SideShift.ai Weekly Report | 5th - 11th November 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one-hundred-and-thirtieth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and thirtieth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This past week, SideShift token (XAI) demonstrated a robust climb, navigating a 7-day price range from $0.1226 to $0.1400. At the time of writing, XAI has pushed beyond previous highs and has found its way above that range, catching up with treasury, and currently trading at a price of $0.1629. This upward trajectory has propelled XAI’s market cap to $22,995,224, marking a significant +32.6% increase from last week’s sum of $17,348,874, a sign of growing momentum.

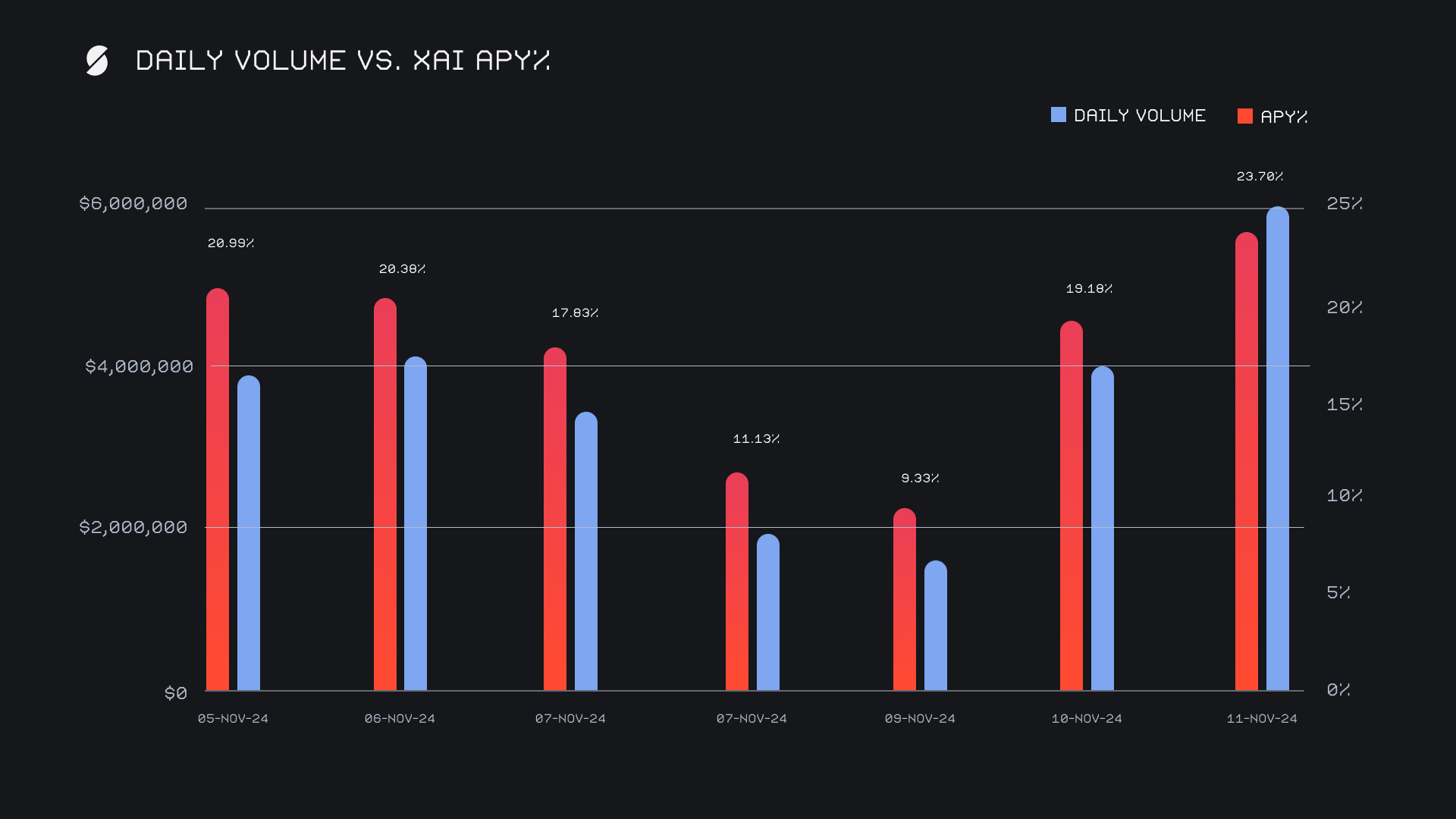

XAI stakers enjoyed a respectable average APY of 17.51% throughout the week. On November 12th, 2024, daily rewards peaked with 73,702.78 XAI being distributed directly to our staking vault, achieving an impressive APY of 23.7%, on a day that reached a record setting $6.1m in volume. The healthy APY’s, which were a result of steady shift action throughout the week, rewarded XAI stakers for their commitment, and reinforced the value of participating in XAI staking. Altogether, XAI stakers received a total of 388,594.91 XAI or $63,302.11 USD in staking rewards this week.

An additional 8 WBTC was added to SideShift's treasury over the course of the week. Due to the ongoing market pump and the investment strategies of our treasury manager, Archie Sterling III, the third in a line of sterling men, the treasury sum sliced through the $20m mark, and is currently valued at a total of $20.78m. Users are encouraged to follow along directly with treasury updates via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 126,593,228 XAI (+0.3%)

Total Value Locked: $19,887,588 (+27.8%)

General Business News

This week marked a historic milestone in the crypto market, as Bitcoin surged past $89,000, achieving its highest price ever and delivering its most significant weekly return since the 2023 banking crisis. Fueled by substantial inflows and post-election optimism, this rally brought a renewed sense of excitement across the sector. Altcoins joined the momentum, with Dogecoin leading the way by soaring +150%, contributing to the market’s total capitalization reaching an unprecedented $3.1 trillion.

