SideShift.ai Weekly Report | 3rd - 9th February 2026

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one hundred and ninetieth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and ninetieth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

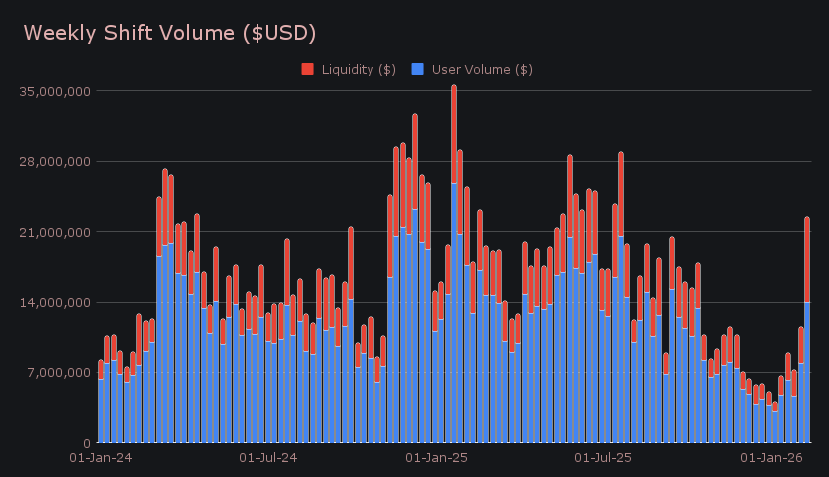

- SideShift volume jumped to $22.86m (+89.3%), its strongest weekly total in eight months amid heightened market volatility.

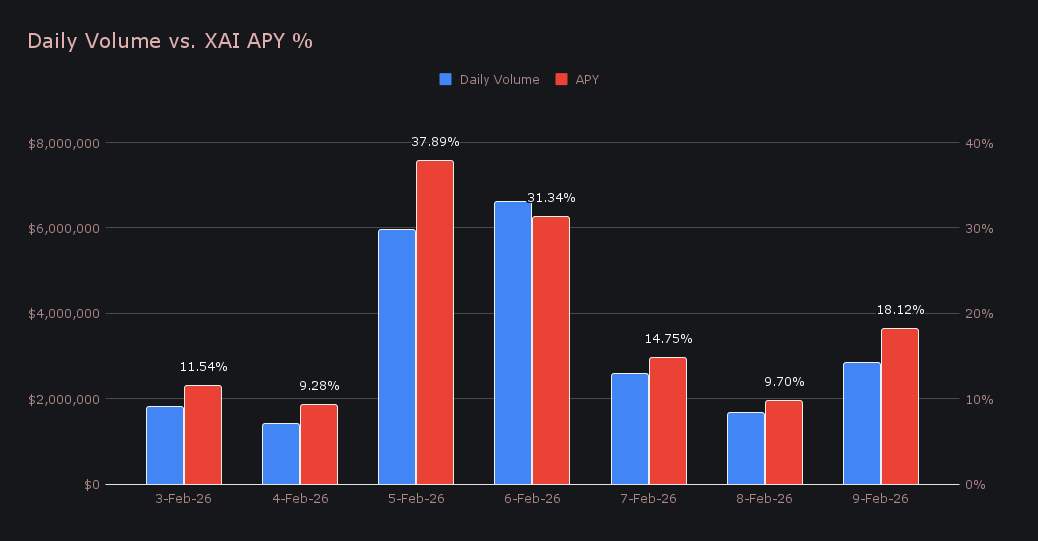

- XAI staking rewards rose sharply, with 459,785 XAI ($49.6k) distributed at an 18.95% average APY, including a peak day reaching 37.89% APY.

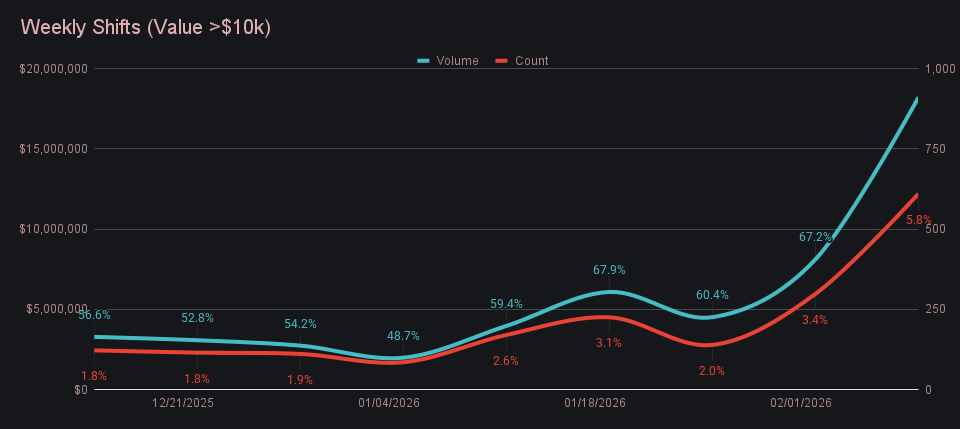

- Large shifts dominated volume, with transactions above $10k making up ~80% of the week and 610 shifts over $20k contributing roughly 66%.

