SideShift.ai Weekly Report | 30th December 2025 - 5th January 2026

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one hundred and eighty-fifth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and eighty-fifth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

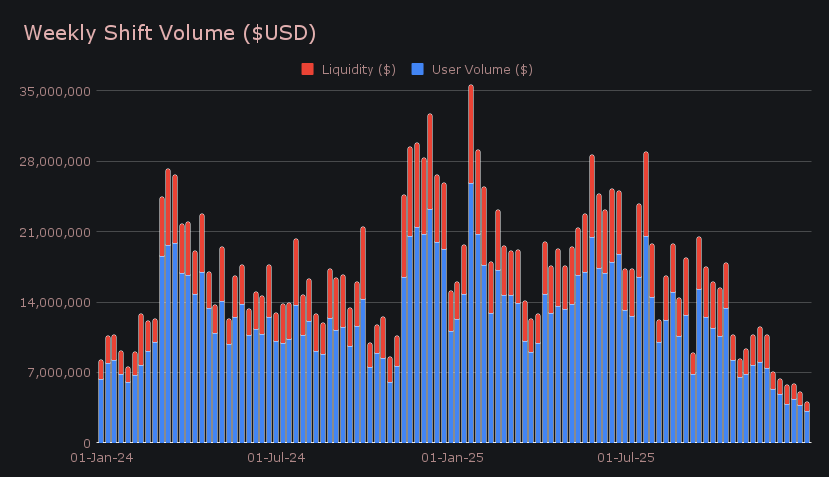

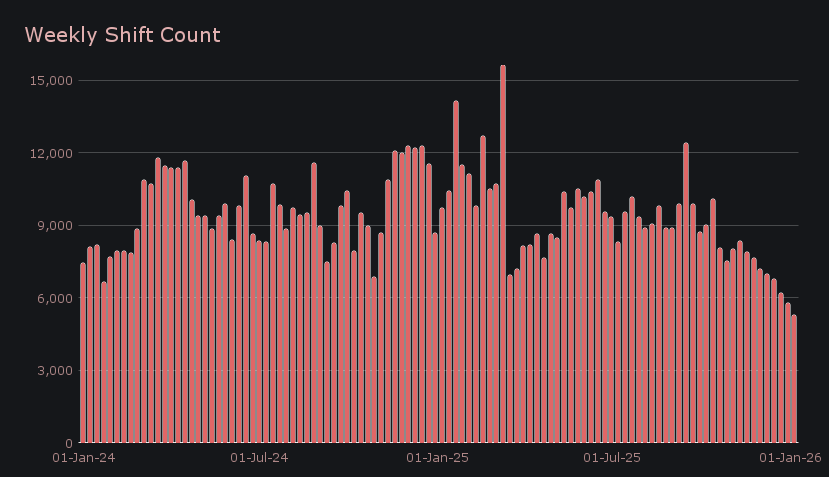

- SideShift processed $4.07m in weekly volume (−19.4%) and 5,275 shifts (−8.6%), as activity dipped around New Year’s before stabilizing.

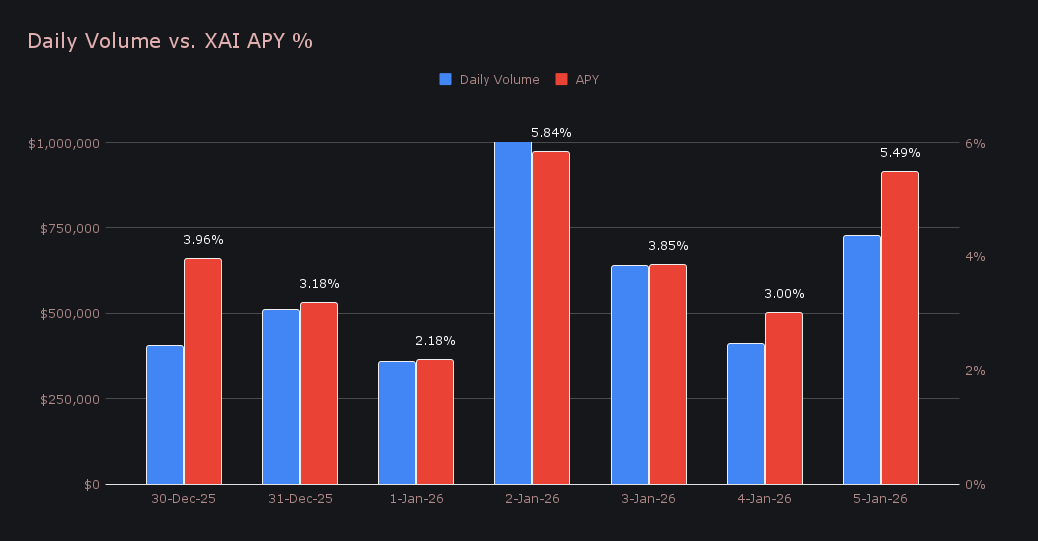

- Stakers earned 103,368 XAI ($11.4k) at a 3.93% average APY, with January 2 marking the most active day.

