SideShift.ai Weekly Report | 7th - 13th October 2025

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one hundred and seventy-fifth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and seventy-fifth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

- SideShift processed $17.87m (+16.0%) across 10,075 shifts (+11.7%), marking its strongest performance of the past month.

- 328,370 XAI ($48,924) was distributed to stakers at an average APY of 13.13%, roughly 4% higher than last week’s average yield.

- BNB activity surged alongside positive price action, with shifting volume up +219.3% to $3.30m, its second-highest weekly result of 2025.

- Activity on the Avalanche network rose +371.2% to $1.56m, fueled by rising flows in USDC (AVAX), WAVAX, and BTC.b.

- Affiliate performance held steady at $3.41m (−1.8%), while direct site shifting dominated overall platform activity.

XAI Weekly Performance & Staking

XAI moved lower along with the broader market this week, giving back recent gains to end at $0.1411. Price action trended downward from early-week highs near $0.154 before finding footing just above $0.1406. The roughly -7% weekly decline placed the token toward the lower end of its recent range, though it held up reasonably well given the broader drawdown. Its market cap closed at $21.85 m (−7.26%).

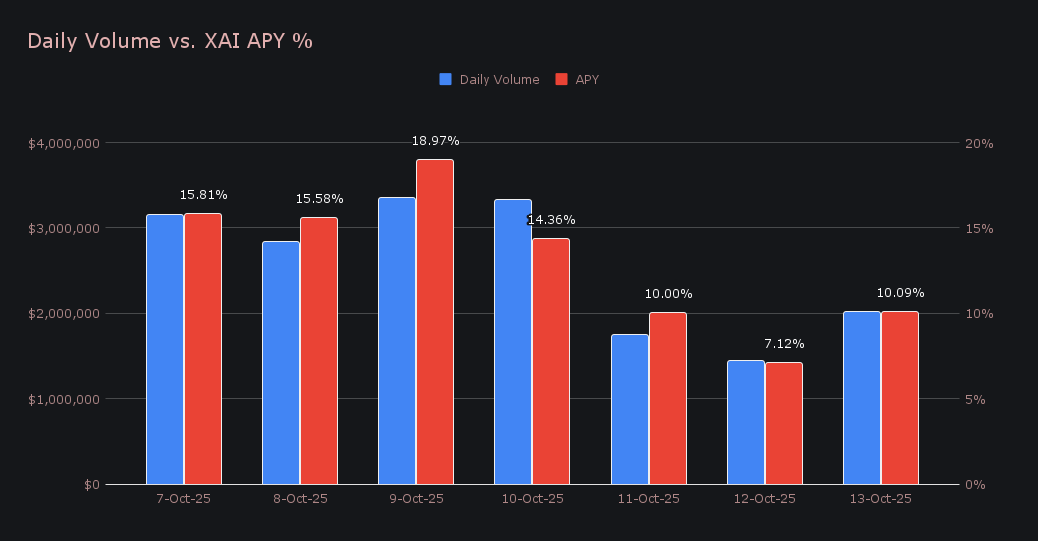

Despite the slower price action, staking activity remained healthy, with 328,369.92 XAI ($48,923.53) distributed to stakers at an average APY of 13.13%, a nice jump of ~4% from the previous period. The highlight came on October 9th, when 66,360.11 XAI was paid out directly to the staking vault at an impressive APY of 18.97%, supported by $3.35 m in daily shifting volume, showing that returns held firm even as prices eased.

