SideShift.ai Weekly Report | 6th - 12th Aug 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one-hundred-and-seventeenth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and seventeenth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week, SideShift token (XAI) moved within the 7-day price bounds of $0.1355 / $0.1420. At the time of writing, XAI is priced at $0.1393, reflecting a steady position towards the middle of this range. The market cap of XAI has experienced a slight increase, now sitting at $19,099,573, marking a +2.13% rise from last week’s $18,700,551.

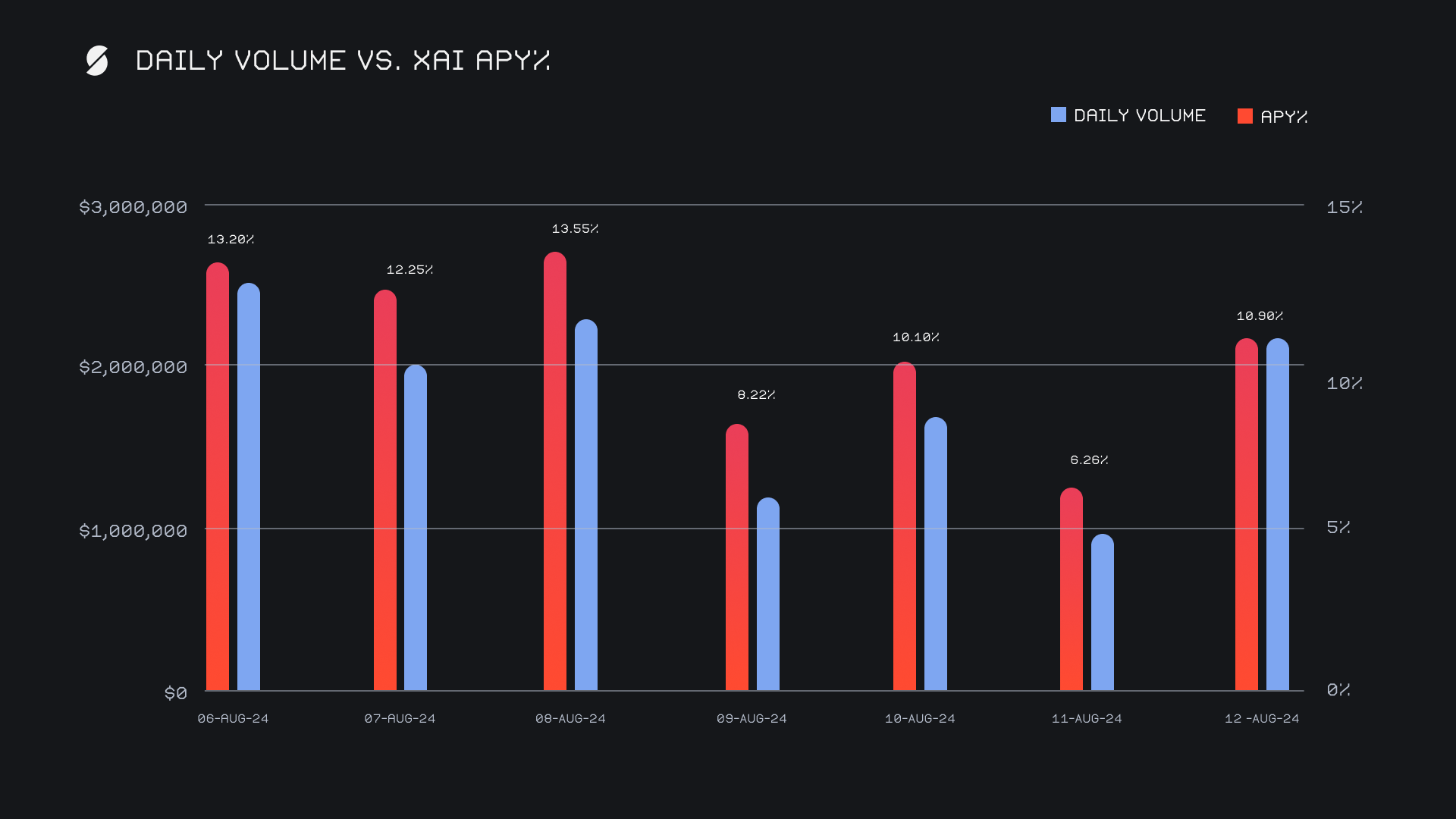

XAI stakers were rewarded with an average APY of 10.64% this week. The highest daily reward of 42,770.72 XAI (equivalent to an APY of 13.55%) was distributed on August 9th, 2024, following a daily volume of $2.3 million. Throughout the week, stakers received a total of 237,599.50 XAI or $33,097.61 USD in staking rewards, consistent returns amidst a choppy week in the market.