- USDT (TRC-20) led at $1.16m (−13.3%), one of the few weeks BTC did not top SideShift volume.

- BTC ranked second at $1.09m (−40.1%), with buying activity remaining modest despite a price rebound.

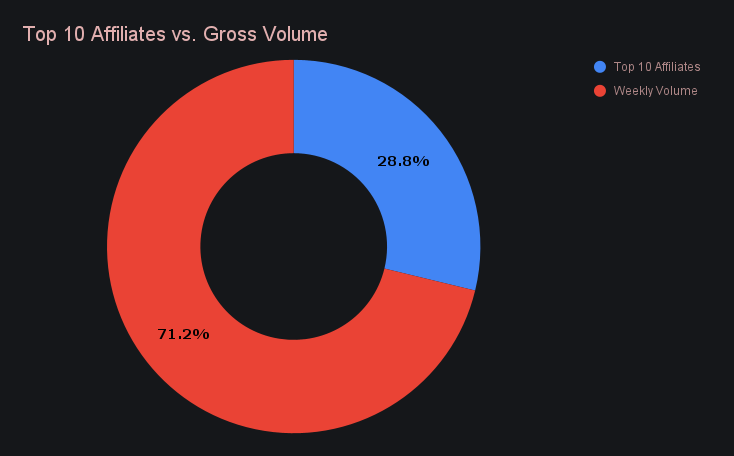

- Affiliate volume rose to $1.17m (+18.7%), accounting for 28.8% of total weekly volume.

XAI Weekly Performance & Staking

XAI moved lower over the holiday period before stabilizing in recent days, with price action now sitting firmly around the $0.11 level. The 30-day chart reflects a drift down from $0.12 in early December, followed by a flatter stretch as activity slowed over the Christmas break. At the time of writing, XAI is priced at $0.1101, giving it a market cap of $17.01m — a roughly ~8% change when compared to the update from the last report.

Staking reflected a quieter end-of-year stretch, with reward distribution running at a slower pace. Over the period, 103,367.98 XAI was paid out to stakers, equivalent to $11,379.16, and the average APY settled at 3.93%. Activity briefly picked up on January 2nd, which stood out as the most active day, delivering 21,794.18 XAI to the staking vault at a 5.84% APY alongside $1.02m in SideShift volume. As the calendar turned and market sentiment improved, overall activity began to show early signs of recovery.

Additional XAI updates:

Total Value Staked: 140,316,440 XAI (+0.2%)

Total Value Locked: $15,277,505 (−10.4%)

General Business News

Over the past two weeks, crypto markets regained some traction, with BTC rebounding toward ~$93k and ETH holding near ~$3.2k, helping stabilize total market capitalization above ~$3t. Investor sentiment has shifted out of prolonged fear, with the Crypto Fear & Greed Index rising into neutral territory (~45), signalling participants have become less risk-averse compared to late 2025. This move unfolded alongside heightened geopolitical tension following U.S. action involving Venezuela, as both TradFi and crypto markets rebounded, with equities and energy prices reacting first and digital assets following through.

SideShift began the year with $4.07m in gross weekly volume, a −19.4% move from the previous reporting window. With the measurement period landing squarely around New Year’s, overall participation was lighter, and user shift volume came in at $3.15m (−16.6%). The softer flow on the user side fed through to liquidity shifting, with liquidity shifting declining to $920k (−27.5%) as fewer large or directional shifts required internal rebalancing. Across the week, this translated to an average of $581k in daily volume alongside 754 shifts per day, setting a low but clean baseline as the year gets underway.

Shift count totaled 5,275 transactions (−8.6%), with activity dipping to 540 shifts on January 1st before rebuilding through the remainder of the week and closing at 906 shifts on January 5th. Larger shifts remained relatively scarce during the period, continuing a trend seen through late December, while overall participation recovered more quickly. Taken together, the count data suggests engagement returned promptly after the holiday pause, even as activity remained skewed toward smaller, routine usage.

