SideShift.ai Weekly Report | 30th January - 5th February 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the ninetieth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the ninetieth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week saw SideShift token (XAI) maintain a fairly narrow trading range, moving within the 7 day bounds of $0.1305 / $0.1371. At the time of writing this report, XAI is sitting at a price of $0.1338 and has a market cap of $17,425,351 (+1.0%).

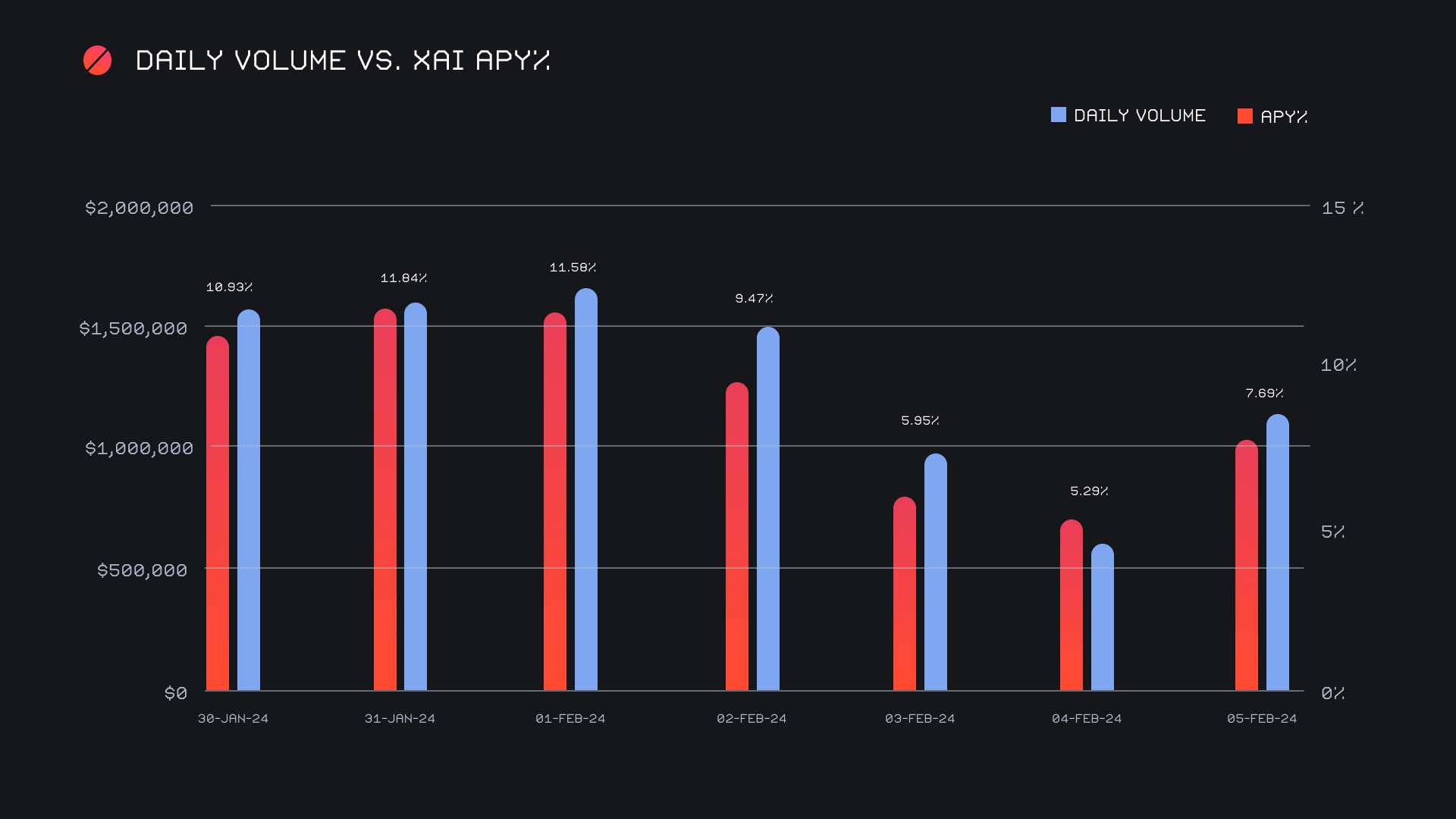

XAI stakers were rewarded with an average APY of 8.96% throughout the week, with a daily rewards high of 35,485.38 XAI being distributed to our staking vault on February 1st, 2024. This was following a daily volume of $1.7m. This week XAI stakers received a total of 190,038.82 XAI, or $25,427.19 USD.

