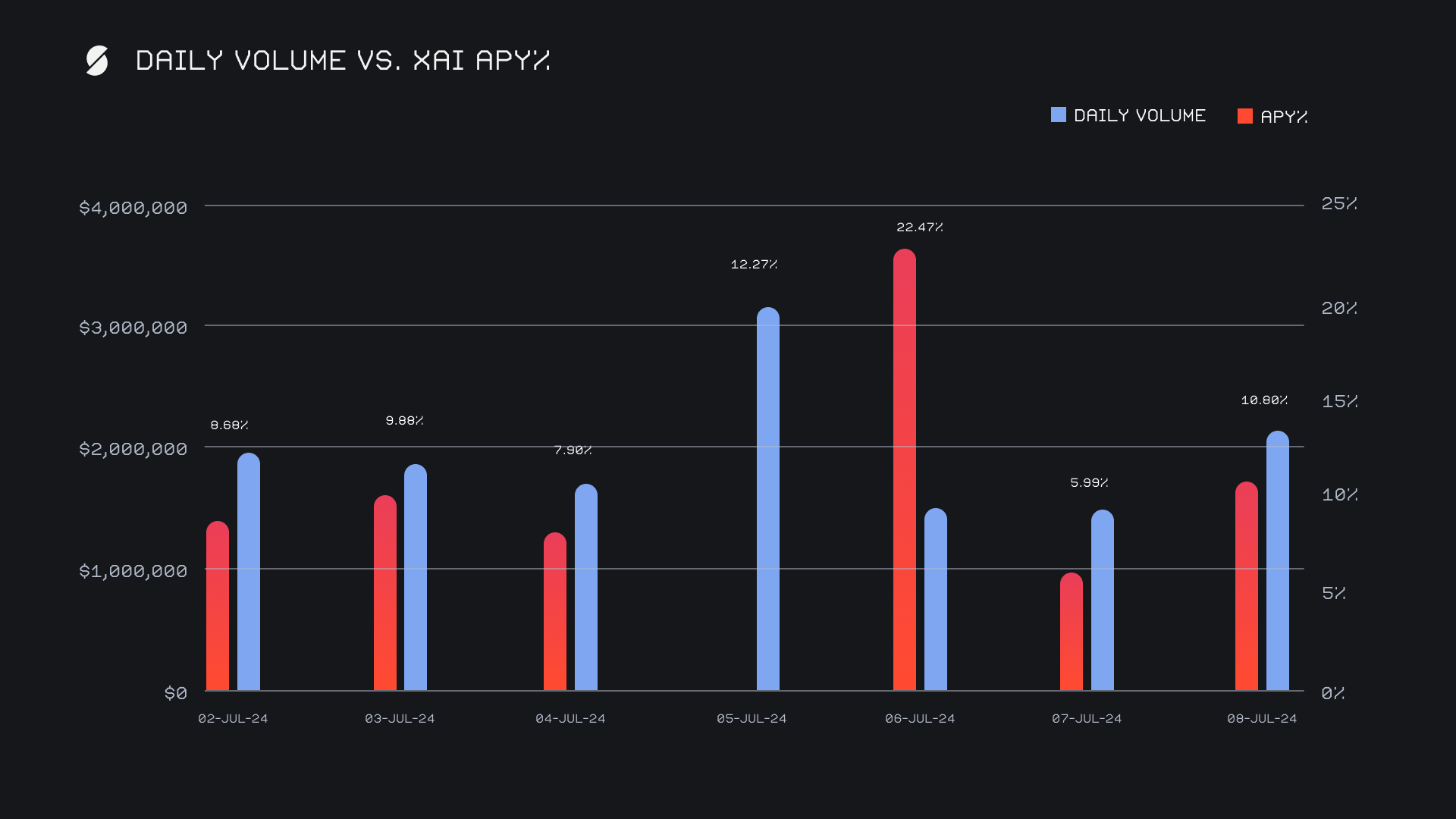

XAI stakers received an average APY of 10.95% this week. The highest daily reward was distributed on July 6th, 2024 and totaled 67,582.58 XAI, translating to an APY of 22.47%. This single daily payout included rewards for the previous two days, which ended with respective volumes of $3.2m and $1.5m. Overall, this week saw XAI stakers receive a total of 205,703.51 XAI or $34,846.17 USD in staking rewards.

