SideShift.ai Weekly Report | 30th September - 6th October 2025

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one hundred and seventy-fourth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and seventy-fourth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

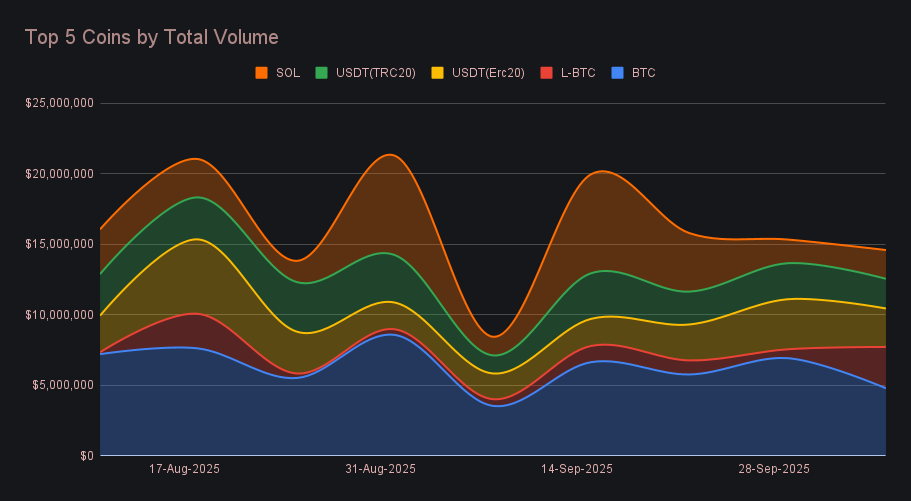

- SideShift processed $15.41m (−3.7%) across 9,019 shifts, holding steady for a third week within the recent $15–17m range.

- SideShift’s treasury reached an all-time high of $33.16m, after an additional 300,000 USDC was added over the past twelve days.

- BTC-led pairs dominated activity, as $1.32m in L-BTC/WBTC (Poly) trading reflected growing cross-network usage among BTC variants.

- Stablecoins ended with a +$98k net inflow, marking a rare three-week stretch of positive flows as users continued moving out of stables.

- SOL volume rose +21.4% to $2.04m, while BNB climbed +113% to $1.03m, standing out amid a week centered on BTC and stablecoins.

XAI Weekly Performance & Staking

XAI held a steady footing this week, trading between $0.1510 and $0.1567 before closing near the upper end of that range at $0.1555. The token’s market cap moved slightly lower to $23.56m (−1.01%), a slight pullback that reflected modest intraday swings but no decisive break in either direction. Over the past month, price action has gradually leveled out following September’s climb, suggesting a period of quiet consolidation around the mid-$0.15 mark.

