SideShift.ai Weekly Report | 5th - 11th March 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the ninety-fifth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the ninety-fifth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week saw SideShift token (XAI) continue its climb towards the $0.20 mark, a price that it regained on March 7th, 2024 and mostly maintained for the remainder of the week. Over the course of the 7 day period, XAI fluctuated within the range of $0.1699 / $0.2088, and at the time of writing is sitting at a price of $0.1990 with a market cap of $26,194,040 (+17.3%).

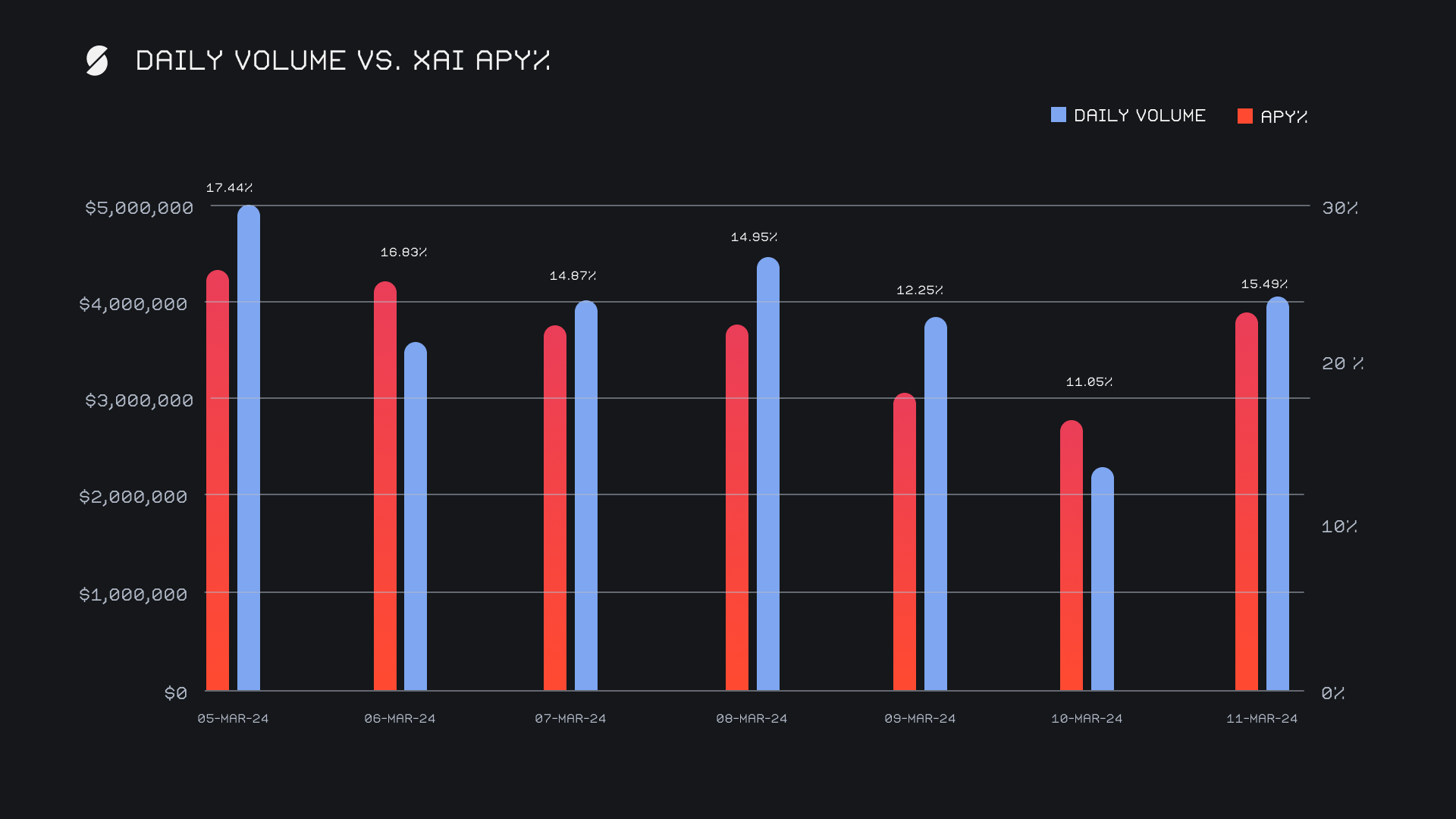

XAI stakers were rewarded with another week of healthy rewards, as this week’s average APY amounted to 14.70%. A daily rewards high of 51,298.48 XAI (an APY of 17.44%) was distributed to our staking vault on March 5th, 2024, following a daily volume of $5.02m. This week XAI stakers received a total of 306,878.21 XAI, or $61,068.76 USD in staking rewards.

SideShift’s treasury is growing, and throughout the week we deposited an additional 90 ETH, and 2 WBTC. These recent deposits in combination with the price appreciation of both assets bring our treasury to a current value of $15.9m. Users are encouraged to follow along directly with live treasury updates, via SideShift.ai/treasury.

Additional XAI updates:

Total Value Staked: 117,230,288 XAI (+0.7%)

Total Value Locked: $23,224,818 (+17.5%)

General Business News

All-time highs are here, as this week saw BTC surge past the $70k price mark for the first time in its 14 year history. This momentum has clearly spilled over to the rest of the market as the total crypto market cap has a firm upwards trajectory of its own, and its impressive $2.82t sum looks primed to move higher.

