SideShift.ai Weekly Report | 6th - 12th May 2025

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one hundred and fifty-third edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and fifty-third edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

- SideShift volume broke out of range – Weekly volume climbed +9.4% to $21.3m, ending a 5-week streak of sideways action.

- Shift count rebounded above 10k – Total shifts rose +22.2% to 10,386, boosted by a jump in small-scale shifts.

- SOL reclaimed its crown – Solana returned to the top of alternate networks with $4.9m in volume, edging past Tron after three weeks behind.

- ETH saw the strongest settlement spike – Settlements jumped +56.5% to $1.5m, helping ETH finish with $4.4m and a +52% rise in shift count.

- Stablecoin flows surged – USDT (ERC-20) hit $6.9m (+26.6%), one of its highest volumes this year, as users shifted out of risk assets.

- Affiliate momentum picked up – Combined affiliate volume rose to $10.7m (+9.6%), led by an +84.8% jump from second place.

XAI Weekly Performance & Staking

Last week saw SideShift token (XAI) trade within the 7-day range of $0.1202 and $0.1335, ultimately closing at a price of $0.1318. After beginning the week at $0.1272, it proceeded to briefly dip to its lowest point on May 10th, before rebounding to $0.1335 the next day. It then held most of those gains and ended the week just below the high.

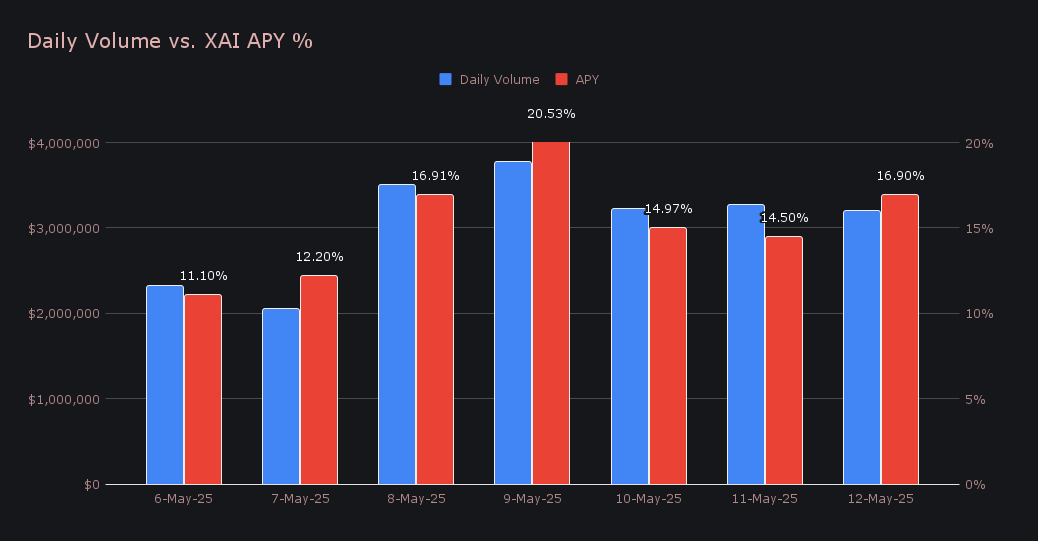

XAI’s market cap increased +7.0% week-on-week to $19,620,721, up from $18,337,638 the week prior. Staking activity also picked up, with an average APY of 15.30%. The highest daily rewards occurred on May 9, when 67,965.9 XAI were distributed directly to our staking vault at an APY of 20.53%. All together, XAI stakers received a total of 362,226.15 XAI or $47,743.57 USD in rewards throughout the period.

Treasury inflows also continued, with another 200,000 USDC being added this week. A healthy current total of $22.89m reflects both appreciating asset prices and the sound investment strategy executed by our treasury manager, Agent Archie Sterling III. Users can follow along directly with live treasury updates via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 133,228,289 XAI (+0.2%)

Total Value Locked: $17,506,068 (+5.5%)

General Business News

This past week marked a clear turning point for crypto markets, with momentum returning across the industry and sentiment flipping firmly bullish. Helping to drive the shift was news of a tariff deal between the U.S. and China, which took some pressure off markets and gave risk assets room to breathe. ETH was front and center, soaring approximately +40% to touch $2,600 in one of its strongest moves of the past year, while BTC climbed to $105k, just a stone’s throw from all-time highs. Memecoins also lit up across the board, with WIF and PEPE among the top large cap gainers, rising +100% and +66%, respectively.

