SideShift.ai Weekly Report | 8th - 14th July 2025

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one hundred and sixty-second edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and sixty-second edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

- +37.4% Weekly Volume Surge – Total shift volume climbed to $23.7m, propelled by profit-taking BTC flows and renewed market energy.

- BTC and Stablecoins Dominate Top 5 – BTC led with $10.9m, while three stablecoins held their podium spots on contrasting deposit-versus-settlement trends.

- Altcoin Action Heats Up – SOL, XRP, and AVAX booked eye-catching gains outside the leaderboard, hinting at a broader rotation.

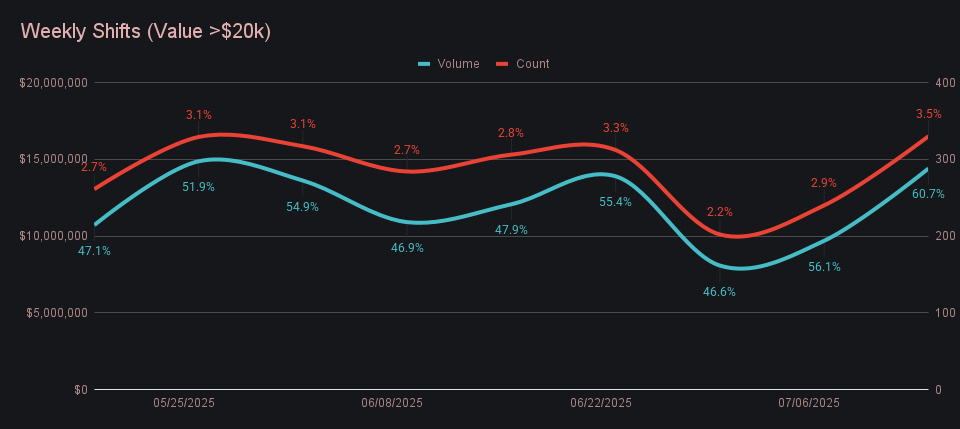

- Whales Step In – Shifts over $20k reached a multi-month high, moving $14.4m across 330 transactions and accounting for 60.7% of all volume.

- Affiliate Volume Rebounds +44.9% – Top integrations combined for $10.1m as second place doubled its volume and shift count jumped +71%.

XAI Weekly Performance & Staking

XAI held within a tight trading range this week, floating between $0.1546 and $0.1597. The 7-day chart showed a measured climb through the middle of the week before dipping into a small retracement. As of now, XAI sits at $0.1567, a level that reflects a +1.1% gain over the period and marks a return to the range’s midpoint. Market cap also edged higher, nudging +0.27% to reach $23,695,297.

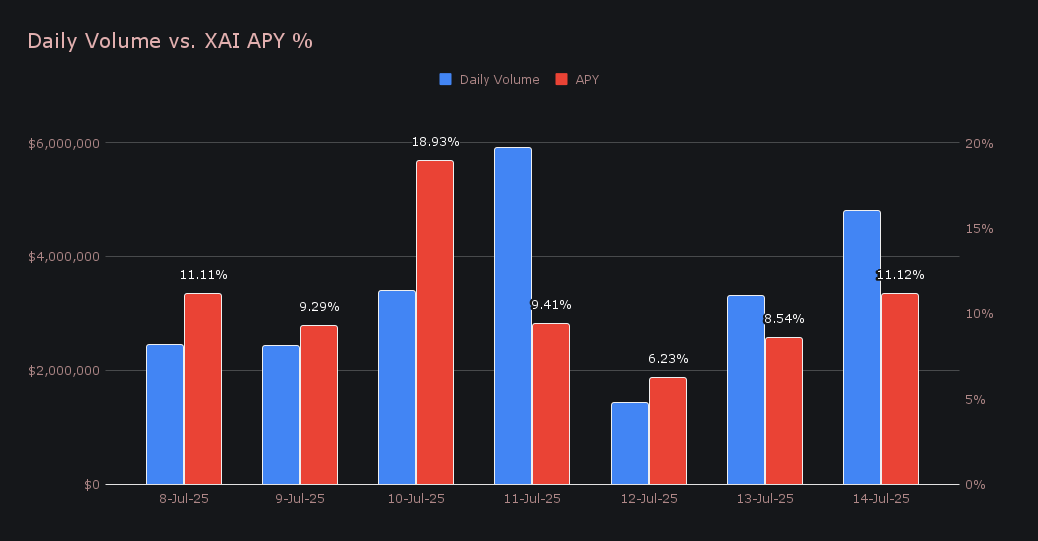

Staking performance held steady, with yields averaging a 10.66% APY across the week. The highest payout came on July 11th, when a total of 64,729.75 XAI was distributed to our staking vault at a peak APY of 18.93%, supported by a daily volume of $3.40m. In total, XAI stakers earned 263,372.80 XAI or $41,257.88 USD.