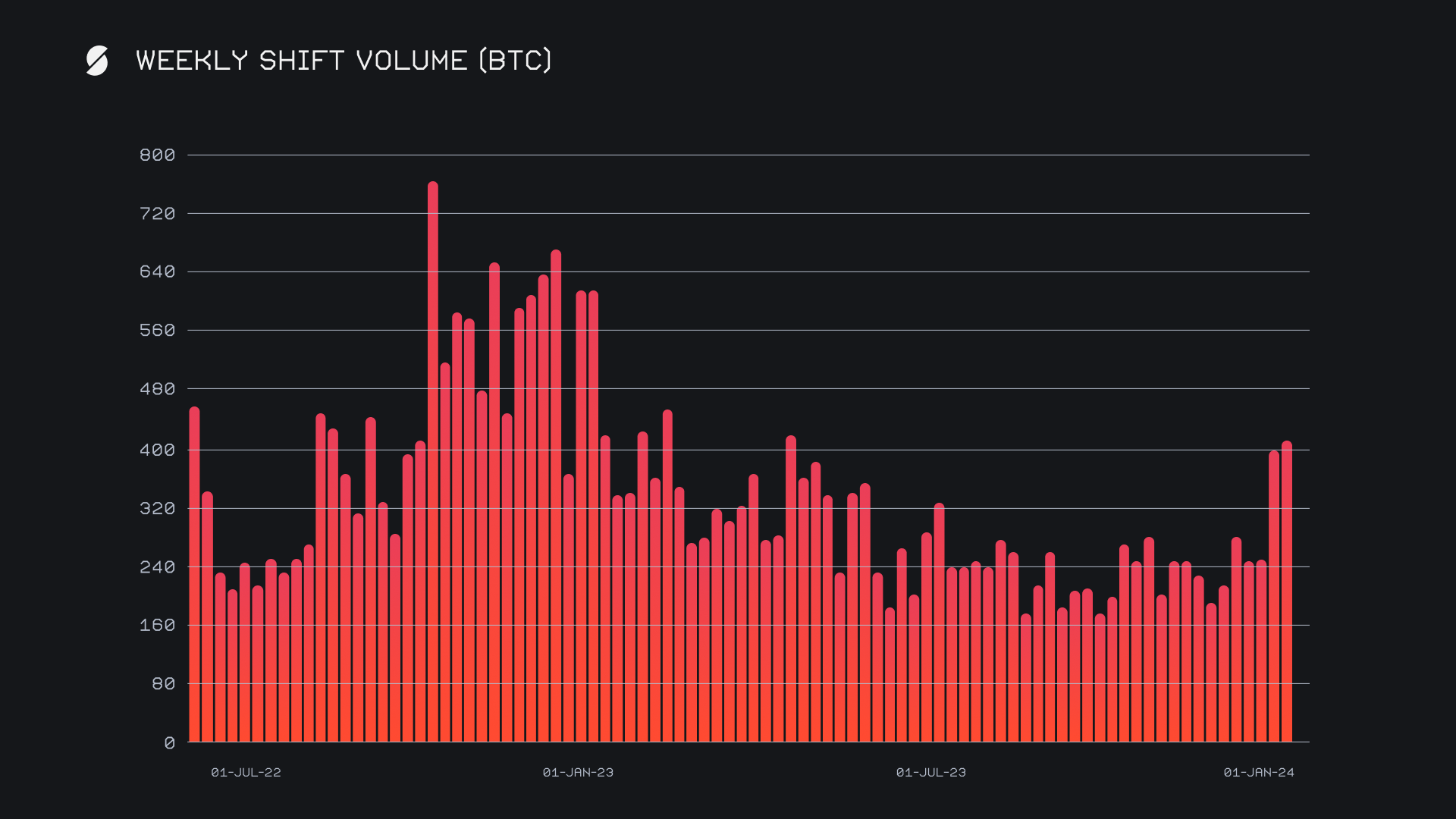

In the wake of our record setting week to begin March 2024, SideShift carried on with the powerful trend and managed to surpass last week’s total. We ended the 7 day period with a significant gross volume of $27.3m (+11.3%), alongside a shift count which held the recently achieved benchmark of 10,000 shifts per week. Gross shift count ended with 10,695, a minor change of just -1.8%. This week, it was our top two affiliates in particular that played a larger role in the overall volume increase. Together, these gross figures combined to produce solid daily averages of $3.9m on a shift count of 1,528. When denoted in BTC, our gross volume amounted to 403.49 BTC, +3.2% higher than last week’s total, even with BTC climbing to all time highs.