The price of 1 svXAI is now equal to 1.2843 XAI, representing a 28.43% accrual on stakers investments. Don’t forget that the easiest way to participate in XAI staking and earn a portion of 25% of our daily revenue, is to create a shift directly to svXAI, from any coin of your choice.

Additional XAI updates:

Total Value Staked: 116,030,969 XAI (+0.2%)

Total Value Locked: $15,425,039 (+0.8%)

General Business News

The past week was a predominately sideways one for the majority of coins. BTC and ETH showed minimal volatility, with both seeing a 7 day volume change of just ±1%. Chainlink led the charge and ended up being the week’s top performer in terms of volume percentage increase, climbing a respectable +26% to trump all coins.

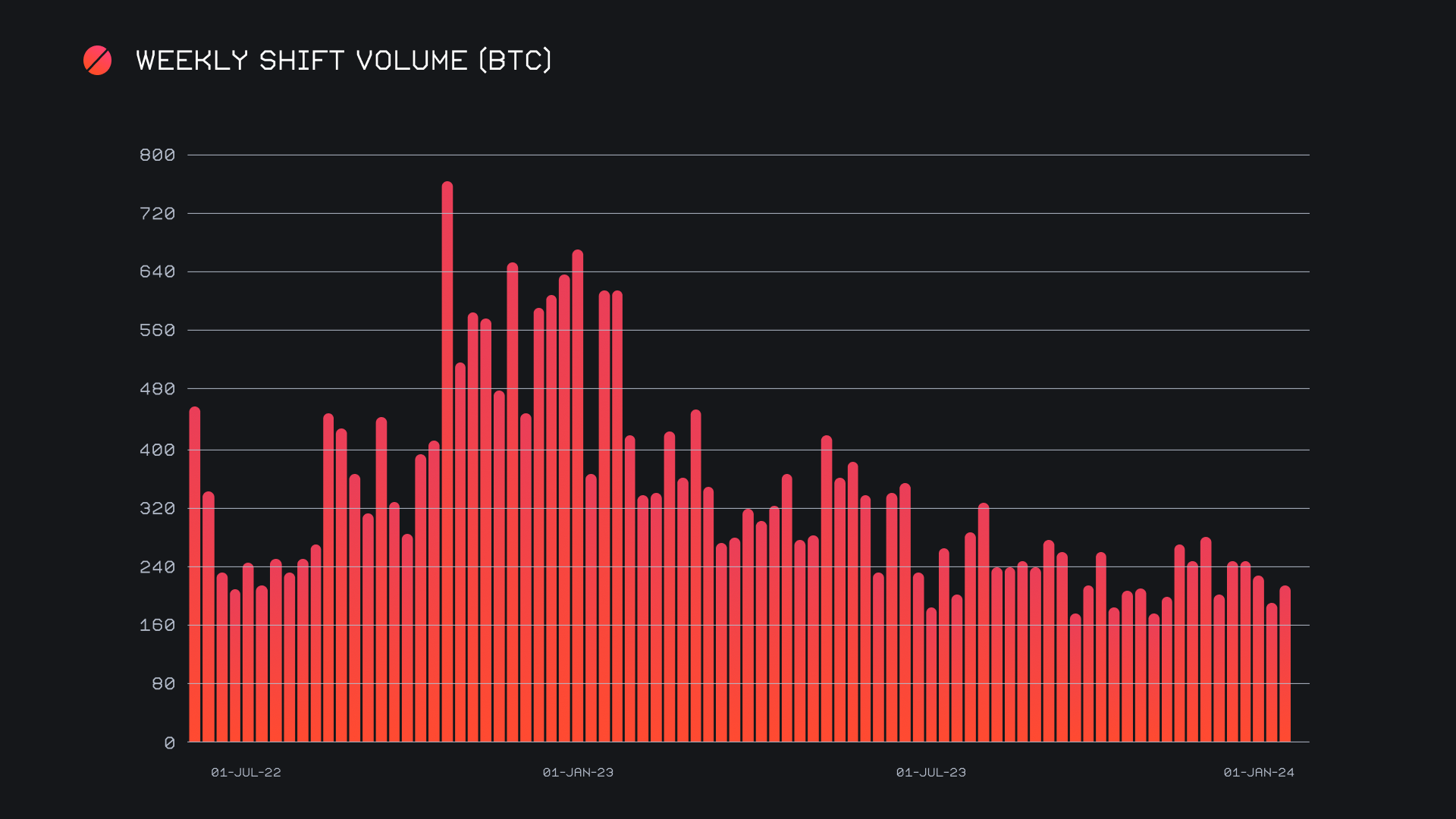

