SideShift.ai Weekly Report | 3rd - 9th October 2023

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the seventy-fifth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the seventy-fifth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week saw SideShift token (XAI) bounce within the 7 day range of $0.0776 / $0.0834, continuing on with the mostly sideways price action seen over the past 3 weeks. At the time of writing, XAI is sitting at a price of $0.0803 and has a current market cap of $10,047,519 (-1.0%).

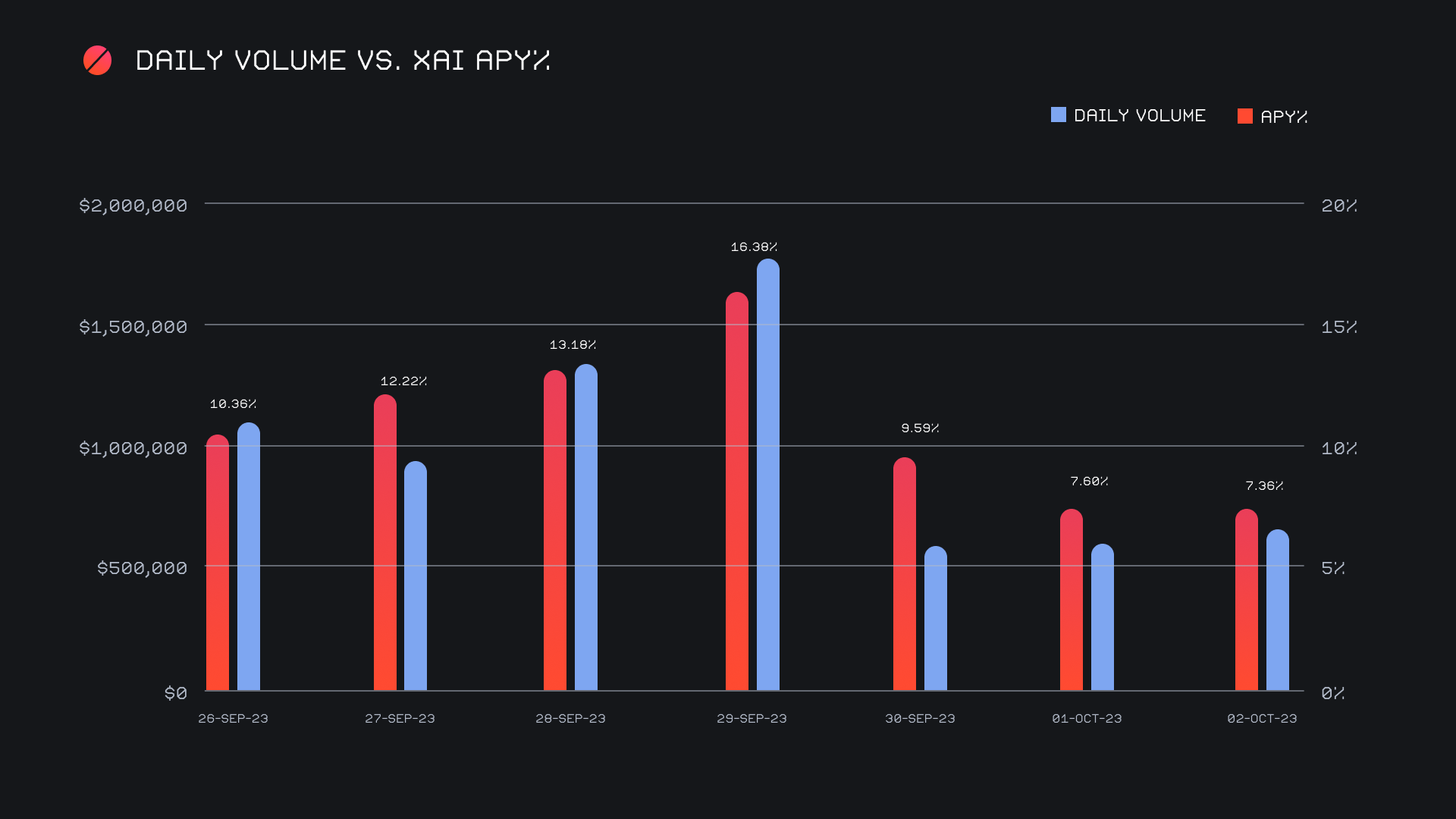

XAI stakers were rewarded with an average APY of 11.56% this week with a daily rewards high of 46,468.92 XAI or $3,690.47 (an APY of 16.38%) being distributed to our staking vault on October 7th, 2023. This was following a daily volume of $1.8m. This week XAI stakers received a total of 222,167.32 XAI or 17,640.09 USD in staking rewards.