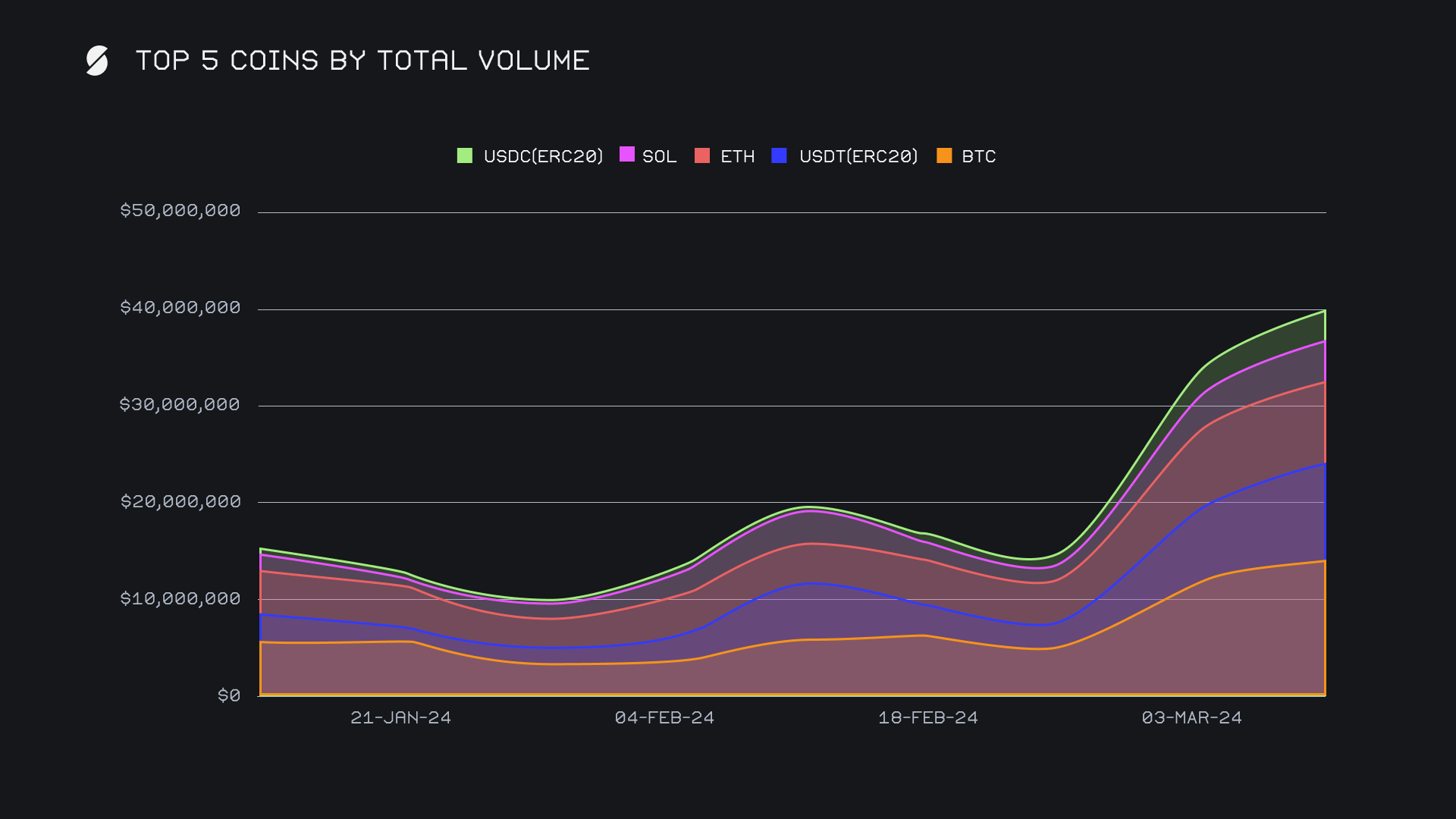

The below chart of our top 5 coins by total volume (deposits + settlements) is a very striking visual of the growth experienced over the past couple of weeks. As a whole, their combined volume has nearly tripled in that timespan, with BTC unsurprisingly showing the most prominent growth. This week BTC ended as our top coin with a massive total volume of $14.6m (+18%), a sum that sat over 50% above our second placed coin. The composition of BTC’s total volume favored user deposits over settlements by more than a 2:1 ratio - this amounted to a massive user deposit sum of $7.4m as compared to a significantly smaller user settlement sum of just $2.9m. This settlement total was only enough to rank third overall, as users were more keen to shift to our top two coins of USDT (ERC-20) and ETH this week. In fact, two thirds of the deposited BTC volume was shifted to one of those coins, a near identical breakdown as compared to last week. The BTC/USDT (ERC-20) pair ended as the most popular with $2.9m in shift volume, with the BTC/ETH pair following in second with $1.9m.