Additional XAI updates:

Total Value Staked: 139,579,449 XAI (+0.1%)

Total Value Locked: $19,594,385 (−8.0%)

General Business News

Crypto markets endured the largest liquidation event in history, with over $19b in positions wiped out — eclipsing both the COVID and FTX crashes — as BTC briefly plunged to lows near $100k before rebounding above $115k. The cascade followed U.S. tariff escalations on China, triggering widespread risk-off selling across exchanges. Altcoins saw even harsher extremes — ATOM briefly crashed to $0.001 in a Binance glitch, while DOGE wicked down roughly −50% as leveraged positions rapidly unwound. In contrast to the broader pullback, BNB reached a new all-time high of $1,370 on October 13th, standing out as one of the few majors to extend gains amid heightened volatility. Across the board, volatility and liquidity dislocations defined one of the most turbulent weeks for crypto trading to date.

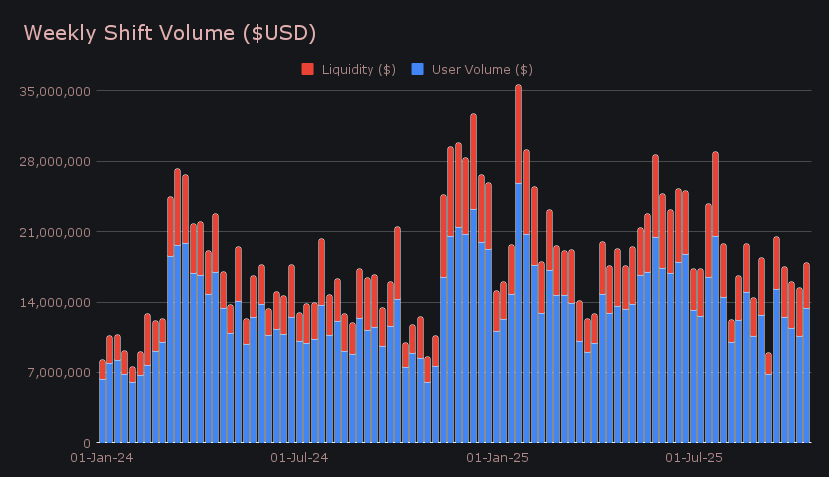

SideShift’s gross weekly volume climbed +16.0% to $17.87m, marking its strongest 7-day total of the past month. User shifting volume rose +26.1% to $13.40m, while liquidity shifting slipped −6.6% to add a further $4.47m as rebalancing needs declined. The week’s top user pair, SOL/BNB ($631k), reflected traders’ brief rotation toward BNB amid its record-setting rally, followed by BTC/USDT (ERC-20) and WBTC/BTC, which together illustrated the enduring strength of BTC-related flows. Weekly volume outside the leading coins was more widely distributed than usual, with noticeable contributions from AVAX, WAVAX, WBTC (ERC-20), ASTER (BSC), and USDC (BSC), an uncommon broadening of activity beyond the core group.

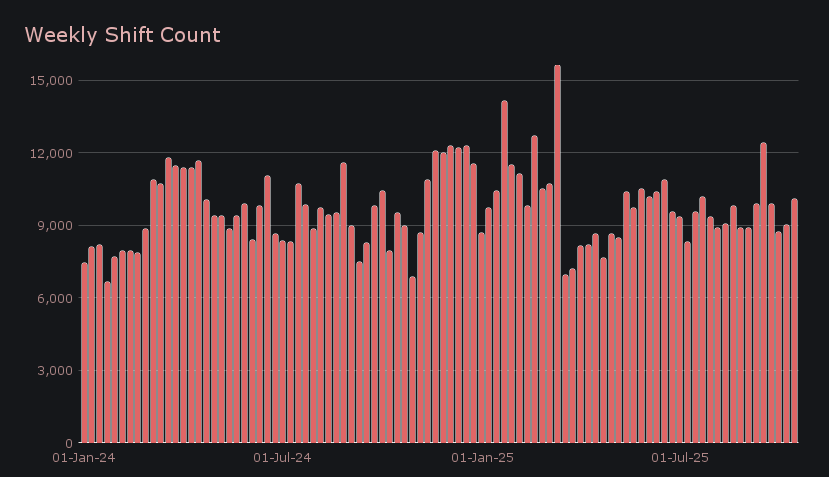

Shift count finished at 10,075 (+11.7%), or roughly 1,439 per day, recapturing the 10k mark for the first time in a month. Both volume and count rose in tandem, suggesting that users remained active through the week’s market swings rather than stepping back. Averaging $2.55m in daily volume, SideShift saw active participation across a wide mix of coins, with BNB’s rebound adding extra momentum to an already strong week.