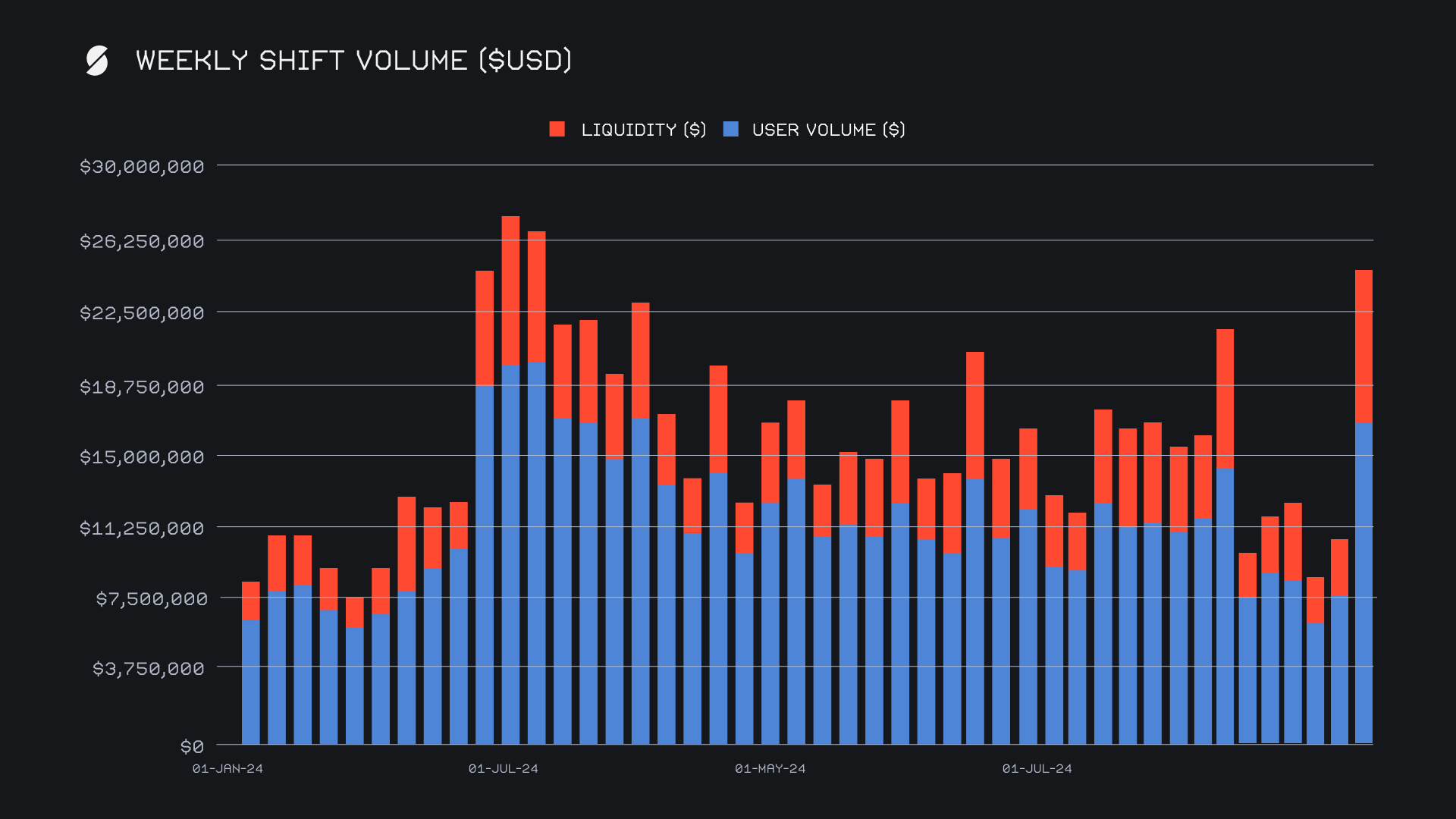

SideShift recorded a significant performance as well, achieving a gross weekly volume of $24.7m, a remarkable +132.4% increase from the previous week, and marking the third highest volume ever seen in the platform's history. User shifting volume contributed $16.5m (+116.2%), while liquidity shifting volume climbed to $8.2m, driven by heightened activity and shifts involving BTC. This impressive weekly total sat approximately ~60% above our YTD running average. Our daily averages ended strong, with volume hitting $3.52m across 1,556 shifts.