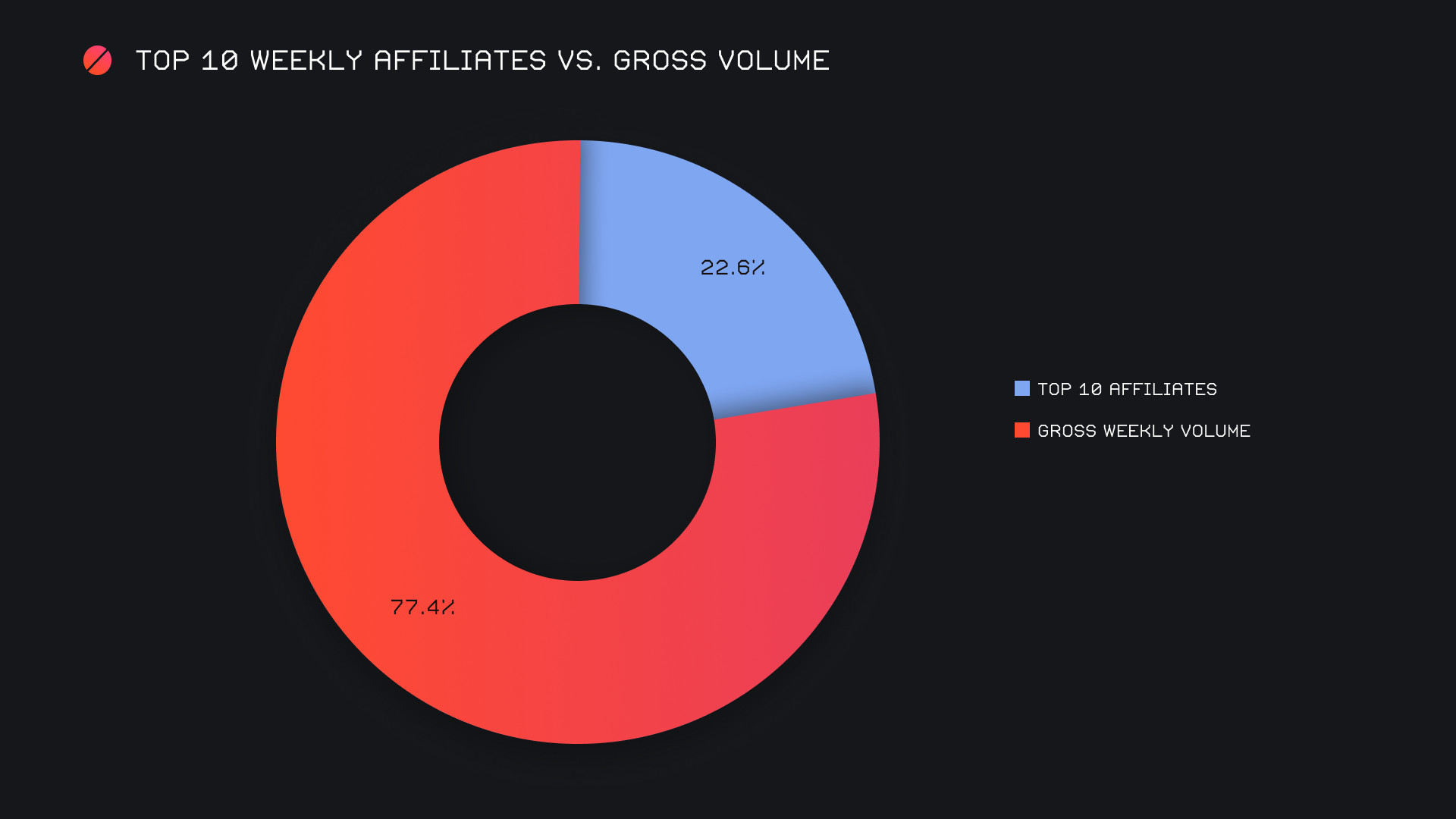

Despite the generally flattish market behavior, SideShift bounced back with a strong performance and reclaimed the $9m mark. We ended the period with a gross $9.1m (+19.5%) alongside a shift count which totalled 7,905 (+2.7%). ETH and SOL shifts in particular played a significant role in this rise. Just as was the case in last week’s report, this week saw a majority of shift volume derive from shifts completed directly on the site. Shifts on the site accounted for a dominant 77.4% of our weekly volume, which was a slight increase from last week’s proportion. Together, these weekly figures combined to produce daily averages of $1.3m on 1,129 shifts. When denoted in BTC, our weekly volume amounted to 211.64 BTC (+15.6%).