The price of 1 svXAI is now equal to 1.2434 XAI, representing a 24.34% accrual on stakers investments. A friendly reminder that the easiest way to participate in XAI staking is to shift directly to svXAI, from any coin of your choice.

SideShift’s treasury is currently sitting at a value of $4.77m. Users are encouraged to follow along directly with live treasury updates.

Additional XAI updates:

Total Value Staked: 111,984,666 XAI (+0.2%)

Total Value Locked: $8,883,189 (+0.9%)

General Business News:

In the wake of some exciting price action occurring last week, this week saw momentum fizzle out as most coins carried on sideways.

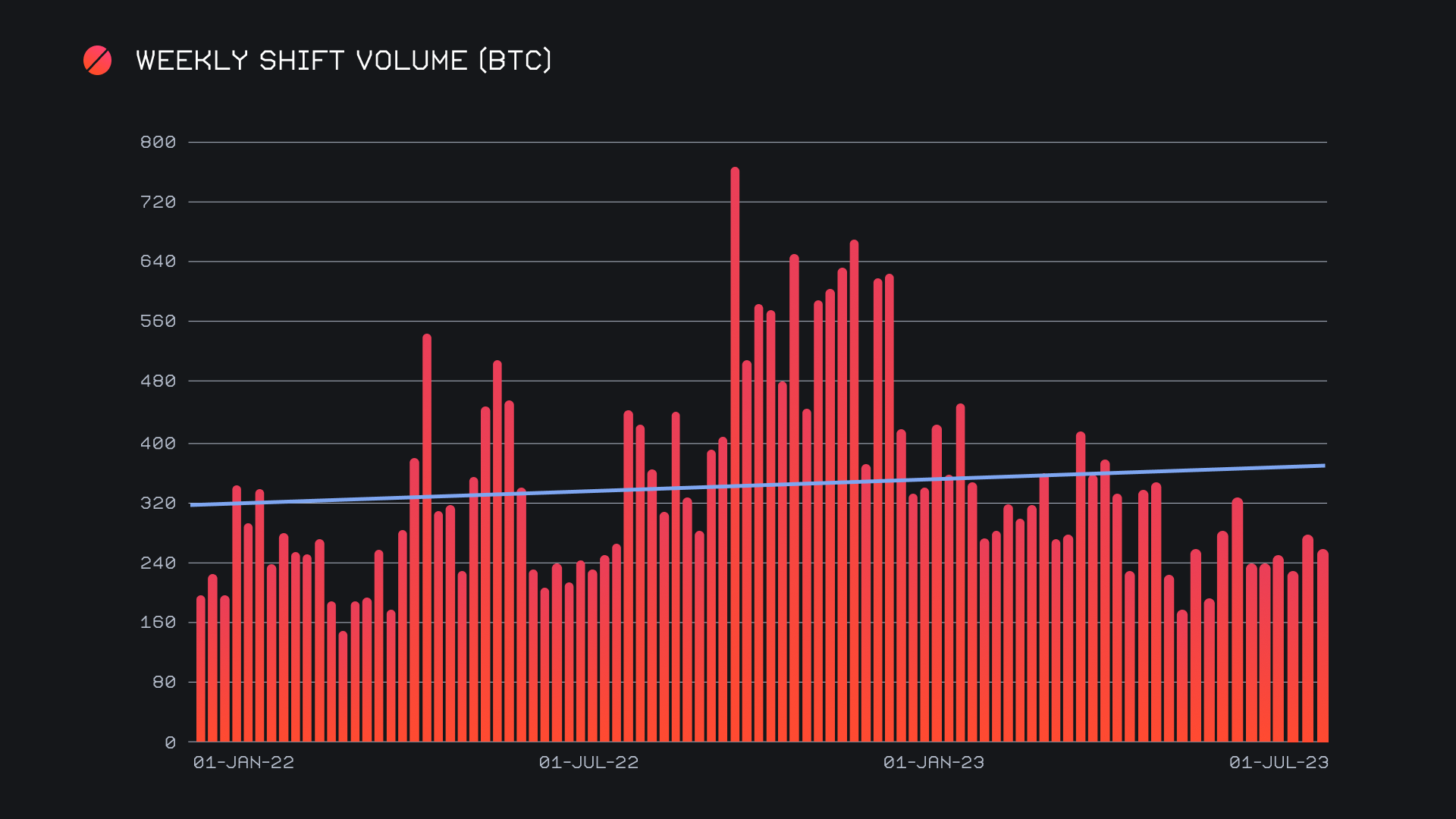

SideShift had a steady performance, noting just minimal changes from the previous period. We rounded off the week with a gross volume of $7.1m (-3.5%), alongside a shift count which dipped by a nearly identical margin of 3.6% for 5,806 shifts. While volume deriving from our integrations remained extremely consistent, we saw quite a drop off in their combined shift count. This tells us that overall shift size coming from integrations was on average larger than last week, and also that the gross count of shifts being carried out directly on the site increased. Together, these figures combined to produce daily averages of $1.0m on 821 shifts. When denoted in BTC, our weekly volume amounted to 254.33 BTC (-5.8%).

