SideShift.ai Weekly Report | 30th July - 5th Aug 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one-hundred-and-sixteenth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and sixteenth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week saw SideShift token (XAI) experience a sharp drop alongside the rest of the market on August 5th, 2024, resulting in its price falling from the $0.15 range to $0.1355, before bouncing slightly to settle at its current price of $0.1364. At the time of writing, the market cap of XAI is $18,700,551, an approximate decrease of -8.25% from last week’s total.

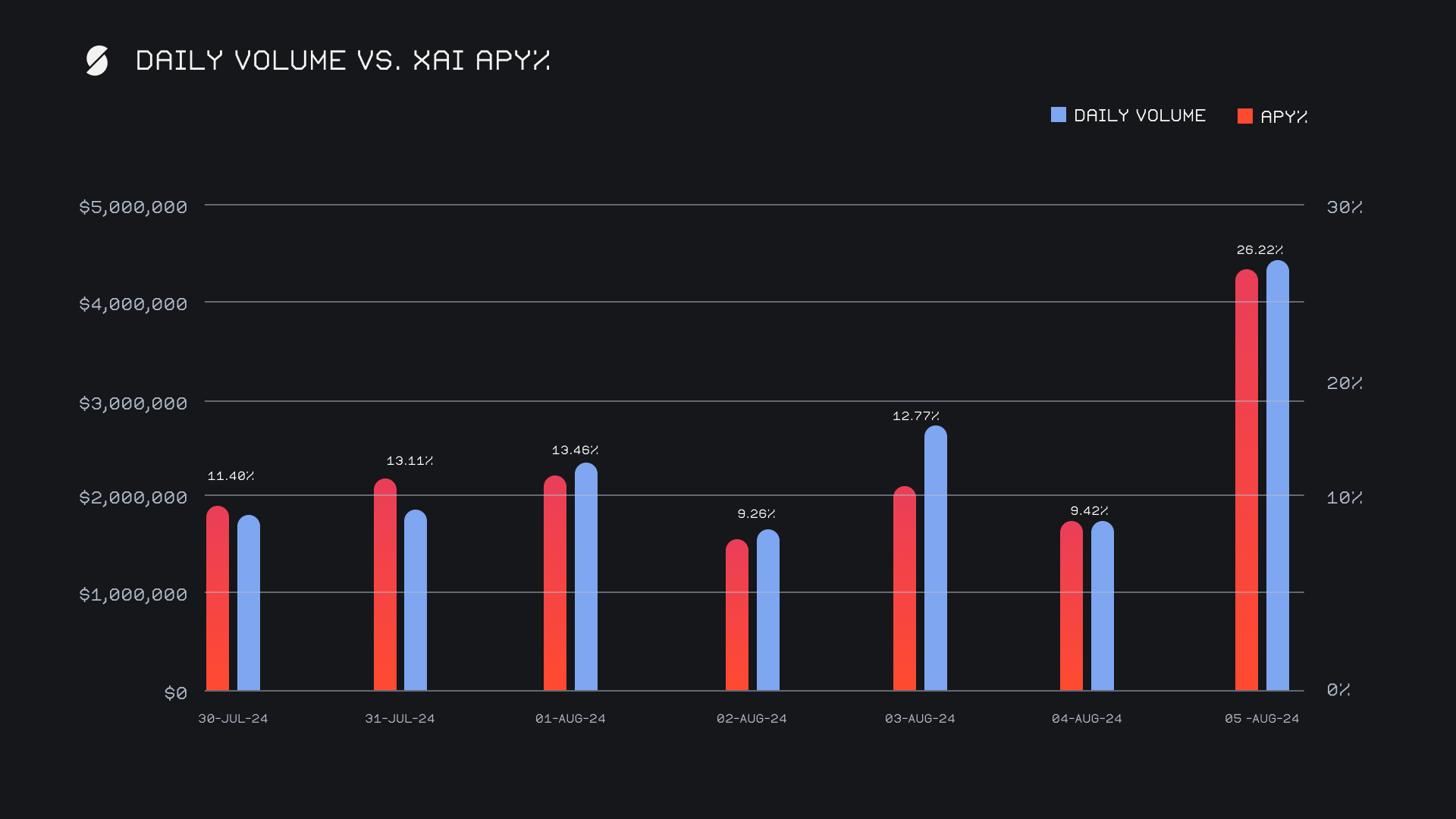

XAI stakers were rewarded with an average APY of 13.66% this week, with a daily rewards high of 78,271.14 XAI (an APY of 26.22%) being distributed to our staking vault on August 6, 2024. This was following an extremely volatile day which led to a healthy daily volume of $4.4m on SideShift. This week, XAI stakers received a total of 298,656.37 XAI or USD 40,736.73 in staking rewards.

