SideShift.ai Weekly Report | 30th April - 6th May 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one-hundred-and-third edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and third edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week SideShift token (XAI) spent the week moving within the 7 day price range of $0.1763 / $0.1874. At the time of writing it is sitting in the middle of that range at a price of $0.1803, and has a market cap of $24,128,618 (-1.3%).

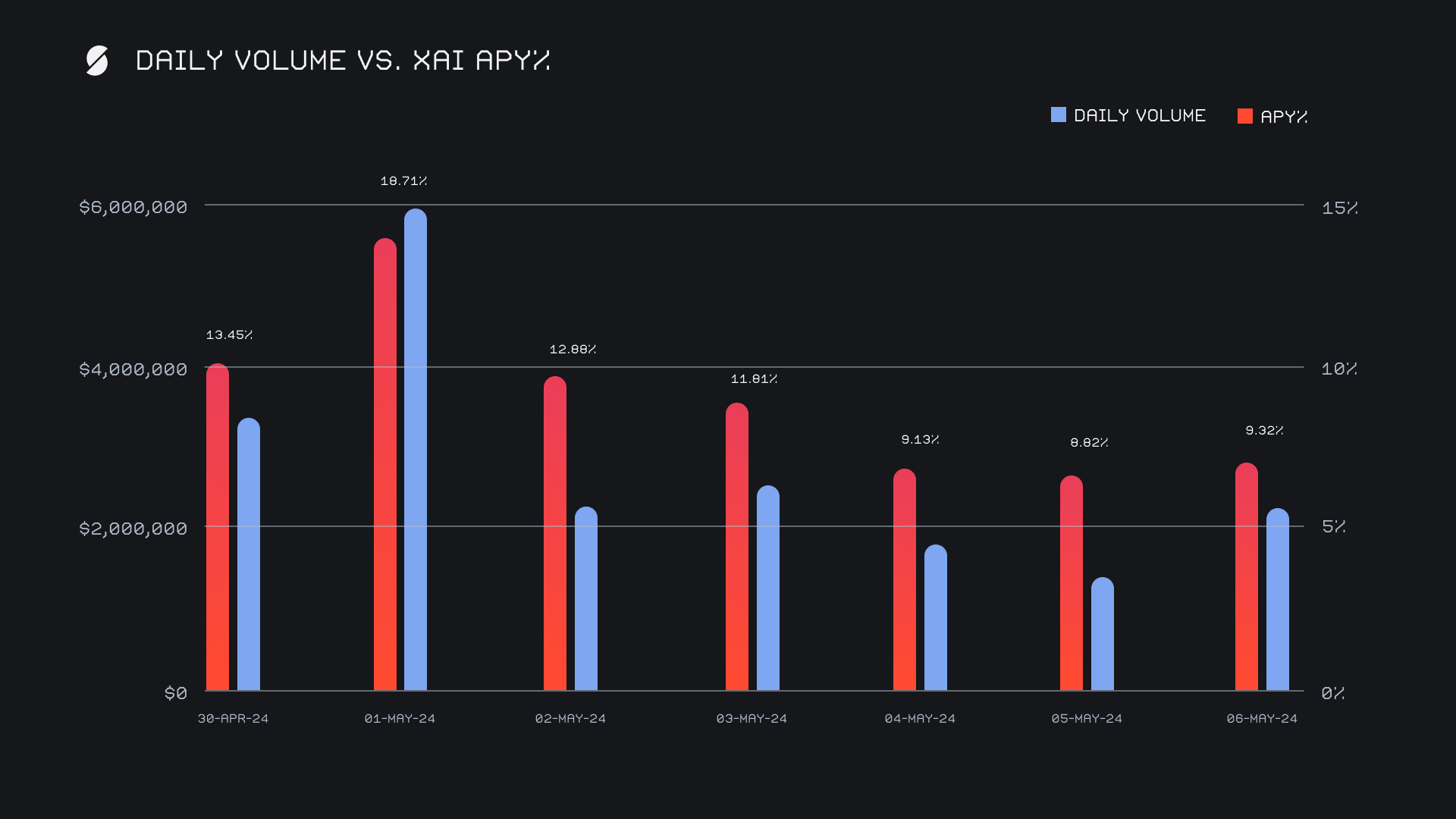

XAI stakers were rewarded with an average APY of 12.02% this week, with a daily rewards high of 56,112.14 XAI (an APY of 18.71%) being distributed to our staking vault on May 2nd, 2024. This was following an outstanding daily volume of $5.9m. This week XAI stakers received a total of 259,044.75 XAI or $46,705.77 USD in staking rewards.