The price of 1 svXAI is now equal to 1.3654 XAI, representing a 36.54% accrual on stakers investments. A friendly reminder that the easiest way to participate in XAI staking is to shift directly to svXAI, from any coin of your choice.

Additional XAI updates:

Total Value Staked: 123,048,816 XAI (+0.2%)

Total Value Locked: $16,862,345 (+2.1%)

General Business News

The crypto markets experienced a mix of cautious optimism and ongoing volatility this week. Bitcoin hovered near $58,000 as the broader market adjusted ahead of key economic data releases, while Ethereum saw significant activity with a whale transferring $154m worth of ETH to exchanges. Meanwhile, memecoins and Layer-1 tokens led a relief rally, signaling a potential shift in market sentiment after recent sell-offs.

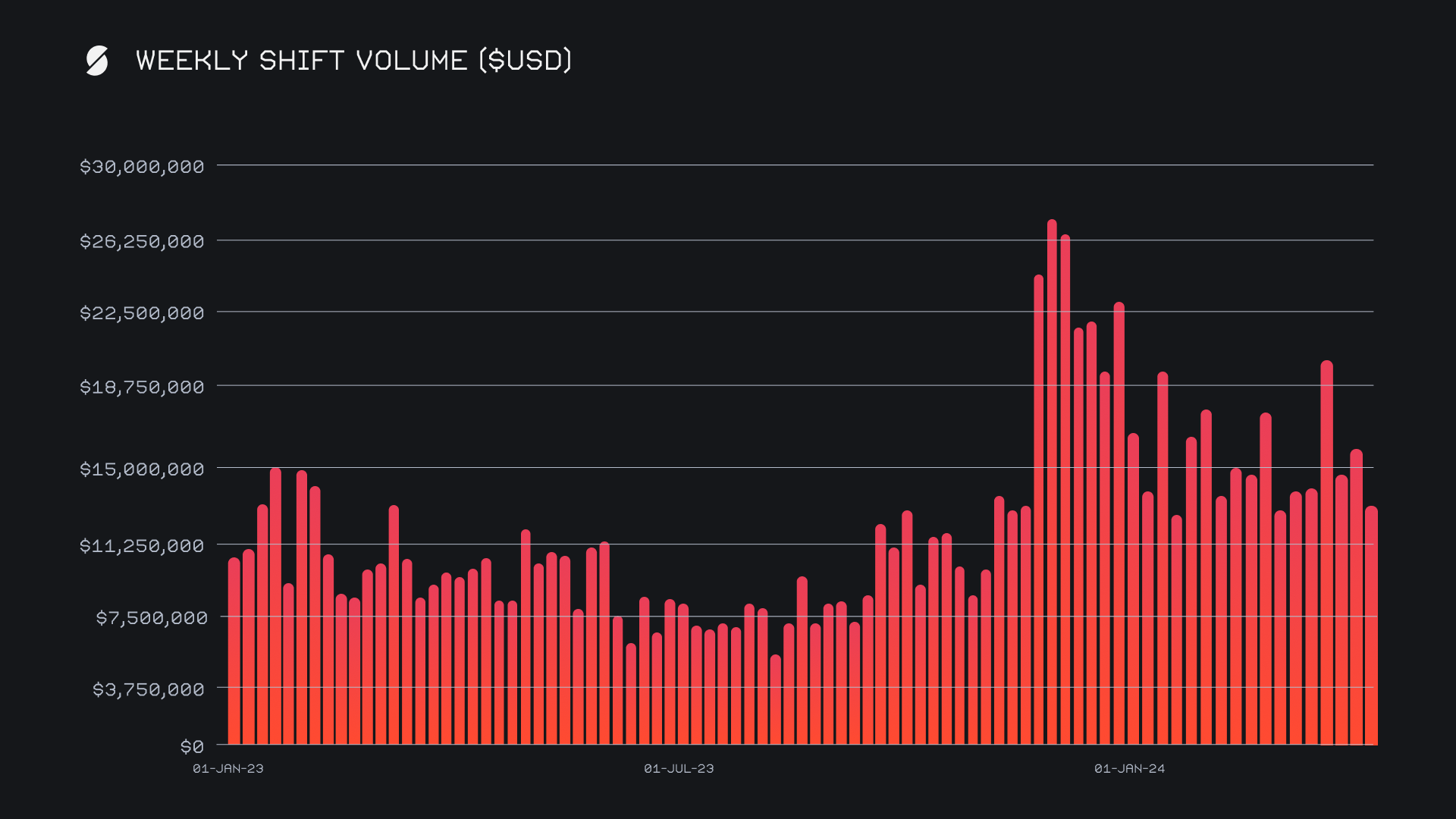

SideShift had a slower overall week and closed with a gross volume of $12.8m, marking a decrease of -21.3% from last week. Our daily averages came in at $1.83m across 1,346 shifts, which resulted in one of our slowest performances in recent months. Nevertheless, we maintained steady engagement, with users continuing to favor core trading pairs, and shift count going on largely unaffected.

Notably, the BTC/USDT (ERC-20) pair reclaimed its position as the most popular choice among users while stablecoins on SideShift are seeing sustained interest - it generated $745k in volume and overtook the BTC/ETH pair, which had held the top spot among users for the previous four weeks. BTC/ETH followed closely with $619k. Our weekly shift count saw only a modest drop, decreasing by -3.3% to a total of 9,422 shifts, which lies within 1% of our YTD average. This week's performance still indicates ongoing participation from our user base, albeit at a slightly reduced pace compared to recent weeks.