Additional XAI updates:

Total Value Staked: 122,818,710 XAI (+0.2%)

Total Value Locked: $16,523,039 (-8.8%)

General Business News

The crypto market experienced a vicious sell-off this week, recording more than $1b in liquidations yesterday alone. This freefall saw BTC plunge below $50,000, while ETH retraced all gains made during its July rally, dipping as low as $2,200. This led a shocking 50 point weekly swing to the downside for the fear and greed index, as it now sits at a level of extreme fear, with a gloomy score of just 17.

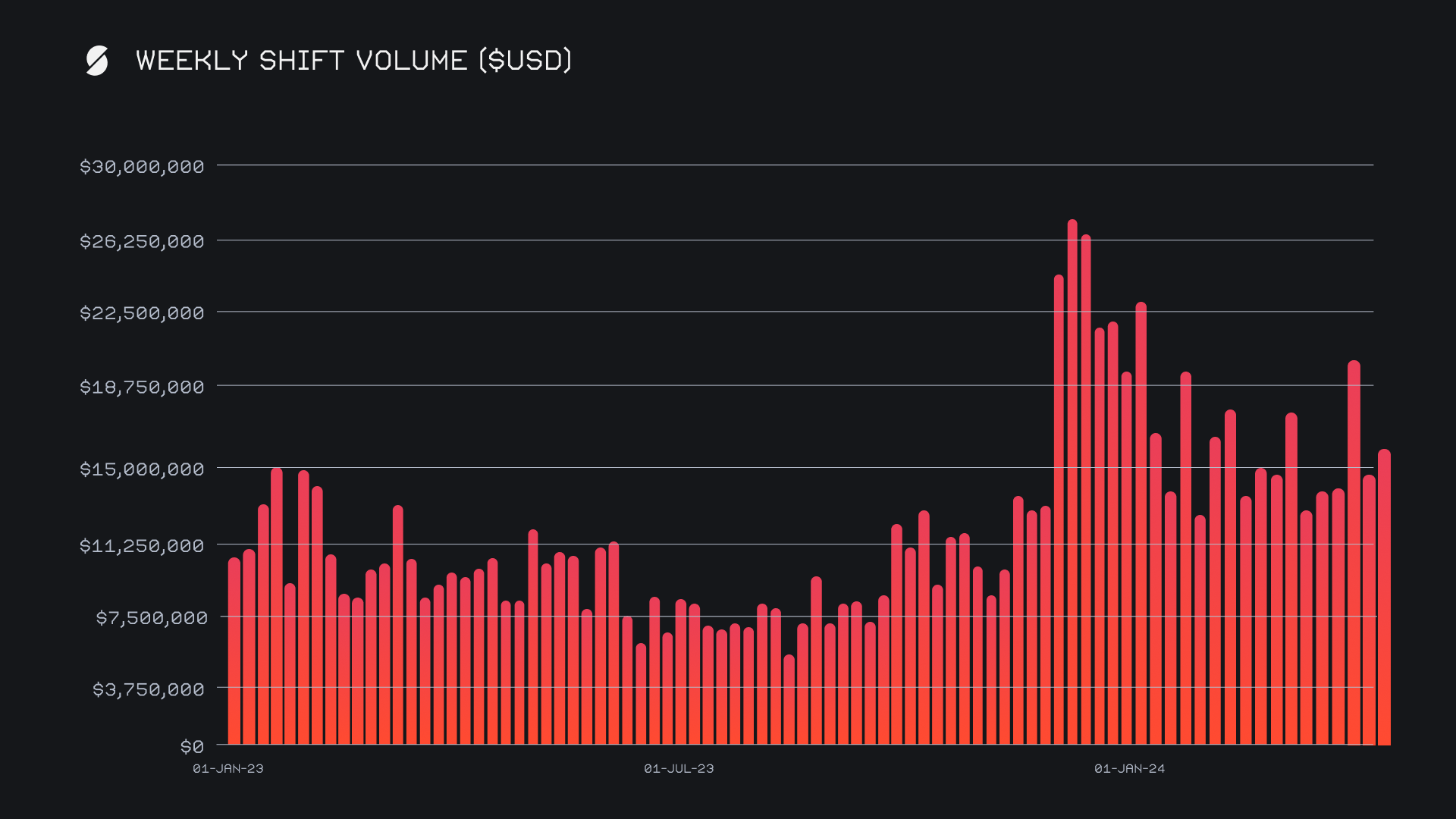

It was very much an average week for SideShift, with both our volume and count falling within 3% of our YTD averages. However it took a solid performance to get here - SideShift embraced the market volatility and ended on a positive note, achieving a gross volume of $16.2m, up by +10.6% compared to last week's $14.7m sum. Our daily averages settled at $2.32m spread across 1,392 shifts, highlighting the uptick in user engagement and shift activity that comes from both upwards and downwards price action. The BTC/ETH trading pair continued to lead the pack with a volume of $787k, however, BTC/USDT(erc20) followed closely with $764k, as all stablecoins witnessed a significant rise in shifting, perhaps unsurprising considering the cascade of prices.