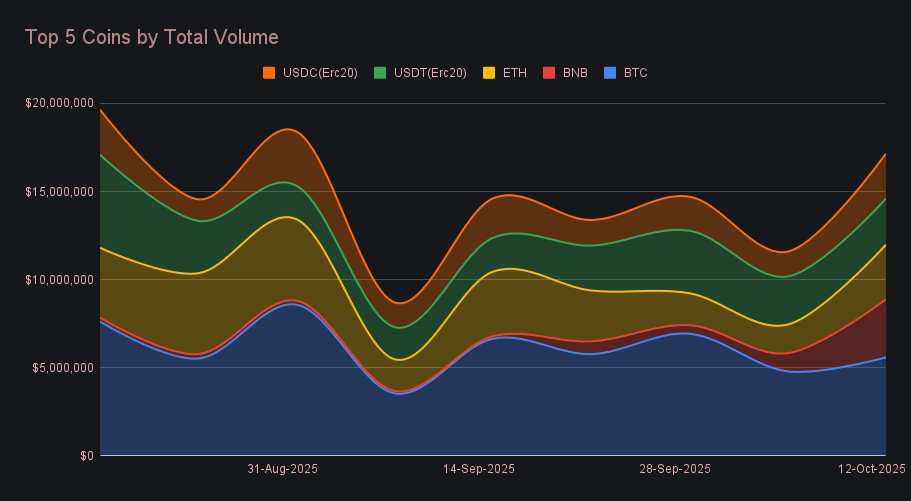

BTC led all coins with $5.59m (+16.6%) in total volume, maintaining its typical share of overall activity. User deposits climbed +21.8% to $2.03m, while settlements increased +35.0% to $2.27m, resulting in relatively balanced flows between both sides, something not mirrored by any other top coin this week. Although a clear jump from the last report, this level of BTC volume remains fairly typical, sitting within roughly 8% of the average observed over the past couple of months.

BNB ranked second with $3.30m (+219.3%), more than tripling its prior week’s total and marking its second-highest weekly result of 2025. The surge came alongside the token’s climb to new all-time highs and the volatility that followed, with settlements jumping +279.2% to $1.62m and deposits rising +59.0% to $725k. It also marked the second consecutive period of accelerating growth, with BNB’s volume more than doubling in back-to-back weeks as BSC activity swiftly picked up. This contrasted with the typical catalyst for the BSC network, usually USDT (BSC) flows, which this time took a backseat to the native BNB itself.

ETH ranked third at $3.09m (+90.3%), with strong participation on both sides as user deposits climbed +122.8% to $1.53m and settlements rose +33.2% to $957k. Among the top stablecoins, USDT (ERC-20) and USDC (ERC-20) rounded out the top five with totals of $2.61m (−4.2%) and $2.56m (+81.0%), respectively. USDT continued its steady presence, while USDC staged a sharp rebound to overtake its counterparts on Tron and Solana, highlighting a brief rotation back toward Ethereum-based stables. SOL meanwhile slipped out of the top 5, despite a +25% rise in total volume to end with $2.56m.