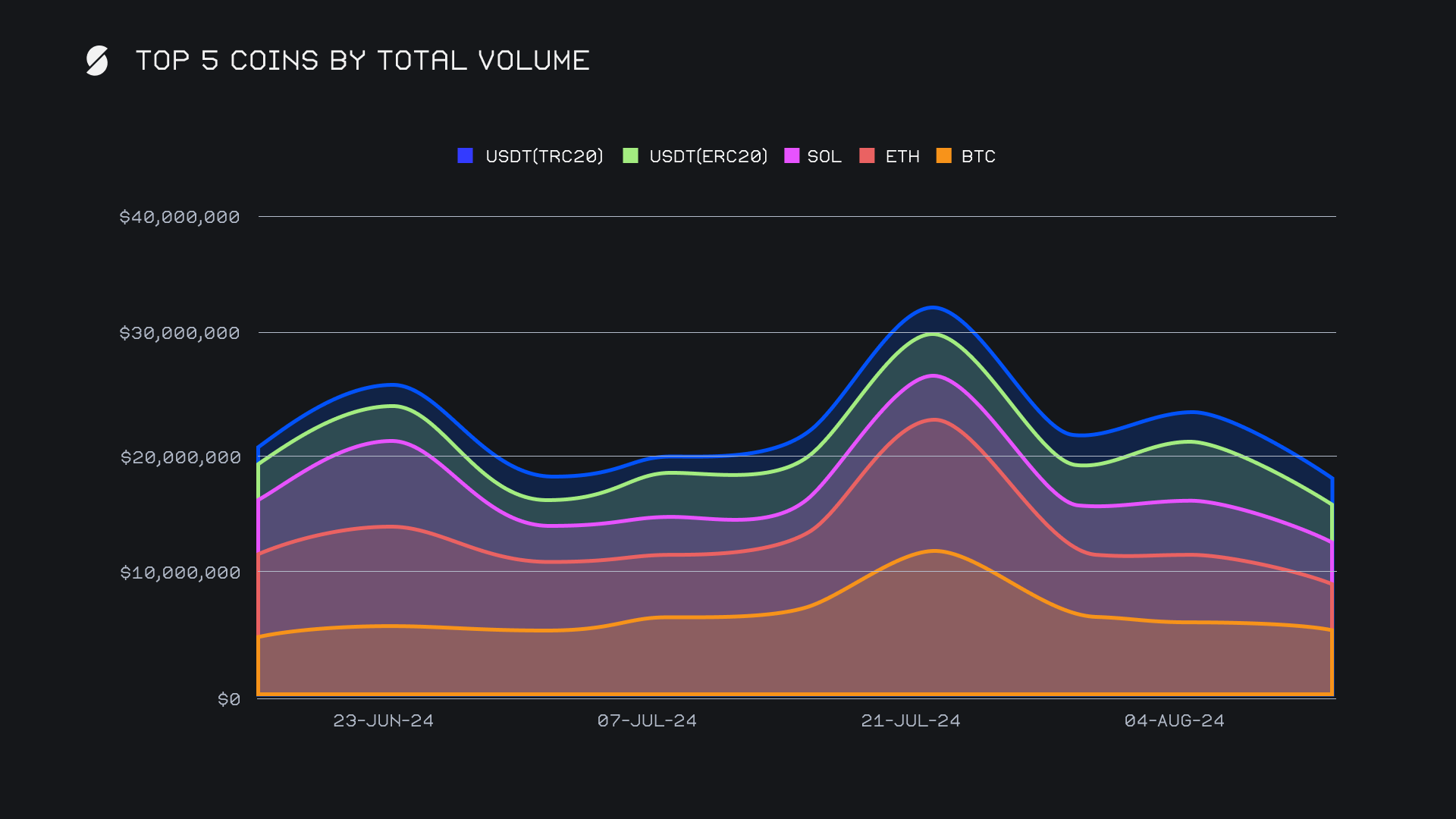

BTC maintained its lead with a total volume of $5.8m, though it did experience a slight decrease of -9.5% from last week. This ended as the least volatile change among our top 5, not a big surprise considering BTC’s continued importance among users and constant presence at the top. User deposits reached $2.3m, a noticeable drop of -20.1%, but still more than $1m higher than any other deposit coin’s volume. User settlement volumes also fell, closing the week at $1.9m, down -14.7%.

ETH took the second spot with a total volume of $4.0m, but saw a sharper decline of -24.9%. The drop was particularly evident in deposits, which plunged by -30.9% to $1.4m. Settlement volumes also reflected this trend, falling by -27.0% to $1.7m. This suggests that user interest in ETH has cooled off significantly after stronger performances in recent weeks. It also coincides with the end of the previously mentioned run of BTC/ETH finishing as our most popular shift pair throughout the last 4 periods.

SOL came in third with a total volume of $3.1m, marking a substantial decrease of -34.7%. Deposits dropped steeply to $951k, down -44.8%, while settlements also decreased by -29.8% to $1.2m. Despite the sharp drops, it is far more common to see vast swings in SOL shifting on a week to week basis, and a 30% - 40% change is not uncharacteristic. Just two months ago, SOL’s total volume ran up to well over $7m, showcasing its volatile nature - however, it's clear that for the time being, users' attention is being placed elsewhere.