SideShift’s treasury received an additional 100,000 USDC last week and is currently sitting at an estimated value of $25.95m. Users can follow with live treasury updates via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 136,526,141 XAI (+0.2%)

Total Value Locked: $21,276,182 (0.0%)

General Business News

It was a milestone week across the crypto space, with markets snapping back to life. BTC broke through $123,000 to set new all-time highs and flip Amazon in market cap, extending its 2025 gains to +29%. ETH reclaimed $3,000, while PENGU and XLM headlined the altcoin breakout with explosive 7-day gains of +101% and +85%, respectively. BTC.d continues to command ~64% of the total crypto market, though that figure has eased slightly from its multi-year high near 66%.

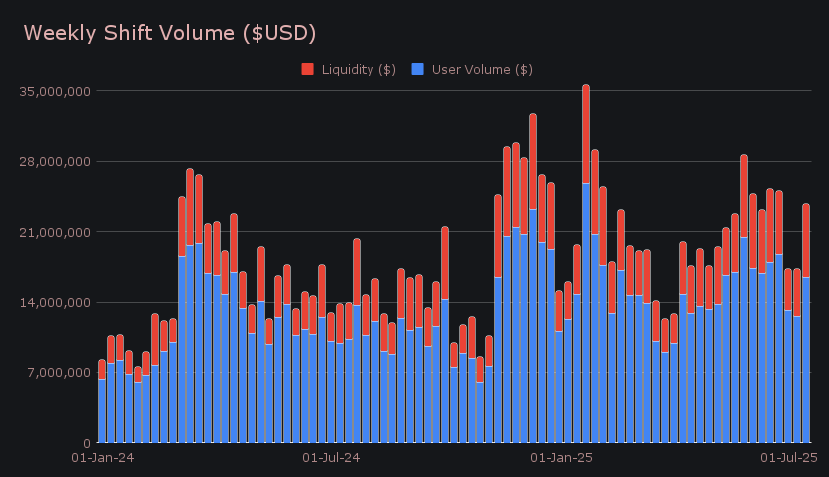

Shift activity on SideShift picked up across the board, with gross volume reaching $23.7m, a +37.4% increase week-on-week and a figure that sits roughly +13% above our YTD average. User-side volume climbed +30.3% to $16.5m, continuing to anchor the majority of weekly activity. Liquidity shifting followed and was elevated at $7.3m (+56.9%), mostly the result of large one-directional flows that occurred over a compressed timeframe, prompting swift internal rebalancing. The top weekly pairs were once again BTC-stablecoin focused, with BTC<>USDT (erc20) leading at a combined volume of $2.05m.

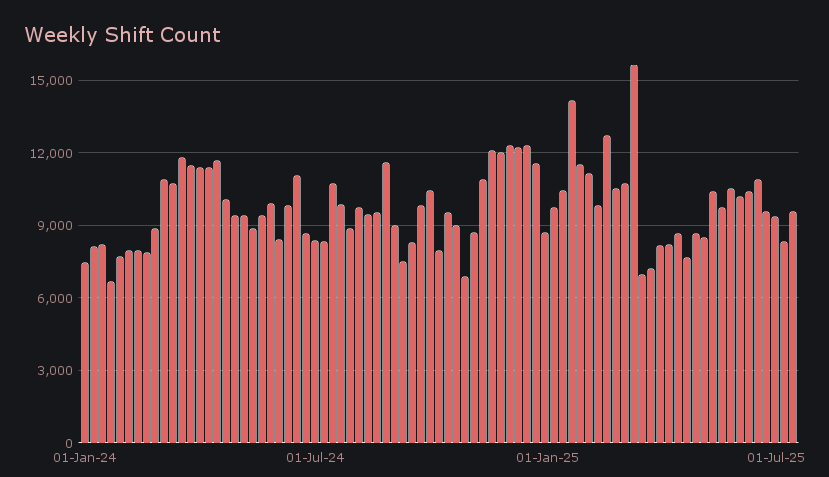

Weekly count rose +15.2% to 9,553 total shifts, a figure which sits just -4% below our running YTD average. While volume saw a more dramatic rise, the more modest gain in count suggests that larger shift sizes were a defining feature of the week. Daily average shifts landed at 1,365, reflecting solid engagement from both recurring and new users.