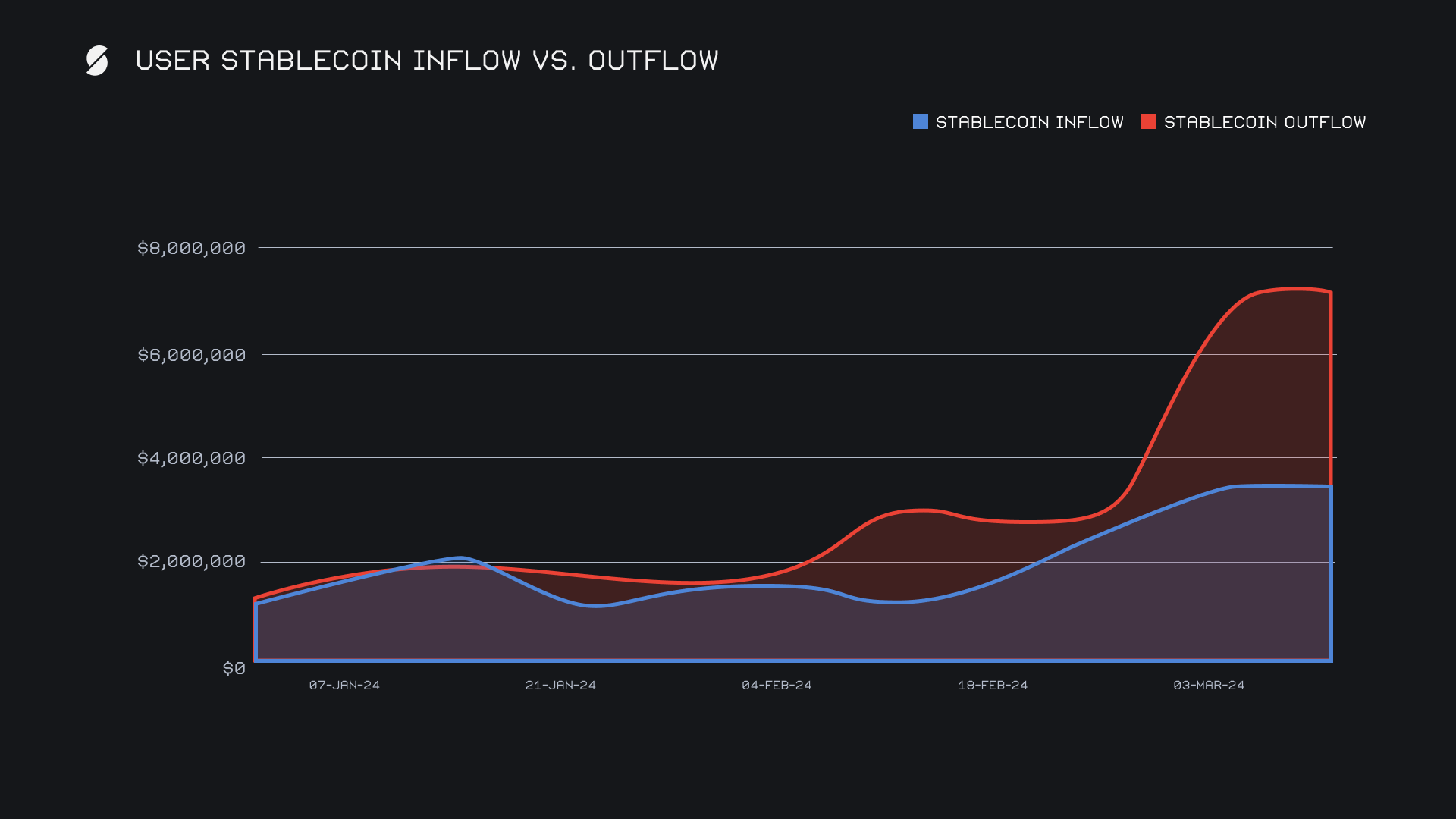

In second and third place for total volume came USDT (ERC-20) and ETH, with respective total volumes of $9.2m (+26.7%) and $9.1m (+7.5%). Once again, these two coins contrasted the behavior of BTC, with user settlements far outweighing deposits. This was particularly notable for USDT (ERC-20), which saw ~3x more settlements versus deposits and helped send total stablecoin outflows up towards the $7m mark. This demand caused some major separation from total stablecoin inflows, as made clear in the chart below. This tells us that although the market is pumping, users are capitalizing on the higher prices and taking some chips off the table.