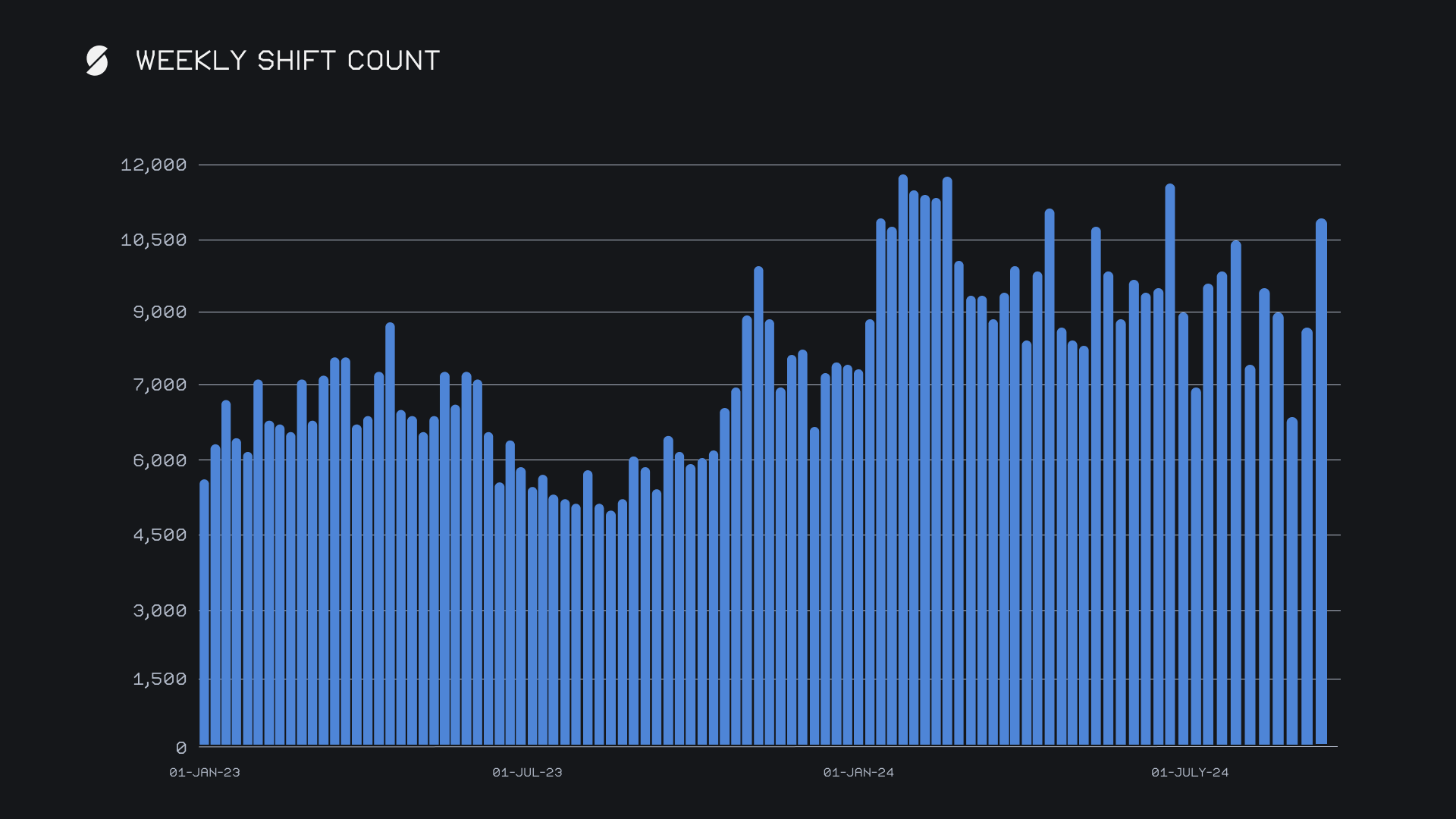

SideShift’s gross weekly shift count recaptured momentum, surpassing the 10k mark and ended at 10,891 shifts, up +25.3% from last week, and +16.7% above our YTD average. This count reflects a return to more typical levels of user engagement, highlighting the sustained interest in shifting activity, as BTC/USDT (erc20) and BTC/ETH re-emerged as the top pairs among users with $2.2m and $1.5m, respectively.