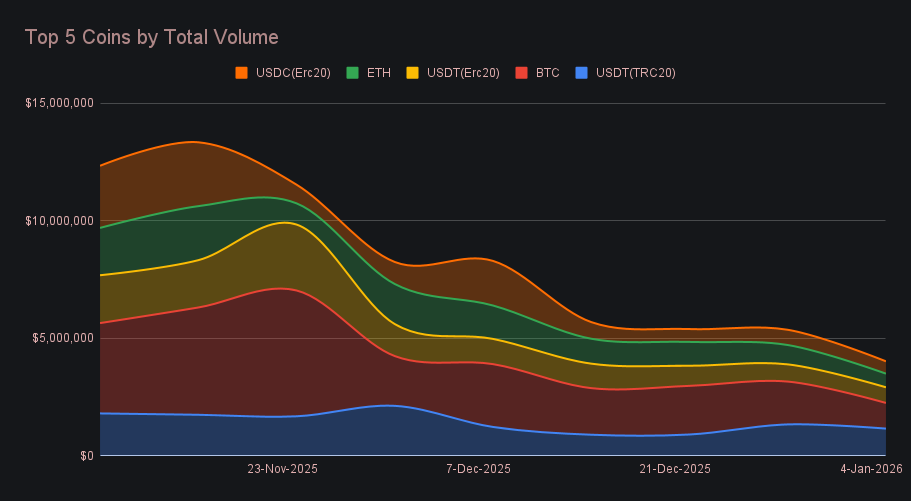

Stablecoins occupied three of the top five positions this week, collectively leading activity among all coins. USDT (TRC-20) ranked first with $1.16m in total volume (−13.3%), built on $421k in user deposits (−4.2%) and $374k in settlements (−29.5%). While user volumes alone were not dominant, the timing and scale of shifts meant TRC-20 liquidity was drawn on more frequently, raising liquidity shifting and lifting it ahead of BTC at the top of the leaderboard. USDT (ERC-20) followed in third with $666k (−9.0%), where deposits rose to $221k (+34.7%) even as settlements eased to $277k (−37.1%). USDC (ERC-20) placed fifth at $525k (−19.1%). Although materially smaller than the USDT variants, it stood out as the only stablecoin in the group to show growth on both user sides, with deposits increasing to $253k (+73.7%) and settlements rising to $176k (+10.6%).

BTC finished second with $1.09m in total volume (−40.1%), marking one of the few instances over the past year where it did not lead SideShift activity. User deposits fell to $438k (−48.3%), while settlements rose to $448k (+39.9%), aligning with BTC’s broader price rebound to around $92.6k (+4.9% on the week). That pickup in buying, however, remained modest in scale — the largest BTC pairs were stablecoin routes and topped out near $136k, limiting BTC’s overall footprint during a quiet stretch. In context, BTC settlement volumes have been lower and more uneven since late November, and while December saw brief spikes, this week’s activity remained well below those heavier periods.

ETH finished fourth with $580k in total volume (−29.5%) for the week. Deposits fell to $289k (−39.4%), while settlements came in at $290k (+5.9%), leaving activity nearly evenly split between the two sides. That profile closely mirrored SOL, which ranked just below in sixth at $507k (−25.2%), following a similar step-down after stronger activity earlier in December. Both assets saw participation cool at the start of the year, but maintained enough baseline usage to remain clustered just outside the stablecoin-heavy top tier.

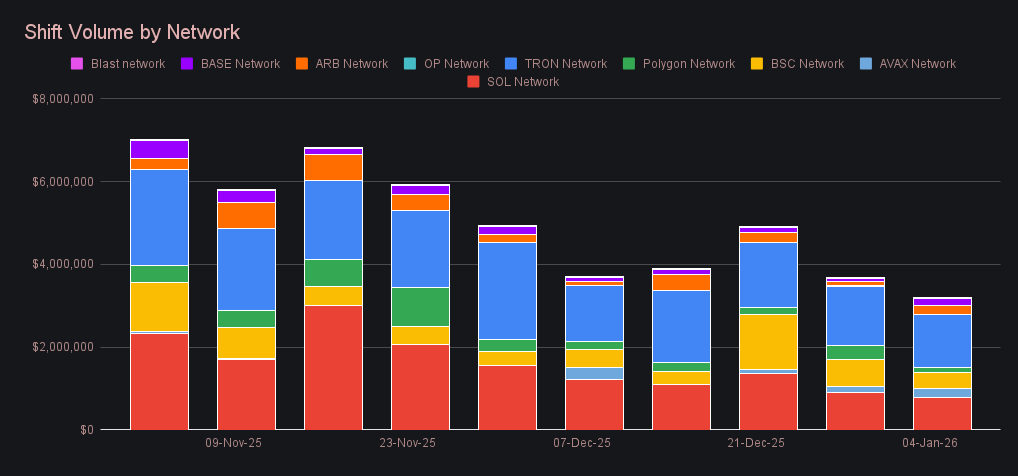

Alternate networks recorded $3.17m in total volume (−13.6%), continuing to outperform the Ethereum network, which finished the period at $2.19m (−6.0%). The Tron network remained the most consistent contributor at $1.28m (−11.2%), retaining a clear lead while other networks shifted more unevenly. The Solana network followed with $785k (−14.5%), holding second place despite another step lower, while BSC dropped to $392k (−38.6%). Further down, Arbitrum and Base posted sharp percentage gains to $232k (+99.1%) and $146k (+129.7%), though both remained smaller in absolute terms, alongside Avalanche at $215k (+47.1%).

In listing news, SideShift recently added support for LYNK on Solana, and RAIN on Arbitrum. Shifting is now live, directly from any coin of your choice.

Affiliate News

Affiliate volume rose to $1.17m (+18.7%), increasing its share of overall SideShift activity for the week. First place led with $250k (+142.0%), reclaiming a clear lead after last week’s dip. Second place followed at $233k (−25.0%), while third place was taken by a new entrant, contributing $171k and establishing a meaningful presence. Together, top affiliates accounted for 28.8% of total volume, up from 17.1% previously, reflecting a more concentrated contribution from integrations during a generally slow period.

That’s all for now - thanks for reading and happy shifting.