Users are encouraged to check out our SideShift staking articles to learn more about XAI staking, and are reminded that the easiest way to participate is to shift directly to svXAI, from any coin of your choice.

An additional 2 WBTC were added to SideShift’s Treasury, bringing the current total to a value of $15.04m. Users can follow along directly with live treasury updates via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 119,643,110 XAI (+0.2%)

Total Value Locked: $21,426,722 (-2.9%)

General Business News

This past week contrasted the previous and was filled with volatile price swings in both directions for the majority of coins. After a few weeks of sideways action, BTC ended up breaking down in the run up to the Fed decision and dipped to the $57k mark, only to then rebound sharply and resume its position around $63k.

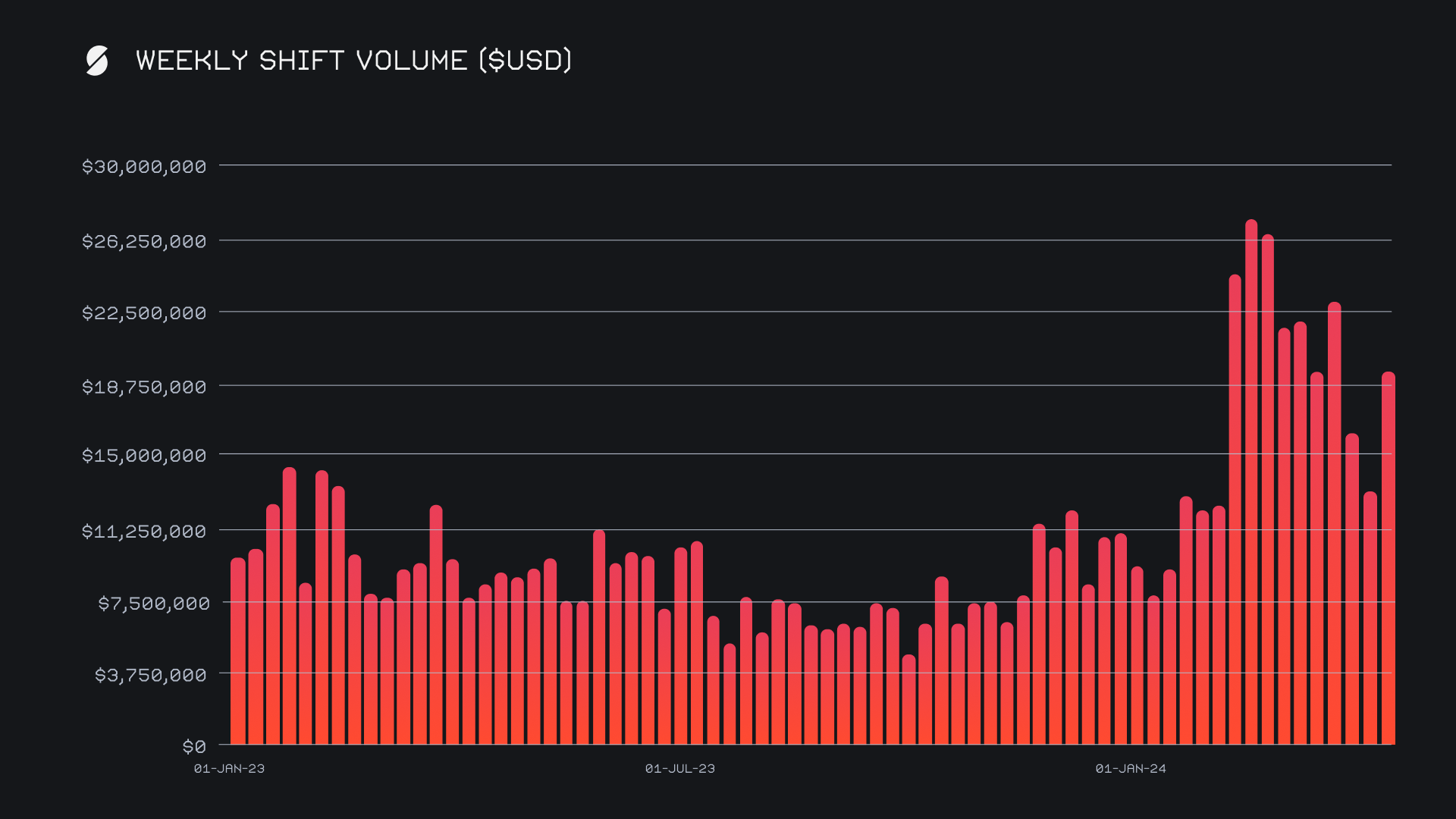

SideShift noted significant shifting unfold when BTC fell below $60k on May 1, 2024 as we recorded our highest ever daily shift volume. A daily sum of $5.9m surpassed previous records achieved just earlier in the year, but this time came as the result of a market dump rather than a pump. This contributed to a solid bounce in our weekly volume total, and we ended up finishing the period with a gross sum of $19.5m (+41.8%). However, this occurred alongside a weekly shift count which hardly budged, changing by a minor +0.1% for a total count of 9,390. This is a clear indication that shifts on average had a far larger size as compared to last week, a period which saw a significant lack of whale shifting. Together, these figures combined to produce daily averages of $2.8m on 1,341 shifts.