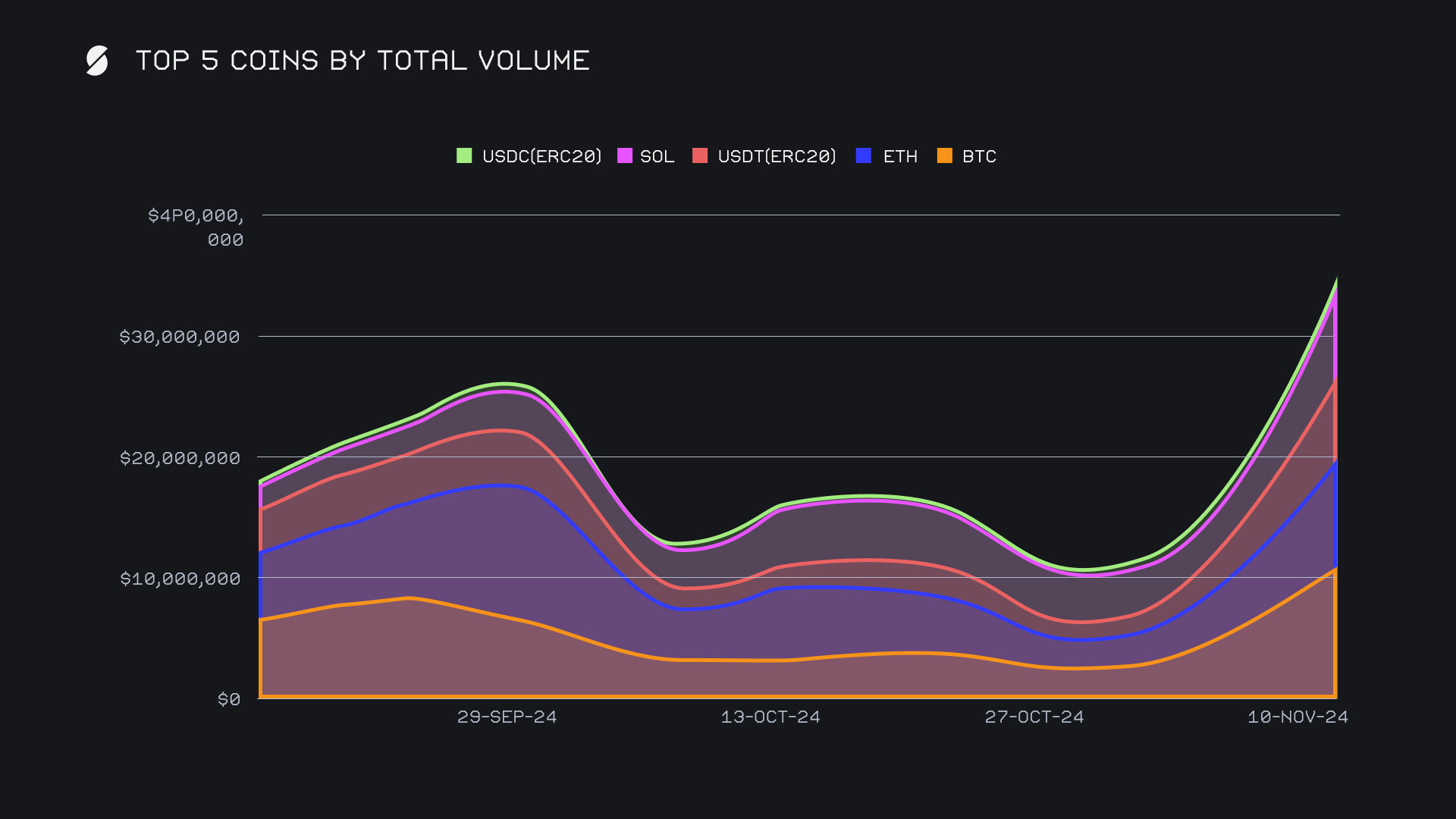

BTC maintained its lead this week with a total volume of $10.8m, showing a substantial +151.6% increase from last week. This surge was driven by a sharp rise in user deposit volume, which nearly tripled to $5.3m (+199.3%), while settlement volume climbed to $2.1m (+89.9%). As indicated by our top shift pairs, the vast amount of BTC deposits represented users capitalizing on gains and seeing an opportune time to shift to both USDT (ERC-20) and ETH. The heightened interest in BTC shifting aligns with the broader market excitement, as BTC experienced historic price action that undoubtedly influenced user shift behavior on SideShift.

ETH secured its place in second, reaching a total volume of $8.1m, which marked a strong +109.9% increase from last week’s figures. Deposit volume rose by +90.4% to $2.3m, but the standout was its settlement volume, which jumped +107.6% to $3.4m. This sharp rebound in overall ETH shift activity occurred following a notable rise in ETHs price, following multiple months of capitulation versus BTC - this move injected a wave of renewed sense of confidence among its users, a welcome change from the more tempered growth seen in recent weeks.

USDT (ERC20) leapt into third place with $7.7m, achieving an impressive +296.1% increase from the previous period, and thereby representing the highest gain among any of our top coins. This move was underpinned by a robust climb in user deposit volume, up +275.6% for $1.6m, and settlement volume, which rose +242.9% for $3.1m. Compared to last week, USDT’s resurgence as a preferred stablecoin emphasized its critical role during this period of heightened market activity, cementing its position as a cornerstone for user shifts.