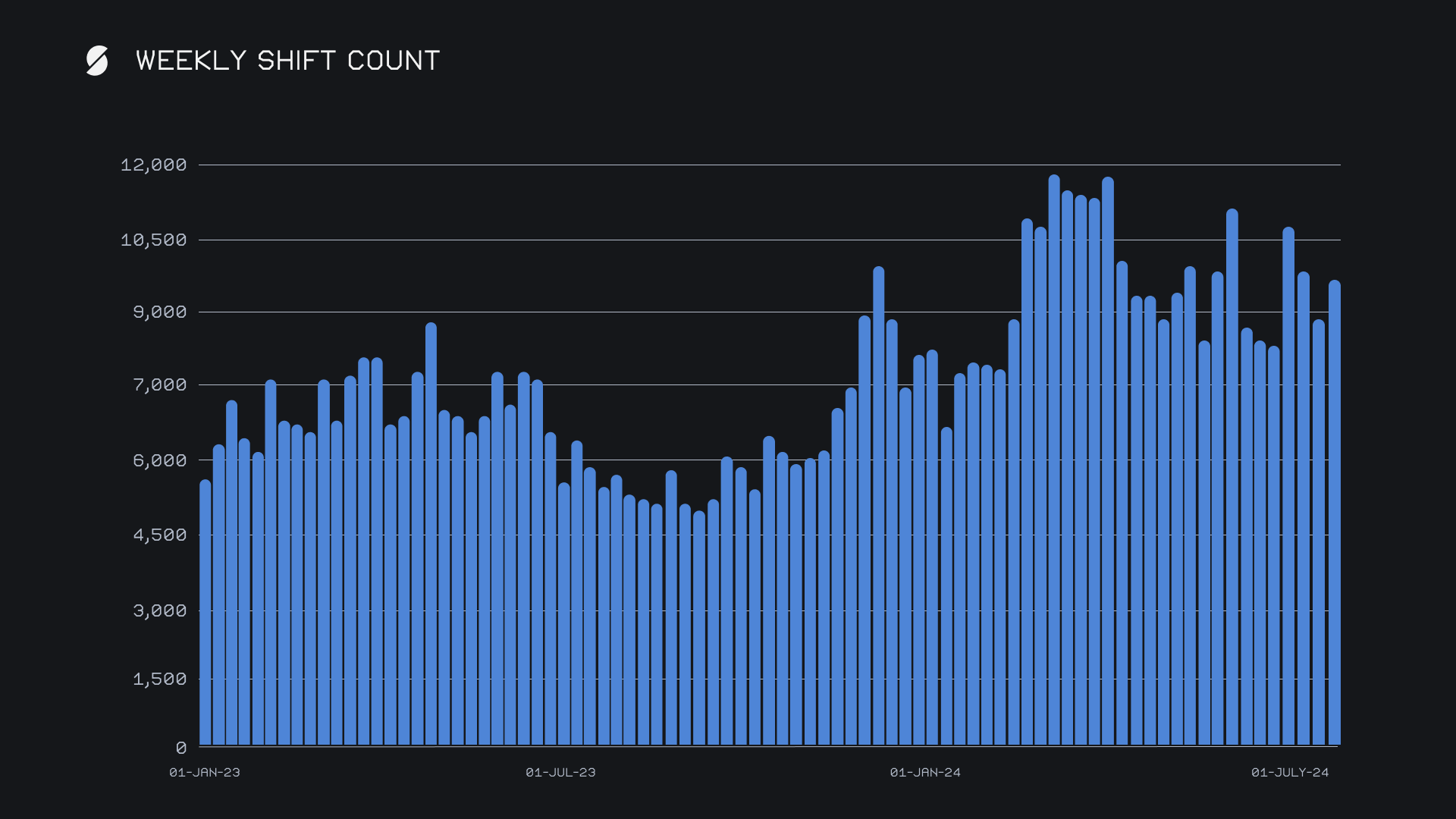

Weekly shift count also had a decent increase of +10.2% from last week, and ended with a total of 9,741 shifts. This derived from a fairly evenly distributed count across days, showing a positive sign of SideShift’s reliability and growing popularity. The chart below is a further indication of this fact, with the upwards trend suggesting sustained interest among users. When compared to one year ago, this week’s shift count measures +72% higher.