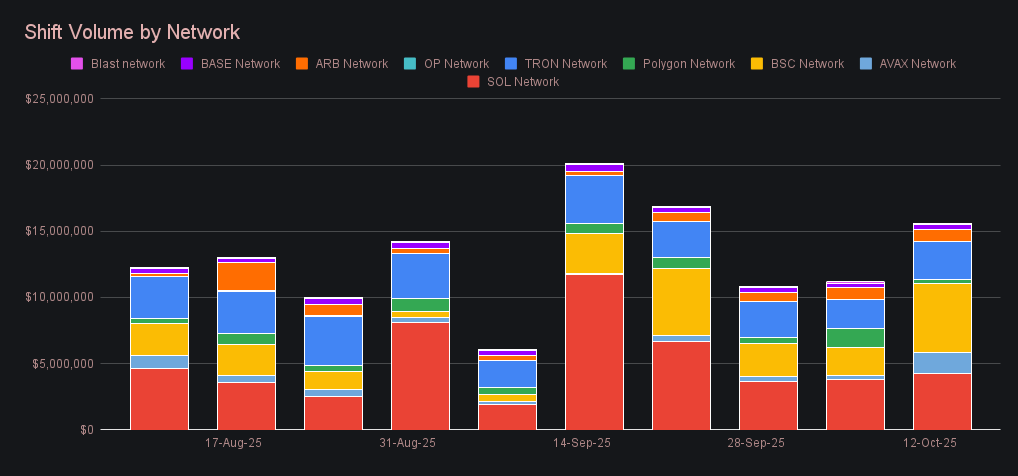

Alternate networks to Ethereum saw an energetic rebound, climbing +40.1% to $15.58m, far outpacing the Ethereum network’s own +26.3% rise to $7.62m. The BSC network led all peers with $5.23m (+153.7%), its busiest stretch of the last few months, as native BNB shifting overshadowed even the strong gains from USDT (BSC) (+67%) and USDC (BSC) (+383%). Solana followed at $4.30m (+12.6%), keeping pace despite the week’s turbulence, while Tron volume rose to $2.82m (+25.9%) on the back of its reliable stablecoin base. The Avalanche network delivered the week’s breakout move, soaring +371.2% to $1.56m thanks to surging shifts in USDC (AVAX), WAVAX, and BTC.b, which combined for over $1m in activity. In contrast, Polygon cooled sharply to $326k (−77.3%) as WBTC (Poly) volume slipped −69% from last week’s $1.7m rush.

In listing news, SideShift has added support for SKY on the Ethereum network with additional listings planned for the coming week.

Affiliate News

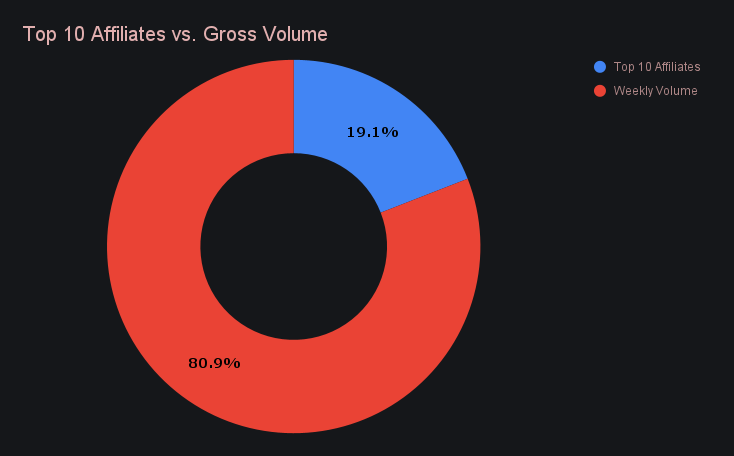

Affiliate volume totaled $3.41m (−1.8%), marking a steady week overall as direct site shifting took a larger share of total activity. First place held firm and extended its solid streak with $1.31m (+15.4%), alongside a notable +37% increase in shift count to 913 shifts. Second place (formerly third) also grew modestly to $353k (+9.1%), while last week’s runner-up moved to third with $289k (−74.2%), reflecting a far quieter week relative to its usual result.

All together, our top affiliates contributed 19.1% of total volume, down −3.4% from the week prior.

That’s all for now - thanks for reading and happy shifting.