- Bitcoin-linked assets accounted for ~40% of total volume, spanning BTC, L-BTC, and WBTC activity.

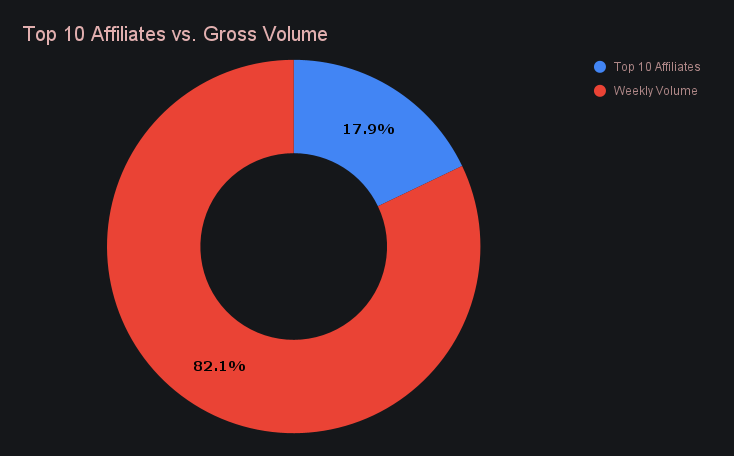

- Affiliate activity rebounded to $4.02m (+184.9%), lifting affiliate share to 17.9% of total SideShift volume.

XAI Weekly Performance & Staking

XAI’s price action remained largely unchanged, continuing to sit in the mid-to-high $0.10 range that has become familiar over recent periods. Trading stayed tight around the current level, with only minor intraday swings and no sustained movement taking place. While momentum on the chart remained quiet, XAI’s market cap crept marginally higher to $16.92m, marking a +0.78% increase from last week.

One point where this week clearly diverged from the prior one was on the staking side. A total of 459,784.90 XAI ($49,587.58) was distributed to stakers, marking a very sharp increase from last week’s payouts. Elevated platform activity pushed the average APY up to 18.95%, one of the strongest 7-day readings in recent memory. The clear standout arrived on February 5th, when 124,210.91 XAI was sent to the staking vault at a 37.89% APY, backed by a robust $5.95m in daily SideShift volume. Unlike last week’s steadier, lower-yield profile, rewards this period were clearly buoyed by heavy shift action taking place mid week.

SideShift’s treasury is currently sitting at an estimated value of $18.42m, or 265.78 BTC. Users can follow along directly with live treasury updates, via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 141,532,101 XAI (+0.3%)

Total Value Locked: $15,342,216 (+1.2%)

General Business News

BTC was hit by one of its most violent sell-offs in years this week, plunging toward the $60k area — levels not seen since late 2024 — as forced selling and large-scale leveraged liquidations tore through the market. After tagging $60k, price swiftly rebounded, regaining ~$10k in a single daily candle before finding some footing around the $70k mark. The bloodbath drove the Crypto Fear & Greed Index down to just 9/100, firmly in “extreme fear” territory and a sentiment reading not seen since the 2022 collapse triggered by the failures of Terra, 3AC, and Celsius.

SideShift delivered its strongest performance in over eight months as extreme market swings translated into decisive on-platform volume. Gross weekly volume climbed to $22.86m, an +89.3% jump from last week and the highest weekly total since mid-July 2025. Volume was not confined to a single session either — February 6th alone recorded $6.6m, matching that same eight-month high on a daily basis. User shifting rose sharply to $14.29m (+71.3%), driven primarily by heavy BTC buying, which in turn pushed liquidity shifting to $8.57m (+129.5%) as SideShift absorbed the resulting imbalance. Stablecoin-to-BTC pairs sat at the center of this push, led by USDT (TRC-20)/BTC at $2.03m, followed by BTC/USDC (ERC-20) and USDC (ERC-20)/BTC, underscoring how directly this week’s volatility translated into BTC-focused repositioning.