2 WBTC was added to SideShift’s treasury on July 2nd, 2024, bringing the current total to a value of $14.88m. Users are encouraged to follow along directly with live treasury updates via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 121,823,669 XAI (+0.1%)

Total Value Locked: $20,430,199 (-6.9%)

General Business News

This week, the crypto market saw some negative price action with Bitcoin experiencing a drop following some major news events, such as large-scale selling from the German government, and the announced Mt. Gox repayments. The fear and greed index subsequently has dropped to its current measurement of 27/100, the lowest levels seen since January of 2023 despite BTC’s price sitting just 21% below ATH levels.

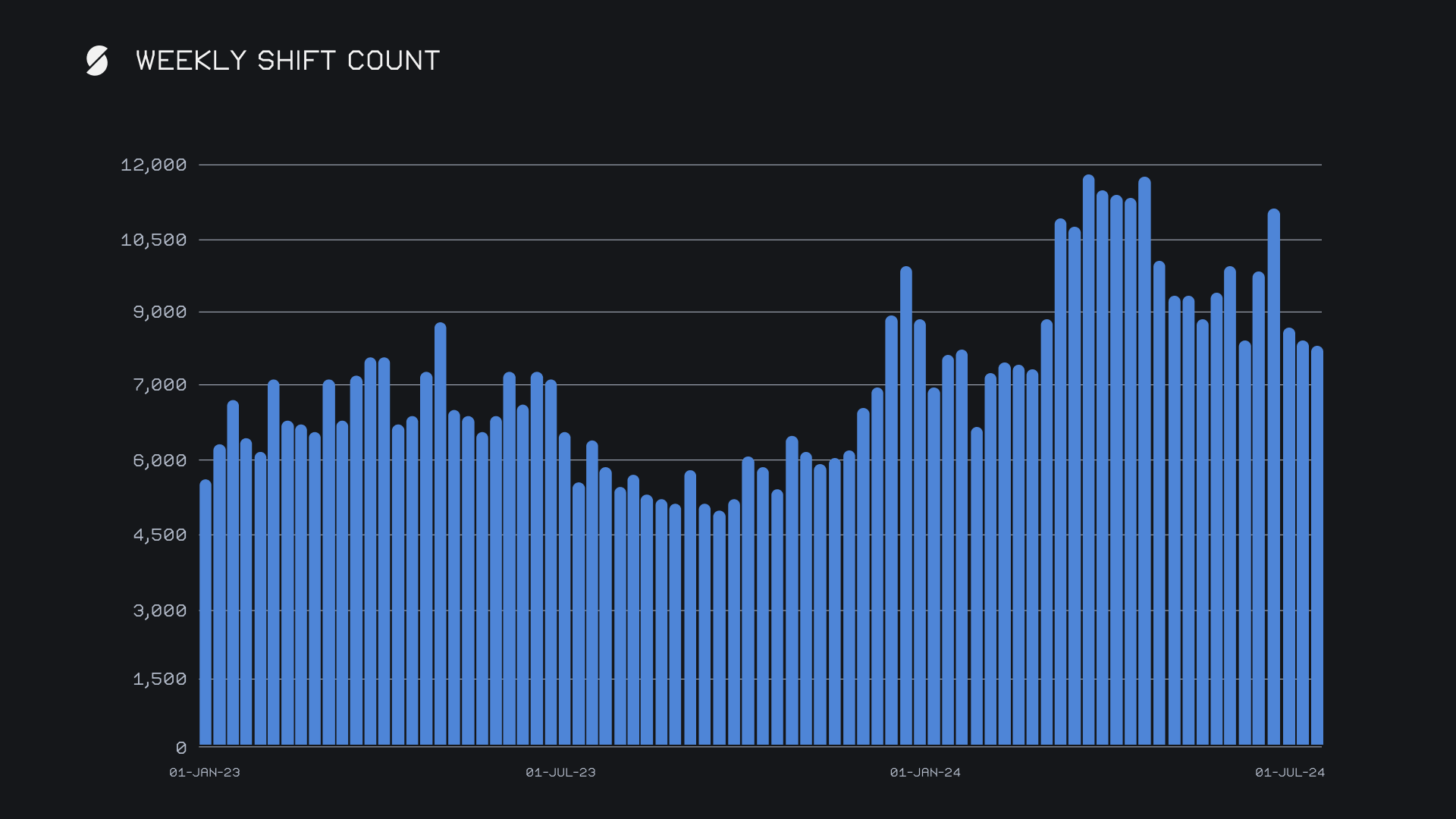

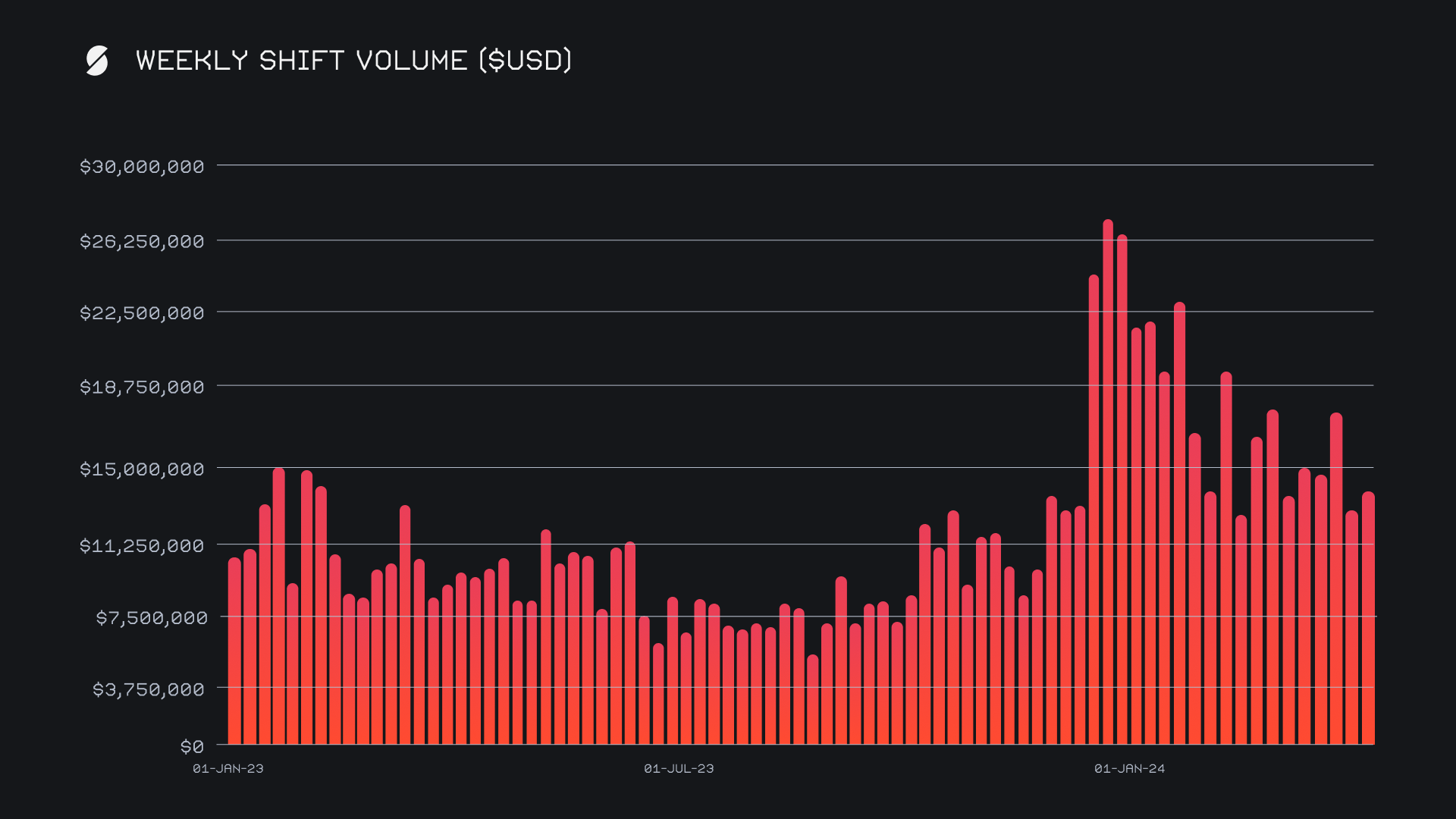

SideShift had a modest performance improvement compared to last week, ending with a gross volume of $13.8m (+6.5%). Our weekly shift count saw a slight decrease of -0.8% and totaled 8,301 shifts, which is a slower week when compared to other performances achieved earlier this year. However, as pointed out in last week’s report, this sum still sits higher than our running average, and is a significant step above those levels measured one year ago.