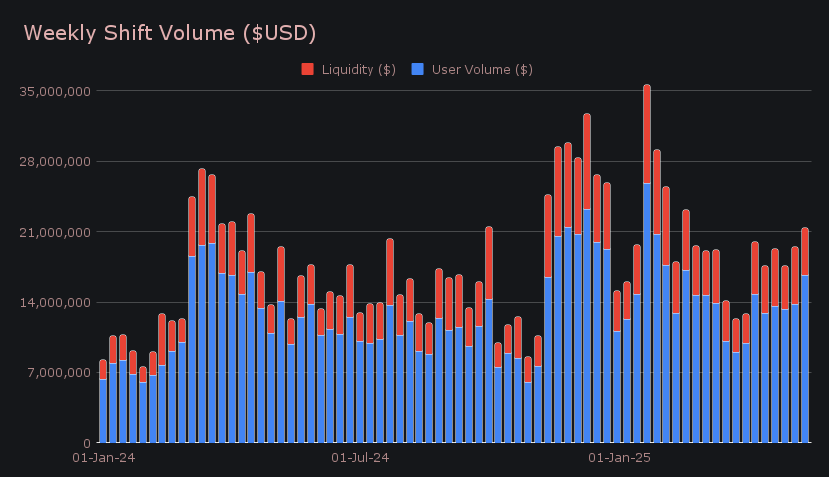

SideShift recorded one of its strongest weekly totals in recent months, with gross volume increasing to $21.3m (+9.4%), and breaking above the range it remained in for the previous 5 weeks. The uptick was powered by a +20.9% rise in user shifting, which reached $16.7m, thanks in part to strong contributions stemming from top integrations. Liquidity shifting, by contrast, dipped to $4.6m (-18.5%) as user flows balanced out more evenly and placed less reliance on internal rebalancing.

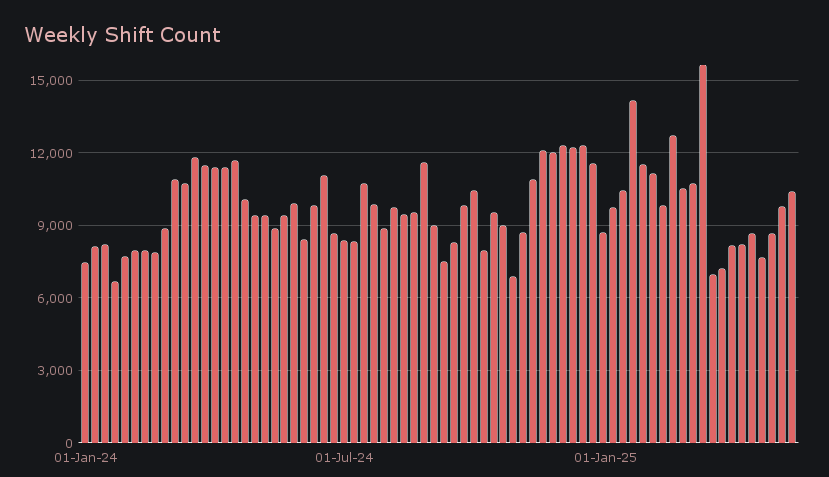

Gross shift count followed suit and jumped to 10,386 (+22.2%), reclaiming the 10k benchmark for the first time since early March. This total also brought the count back in line with our year-to-date average, finishing +3.5% higher after spending the past several weeks below trend. When combined with this week’s volume, SideShift processed an average of $3.05m in daily volume across 1,484 shifts.