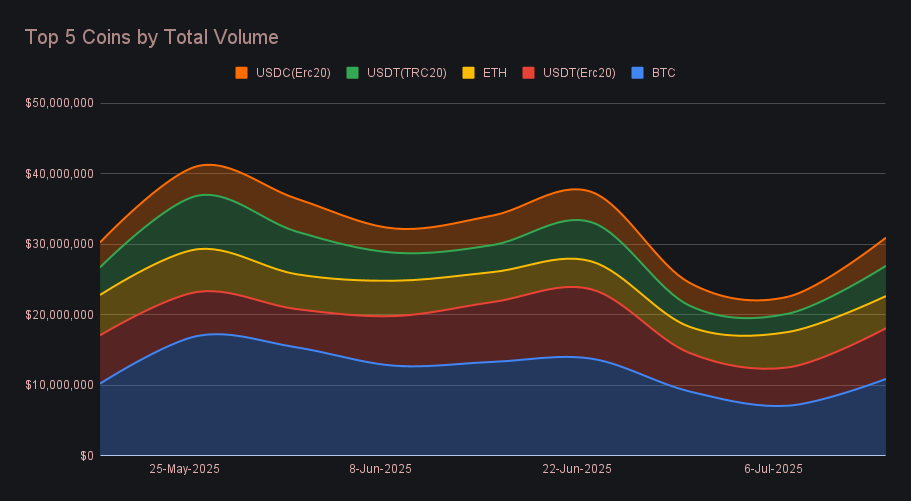

BTC remained firmly in the lead with $10.9m in total volume shifted, rising +53.3% versus last week to extend its dominance at the top. The surge was led by a +72.3% jump in user deposits, which climbed to $4.5m to confidently lead all coins. The spike in deposits coincided with BTC’s push to new all-time highs, as users took profit amid price acceleration. That aligned with SideShift’s daily volume high of $5.91m on July 11, when BTC broke through its $111k ceiling, and again on July 14 as it surged toward $123k, when we ended with a daily volume of $4.80m. A majority of this activity came from users shifting BTC into ETH-based stablecoins, though direct BTC demand was also apparent throughout the week, with user settlements rising +18.2% to $3.03m.

Our top stablecoin grouping delivered a clean sweep of gains and once again occupied three of the week’s top five spots - a positioning they’ve now maintained consistently for nearly two months. USDT (ERC20) ended second overall, with total volume rising +32.5% to $7.2m. Activity was primarily driven by a +37.0% increase in user deposits for $2.80m, while settlements rose more moderately by +11.0%. In contrast, both USDT (TRC20) and USDC (ERC20) saw their weekly gains anchored by settlements. USDT (ERC20) secured fourth place with a +65.5% jump to $4.3m overall, as settlements rose +67.0% for $1.46m and deposits trailed at +24.2%. USDC (ERC20) followed in fifth, climbing +65.8% to $4.0m, with settlements up +54.5% for $2.1m. The diverging patterns reflect varying user preferences, but together, these three continued to act as key bridges amid broader asset reallocation during a fast-moving week.

ETH’s activity took a notable step back, falling to third place with $4.5m in total volume. That marked a weekly decline of -12.9%, and stood in stark contrast to its performance the week prior, when it was one of the only top coins to observe a rise. Still, last week’s gain was largely driven by a temporary influx of user deposits, which did not end up playing out this week. Deposits dropped -34.0% to $1.3m, while settlements jumped +50.4% to $2.7m, suggesting that most of the week’s activity stemmed from users moving into ETH rather than rotating out. The reversal in trend coincided with the wider altcoin push, where other majors and high-beta assets appeared to capture more attention.

While the top 5 still made up a majority of overall volume, notable and meaningful contributions were observed elsewhere. SOL climbed +34.2% to $3.04m in weekly volume, continuing its strong activity just outside the leaderboard after falling out in May. XRP and, to a lesser extent, AVAX, stood out for their outsized gains as XRP soared +254.5% to $1.5m, while AVAX surged +243.4% to $904k. Furthermore, these increases occurred alongside a sharp rise in whale shifting, with shifts larger than $20k representing 60.7% of the period’s gross volume, marking a multi-month high. In total, these whale shifts summed $14.4m across 330 shifts, with increased activity evident across both the top-ranked coins and those trailing close behind.