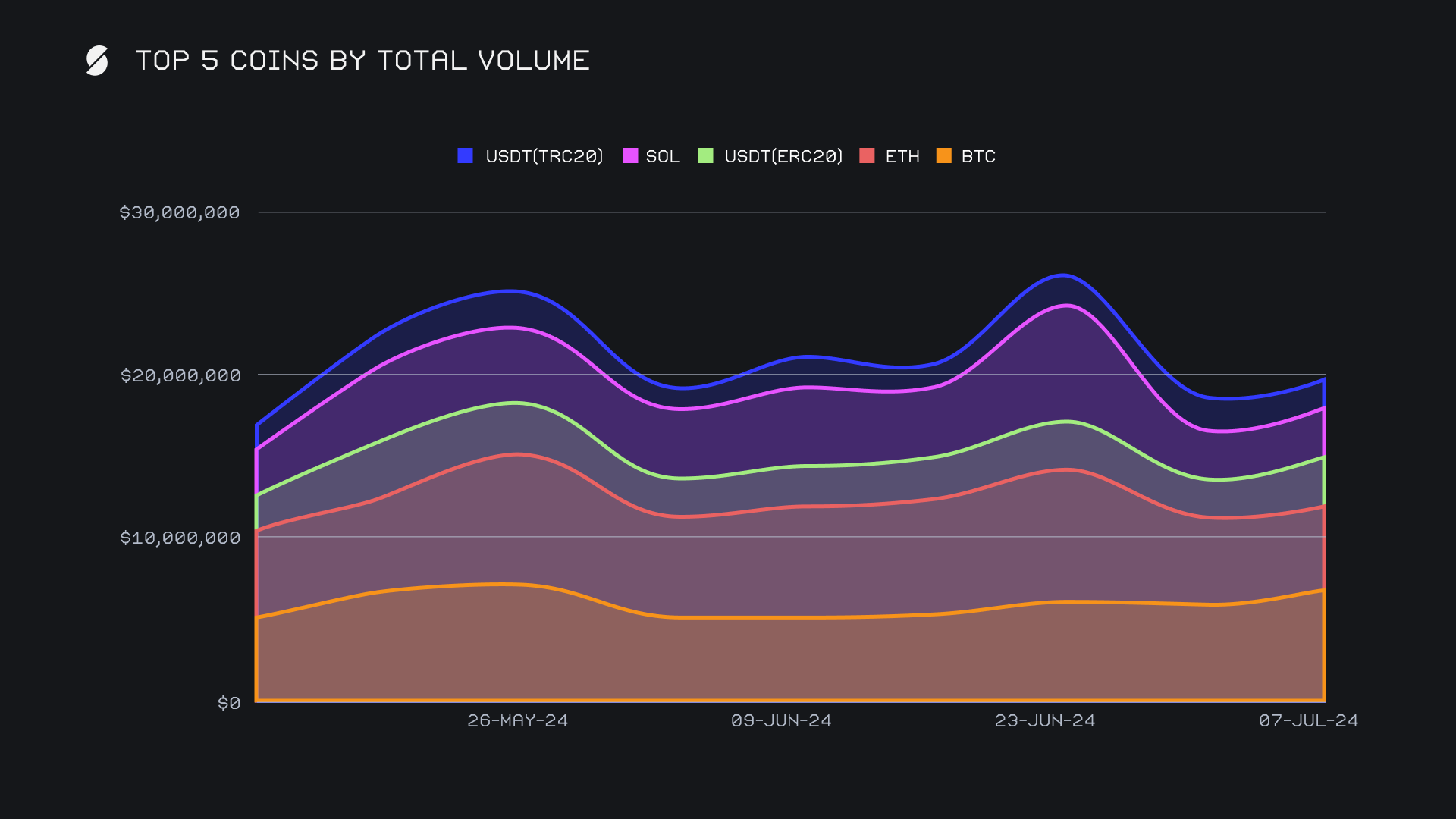

Despite the minor drop in shift count, our daily averages stood at $2.0m on 1,186 shifts, showcasing a steady demand which this week tended to center around both BTC and stablecoins. BTC/USDT (ERC-20) emerged as the week’s most popular pair among users with a weekly total of $805k, leapfrogging the previously dominant ETH/SOL pair. Similar to shift count, the positive difference of our weekly volume as compared to levels seen one year ago is evident, and noted in the below chart.

BTC surged to reclaim its position as the top coin with a total weekly volume of $6.6m, marking a robust increase of +21.1%. This jump in shift volume overtook ETH, which confidently sat on top for the previous six weeks. This resurgence was driven by a rise in both deposit volume, which ended with $2.5m (+11.2%), and settlement volume, which climbed to $2.1m (+8.5%). Both of these sums were enough to finish as the week’s most deposited and settled coin, outlining the idea that users tend to gravitate to BTC during times of uncertainty.

ETH followed in second place with a total volume of $5.1m, experiencing a decline of -13.2%. Although still carrying on with notable shift volume, this week’s decrease mainly stemmed from a drop in user demand, with ETH settle volume dropping out of first place for only the second time in the past two months. It fell -14.2% for $2.1m, while user deposits decreased a more substantial -28.5%, albeit for a lower $1.7m. Despite the drops, ETH still remained quite relevant, as the BTC/ETH pair ended just shy of the top spot with a total of $782k.

USDT (ERC-20) recorded the most remarkable increase among our top coins, moving up to third place with a total volume of $3.4m (+65.1%). This sharp rise was driven by a significant boost in both deposit volume, which reached $915k (+33.6%), and settlement volume, which soared to $1.4m (+63.8%). Although USDT (ERC-20) was clearly the preferred stablecoin among users, most other stablecoins also enjoyed a jump in total volume, with the vast majority recording double digit increases or higher. Examples here include USDT (BSC) rising +89.8% for $627k, and USDC (SOL) increasing +22.8% for $364k. Cumulatively, stablecoin shifting rose +26.3% this week, a noteworthy change occurring amidst a rather negative market sentiment.