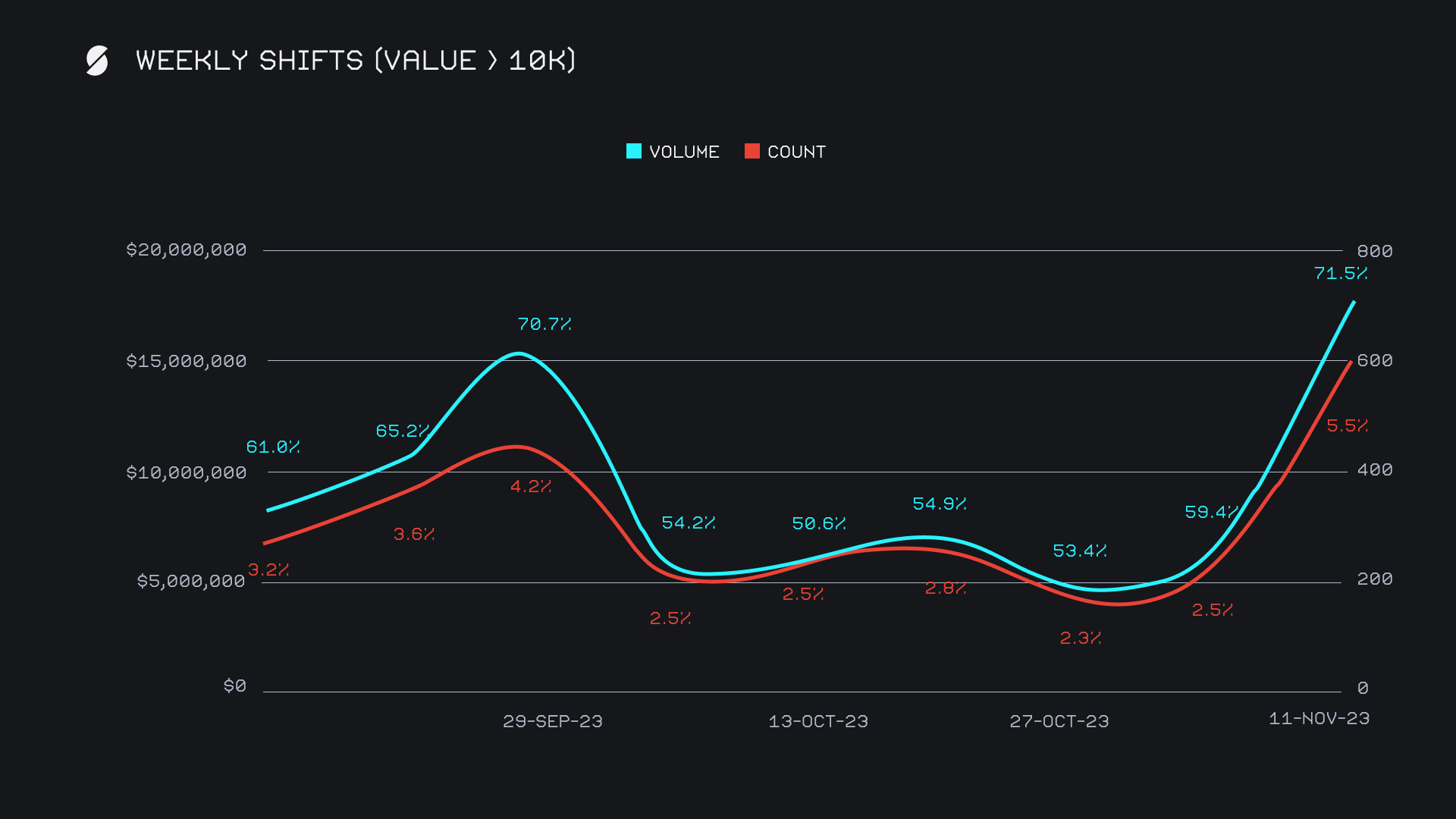

Shift action this week was not only driven by our top coins, but also by key contributions made from a variety of coins outside the top 5. Several saw their weekly volumes more than triple - examples include TRX exploding +712% for $1.4m, BCH increasing +283% for $676k, ADA rising +335% for $557k, and DOGE seeing the highest percentage gain of all, climbing +748% for $467k. This widespread increase in shift action was also complimented by a notable spike in whale shifting, as weekly shifts with a value exceeding $10k accounted for 71.5% of our volume, a multi month high. A weekly sum of $17.6m in whale shifting was a near tripling from last week’s total of $6.3m.