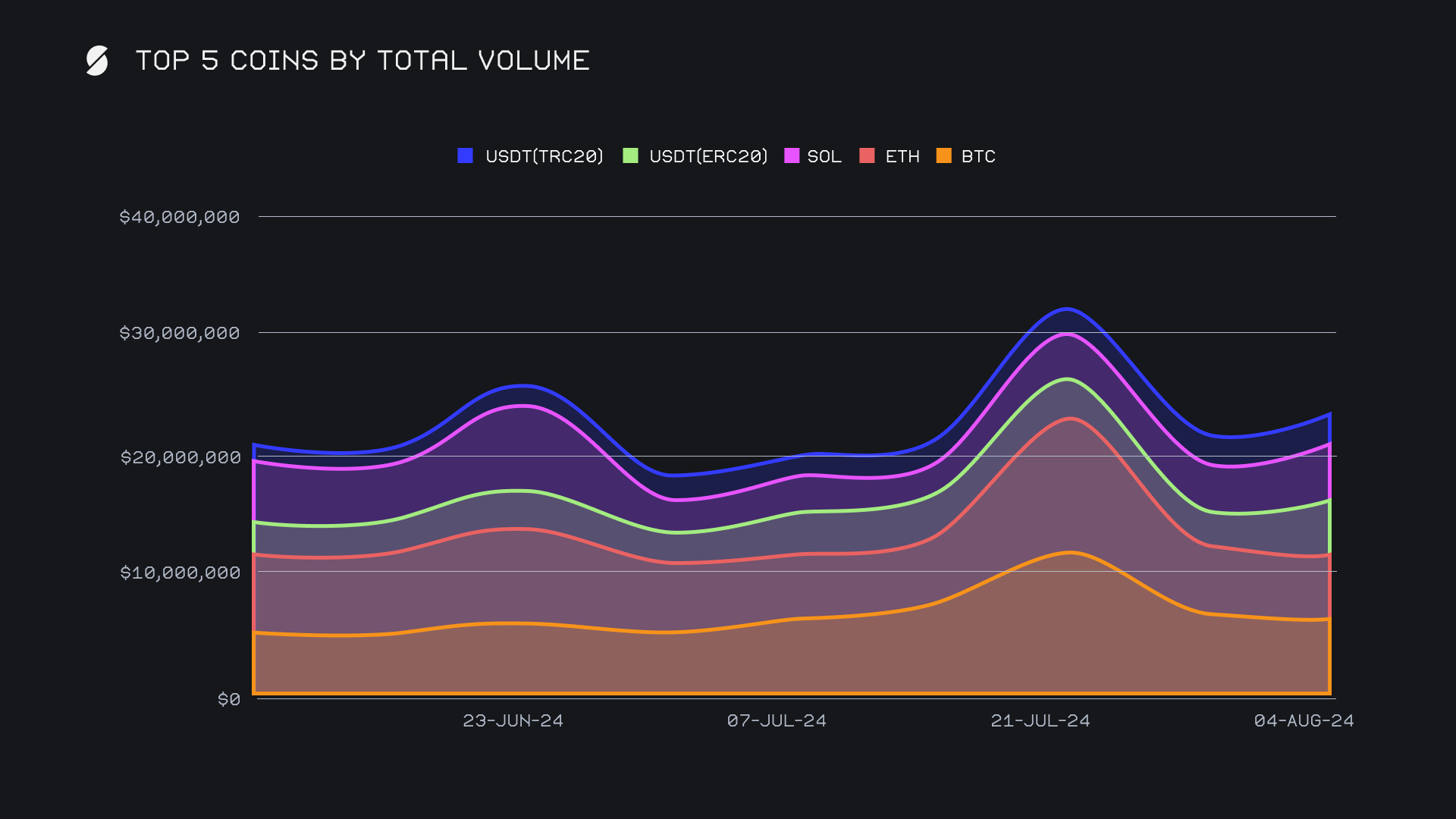

BTC hung onto its first place title for the fifth straight week and achieved a total volume (deposits + settlements) of $6.4m, although this marked a decrease of -11.4% from last week. As is typically the case, volume came from larger user deposits vs settlements, which ended with respective totals of $2.9m (-8.5%) and $2.2m (+2.5%). Although BTC retained the spotlight, this reduction in deposit volume suggests users might be deciding to hold onto their BTC while user demand for receiving BTC is also slightly up. Users might have also shifted their attention to other coins this week.

ETH secured the second spot with a total volume of $5.3m, reflecting a slight decline of -5.9% from last week's $5.7m. User deposit volume showed resilience at $2.0m to represent a +5.0% increase. However, ETH settlement volume dipped to $2.4m, being -5.1% decrease compared to last week that shows a recent switch in user preference to receiving ETH, not surprisingly as one of hardest top coins hit price wise this week. Nevertheless it has continued to remain the settlement coin for our top user shift pair since the beginning of July 2024, showcasing that its demand has not sizzled out yet.

Meanwhile, USDT (erc20) surged ahead and captured third position with an impressive total volume of $4.8m, a huge increase of +56.1%, and representing the largest change among our top coins. Deposits soared to $1.7m, up by +53.1%, and settlements followed suit with a modest +3.7% rise to $1.7m. These significant increases both ways can be attributed to the extreme market volatility during the week, with some users exiting in a panic to the safety of stablecoins, while others taking the opportunity at buying the dip.