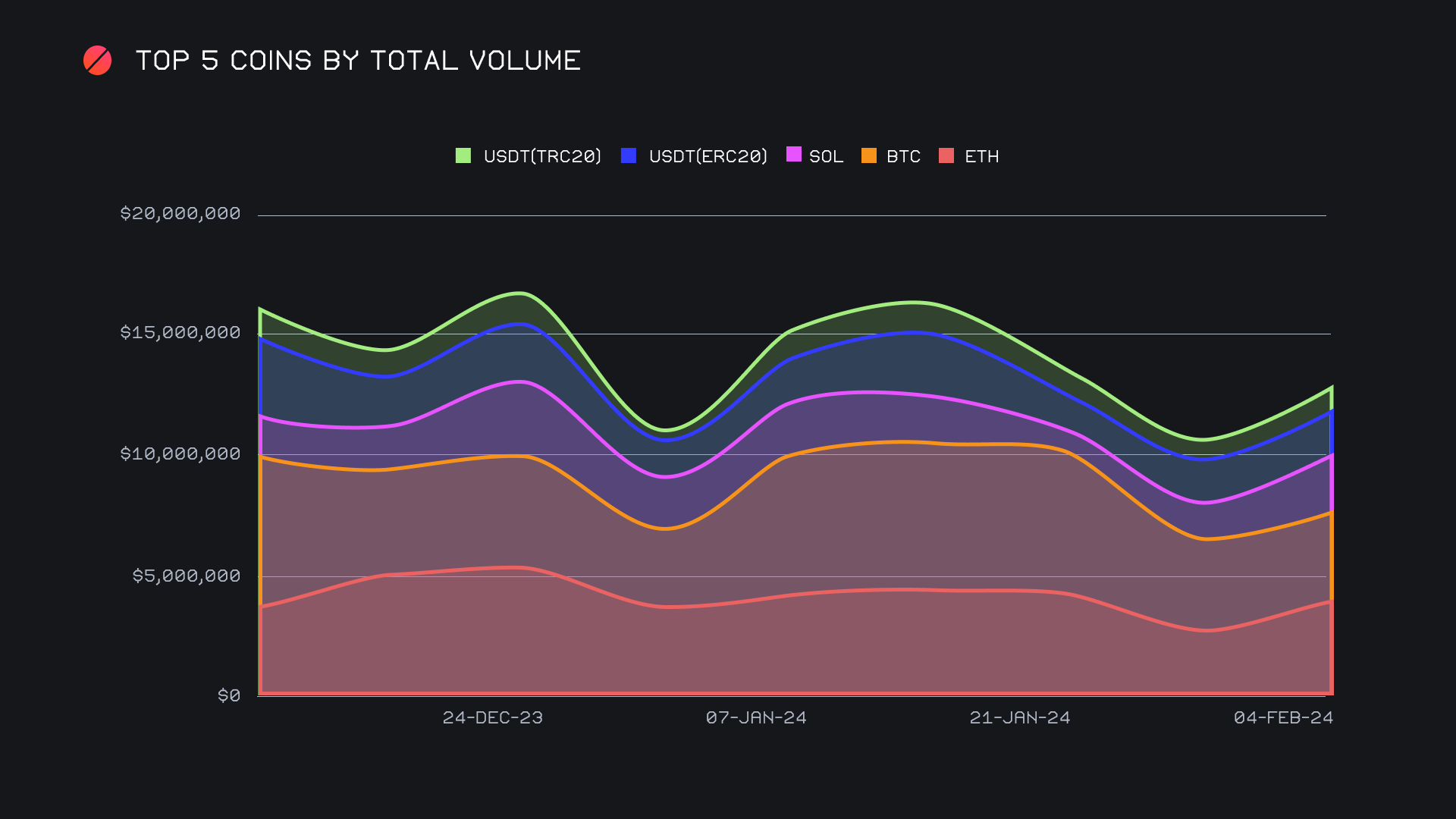

On the back of an impressive +40% rise, ETH stormed to the top of the list this week with a total volume of $4.1m (deposits + settlements). This move leapfrogged BTC for first place, which sat approximately ~10% lower with a total volume of $3.7m (-1%). The momentum for ETH has really held up recently, as the weekly average over the past two months is now comfortably sitting over $4.2m. Most notably, this has been driven from the settlement side, as ETH has now finished as the most popular settlement coin for users in 6 of the past 8 weeks. In most of these weeks, the competition hasn’t even been close. This week saw ETH settlements jump +29.7% for a gross $1.8m - this sat nearly $800k higher than the next most demanded coin, which was USDT (ERC-20) with ~$1m. In the chart below you can visualize the recent upwards tilt of ETH, while also noting the shrinking in BTC dominance.

BTC still remained the preferred deposit method for users as it accounted for $1.8m in user deposits (+27.9%) and easily finished as our week’s most deposited coin. 37% of this deposit volume was shifted to ETH, as the BTC/ETH pair resumed its position as the most popular among users, this week doing so with $677k. However, despite the decent influx of BTC, an abrupt decline of -36% in user settlements produced a settlement sum of just $929k, thereby hurting BTC’s overall total volume. Instead of stacking BTC, it seems users had their eyes focused not only on ETH, but also coins such as USDT (ERC-20), and SOL.

Ending the week in third place overall, SOL watched its total volume rise by a sizable +54.5%, and finished with a gross $2.3m. Similar to ETH, SOL has maintained some solid strength in recent months, despite incurring a minor lull a few weeks ago which saw its total volume momentarily dip below $1m. SOL settlements had the slight edge this week, slightly outweighing deposits by a measurement of $938k to $872k. Still, in terms of a percentage change, both of these figures represent increases of >40% on the week, a telltale sign that SOL overall shifting is back on the up.