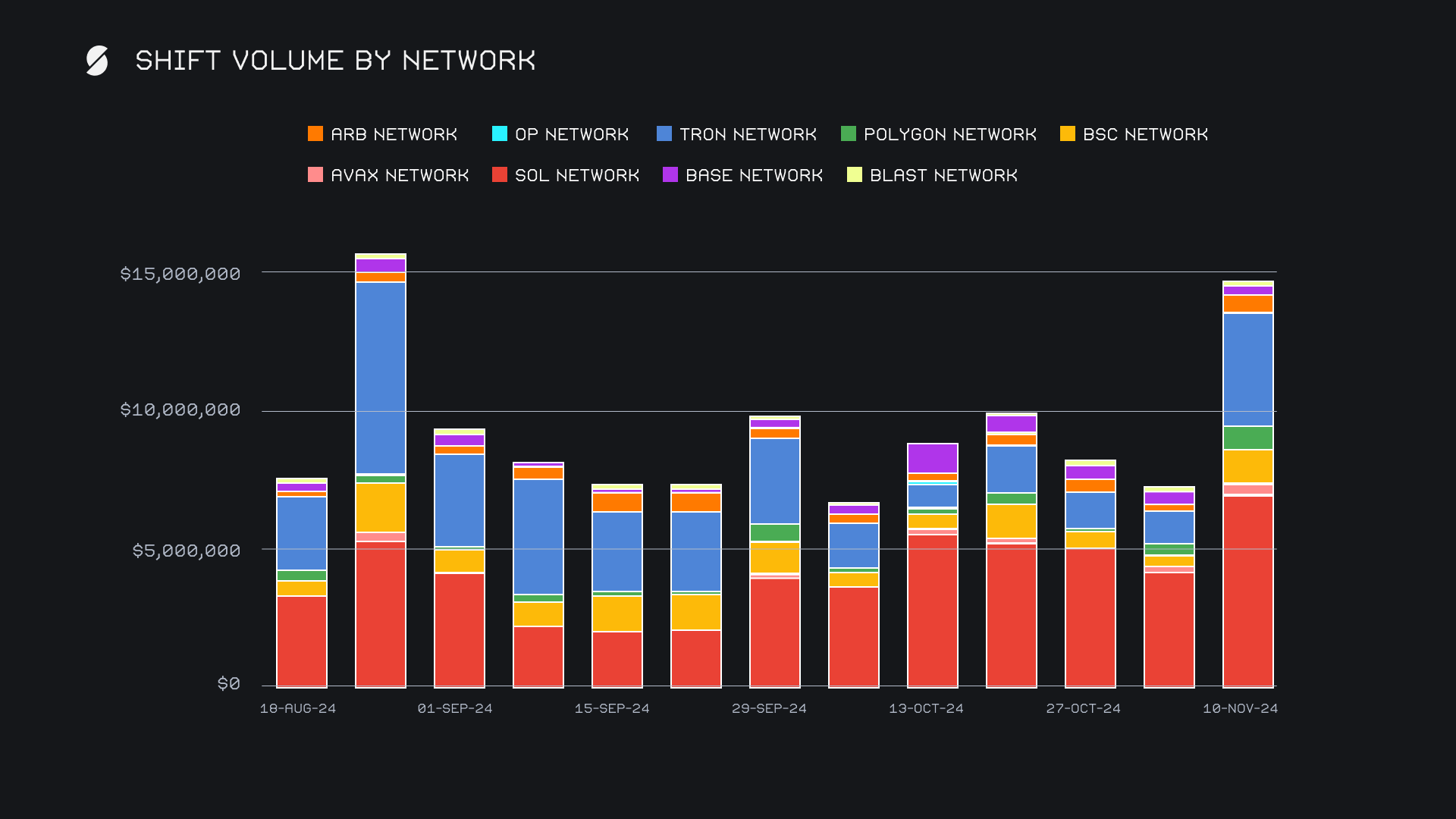

This week, alternate networks to ETH recorded a strong uptick of +103.4%, reaching a combined total volume of $14.7m (deposits + settlements). The Solana network led the charge with $7.0m (+67.5%), maintaining its position as the dominant network, driven by consistent interest in native SOL shifting. The Tron network saw a remarkable +247.7% increase to $4.1m, fueled by a revival in both TRX and USDT (TRC20) shifting. Similarly, the Binance Smart Chain (BSC) network climbed +193.4% to $1.3m, supported by rising shift action in both BNB and USDT (BSC). The Polygon network also stood out, doubling its volume to $827k (+100.1%). Notably, while most networks saw positive momentum, Base and BLAST were the only networks to experience declines, with Base down -10.5% and BLAST dropping -11.9%.

In listings news, SideShift added support for USDS on the Ethereum network, and ETH on the Scroll network this past week - shifting is now live, directly from any coin of your choice. In general news, site stability has improved and staking stats have been re-added back to the homepage.