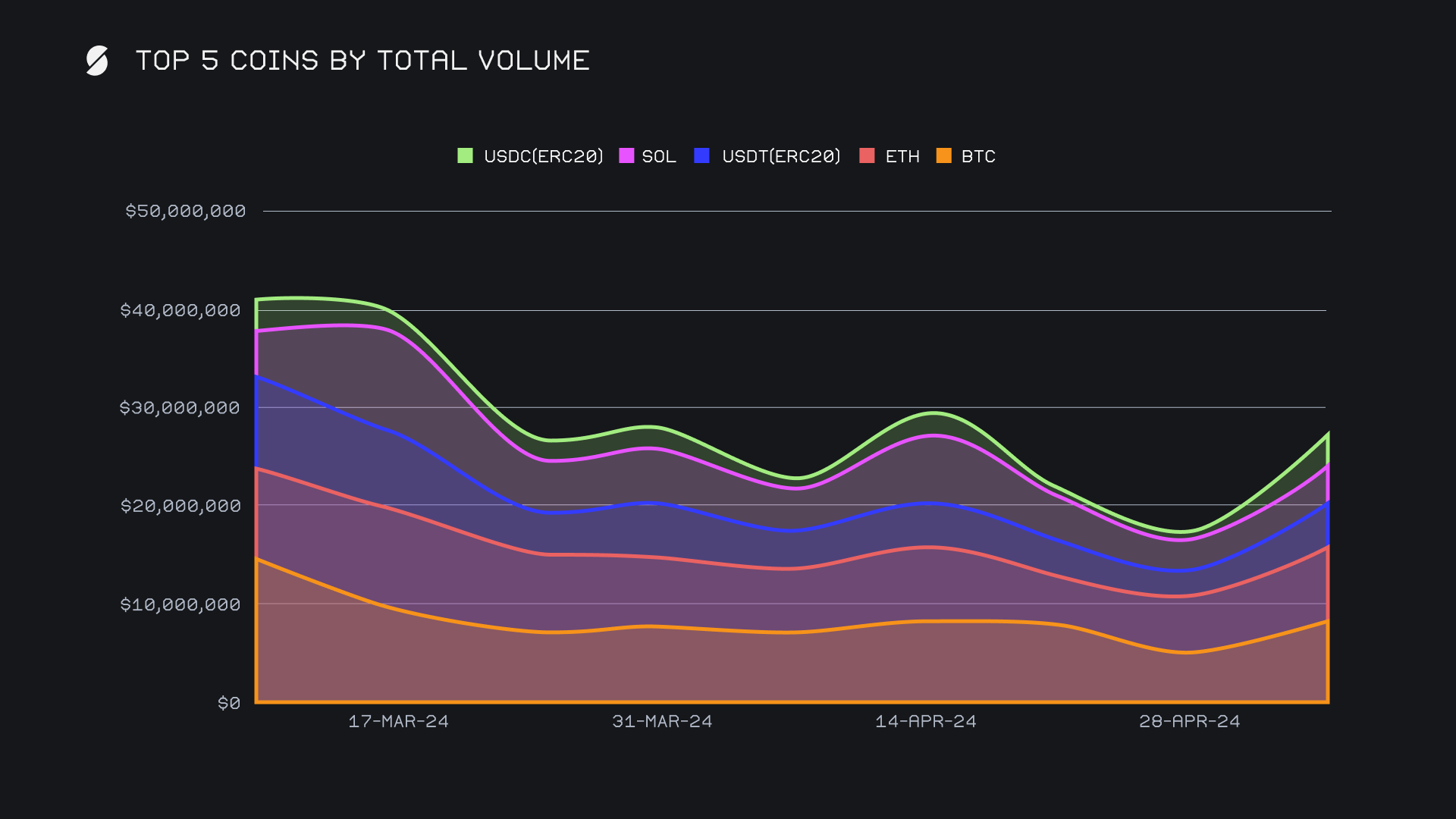

All of our top 5 coins saw a double digit increase in weekly total volume (deposits + settlements), with our top two stablecoins catching eyes in particular and noting impressive triple digit increases. Still, BTC remained at the helm of our top coins grouping, and this week topped the list with a total volume of $9.0m (+77.2%). This derived from a fairly balanced spread between deposits and settlements, with respective user totals of $3.0m and $3.6m - BTC ended both as the week’s most deposited and demanded coin from users.

ETH was demoted to second place after reigning supreme last week, primarily due to the fact that its demand did not increase at the same rate as our leading coin, BTC. Nevertheless, ETH finished with a respectable total volume of $6.4m (+14.8%) thanks to some solid inflows in addition to the popularity of the ETH/SOL pair, which summed $842k.