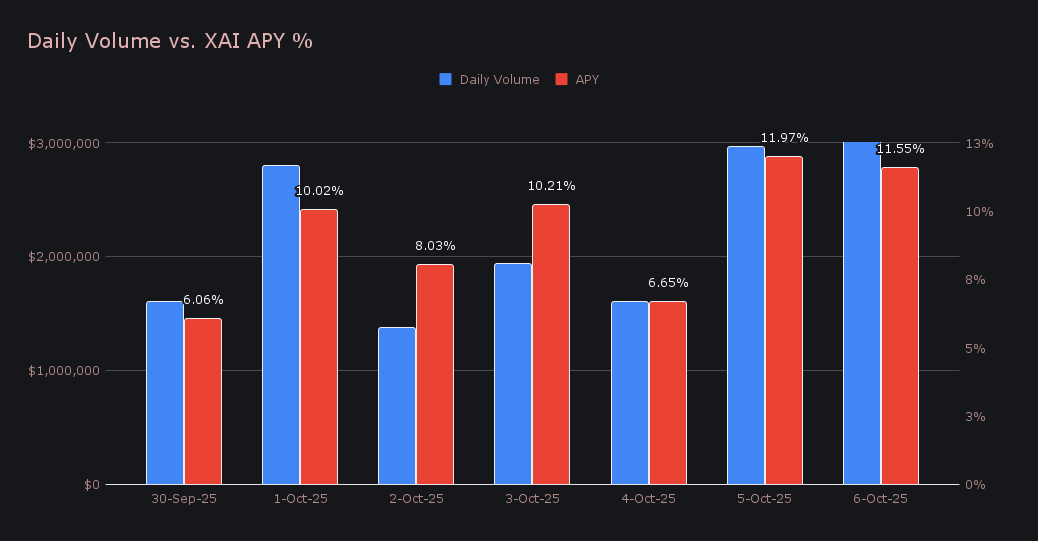

Staking activity remained rather consistent with past reports, as 234,696.78 XAI ($36,077.28) was distributed at an average yield of 9.21%. This was a marginal increase of +0.16% from the week prior. The standout day came on October 5, when 43,143.18 XAI was deposited directly to the staking vault at an APY of 11.97%, supported by $2.96m in daily volume.

300,000 USDC was added to SideShift’s treasury over the past twelve days, bringing the current estimated total to an all time high with a sum of $33,162,345. Users can follow along directly with live updates at sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 139,401,856 XAI (+0.2%)

Total Value Locked: $21,293,196 (−0.8%)

General Business News

BTC kicked off “Uptober” in full force, breaking through its previous ceiling to set a new ATH above $126,000. The move marked a pivotal moment for the market and helped propel total crypto cap beyond $4.2 trillion, reflecting the strength of the rally across major assets. Adding to the momentum, BNB captured its own spotlight after surging beyond $1,200, extending a multi-week climb to new highs of its own that has drawn renewed attention to the Binance ecosystem and its growing on-chain activity.

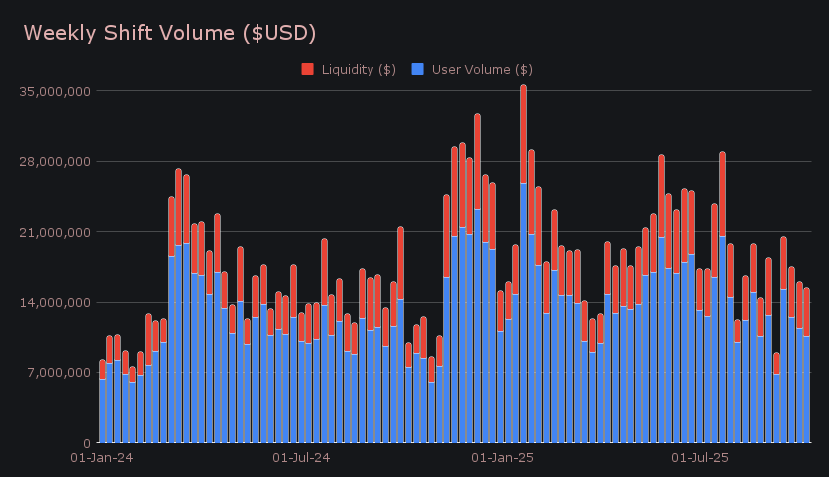

SideShift’s gross volume closed the week at $15.41m (−3.7%), marking a third straight week where total volumes held within the recent $15–17m range. User shifting volume summed $10.63m (−6.6%), while liquidity shifting increased to $4.79m (+3.4%). Activity leaned heavily toward BTC-denominated flows across multiple networks, which collectively drove much of the week’s movement and defined SideShift’s internal mix. The standout user pair was L-BTC/WBTC (Poly), which claimed the top spot for the first ever time with $1.32m in total volume — a rare result that underscored the Liquid Network’s expanding role in Bitcoin-related shifting. Other popular pairs USDT (ERC-20)/BTC ($484k) and BTC/USDT (ERC-20) ($316k) followed, maintaining their usual positions atop the list but trailing their typical volumes.