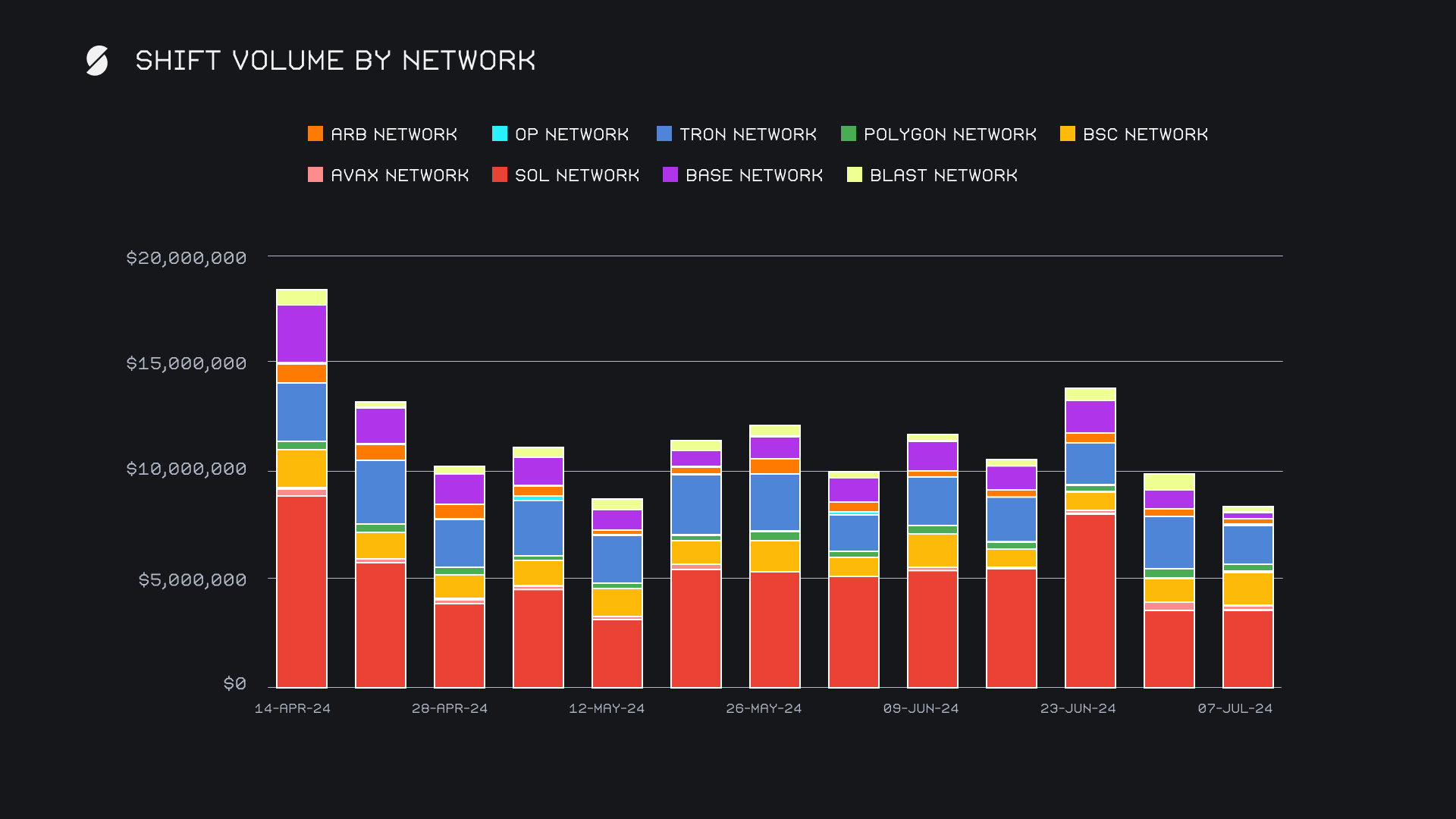

Despite the native SOL token slipping out of our top 3 coins, the Solana network as a whole maintained its lead among alternate networks to ETH and experienced a slight increase to $3.7m (+2.3%). The -3.3% decline in SOL shifting was balanced out by increases of stablecoin shifting on Solana, resulting in the network carrying on in first place as usual. Still, the recent decline in shifting of the native SOL token is evident and could reflect a waning interest among users, temporary as it may be.

Following Solana, the Binance Smart Chain (BSC) network saw a significant rise, and came in second with $1.6m (+44.4%). This boost was driven by a +25% jump in the native BNB token, in addition to increases among BSC-based stablecoin shifting. The Tron network took the third spot, though it experienced a decline, ending the week with $1.9m (-17.9%). Despite the drop, Tron remains one of the most steady networks, indicating a solid user base with consistent shifting. Other worthy mentions include the Base network with $282k (-68%) and the Blast network with $250k (-60.9%), both of which saw substantial decreases, reflecting a shift in user preference away from these networks this week.