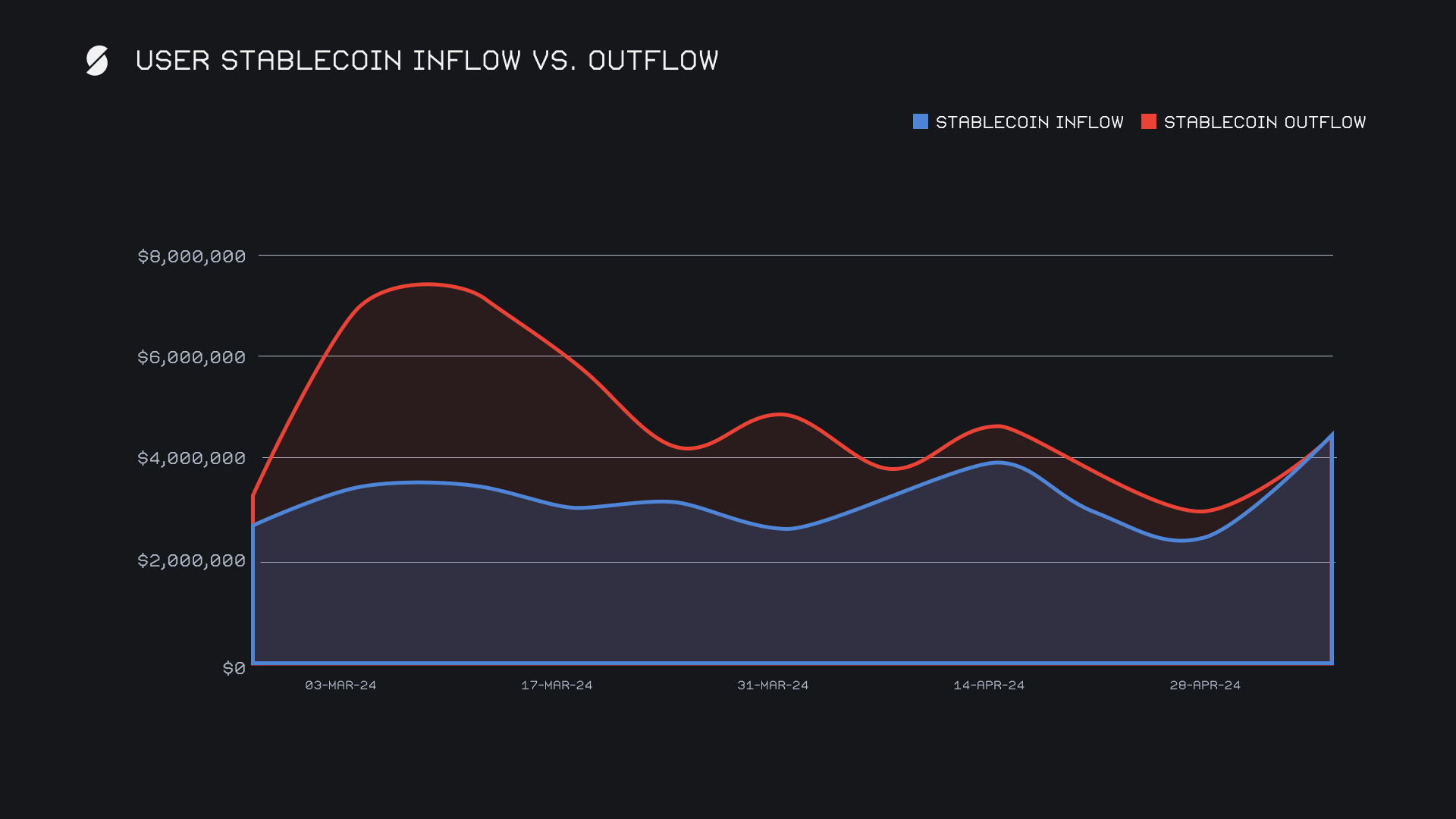

A +110% increase in USDT (erc20)’s total volume represented the first time this sum has exceeded the $5m mark throughout the past six weeks. The resurgence of the commonly shifted BTC/USDT(erc20) pair played a factor in this rise, as the pair towered over others with a weekly total of $1.5m. Interestingly however, and despite the user demand for USDT(erc20), stablecoins as a whole opposed this trend and witnessed their inflows exceed that of outflows. Essentially, this means that SideShift users were more keen to trade their stablecoins as opposed to holding them, possibly a reflection of a bullish mentality currently embraced by SideShift users.

The biggest observable change by far in this category was the growth of USDC(erc20) user deposits, as it spiked +380% for $1.2m. This was enough to finish third overall among user deposits, ahead of other popular coins such as USDT(erc20) and SOL. This was the primary driving force behind the overall surge in stablecoin deposits, although less common stablecoins such as USDC (trc20), USDT (BSC), and DAI (erc20) all also contributed, and noted triple digit increases in their weekly deposit sums. Respectively, these stablecoins ended with deposit volumes of $362k, $293k, and $150k. A positive net stablecoin flow of $16k on the week tells us that net user inflows exceeded that of outflows, and only for the second time since we began tracking this metric over one year ago. This comparison between stablecoin inflows vs outflows is illustrated below, and we will be keeping a sharp eye out to see how this trend unfolds in the coming weeks.