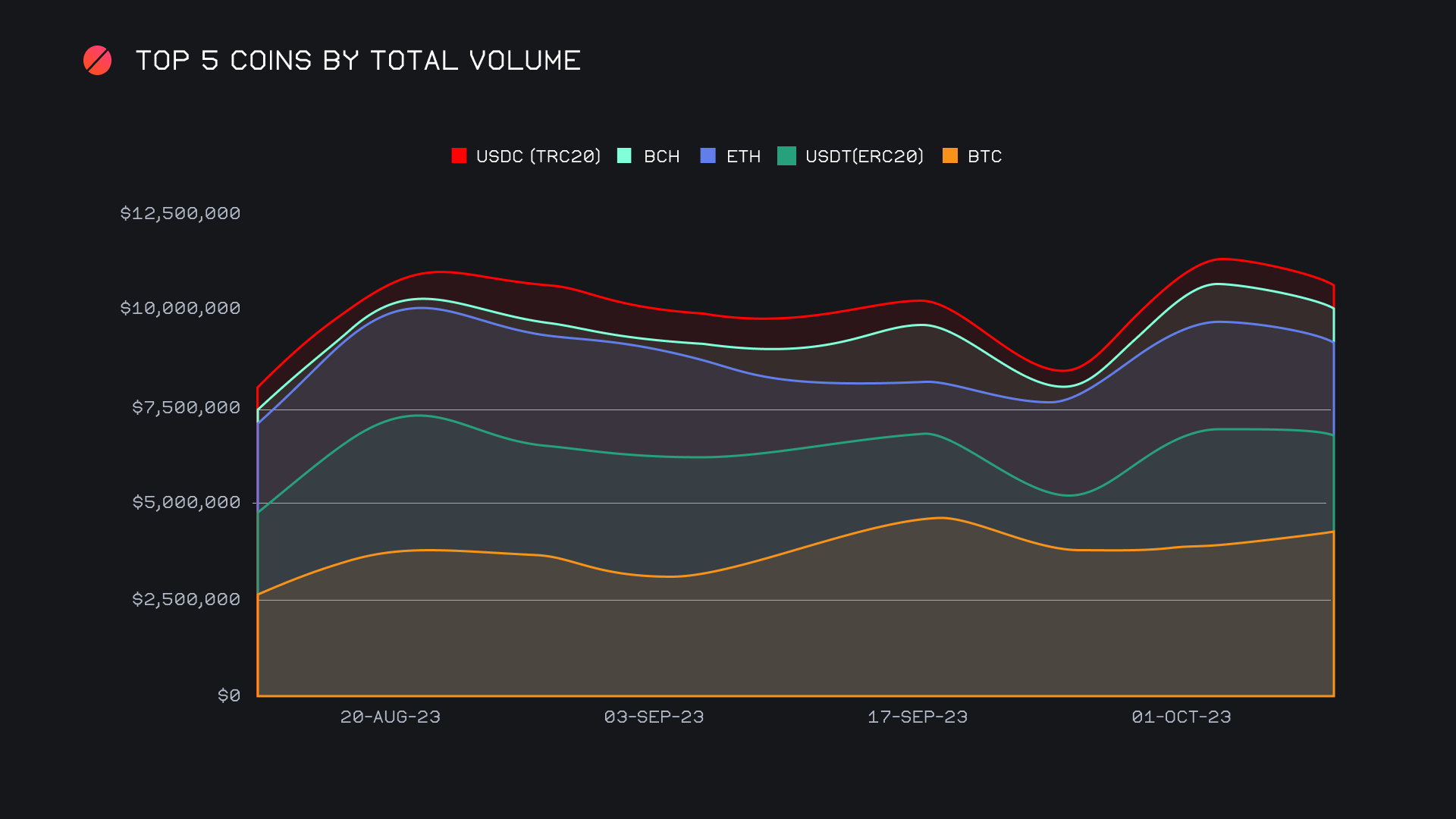

As last week’s pump saw SideShift users selling large amounts of BTC, this week saw the opposite. Although still remaining as our most deposited coin, user BTC deposits fell 11% for a net $1.7m. Instead we saw an increase in deposits among various stablecoins, as well as other coins such as XRP and newly added ETH (base). In the majority of instances these deposits were shifted to BTC, aiding in the rise of user BTC settlements, which climbed 23.5% for a net $1.3m. This not only resulted in BTC finishing as our most settled coin for the week, but also recording the highest percentage gain among any top coin.

This general strength allowed total BTC volume (deposits + settlements, and liquidity shifts) to tower above all others with a sum of $4.3m (+9.8%). For some comparison, ETH sat more than 40% lower, with a total of $2.5m (-13.4%). As illustrated in the chart below, total BTC volume has now been on a gradual climb for the better part of the past two months. Users have been more inclined to buy when price action is sideways, while selling any pumps. BTC continues to drive shifts, from both the deposit and settlement side, while other coins are far more volatile.

A key reason for the ongoing performance is the prevalence of the BTC/USDT (ERC-20) pair. In 15 out of the past 16 weeks, it has ranked as the most popular among users, with this week being no exception. It held its ground as the top pair with a sum of $798k, despite a few other BTC based pairs generating some respectable volume. Examples here include ETH/BTC with $661k, BTC/ETH with $331k, and BTC/BCH with $314k. As these pairs were by far the most shifted by users, it's no surprise to have seen total BTC volume claw its way higher.