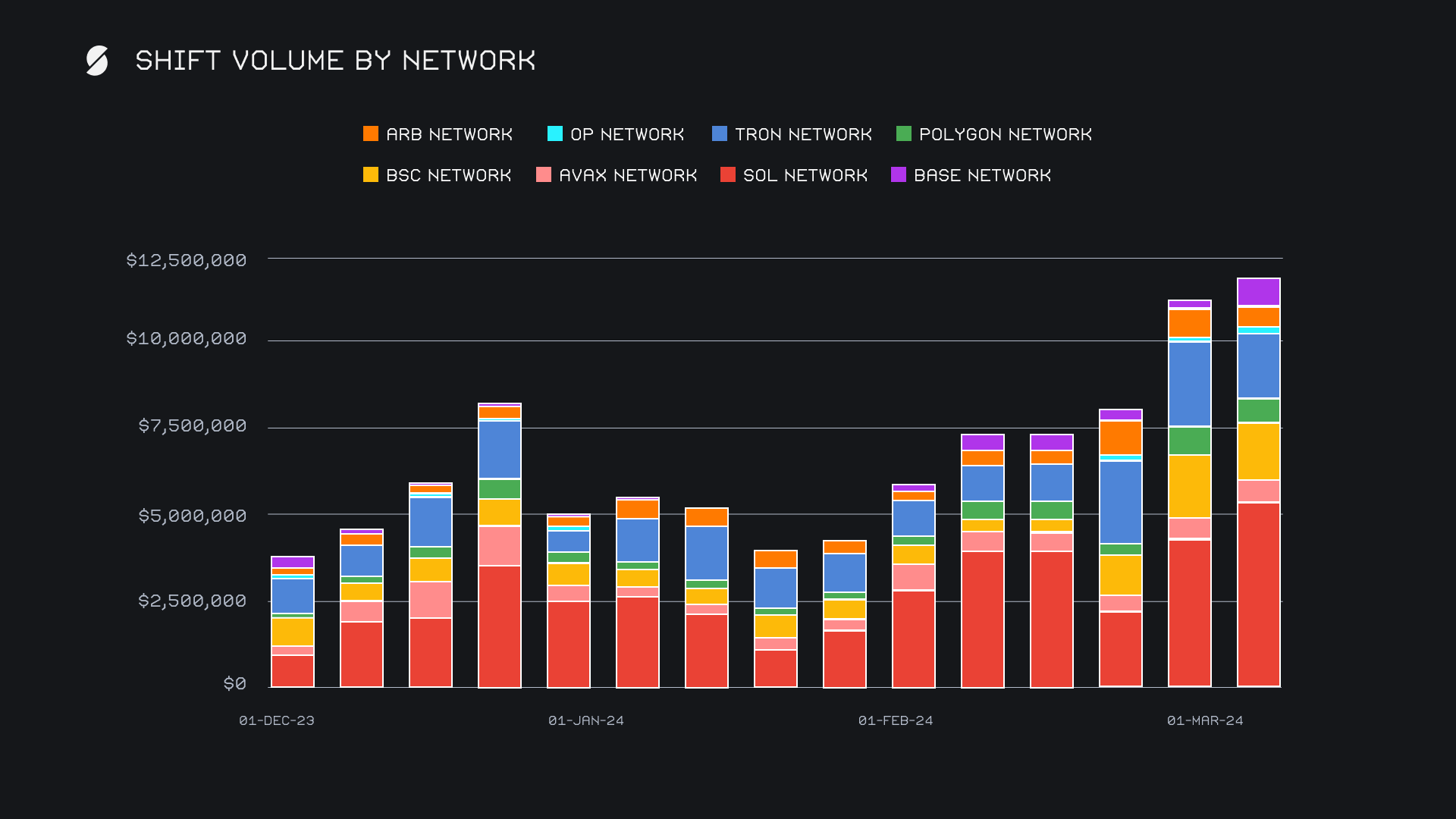

When looking at alternate networks to ETH, we can also see the sustained strength as their cumulative sum exceeded $11m for the second week in a row. Confidently leading this group was the Solana network, which tallied a respectable $5.4m (+23.8%) overall. The native SOL coin alone ended with $4.5m - this amounted to its highest ever weekly total volume, and was enough to secure a fourth placed finish overall this week. More recently added Solana tokens are slowly beginning to gain some traction on SideShift, but have yet to translate into any major volume. In second place came the Tron network with $1.9m (-25%), followed by the Binance Smart Chain (BSC) network in third with $1.7m (-7.6%). Although these are still decent nominal sums, you can see in the chart below how these networks are not showing the same sort of growth that we are seeing from the Solana network, and that it is Solana which is predominantly driving this grouping higher. A final interesting observation about alternate networks was a sharp +228% spike from the Base network, as it ended with a total $760k on the week. This move surpassed weekly volumes from the Arbitrum, Polygon, and Avalanche networks.