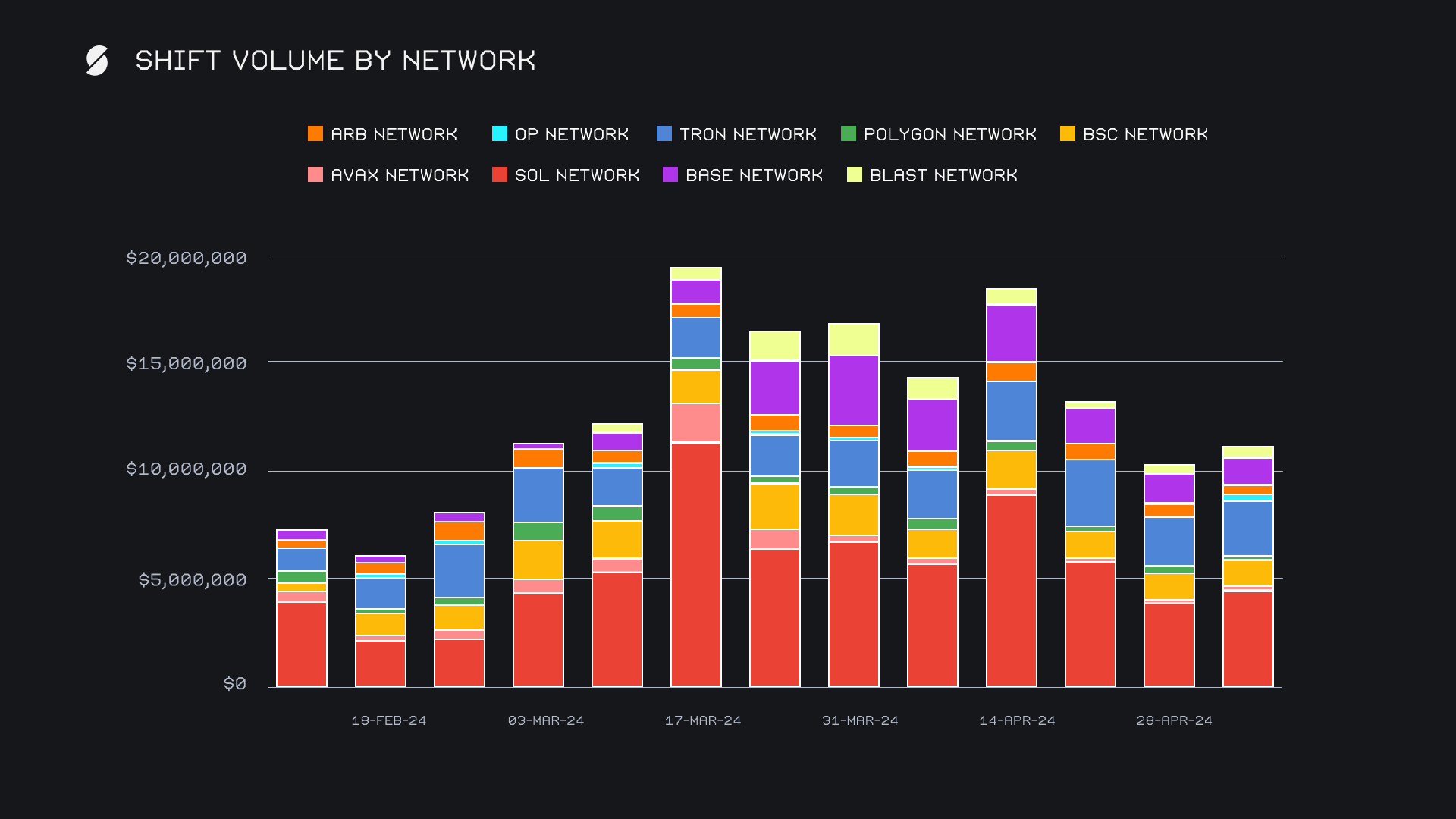

Alternate networks to ETH noted a decent positive rise of +8.8% overall, but when compared to the weekly change of both our top coins and the Ethereum networks +30.5% rise, it’s clear that alternate networks were not the focus of users this week. Four out of our nine alternate networks to ETH recorded a weekly volume increase, and was once again led by the Solana network which has come to establish itself as the dominant leader among alternate networks in recent months. It ended with a total $4.6m (+17.3%), bouncing from last week’s $3.9m sum, the lowest total seen for the Solana network in over two months. The Tron network finished in second place with $2.6m (+11.1%), followed by the Base network with $1.3m (-1.9%). As a whole, alternate networks to ETH were involved in 28.6% of shift volume this week, as compared to the Ethereum networks proportion of 32.5%.