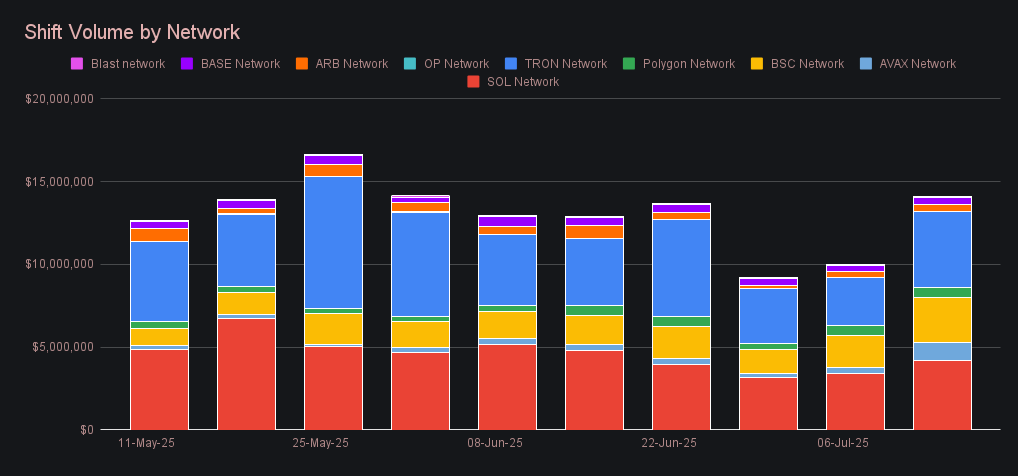

Alternate networks to the Ethereum networks saw a significant boost, climbing +41.1% to $14.07m in combined total volume, now sitting just shy of the Ethereum networks’ $14.35m (+8.4%). Tron led all alternate chains with $4.58m in volume, on the back of an impressive +60.7% rise, and continued its dominance in stablecoin flows. Solana followed closely with $4.20m (+23.2%) amid strong demand for both the native coin and stables. The BSC network maintained its upward momentum, rising +40.9% to $2.73m, while AVAX posted a sharp rise to $1.10m (+202.0%). Arbitrum and Base saw modest increases to $405k (+3.0%) and $429k (+14.1%) respectively. The only network to decline was Polygon, dipping -9.0% to $578k.

In listing news, SideShift added support for the native stablecoin of the Aave protocol, GHO, as well as the governance token of Maple Finance’s, SYRUP. Shifting of both of these tokens is now live, from any coin of your choice.

Affiliate News

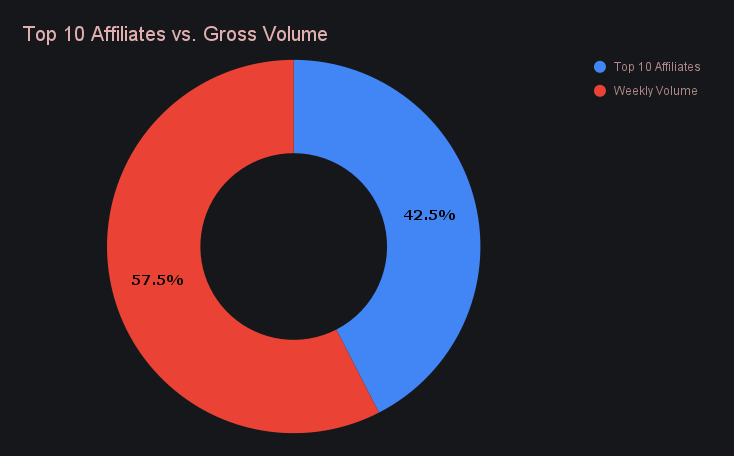

Top integrations also logged a strong performance this week, combining for $10.1m, a +44.9% rise that lifted their share of the total volume to 42.5%. Gains were seen across all three leaders, with second place particularly standing out after more than doubling to $3.93m (+101.2%), alongside a +71% rise in count to 875 shifts. Meanwhile, our top placed affiliate maintained its lead with $4.16m (+18.6%), while third place added $814k (+13.0%).

That’s all for now - thanks for reading and happy shifting.