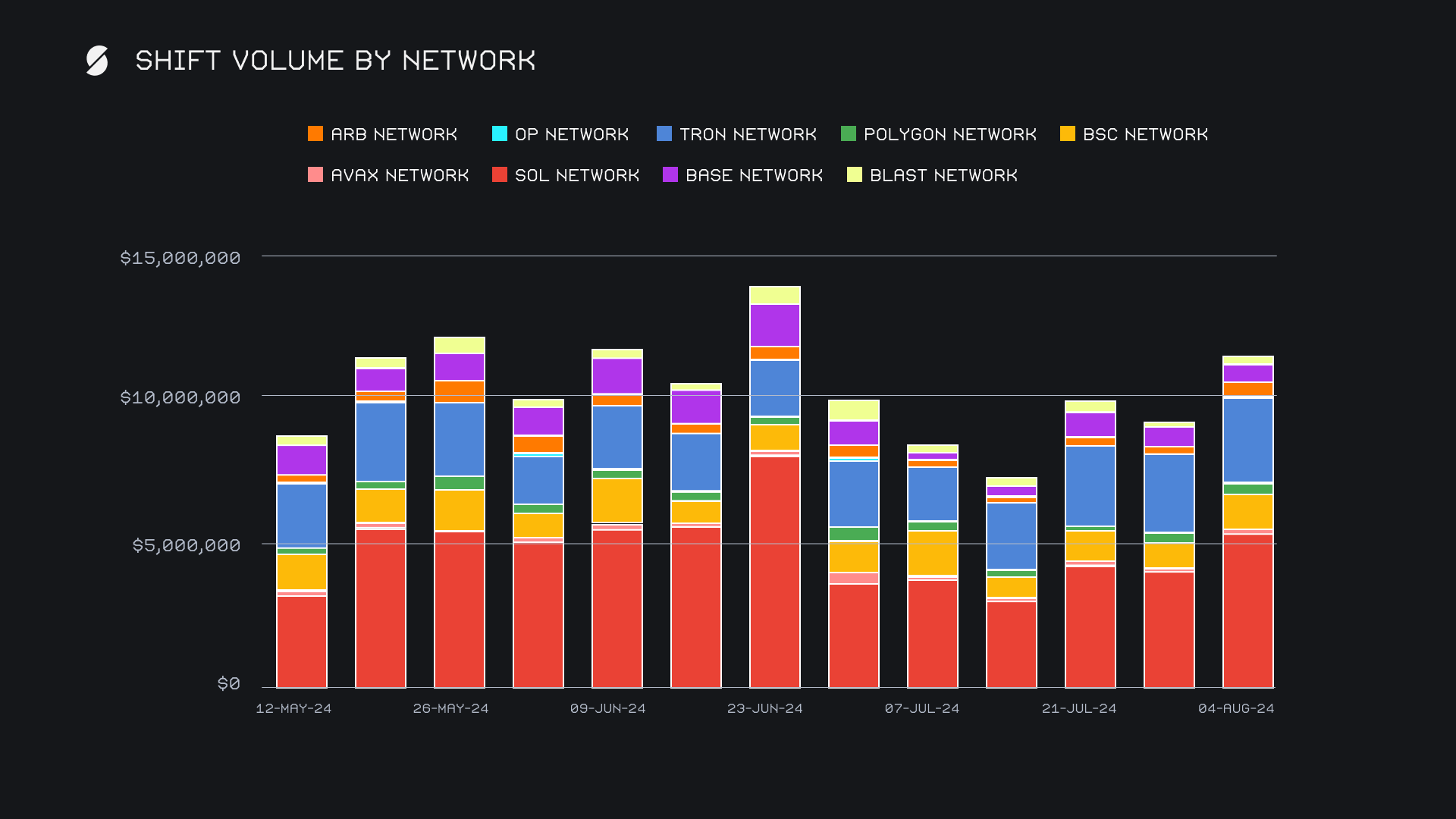

All but one alternate network to Ethereum noticed an increased attention this week, with many showing impressive gains. The Solana Network retained its assertive position, with its volume increasing by a decent +31.9% to end with $5.3m. A near 8x in USDT(sol) shifting helped the cause, which again could be contributed to volatility, while still the always reliable volume coming from the native SOL token. The Tron network also performed well, showing an +8.7% increase with volume at $2.9m. Similarly the Binance Smart Chain (BSC) saw + 28.6% rise for $1.2m total volume, while the Arbitrum network enjoyed a +81% boost for $479k. The Base network was the only one to incur a weekly drop, falling -15.4% for $608k voluyme. A combined proportion of 35.2% of volume saw alternate networks to ETH surpass the Ethereum network this week, which ended up accounting for a lesser 32.9% of shift volume.