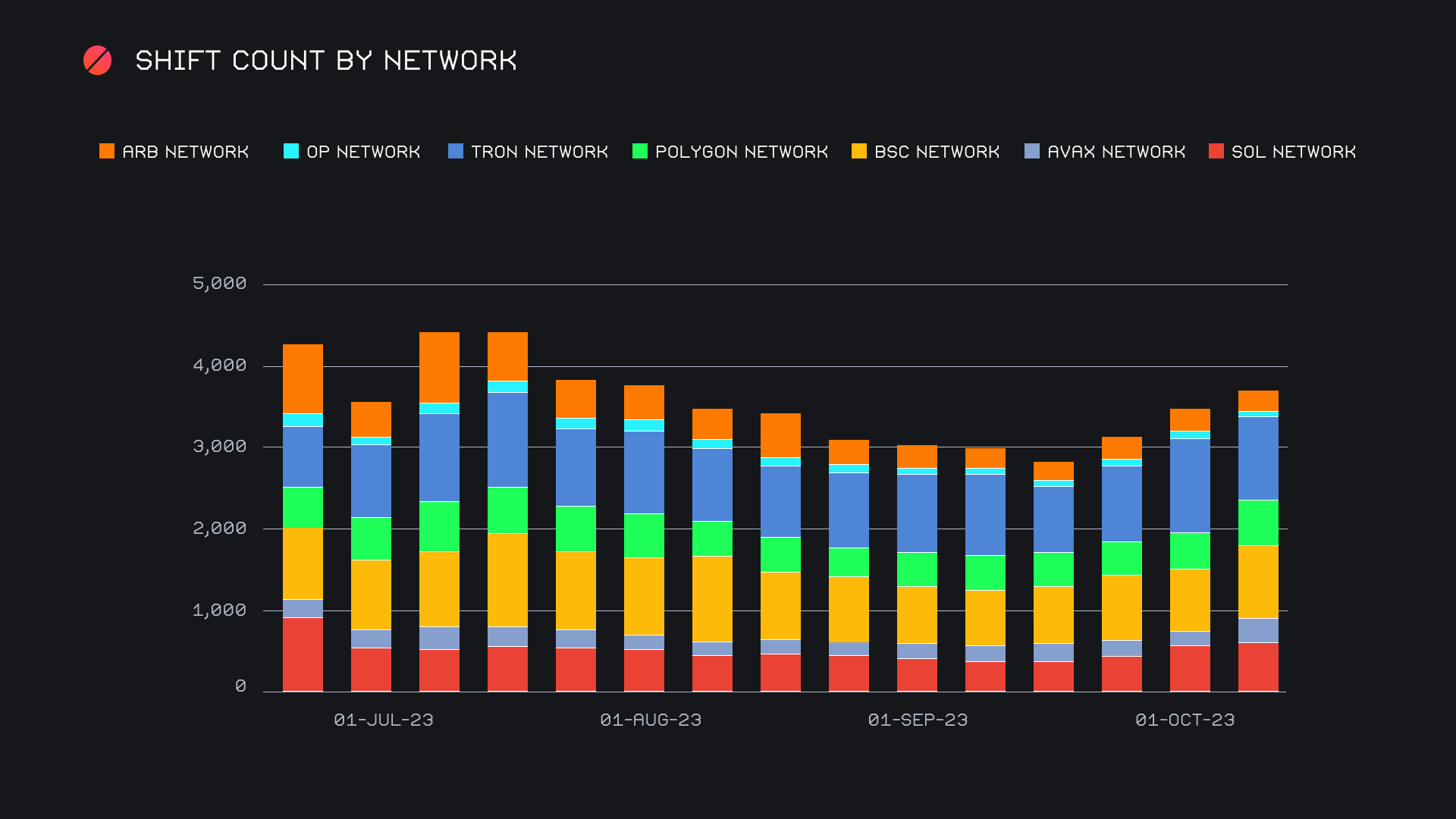

Although the focus of users is revolving heavily around our top 3-4 coins at the moment, a look at alternate networks to ETH reveals that a sizable amount of shifting is still taking place here. Particularly when charting shift count, we can observe a fairly consistent level of shifts taking place over the course of the past 3 months. In fact, shift count on alternate networks hit a 2 month high this week, as their combined sum of 3,692 represented more than half of our total count. At the forefront of this charge was the Tron network, as Tron shifts have now surpassed a count of 1,000 in two consecutive weeks. A look at the distribution of shift count among alternate networks allows for a clearer understanding of where shifts are taking place, contrary to what the volume chart may suggest.