Affiliate News

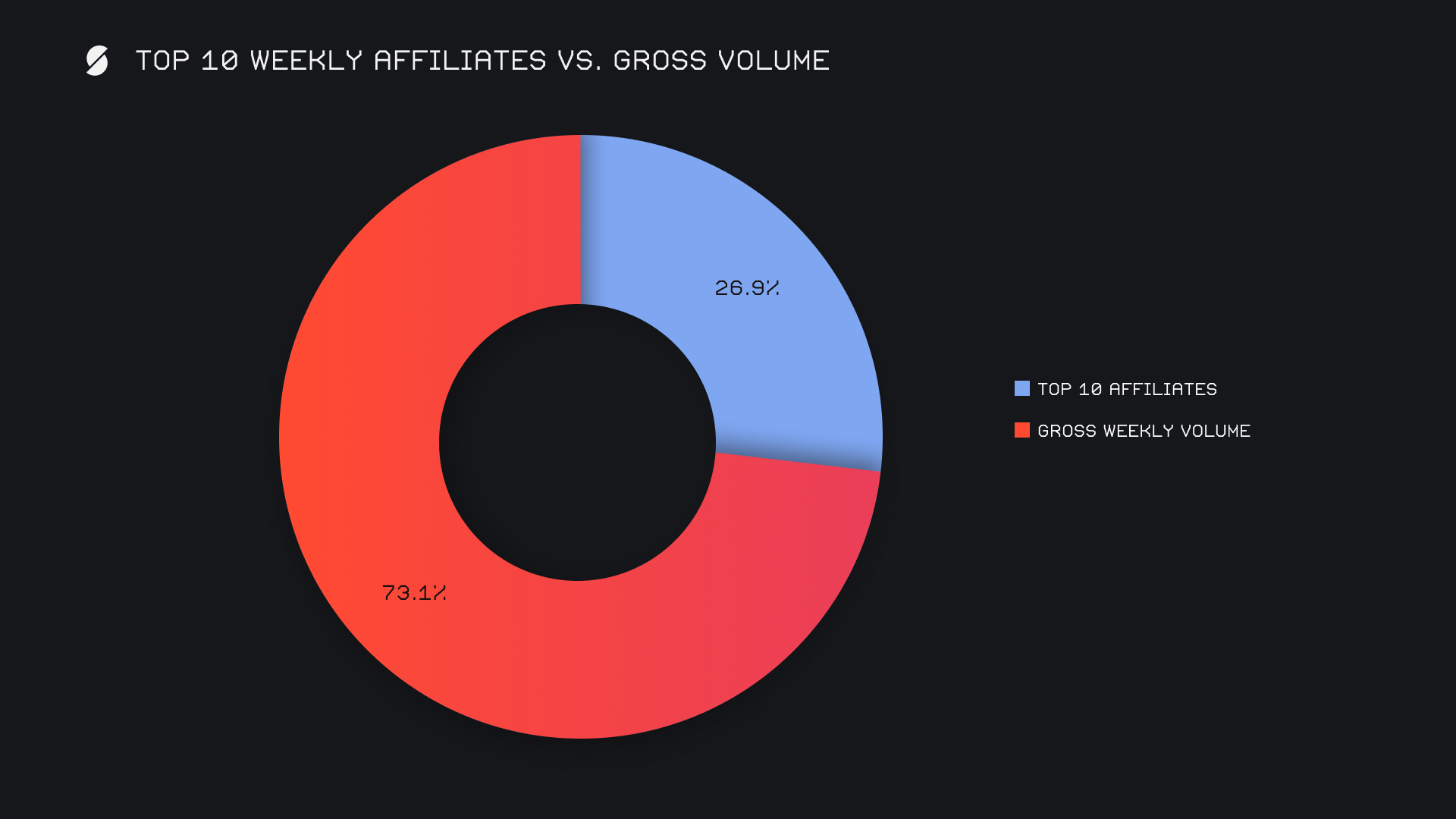

Our top affiliates had a standout performance, combining for a total volume of $6.6m, up +232% from last week's $2.0m. Our first-place affiliate maintained its lead, recording $2.9m, marking an impressive +264.8% increase. Our second-place affiliate also held its position and posted significant growth with $2.3m (+329.9%), leading the shift count among top affiliates as usual with 1,314 shifts (+96.7%). Third place saw a change this week, bringing in $464k (+154.8%) and highlighting shifting dynamics within the affiliate rankings.

Altogether, our top affiliates accounted for 26.9% of the total weekly volume, a welcome increase of +8% from last week's proportion.

That’s all for now. Thanks for reading and happy shifting.