Whale activity returned in force this week and did most of the heavy lifting. Shifts valued above $10k made up nearly 80% of total volume, a sizable jump from early January, when the share of high-value shifts briefly slipped below the 50% mark. Even more telling, shifts over $20k alone accounted for roughly 66% of weekly volume, reinforcing just how concentrated activity became at the upper end, with the vast majority of this trading taking place directly on the site. The result was a clear case of scale overpowering frequency, with a relatively small number of large shifts (610) exerting an outsized influence on total volume.

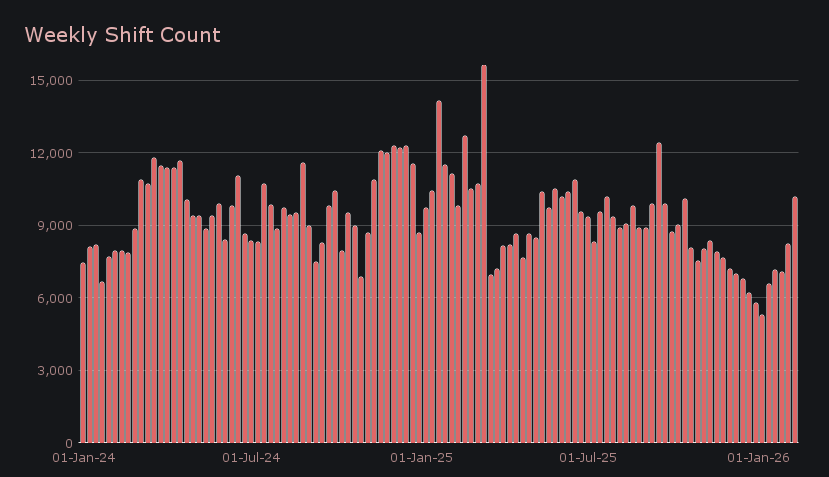

Shift count rose to 10,570 (+21.9%), marking the first time totals have cleared the 10k level in roughly five months. While participation picked up meaningfully, it grew at less than a quarter of the pace of weekly volume, reinforcing that this was not a week defined by sheer transaction frequency. Even with shifts returning to upper-range levels, it was the size of individual shifts, not a surge in smaller ones, that powered SideShift’s strongest showing in several months.

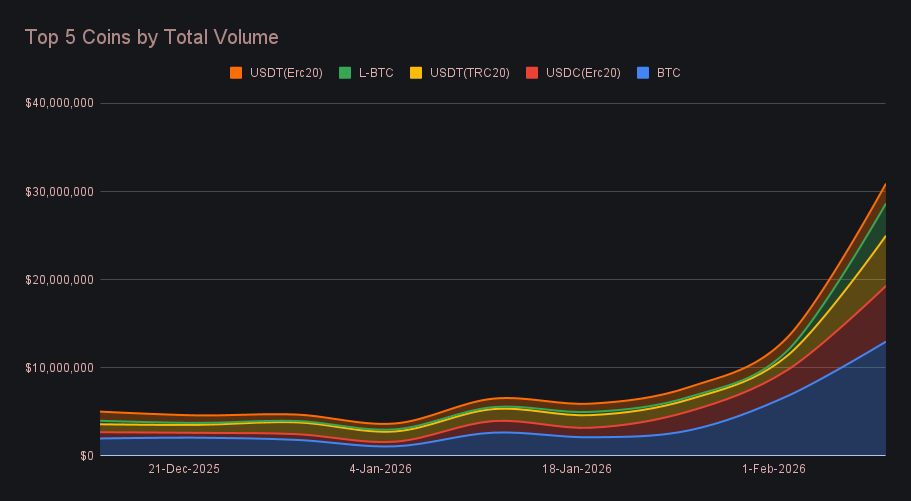

BTC sat comfortably at the top of the table, generating $12.97m in total volume (+90.5%), more than doubling its footprint from last week. User deposits climbed to $3.78m (+70.6%), while settlements steeply rose to $4.60m (+125.9%), reflecting heavy two-way repositioning during the sharp market swings. The scale of BTC shifting also stood out on a longer view, marking its strongest showing since last spring, when it was in price discovery. That dominance extended beyond spot BTC alone, with L-BTC adding $3.65m (+543%) and WBTC (Polygon) contributing a further $1.66m (+868%), bringing Bitcoin-linked assets to roughly 40% of total weekly volume.