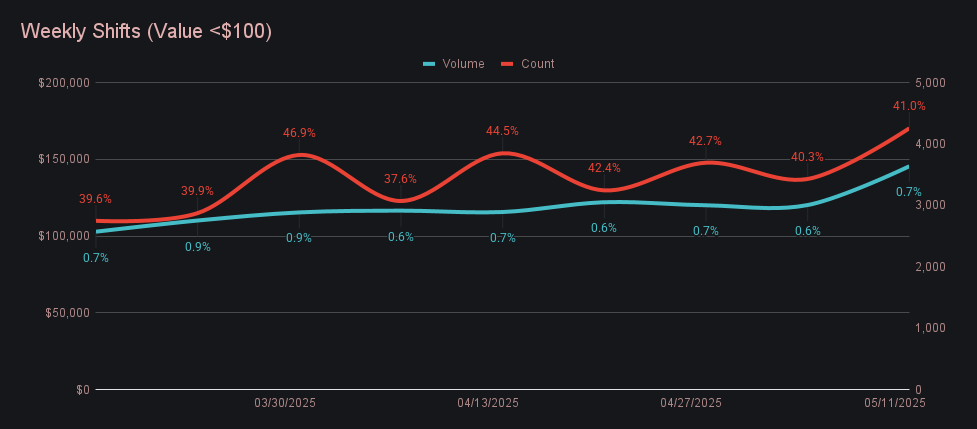

The increase in count was helped by a rise in small-scale shifts, with those with a value less than $100 increasing by 826 to total 4,254, the highest sum in months. This uptick reflects a steady boost in casual user activity, as more users opted to shift modest amounts across a range of coins. As shown in the chart below, these lower-value shifts accounted for 41.0% of all shifts by count, a notable share even if proportionally lower than earlier in the year, while contributing just 0.7% of weekly volume.

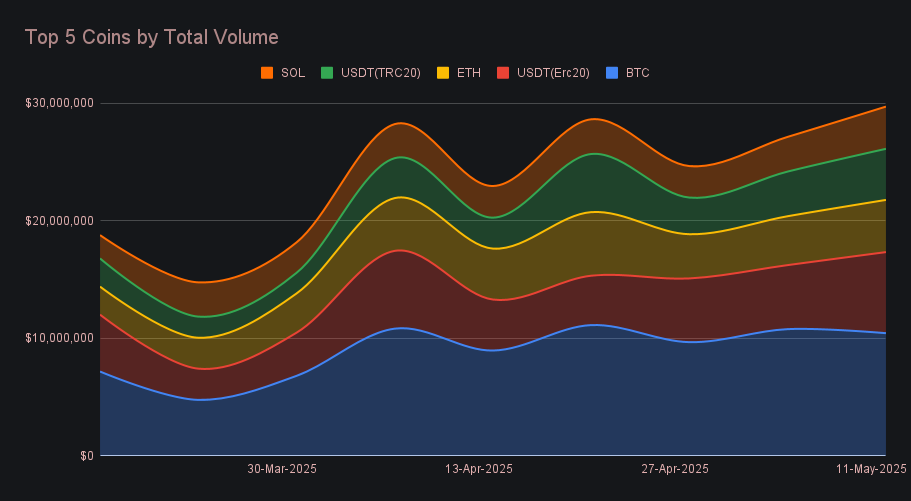

BTC retained its lead with $10.4m in total volume (-3.2%), marking its third week above $10m in the past month. Despite the slight dip, it remained the most shifted coin, with user deposits climbing +28.2% to $4.9m, while settlements slipped -1.9% to $4.1m. This reversal from recent trends suggests increased profit-taking as BTC reached new local highs. Notably, BTC/USDT (ERC-20) and its inverse continued to dominate user pair activity, combining for $3.36m in volume. BTC/USDT (ERC-20) alone reached $2.39m, the second-highest single pair volume of the year, trailing only the rush of ETH/SOL shifts we had in January.

USDT (ERC-20) held firmly in second place with $6.9m in total volume (+26.6%), marking one of its highest weekly totals so far this year. The growth was the largest among any top coin and was driven primarily by a rise in user settlements, which climbed +27.5% to $3.4m. Although user deposits nearly doubled to $1.8m (+92.7%), the imbalance between inflows and outflows widened this week, pointing to a renewed wave of users selling risk assets and shifting into stablecoins.

ETH placed third with $4.4m in total volume (+6.7%), a steady climb that reflected more stable shift activity relative to other top coins. User deposits reached $2.4m (+11.9%), while settlements rose to $1.5m (+56.5%), the largest settlement gain among any major user coin this week. This move followed a quieter performance last week and helped bring ETH’s activity closer to balance, though deposits have continued to outpace settlements overall. ETH also saw a sharp increase in user shifts, with count jumping +52% to 2,756, ranking second overall. SOL, meanwhile, experienced a more significant change in total volume, climbing +19.7% to $4.2m, but saw a far smaller percentage gain in shift count by comparison.