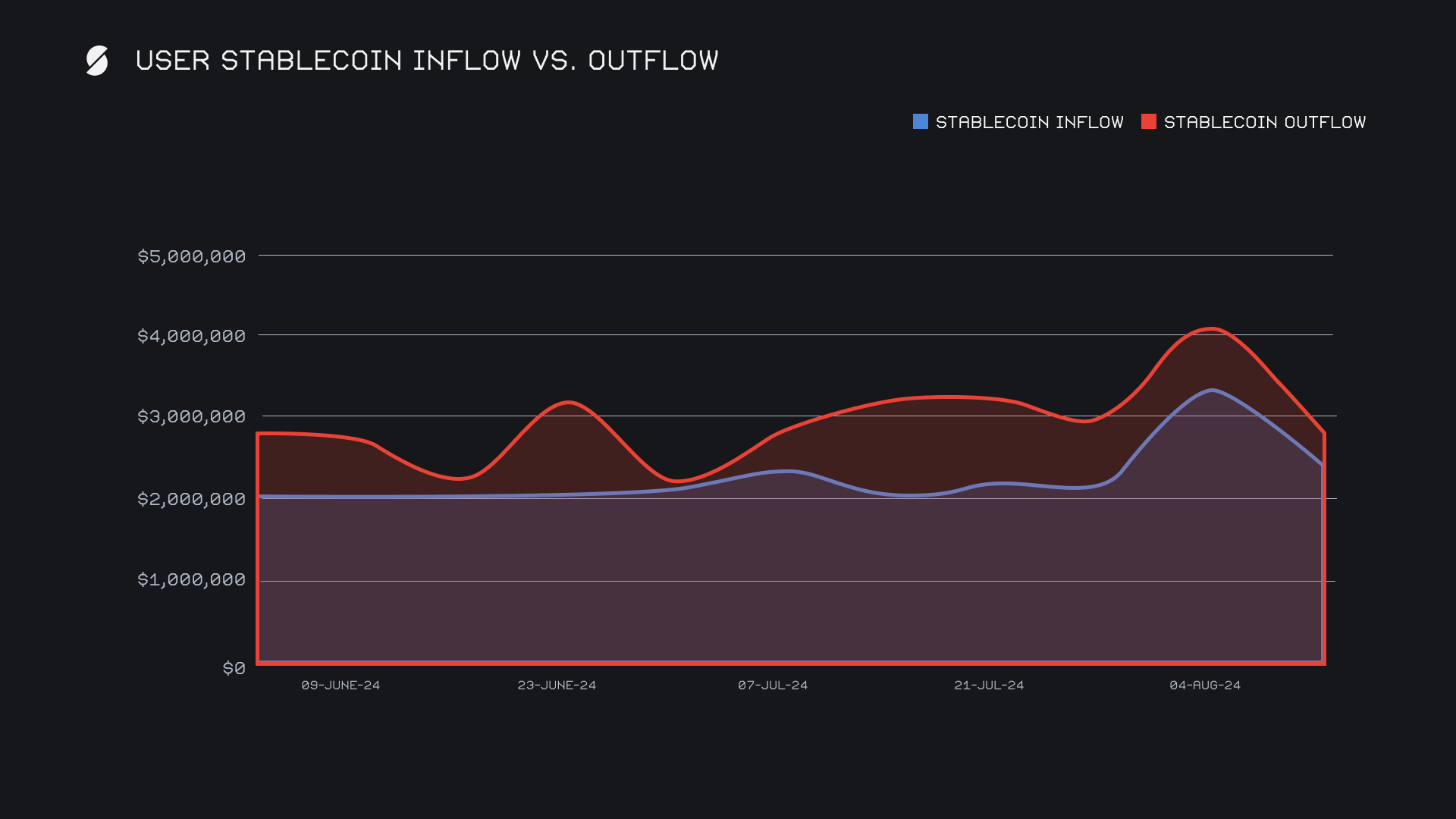

Stablecoins as a whole enjoyed a rather steady performance this week, and in a rare occurrence, stablecoins occupied places 4-8 in our total volume rankings. This is a change from a more typical week, which tends to see an intense volume concentration among 1-2 stablecoins, with most others incurring little shift action. For most, these higher overall rankings were simply the results of less shift volatility than “risk on” assets. The exception here was USDC (SOL), which rose to 6th place on the back of an impressive +172% surge to end with a volume of $812k, and easily finished as the week’s top gainer. Conversely, USDC (ERC-20) was the stablecoin to incur the most violent drop, as it fell -48.4% to 8th place, with a more standard volume of $585k. Overall, stablecoin settlements are still continually exceeding inflows - this week finished with a net outflow of -$414k, a trend which is seldom broken.