Affiliate News

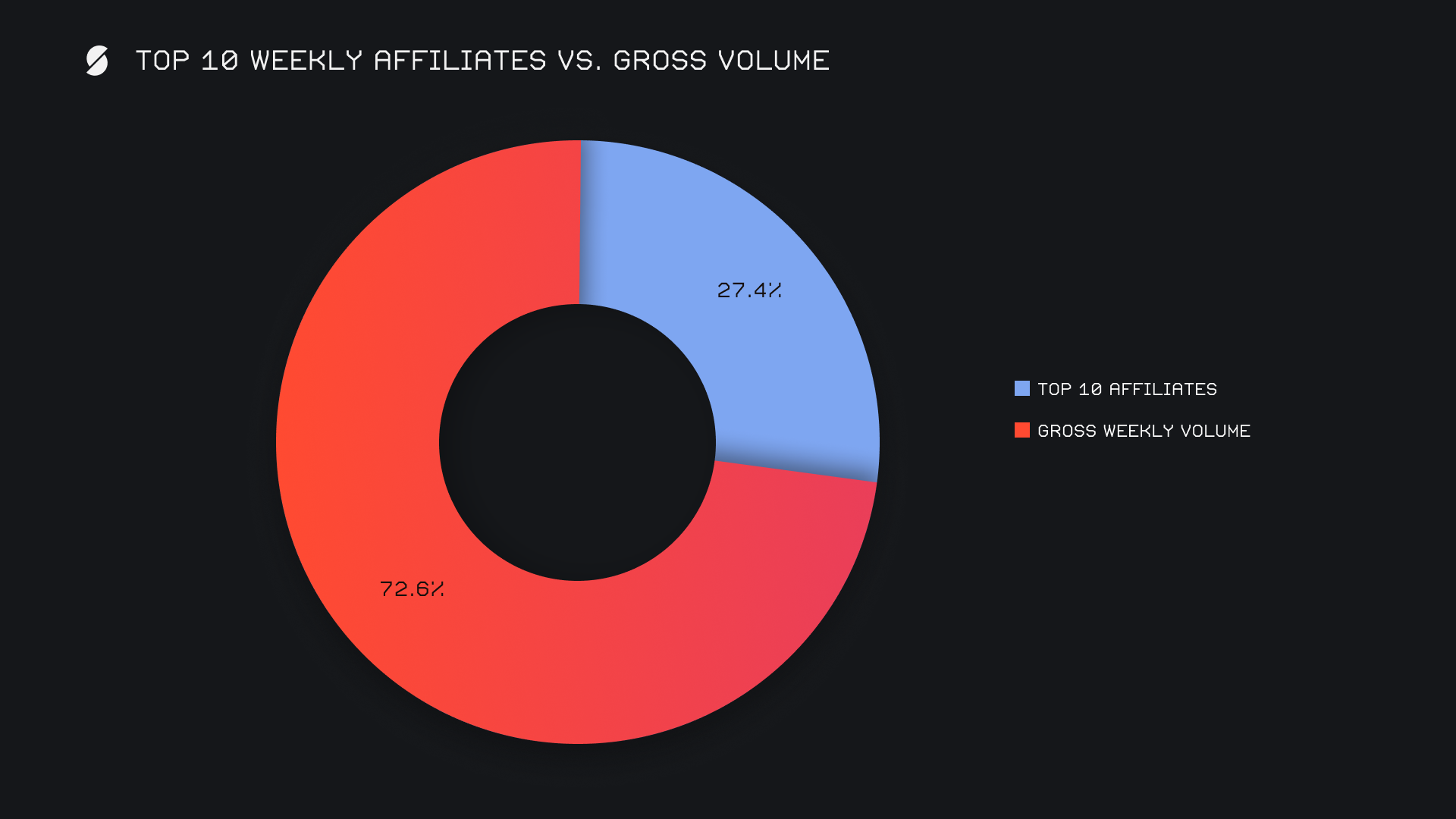

This week, our top affiliates generated a combined total volume of $3.8m, a nominal increase of $470k (+14.1%) from last week. Our top affiliate remained unchanged and closed the week with a solid +30% rise for $1.7m. It has displayed its recent strength, ending as our top affiliate in 5 of the past 6 weeks. Our second placed affiliate saw a notable rise, with volume increasing by +50.7% to $932k, surpassing the previous third place. Meanwhile, our third placed affiliate experienced a decline of -21.2% and finished with $847k, although still dominating the affiliate shift count with a total 844 shifts. This figure for shift count is more than double that of second place.

Altogether, our top affiliates accounted for 27.4% of our total weekly volume, +1.9% higher than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.