Affiliate News

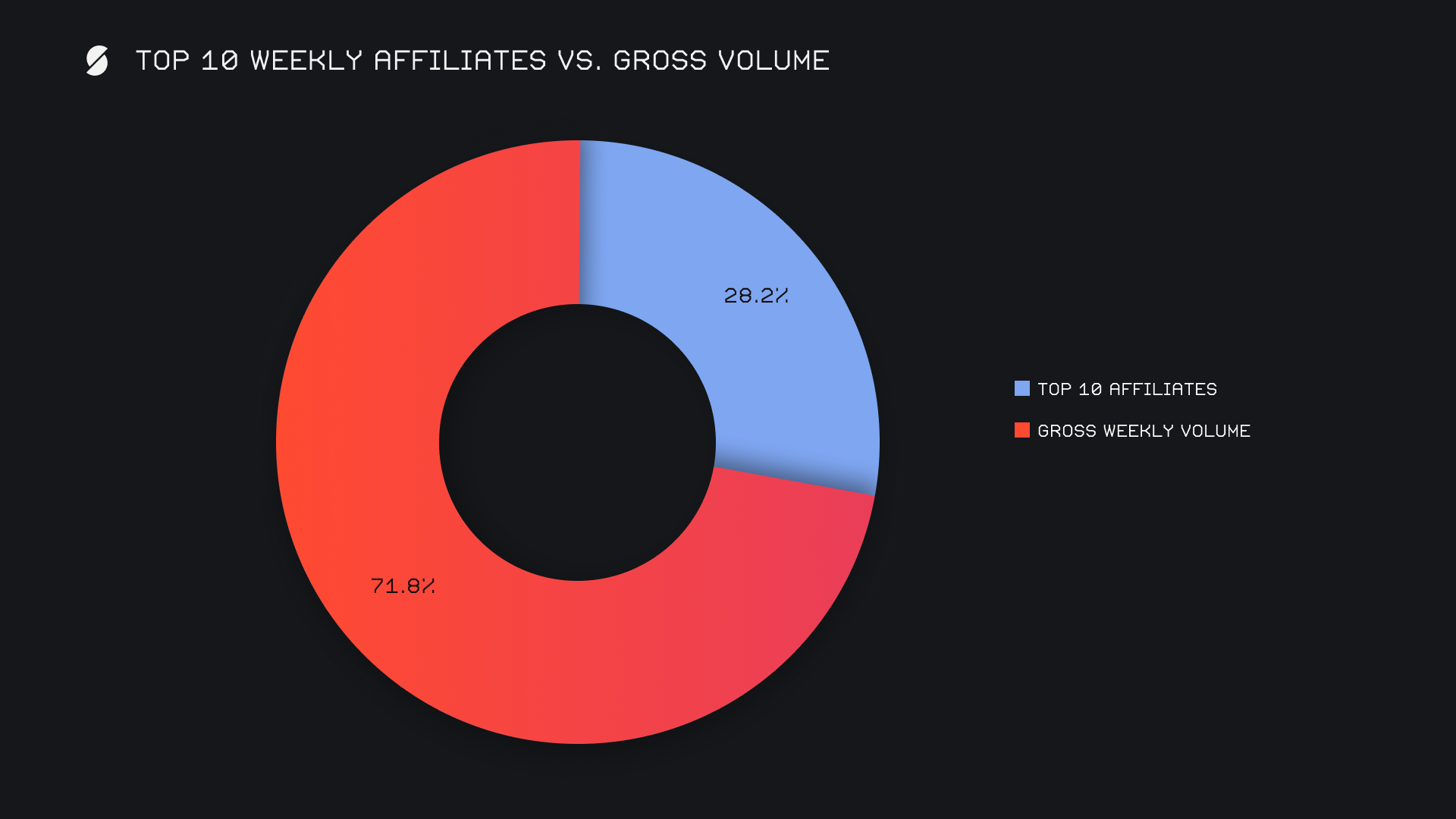

Our top affiliates had a very strong performance and came together for a gross $5.5m, representing a sizable increase of nearly +90% on the week. Our top affiliate had an especially dominant showing, and saw its weekly volume rise by +251% to finish with $2.4m on 316 shifts. Second and third placed affiliates also enjoyed weekly gains, and ended with respective volumes of $1.3m, and $1.1m. Combined shift count for our top affiliates actually fell -3.7% and totalled a count of 2,048, further supporting the notion that we saw larger shift sizes on average this week for not only shifts completed directly on the site, but also for most affiliates.

All together, our top affiliates accounted for 28.2% of our weekly volume, +7.2% higher than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.