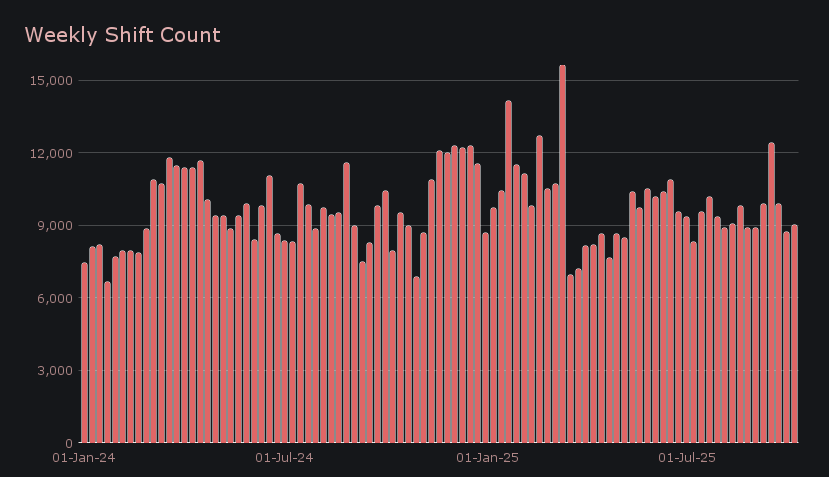

Shift count finished at 9,019 (+3.3%), averaging 1,288 shifts per day alongside $2.20 in volume. The increase in count against a decline in user volume showed that users were shifting more frequently but in smaller sizes. Overall, shift activity has remained relatively flat in recent months, despite a one time spike mid September, with whale and other large-size shifts continuing to be the main factor behind weekly volume changes.

BTC led once again but saw a clear drop in activity, with total volume sliding to $4.80m (−30.8%). User deposits rose to $1.67m (+26.7%), though settlements fell sharply to $1.68m (−50.6%), resulting in a more balanced flow after a few weeks of far heavier outflows. Meanwhile, L-BTC saw a sharp pickup in activity to finish in second, climbing +364.8% to $2.93m, with deposits expanding to $1.46m (+363.3%), the vast majority of which flowed into yet another variant, WBTC on Polygon. It was an interesting shift in dynamics, as users moved fluidly between multiple BTC formats, pointing to a gradual broadening in how users access BTC beyond its native chain.

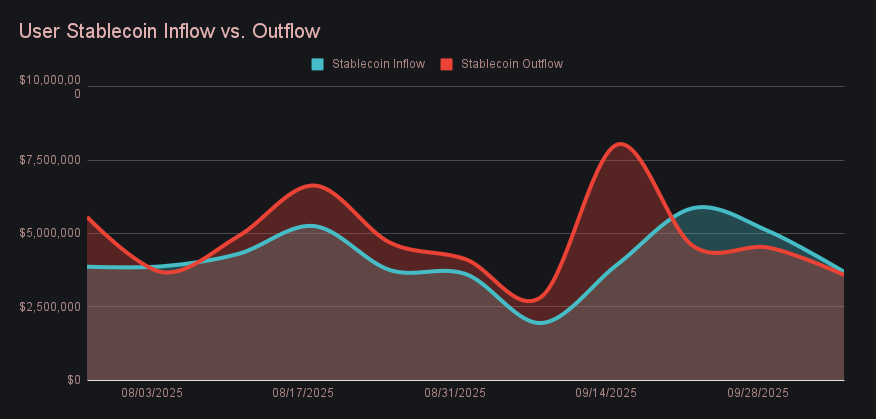

Conversely, stablecoin activity cooled, with both major USDT variants posting declines in total volume. USDT (ERC-20) finished third overall at $2.73m (−23.2%), while USDT (TRC-20) ranked fourth at $2.10m (−17.6%). Settlements outweighed deposits for these two individually, but that wasn’t the case across the wider stablecoin group. On aggregate, user inflows exceeded outflows for the third consecutive week — the first time this has ever occurred on SideShift. The +$98k net stablecoin flow was smaller than last week’s +$558k, yet it extended a meaningful pattern where users, on average, continue to deposit more stablecoins than they receive. This streak points to a clear shift toward risk-taking, as users position more aggressively across the market on average rather than remaining parked in stables.

Rounding out the top five, SOL recorded $2.04m (+21.4%) in total volume. Deposits slipped to $696k (−18.5%), while settlements climbed +88.0% to $1.23m, showing a clear pickup in user activity as price strength persisted. In contrast, ETH fell to seventh with $1.63m (−10.3%), marking a quieter week for the network as attention shifted elsewhere. SOL’s consistent activity kept it in the top group despite the main focus this week continuing to be on BTC and stables. One clear exception to this however was BNB, which posted a strong +$113% rise to $1.03m, for an 11th placed finish.