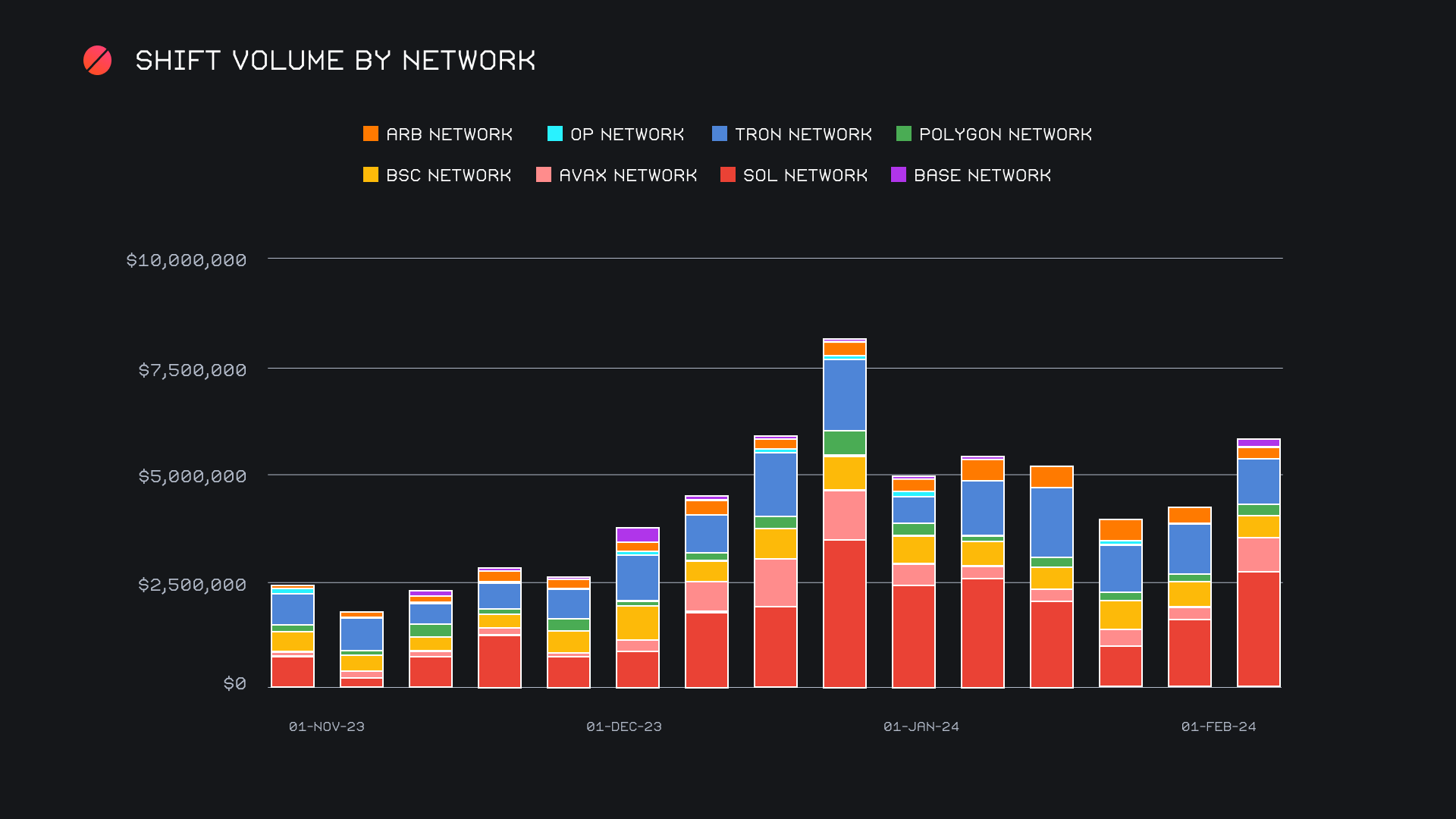

Not only did the native SOL token notice this uptick in shift action, but also USDC on Solana, which managed to nab 7th spot this week. A total volume of $536k represented a move of +149.2% on the week, marking the most significant change among all of our top coins. This contributed to the Solana network having one of its most impressive performances on SideShift to date. Its combined sum of $2.8m (+65.5%) led all alternate networks to ETH, nearly triple the volume of the runner-up, the Tron network. The Tron network still managed to surpass $1m, but just barely, with a final sum of $1.01m (-12.5%). Meanwhile, the Avalanche network charged its way into third place, after laying low for the better part of 5 weeks. Thanks to a quick surge in stablecoin shifting, the Avalanche network ended with a combined $745k (+160.6%). Even the Base network got in on the action, thanks to ETH (BASE) shifts incurring a spike which saw its network volume rip from just $13k last week, to $152k this week. All together, these alternate networks tallied $5.8m, now sitting only just behind the Ethereum network’s gross sum of $6.1m.

An observation about these alternate networks to ETH is that in many cases, a sizable proportion could be accounted for by stablecoins on these networks. In the cases of USDC on SOL, USDC on AVAX, and USDT on AVAX, all of these coins recorded a weekly total volume greater than $250k, and saw a positive volume change exceeding 100%. USDT on Ethereum remains the clear user favorite for the time being, but it will be interesting to see if alternatives can continue to build momentum and truly become popular among users.

Affiliate News

SideShift’s top affiliates came together this week for a combined total of $2.1m, an increase of about +16% from last week’s total. Our top two integrations had the most significant changes here, recording respective volume increases of +38.6%, and +30%. As for our first placed affiliate - it remains unchanged, and has now held the top spot for 9 consecutive weeks. This week it ended with $1.2m, which translated to 13.2% of our total weekly volume.

All together, our top affiliates represented 22.6% of our weekly volume, 0.8% lower than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.