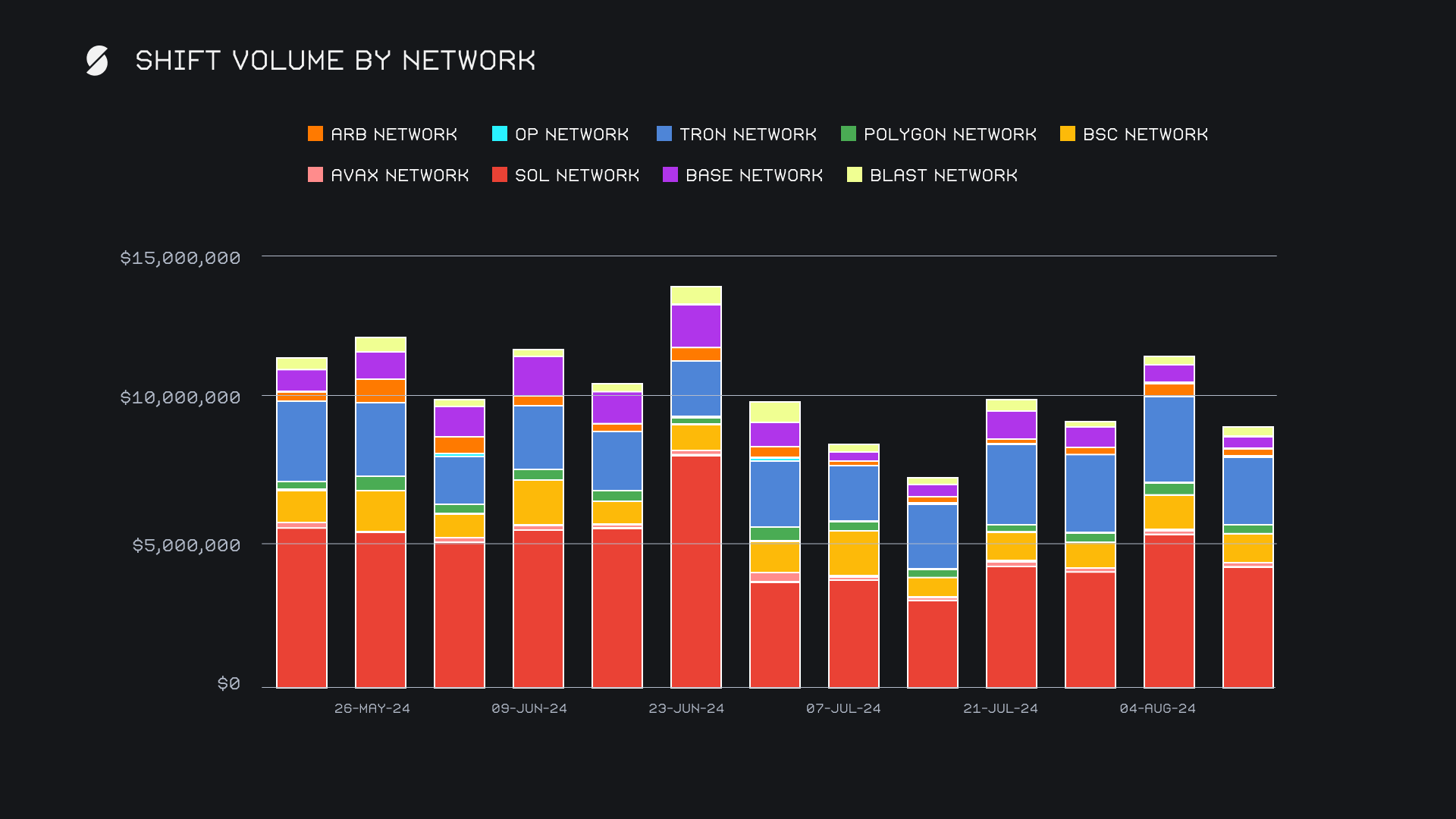

Alternate networks to Ethereum followed the same general pattern as already outlined, with 8 out of 9 networks seeing declines in shift volume. The Solana network maintained its position as the leader among alternate networks, although it experienced a -20.2% drop, and closed the week with $4.2m in volume. This decline was in line with the broader market trend but still reflected strong engagement compared to other networks. The Tron network followed suit with its volume falling by -19.3% to $2.4m. This places Tron as the second most active alternate network, though the decrease reflects a general cooling in activity across the board. The Binance Smart Chain (BSC) network came in third and ended the week with $977k, -15.6% lower than last week. In the cases of these alternate networks, the relevance of stablecoin shifting on the related networks played a key role in the volume they generated this week.

In contrast, the BLAST network was the only one to buck the trend, recording a +16.3% increase in volume to $315k. This positive movement, while modest, stood out in an otherwise subdued week for alternate networks to ETH.