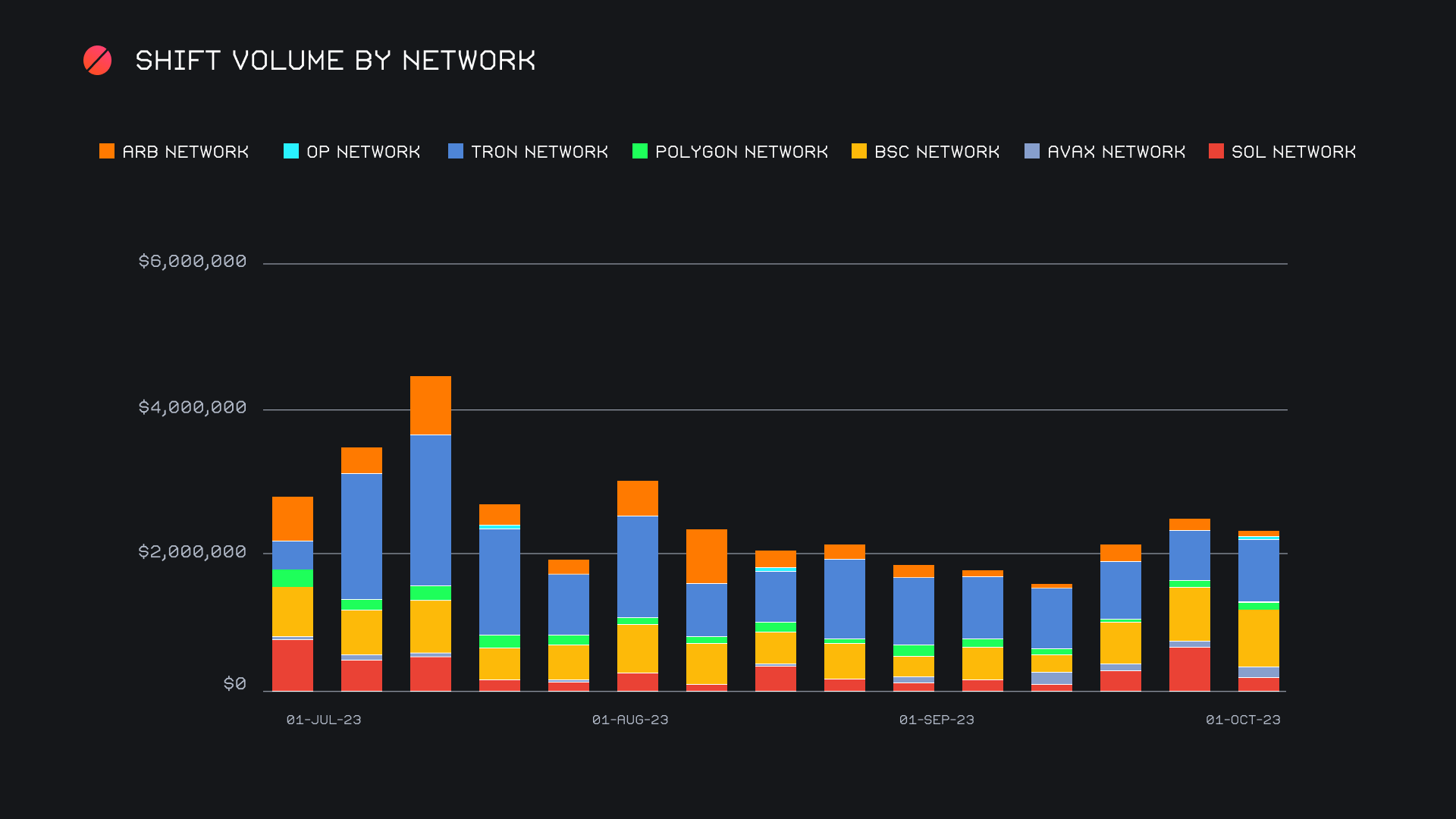

With this in mind, we can take a look at the volume of alternate networks to get the full picture. As a whole, they maintained the $2m mark with a combined sum of $2.3m (-8%). Here, we can note some similarities to shift count. Firstly, just as with shift count, the Tron network claimed first place, increasing 25.9% for a total $879k. This was followed by the Binance Smart Chain (BSC) Network with $795k (+5.8%). However as we move beyond this, shift count doesn’t align with volume nearly as well. Although shift count for the SOL network carried on in a relatively similar fashion, volume dropped by a sizable 60.2% for a total $283k, following last week’s surge. The ARB network had a similar occurrence, with shift count hardly wavering but volume falling 54% for a sum of just $66k. This is a good example of how the composition of alternate networks is ever-changing, with volume levels following an ebb and flow.

In listing news, SideShift added support for a handful of ERC-20 coins, and one coin on the Base network. These include Pax Dollar (USDP), Tokenize Xchange (TKX), Huobi (HB), dYdX (DYDX), and USDC (base). Shifting for all of these tokens is now live. We are always open to new listings, and welcome any suggestions from our users.