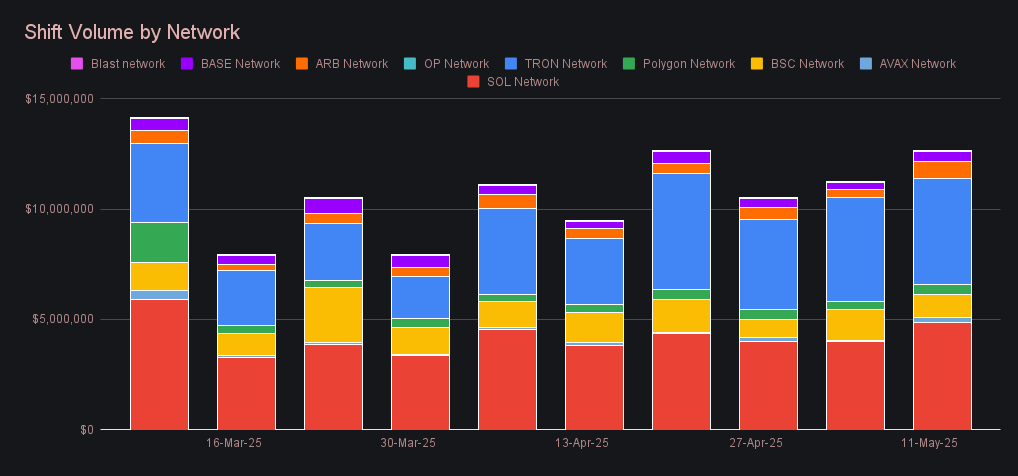

Alternate networks to ETH generated a combined $12.6m in volume this week (+12.4%), narrowing the gap with the Ethereum network to just 4%, compared to a 14% difference last week. The Tron and Solana networks were nearly tied for the top spot, with Tron finishing at $4.8m (+2.5%) and Solana just ahead at $4.9m (+21.2%). After trailing for the past three weeks, Solana reclaimed its usual lead among alternate networks, overtaking Tron with a stronger weekly gain. Elsewhere, the Arbitrum network more than doubled to $741k (+112.9%), while Base climbed to $447k (+32.3%) and the Polygon network held steady at $438k (+17.4%). Avalanche rebounded sharply to $225k (+223.8%), whereas the BSC network declined to $1.1m (-22.8%), being one of the only networks to record a decline.

Affiliate News

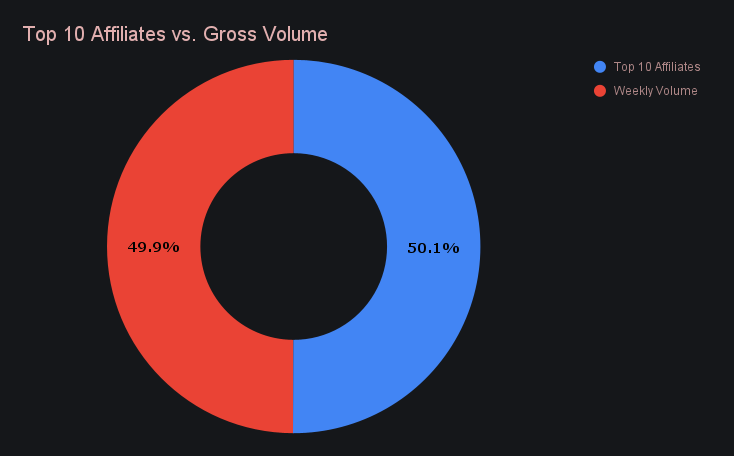

Affiliate shifting totaled $10.7m this week, rising +9.6% from the week prior. The ranking among our top three affiliates remained unchanged, with our second-place affiliate recording the most meaningful increase, surging +84.8% to $3.1m. First place, meanwhile, held steady with $5.9m (-11.0%), continuing a strong run of consistent performance despite the slight decline. Third place gained +36.3% to finish at $689k. Combined, our top affiliates contributed 50.06% of total weekly volume, nearly identical to last week’s share.

That’s all for now. Thanks for reading and happy shifting.