Affiliate News

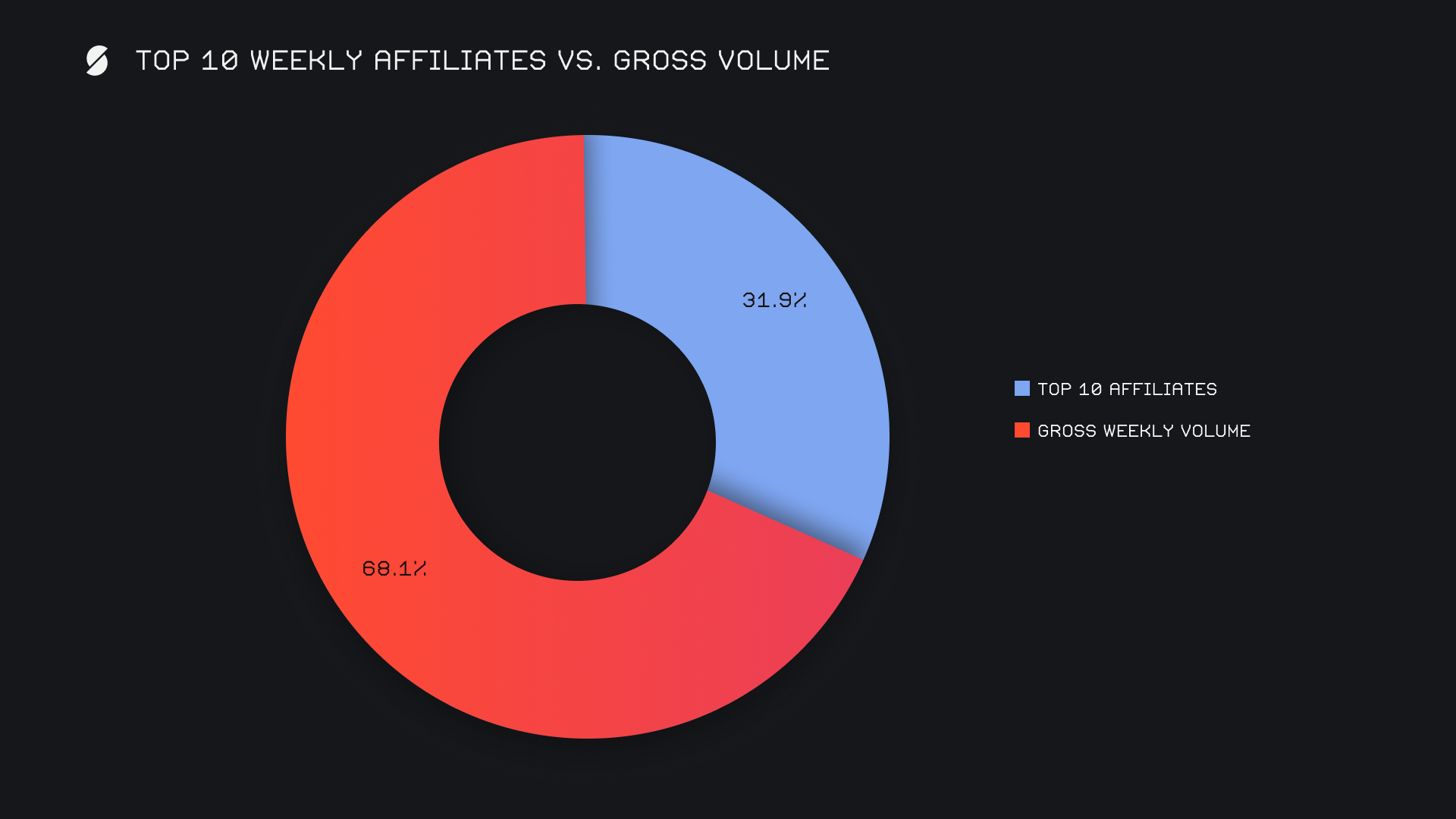

This week, our top affiliates generated a combined total volume of $5.2m, showing a solid increase of +17.3% from last week. Our top affiliate rankings saw some promising movements. The first-place affiliate experienced a slight decrease of -2.6%, bringing its volume to $2.2m but maintaining its top spot. Our second-placed affiliate more than doubled its performance, and exploded by +107.2% to reach $1.5m, marking a significant rise from its previous third place finish. Meanwhile, our third-place affiliate also saw an uptick, and increased by +12.9% to finish the week with $1.2m.

All together, our top affiliates accounted for 31.9% of our total weekly volume, a slight increase of +1.8% from last week’s proportion, and representing a consistent contribution to SideShift’s performance.

That’s all for now. Thanks for reading and happy shifting.