Affiliate News

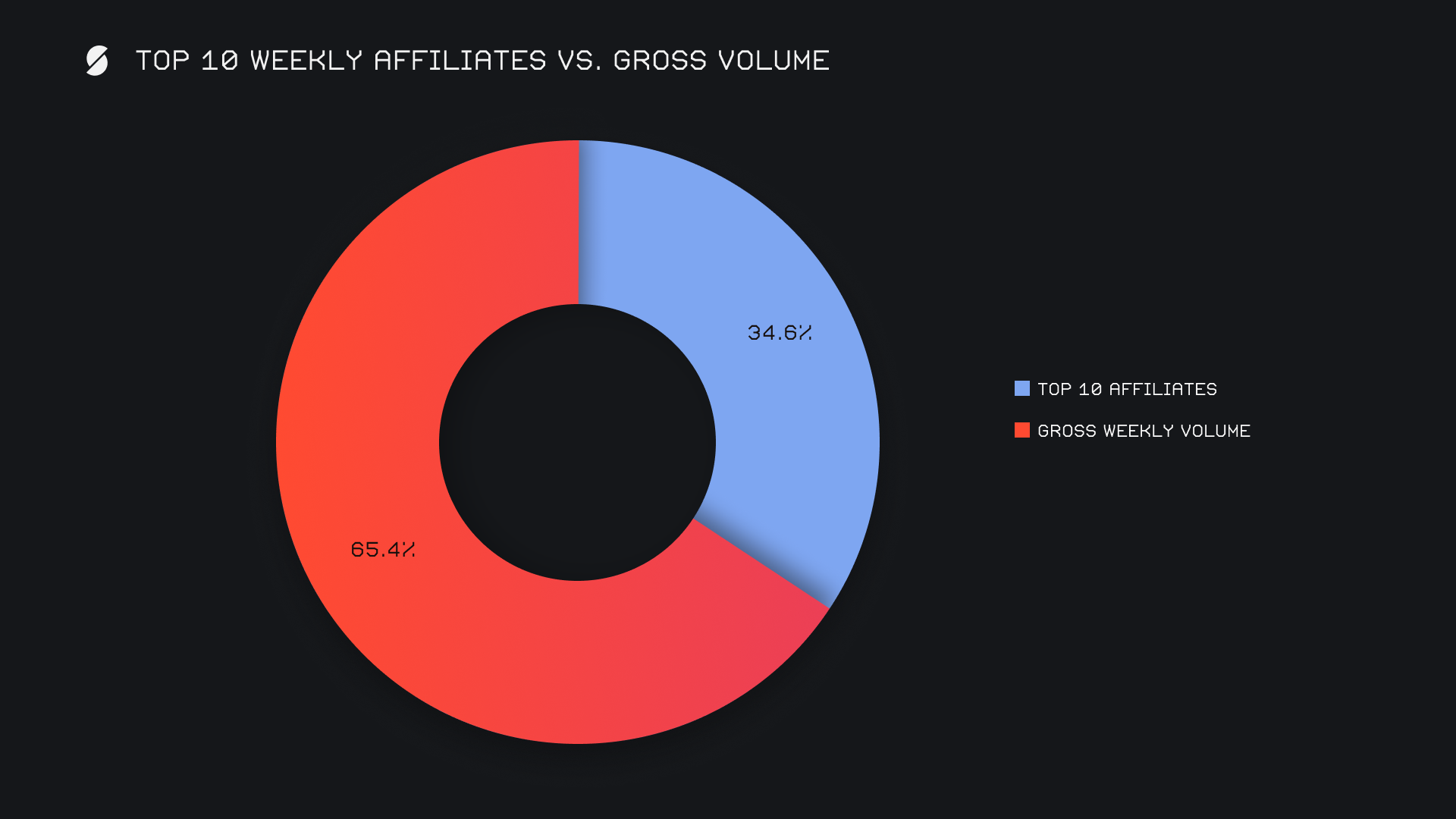

As mentioned earlier, our top affiliates had an outstanding performance and were a definite reason for the increase in overall volume this week. Most notably, our top affiliate retained its position and took another substantial leap forward, ending with a gross volume of $4.7m (+34.2%). It did so with a total shift count of 633, producing a sizable average shift value of ~$7.4k. Second and third placed affiliates demonstrated similar strength, with both noting growth greater than 10% on the week, and ending with respective volumes of $2.5m and $1.5m.

All together, our top affiliates represented 34.6% of our weekly volume, +3.1% higher than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.