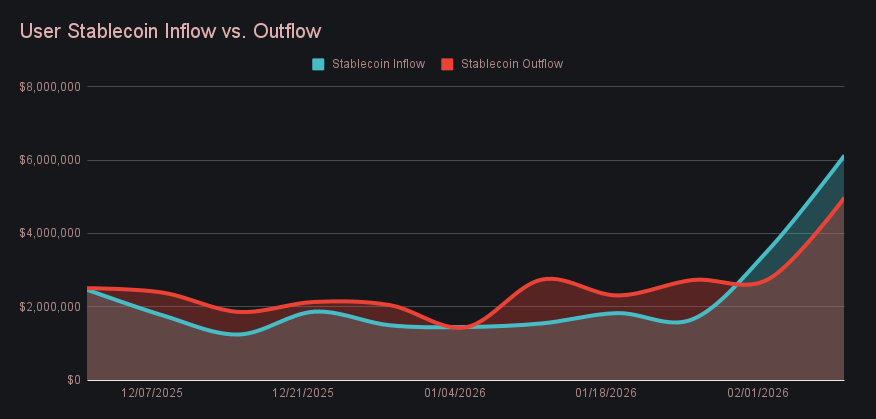

Stablecoins again accounted for a large share of weekly volume and completed the top five, with activity firmly tilted toward selling into volatility. USDC (ERC-20) ranked second overall at $6.32m (+113.6%), driven primarily by user settlements, which climbed to $2.01m (+659.8%), while deposits slipped marginally to $1.26m (−3.6%). USDT across Tron and Ethereum followed with a combined $7.96m in total volume, led by USDT (TRC-20), where deposits surged to $2.46m (+240.9%), signalling aggressive BTC accumulation via Tron rails, while USDT (ERC-20) contributed $2.26m (+49.9%) with a more balanced split between deposits and settlements. These patterns were reflected in net user stablecoin flows, which remained positive for a second straight week and registered a + $1.15m net inflow, one of the strongest readings on record and a clear indication that capital continued to lean into risk during the sell-off.

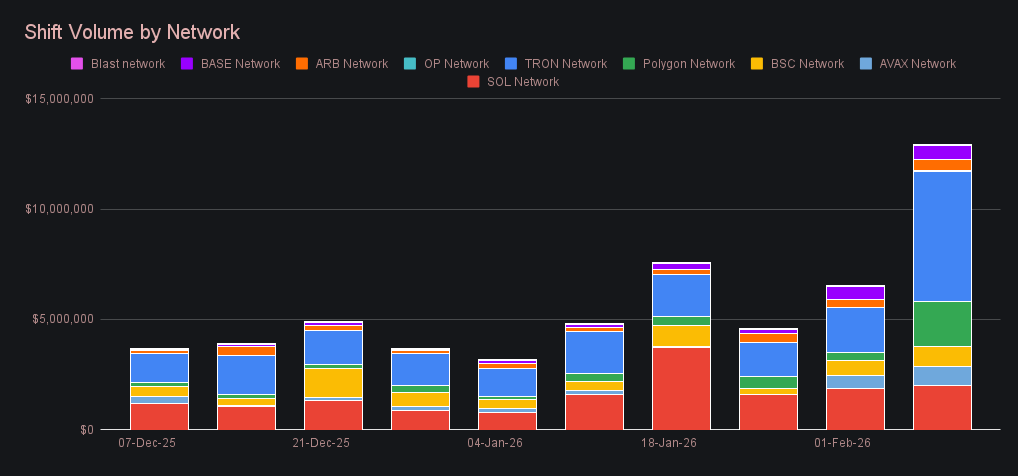

One of the more striking divergences this week came from ETH. Even as SideShift delivered one of its strongest weeks of the past year, ETH finished lower in total coin volume, falling −47% to $1.39m. That pullback, however, did not reflect reduced activity on Ethereum itself, with Ethereum network volume rising to $9.15m (+20.4%). Beyond Ethereum, alternate networks expanded aggressively, with combined volume nearly doubling to $12.90m (+98.4%). The Tron network led decisively at $5.92m (+192.0%), followed by Solana at $2.03m (+8.9%) and Polygon at $2.01m (+445.3%), while BSC and Avalanche contributed $901k (+32.8%) and $881k (+47.1%), respectively. Arbitrum added $497k (+32.3%), and Base remained steady at $630k (+8.2%).

Affiliate News

Affiliate volume jumped sharply this week, combining for $4.02m (+184.9%) and materially outpacing last week’s totals. Among top partners, first place generated $553.7k (+12.2%), while second place added $289.4k (+23.6%). Third place recorded the strongest relative move of the group, rising to $235.1k (+317.8%) after a far smaller contribution last week. Overall affiliate volume extended well beyond the contribution of the top partners alone, pointing to a notable increase in referral driven activity.In total, top affiliates accounted for 17.9% of SideShift volume, up from 12.3% in the prior report.

That’s all for now - thanks for reading and happy shifting.