Affiliate News

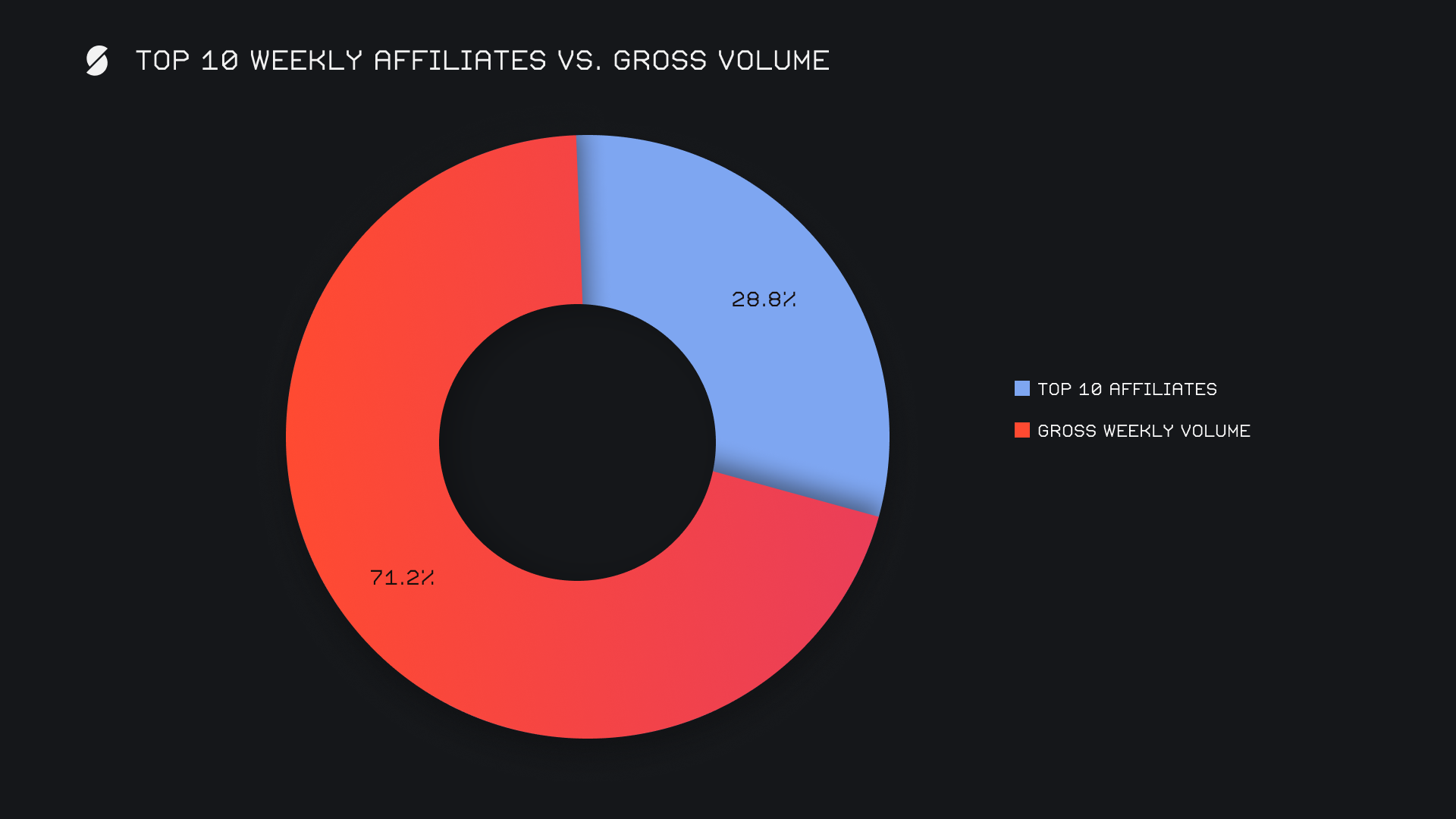

This week, our top affiliates generated a combined total volume of $3.7m, reflecting a notable decrease of -29% from last week and falling at a faster rate than our overall gross volume. The affiliate rankings experienced some changes, with our first-place affiliate maintaining its position despite a drop of -29.6% to $1.5m. Meanwhile, our second and third places switched positions; the new second-place affiliate ended the week with $960k, down -17.2%, while the former second-place affiliate dropped to third with $873k, marking a hefty -40% decline.All together, our top affiliates accounted for 28.8% of our total weekly volume, -3.1% lower than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.