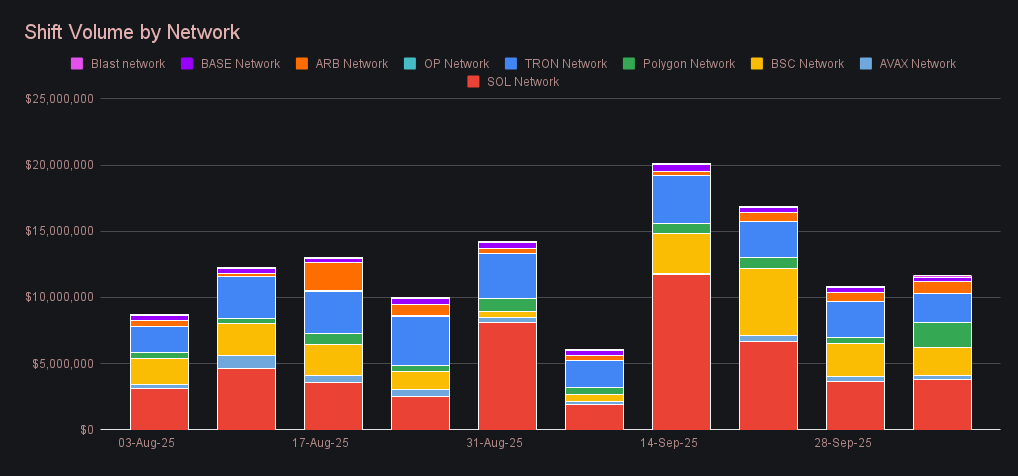

Alternate networks to Ethereum totaled $11.58m (+7.9%), while the ETH network itself saw less attention, slipping to $6.88m (−9.0%). The Solana network again led with $3.84m (+4.7%), followed by Tron ($2.24m, −17.5%) and BSC ($2.06m, −17.3%), both holding respectable volume despite lighter stablecoin shifting. Polygon was the standout, vaulting to $1.88m (+279.9%) to mark its strongest performance in recent memory, while Arbitrum also climbed to $874k (+32.8%). Avalanche ($332k, −6.9%) and Base ($313k, −13.7%) rounded out the group, adding to a week where interest in non-Ethereum ecosystems slightly expanded.

In listing news, SideShift has added support for several new assets including ASTER (BSC), AVNT on Base, XPL, USDT0 on Polygon and Arbitrum, and WBETH and MYX on BSC. Shifting of all of these tokens is now live, directly from any coin of your choice.

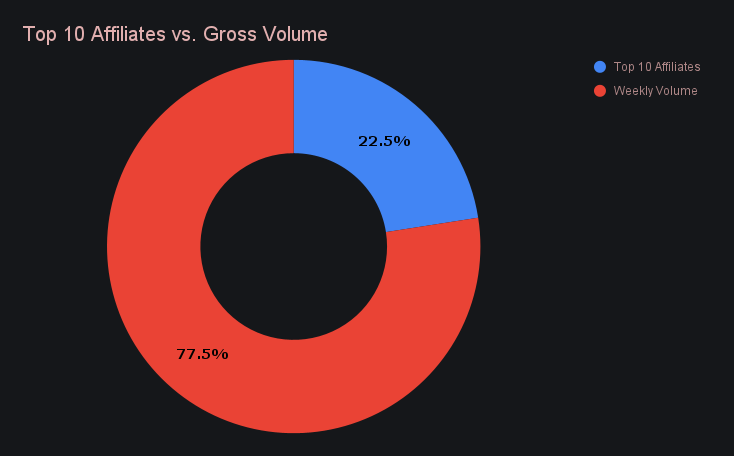

Affiliate News

Affiliate activity totaled $3.47m (−30.9%), marking a slower showing overall as each of the top three affiliates saw declines in volume. First place led with $1.14m (−27.1%), followed closely by second at $1.12m (−52.1%), while third finished with $324k (−26.6%). The ranking order remained unchanged, though the collective dip was largely offset by stronger direct site activity, which helped stabilize total platform volume.

All together, our top affiliates contributed 22.5% of total site volume, down −8.9% from last week.

That’s all for now - thanks for reading and happy shifting.