Affiliate News

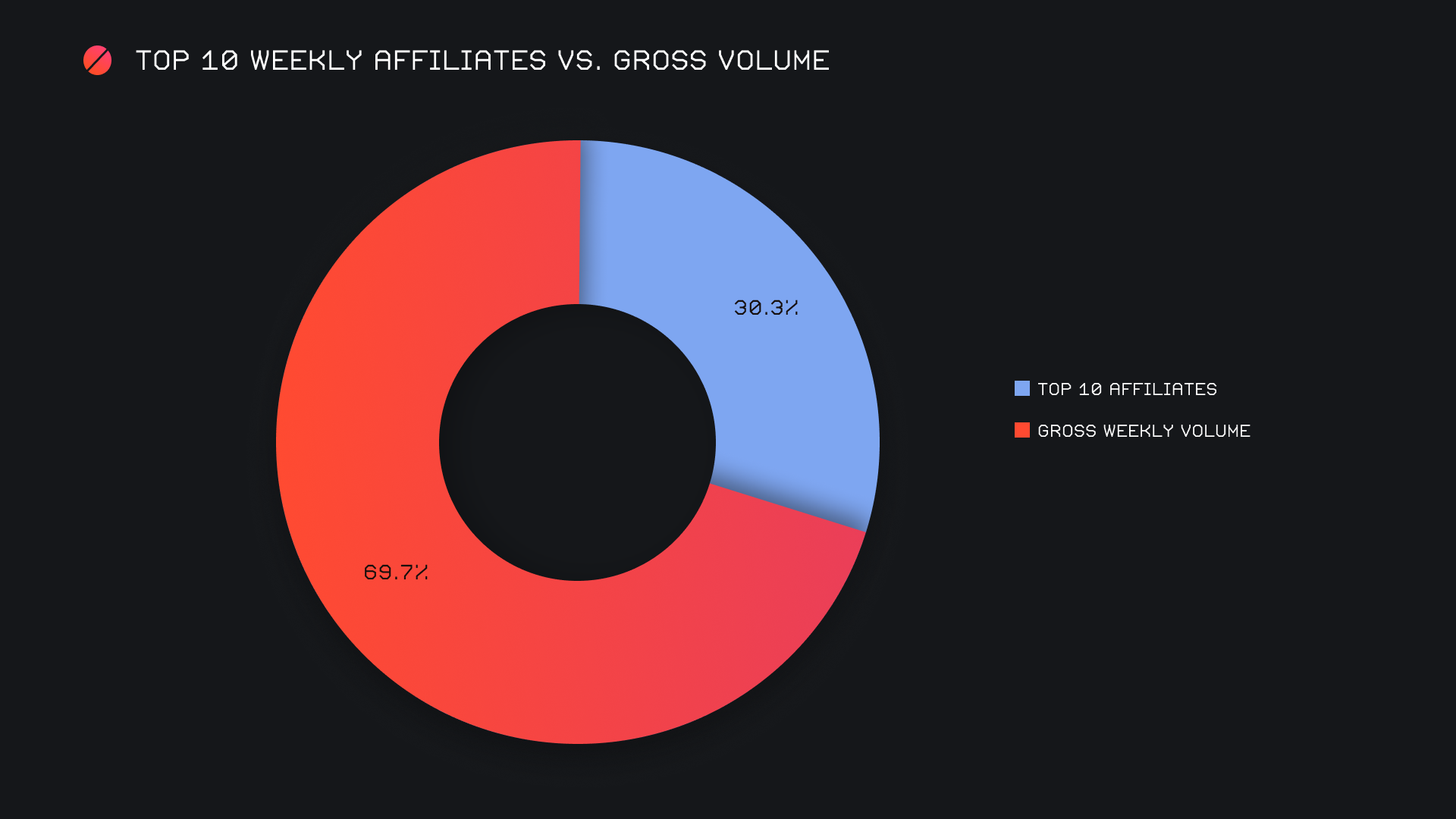

Our top 10 affiliates maintained their collective strength with a sum of $2.1m, just a minimal change of +0.9% from the previous week. Accounting for nearly 60% of this sum was our first placed affiliate, as it ended with a total volume of $1.3m.

Shift count however had a bit of a hiccup and fell 20.4% for a total 2,020 shifts. However, as previously mentioned, this was compensated for by shifts taking place directly on the site. Collectively, our top 10 affiliates represented 30.3% of the weekly volume, 1.3% higher than last week’s proportion.

That’s all for now. Thanks for reading, happy shifting and we’ll see you next time.